Abrasive Paper Market Outlook:

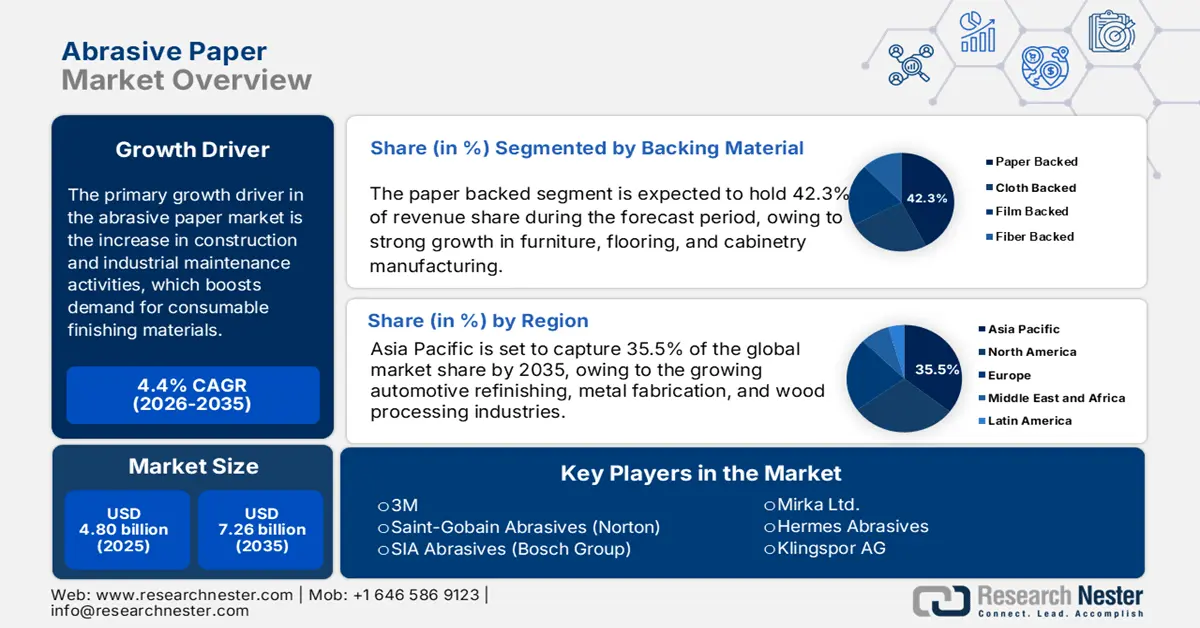

Abrasive Paper Market size was estimated at USD 4.80 billion in 2025 and is expected to surpass USD 7.26 billion by the end of 2035, rising at a CAGR of 4.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of abrasive paper is evaluated at USD 5 billion.

The primary growth driver in the abrasive paper market is the increase in construction and industrial maintenance activities, which boosts demand for consumable finishing materials. According to the U.S. Department of Commerce, total abrasive grain consumption is supported by stronger allocations from merchant and industrial trade sectors. Moreover, demand has been driven by rising infrastructure investments and refurbishment projects.

The supply chain disposition will continue to be based on aluminum oxide sourced globally, with imports increasingly contributing to U.S. grain consumption from 2021 to 2023. The U.S. manufacturers expanded their production capacity through capital reinvestments in grain and cloth coating plants, while some assembly lines were modified and relocated to improve the manufacturing of abrasive paper, which drove primary mercantile demand growth. The U.S. PPIs for abrasive nonmetallic goods rose from 313.40 in May 2024 to 330.60 in May 2025, while the annual percentage increase for final demand goods PPIs exceeded, reflecting the ongoing growth in haul and move services. Investments in research and development focused on improving the durability of grain blends and environmentally friendly bonding agents, supported by regional export agencies providing grants to enhance trade competitiveness.

