Nanosized Alumina Market Outlook:

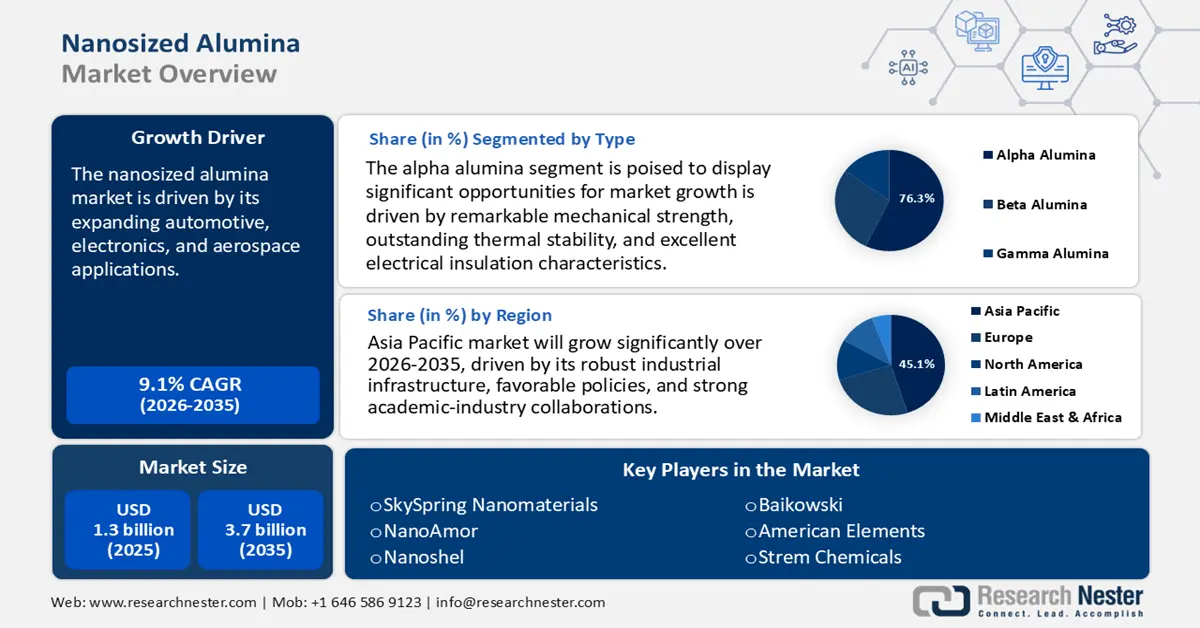

Nanosized Alumina Market size was valued at USD 1.3 billion in 2025 and is projected to reach USD 3.7 billion by the end of 2035, rising at a CAGR of 9.1 % during the forecast period, from 2026 to 2035. In 2026, the industry size of nanosized alumina is evaluated at USD 1.6 billion.

The global nanosized alumina market is expected to witness steady growth, primarily driven by its expanding automotive, electronics, and aerospace applications. In the electronics sector, the trend towards miniaturization and the need for efficient thermal management solutions have led to increased utilization of nanosized alumina in components such as transistors and capacitors. Its excellent thermal conductivity and electrical insulation characteristics render it an optimal choice for these applications. The swift progress in the semiconductor sector and nanotechnology significantly enhances this demand. Additionally, in the automotive industry, the shift towards electric vehicles and the emphasis on lightweight, high-strength materials have positioned nanosized alumina as a valuable component. For instance, a study by the University of Michigan has shown that the addition of nano-sized reinforcing particles such as titanium carbide (TiC) to aluminum can considerably enhance the strength and temperature-limiting capabilities of the lightweight aluminum alloys, which aid directly in the implementation of electric vehicles in terms of length and fuel efficiency. The 3D visualization methods of the study demonstrated how nanoparticles were used to achieve the ideal solidification and scalable production, and can be useful in automotive light-weighting and material design.

Furthermore, it is extensively utilized in coatings, catalytic converters, and high-performance batteries, contributing to improved fuel efficiency and reduced emissions. For instance, the researchers in a study of nanosized alumina particles (Al 2 O 3-NPs) by ACS Omega, discovered that the addition of nanosized alumina particles (Al 2 O 3-NPs) to biodiesel led to a substantial increase in engine performance, as well as a decrease in emissions, with up to 61.2% reduction in hydrocarbs, 24.4% reduction in NOx and 39.5% reduction in CO emissions, and the increase in emission and efficiency benefits, indicating the increasing demand of nanosized alumina is in clean energy automotive products.

