Motor Monitoring Market Outlook:

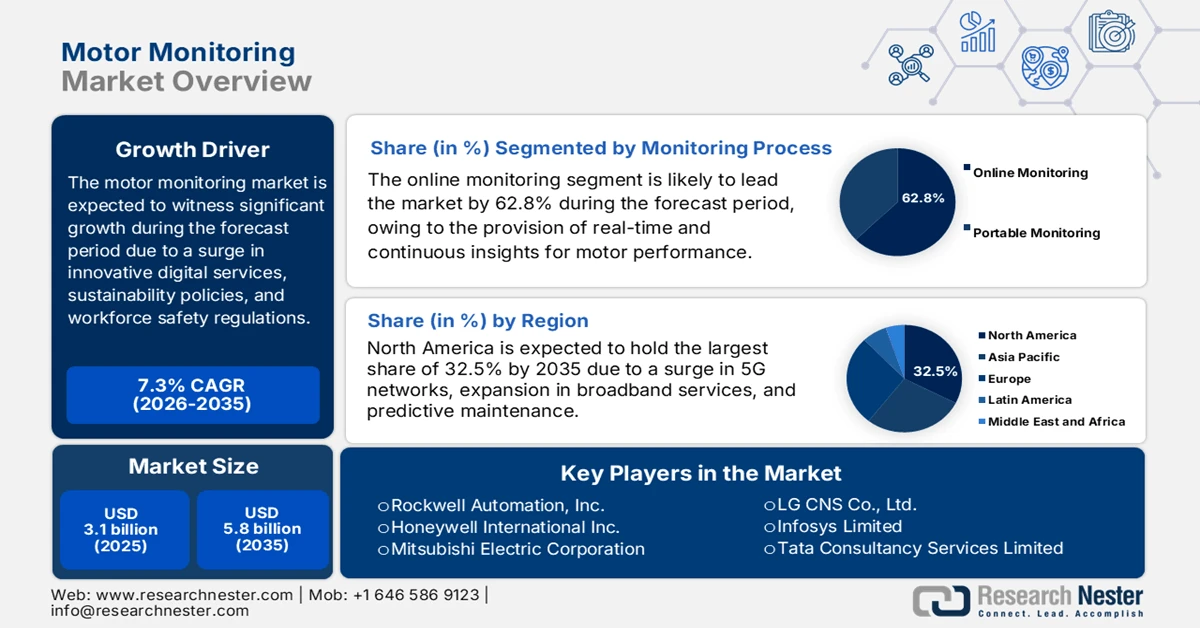

Motor Monitoring Market size was over USD 3.1 billion in 2025 and is estimated to reach USD 5.8 billion by the end of 2035, expanding at a CAGR of 7.3% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of motor monitoring is assessed at USD 3.3 billion.

The international market is gradually evolving beyond conventional predictive maintenance, with growth factors emerging from advanced digitalized ecosystems, workforce safety, and sustainability mandates. These have readily reshaped the overall industry for deploying monitoring technologies and ensuring innovation, resilience, and compliance across different sectors. According to official statistics published by the International Labor Organization in 2026, 2.9 million workers die every year due to work-related causes. In addition, 395 million workers sustain fatal-work injury every year globally, while 2.4 billion are exposed to excessive heat each year. Besides, USD 361 billion can effectively be saved internationally by integrating optimized health and safety measures to combat injuries in workplaces, thus making it suitable for bolstering the market.

Furthermore, the integration with digital twins, cybersecurity-embedded monitoring systems, along with circular economy integration, are other drivers uplifting the motor monitoring market globally. As stated in an article published by Decision Analytics Journal in March 2023, it has been projected that 75% of Internet of Things (IoT) companies readily utilize digital twin technology. Simultaneously, by the end of 2027, more than 40% of large-scale organizations globally are predicted to utilize this particular technology in their respective projects to enhance revenue. Besides, the overall international digital twin industrial size was valued at USD 8 billion as of 2022, and is further expected to grow at nearly 25% by the end of 2032. Additionally, the industry is set to boost by almost USD 32 billion by the end of 2026, thereby denoting an optimistic outlook for the market’s growth and development.

