Honeycomb Core Materials Market Outlook:

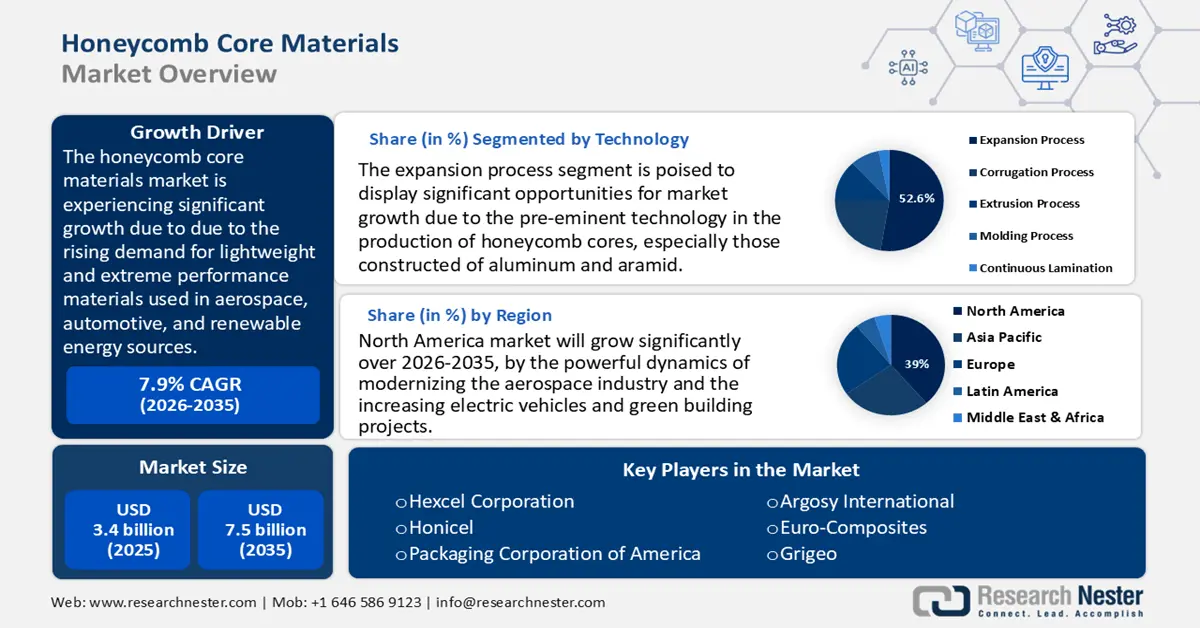

Honeycomb Core Materials Market size was valued at USD 3.4 billion in 2025 and is projected to reach USD 7.5 billion by the end of 2035, rising at a CAGR of approximately 7.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of honeycomb core materials is assessed at USD 4.2 billion.

The global honeycomb core materials market is expected to grow significantly, primarily due to the rising demand for lightweight and extreme-performance materials used in aerospace, automotive, and renewable energy sources. This trend is captured by NASA in its strategic initiatives to develop core materials that are ultra-lightweight and have scalable and cost-effective production processes. Such materials are intended to decrease the area density by half or more than conventional honeycomb cores without a loss or enhancement in the mechanical properties. This drive enhances more effective missions in space, the impacts of which then extend to commercial aerospace and automobile sectors in the bid to cut down on fuel consumption and emissions. Other areas where the government is investing in renewable energies are in the wind turbine, where honeycomb structures are lightweight, which increases efficiency and decreases the total weight of the system, which accelerates the market requirements.

The honeycomb core materials supply chain entails the importation of specialty fibers together with aluminium core material, mainly from Europe and Asia, which are involved in manufacturing and assembly within North America and the Asia-Pacific areas. The growth of the aerospace, auto, and construction industries is being met by capacity additions in composite manufacturing factories and separate construction assembly lines. Such trends are tested in the Producer Price Index data on metals and metal products, especially aluminum pricing is based on the movements of raw materials costs as it is a crucial constituent of honeycomb constructions. The PPI for metals and metal products was 308.814 in 2024, which further reached 326.99 in 2025. Additionally, the Department of Energy and NASA are investing in research and development and deployment on production efficiency and recyclable materials to reduce the impact of raw material price volatility and boost supply chain resilience. For instance, USD 17 million was invested by the Department of Energy in 2025 on several initiatives to help attain the said objectives. Furthermore, NASA's LunaRecycle Challenge, as well as OSMA Supply Chain Resiliency Program, also promote the creation of recyclable, lightweight structures in space, thereby supporting the essential materials required in the market.

