Ferrite Cores Market Outlook:

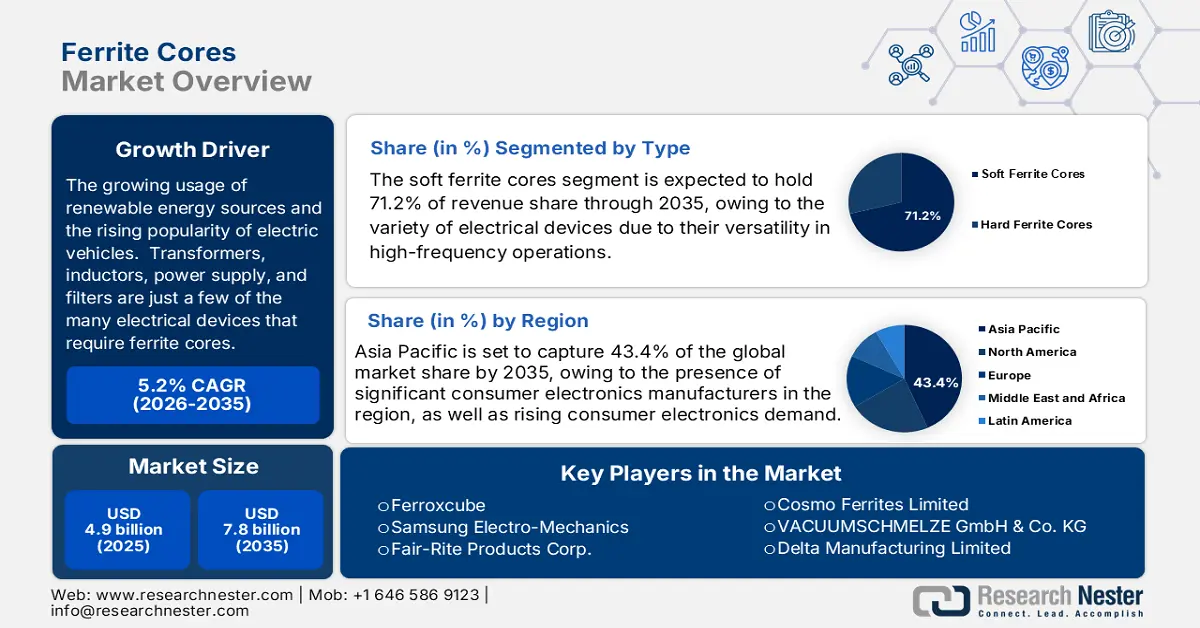

Ferrite Cores Market size was valued at USD 4.9 billion in 2025 and is projected to reach USD 7.8 billion by the end of 2035, rising at a CAGR of 5.2 % during the forecast period, i.e., 2026‑2035. In 2026, the industry size of ferrite cores is evaluated at USD 5 billion.

The global ferrite cores market is anticipated to grow significantly over the forecast years, primarily driven by the expanding demand for electronic devices, the growing usage of renewable energy sources, and the rising popularity of electric vehicles. Transformers, inductors, power supplies, and filters are just a few of the many electrical devices that require ferrite cores. It is anticipated that the growing use of renewable energy sources, electric vehicles, and industrial automation will fuel ferrite core demand in the upcoming years. According to the DOE in its Critical Materials Assessment, the motors of wind turbines and electric cars use rare earth elements and ferrite materials, which drive their expansion as clean energy policies and technology adoption grow.

Furthermore, according to the report by NREL, soft ferrites, i.e., MnZn and NiZn types, have a relative permeability of between 15 and 20,000 and saturation magnetization of up to 0.545 T. They are extensively applied in the transformer cores and antenna cores. The development of additive manufacturing can lead to more encouraging ferrite integration in complex core structures to facilitate the development of the ferrite cores market. Since ferrites are frequently utilized in electrical components, the manufacturing industry needs to place greater attention on and value them. For example, in preference, MnZn ferrites are chosen due to their highly permeable, low power losses, and stability. They have many applications in different fields of electricity, such as power supplies, transformers, and memory devices. The nature of their use and their performance characteristics highlight the increasing industrial dependence on ferrite materials to manufacture electrical components. Moreover, ORNL created an electric vehicle motor with ferrite permanent magnets, which was 75% more efficient than a similarly large commercial motor. The innovation makes it less dependent on rare-earth materials and makes it more efficient. These developments will spearhead such ferrite core demands in high-efficiency transportation.