Key Motor Monitoring Market Insights Summary:

Regional Highlights:

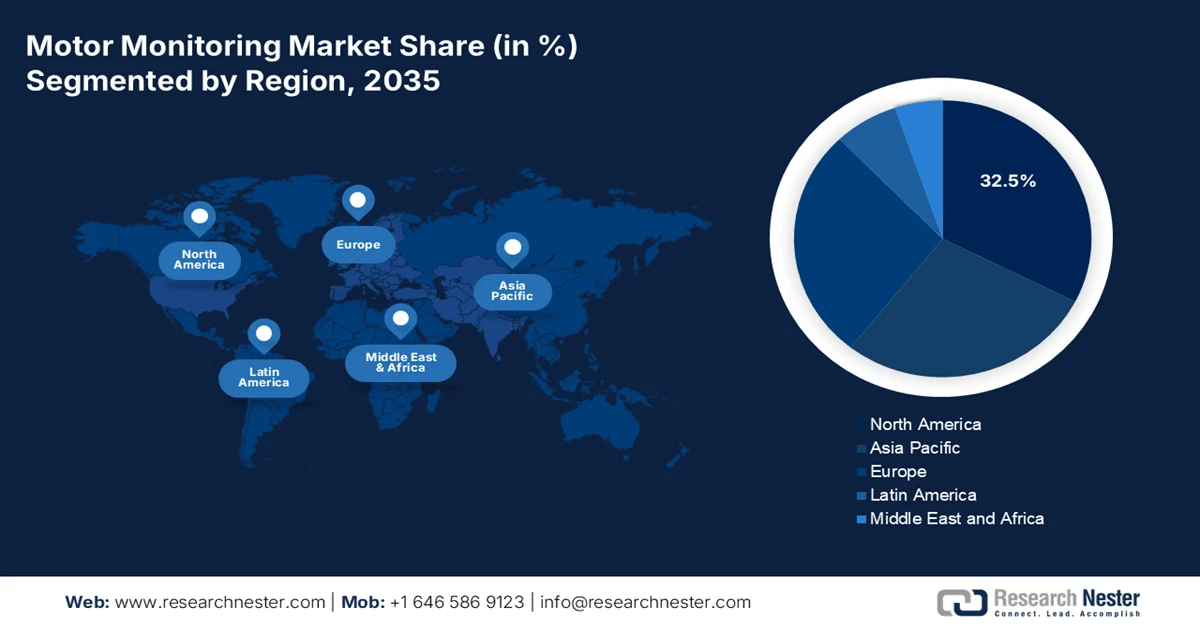

- North America in the motor monitoring market is projected to capture the leading 32.5% share by 2035, reinforced by rapid 5G infrastructure rollout, broadband expansion, and widespread adoption of predictive maintenance solutions.

- Europe is poised to emerge as the fastest-growing region through 2035, stimulated by strong ICT investments, government-led digital innovation initiatives, and accelerating industrial automation adoption.

Segment Insights:

- The online monitoring segment is projected to dominate with a 62.8% motor monitoring market share by 2035, leveraged by continuous real-time motor diagnostics and predictive analytics capabilities enabled through IoT, AI, and cloud integration.

- The on-premise deployment sub-segment is anticipated to account for the second-largest share by 2035, reinforced by organizational demand for in-house data control, cybersecurity assurance, and regulatory compliance in sensitive industries.

Key Growth Trends:

- Focus on ESG and green financing

- Reduction of supply chain disruptions

Major Challenges:

- Increase in capital investment expenses

- Integration complexity with legacy systems

Key Players: Parker Hannifin, TechnipFMC, Weir Group, IMI plc, Samson AG,ABB Ltd, Toshiba Corporation, General Electric Company.

Global Motor Monitoring Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.1 billion

- 2026 Market Size: USD 3.3 billion

- Projected Market Size: USD 5.8 billion by 2035

- Growth Forecasts: 7.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.5% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, Canada

- Emerging Countries: India, South Korea, France, United Kingdom, Italy

Last updated on : 22 January, 2026

Motor Monitoring Market - Growth Drivers and Challenges

Growth Drivers

- Focus on ESG and green financing: The presence of financial institutions is associating lending terms with environmental, social, governance (ESG) performance, which is deliberately boosting the market. According to official statistics published by NLM in November 2022, key point source monitoring by satellite are able to evaluate anthropogenic carbon emissions, since cities effectively contribute to 70% of anthropogenic emissions. Besides, as per a data report published by the IEEE Organization in March 2025, road transport readily accounts for almost 12% of international greenhouse gas emissions. Therefore, to combat this, an IoT-based real-time vehicle emission monitoring and prediction system achieves an 83% accuracy rate, thus denoting a positive impact on the market’s growth globally.

