Paper Pigments Market Outlook:

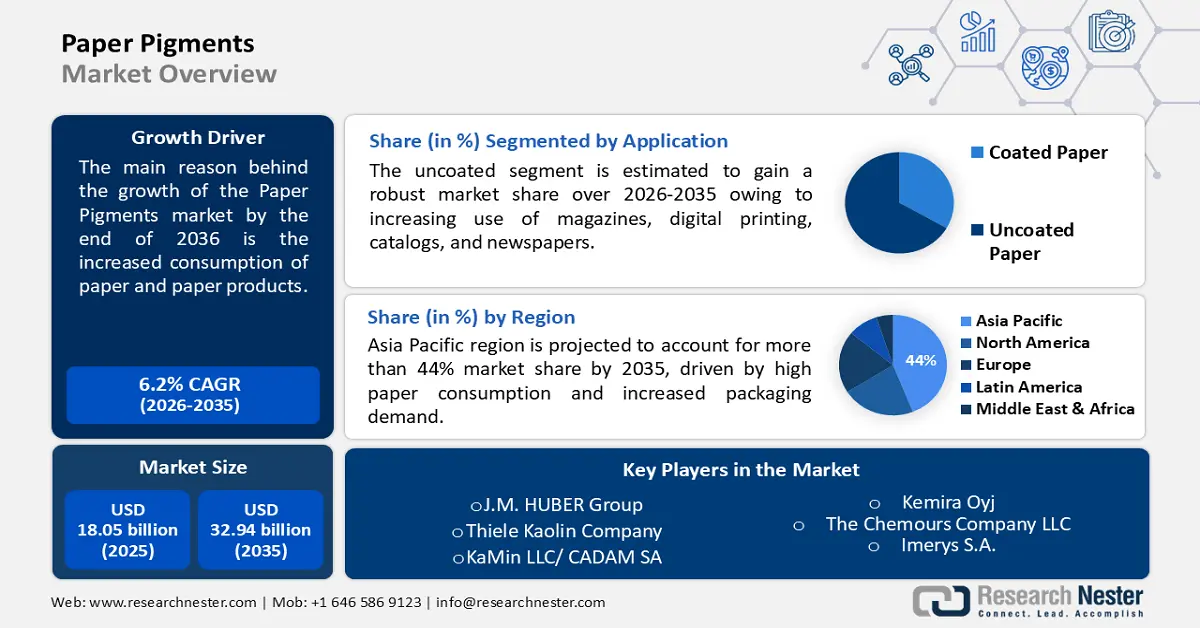

Paper Pigments Market size was valued at USD 18.05 billion in 2025 and is set to exceed USD 32.94 billion by 2035, registering over 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of paper pigments is estimated at USD 19.06 billion.

The growth of the market can be attributed to the increased consumption of paper and paper products. Recently, it was estimated that global consumption of paper totaled 400 million tons in 2020. This figure is projected to rise in the next decade with the consumption value at around 470 million tons by 2031. The increasing use of paper in various industries including the packaging industry. The restriction from the government over plastic usage increased the use of paper for packaging goods and products. Paper is an eco-friendly product and can be disposed of easily as it does not harm the environment even after combustion.

The recent industrialization has led to an increment in the utilization of paper across various industries. Owing to its advantages such as improving the appearance of color and insolubility. Thus, the large production of paper for various purposes is estimated to expand the paper pigment market size in the forecast period. In 2022, it was anticipated that approximately 300 million tons of paper are produced across the world every year. The growing number of educational institutions, land dealings, and medical sectors is also estimated to boost the market growth. The market growth is also attributed to the increasing finance sector during the forecast period.

