Energy Efficient Motor Market Outlook:

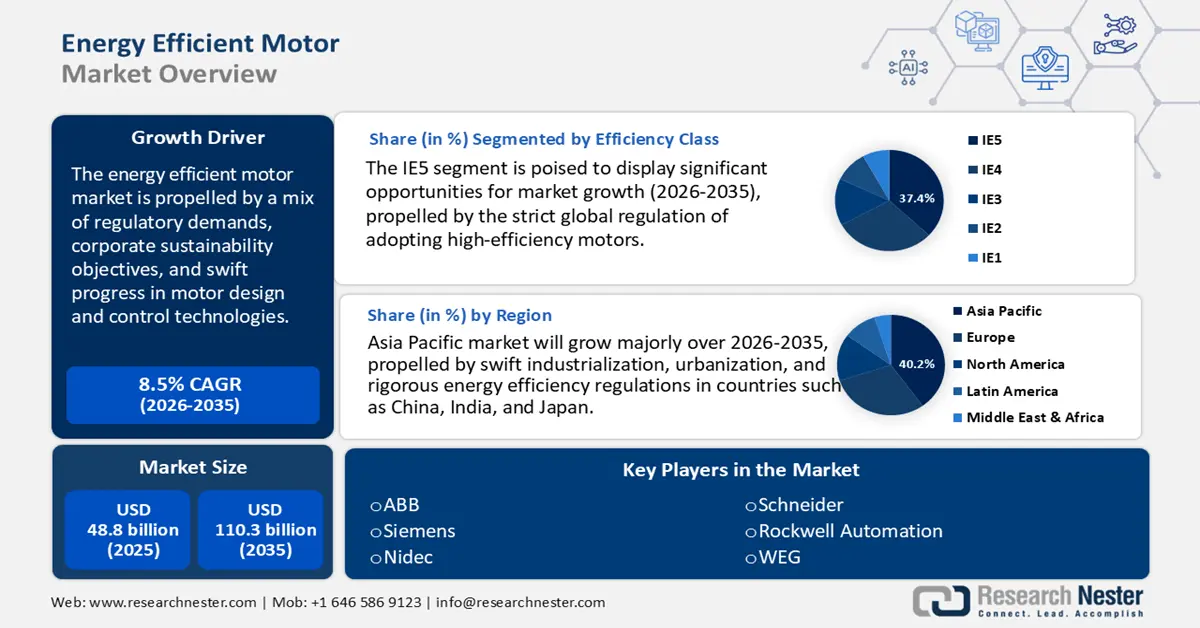

Energy Efficient Motor Market size was USD 48.8 billion in 2025 and is estimated to reach USD 110.3 billion by the end of 2035, expanding at a CAGR of 8.5% during the forecast period, i.e., 2026-2035. In 2026, the industry size of energy efficient motor is assessed at USD 52.9 billion.

The expansion of the market is being propelled by a mix of regulatory demands, corporate sustainability objectives, and swift progress in motor design and control technologies. Stricter energy efficiency regulations in numerous countries are establishing higher-efficiency classes such as IE3, IE4, and even IE5/IE6 as standard, compelling industries to upgrade outdated motors to evade non-compliance and elevated energy expenses. Furthermore, increasing electricity costs and a heightened focus on minimizing greenhouse gas emissions indicate that the total cost of ownership (which includes energy and emissions expenses) has become a more significant consideration in purchasing choices. Technological advancements such as synchronous reluctance designs, superior materials, and enhanced control systems enable motors to function with reduced losses, flatter efficiency curves even at partial loads, and extended lifespans, thereby enhancing return on investment.

A notable instance is ABB’s IE5 SynRM (synchronous reluctance) motor series. As stated on ABB’s official website, substituting traditional induction motors with IE5 SynRM models can result in up to 40% lower energy losses when compared to IE3 induction motors. ABB projects that if up to 80% of motors currently utilized in industrial settings were replaced with IE5-class machines, the global electricity savings could reach approximately 160 terawatt-hours annually, surpassing the energy consumption of some entire countries. Another case in point is Bosch: in 2022, about 50% of Bosch Rexroth’s electric motor sales were attributed to the highest efficiency motors available in their range.

Key Energy Efficient Motor Market Insights Summary:

Regional Insights:

- Asia-Pacific is poised to hold a 45.6% share by 2035 in the fast fashion market, spurred by its large manufacturing base and rapidly expanding consumer markets.

