Brushless DC Motor Market Outlook:

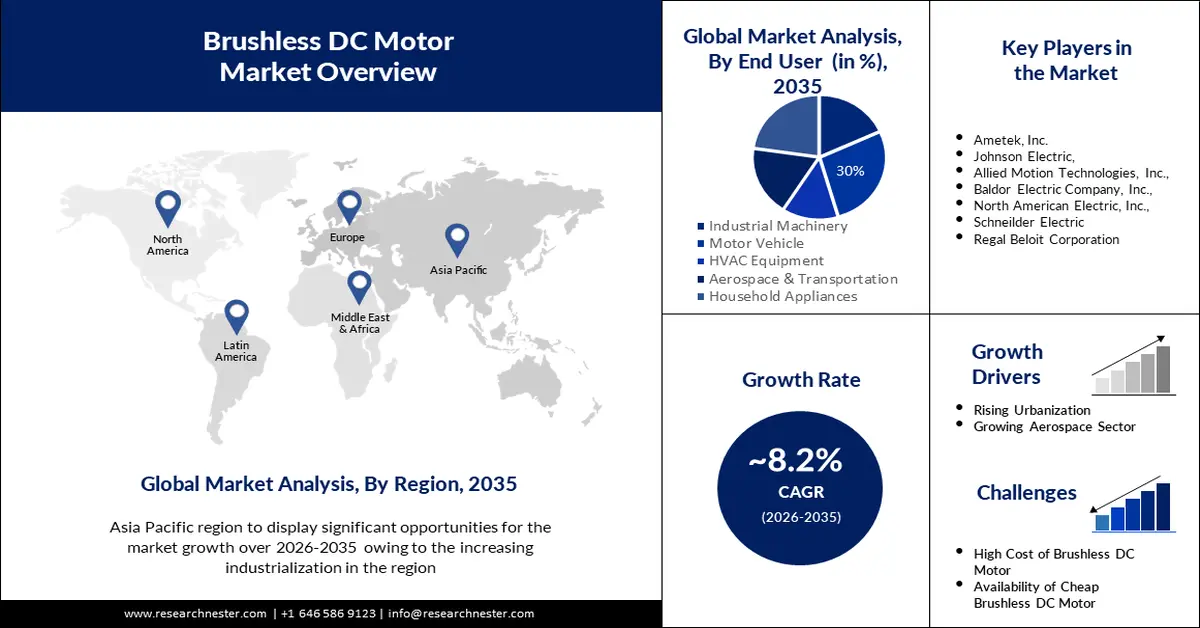

Brushless DC Motor Market size was valued at USD 14.17 billion in 2025 and is likely to cross USD 31.16 billion by 2035, expanding at more than 8.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of brushless DC motor is assessed at USD 15.22 billion.

Brushless direct current motors have significant applications in various industrial production activities, due to their simple structures, low noise levels, and high speeds. To improve operational efficiency and lower functional costs, the optimization of brushless DC motors was analyzed by the National Center for Biotechnology Information in March 2024 using the JAYA algorithm. This approach identifies the optimal parameters through electromagnetic structure selection and efficiency calculation.

The surging global supply of electric motors also underscores the brushes DC motor market expansion. Electric motors section encompasses brushless DC motors, output variant < 750 watts, AC motors, DC generators, multi-phase, output variant 0.75-75 kW, AC motors, and single-phase, among others. In 2023, the worldwide trade of electric motors was USD 71.5 billion, with an annualized growth rate of 3.66%. It ranked 51st among 1217 items in terms of trade value in 2023, contributing 0.32% of world trade. In terms of the Product Complexity Index (PCI), the electric motor sub-sector was at 209 out of 1044 products, denoting a PCI of 0.91, finds the OEC. In 2023, the top exporters included China (USD 17.3 billion export trade value), Germany (USD 8.78 billion), and the U.S. (USD 4.88 billion). The leading importers comprised the U.S. (USD 12.7 billion), Germany (USD 7.51 billion), and China (USD 3.73 billion).