Ferrite cores mainly rely on raw materials such as iron oxide and other metal oxides, whose raw materials are obtained at the international level, in relation to the material supply chain, manufacturing capacity, and global trade. According to Mineral Commodity Summaries 2025, published by the U.S. Geological Survey, the U.S. depends heavily on imports of various key minerals required in the production of ferrite and is therefore exposed to the volatility of the global ferrite cores market. Manufacturers are reacting by increasing domestic capacity and investing in scalable production technologies, and additive manufacturing of soft magnetic materials to enhance supply resilience and demand growth. For instance, according to the report prepared by the U.S. Department of Energy, the use of soft magnetic materials such as ferrites as an essential component in high-frequency high-power conversion is vital, as it facilitates the inductive switching of energy and power density gains into a high-power density. It observes that the electricity demand is rising by 30% as power electronics and grid modernization cause changes in electricity demand, which requires material innovations such as ferrites that will minimize power losses and enhance converter efficiency.

The Producer Price Index (PPI) of ferrous and nonferrous metal products, including ferrite products, has been moderately volatile due to the inflation of the costs of raw materials and supply chain limitations. By August 2025, the Producer Price Index (PPI) of Nonmetallic Mineral Products was about 352.91 (Index 1982=100), which means the price levels of input materials used to produce ferrites have increased moderately but steadily. This steady pricing system ensures that the ferrite cores market of ferrite cores can continue to grow as more manufacturers can set plans for capacity growth and investment into technological developments with more stable costing systems.

Key Ferrite Cores Market Insights Summary:

Regional Insights:

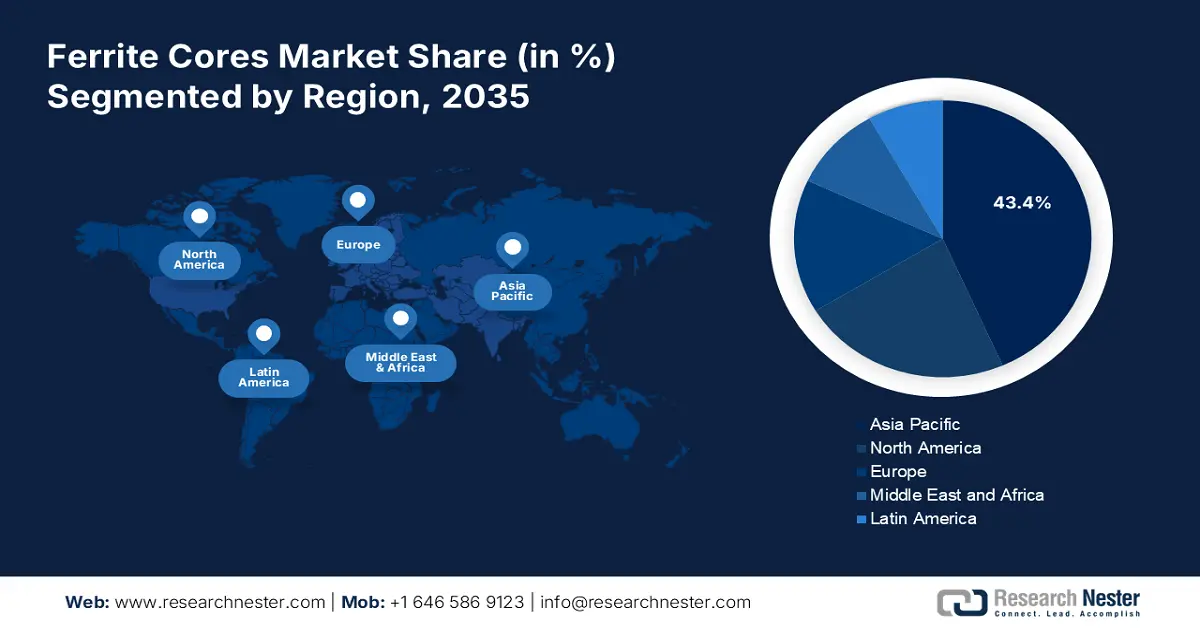

- Asia Pacific is predicted to hold a 43.4% share by 2035 in the Ferrite Cores Market, owing to the presence of major consumer electronics manufacturers and rising demand for electronic devices.