Key Honeycomb Core Materials Market Insights Summary:

Regional Highlights:

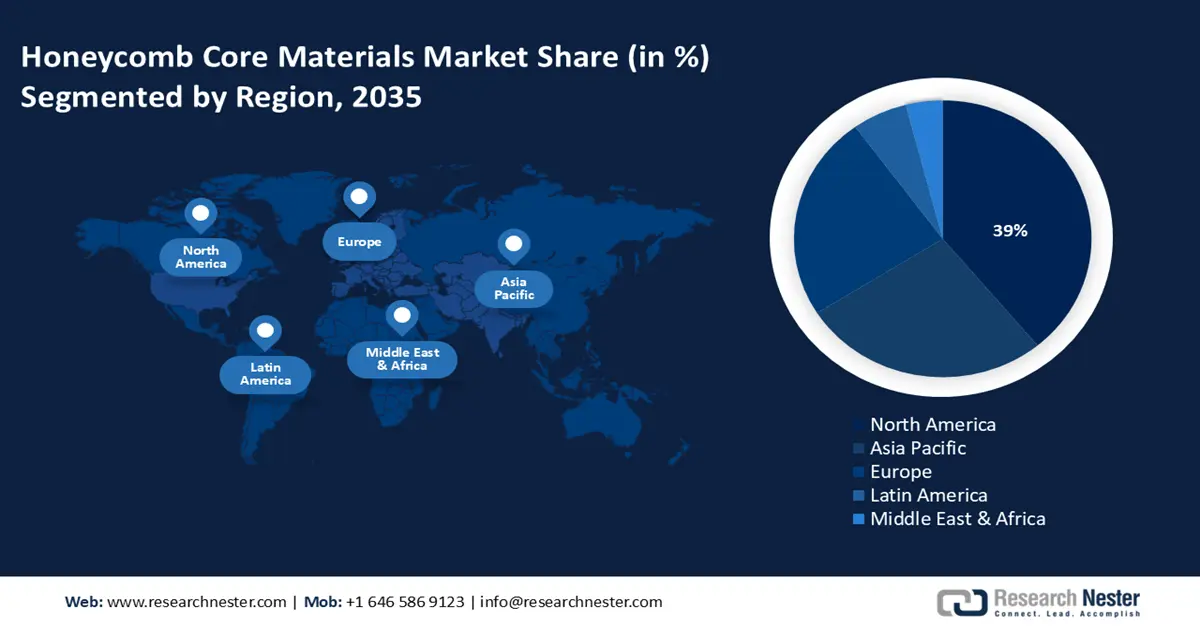

- North America honeycomb core materials market is projected to hold a 39% share by 2035, driven by modernizing the aerospace industry and increasing EV and green building projects in the region, supported by government initiatives.

- Asia Pacific is expected to account for 27% share over 2026-2035, owing to rapid growth in aerospace, lightweight automotive structures, and sustainability infrastructures.

Segment Insights:

- Expansion process segment is projected to account for 52.6% share over 2026-2035 in the honeycomb core materials market, propelled by pre-eminent technology in the production of honeycomb cores.

- Aerospace & defense segment is expected to hold a 41.4% share by 2035, owing to the demand for lighter and high-performance materials.

Key Growth Trends:

- Regulatory pressures and compliance costs

- Catalytic technologies advances

Major Challenges:

- Technical Barriers to Trade (TBT)

- Non-tariff barriers & regulatory overlap

Key Players: Hexcel Corporation, Honicel, Packaging Corporation of America, Argosy International, Euro-Composites, Grigeo, Dufaylite Developments, Cartoflex, Corinth Group, Axxion Group, TenCate.