The supply chain of alumina and its related nanosized products includes integrated mining-refinery-smelter facilities in major alumina producers in the world, such as India and China, with national data on output refined alumina production, indicating increased production of 5,208 thousand tonnes in 2021-22 over 6520 thousand tonnes production in 2020-21 as per national mining reports. The top producers, such as Vedanta, have refineries that have capacity upgrades that can certainly accommodate the scale-up of the nanosized product lines underpinned by the domestically sourced bauxite and the additional imports. The Lanjigarh alumina refinery of Vedanta Aluminum in Odisha has increased its alumina refining capacity by 3.5 million tonne per annum (MTPA), from its earlier capacity of 2 MTPA, and is now struggling to expand its overall capacity to 5 MTPA to help it sustain the rise in alumina production. This has added capacity that empowers the raw material supply chain, which is important in advanced applications like nanosized alumina, which contributes to the growth of the market. The refinery assists major smelters of aluminum and improves the efficiency of production, which leads to the sustainable growth of the market.

Additionally, the Producer Price Index of Alumina and Aluminum Production increased by 182.121 in July 2025 to 191.266 in August 2025 as the cost of production goes up with the rising demand levels of the advanced materials like nanosized alumina. The significant investment in the research, development, and demonstration programmes is reinforcing the deployment pathways, promoting innovation, and accelerating international trade in both raw and value-added nanosized alumina products.

Key Nanosized Alumina Market Insights Summary:

Regional Highlights:

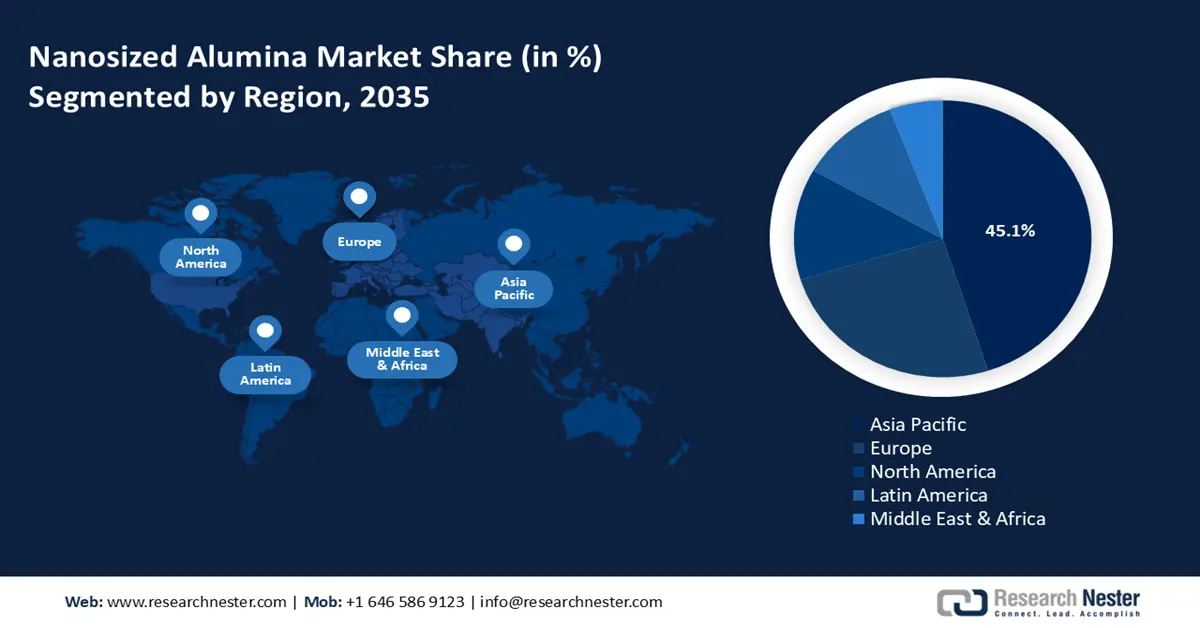

- The Asia Pacific nanosized alumina market is projected to hold a 45.1% share during 2026-2035, owing to the rapidly growing demand in electronics, energy storage, catalysts, and environmental applications.