- The North American ferrite cores market is expected to capture a 22.9% share by 2035, impelled by increasing adoption in electronics, electric vehicles, and healthcare applications.

Segment Insights:

- The soft ferrite cores segment is projected to account for 71.2% share by 2035 in the Ferrite Cores Market, owing to their magnetic characteristics, which provide efficient performance in transformers and inductors.

- The manganese-zinc (Mn-Zn) ferrite cores segment is expected to hold a noteworthy share by 2035, propelled by their versatile magnetic properties suitable for a wide range of electrical applications.

Key Growth Trends:

- Rising use of ferrite cores in the healthcare industry

- Rapid expansion of the telecommunication sector

Major Challenges:

- Volatility in Raw Material Prices

- Availability of alternative material

Key Players:Ferroxcube, Samsung Electro-Mechanics, Fair-Rite Products Corp., Cosmo Ferrites Limited, VACUUMSCHMELZE GmbH & Co. KG, Delta Manufacturing Limited, Guangdong FengHua Advanced Tech, Kitagawa Industries, Hitachi Metals, Ltd., Arnold Magnetic Technologies, JFE Ferrite Co., Ltd., Daido Steel Co., Ltd., Bourns, Inc., Lynas Rare Earths Ltd., Kumar Magnet Industries

Global Ferrite Cores Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.9 billion

- 2026 Market Size: USD 5 billion

- Projected Market Size: USD 7.8 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.4% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: Vietnam, India, Mexico, Thailand, Indonesia

Last updated on : 24 October, 2025

Ferrite Cores Market - Growth Drivers and Challenges

Growth Drivers

- Rising use of ferrite cores in the healthcare industry: The increased demand for ferrite cores in the healthcare industry is driving market expansion. Enhanced ferrite cores are used as a contrast agent for magnetic resonance imaging (MRI) and medical X-ray diagnosis. Growth in the market is also fueled by the expanding applications of MRI technology, particularly in the diagnosis of cancer. The ferrite cores market expansion is further aided by the extensive use of ferrite cores in a wide range of medical applications. Ferrite cores are utilized in transformers in power supplies for medical devices. They aid in lowering heat production and increasing efficiency, particularly in high-power applications. The market is also expanding as a result of government spending on the healthcare sector and technical advancements in the field.

- Rapid expansion of the telecommunication sector: The telecommunications sector's explosive growth following the rollout of 5G networks. The growth in demand for high-frequency components has led to a rise in the need for ferrite cores, which are utilized in antennas and radio frequency devices. Inductors require a core that can effectively accommodate the high frequencies used in telecom networks. EP cores, which are usually composed of iron powder or ferrite, are perfect for telecom applications since they have minimal core losses and work well in high-frequency settings. Despite their excellent performance, telecom inductors are capable of remaining small due to the compact design of EP cores. This is essential in telecom systems where cost-effectiveness is a major consideration and space is restricted.

- Renewable Energy and Electrification: The increasing electrification and the adoption of renewable energy are the major forces behind the global demand for ferrite cores. Ferrite cores are an important component of electric vehicles (EVs) and renewable power systems, since they have better magnetic properties and energy efficiency. According to the assessment conducted by the U.S. Department of Energy (2023), if countries aim to achieve the net-zero goal by 2050, the demand for such vital materials as ferrites is likely to grow tremendously, and the production of electric vehicles is predicted to increase significantly by 2030. The growth of renewable energy capacity, specifically wind and solar, also contributes to the growth of the high-performance ferrite cores in power conversion equipment, supporting the continuous market expansion based on the global decarbonization process.

Challenges

- Volatility in Raw Material Prices: The volatility of raw material prices is one of the main factors limiting the global ferrite cores market. Iron oxide, nickel, and zinc are common materials used to make ferrite cores, and their prices might vary depending on supply and demand. Price fluctuations can have a big effect on production costs, which lowers businesses' profit margins. Price fluctuations for raw materials can have an impact on ferrite core makers' profitability and make it challenging to predict consumer prices. Additionally, the increasing stress of geopolitical tensions, trade restrictions, and transport disruptions contributes to supply uncertainties. Manufacturers also have problems with long-term contracts that are not stable and slow down the production timeline, and also increase operational risks. All these contribute to the heightened market instability and reluctance to make capital investments in the ferrite cores market.