Key Brushless DC Motor Market Insights Summary:

Regional Highlights:

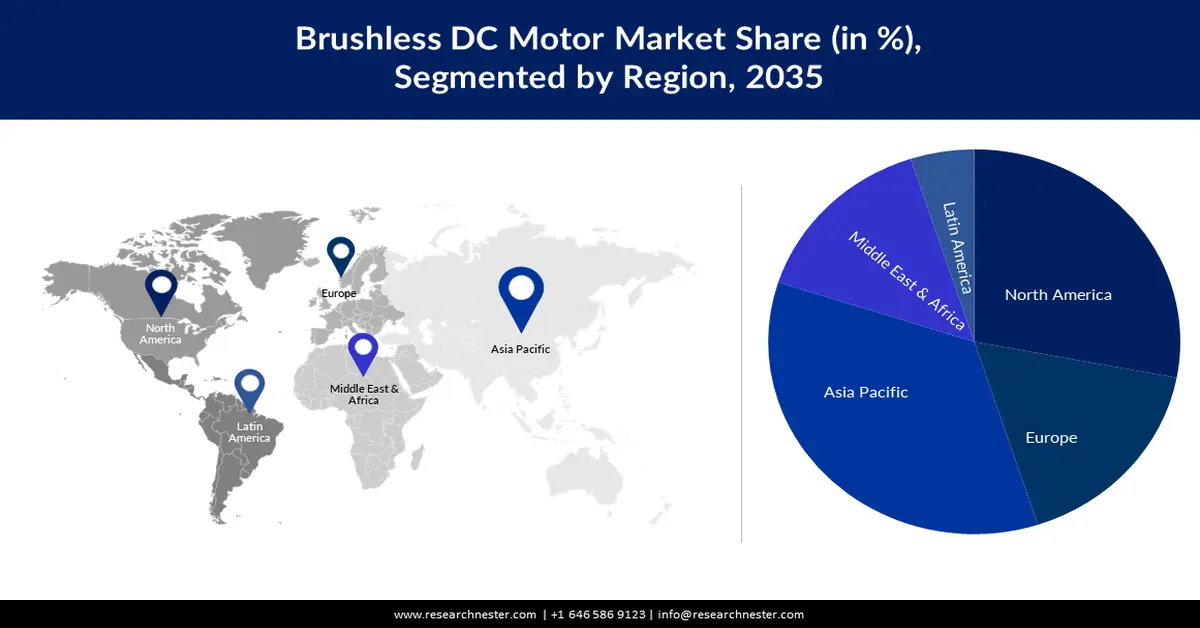

- The Asia Pacific brushless DC motor market is projected to capture a 35% share by 2035, attributed to increasing industrialization, surging technological advancements, and growing investment in research and development.

- The North America market is expected to secure a notable share by 2035, driven by increasing aerospace & defense sector, rise in use of electric vehicles, and growing automotive sector.

Segment Insights:

- The motor vehicles segment in the brushless dc motor market is forecasted to attain a 30% share by 2035, driven by rising global auto sales and the high efficiency and long lifespan of brushless DC motors.

- The 0-750 watts segment in the brushless dc motor market is expected to achieve a significant share by 2035, driven by increasing demand for energy-efficient and reliable motor systems across industries.

Key Growth Trends:

- Demand for traction motors in EVs

- Regulations and energy conservation standards to promote sustainability

Major Challenges:

- Exorbitant cost of brushless DC motor

Key Players: ABB Ltd., Ametek, Inc., Johnson Electric, Allied Motion Technologies, Inc., Baldor Electric Company, Inc., North American Electric, Inc., Schneider Electric, Regal Beloit Corporation, Arc System Inc.

Global Brushless DC Motor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.17 billion

- 2026 Market Size: USD 15.22 billion

- Projected Market Size: USD 31.16 billion by 2035

- Growth Forecasts: 8.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 11 September, 2025

Brushless DC Motor Market Growth Drivers and Challenges:

Growth Drivers

- Demand for traction motors in EVs: Hybrid, Electric, plug-in hybrid, and fuel cell EVs all work on traction motors and convert electrical energy to mechanical energy. Several types of electric motors EVs, with each providing a unique set of benefits, characteristics, and trade-offs such as size, power, weight, range, performance, and cost. These include alternating current (AC) induction motors, DC brushed motors, permanent magnet synchronous motors (PMSMs), brushless direct current motors, internal permanent magnet (IPM) motors, and switched reluctance motors (SRMs). The BLDC motor utilizes electronic commutation to mitigate the flow of current through windings.