Global Honeycomb Core Materials Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.4 billion

- 2026 Market Size: USD 4.2 billion

- Projected Market Size: USD 7.5 billion by 2035

- Growth Forecasts: 7.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, France

- Emerging Countries: India, South Korea, Brazil, Italy, Canada

Last updated on : 19 August, 2025

Honeycomb Core Materials Market - Growth Drivers and Challenges

Growth Drivers

- Regulatory pressures and compliance costs: The updated Toxic Substances Control Act (TSCA) regulations pursued by the U.S. Environmental Protection Agency have placed increasing pressure on regulations to remove low-volume exceptions to some targeted toxic chemicals, including PFAS. The transition also forces chemical manufacturers, such as a firm that produces materials used to make honeycomb core, to generate longer safety reviews and compliance tests. For instance, stricter EU environmental regulations, supported by over USD 20 billion annually in industry-wide compliance investment, with up to 10% of capital spending now focused on meeting regulatory standards, are driving innovation in advanced material expansion, pushing manufacturers to shift toward lightweight, recyclable materials such as honeycomb cores. This regulatory push is acting as a catalyst for growth, encouraging the adoption of sustainable, high-performance structures across aerospace, wind energy, and mobility sectors. This requirement makes it more necessary to have sophisticated compliance management systems to eliminate financial risks.

- Catalytic technologies advances: Advancements in catalytic technologies have demonstrated up to 50% enhancement in energy efficiency in chemical processes such as ethylene production, according to the U.S. Department of Energy. Furthermore, global industry roadmaps estimate a 20–40% reduction in energy intensity by 2050 through extensive catalyst deployment. These developments support cost-effective, sustainable chemical manufacturing. Such gains reduce both the cost of production and the environmental impact of the product so that the manufacturing process of the honeycomb core materials can be adapted to greener operations without the loss of profit-making ability. Optimized catalytic technique promotes the production of novel core materials having improved performance qualities to achieve growth in the honeycomb core materials market in a sustainable manner.

- Infrastructure support and international trade dynamics: Steady raw materials supply of aramid fibers and aluminum supports the capacity building of global manufacturing of honeycomb core materials with stable raw material sourcing, especially in the Asia-Pacific. However, complicated regulatory and tariff systems influence trade flows, which forces manufacturers to seek optimal import-export strategies to ensure supply is not compromised. Such as the market share occupied by Asia-Pacific contains more than 40.9% of the manufacturers because they are taking advantage of the rise in exports and growth in regional infrastructure. It is important to navigate these dynamics within trade dynamics to be able to sustain production and cater to the increase in demand globally.

Challenges

- Technical Barriers to Trade (TBT): The Technical Barriers to Trade (TBT) is an agreement of the WTO designed to make sure that technical regulations do not generate unnecessary barriers and encourage countries to use international standards wherever possible, and promote transparency and non-discrimination in how these standards are applied. However, the processes of conformity assessment, labelling, and testing that are country-specific tend to slow down the exports of the honeycomb core material and increase the expenses of compliance. These obstacles have an unequal effect on the small manufacturers and create unnecessary delays, non-transparency, and uncertainty. These inefficiencies weaken the facilitation of global trade, and this goes contrary to the initial mandate of TBT's authority.

- Non-tariff barriers & regulatory overlap: Many costly, non-tariff barriers often stand in the way of chemical suppliers, as these range from unnecessary paperwork to conflicting environmental requirements. A CEPR research study discovered that an increment of 10% of regulatory alignment only leads to a rise of 2% in bilateral trade, hence displaying how a regulatory mismatch significantly restricts global trade prospects. These overlaps increase certification and legal expenses to suppliers of honeycomb material and delay approvals of their new products in major regions.

Honeycomb Core Materials Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 3.4 billion |

|

Forecast Year Market Size (2035) |

USD 7.5 billion |

|

Regional Scope |

|

Honeycomb Core Materials Market Segmentation:

Technology Segment Analysis

The expansion process segment is expected to grow at the highest revenue share of 52.6% over the projected years from 2026 to 2035, attributed to pre-eminent technology in the production of honeycomb cores, especially those constructed of aluminum and aramid, which either use manual lamination or continuous lamination. The scalable and uniform composite production approaches, such as those aligned with ISO 10303 and ASME Y14.37, improve overall production quality while reducing cost variability, as per the National Institute of Standards and Technology (NIST). The communication and effectiveness of the product lifecycle are enhanced by these standardized procedures, which directly contribute to more robust and economical production systems. For instance, the Materials Genome Initiative (MGI) encourages data-driven materials innovation and digital process administration, aiming to produce sophisticated materials twice as quickly and at a much lower cost. These developments improve consistency and scalability by supporting increased efficacy and consistency in composite manufacturing processes, such as expansion-based honeycomb core fabrication.