Key Abrasive Paper Market Insights Summary:

Regional Highlights:

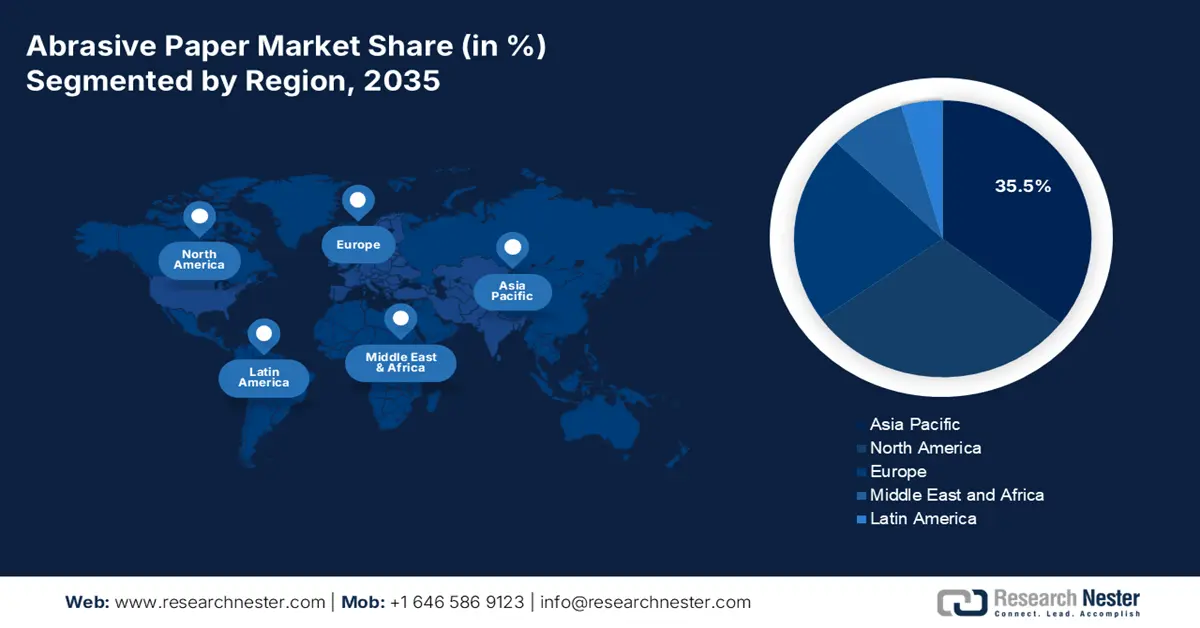

- By 2035, the Asia Pacific region is expected to hold a 35.5% share of the abrasive paper market owing to DIY renovations and an increasing demand for high-quality finishes for furniture

- By 2035, the North American region is projected to capture 29.7% of the market share impelled by advancements in surface finishing technology

Segment Insights:

- By 2035, the paper-backed segment in the abrasive paper market is projected to account for 42.3% of the market propelled by strong growth in furniture, flooring, and cabinetry manufacturing

- By 2035, the aluminium oxide paper segment is anticipated to reach a 38.3% share driven by its high hardness, durability, and effectiveness across wood, metal, and automotive processes

Key Growth Trends:

- Growth in furniture and wood product manufacturing

- Increase in metal fabrication activities

Major Challenges:

- Limited recycling and sustainability adoption

- Intense price competition

Key Players: 3M, Saint-Gobain Abrasives (Norton), Fujimi Incorporated, SIA Abrasives (Bosch Group), Deerfos, Carborundum Universal Limited (CUMI), Mirka Ltd., Hermes Abrasives, Klingspor AG, Awuko Abrasives, Flexovit Abrasives, Kinik Company, Asahi Diamond Industrial Co., Ltd., Kovax Corporation, Nihon Kenshi Co., Ltd.

Global Abrasive Paper Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.80 billion

- 2026 Market Size: USD 5 billion

- Projected Market Size: USD 7.26 billion by 2035

- Growth Forecasts: 4.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: Vietnam, Indonesia, Mexico, Thailand, Turkey

Last updated on : 22 August, 2025

Abrasive Paper Market - Growth Drivers and Challenges

Growth Drivers

- Growth in furniture and wood product manufacturing: The worldwide furniture market is growing due to increasing demand from urban housing and furniture export-driven industries in Vietnam, India, and China, and the overall higher spending power of the population. Abrasive paper is an extremely active form of abrasive production, as it is used for wood sanding and the finishing process before coating the wood. The furniture sector's growth is going to align with increased consumption of coated abrasives, and, therefore, the market for coated abrasives is growing rapidly.