- Availability of alternative material: The availability of alternative materials, including composites and powdered iron cores, presents a threat to competition, especially for applications that call for affordable and lightweight solutions. In some circumstances, new materials that might be more effective or less expensive are being developed. Ferrite cores must continue to improve or become more affordable to remain competitive. Moreover, the development of nanomaterials and magnetic alloys is increasing the number of choices available to designers, and can help usher in less reliance on the old ferrite cores. Innovation and adaptation by the ferrite manufacturers will play a very important role in the retention of market share in the changing needs of the industry.

Ferrite Cores Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 4.9 billion |

|

Forecast Year Market Size (2035) |

USD 7.8 billion |

|

Regional Scope |

|

Ferrite Cores Market Segmentation:

Type Segment Analysis

The soft ferrite cores segment is projected to grow with the largest ferrite cores market share of 71.2% by 2035, owing to their magnetic characteristics, which provide efficient performance in transformers and inductors. They are a preferred option for a variety of electrical devices due to their versatility in high-frequency operations, which accounts for their widespread usage. These ferrite cores are effective and versatile, particularly in contemporary electronic gadgets that require the best electromagnetic performance.

Mn-Zn ferrites with high permeability and low power losses at low frequencies have wide use in transformers and inductors in automotive, telecommunications, and consumer electronics applications. The applications are critical to improving the performance and energy efficiency of electronic gadgets. On the other hand, Ni-Zn ferrites, which are more desirable due to their high resistivity and high-frequency application, are also used in broadband transformers and antennas, particularly in the telecommunications sector. The growing power requirement of ferrite-based materials in electric cars, renewable energy, and 5G networks is driving the development of such materials.

Material Segment Analysis

The manganese-zinc (Mn-Zn) ferrite cores segment is likely to hold a noteworthy share by the end of 2035. Since Mn-Zn ferrite cores have well-known and versatile magnetic properties, they are a preferred choice in many electrical applications. In transformer and inductor applications, high magnetic permeability is required, as this material works remarkably well. The ferrite cores market environment highlights manganese-zinc ferrite cores' effectiveness, which is indicative of their wide range of applications and efficiency in many electronic devices.

High-permeability Mn-Zn ferrite cores hold the characteristics that are essential in applications where energy transport at low frequencies is necessary. They are very easily permeable, thus can be made into compact designs in transformers and inductors, which are vital in the automotive and power supply systems. Improvement in the manufacturing process has resulted in better consistency and performance of these materials. Low-loss Mn-Zn ferrite cores reduce the energy dissipated in high frequency, thus their use is suitable for high frequency power supply and communication devices. It has been designed to optimize microstructures and sintering conditions to obtain low core losses and to increase the efficiency of electronic devices. The combination of these improvements in Mn-Zn ferrite core materials leads to the creation of more efficient and smaller electronic units, which has been driving market growth.

Application Segment Analysis

The transformer segment is projected to grow steadily over the forecast years from 2026 to 2035. Transformer cores are made of ferrite so that they can transfer energy with high efficiency, as ferrite reduces the losses of the core and enhances the magnetic properties, which are necessary in converting power and regulating voltage in all industries. The U.S Department of Energy describes the benefit of using efficient transformers in power grids as the resulting saving of electrical energy in the form of billions of kilowatt-hours each year. Additionally, energy losses can be minimized by up to 11% to 29% with lower-loss medium-voltage, liquid-immersed distribution transformers, leading to high energy and cost savings throughout their lifespan. This efficiency gain is concurrent with the rising need for ferrite cores, which are key components of transformers that facilitate such energy-saving, thus contributing to the growth of the ferrite cores market. Furthermore, the current trend towards energy efficiency standards worldwide is likely to maintain a strong demand for ferrite core-based transformers in the industrial and consumer markets, contributing to the growth of the market on the whole.