- North America is anticipated to maintain a substantial share by 2035, upheld by high consumer spending and rapid adoption of digital channels

Segment Insights:

- The conventional segment in the energy efficient motor market is projected to command an 85.7% share by 2035, underpinned by its low price and immediate trend availability.

- The apparel segment is expected to retain a leading share by 2035, propelled by high purchase frequency and constant trend turnover.

Key Growth Trends:

- Strong efficiency targets via the top runner program

- Rising demand from automation & drives businesses

Major Challenges:

- High initial expense of premium motors

- Issues with infrastructure compatibility

Key Players: ABB Ltd., Siemens AG, Nidec Corporation, Schneider Electric SE, Mitsubishi Electric, General Electric (GE), Rockwell Automation, WEG S.A., Regal (Rexnord), Bosch Rexroth AG, Toshiba Corporation, Hitachi, Ltd., Panasonic / Electrics, Yaskawa Electric Corporation, Mitsubishi Heavy Industries (MHI).

Global Energy Efficient Motor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 48.8 billion

- 2026 Market Size: USD 52.9 billion

- Projected Market Size: USD 110.3 billion by 2035

- Growth Forecasts: 8.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia-Pacific (45.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Vietnam, Mexico, Indone

Last updated on : 31 October, 2025

Energy Efficient Motor Market - Growth Drivers and Challenges

Growth Drivers

- Strong efficiency targets via the top runner program: Japan’s Top Runner regulation for three-phase AC motors (0.75-375 kW) requires minimum weighted average energy efficiency values based on shipment volume, which increase each fiscal year. For instance, motors within the 33.5-41 kW range are now obligated to achieve 95.0% efficiency at 60 Hz according to the standard. This regulatory impetus compels manufacturers to enhance product designs, phase out low-efficiency motors, and embrace premium classes (IE3+), thereby stimulating research and development, product enhancements, and market growth in motor replacement and retrofit sectors.

- Rising demand from automation & drives businesses: The fields of industrial automation, robotics, and variable speed drive applications necessitate motors that offer higher efficiency, enhanced control, and reduced operating costs. A prominent instance is Yaskawa Electric Corporation, whose business divisions encompass AC drives, servo motors, industrial robots, and motion control, where efficiency improvements directly correlate with decreased lifecycle energy consumption. As factories increasingly implement automation (such as servo systems and inverters), the demand for efficient motor performance escalates significantly, contributing to the expansion of the premium motor market.

- Energy cost pressures & national carbon-neutral goals: Japan’s strategic energy plan emphasizes environmental objectives of approximately 46% reduction in greenhouse gas emissions by FY 2030 (compared to FY 2013), while also prioritizing energy security and economic efficiency. Coupled with rising electricity costs and industrial energy expenses, this situation exerts pressure on end-users to minimize energy losses. Organizations that utilize energy-efficient motors (for instance, by replacing IE1 standard motors) can realize considerable cost savings over time, thereby strengthening the business rationale for premium efficiency motors.

1. Emerging Growth of Robotics

The emerging growth of robotics is a key driver for the market, as robots require high-performance motors that deliver precision, reliability, and low energy consumption. With increasing automation across industries such as manufacturing, logistics, and healthcare, the demand for motors that enhance operational efficiency and reduce power losses is rising. Energy-efficient motors enable longer operational life and lower heat generation, which are critical for robotic systems. Furthermore, advancements in servo and brushless DC motor technologies are enhancing the energy efficiency of robotic applications. As robotics continues to expand globally, the adoption of energy-efficient motors is expected to accelerate significantly.

Growth of Robotics

|

Country |

Export Value in 2022 ($) |

Export Value in 2023 ($) |

Growth ($) |

Growth (%) |

|

Japan |

142M |

279M |

136M |

95.7% |

|

U.S. |

46.2M |

86.9M |

40.7M |

88.1% |

|

South Korea |

29.1M |

51.2M |

.1M |

76.2% |

|

Poland |

65.8M |

106M |

39.9M |

60.7% |

|

China |

133M |

183M |

49.6M |

37.2% |

Source: OEC

2. Rising Import and Export Activities in the Aerospace

The rising import and export activities in the aerospace sector are driving the energy efficient motor market by increasing the demand for advanced motion control and propulsion systems. Aerospace manufacturing and maintenance require precision-driven, lightweight, and power-efficient motors to enhance fuel economy and reduce emissions. As global trade in aircraft components and systems expands, manufacturers are investing in high-efficiency motor technologies to meet international performance and sustainability standards. Energy-efficient motors play a crucial role in optimizing production lines and reducing operational costs in aerospace facilities. Consequently, the growing global aerospace trade is fostering innovation and the adoption of energy-efficient motor solutions.