- Reduction of supply chain disruptions: Industries across different regions are significantly investing in the motor monitoring market to successfully expand motor lifespans and diminish reliance on volatile supply chains. As stated in an article published by the IEA Organization in 2026, there has been the absence of disruptions for the international car production, with China’s car output reaching about 27 million as of 2024. This denotes a 30% rise from the previous year, and meanwhile, the output in India upsurged by 30% to nearly 30 million cars. Besides, exports from four massive car-producing locations demonstrate 20% of international car production, while electric cars presently account for more than 15% of the worldwide car trade, which is creating a positive impact on the market.

Total Yearly Car Exports by Region (2019-2024)

|

Year |

China (Million) |

Europe (Million) |

U.S. (Million) |

China (Million) |

|

2019 |

0.7 |

5.2 |

1.6 |

4.3 |

|

2020 |

0.8 |

4.2 |

1.2 |

3.4 |

|

2021 |

1.6 |

3.9 |

1.4 |

3.3 |

|

2022 |

2.7 |

4.2 |

1.3 |

3.2 |

|

2023 |

4.4 |

4.7 |

1.4 |

3.9 |

|

2024 |

5.5 |

4.5 |

1.2 |

3.7 |

Source: IEA Organization

- Increase in stringent regulations: Governments are significantly mandating stringent safety standards across sectors, such as chemicals and mining, which is positively uplifting the market internationally. As stated in a data report published by NITI Aayog in July 2025, the chemicals industry in India was significantly valued at USD 220 billion as of 2023, and is further predicted to grow by almost USD 400 billion to USD 450 billion by the end of 2030. In addition, the industry’s aspirations are expected to reach nearly USD 850 billion to USD 1,000 billion by the end of 2040, based on governmental support. Therefore, the aspect of government intervention is crucial to ensure that the overall industry successfully gains its potential, which in turn marks a huge growth opportunity for the market.

Challenges

- Increase in capital investment expenses: Systems in the motor monitoring market, particularly those integrating advanced IoT sensors, AI-driven analytics, and cloud-based platforms, require significant upfront investment. For small and medium enterprises (SMEs), the cost of deploying vibration sensors, acoustic monitoring devices, and predictive analytics software can be prohibitive. Beyond hardware, companies must also invest in integration with existing legacy systems, workforce training, and cybersecurity measures. This financial burden often delays adoption, especially in developing economies where industrial budgets are constrained. Moreover, the return on investment (ROI) is not immediate, as benefits such as reduced downtime and improved efficiency accrue over time.

- Integration complexity with legacy systems: Many industries, particularly in oil and gas, power generation, and manufacturing, operate with decades-old motor infrastructure. Integrating modern monitoring technologies with these legacy systems poses significant technical challenges. Compatibility issues arise when attempting to connect advanced IoT sensors or cloud-based platforms with outdated motor designs and analog control systems. This often requires custom engineering solutions, increasing both cost and implementation time. Additionally, legacy systems may lack standardized communication protocols, making data collection inconsistent and unreliable. Companies must often replace or retrofit equipment, which disrupts operations and adds further expense in the overall market.

Motor Monitoring Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.3% |

|

Base Year Market Size (2025) |

USD 3.1 billion |

|

Forecast Year Market Size (2035) |

USD 5.8 billion |

|

Regional Scope |

|

Motor Monitoring Market Segmentation:

Monitoring Process Segment Analysis

The online monitoring segment, which is part of the monitoring process, is anticipated to garner the largest market share of 62.8% by the end of 2035. The segment’s growth is highly driven by its ability to provide continuous, real-time insights into motor performance. Unlike portable monitoring, which is periodic and reactive, online systems integrate sensors directly into motors and connect to centralized platforms, enabling predictive analytics and immediate fault detection. This reduces downtime, enhances safety, and optimizes maintenance schedules. Industries such as oil and gas, power generation, and automotive rely heavily on online monitoring because even minor disruptions can result in significant financial losses. The integration of IoT, AI, and cloud computing has further strengthened online monitoring, allowing companies to detect anomalies such as vibration irregularities, overheating, or electrical faults before they escalate.