Our in-depth analysis of the ferrite cores market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Material |

|

|

Application |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ferrite Cores Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is expected to lead the ferrite cores market with a share of 43.4% during the forecast period. This is due to the presence of significant consumer electronics manufacturers in the region, as well as rising consumer electronics demand. The need for ferrite cores in the area is also anticipated to be driven by the growing use of electric vehicles and renewable energy sources. For example, Vietnam had exports of USD 72.6 billion of electronics, computers, and components in 2024, 26.6% higher than 2023, and constituted 17.9 percent of total exports in the country. In addition, foreign direct investment in ASEAN manufacturing, especially electronics, has increased by 134% to USD 45 billion, according to SEADS. This intensive industry contributes to the increasing demand for ferrite cores that are needed in electronic circuits for filtering, inductance, and the suppression of electromagnetic interference. Furthermore, the growth is largely influenced by the high rate of mobile technologies and digital infrastructure growth. Enterprise Asia estimates that mobile technologies and services contributed 5.3% to the GDP in the region in 2023, equivalent to USD 880 billion in economic value, and estimates this to increase to USD 1 trillion with the implementation of 5G in 2030. Additionally, the mobile internet users in the area are projected to grow by 1.4 billion in 2023 (51% penetration) to 1.8 billion in 2030 (61% penetration). This trend leads to the need to upgrade electronic parts such as ferrite cores in filters, inductors, and RF modules required in the present communication and power electronics.

China is anticipated to be the Asia-Pacific region's biggest ferrite cores market for ferrite cores. The need for ferrite cores is anticipated to be driven by the nation's sizable electronics industry and the rising demand for consumer devices, including smartphones and tablets. Furthermore, it is anticipated that the nation's initiatives to switch to renewable energy sources such as solar and wind will raise demand for ferrite cores in the area. For instance, the renewable energy sector is dominated by China, which has 180 GW of utility-scale solar and 159 GW of wind power under construction, propelling colossal clean energy infrastructure growth. This explosive solar and wind capacity increase creates a high demand for ferrite cores, key elements in transformers, inverters, and other power electronics in the operation of renewable energy systems.

In addition, in March 2025, the Ministry of Finance's Department of Revenue issued a notification imposing an anti-dumping charge on Chinese imports of Soft Ferrite Cores. This action comes after an inquiry by a designated body found that the domestic industry was being materially harmed by the dumped items. Soft ferrite cores made of manganese zinc that fall under tariff item 8505 11 10 and have certain geometries and lengths are subject to the duty. The duty rates differ, with 31% applied to items from Huzhou Halting Electronic Technology Co., Ltd., zero for Yabim Yinchuan Electronics Co., Ltd. and Hengan Group DMEGC Magnetics Co., Ltd., 35% for all other Chinese firms, and 35% when the country of export is any country other than China.

India has seen remarkable growth in the market, renowned for its cutting-edge electronics sector. The demand for ferrite cores in the nation is also anticipated to be driven by the increasing use of electric vehicles and renewable energy sources such as solar power. The need for ferrite cores in the nation is also anticipated to be driven by solar power. For example, as of July 2025, the solar power capacity in India had reached 119.02 GW, with the total renewable energy capacity of India standing at 227 GW, and this is due to government programs such as the PM Surya Ghar Yojana and PM Kusum Yojana, which encourage the use of solar power. This strong development of the solar infrastructure directly increases the need for ferrite cores that are the key elements in the solar inverters, power electronics necessary to convert and provide electricity efficiently, and to distribute energy in the growing renewable industry. In addition, in November 2021, the Indian government also selected 42 companies under the PLI Scheme in White Goods with an investment of about Rs. 4,614 crore (USD 619 million) in the manufacture of air conditioners and LED components. This program will enhance domestic production and exports, and this is an aspect of the electronics production strategy set at USD 300 billion, which will result in increased demand for ferrite cores used in these electronic products. Moreover, this will open up a lot of growth prospects for both exports and domestic consumption in India. Every government program, including PLI and SPECs, is a step in the right direction.