Key Paper Pigments Market Insights Summary:

Regional Highlights:

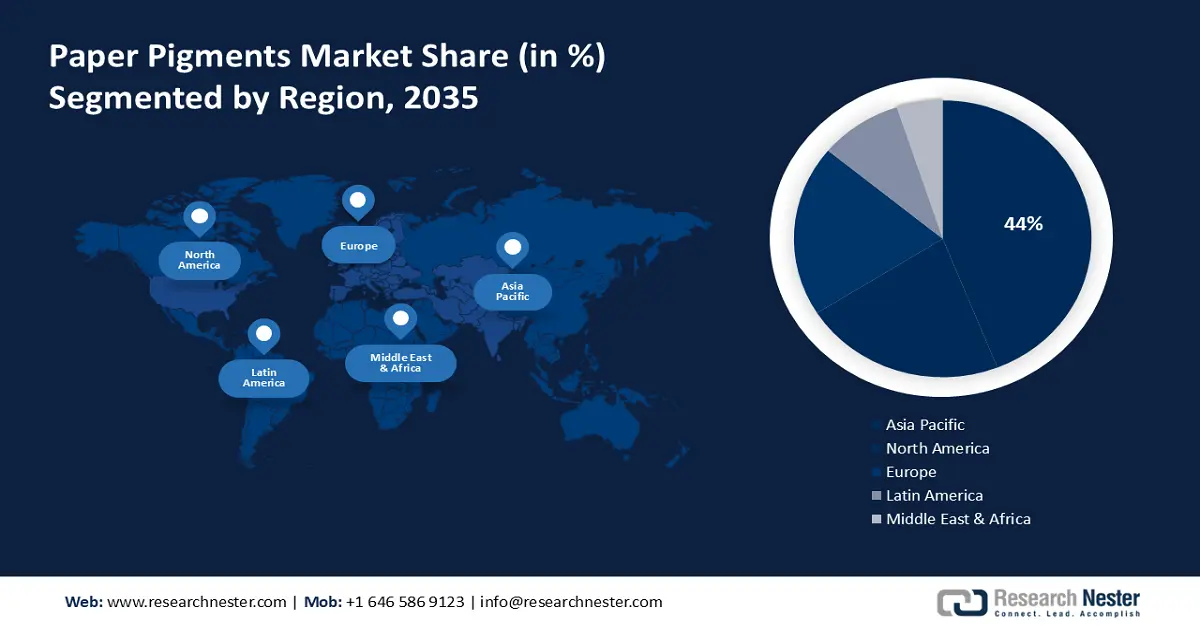

- The Asia Pacific paper pigments market will dominate over 44% share by 2035, driven by high paper consumption and increased packaging demand.

Segment Insights:

- The uncoated paper segment in the paper pigments market is expected to capture the largest share by 2035, driven by increasing use in magazines, digital printing, catalogs, and newspapers.

- The packaging segment in the paper pigments market is projected to achieve the highest market share by 2035, fueled by fast industrialization and the shift to paper-based packaging due to plastic bans.

Key Growth Trends:

- Increased Production of Packaging Paper Across the World

- Recent Demand for Printing and Writing Paper with Increasing Institutions

Major Challenges:

- Environmental Concerns Regarding Paper Recycling

- Stringent Government Rules to Protect Plants and Prevent Deforestation

Key Players: Omya AG, Kemira Oyj, The Chemours Company LLC, Imerys S.A., BASF, Minerals Technologies Inc., Ashapura Group, J.M. HUBER Group, Thiele Kaolin Company, KaMin LLC/ CADAM SA.

Global Paper Pigments Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.05 billion

- 2026 Market Size: USD 19.06 billion

- Projected Market Size: USD 32.94 billion by 2035

- Growth Forecasts: 6.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 9 September, 2025

Paper Pigments Market Growth Drivers and Challenges:

Growth Drivers

-

Increased Production of Packaging Paper Across the World – The adoption of paper packaging across various industries such as food & beverages, bakery, confectionery, personal care & cosmetics, and others, are expected to boost the demand for paper pigments. It was estimated that the production value of global packaging paper and board was around 257,000 metric tons in 2018, up from 236,000 metric tons in 2016.

-

Recent Demand for Printing and Writing Paper with Increasing Institutions – Lately, it was estimated that the global consumption of printing and writing paper was approximately 90 million tons in 2021.

-

Soaring Expenditure on Chemical Industry Owing to Rising Use of Dyes – The capital expenditure on the global chemical industry is projected to be USD 239 billion in 2023. This is a significant rise from USD 220 billion in 2020.

