Permanent Magnet Motor Market Outlook:

Permanent Magnet Motor Market size was valued at USD 58.79 billion in 2025 and is projected to reach USD 132.45 billion by the end of 2035, rising at a CAGR of 9.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of permanent magnet motor is assessed at USD 61.80 billion.

The global market for permanent magnet motors (PMMs) is experiencing rapid growth, driven by increasing demand for energy-efficient products across various industries, including automotive, renewable energy, and industrial automation. PMMs depend on a supply chain that utilizes rare-earth elements such as neodymium and dysprosium, among others, which are typically sourced from China. For instance, China imports rare earths from other nations and processes them, producing 60% of the world's rare earths while processing roughly 90% of them. A recent U.S. Department of Commerce report indicates a pressing national security issue with the level of import dependency due to the manufacture of neodymium-iron-boron (NdFeB) magnets in the U.S. The United States imported 75% of its supply of sintered NdFeB magnets from China in 2021. This has prompted the U.S. government to provide funding for domestic magnet production and the sourcing of recycling technology.

The import and export nature of PMM also has a significant effect. For instance, the U.S. heavily imports NdFeB magnets from China, which dominates the global market partly due to the availability of raw materials. Furthermore, global trade shapes the growth of industries in areas that seek to expand businesses to address the necessity of supply chain disruptions or shortages following the COVID pandemic. Forecasts indicate U.S. domestic production of NdFeB magnets could meet as much as 51% of national demand by 2026. Investments in technology development are considerable, with the U.S. supporting programs to develop NdFeB magnet production and human capital development for materials scientists and production line workers.

Key Permanent Magnet Motor Market Insights Summary:

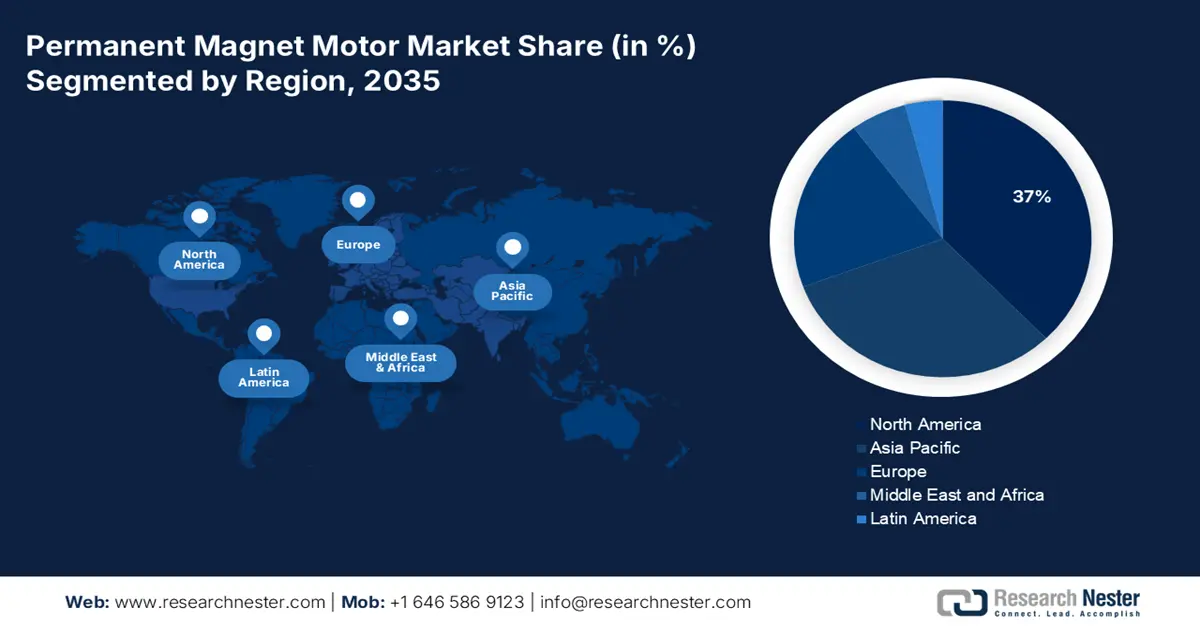

Regional Highlights:

- North America permanent magnet motor market is poised to hold a revenue share of 37% by 2035, impelled by government initiatives supporting digital infrastructure and clean energy.

- Asia Pacific is projected to account for a 31% revenue share by 2035, driven by increased EV adoption and large-scale ICT investments.

Segment Insights:

- PMAC segment is projected to hold a dominant 45.2% revenue share by 2035 in the permanent magnet motor market, propelled by their energy efficiency and torque density.