- The North American market is expected to capture a 13% share by 2035, fueled by the increasing need for high-performance materials in semiconductors, EV batteries, and environmental technologies.

Segment Insights:

- The alpha alumina segment nanosized alumina market is projected to account for 76.3% share by 2035, propelled by its remarkable mechanical strength, outstanding thermal stability, and excellent electrical insulation characteristics.

- By 2035, the B2B distribution channel is expected to hold a 41.3% share owing to the specialized and technical nature of nanosized alumina.

Key Growth Trends:

- Catalytic converter applications

- Battery technology advancements

Major Challenges:

- Environmental and regulatory challenges

- Enhanced scalability and production expenses

Key Players: SkySpring Nanomaterials, NanoAmor, Nanoshel, Baikowski, Sumitomo (Group companies producing specialty alumina), Alcoa (specialty/nano alumina lines), Hindalco / AluChem (Hindalco specialty alumina expansion), American Elements, Strem Chemicals, Washington Mills, Rusal (specialty alumina / downstream groups), CUMI (Carborundum Universal Ltd.), Alpha HPA (high-purity alumina specialist), Advanced Nano Products, Hongwu International Group.

Global Nanosized Alumina Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.3 billion

- 2026 Market Size: USD 1.6 billion

- Projected Market Size: USD 3.7 billion by 2035

- Growth Forecasts: 9.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, Germany, United States, South Korea

- Emerging Countries: India, Vietnam, Brazil, Malaysia, Thailand

Last updated on : 24 October, 2025

Nanosized Alumina Market - Growth Drivers and Challenges

Growth Drivers

- Catalytic converter applications: Nanosized alumina is an important catalyst support in automotive catalytic converters that aid in the minimization of harmful emissions. According to the research conducted by the U.S. National Institutes of Health (NIH), alumina nanoparticles can enhance the oxidation of hydrocarbons (HC) by more than 61.2%, and nitrogen oxides (NOx) emissions by about 24.4% in engine tests compared to conventional catalysts. This catalytic activity increases the rate of conversion of toxic gases into less toxic nitrogen and carbon dioxide, thereby ensuring that the stricter emission rules of such agencies as the EPA are met. Tier 3 standards outlined in the EPA report require a reduction in smog-forming substances amounting to 80% and a reduction in particulate matter amounting to 70% in 2025, and this enforces the stricter emission limits that will compel the auto industry to adopt nanosized alumina in catalyst converters to achieve better performance and compliance. These laws increase the requirement for sophisticated catalyst materials to comply with new environmental stringency and the fuel quality requirements. This market expansion is expected to grow further as the emission standards will become stricter to propel the growth of the nanosized alumina market in the chemical and automotive industries.

- Battery technology advancements: As a separator or solid electrolyte, nanosized alumina is being explored as an ionic conductor; mechanical strength and chemical stability have been demonstrated to be outstanding. The FY 2022 Q4 report by the U.S. Department of Energy shows that solid-state electrolytes have made huge progress, with materials such as beta-alumina showing ionic conductivities of over 0.5 S/cm at high temperatures to improve battery performance and safety. The report also highlights scaled synthesis and interface stability enhancement of alumina-based electrolytes, which are essential in high-energy lithium-metal batteries. These technological advances are directly related to the growing use of nanosized alumina in energy storage and promote market growth through the growing need to have a safer and high-performance battery in an electric vehicle or grid storage. Due to the rapid rate of electrification, the necessity for high-performance nanosized alumina materials in batteries is increasing rapidly, which would help to maintain continuous market dynamics in the chemical and energy storage sectors.

- Technological progress and research: Advances in material science have greatly enhanced the synthesis and manipulation of nanoscale alumina particles. Innovative methods, such as environmentally friendly hydrothermal treatments, now allow for precise control over particle size, morphology, and surface properties. For instance, researchers have developed ammonium bicarbonate and aluminum nitrate, which give high surface area γ-alumina nanoparticles by sustainable co-precipitation synthesis, increasing the market of nanosized alumina by sustainable and efficient production. These advancements enable industries to tailor nanosized alumina for specific applications, enhancing performance in catalysis, electronics, and ceramics. This process not only achieves high purity and uniformity but also allows for the recycling of by-products, aligning with suitable manufacturing practices. Such innovations are pivotal in meeting the growing demand for enhanced materials with superior properties.