Deployment Model Segment Analysis

By the end of the forecast period, the on-premise sub-segment, part of the deployment model segment, is projected to hold the second-largest share in the motor monitoring market. The sub-segment’s growth is highly fueled by the aspect of storing and processing monitoring data within the organization’s infrastructure, ensuring compliance with strict regulatory frameworks in sectors such as defense, aerospace, and energy. This model is particularly favored in regions with heightened cybersecurity concerns, where companies prioritize minimizing exposure to external networks. On-premise systems also offer greater customization, allowing integration with legacy equipment and tailored analytics suited to specific industrial environments. While cloud adoption is rising, many enterprises remain cautious due to data sovereignty laws and the need for uninterrupted operations in remote or high-risk facilities.

Application Segment Analysis

Based on the application segment, the electric motors sub-segment is expected to hold the third-largest market share by the end of the stipulated timeline. The sub-segment’s development is highly propelled by its importance in monitoring since it is considered the workhorse of the industry, and its failure can lead to expensive downtime. According to official statistics published by the IPIECA Organization in June 2023, electric motors represent more than 80% of electricity utilization at an onshore or refinery oil and gas production infrastructure. Besides, deliberately replacing oversized motors can save almost 1.2% of present electric motor consumption, particularly on average for the U.S.-based petroleum industry. Based on this, the installation of three 50% pumps instead of two 100% pumps is regarded as the best solution for electric motors across different regions.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Monitoring Process |

|

|

Deployment Model |

|

|

Application |

|

|

Technology |

|

|

Sensor Type |

|

|

Industry Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Motor Monitoring Market - Regional Analysis

North America Market Insights

North America market is anticipated to garner the highest share of 32.5% by the end of 2035. The market’s upliftment in the region is primarily attributed to 5G infrastructure, broadband expansion, and predictive maintenance. According to official statistics published by 5G Americas Organization in April 2025, both the U.S. and Canada jointly account for over 182 million 5G connections, demonstrating an almost 20% year-over-year (YoY) growth rate. Besides, the 5G network performance has notably advanced in the U.S., driven by 5G standalone deployment. Additionally, in 2024, the country reached a median standalone download speed of 388.4 Mbps, denoting a rise from 305.3 Mbps from the previous year. Therefore, with the continuous development of the 5G connection, there is a huge growth opportunity for the market in the overall region.

The motor monitoring market in the U.S. is growing significantly due to spectrum management, emphasizing broadband expansion, industrial automation, federal investment, and ICT modernization. As stated in a data report published by the USITC Organization in May 2024, electric vehicle parts and overall electric vehicles, including hybrid production accounts for 1.4% and 4.2% for the U.S. In addition, an increase in electric vehicles and hybrid exports from the country resulted in an output of 6.5%. Moreover, as per the March 2024 EIA Government article, small-scale systems in the country comprise less than 1 MW, that is, 1,000 kilowatts of electricity generation capacity. Additionally, the overall domestic utility-scale electricity generation has been almost 4.1 kWh, thereby denoting a huge growth opportunity for the market to expand in the whole of the nation.

The motor monitoring market in Canada is also growing, owing to growth in the ICT industry, broadband expansion, and robust investment opportunities in digitalized technologies. Besides, based on government estimates published by the Government of Canada in January 2026, the Canada Radio-Television and Telecommunications Commission (CRTC) has selected almost 70 projects to receive generous funding from the broadband fund. These particular projects have been significantly awarded with an estimated USD 769 million to optimize cellphone and high-speed internet services for more than 320 communities. This, in turn, represents more than 53,000 households, more than 650 kilometers of major transportation roads, and at least 6,000 kilometers of fiber to domestic communities. Therefore, with the provision and availability of funds, the market is poised to gain exposure in the overall nation.