Global Trade Statistics for Aerospace in 2021

|

Top Exporter |

Export USD |

Top Importer |

Import USD |

|

France |

$31,180,881,189 |

United States |

$30,426,302,177 |

|

Germany |

$28,271,188,899 |

Ireland |

$17,374,874,701 |

|

United States |

$14,960,918,272 |

China |

$13,048,176,775 |

|

United Kingdom |

$13,019,670,498 |

Germany |

$12,664,293,238 |

|

Canada |

$12,347,207,605 |

France |

$11,459,306,006 |

Source: globaledge.msu.edu

Challenges

- High initial expense of premium motors: Energy-efficient motors, particularly those classified as IE4 and IE5, entail considerably higher initial costs when compared to standard IE1 motors. This price gap frequently deters small and medium-sized enterprises from making upgrades, even though they could realize long-term savings. Furthermore, the lack of awareness regarding the benefits of lifecycle costs further hinders adoption, especially in markets and industries that are sensitive to costs and operate with limited capital budgets.

- Issues with infrastructure compatibility: Numerous legacy industrial systems are not engineered to support energy-efficient motors without undergoing modifications. Variations in physical dimensions, starting torque, or control compatibility often necessitate further investment in retrofitting, inverters, or redesigning the system. These technical challenges elevate the complexity of implementation and prolong the replacement cycle for older, inefficient motors, particularly in developing regions or in older manufacturing facilities.

Energy Efficient Motor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.5% |

|

Base Year Market Size (2025) |

USD 48.8 billion |

|

Forecast Year Market Size (2035) |

USD 110.3 billion |

|

Regional Scope |

|

Energy Efficient Motor Market Segmentation:

Efficiency Class Segment Analysis

The IE5 motors segment will dominate by holding 37.4% revenue share in the global energy efficient motor market in 2035, Stringent global regulations are propelling the adoption of high-efficiency motors. For instance, the U.S. Department of Energy's Energy Conservation Standards for Electric Motors require elevated efficiency levels, urging industries to transition to IE5 motors. These motors provide considerable energy savings and lower operational costs, in line with global initiatives aimed at decreasing carbon emissions. ABB’s IE5 SynRM motors achieve up to 50% lower energy losses compared to IE2 motors, merging the performance of permanent magnets with the simplicity of induction for heavy industry and HVAC applications. Their IE4 SynRM motors cut losses by 40% relative to IE3, ensuring safety and efficiency in hazardous environments. A record-setting ABB motor in India reached 99.13% efficiency, resulting in energy savings of 61 GWh and $5.9 million over a span of 25 years, as part of the Top Industrial Efficiency initiative.

Application Segment Analysis

HVAC systems remain at the forefront of the energy efficient motor market, propelled by significant enhancements in both commercial and residential infrastructures that focus on minimizing energy usage and achieving sustainability objectives. The increasing demand for sophisticated HVAC solutions accelerates the implementation of high-efficiency motors that enhance performance and decrease operational expenses. Johnson Controls’ YORK YVAM chillers reduce power consumption by 40%, whereas CYK heat pump chillers attain a COP of 8.0, providing effective heating and cooling. Their VSD FP Series III drives can lower energy costs by as much as 60% in HVAC applications.

Motor Type Segment Analysis

AC motors, particularly asynchronous types, are the leading choice in the energy efficient motor market due to their adaptability and extensive application in both industrial and commercial sectors. Their sturdy construction and economical nature render them suitable for uses such as pumps, fans, and conveyors. Siemens is at the forefront of the energy efficient motor market with its Simotics SD motor series, which reliably attains IE4 super-premium efficiency throughout the entire power range from 2.2 kW to 1,000 kW. This range includes 6-pole motors starting at 75 kW and 8-pole motors beginning at 55 kW, surpassing the requirements set by the European Union's ErP 2019/1781 directive. These motors find extensive application in industries including water, wastewater, chemical, oil & gas, cement, paper, marine, and metal processing, leading to substantial energy savings and a decrease in CO₂ emissions.

