Honeycomb Paper Market Outlook:

Honeycomb Paper Market size was valued at USD 8.33 billion in 2025 and is expected to reach USD 13.83 billion by 2035, expanding at around 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of honeycomb paper is evaluated at USD 8.72 billion.

The increasing demand for sustainable and eco-friendly packaging solutions is driving the honeycomb paper market. Honeycomb papers offer a lightweight, strong, and recyclable alternative to traditional packaging materials like plastic and corrugated cardboard. As more industries and consumers focus on reducing environmental impact, the adoption of honeycomb paper for packaging and protective applications is rising.

Additionally, its applications across various sectors including automotive, construction, and consumer goods further fuels honeycomb paper market growth. In the automotive industry, honeycomb paper is used for various applications due to its lightweight and impact-resistant properties. It is used in interior panels for vehicle doors, dashboards, and roof linings, door trim panels, and also in automotive flooring and carpeting. The use of honeycomb structures in automotive components can lead to weight reductions of up to 30% compared to traditional materials.

Key Honeycomb Paper Market Insights Summary:

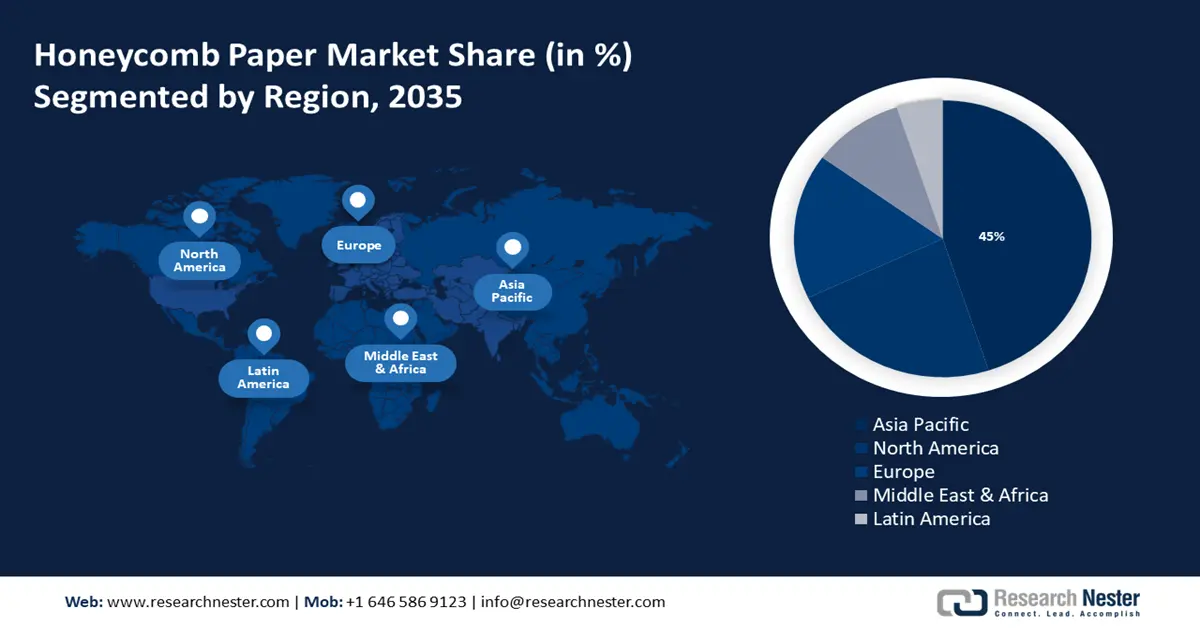

Regional Highlights:

- The Asia Pacific honeycomb paper market will dominate around 45% share by 2035, driven by rapid industrialization and urbanization, fueling demand for honeycomb paper in construction and packaging.

- The North America market will hold notable share by 2035, driven by increasing demand for sustainable packaging, industrial applications, and government regulations.

Segment Insights:

- 10 to 30 mm segment in the honeycomb paper market is expected to achieve 48% growth by the forecast year 2035, driven by its balance of mechanical, insulation, and customization properties.

- The continuous unexpanded core segment in the honeycomb paper market is projected to experience a massive CAGR through 2035, driven by lightweight, strong material use in aerospace applications.

Key Growth Trends:

- E-commerce expansion

- Growing construction industry

Major Challenges:

- Competition from alternative materials

- Limited availability of raw materials

Key Players: YOJ-Pack-Kraft, Schütz GmbH & Co. KGaA, MAC PACK, Lsquare Eco Products Pvt. Ltd., Helios Packaging, Crown Holdings, Inc., Greencore Paper Conversion Pvt. Ltd., Axxor, EcoGlobe Packaging Private Limited.

Global Honeycomb Paper Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.33 billion

- 2026 Market Size: USD 8.72 billion

- Projected Market Size: USD 13.83 billion by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Thailand, Malaysia, Indonesia

Last updated on : 17 September, 2025

Honeycomb Paper Market Growth Drivers and Challenges:

Growth Drivers

- E-commerce expansion - With the rise of online shopping, there is a greater need for efficient, protective, and sustainable packaging solutions. Honeycomb paper is increasingly used for packaging and cushioning products during shipping, ensuring they arrive safely and intact. Additionally, e-commerce companies are aggressively adopting eco-friendly practices. Honeycomb paper, being recyclable and biodegradable, aligns with the sustainability goals of online retailers and caters to environmentally conscious consumers.