- NdFeB segment is poised to account for a major revenue share by 2035, owing to their higher magnetic power and applications in high-power-density uses.

Key Growth Trends:

- Shift towards electric vehicles (EVs)

- Energy efficiency legislation and sustainability goals

Major Challenges:

- Rare earth material supply constraints

- High initial manufacturing costs

Key Players: ABB Ltd., Siemens AG, Nidec Corporation, Rockwell Automation, Inc., Wolong Electric Group Co., Ltd., WEG S.A., Toshiba Corporation, Emerson Electric Co., Hyundai Electric & Energy Systems, Franklin Electric Co., Inc., Allied Motion Technologies Inc., Yaskawa Electric Corporation, Havells India Ltd., Firstway (M) Sdn. Bhd., Austorque Australia Pty Ltd.

Global Permanent Magnet Motor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 58.79 billion

- 2026 Market Size: USD 61.80 billion

- Projected Market Size: USD 132.45 billion by 2035

- Growth Forecasts: 9.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (37% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Mexico, Vietnam, Thailand

Last updated on : 6 October, 2025

Permanent Magnet Motor Market - Growth Drivers and Challenges

Growth Drivers

- Shift towards electric vehicles (EVs): The increase in global EV adoption is accelerating demand for permanent magnet synchronous motors (PMSM). As per the International Energy Agency (IEA), global sales of electric cars increased by more than 25% to reach 17 million in 2024. The total number of electric vehicles delivered in 2020 was surpassed only by the 3.5 million more vehicles sold in 2024 than in 2023. The high efficiency and high torque density of PMSMs are essential in EV powertrains. Currently, Asia-Pacific, aided by China, is the largest producer of EVs, contributing to the PMM market demand for the region through 2030. China exports 16,000 tons of rare earth permanent magnets to Europe annually, which accounts for almost 98% of the EU market.

- Energy efficiency legislation and sustainability goals: Global regulations for energy efficiency, such as the EU's Ecodesign Directive and the U.S. Department of Energy efficiency standards, create a mandate for PMM adoption. The NIST framework for cybersecurity in manufacturing promotes secure, energy-efficient systems, leading to the adoption of PMMs in smart factories. The European regions' carbon neutrality targets by 2050 are fostering greater PMM adoption. Likewise, the Asia-Pacific region is benefiting from China's recently implemented energy efficiency policies.

- Industrial automation and Industry 4.0: The growth of industrial automation is generating demand for small form-factor, very high-performance PMMs for new applications in robotics and smart manufacturing. According to the World Robotics report, 4,281,585 units were working in factories across the globe in September 2023, a 10% rise. More than half a million units were installed annually for the third year in a row. Among all newly deployed robots in 2023, Asia accounted for 70% of installations, followed by Europe at 17% and the Americas at 10%. There is a strong interest for PMMs in precision applications that incorporate AI and IoT.

Emerging Trade Dynamics in the Market

In 2023, global rare-earth metal compounds trade reached $3.52 billion, up 3.49% from 2022’s $3.4 billion. Over five years, it grew annually at 22.5%, ranking 631st in global trade value (0.016%) and 341st in product complexity with a PCI score of 0.58.

Export and Import of Rare-Earth Metal Compounds in 2023

|

Exporters |

Export Value (USD) |

Importers |

Import Value (USD) |

|

Myanmar |

$1.44 B |

China |

$1.98 B |

|

Malaysia |

$531 M |

Japan |

$478 M |

|

China |

$513 M |

Vietnam |

$183 M |

Source: OEC

Challenges

- Rare earth material supply constraints: Permanent magnet motors are heavily reliant on rare earth elements like neodymium and dysprosium for high-performance magnets. These rare earth elements are concentrated in geographic areas, most notably in China, which adds supply chain risk and variability in pricing of the materials. The effect of geopolitical relations, a lack of trade agreements, and strict export quotas may enhance limited supply, threaten tariffs, or increase prices overnight. To offset a declining rare earth supply chain (price or availability), manufacturers need to find other supply sources, start investing in magnet recycling practices, or simply develop a motor technology that uses permanent magnets with less rare earth content.

- High initial manufacturing costs: Manufacturing permanent magnet motors is expensive because of the materials, precision engineering, and specialized manufacturing processing, costing a manufacturer more at the beginning than for an induction or wound-field motor. While PM motors are inherently more efficient and result in lower total lifetime operating costs, the upfront cost of the PM motor can be prohibitive for price-sensitive environments such as small-scale industrial automation or residential HVAC. Finding PM motor efficiency increases while also making them price competitive is an ongoing challenge, and many manufacturers are experimenting with economies of scale and optimization of design to help find a balance.