Challenges

- Environmental and regulatory challenges: The nanosized alumina market encounters considerable hurdles due to stringent regulatory requirements and growing environmental concerns. The usage of nanomaterials, including nanosized alumina, raises critical concerns about potential toxicity, bioaccumulation, and long-term environmental impact. Regulatory bodies require rigorous assessments for nanoparticle production, handling, and disposal, significantly increasing compliance costs and operational complexity. Additionally, public apprehensions regarding the safety of nanoscale materials further hinder widespread adoption. These uncertainties compel manufacturers to invest in thorough research and transparent safety evaluations, which, while essential for market credibility, may delay product development and restrict the pace of market expansion.

- Enhanced scalability and production expenses: Significant production expenses and scalability issues pose substantial constraints in the global nanosized alumina market. Achieving precise control over particle size, morphology, and purity demands advanced technologies, specialized equipment, and skilled labor, all of which contribute to elevated manufacturing expense. The elevated expenses associated with nanosized alumina hinder its broad acceptance, especially in industries that are sensitive to pricing. Moreover, scaling up production while maintaining consistent quality and performance remains a complex task. Variations in material characteristics at larger volumes can impact application outcomes, further complicating commercialization efforts. These cost and scalability barriers collectively constrain the market's growth and broader Industrial penetration.

Nanosized Alumina Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.1% |

|

Base Year Market Size (2025) |

USD 1.3 billion |

|

Forecast Year Market Size (2035) |

USD 3.7 billion |

|

Regional Scope |

|

Nanosized Alumina Market Segmentation:

Type Segmentation Analysis

The alpha alumina segment is projected to lead the global market by 2035, with the largest revenue share of 76.3%, attributed to its remarkable mechanical strength, outstanding thermal stability, and excellent electrical insulation characteristics. These attributes make alpha alumina highly desirable for applications in electronics, ceramics, and aerospace industries. Its superior hardness and wear resistance also contribute to its widespread use in abrasive and cutting tools. Advancements in the controlled synthesis of alpha alumina nanoparticles have enhanced efficiency, allowing for precise tailoring of particle size and morphology, thereby broadening their stability at high temperature and in harsh environments, further solidifying their position as a preferred choice for demanding applications.

High-purity alpha alumina is essential in electronics, optics, and the battery industry, where purities to below 10 ppm are needed. Australian Critical Minerals R&D Hub (managed by CSIRO) is researching new lower-energy processes for high-purity alumina to decrease environmental impact. High-purity alpha alumina is priced at a premium in the nanosized alumina market, as it is needed in high-end CMP slurries or sapphire substrates, to push the market growth forward as fabs and LED/sapphire manufacturers seek defect-free and ultra-pure alpha alumina. Meanwhile, the Coated/Surface-treated Alpha Alumina enhances the dispersion, compatibility, and bonding in the composite matrices or slurry. Agglomeration is minimized and stability is increased in the suspension using these surface treatments, enabling nanosized alpha alumina to be applied in large-volume B2B applications (e.g., thermal pastes, polishing slurries). With rising demand for stable nanopowder suspensions with consistent performance by more end users, coated/surface-treated alpha alumina is a driver of growth through its potential for wider adoption in electronics, coating, and catalysis market segments.

Distribution Channel Segment Analysis

By 2035, the B2B distribution channel is expected to grow with a market share of 41.3% owing to the specialized and technical nature of nanosized alumina, which necessitates tailored consultations, bulk negotiations, and comprehensive post-sale support services inherently provided within the B2B framework. Industrial entities integrating nanosized alumina into complex manufacturing processes benefit from direct interactions with suppliers, ensuring precise alignment with specific requirements. The B2B model facilitates in-depth discussion of product specifications, quality standards, and logistical considerations, fostering long-term partnerships and consistent supply chains.

Direct Supply enables sales directly between producers and customers to ensure quality, economy, and punctuality, backed by strong logistics and supplier control, which positively affects the business performance by enhancing the focus on customers and their ability to provide services, as demonstrated by the data on the Alibaba platform profiles of the suppliers. Meanwhile, the E-Catalogue provides digital product listings, allowing buyers to easily compare and choose goods, making the buying process easier and products more accessible to them; a commercial e-commerce portal on government initiatives is expected to control a market with the assistance of online catalogues to enhance procurements.