CRTC Funding by the Canada Government for Projects (2023-2025)

|

Month and Year |

Project Purpose |

Fund Amount |

Location |

|

December 2023 |

Serving satellite-based communities |

USD 35 million |

Nunavut |

|

March 2024 |

Optimize cellphone service along 70 kilometers of Highway 37 |

USD 11.9 million |

North British Columbia |

|

July 2024 |

Ensure fiber internet to 5 communities |

USD 79.4 million |

North Quebec |

|

July 2024 |

Ensure fiber internet across 4 Inuit communities |

USD 271.9 million |

Nunavut |

|

August 2024 |

Improve cellphone services along 100 kilometers of major roads |

USD 17 million |

Newfoundland and Labrador, Quebec, and Ontario |

|

October 2024 |

4 projects to enable fiber internet to 16 rural communities |

USD 8 million |

Manitoba |

|

January 2025 |

Enable fiber internet to 3 communities |

USD 14 million |

British Columbia and Yukon |

|

June 2025 |

Improve accessibility to reliable and high-quality internet services |

USD 17 million |

Alberta, British Columbia and Ontario |

|

November 2025 |

3 projects to optimize access to suitable internet services |

USD 15 million |

Saskatchewan |

Source: Government of Canada

Europe Market Insights

Europe motor monitoring market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by robust information and communication technology investment, government-backed digitalized innovation programs, and industrial automation. According to official statistics published by the World Economic Forum in January 2026, supply chain leaders in the region have readily deployed an artificial intelligence-based inventory model for reducing stock levels by 17% across stock-keeping unit codes (SKUs). In addition, regional leaders utilized artificial intelligence to effectively transform the procurement process by automating and streamlining the procurement function. This has leveraged point solutions, AI applications, and out-of-the-box automation, leading to efficiency optimization of more than 20%, thus boosting the market’s growth.

The market in Germany is gaining increased traction due to federal investments, predictive maintenance adoption, and industrial automation, readily escalating across automotive and manufacturing sectors. As stated in an article published by the ITA in November 2024, the auto industry generated more than USD 611 billion in overall sales, denoting a rise by 11% in 2022. This significantly includes USD 496.3 million for motor vehicles, USD 15.7 million for trailers, and USD 99.8 million for parts and accessories. Besides, automotive suppliers in the country generated nearly 16.3% of the industry’s manufacturers and turnover of trailers and bodies, accounting for nearly 2.6%. Moreover, the automotive sector is the country’s largest industrial sector, constituting nearly a quarter of overall industry revenues and effectively supporting 780,000 employment opportunities.

The motor monitoring market in the UK is also developing, owing to the adoption of Industry 4.0, energy efficiency mandates, as well as expansion in the domestic ICT infrastructure. As stated in an article published by the UK Government in January 2025, the cloud-first policy in the country has been accelerating, with nearly 55% of central government organizations reporting that more than 60% of their estate is operating on cloud platforms. Besides, the domestic public sector depends on third parties to augment data and digital teams. Of the £26 billion public sector digital and data spending as of 2023, less than 25%, which is almost £5 billion, has been allocated for the permanent public sector staff, and meanwhile, 55%, which is £14.5 billion, has been spent on IT consultants, managed service providers, and contractors. Therefore, with an increase in the focus on digitalization, there is a huge growth opportunity for the market in the country.

APAC Market Insights

The Asia Pacific motor monitoring market is predicted to witness considerable upliftment by the end of the stipulated duration. The market’s growth in the region is highly fueled by the presence of AI-driven monitoring technologies, IoT integration, 5G-enabled predictive analytics, along with smart manufacturing and industrial automation. According to official statistics published by the Asia Silicon Valley Development Agency in January 2026, the IoT market in Taiwan is valued at NT 2.2 trillion as of 2024. Additionally, this further increased to NT 2.8 trillion, thereby denoting a 5.0% rise from the previous year. Besides, as per the September 2025 ITA article, with over USD 165 billion invested in 2024, the U.S.-India tactical tech partnerships continued to grow, with an increase in the demand for industrial automation in India, thereby making it suitable for bolstering the overall market in the region.

The motor monitoring market in China is gaining increased exposure due to carbon neutrality goals, energy efficiency strategies, smart manufacturing and industrial policy, along with export competitiveness and manufacturing scaling. As per an article published by the State Council Information Office in May 2025, the presence of robots production industry, along with an efficient supply chain, the Midea factory has successfully delivered over 80,000 industrial robots. Besides, based on the provincial government, Guangdong's industrial robot output surpassed 240,000 sets or units as of 2024, denoting a YoY growth by 31.2%. In addition, 1 out of every 3 industrial robots in the country is currently manufactured in Guangdong. Therefore, based on continuous development in automation, the market in the country is expected to grow in the upcoming years.