Vietnam Wood Products Exports and Imports (2023)

|

Country |

Export Value (USD) |

Country |

Import Value (USD) |

|

China |

1.86B |

China |

656M |

|

Japan |

1.55B |

United States |

254M |

|

United States |

988M |

Thailand |

125M |

|

Malaysia |

160M |

Chile |

61.6M |

|

Indonesia |

115M |

Brazil |

43.1M |

Source: OEC

- Increase in metal fabrication activities: The metal fabrication demand in energy, aerospace, and industrial equipment is growing in machinery-based metal fabricators. Abrasive paper is an important form of abrasive product, used in deburring, cleaning, and surface finishing of metal materials. The latest statistics also indicated that the shipments of fabricated metal products accounted for USD 42,560 million in June 2025. These are signs of stable demand for abrasive paper as the number of finished and prepared metal products is set to increase worldwide.

- Rising demand from electronics and semiconductor industries: Many electronic devices, printed circuit boards (PCBs), and semiconductor wafers require smaller components and require precise abrasive materials for micro-finishing tasks. Abrasive papers are used for grinding silicon wafers, polishing LCD/LED displays, and surface finishing on electronic housings. With the increasing demand for smartphones, laptops, wearable devices, and 5G infrastructure, many electronic devices are continuing to be a fast-growing end-use segment. Artificial intelligence and automation are strong, emerging trends that will drive growth for ultra-fine finishing abrasives in the future.

1. Abrasive Paper Market Overview

Leading Exporters and Importers of Abrasive Powder, Grain on Paper or Paperboard Support (2023)

|

Country |

Export Value (USD Million) |

Country |

Import Value (USD Million) |

|

China |

249 |

Germany |

150 |

|

Germany |

138 |

United States |

142 |

|

Canada |

129 |

Poland |

99.3 |

Source: OEC

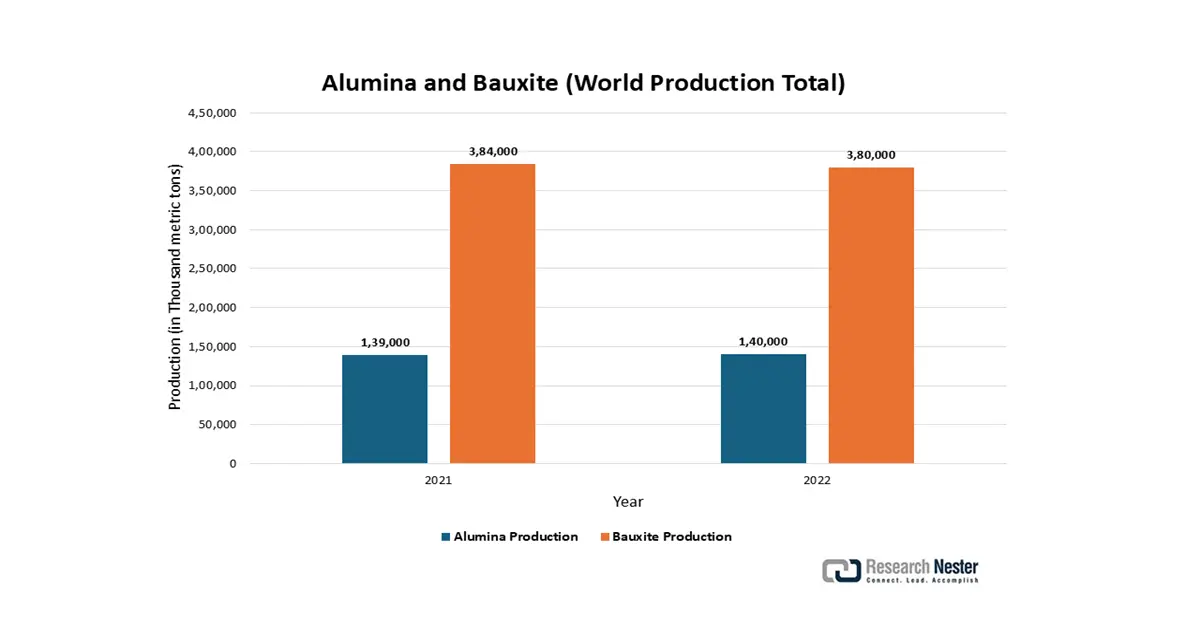

2. Bauxite and Alumina Production

The production of bauxite and alumina is the foundational supply chain for synthetic abrasive grains, primarily aluminum oxide, which is the essential raw material fused onto coated abrasive products. Growth in key consumption sectors, specifically metal fabrication, machinery, and wood product manufacturing, directly drives demand for these high-performance abrasives. Consequently, the stability, cost, and technological advancement of the bauxite-to-alumina value chain are critical determinants of abrasive market capacity, product innovation, and competitive pricing, making it a core indicator of overall industrial abrasives growth.

