Toilet Paper Market Outlook:

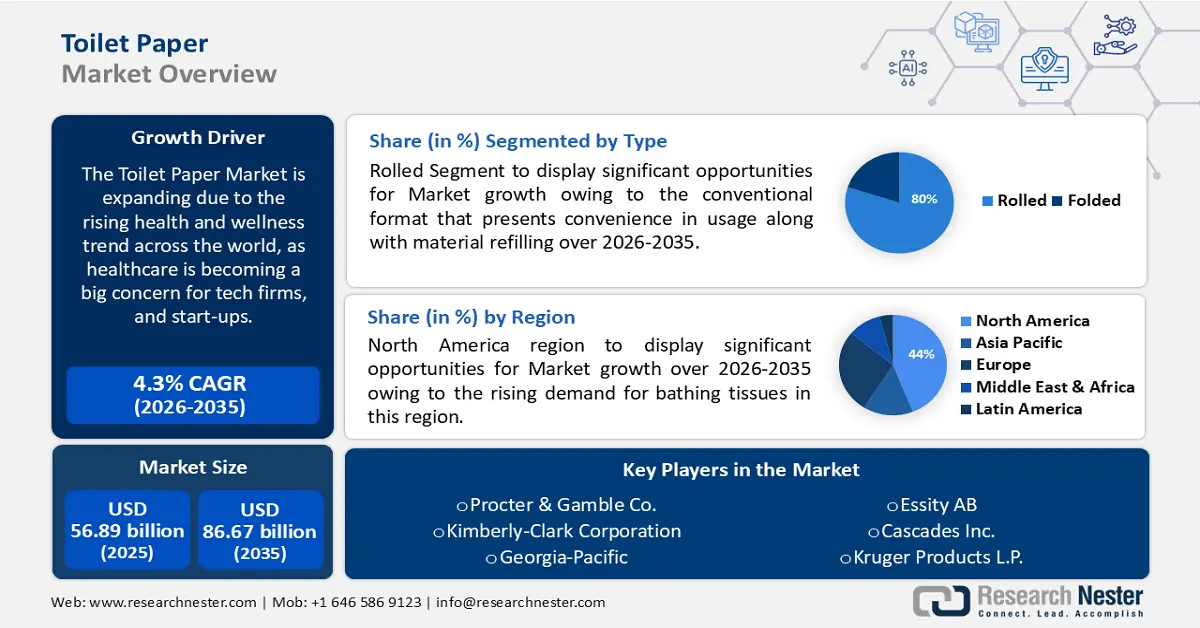

Toilet Paper Market size was over USD 56.89 billion in 2025 and is anticipated to cross USD 86.67 billion by 2035, witnessing more than 4.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of toilet paper is assessed at USD 59.09 billion.

The rising health and wellness trend across the world will exponentially help the market to grow in the upcoming years. Healthcare is becoming a more important focus for tech firms, and start-ups in the field are expanding quickly as well. In 2020, 43% of Americans reported following a particular diet or eating pattern, up from 38% in 2019. Similarly, toilet papers are increasingly used by them after becoming more conscious about their health.

In addition, there is an increase in the expected growth rate of the toilet paper market by the end of 2036 due to the increasing e-commerce industry. As per the recent reports in 2022, e-commerce sales rose by 3% in Europe and 7% in the US and Asia. Furthermore, a virtual sales strategy has been used by over 90% of B2B organizations since 2020, as a result of enhanced process efficiencies and better controlling software.

Key Toilet Paper Market Insights Summary:

Regional Highlights:

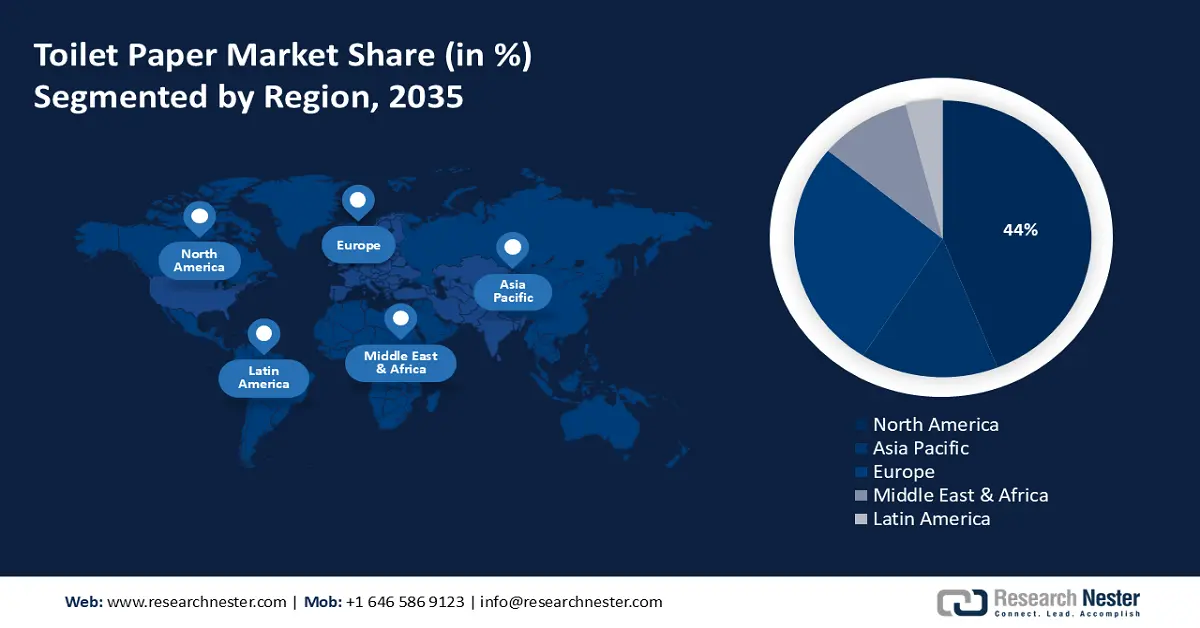

- North America toilet paper market is expected to capture 44% share by 2035, driven by rising demand for bathing tissues and high commercial tissue production.

- Europe market will achieve a 27% share by 2035, attributed to technological advancement in manufacturing toilet papers.

Segment Insights:

- The rolled (type) segment in the toilet paper market is expected to hold a 80% share by 2035, fueled by the conventional and convenient format of rolled toilet paper.

- The hospitals segment in the toilet paper market is projected to hold a 49% share by 2035, attributed to the rising emphasis on patient hygiene in global healthcare facilities.

Key Growth Trends:

- Rising consumer interest in sustainable toilet papers globally

- Increasing travel and tourism after the lockdown

Major Challenges:

- The appearance of bidet toilets

- Disruption in the supply chain systems

Key Players: Procter & Gamble Co., Business PlanningMain Product OfferingsFinancial ExecutionMain Performance IndicatorsKimberly-Clark Corporation, Georgia-Pacific, Essity AB, Cascades Inc., Kruger Products L.P., Metsä Tissue Corporation, Hengan International Group Company Limited, Seventh Generation Inc., Wausau Paper Corp.

Global Toilet Paper Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 56.89 billion

- 2026 Market Size: USD 59.09 billion

- Projected Market Size: USD 86.67 billion by 2035

- Growth Forecasts: 4.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 17 September, 2025

Toilet Paper Market Growth Drivers and Challenges:

Growth Drivers

-

Rising consumer interest in sustainable toilet papers globally - A rising number of consumers are demanding toilet paper manufactured ethically due to their increased awareness of issues like deforestation and global warming. Over 35% of respondents to the toilet paper market research said they looked for items with environmentally friendly packaging, 37% said they picked sustainable products to help protect the environment, and 41% said they avoided using plastic wherever possible.

The global industry has embraced techniques such as sustainable supply chains, alternative fibers, and a reduction in non-recyclable plastic packaging in response to evolving demands. - Increasing travel and tourism after the lockdown - The United Nations World Tourism Organization’s (UNWTO) forward-looking scenarios for 2023 explained that international arrivals have recovered between 80% and 95% of pre-pandemic levels, which is consistent with the quarter 1 2023 findings. The latest UNWTO Confidence Index demonstrated that performance for the period is on pace to be even better than in 2022. The Panel of Experts at UNWTO stated their confidence in a robust peak season (May to August) in the Northern Hemisphere. Increasing demand for hygiene packaging while staying out or traveling somewhere else will help in the toilet paper market expansion.

Moreover, the Global Future Council on Sustainable Tourism places a strong emphasis on developing sustainability standards and metrics, developing a workforce that is inclusive and well-trained, giving local communities a priority, matching traveler numbers with destination capacity, and allocating funds for infrastructure that is pertinent to the destination. - Rise in panic purchasing amongst people recently - According to our recent survey, thirty percent of millennials stated they shop for groceries, twenty-one percent for domestic goods, twenty percent for health products, and eighteen percent for personal care.

Due to their larger storage facilities, large-scale shops with well-established supply chains can handle this better than smaller stores, which mostly restock their inventory on demand. Businesses may easily handle such high demand and maintain ideal stock levels with the aid of a smart, multi-echelon inventory management system.