North America Market Insights

The North American ferrite cores market is projected to grow with a significant revenue share of 22.9% over the forecast years, primarily driven by the growing need for electronics and automobiles, electric vehicles, and renewable energy systems. The growing utilization of ferrite cores in healthcare applications, especially in MRI and medical diagnostics, transformers, and power supplies of medical devices. For example, the creation of manganese ferrite-type MRI contrast agents, which improve imaging sensitivity and imaging resolution of liver diagnostics. The development is an illustration of the growing need for ferrite cores in the North American healthcare industry, specifically in the MRI and medical diagnostics markets, which are expanding given their significance in enhancing the accuracy of the diagnosis.

Additionally, the development of telecommunications, in particular, the implementation of 5G networks, greatly increases the demand for ferrite cores in antennas and high-frequency inductors. For instance, the OpenCoreNet project, the NIST 5G Core Networks Testbed, is an example of the North American interest in developing 5G networks with state-of-the-art core and edge network components, suitable for major applications in vehicle teleoperation and control in industries. This massive government project is a driver of high-performance ferrite core use in antennas and inductors, which are needed to ensure low-loss and high-frequency signal management is realized in the growing 5G networks throughout the region. Furthermore, the development of industrial automation and the government financing of renewable energy also led to the growth of demand. According to the official statistics and reputable reports by industry observers, these drivers are being facilitated by government expenditure on health and industry, and the impetus to use energy-efficient, environmentally friendly technologies such as electric cars and solar/wind power.

The ferrite cores market in the U.S. is expected to dominate the North American region with a significant share by 2035, attributed to a growing industrial automation industry and robust federal investment in renewable energy projects, such as solar and wind projects, that will mitigate carbon emissions. The Office of Energy Efficiency and Renewable Energy (EERE) in the U.S. Department of Energy promotes large-scale investment in solar, wind, and energy-efficiency technologies, which has led to a decrease in carbon emissions and a transition to clean energy systems. This federal subsidy drives demand for ferrite cores in transformers and inductors in the renewable energy infrastructure, which supports the market growth in the U.S.

Additionally, the rise of electric vehicles and increased demand in telecommunications support further growth. The United States Department of Homeland Security outlines the importance of 5G and future 6G in the development of communication infrastructure that is of critical significance in national security and economic development. With the growth of telecommunication networks, a larger use of 5G elements, including antennas and inductors with ferrite cores, is growing the ferrite cores market in the U.S by facilitating higher-frequency signal processing with low loss that is vital to current wireless networks. Ferrite cores are extensively used in transformers, inductors, and power supplies, which are critical for these sectors. Government regulations emphasizing energy efficiency and environmental sustainability continue to foster the adoption of ferrite core technology across industries.

Canada’s ferrite cores market is likely to grow steadily during the projected years, attributed to the emphasis on clean energy, such as hydroelectric, solar, and wind energy, as a pillar of its energy portfolio. The automation industry of the country, the encouragement of electric vehicles, and the establishment of renewable energy infrastructure contribute to the demand for ferrite cores. According to Statistics Canada, the latest motor vehicle registration in Canada exhibits a gradual increment, with zero-emission vehicles (ZEVs) taking the market share. This massive adoption of ZEVs spurs the demand for ferrite cores in electric car power electronics, which promotes market expansion as they contribute to energy efficiency and electromagnetic interference.

Moreover, official government programs to boost green technology and reduce greenhouse gas emissions accelerate the use of ferrite cores in power transformers and electronic devices. For instance, the 2035 Nationally Determined Contribution of Canada pledges that by 2030, Canada will cut greenhouse gas emissions by 40-45 percent of the 2005 levels and by 2050, the country will have net-zero emissions. The scheme comprises investments worth over CAD 94 billion in clean technology and renewable energy infrastructure that will propel energy efficiency within the power systems. This significant federal investment boosts the demand for ferrite cores in power transformers and electronic parts, which are essential in facilitating energy-efficient renewable energy and electric vehicle technologies and, consequently, market development in Canada.

Europe Market Insights

The European market is expected to expand substantially over the forecast years, mainly due to the rising demand for renewable energy systems and the growing electric vehicle market. The Green Deal regulatory drive of the European Union to achieve energy efficiency and carbon reduction promotes the use of ferrite cores in wind turbines and solar inverters. The European Green Deal is to be climate neutral in 2050, and wind power will have a central role in the plan, as it is already the largest source of electricity in Europe at 15 percent and will become the leading source of electricity in 2027. With 300,000 employees, the wind sector is the core of the economic revival of the EU, creating demand in the ferrite cores involved in wind turbine transformers and power electronics. These clean energy programmes directly assist in the increased market in Europe, as they facilitate power-saving power conversion and reduction of electromagnetic interference, which is highly essential in renewable energy systems.