NdFeB magnets are a popular choice for brushless DC motors with base materials -neodymium (Nd), boron (B), and iron (Fe).A number of permutations and combinations are incorporated to enhance magnetic properties. Additives such as dysprosium (Dy), gallium (Ga), and terbium (Tb) perform well with NdFeB magnets, allowing high coercivity in elevated temperatures.Additionally, BLDC power electronics are based on materials like gallium nitride (GaN), silicon (Si), and silicon carbide (SiC). Of these three materials, Si dominated the power market and held a revenue share of 93% in 2022, SiC at 6%, and GaN at 1%, as a 2023 U.S. DOE report. These metrics were determined by cumulative market 2022 value of USD 47.8 billion in 2022 (all device types) and a CAGR of 4.4% through 2027.

- Regulations and energy conservation standards to promote sustainability: The brushless DC motor market dynamics are shaped by the prevalent government regulatory standards. The November 2022 Joint Recommendation was submitted by the Electric Motors Working Group (ASAP, ACEEE, NEMA, NEEA, NRDC, PG&E, SCE, and SDG&E), amending electric motor energy conservation standards. The U.S. DOE considered these recommendations and integrated them with the statutory 42 U.S.C. 6295(p)(4) to roll out the Direct Final Rule in June 2023.

Furthermore, ENERGY STAR criteria play a pivotal role in the sales of residential air conditioners. Low-end WAHPs have single stage compressors, while higher efficiency systems use variable speed compressors to enhance temperature and humidity control. Variable speed electronically commutated motors (ECM) are widely utilized to improve energy efficiency. According to a March 2023 EIA report, the ENERGY STAR criteria can bring down annual electricity consumption by approximately 10% less than the Federal standard, thereby recommending energy efficiency for refrigerators. This includes efficient compressors, brushless direct current fan motor, larger condenser, variable defrost, dual evaporators, vacuum-insulated panels, and refrigerants (Isobutane vs. R134a).

Consequently, the consensus-recommended efficiency levels for electric motors were adopted as the new and amended standard levels in the June 2023 Direct Final Rule. 88 FR 36066, 36144-36145.

Challenges

- Exorbitant cost of brushless DC motor: The high cost of brushless DC motors is one of the major factors predicted to slow down market growth. For instance, to function well, brushless DC motors need specialized electronic control systems that include sensors, controllers, and power electronics. The cost of these parts may increase the motor’s overall price.

Brushless DC Motor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.2% |

|

Base Year Market Size (2025) |

USD 14.17 billion |

|

Forecast Year Market Size (2035) |

USD 31.16 billion |

|

Regional Scope |

|

Brushless DC Motor Market Segmentation:

End user Segment Analysis

The motor vehicles segment is estimated to hold a 30% share of the global brushless DC motor market in 2035. The growth of the segment can be attributed to the increasing demand for statistical charts & tables and automobiles across the globe. As a result of their high efficiency, minimal maintenance needs, and extended lifespan, brushless DC motors forecast estimates, and much is likely to be in more demand as global auto sales rise.

Power Output Segment Analysis

The 0-750 watts segment is expected to garner a significant brushless DC motor market share in 2035. The increasing demand for energy-efficient and dependable motor systems in a variety of industries, including robotics, electric cars, industrial automation, and aerospace, has led to an increase in the use of brushless DC motors with power ratings of 0-750 watts. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global brushless DC motor market includes the following segments:

|

Power Output |

|

|

End user |

|

|

Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Brushless DC Motor Market Regional Analysis:

APAC Market Insights

The brushless DC motor market in Asia Pacific, is projected to be the largest with an enormous share of 35%, by the end of 2035. The growth of the market can be attributed majorly to the increasing industrialization. Rapid industrialization in the area has raised the demand for high-performance motors across a range of sectors, including the automobile, healthcare, aerospace, and other industries. In addition to this, the surging technological advancements in the region and growing investment in research and development are also anticipated to boost the market growth during the forecast time period. In 2023, India’s industrial production increased by an average of over 6%, reaching a record high of more than 130% in 2021.