Permanent Magnet Motor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.7% |

|

Base Year Market Size (2025) |

USD 58.79 billion |

|

Forecast Year Market Size (2035) |

USD 132.45 billion |

|

Regional Scope |

|

Permanent Magnet Motor Market Segmentation:

Motor Type Segment Analysis

The PMAC segment of the permanent magnet motor market is projected to hold a dominant 45.2% revenue share by the end of 2035. The growth is fueled by their energy efficiency and torque density, which make them ideal for EVs and industrial applications. A 28-horsepower motor powering a 25-ton centrifugal compressor would save roughly 9000 kWh annually, resulting in 10% to 15% energy savings due to improved motor and electronics efficiency. Organizations should seek ways to leverage the opportunities to design competitively priced PMAC products that bridge the performance gaps.

Magnetic Material Type Segment Analysis

The NdFeB segment is poised to account for a major revenue share in the market due to their higher magnetic power and applications in high-power-density uses such as EVs and wind turbines. Approximately 93% of the current market for NdFeB magnets is for sintered magnets. NdFeB magnets consist of about 69% iron, 1% boron, and 30% rare earth metals (Nd, Pr, Dy) with small additions of Co, Al, Tb, and Ho. Many businesses are stepping into the innovation of recycling used rare-earth products with existing rare-earth-free magnets. The most prominent Asia Pacific businesses dominate the market on account of their access to raw materials in China.

End use Industry Segment Analysis

The automotive segment of the permanent magnet motor market is projected to hold a significant revenue share by the end of 2035. Mainly due to the significant global adoption of electric vehicles (EVs). PMMs are appealing for use in EV propulsion due to their high efficiency, compact size, and high torque. The fleet of electric cars had grown to about 58 million by the end of 2024, accounting for over three times the number of electric cars in 2021 and roughly 4% of all passenger cars. The automotive sub-segment is enhanced by government subsidies for EVs, stringent emission regulations, and increased consumer demand for sustainable transport options.

Our in-depth analysis of the permanent magnet motor market includes the following segments:

|

Segment |

Subsegments |

|

Motor Type |

|

|

Magnetic Material Type

|

|

|

Cooling Method |

|

|

Power Rating |

|

|

End-Use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Permanent Magnet Motor - Regional Analysis

North America Market Insights

The North American market is poised to hold a revenue share of 37% by 2035, led by the government initiatives that support digital infrastructure and clean energy. The National Telecommunications and Information Administration (NTIA) indicated that around USD 42.45 billion was set aside in the Portioning Explain and Ladder your Path (BEAD) program for extending digital infrastructure until 2030. These initiatives indirectly drive the demand for PMM systems due to increased workloads that develop in data centers, 5G towers, and smart grid systems. Furthermore, the rising number of electric vehicles (EVs) also contributes to market expansion.

Additionally, demand for permanent magnet motors has been increasing in the U.S. due to investments in smart infrastructure and a targeted federal funding approach. The deployment of fiber optic broadband conduit infrastructure has increased the application of PMMs in that area. The Federal Communications Commission (FCC) has also indicated that deployment of spectrum under the planning 5G initiatives will increase the application of PMMs in connectivity technology with respect to cooling systems, antenna actuators, and telecom modules. Furthermore, the U.S. Department of Energy has made investments to ensure PMM growth in the U.S. while promoting domestic production of components pertaining to EV motors through the use of the Advanced Technology Vehicles Manufacturing Loan Program.

The growth of Canada's permanent magnet motor sector is attributed to increased investment in renewable energy projects, the electric car market, and advances in smart manufacturing. Federal clean energy policies, as well as incentivizing programs at the provincial level, help to accelerate the uptake of energy-efficient motors across industrial sectors. Local research collaboration paired with the avoidance of reliance on rare-earth materials is being explored to mitigate supply-chain risk. The increasing uptake of automation in several sectors, such as mining, forestry, and transportation, continues to drive demand, while collaboration with U.S. technology vendors supports innovation and sustainable development of permanent magnet motor applications.

Asia Pacific Market Insights

The Asia Pacific permanent magnet motor market is poised to hold a revenue share of 31% throughout the forecast period. The growth is driven by the increased adoption of electric vehicles (EVs) and large-scale investment in information and communication technologies (ICT). China held over 92% of the world market for NdFeB magnets and magnet alloys in 2020. With roughly 58% of the rare earth mining industry, 89% of the oxide separation market, and 90% of the metallization market, China also controlled the 2020 upstream value chain phases. As of 2023, millions of businesses had made PMM-integrated technologies available within their business plans.