The motor monitoring market in India is also growing, owing to government-backed digitalized strategies, ICT expansion, rapid industrialization, and government expenditure. Based on the government estimates published by the PIB Government in January 2025, the industrial sector in the country grew by 6.2% by the end of 2025. Besides, in 2024, the automobile sector witnessed a 12.5% sales growth in the domestic market, thus recognizing the sector’s potential and the government extending the PLI scheme by a year. In addition, the domestic production of electronics has substantially surged from ₹1.9 lakh crore to ₹9.5 lakh crore in 2024, further expanding at a 17.5% growth rate. Therefore, based on all these drivers, there is a huge growth opportunity for the market in the country.

Key Motor Monitoring Market Players:

- Siemens AG (Germany)

- ABB Ltd (Switzerland)

- Schneider Electric SE (France)

- General Electric Company (U.S.)

- Emerson Electric Co. (U.S.)

- Rockwell Automation, Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Toshiba Corporation (Japan)

- Yokogawa Electric Corporation (Japan)

- Hyundai Electric & Energy Systems Co., Ltd. (South Korea)

- LG CNS Co., Ltd. (South Korea)

- Infosys Limited (India)

- Tata Consultancy Services Limited (India)

- Wipro Limited (India)

- Sapura Energy Berhad (Malaysia)

- YTL Corporation Berhad (Malaysia)

- Schneider Electric Australia Pty Ltd (Australia)

- Fuji Electric Co., Ltd. (Japan)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- Siemens AG is one of the leading players in industrial automation and motor monitoring solutions, leveraging IoT-enabled platforms for predictive maintenance. The company’s investments in AI-driven diagnostics and smart factory integration strengthen its position in Europe and globally.

- ABB Ltd readily offers advanced motor monitoring systems with a focus on energy efficiency and reliability. Its portfolio includes vibration and electrical monitoring technologies, widely adopted in oil & gas and power generation industries.

- Schneider Electric SE integrates motor monitoring into its digital energy management solutions. The company emphasizes sustainability, offering cloud-based monitoring platforms that align with global energy efficiency mandates.

- General Electric Company provides industrial motor monitoring solutions through its digital division, GE Digital. Its Predix platform supports predictive analytics, enabling reduced downtime and optimized performance across manufacturing and energy sectors.

- Emerson Electric Co. specializes in automation and monitoring technologies, with strong adoption in process industries. Its motor monitoring systems combine vibration analysis and IoT connectivity, enhancing operational reliability and safety.

Here is a list of key players operating in the global market:

The international motor monitoring market is highly competitive, with leading players from the U.S., Europe, Japan, South Korea, India, Malaysia, and Australia driving innovation. Companies are focusing on strategic initiatives such as mergers, acquisitions, and partnerships to expand market presence. Digital transformation, AI-driven predictive analytics, and integration with IoT platforms are central to their strategies. Firms are also investing heavily in research and development to enhance monitoring accuracy and reduce downtime. Besides, in October 2025, MTU Maintenance, along with Teledyne Controls, declared their partnership with the objective of delivering enhanced engine health monitoring as well as predictive maintenance services to their respective consumers. Therefore, with Teledyne’s Data Delivery Solutions, MTU benefited from direct accessibility to wide-ranging series of flight data, thus bolstering the motor monitoring industry’s growth globally.

Corporate Landscape of the Motor Monitoring Market:

Recent Developments

- In November 2025, EBARA Corporation, along with Mitsubishi Electric Corporation, notified that they have successfully reached an agreement for effectively transferring assets from Mitsubishi Electric to EBARA for the purpose of acquiring the three-phase motor business.

- In September 2025, Hyundai Motor has introduced its 2030 vision and effectively reinforced its target of 5.5 million international vehicle sales, with electrified vehicles projected to reach 3.3 million units, including more than 18 electric vehicle and hybrid model lineup.

- In February 2023, OMRON Corporation internationally launched its K7DD-PQ Series of innovative motor condition monitoring devices, particularly in Japan. This particular series is the newest addition to the organization’s portfolio o condition monitoring devices for automating the monitoring of abnormalities across manufacturing facilities.

- Report ID: 8359

- Published Date: Jan 22, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Motor Monitoring Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.