Manual and continuous expansion is expected to grow substantially within the expansion segment. Manual expansion (low-volume or custom production) simply involves pulling sheets by hand, has the advantage of flexibility and low investment costs, and is suitable for SMEs or prototyping. Whereas continuous expansion has automated systems that can stretch cores in a monotonous way and allow mass production with consistent quality and a high throughput. Ideally applicable to aerospace and automotive industries, the technique is favorable to efficiency, precision, and scalability. Whereas manual expansion is swift and accessible, continuous expansion reinforces market development with automation and form structure coherence. The two methods play different functions in addressing the various needs of the industries.

Application Segment Analysis

The aerospace & defense segment held the revenue honeycomb core materials market share of 41.4% in 2025 and is anticipated to expand significantly over the projected years by 2035, owing to the need for high performance as well as lighter materials in the industry. NASA has traditionally been a proponent of honeycomb sandwich panel use in spacecraft and aircraft construction, as they provide optimal strength-to-mass ratios, vital in fuel-sensitive applications. In addition, the NASA Game-Changing Development Program is attempting to develop core materials with half the area density of standard honeycomb panels yet with all the mechanical properties of the honeycomb and the key industrial interest in such materials to enable the next generation flight systems. This constant aim to find a better piece of lower weight and higher strength is maintaining the leadership of aerospace and defense holds in the discrete demand of honeycomb material.

The use of honeycomb core materials in protective transit packaging is gaining preference in most applications because of their outstanding capacity to absorb shocks, creating a rigid package effect that holds packaged goods intact in most cases during transit. The hexagonal structure is very lightweight but strong, which allows the fast and efficient filling of space and cushioning in delicate electronics or ceramics processes, and saves freight weight and the environment. As pallet packaging materials, honeycomb cores are recyclable and lighter, and, when compared to wood or plastic pallet packaging, they provide an eco-friendly packaging solution that increases fuel efficiency and reduces transport costs. Honeycomb does well on both of these uses through the provision of operational savings, improved protection, and sustainability to meet the increasing requirements of the industries.

Material Segment Analysis

The aluminum core materials segment is projected to grow at a revenue share of 38.1% over the forecast years from 2026 to 2035, attributed to their high strength-to-weight ratio, corrosion resistance, and thermal properties, making them inevitable in lightweight structural applications. A study estimated that a 0.9% decrease in aircraft weight will result in about a 0.77% decrease in fuel use, and aluminum honeycomb panels weigh up to 69.9% less than solid panels and play an increasingly important role in helping airlines achieve these fuel savings. According to NASA, regarding ultralightweight materials, reducing the weight of the panels while maintaining the same strength and stiffness could substantially increase mission capability at reduced launch costs. The segment is further reinforced by the efficiency gains across the aerospace and defense industries.

Our in-depth analysis of the honeycomb core materials market includes the following segments:

|

Segment |

Subsegment |

|

Material |

|

|

Technology |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Honeycomb Core Materials Market - Regional Analysis

North America Market Insights

The North American honeycomb core materials market is projected to capture about 39% share in 2025 with an estimated growth rate of 6.7% over the forecast years from 2026 to 2035, driven by the powerful dynamics of modernizing the aerospace industry and the increasing electric vehicles and green building projects. The government’s encouragement through various agencies, such as the DOE and EPA, drives growth in the U.S. For instance, in October 2023, decarbonizing chemical manufacturing received USD 78 million in funding by the Department of Energy, supporting the sustainable feedstocks and low-carbon manufacturing processes, which have direct application and importance to the chemical inputs in the honeycomb core. In January 2025, USD 23 million on renewable chemicals made of biomass and waste, encouraging greener chemical synthesis pathways toward the production of honeycomb core, was allocated by the DOE BETO.