India is predicted to emerge as the region with the highest CAGR in the Asia Pacific permanent magnet motor market. Growth in this sector can be attributed to the expansion of digital infrastructure and strong government support. NFTDC’s advanced rare-earth materials expertise and MAM’s strengths in mining, powder metallurgy, e-mobility, and financing drive a TRL-9 plant targeting 500 TPY magnets, scaling to 5,000 TPA by 2030 for self-reliance. The Smart Cities Mission has implemented PMM-based heating, ventilation, and air conditioning (HVAC) and transport automation in more than 90 cities. Several government initiatives, including Digital India and the Production Linked Incentive (PLI) scheme, support local PMM manufacturing and R&D. India is expected to see market growth, additionally, based on the significant expansion of the local electric vehicle market and a noted contribution from NASSCOM in AI-optimized PMM-driven data centers.

The permanent magnet motor market in China has flourished due to its manufacturing base and advanced development in the electronics sector. As electric vehicle output grows, renewable energy projects expand, and industrial automation progresses, demand for permanent magnet motors will grow as well. China's proportion of worldwide electric car sales surged in 2024, with sales of electric cars rising by about 40% year over year. China sold half of the world's electric cars in 2021, and by 2024, that number had increased to over two-thirds. The country's institutional support, robust research capabilities, and large-scale infrastructure development will enable an ongoing cycle of technological advancement, which will further consolidate China's role as a global leader in the production and application of permanent magnet motors.

Europe Market Insights

The European permanent magnet motor market is poised to hold a significant share throughout the forecast period. The European permanent magnet motor market is aided by high industrial automation, renewable energy sources, and electric mobility initiatives. Supporting EU policies focusing on energy efficiency and reducing carbon emissions incentivizes adoption for the manufacturing, automotive, and robotics sectors. An increase in the demand for high-performance motors in wind energy applications and HVAC applications will build demand for a growing market. It is forecasted that increasing R&D collaboration and regional expertise in precision engineering will cultivate opportunities in more sophisticated motor technologies and foster ongoing market growth across a diverse range of applications.

In Germany, the robust automotive, industrial automation, and renewable energy industries drive the demand for permanent magnet motor technologies. The government's commitment to energy efficiency and electrification will open up space for innovation and new products in the field of high-performance motors. As well, Germany's extensive engineering experience and the sustainability agenda provided by the government indicate that new applications of PM motors in electric vehicles, robotics, and advanced manufacturing will be drafted. Germany ended its €4,500 EV subsidy in December 2023, causing a 4-point market share drop in 2024, prompting new corporate EV tax incentives from July 2024 to 2028.

The market for permanent magnet motors in the UK is growing through government initiatives to support the electrification of transportation, offshore wind projects, and improvements in industrial efficiencies. Government policy supports low-carbon technologies and advanced manufacturing that drives permanent magnet motors across the transportation sector (automotive, aerospace, and marine). An innovation ecosystem composed of research collaboration as well as start-up activity supports the development of high-efficiency motors. Sales of electric cars increased from 24% in 2023 to approximately 30% in the UK, the second-largest automobile market in Europe. The Vehicle Emissions Trading Scheme was first implemented in 2024, requiring 22% of all new registrations to be fuel cell electric vehicles (FCEVs) or BEVs.

Key Permanent Magnet Motor Market Players:

- ABB Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- Nidec Corporation

- Rockwell Automation, Inc.

- Wolong Electric Group Co., Ltd.

- WEG S.A.

- Toshiba Corporation

- Emerson Electric Co.

- Hyundai Electric & Energy Systems

- Franklin Electric Co., Inc.

- Allied Motion Technologies Inc.

- Yaskawa Electric Corporation

- Havells India Ltd.

- Firstway (M) Sdn. Bhd.

- Austorque Australia Pty Ltd.

The permanent magnet motor market is driven by a high demand for automation and IoT. ABB and Siemens dominate the global PMM landscape with AI-driven motor controls. Rockwell Automation has embraced NIST's cybersecurity framework to improve Trust. Havells and Firstway are targeting cost-sensitive applications with ferrite motors. Australian companies are exploring rare-earth-free and other sustainable electric motor innovations. Companies are primarily focusing on R&D and recycling opportunities while exploring potential private-sector partnerships to combat supply chain risks.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In August 2024, Rockwell Automation announced the adoption of NIST’s cybersecurity framework to integrate secure IoT connectivity into its PMM-based automation systems to protect motor-driven systems in smart manufacturing from cyber threats and address vulnerabilities in IIoT networks.

- In May 2024, EVR Motors Ltd. developed a new plant in Haryana, India, to produce its Trapezoidal Stator Radial Flux Permanent Magnet (RFPM) motor for ICT applications such as robotics and IoT-enabled manufacturing.

- Report ID: 5170

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Permanent Magnet Motor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.