End Use Segment Analysis

The automotive segment is predicted to grow with a significant market share over the forecast years, owing to the need for lightweight and high-strength materials to enhance fuel efficiency and reduce emissions. The high strength-to-weight ratio of nanosized alumina makes it perfect for automotive paints, catalyst converters, and high-power batteries, particularly for electric and hybrid vehicles. Its use in automotive applications is fast developing due to the change to more energy-efficient and greener cars and more stringent emission standards. Nanotechnology with nanosized alumina plays a significant role in advancing the automotive industry by employing nanotechnology in wear and tear, fuel economy, and emission reduction by using nanotechnology in coatings, lightweight body parts, and engine parts. The vehicle fleet in the world is set to double in 2030, therefore, accelerating the demand for nanosized alumina in the innovations of vehicles.

Our in-depth analysis of the nanosized alumina market includes the following segments:

|

Segment |

Subsegment |

|

Type

|

|

|

Distribution Channel |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Nanosized Alumina Market - Regional Analysis

Asia-Pacific Market Insights

The Asia Pacific market is anticipated to grow with the largest revenue share of 45.1% during the projected years from 2026 to 2035, mainly driven by a rapidly growing demand in electronics, energy storage, catalysts, and environmental use. The regional alumina production capacity is steadily increasing due to major investment in infrastructural developments and improvement of technologies in order to enhance sustainability and efficiency. For instance, the Asian Development Bank (ADB) heavily invested in sustainable energy and the upgrade of industrial infrastructure in the Asia-Pacific region. ADB raised a record amount of funds in 2024, reaching up to USD 14.9 billion, of which USD 8.7 billion was non-sovereign cofinancing, to finance clean energy projects and infrastructure resilience in Asia and the Pacific. The specific areas of these investments are aimed at the generation of renewable energy, transmitting electricity, and energy efficiency improvement, which indirectly serve other sectors of the economy, such as alumina refining through modernization of energy sources and reduction of emissions. Additionally, the production of alumina in Africa and Asia increased by 6.49% per year, from 13.014 million tonnes in 2023 to 13.859 million tonnes in 2024, which can be explained by the growth momentum due to the consistent monthly production of 1.2 million tonnes. This growing alumina production base has formed the rising demand for nanosized alumina in the Asia Pacific, fuelled by industrial uses of the alumina in electronics, catalysis, and advanced materials, which follows the growing interests of the region in sustainable chemical technologies. This trend is favourable to greater usage of nanosized alumina in high-technological and eco-friendly industrial sectors.

China’s market is projected to lead the Asia Pacific region by 2035, owing to the rising demand in the aluminum smelting, electronics, and automotive industries. According to Shanghai Metals Market (SMM) data, the production of metallurgical-grade alumina in China was 1.67% month-to-month and 9.80% year-to-year increase, with a total production capacity of approximately 103,020 tonnes at the end of the year, and the operating rate of 86.30%. Full-year 2024 production was up by 4.86%. This consistent increase in the level of alumina production and output facilitates the development of the Chinese market. Additionally, the government policies in the country focus on environmental safety and resource consumption, which leads to investment in sustainable production of alumina and refining technologies. For instance, the Chinese high-quality development of the aluminum industry (2025-2027) plan is intended to increase domestic bauxite supply by 3% to 5%, and recycle more than 15 million tons of aluminum. These goals indicate that there will be solid support upstream in developing better alumina technologies, such as nanosized alumina, as China switches to high-value and high-precision materials in its aluminum and materials policy. Alumina futures trading through the Shanghai Futures Exchange is also growing in China to enhance stability in the market.

The market in India is expected to grow with the fastest CAGR over the projected years by 2035, driven by growing needs in energy storage, catalysis, and finer ceramics, and the encouragement of a sustainable development of chemical production and nanotechnology by the government. The industry in India is an important part of the emerging chemical industry in the country, where India installed alumina refining capacity of about 7560,000 tonnes per year, and the production capacity was about 6,520 thousand tonnes. This stable refining base promotes the development of the nanosized alumina in India since it forms the required infrastructure of raw materials, which is expected to facilitate more production to be used in high-level applications in energy storage, catalysis, and nanotechnology.