Source: USGS

Challenges

- Limited recycling and sustainability adoption: There is a limitation on recycling of spent abrasive paper because it is contaminated with foreign matter and bonding resins. This finite circularity of the abrasive paper reduces the recycling of used abrasive paper, contributing to the waste in landfills as well as the strict regulatory aspect of waste disposal regulations. This is driving manufacturers to work on biodegradable backings and eco-friendly bonding agents, yet significant R&D expense and low speed of market adoption continue to be a hindrance to sustainability efforts within the sector.

- Intense price competition: The market is highly fragmented with many regional and unorganized competitors offering low-cost abrasive paper products, particularly in Asia-Pacific. The ITC Trade Map (2023) shows that imports to India from China increased by 15% from 2021 to 2023 as a result of cheaper pricing. The fierce competition lowers average selling prices, which affects the profits of established global manufacturers focusing on premium-quality abrasives, making it difficult for them to pass on higher costs for their raw materials and energy.

Abrasive Paper Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.4% |

|

Base Year Market Size (2025) |

USD 4.80 billion |

|

Forecast Year Market Size (2035) |

USD 7.26 billion |

|

Regional Scope |

|

Abrasive Paper Market Segmentation:

Backing Material Segment Analysis

The paper-backed segment is predicted to gain the largest market share of 42.3% during the projected period, due to strong growth in furniture, flooring, and cabinetry manufacturing, as they are more economical, more flexible, and easier to dispose of than cloth-backed products. According to the U.S. Department of Commerce's International Trade Administration (ITA), U.S. furniture and wood product manufacturing is expected to continue to demonstrate steady growth, thus increasing demand for wood finishing abrasives.

Product Type Segment Analysis

The aluminium oxide paper segment is anticipated to constitute the most significant growth by 2035, with 38.3% abrasive paper market share, mainly due to global standards for performance and cost and subsequent high hardness, durability, and effectiveness across wood, metal, and automotive processes. The Occupational Safety and Health Administration (OSHA) examines its widespread use in metal finishing and automotive surface preparation, based on its value, cost, and performance. NIOSH also recognizes aluminium oxide as the main abrasive workhorse in general-purpose sanding.

End use Segment Analysis

The metal fabrication paper segment is anticipated to constitute the most significant growth by 2035, with a 25.6% abrasive paper market share, mainly due to its usage in grinding, deburring, and surface finishing of metals. Abrasive paper is irreplaceable. In the Asia-Pacific, as infrastructure and machinery demand are increasing, it is driving the market. According to NIST, advancements in standards for metal processing and surface performance are encouraging the protection of coated abrasives such as abrasive paper.

Our in-depth analysis of the global abrasive paper market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Backing Material |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Abrasive Paper Market - Regional Analysis

Asia Pacific Market Insights

By 2035, the Asia Pacific market is expected to hold 35.5% of the abrasive paper market share due to growing automotive refinishing, metal fabrication, and wood processing industries. Increasing investments in manufacturing centers in Southeast Asia and demand for sophisticated coated abrasives in electronics polishing will underpin consumption. Moreover, key manufacturers are concentrating on product launches that offer flexible, waterproof, and heat-resistant abrasive papers. DIY renovations and an increasing demand for high-quality finishes for furniture will also drive regional consumption.

China's abrasive paper market will continue to be the largest in the Asia Pacific, due to expanding manufacturing output, growth in the metalworking industry, and increasing applications for automotive maintenance products. China’s attention to abrasives for high-precision electronic polishing will lead to continual technological advancements. It will also benefit from continued industrial upgrades and smart manufacturing initiatives endorsed by the government. Overall, the rise in urban renovations and associated infrastructure developments in domestic and commercial environments will use more abrasive paper in construction finishing processes and interior refinishing sectors.

Country-wise Natural or Artificial Abrasive Powder or Grain Export Statistics (2023)

|

Country |

Export Value (USD thousands) |

Quantity (kg) |

|

China |

98,106.06 |

13,315,700 |

|

Republic of Korea |

90,347.07 |

5,867,940 |

|

Japan |

85,135.45 |

1,338,960 |

|

Malaysia |

9,652.81 |

649,856 |

|

India |

2,626.13 |

449,778 |

|

Australia |

1,700.66 |

80,974 |

|

Indonesia |

349.33 |

77,677 |

Source: WITS

North America Market Insights

The North American market is expected to hold 29.7% of the abrasive paper market share due to increases in automotive refinishing, metal fabrication, and woodworking markets. The increase in demand for high-quality coated abrasives, expanding furniture manufacturing, and advancements in surface finishing technology are positioned to give the market favorable momentum.