The Greenhouse Gas Reduction Fund, an initiative by the EPA created by the Inflation Reduction Act, has budgeted USD 27 billion in grants to the entire country, supporting industrial sectors adapting to low-carbon materials operations and cleaner production, thereby benefiting honeycomb core manufacturers. Governmental initiatives in terms of safer and cleaner infrastructure and chemical manufacturing are envisioned and thus advertised in a strategic sense. A five-year funding amounting to USD 40 million was awarded to the DOE's RAPID institute to improve process intensification in chemical and material production, increasing efficiency and sustainability in honeycomb production.

The U.S. honeycomb core materials market continues to be a major player in the North American market, supported by the aerospace industry, providing exportation of USD 143.8 billion in 2023. In 2023, the Department of Energy allocated 78 million dollars to decarbonize chemical manufacturing, which leveraged the advanced eco-efficient composites-supporting production methods to make them lightweight. The U.S. EPA’s Green Chemistry Program, in collaboration with the American Chemical Society, has recognized 144 technologies over the past 25+ years that reduce hazardous chemicals, resource use, and emissions. As of 2022, these innovations have annually eliminated 830 million pounds of harmful substances, saved 21 billion gallons of water, and cut 7.8 billion pounds of CO₂-equivalent emissions—advancing sustainable input streams for core materials. The success of such programs increases the competitiveness of U.S. manufacturers dealing with the following sectors, such as aerospace, EVs, and green buildings.

The honeycomb core materials market in Canada is expected to grow with an upward trend during the projected years by 2035, due to investment in sustainable infrastructure and transport. As per Statistics Canada, funding of approximately CAD 20.4 billion in Q1 2024 was invested in non-residential building construction, which supported the use of lightweight structural panels. In addition, CAD 1.5 billion in the Strategic Innovation Fund was allocated by the Government of Canada to promote critical minerals projects, clean technologies, and materials innovation. Such financing goes toward local production of low-carbon and high-strength materials such as honeycomb cores, particularly in the vehicle and aircraft industries. The demand is further pushed forward by the policies of Canada encouraging the use of zero-emission vehicles and green procurement.

Asia Pacific Market Insights

The Asia Pacific honeycomb core materials market is expected to grow at a steady rate with a revenue share of 27% from 2026 to 2035. This growth is driven by exponential growth in the aerospace industry and lightweight automotive structures, and sustainability infrastructures. Such trends are endorsed by government commitments to green manufacturing and material efficiency. For example, China’s National Development and Reform Commission released its 14th Five-Year Plan for Circular Economy (2021–2025), mandating a 20% increase in resource productivity versus 2020, and setting a 60% utilization target for construction waste by 2025. The plan also aims to reduce energy use per unit of GDP by 13.5% and water use per GDP by 16% to support resource security and sustainability, which will foster demand for lightweight composite materials like honeycomb cores. Similarly, METI in Japan has encouraged resource-saving technologies that would enhance material use efficiency, and companies using lightweight materials in transportation and construction have been given incentives that encourage investment. Adding to these regional policies and a rise in demand in other sectors such as EVs, aerospace, and prefabricated buildings makes APAC an ever-greater strategic growth region in terms of honeycomb core materials.

China’s honeycomb core materials market is predicted to dominate the Asia Pacific market, due to developing construction materials towards lightweight materials, which are partially fueled by the goal set in the 14th Five-Year Plan calling for an increase of 20% in resource productivity and a 60% utilization rate of construction waste by 2025. China's Ministry of Industry and Information Technology (MIIT) has identified carbon fiber as a strategic new material that is essential for industries like aircraft, building, high-speed rail, and transportation equipment. Since carbon fiber serves as the main skin material for honeycomb core sandwich constructions, this strategy directly promotes the development and wider usage of honeycomb core materials in these high-performance industries. Furthermore, the China Petroleum and Chemical Industry Federation reports that the country's petrochemical sector generated ¥16.56 trillion in revenue in 2022, a 14.4% year-over-year increase. This performance is indicative of the chemical sector's expansion, which supports the growing demand for advanced materials like honeycomb cores in sectors like construction and aerospace.