In addition, the government focuses on enhancing the sustainable production of chemicals and nanotechnology, and, as a result, nanosized alumina finds new applications in energy storage and catalysis, and in advanced ceramics. For example, the Government of India has created the National Program on Nano Science and Technology (Nano Mission), which has contributed to the development of advanced research and development in nanomaterials, which facilitates innovations in energy storage, catalysis, and advanced ceramics. The program is an example of how the government is determined to ensure that nanosized applications of alumina are fast-tracked to increase sustainable growth in the chemical and nanotechnology sectors in India. Furthermore, the investments in the modernization of alumina plants in order to enhance efficiency and decrease emissions are in accordance with the national policies related to the industrial and environmental spheres. This development trend positions India as a nanosized alumina market that is sizeable due to policy support and availability of resources.

North America Market Insights

The North American market is expected to grow with a revenue share of 13% over the forecast years, driven by the increasing need for high-performance materials in semiconductors, EV batteries, and environmental technologies, and more stringent regulations that favor the adoption of cleaner chemical processes. Additionally, the 2023 value of mineral commodity production in the U.S. was USD 105 billion according to the USGS 2024 Mineral Commodity Summaries, with 23.7 billion USD of the value being industrial minerals, with an increase of 7% over 2022. In addition, the U.S. Chemical Manufacturing industry alone comprises approximately 13500 establishments in more than 9000 enterprises with shipments of chemicals worth approximately USD 555 billion annually. The ratio of metals and metal compounds in the 3.3 billion pounds of total TRI chemical releases in 2023 made up almost two-thirds of the total releases, which showed the significance of the chemical industries dependent on metals in the environmental regulation scenario. Moreover, the long-term patterns in production, imports, exports, and consumption of alumina in North America can be found in the USGS Bauxite and Alumina Historical Statistics, as U.S. alumina production reached 810,000 tons in 2024 with approximately 69% of the total alumina produced utilized to smelt primary aluminum and the remaining 310,000 tons being utilized in nonmetallurgical products such as abrasives and ceramics. Such continuous investments in the alumina refining and specialty alumina products help the development of nanosized alumina uses in North America, especially in the highly developed ceramics, catalysis, and high-technological industries.

The U.S. market is predicted to dominate the North America region with the largest share by 2035, attributed to a high R&D intensity as well as clean technology requirements, which makes the country a global leader in advanced material innovation. In 2024, the U.S. Department of Energy chose 11 projects that will promote the development of manufacturing in the US economy of next-generation batteries, including design innovations in scalable manufacturing processes of nanolayered films that are important to battery performance. These investments, which have a cost of USD 25 million, are to enhance productivity and cost reduction in numerous battery technologies, to enable the development of nanosized alumina use in energy storage industries, increase the efficiency of materials, and enable increased manufacturing scale. In nanomaterials, funding industry partnerships is run by the National Institute of Standards and Technology (NIST), which operates the Advanced Materials Center of Excellence. By 2023, the U.S. government had invested $40 billion in nanotechnology R&D across more than 30 federal agencies to allow wide commercialization. By 2020, product revenues realized through nanotechnology in the world amounted to USD 3 trillion, with the U.S. contributing about USD 750 billion. This has been a continuous federal support aimed at the development of nanosized alumina, an important nanomaterial in electronics, energy storage, and precision coatings.

The market in Canada is likely to grow steadily by 2035, due to the chemical industry in Canada, which is shifting to a low-emission, high-value production, in line with the growth of nanomaterials. The federal government allocated CAD $1.5 billion in the Strategic Innovation Fund in 2023 to clean technologies, which include nanomaterials for batteries and catalysts. Additionally, the Clean Growth Program, which was completed by Natural Resources Canada in 2022, allocated over USD 155 million in clean technology research and demonstration in energy, mining, and forestry. The program has promoted the development of advanced materials, such as nanosized alumina, to enable the sustainable growth and innovation in the nanomaterials market in Canada by assisting in the development of innovative partnerships between federal laboratories and innovators through the Science and Technology Assistance for Cleantech program.