In addition, the promotion of ferrite cores in the antennas and inductors in Europe is also driven by advances in the telecommunications field, particularly the implementation of 5G. The government investments in the UK amounting to 200 million are an attempt to enhance semiconductor and electronic manufacturing, which entails production of a ferrite core-based manufacturing that is essential in automobiles and the telecommunications industries. The power management is driving the demand for the ferrite cores as the clean energy transition is fueling growth. The market of Germany is advantaged by the fact that the nation has made a 10-billion-euro investment in green technologies, which are in favor of renewable energy and automotive electronics. Germany also has a good manufacturing background, and policies that encourage the reduction of EMI also serve as an impetus for the demand for ferrite cores.

Key Ferrite Cores Market Players:

- Ferroxcube

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Samsung Electro-Mechanics

- Fair-Rite Products Corp.

- Cosmo Ferrites Limited

- VACUUMSCHMELZE GmbH & Co. KG

- Delta Manufacturing Limited

- Guangdong FengHua Advanced Tech

- Kitagawa Industries

- Hitachi Metals, Ltd.

- Arnold Magnetic Technologies

- JFE Ferrite Co., Ltd.

- Daido Steel Co., Ltd.

- Bourns, Inc.

- Lynas Rare Earths Ltd.

- Kumar Magnet Industries

To provide high-quality, robust, and adaptable ferrite cores that satisfy the changing demands of sectors such as telecommunications and renewable energy sources, major firms are investing resources in research and development. Prominent companies are increasing their ferrite cores market share through partnerships and acquisitions. Additionally, concentrate on growing and diversifying their product lines to meet the various demands of end users in various sectors. This strategy appeals to customers who care about the environment in addition to meeting legal requirements.

Top Global Ferrite Cores Manufacturers

Recent Developments

- In July 2025, TDK Corporation introduced a new series of massive-sized ferrite cores into various shapes such as E, U, I, PM, and PQ. A wide range of power ferrite materials is used to make the cores, such as N27, N87, N88, N92, N95, and N97. The launch is known as the most extensive ferrite cores line in the industry, which aims at industrial clients, including motor drives, EV charging systems, railway traction, power transformers, UPS systems, solar inverters, and welding and medical equipment. The cores have low-loss optimization at high switching rates, and stable thermal performance between +100 °C and +140 °C. Toshiba, known as TDK, also provides coil former accessories and mounting hardware that are compatible with the annuities.

- In August 2024, Vishay Intertechnology expanded its shielded IFDC and semi-shielded IFSC families of wire-wound, surface-mount ferrite inductors with three new devices in the sizes 2020DE, 3232DB, and 5050HZ. These are low-cost, high-performance inductors with better inductance and inductive current ratings, with reduced DCR, as compared to previous-generation ferrite offerings, and are suitable for computer and consumer applications. The new devices have high performance versus comparable-sized devices, including higher operating temperatures to +125 °C and operating voltages to 120 V. The IFSC-2020DE-01 and IFSC-3232DB-01 have 40 times lower DCR, and the IFDC-5050HZ has high saturation currents up to 14 A. Samples and production quantities of the new inductors are available now, with lead times of 10 to 12 weeks.

- In February 2024, Bourns announced the launch of its SRR5228A and SRR5828A series of shielded power inductors, both equipped with a ferrite core and ferrite shield to reduce magnetic field radiation. These automotive-grade inductors are AEC-Q200 compliant and are suited to installations that are noise-sensitive, like automotive driver assistance systems, automotive infotainment, or lighting designs. They can also be used in DC-DC converters and power supplies in consumer, industrial, and telecom uses. There is a range of inductances available up to 1000 μH and a heating current of up to 5.2 A with an operating temperature of -400 °C to +150 °C. They are RoHS-compliant and free of halogen.

- Report ID: 7641

- Published Date: Oct 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ferrite Cores Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.