The Indian honeycomb core materials market is expected to witness a substantial rise in the APAC market, due to the growth of the chemicals and petrochemicals industry in the country. For instance, according to India’s Department of Chemicals & Petrochemicals, the sector contributed 9.8% to the country's manufacturing GVA and 1.4% to the overall GVA in 2022–23, underlining its foundational role in supporting advanced materials development, including honeycomb core material adoption. Manufacturers of specialty chemicals and composite materials have benefited from capital incentives under the production-linked incentive (PLI) program, which has increased use in the construction and automotive sectors. With a total investment of 1.97 lakh crore, the PLI scheme is stimulating the production of lightweight composite materials domestically by focusing on 14 key industries, such as advanced textiles, specialty chemicals, and vehicles. This program encourages local manufacturing and material innovation, supporting the use of honeycomb core structures in construction and transportation.

Europe Market Insights

The honeycomb core materials market in Europe is anticipated to grow at a substantial rate of 24% over the projected period by 2035. The EU’s Chemicals Strategy for Sustainability, as part of the European Green Deal, supports the development of safe and sustainable-by-design materials, providing a regulatory push for the adoption of lightweight, low-toxicity honeycomb core composites in construction, transportation, and aerospace, ensuring environmental safety across their lifecycle. Meanwhile, the Circular Economy Action Plan of the EU in force dictates product lifecycle regulation, eco-design standards, and recycling requirements in various sectors, such as the construction and transport industries, under which the conditions will be favorable toward eco-efficient core materials. Together, this combination of chemical industry strength, sustainable material policy convergence, and material security efforts makes Europe a major growth engine in the space of the honeycomb core materials market.

In the UK, state-sponsored schemes such as Innovate UK have sponsored honeycomb core research and development in the aerospace sector in support of the country’s overall Net Zero Strategy goals by 2050. Output in the aerospace and automotive manufacturing industries, two important application industries, rose by 4.2% in the UK in 2023, according to the UK Office for National Statistics.

Furthermore, Germany’s BMWK identifies lightweight construction as a key cross-sector technology, contributing €124 billion to the economy and employing 1.3 million people (2024). It supports SMEs with innovation and market access programs to expand lightweight adoption. These initiatives boost demand for advanced materials like honeycomb cores in automotive, aerospace, and construction sectors. The strategy reinforces Germany’s position in sustainable material innovation.

Key Honeycomb Core Materials Market Players:

- Hexcel Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Honicel

- Packaging Corporation of America

- Argosy International

- Euro-Composites

- Grigeo

- Dufaylite Developments

- Cartoflex

- Corinth Group

- Axxion Group

- TenCate

The honeycomb core materials market is highly competitive with the presence of industry leaders, such as Hexcel and Toray, who have a market lead in innovativeness and partnerships at the aerospace level. Euro-Composites and Honicel are European firms leading with sustainable, lightweight composites. Toyobo and Asahi Kasei, organizations that constitute Japanese manufacturers, contribute to high-tech resin and fiber technologies. Small businesses, regional innovators serve local demand, particularly to interpret domestic needs, often by customization and the benefit of cost. These regional innovators include players such as Corex (India) and Sing Core (Malaysia). Changes in strategic moves involve building up R&D facilities, localization of supply chains, and sustainability-oriented product developments to address dynamic market demands.

Top Global Honeycomb Core Materials Manufacturers

Recent Developments

- In February 2025, Hexcel Corporation announced its Flex-Core HRH-302, a non-metallic, mid-temperature honeycomb core, especially made to be employed within the aerospace thermal management market. Its product has been announced before the JEC World 2025. Due to the high conformability that it exhibits, HRH-302 is suitable to target complex nacelle structures as well as future Urban Air Mobility (UAM) propulsion systems. It satisfies an increasing trend in demand for lightweight and thermally rugged core materials in next-gen aviation initiatives. This introduction complements the Hexcel plan to increase its participation in aerospace composites.

- In October 2023, EconCore announced a new thermoplastic honeycomb core based on recycled polyethylene terephthalate (rPET) aimed at use in eco-friendly automotive and transport packaging applications. Such innovation is consistent with the rising demand for environmentally friendly materials in the world, where high-volume industries target carbon emission reduction. RPET core has several major advantages, including lightweight, potential recyclability, and suitability in complex shapes applications-which makes it an attractive option to serve as a solution to automotive interior designs and reusable logistics packaging. EconCore development achieves this using post-consumer PET waste, thus contributing to circular economy intentions without compromising the mechanical performance and thermal stability.

- Report ID: 8001

- Published Date: Aug 19, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Honeycomb Core Materials Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.