Our in-depth analysis of the energy efficient motor market includes the following segments:

|

Segment |

Subsegments |

|

Efficiency Class |

|

|

Application |

|

|

Motor Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Energy Efficient Motor Market - Regional Analysis

Asia Pacific Market Insights

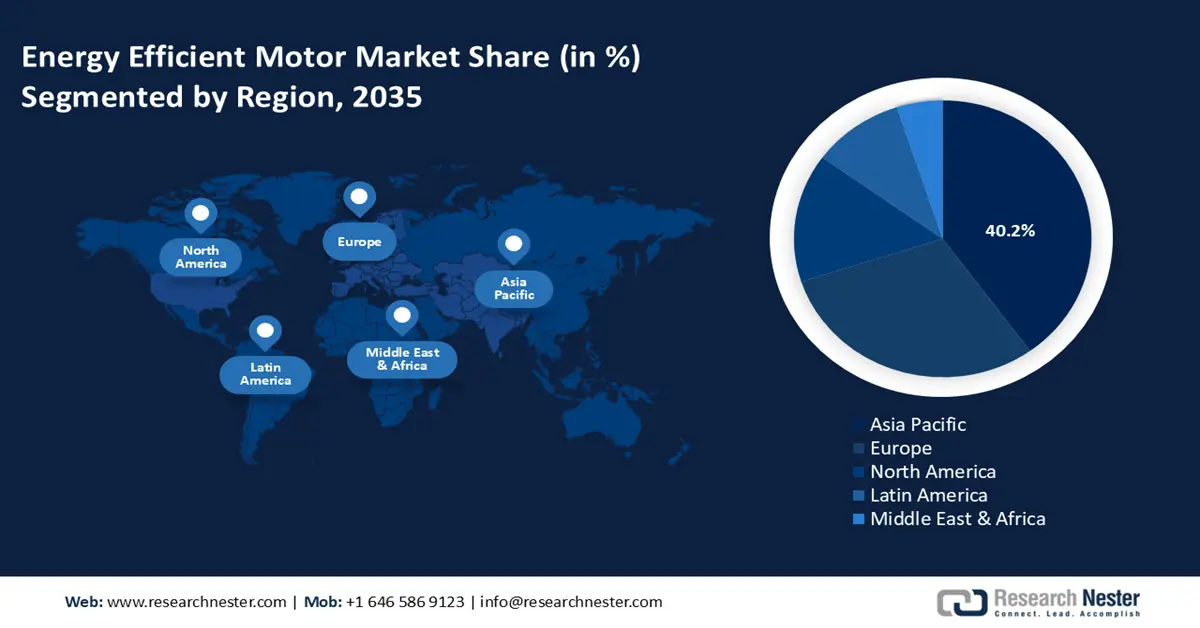

The Asia Pacific occupies a leading role in the global market, representing 40.2% of the total market share. This dominance is propelled by swift industrialization, urbanization, and rigorous energy efficiency regulations in countries such as China, India, and Japan.

China is anticipated to reach a considerable market value by 2035, making a substantial contribution to the regional demand. This expansion is driven by extensive industrial activities and infrastructure advancements. The WEG W23 Sync+ Ultra series integrates permanent magnet and synchronous reluctance technologies, achieving efficiencies that exceed IE5 with 36% lower losses compared to IE3 motors. Supporting a range from 0.75 to 1,250 kW, these motors are well-suited for pumps and compressors. WEG’s Motion Fleet Management enhances energy utilization through real-time monitoring and predictive maintenance.

India's energy efficient motor market is expected to attain a significant size by 2035, constituting a major part of the regional demand. This market growth is fueled by agricultural modernization, infrastructure enhancements, and industrial improvements. Larsen & Toubro (L&T) plays a pivotal role in advancing India’s market, achieving a 15.9% reduction in energy intensity in 2023-24. The Heavy Engineering division’s Green Portfolio provides sustainable solutions in green fuels, nuclear energy, and cleaner fossil fuels, underscoring L&T’s strong dedication to energy efficiency and sustainability.

Europe Market Insights

Europe’s energy-efficient motors market is experiencing notable growth, propelled by stringent efficiency regulations and extensive industrial retrofitting. Major countries such as Germany, France, and the UK account for the bulk of regional demand, with pumps and fans representing more than half of all applications.