Nanosubstances are also regulated by the Environmental Protection Act through the Canadian Chemical Management Plan (CMP), which promotes safer manufacturing at the nanoscale. Chemicals Management Plan (CMP) of Canada, which has been analyzing more than 4,300 substances in terms of environmental and human health hazards, including nanomaterials, according to the Canadian Environmental Protection Act (CEPA 1999). Through stringent risk management and collaboration activities, the CMP contributes to safer manufacturing and use of nanosubstances, including the nanosized alumina, ensures regulatory compliance, and encourages innovation. This systematic control favours the emerging nanomaterials industry in Canada, supporting nanosized alumina development in a responsible manner in industrial and environmental settings.

Europe Market Insights

The European market is anticipated to grow significantly with a revenue share of 25.2% from 2026 to 2035, driven by its commitment to sustainable and eco-friendly solutions. Within Europe, Germany and the UK stand out as significant contributors, leveraging their strong industrial infrastructures, stringent quality standards, and strong academic-industry collaborations. Germany's emphasis on high-quality nanomaterials and advanced manufacturing processes has positioned it as a key player in the nanosized alumina market, for instance, Nabaltec AG, a chemical industry company based in Schwandorf, Bavaria. Nabaltec specializes in producing flame-retardant fillers, environmentally friendly additives for the plastics industry, ceramic raw materials for the refractory industry, and technical ceramics. Their products, developed from aluminum hydroxide and aluminum oxide, cater to various applications, including electronics and ceramics, aligning with Germany's focus on sustainable and high-performance materials.

Meanwhile, the UK has emerged as a hub for nanotechnology innovation, with companies like Nanoco Technologies Ltd. Leading the way. Nanoco, originating from the University of Manchester, specializes in the advancement and large-scale manufacturing of quantum dots as well as various nanoparticles, including those that are free of cadmium. Their proprietary molecular seeding process enables the production of high-grade nanomaterials for various applications, such as electronics and displays. The strategic initiatives and advancements by these companies underscore the significant roles the UK and Germany play in Europe's nanosized alumina market, contributing to the region's continued growth and leadership in this sector.

Key Nanosized Alumina Market Players:

- SkySpring Nanomaterials

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NanoAmor

- Nanoshel

- Baikowski

- Sumitomo (Group companies producing specialty alumina)

- Alcoa (specialty/nano alumina lines)

- Hindalco / AluChem (Hindalco specialty alumina expansion)

- American Elements

- Strem Chemicals

- Washington Mills

- Rusal (specialty alumina / downstream groups)

- CUMI (Carborundum Universal Ltd.)

- Alpha HPA (high-purity alumina specialist)

- Advanced Nano Products

- Hongwu International Group

Key players in the nanosized alumina market leverage enhanced technologies such as controlled hydrothermal synthesis, sol-gel processing, and surface modification techniques. These innovations enable process control over particle size, morphology, and functional properties, allowing companies to deliver high-performance materials tailored to demanding applications in electronics, aerospace, and automotive industries.

Top Global Nanosized Alumina Manufacturers

Recent Developments

- In August 2024, Alcoa acquired Alumina Limited, which made it a complete owner of the Alcoa World Alumina and Chemicals (AWAC) joint venture. Valued at about USD 2.8 billion in terms of the share swap, the transaction solidifies Alcoa's vertical dominance of the world in the production of alumina and bauxite. The acquisition would enable a faster acceleration of U.S. nanosized alumina capability, with the refining assets and scale of Alumina to be under the control of Alcoa. As Alcoa gains more control over the high-quality alumina feedstocks, it can be more inclined to invest in downstream innovations, including nanoscale alumina to use as catalysts, electronics, or high-tech materials.

- In April 2023, Alcoa broadened its EcoSource low-carbon alumina brand to non-metallurgical grades of alumina, i.e., hydrates and calcined (water treatment, ceramics, glass, and flame retardants). The CO2e intensity of EcoSource production is less than 0.6 tons of alumina (Scope 1+ Scope 2 emissions). The expansion into specialty alumina grades over smelter-grade will enhance Alcoa’s niche markets and open opportunities to high-end, low-carbon alumina grades. This may help expedite the R&D and acceptance of nanosized alumina, particularly regarding signature low-carbon branding or high-purity alumina as a competitive attribute.

- Report ID: 7620

- Published Date: Oct 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Nanosized Alumina Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.