Japan is the world’s fourth-largest automotive producer and is home to companies such as Toyota, Nissan, Honda, Mazda, Mitsubishi, Subaru, Suzuki, and Daihatsu. The auto production space is vital for Japan’s economic health, contributing 2.9% to its GDP and is 13.9% of its manufacturing GDP, as per the International Trade Administration (ITA) 2024 report. In terms of trade, Japan exported cars worth USD 113.4 billion in 2024 and were mainly supplied to the U.S. (USD 41.3 billion), Australia (USD 8.61 billion), China (USD 6.47 billion), Canada (USD 5.92 billion), and Saudi Arabia (USD 3.70 billion).

North America Market Insights

The North America brushless DC motor market is estimated to register a notable share by the end of 2035. The growth is attributed majorly to the increasing aerospace & defense sector. The desire to lower carbon emissions and enhance air quality is driving a rise in the use of electric vehicles (EVs) across the region. For instance, owing to their high efficiency and low maintenance needs, brushless DC motors are widely used in EVs. The need for brushless DC motors is anticipated to rise along with the popularity of EVs. Further, the growing automotive sector in the region is also anticipated to contribute to the market growth in the region. In addition, the region's expanding service market is also anticipated to boost market growth during the forecast period.

The U.S. brushless DC motor market demand is driven by the high electric motor trade in the country. The U.S. export value was USD 5.19 billion and ranked 69 out of 1,227 products (between February 2024 and January 2025). In 2024, the U.S. export destinations primarily included Mexico (USD 1.11 billion), Canada (USD 1.01 billion), Germany (USD 363 million), South Korea (USD 260 million), and China (USD 260 million). In January 2025, the country’s exports were predominantly to Mexico (USD 102 million), Canada (USD 94.9 million), Germany (USD 27.4 million), UK (USD 17.8 million), and South Korea (USD 16.2 million). As per SelectUSA data, the U.S. sold 11.5 million light-weight vehicles in 2022, and in 2023, 4.9 million vehicles were manufactured by international automakers in the U.S. It is affiliated with several foreign-owned companies, which support 500,000 jobs in the U.S. The FDI in the automotive industry stood at USD 195.6 billion in 2023. The same year, 1.6 million light-weight vehicles, automotive parts worth USD 93.7 billion, and 160,000 trucks were exported.

Brushless DC Motor Market Players:

- ABB Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ametek, Inc.

- Johnson Electric

- Allied Motion Technologies, Inc.

- Baldor Electric Company, Inc.

- North American Electric, Inc.

- Schneider Electric

- Regal Beloit Corporation

- Arc System Inc.

The market has a wide scope of applications and new companies entering the space. This has implored players to strengthen their positioning and participate in strategic initiatives such as collaborations, product launches, RD&D, and mergers and acquisitions, thereby gaining a competitive edge. Some of the notable players include:

Recent Developments

- In December 2024, Oriental Motor USA Corp. revealed the launch of the BLS Series of brushless DC motors and 24 VDC universal drivers. This new BLS Series is ideal for upgrading existing systems or powering new applications.

- In April 2023, Elnor Motors announced the launch of a new brushless DC motor design at OTC Houston 2023. The company targets export-focused OEMs interested in custom HazLoc electric motors.

- In December 2022, Nidec Corporation announced the development of a single-phase, low-vibration, and low-cost brushless DC motor. This product is widely being installed in electric fans.

- In February 2022, Toshiba Electronic Devices & Storage Corporation introduced TC78B011FTG, a three-phase brushless DC motor control pre-driver IC. This product's main application areas are high-speed motors and the suction motors of cordless and robot vacuum cleaners.

- Report ID: 4925

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Brushless DC Motor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.