The U.S. abrasive paper market is expected to grow due to the expanding number of automotive refinishing jobs, consistent output growth in metal fabrication with an increasing number of contracts, and strong home renovation projects. Recent technological advances in abrasive materials are influencing demand patterns in industrial sectors, with micro-abrasive papers for polishing electronic parts and components in aerospace applications. In 2023, the United States exported natural or artificial abrasive powder or grain valued at USD 121,521.47 thousand, totaling 5,819,310 kg, while Canada exported USD 3,165.75 thousand worth, amounting to 264,264 kg.

Europe Market Insights

The European abrasive paper market is expected to hold 22.1% of the market share due to strong demand from the automotive and metal fabrication. EU automotive production is scheduled to increase by 9% by 2030 as production of electric vehicles ramps up. Similarly, production of metal fabrication will increase 6.3% during the period as renewable energy infrastructure increases and additional purchasing of machinery occurs in Europe. As a result of these industries growing or stabilizing, abrasive paper usage will continue to increase throughout Europe for precision surface finishing applications, grinding, and component refurbishing.

Germany's abrasive paper market could benefit from growth in the automotive and metal fabrication industries from 2025-2035. It is estimated that German automotive production will have a 7.6% increase by 2030, under the growth of electric vehicle assembly alone. Similarly, metal fabrication production in Germany is also estimated to increase between 2025-2035, anchoring demand for machinery assembly, fabricated steel structures, and industrial equipment.

Europe Country Natural or Artificial Abrasive Powder or Grain Export Statistics (2023)

|

Country |

Export Value (USD thousands) |

Quantity (kg) |

|

Germany |

389,341.64 |

26,521,800 |

|

Italy |

67,070.14 |

5,145,830 |

|

France |

19,678.91 |

1,734,740 |

|

Spain |

20,395.61 |

1,675,540 |

|

United Kingdom |

7,105.35 |

141,661 |

Source: WITS

Key Abrasive Paper Market Players:

- 3M

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Saint-Gobain Abrasives (Norton)

- Fujimi Incorporated

- SIA Abrasives (Bosch Group)

- Deerfos

- Carborundum Universal Limited (CUMI)

- Mirka Ltd.

- Hermes Abrasives

- Klingspor AG

- Awuko Abrasives

- Flexovit Abrasives

- Kinik Company

- Asahi Diamond Industrial Co., Ltd.

- Kovax Corporation

- Nihon Kenshi Co., Ltd.

The global abrasive paper market is fragmented with a high degree of competition among competing companies. Dominant players, such as 3M and Saint-Gobain, compete in R&D, global distribution and variety of products. Businesses have implemented strategic initiatives with a focus on three objectives: capacity expansion, product development, and mergers and acquisitions aimed to improve their position in the market. For example, Saint-Gobain's continuous expansion in the Asia continent, capitalizing on opportunities within the automotive and metalworking industries with projections for growth in the industrial business; Deerfos and CUMI are actively investing in sustainable abrasives that comply with new environmental practices to gain a competitive advantage in the rest of the world.

Some of the key players operating in the market are listed below:

Recent Developments

- In 2024, Sia Abrasives, a branch of the Bosch Group, set up a completely automated smart coating line in Frauenfeld, Switzerland. Using this AI-powered technology, grain distribution and bonding are enhanced, which raises coating uniformity by 26% and lowers production energy usage by 31%. In addition to the new ECHA chemical safety guidelines on sustainability, this invention increases production and decreases waste from resin bonding agents. By this modification, Sia Abrasives strengthens its market dominance in Europe's abrasive paper sector by slowly incorporating automation-driven efficiency together with green compliance.

- In March 2024, Hermes Abrasives launched a new premium abrasive paper using a water-based resin bonding system that increases paper flexibility for precision automotive finishing while removing 91% of formaldehyde emissions during production. By the end of 2025, this technology is expected to lower overall VOC emissions by 41% across Hermes’ German production sites. Furthermore, partners from the chemical industry that supply binders and additives have cited increasing demand for bio-derived resins, which are compatible with the process, making Hermes a champion of sustainability in the European abrasive paper industry.

- Report ID: 7945

- Published Date: Aug 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Abrasive Paper Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.