Germany is expected to capture a significant portion of the market, influenced by rigorous government regulations regarding energy consumption and a strong emphasis on industrial modernization. The nation’s commitment to lowering carbon emissions and enhancing operational efficiency within manufacturing sectors drives the demand for advanced motor technologies. SEW-Eurodrive stands out as a prominent player in Germany's market, providing solutions that markedly decrease energy consumption. Their DR2C synchronous motors, which achieve IE5 efficiency, can cut energy losses by as much as 50% in comparison to conventional IE3 motors. These motors are especially well-suited for applications with variable loads or frequent start/stop cycles, leading to considerable energy savings and bolstering Germany’s sustainability objectives.

The UK is projected to spearhead the market, fueled by strict energy regulations and a robust initiative towards carbon neutrality in both commercial and industrial sectors. Investments in infrastructure enhancements and the increasing adoption of smart technologies further stimulate demand. Schneider Electric's Altivar 600 variable speed drives have been acknowledged for their energy efficiency, achieving up to 50% optimized energy consumption relative to applications lacking drives. These drives are particularly effective in scenarios involving pumps, fans, and compressors, resulting in substantial energy savings and supporting sustainability initiatives.

North America Market Insights

North America is expected to represent 25% of the global market by the year 2035. This market growth is propelled by rigorous regulatory frameworks, the modernization of industrial infrastructure, and an increasing adoption of energy-saving technologies across HVAC, manufacturing, and water treatment sectors, all aimed at minimizing operational costs and environmental impact.

The U.S. is projected to capture the largest market share within North America by 2035, fueled by significant industrial modernization and strict energy efficiency regulations. Rockwell Automation’s PowerFlex drives can provide energy savings of up to 50% by decreasing motor speeds in fan or pump systems by 25%. The PowerFlex 755T series features regenerative capabilities that return energy to the supply grid. At the Sibanye-Stillwater mine, the PowerFlex 6000T VFDs achieved energy savings of 62% and 48%, respectively.

Canada is anticipated to play a crucial role in the North American market by 2035, driven by industrial modernization, more stringent emissions regulations, and comprehensive energy conservation initiatives. Infinitum Electric has launched an ultra-high-efficiency motor line (the IEs Series) tailored for the Canadian market to support HVAC fan, pump, and general-purpose applications. Their Canadian-specified IEs motors (5-15 HP, 575V) are approximately 10% more efficient than traditional motors, while also being lighter, smaller, and quieter.

Key Energy Efficient Motor Market Players:

- ABB Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- Nidec Corporation

- Schneider Electric SE

- Mitsubishi Electric

- General Electric (GE)

- Rockwell Automation

- WEG S.A.

- Regal (Rexnord)

- Bosch Rexroth AG

- Toshiba Corporation

- Hitachi, Ltd.

- Panasonic / Electrics

- Yaskawa Electric Corporation

- Mitsubishi Heavy Industries / MHI

Leading companies set themselves apart by utilizing cutting-edge technologies and features. Numerous organizations implement synchronous reluctance (SynRM) or permanent magnet-assisted designs to minimize rotor losses and eliminate dependence on rare earth magnets. The incorporation of variable frequency drives (VFDs) and digital intelligence / IoT connectivity facilitates real-time monitoring, predictive maintenance, and adaptive control. Additionally, some companies embrace regenerative braking/energy recovery circuits or innovations in power electronics (such as gate-driver ICs) to reclaim wasted energy and enhance efficiency. Furthermore, several firms optimize thermal management, advanced laminations, low-loss materials (like amorphous cores), and compact designs to maximize power density and decrease stray losses.

Here are some of the major key players:

Recent Developments

- In September 2025, Brazilian motor manufacturer WEG announced a substantial investment of around $207 million aimed at expanding its operations in Santa Catarina by 2028. The company intends to construct a new facility dedicated to the production of large-scale equipment, which includes compensators and turbo generators, while also enhancing its existing operations in Jaragua do Sul to accommodate the increasing demand.

- In September 2025, Taiwan Semiconductor Manufacturing Company (TSMC) initiated the EUV Dynamic Energy Saving Program across its Fabs 15B, 18A, and 18B. This initiative has already achieved a 44% reduction in peak energy consumption of its Extreme Ultraviolet (EUV) lithography tools, to save 190 million kilowatt-hours of electricity and decrease carbon emissions by 101 kilotons by 2030.

- Report ID: 8206

- Published Date: Oct 31, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Energy Efficient Motor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.