- Growing construction industry - Honeycomb paper is used in lightweight and durable wall panels and partitions, which are essential for modern, flexible building designs. These panels offer good thermal and acoustic insulation. Moreover, honeycomb paper is also incorporated into flooring systems to provide structural support while reducing weight, which can be beneficial in both residential and commercial buildings. For instance, honeycomb paper sandwich panels have been used in commercial buildings like office spaces and industrial warehouses.

- Sustainability in packaging - The packaging industry is a major contributor to plastic waste and there is a growing shift towards more sustainable alternatives like honeycomb paper. Many regions are implementing regulations and bans on single-use plastics. For instance, the European Union’s Single-Use Plastic Derivative aims to reduce plastic waste by restricting the use of certain plastic products. This regulatory environment pushes companies to seek eco-friendly alternatives, such as honeycomb paper for packaging.

Challenges

- Competition from alternative materials - There are numerous alternative materials in packaging and construction that are also advancing in sustainability and performance, such as biodegradable plastics and advanced composites. The presence of such well-established and emerging alternatives can pose competitive challenges for the honeycomb paper market.

- Limited availability of raw materials - The production of honeycomb paper relies on specific raw materials, such as specialized paper and adhesives, which may have limited availability or price volatility. These fluctuations can affect production stability and pricing of honeycomb paper products.

Honeycomb Paper Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 8.33 billion |

|

Forecast Year Market Size (2035) |

USD 13.83 billion |

|

Regional Scope |

|

Honeycomb Paper Market Segmentation:

Cell Size

The 10 to 30 mm segment is anticipated to hold honeycomb paper market share of more than 48% by 2035. The honeycomb paper products drive market growth by providing versatile and efficient solutions for packaging and construction applications. This range offers a balance of mechanical properties, insulation, and customization options that meet the needs of various industries, contributing to the market expansion.

Core Type

The continuous unexpanded core segment dominates the honeycomb paper market and is expanding at a massive CAGR. Honeycomb paper with continuous unexpanded cores is used in aerospace applications for its lightweight and strong properties. For instance, Boeing uses honeycomb panels in aircraft interiors to reduce weight and improve efficiency. The Gill Corporations’ GILLFLOOR 4417 is a high strength floor panel made from unidirectional fiberglass reinforced epoxy facings bonded to meta-aramid honeycomb core used in versatile flooring panels suitable for different areas in aircraft.

Our in-depth analysis of the honeycomb paper market includes the following segments:

|

Core Type |

|

|

Cell Size |

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Honeycomb Paper Market Regional Analysis:

APAC Market Insights

Asia Pacific industry is expected to hold largest revenue share of 45% by 2035. Rapid industrialization and urbanization is driving the demand for honeycomb paper products in construction and packaging. Urban development projects and infrastructure improvements contribute to the growing need for lightweight and durable materials. Moreover, the increasing awareness of environmental concerns and the push towards reducing plastic waste have increased the adoption of eco-friendly packaging solutions.

China is a major contributor to the Asia Pacific honeycomb paper market due to its extensive industrial base and construction projects. The country’s focus on sustainable development and environmental regulations also supports the adoption of honeycomb paper.

Presence of active key players in India such as Hexacell Packaging Pvt Ltd., EcoGlobe Packaging Pvt Ltd, and Packraft Container India are providing honeycomb paper products for various applications.

South Korea’s construction industry, focusing on high-tech and green building solutions, supports the use of honeycomb paper in construction materials. The industry is projected to grow steadily with increasing investments in infrastructure and sustainable building practices.

North American Market Insights

The market in North America is expected to gain a notable honeycomb paper market share by the end of 2035. The growth is attributed to the growing demand for sustainable packaging, industrial applications, and technological advancements. Moreover, supportive government policies and regulations drive further adoption of honeycomb paper in the region.

In the U.S., the rapid growth of e-commerce and online retailing provide opportunities for honeycomb paper manufacturers to offer customized packaging solutions tailored to the needs of online sellers and consumers.

Businesses in Canada are investing in eco-friendly packaging solutions and promoting innovation. Companies that explore alternative materials and design solutions contribute to the ongoing development of sustainable packaging technologies. This not only benefits the environment but also positions businesses as pioneers in their industry.

Honeycomb Paper Market Players:

- Honicel Nederland B.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- YOJ-Pack-Kraft

- Schütz GmbH & Co. KGaA

- MAC PACK

- Lsquare Eco Products Pvt. Ltd.

- Helios Packaging

- Crown Holdings, Inc.

- Greencore Paper Conversion Pvt. Ltd.

- Axxor

- EcoGlobe Packaging Private Limited

- DuPont de Nemours, Inc.

The key players are investing in technological advancements and innovative designs to enhance the performance and sustainability of their honeycomb packing solutions, catering to the stringent demands of various industries including electronics, automotive, and e-commerce.

Recent Developments

- In January 2024, the European Manufacturers Paper Honeycomb Association (EMPHA) a pan-European association for paper honeycomb core and board product manufacturers has joined the environmental campaign Two Sides to support the promotion of environmentally friendly packaging options and will permit the EMPHA to utilize Two Sides' resources, such as industry data and sustainability guidance.

- In April 2023, DuPont de Nemours, Inc. the largest aramid paper provider for honeycombs introduced Kevlar N636 1 mil paper to provide aerospace clients with a novel, cost-effective, and simple-to-use method for producing honeycomb core panels that are more than 15% lighter or more which aids in reducing the carbon footprint of an airplane.

- Report ID: 6307

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Honeycomb Paper Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.