Challenges

-

The appearance of bidet toilets - While utilizing a bidet can be a terrific alternative to using toilet paper, there are certain disadvantages and hazards involved. Undoubtedly, not everyone is a good fit for a bidet, and people may want to hold off on using one for a while if their immune system is compromised.

-

The worldwide toilet paper business isn't growing as much because of growing environmental worries about things like deforestation and climate change caused by cutting down trees.

- Disruption in the supply chain systems

Toilet Paper Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.3% |

|

Base Year Market Size (2025) |

USD 56.89 billion |

|

Forecast Year Market Size (2035) |

USD 86.67 billion |

|

Regional Scope |

|

Toilet Paper Market Segmentation:

Ply Count Segment Analysis

In toilet paper market, one segment is likely to dominate over 46% share by 2035 driven by the inexpensiveness of the one-ply toilet paper. One-ply papers are shown to be 22% more efficient than two-fold papers in the market survey. It's frequently utilized in business settings where clogged pipes from paper items that don't break down quickly might be a problem, such as airports, schools, etc. To discourage workers from sitting down at their desks too much in the hopes that they can hold it until they get home to the comforts of a two-ply supply, employers also frequently use single-ply.

Application Segment Analysis

In toilet paper market, hospitals segment is predicted to hold more than 49% revenue share by 2035 led by the increasing requirement for patient hygiene in the healthcare sector across the world. The situation of hygiene in healthcare institutions is depicted in a sharper and more concerning light by the recently developed global estimate. 51% of healthcare institutions exceeded the requirements for basic hygiene services, even though 68% of them had hygiene facilities at points of care and 65% had handwashing stations with soap and water at the restrooms.

Type Segment Analysis

In toilet paper market, rolled segment is estimated to hold over 80% revenue share by the end of 2035 on account of the conventional format that presents convenience in usage along with material refilling. 42 million tons of rolled toilet paper are used annually worldwide. If toilet paper were spread out, that would equate to roughly 184 billion rolls, or 22 billion kilometers, covering 2.2 million square kilometers. This entire roll of toilet paper could circle the earth once every ten minutes or make a round trip to the sun every seven days.

Our in-depth analysis of the global toilet paper market includes the following segments:

|

Product |

|

|

Raw Material |

|

|

Ply Count |

|

|

Application |

|

|

Type |

|

|

Place Type |

|

|

Distribution Channel |

|

|

Packaging Type |

|

|

End-User Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Toilet Paper Market Regional Analysis:

North American Market Insights

By the end of 2035, North America region is expected to dominate around 44% toilet paper market share. This market growth will be credited to the rising demand for bathing tissues. This region produces more commercial or away-from-home tissue than any other place in the world, with an average production rate of almost 35%.

Within the consumer tissue, there is competition not only between brands but also between different product kinds in the region. For instance, products that offer more affordable answers to the daily requirements of Americans on a budget, like toilet paper, are putting more competitive pressure on paper napkins and facial tissues.

European Market Insights

By 2035, Europe ABC toilet paper market in Europe region is anticipated to hold more than 27% revenue share and will hold the second position driven by technological advancement in manufacturing toilet papers in this region. Over the past twenty years, the premium segment in toilet paper has grown to represent 25% of the category's overall increase and 15% of all rolls consumed in France, yielding a 20% segment value share.

Precision manufacturing technology is a hallmark of Germany, a manufacturing and technical powerhouse. During the early stages of the business, the nation was instrumental in creating technology related to pulp and paper. This function has persisted into the twenty-first century, as Germany is home to numerous businesses that sell tissue production and convert technologies globally.

Toilet Paper Market Players:

- Procter & Gamble Co.

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kimberly-Clark Corporation

- Georgia-Pacific

- Essity AB

- Cascades Inc.

- Kruger Products L.P.

- Metsä Tissue Corporation

- Hengan International Group Company Limited

- Seventh Generation Inc.

- Wausau Paper Corp.

Recent Developments

Procter & Gamble Co. created Mr. Clean, the household cleaning brand which is similar to indomitable cleaning power, is solving the requirements for cleaning efficiency and advantage and declared the launch of its newest creations - Magic Eraser Ultra Foamy and Magic Eraser Ultra Thick on April 10, 2024.

Kimberly-Clark Corporation declared on March 27, 2024, that Mike Hsu, Chairman, and Chief Executive Officer, and members of his executive management team are uncovered the next phase of the organization's conversion, comprising the latest functional model and main commercial undertakings planned to expand its brands and businesses at a quicker pace than its categories.

- Report ID: 6025

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Toilet Paper Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.