-

High Investment in Research and Development Activities – World Bank revealed the statistics of the expenditure made in the research and development sector in 2020 amounted to 2.63% of the total GDP globally. This was a rise from 2.14% of the total GDP in 2016.

Challenges

- Environmental Concerns Regarding Paper Recycling - The paper is made from wood pulp which increases deforestation and the loss of many plants. To reduce this government has passed regulations to decrease the use of paper in the industries and packaging sectors. The extreme cutting of trees can cause global warming across the world hampering the market growth during the forecast period.

- Stringent Government Rules to Protect Plants and Prevent Deforestation

- Growing Digitization of the World

Paper Pigments Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 18.05 billion |

|

Forecast Year Market Size (2035) |

USD 32.94 billion |

|

Regional Scope |

|

Paper Pigments Market Segmentation:

Application Segment Analysis

The global paper pigments market is segmented and analyzed for demand and supply by application into coated paper and uncoated paper. Out of the two types, the uncoated paper segment is estimated to gain the largest market share over the projected time frame. The growth of the segment can be attributed to the increasing use of magazines, digital printing, catalogs, and newspapers. The newspapers and magazines are the daily routines of many industries and organizations to get updates on the sector. The newspaper carries industrial, political, and other types of general information. The increasing use of newspapers by many educational students to gather information is also estimated to boost the market growth. The number of people who used newspapers in the U.S. in the year 2020 as per the estimations was about 24 million on weekdays and over 25 million on weekends.

End-user Segment Analysis

The global paper pigments market is also segmented and analyzed for demand and supply by the end-user industry into print media, stationary, packaging, personal care, and others. Out of these, the packaging sector is anticipated to garner the highest market share by 2035. Fast industrialization has propelled the population to adopt online shopping, further prompting the production of paperboard. Thus, the high consumption of paperboard is estimated to foster the demand for paper pigments and expand the size of the market. According to records, the global consumption of paper and paperboard totaled 410 million tons in 2021. The consumption is projected to rise over the upcoming years and reach 480 million tons by 2032. The increasing number of people shopping in stores is also estimated to increase the market growth as many stores totally banned plastic for packaging products. Paper bags, paper cups, and paper plates in hotels and the food sector is driving the market growth during the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Application |

|

|

By End User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Paper Pigments Market Regional Analysis:

APAC Market Insights

Asia Pacific region is projected to account for more than 44% market share by 2035. The growth of the market can be attributed majorly to the high consumption of paper in the region. China is the largest producing country which produced 120 million tons of paper in 2020. Further, the high consumption of paper units in the region is another growth factor of the market. As per the estimations in 2018, about 460 billion units of paper and paperboard packaging are used across the Asia Pacific region. The increasing number of educational institutions and growing industries across the region are estimated to propel market growth. The rising number of hospitals and healthcare centers is also anticipated to drive market growth in the coming years. Also, the growing paper packaging industries in the region is also expected to hike the market growth.

North American Market Insights

Further, the North American paper pigments market is also anticipated to drive market growth owing to the increasing presence of dominant key players in the region. Additionally, the rising number of pigments available in the region is also estimated to drive market growth. The increasing utilization of tissue paper and toilet paper in the region is also the reason for the hike in market growth. According to the estimations, the amount of toilet paper used by Americans in the year 2020 was over 320 million.

Paper Pigments Market Players:

- Omya AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kemira Oyj

- The Chemours Company LLC

- Imerys S.A.

- BASF

- Minerals Technologies Inc.

- Ashapura Group

- J.M. HUBER Group

- Thiele Kaolin Company

- KaMin LLC/ CADAM SA

Recent Developments

-

Kemira Oyj and Veolia Wasser Deutschland have entered into a mutual collaboration. This merger is expected to perform a full-scale technology assessment of the new phosphorus recovery technology ViviMag.

-

Omya AG has joined hands with IFG to enter into an R&D partnership. This collaboration will explore the incorporation of calcium carbonate within fibers.

- Report ID: 4426

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Paper Pigments Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.