Energy-Efficient Air Compressor Market Outlook:

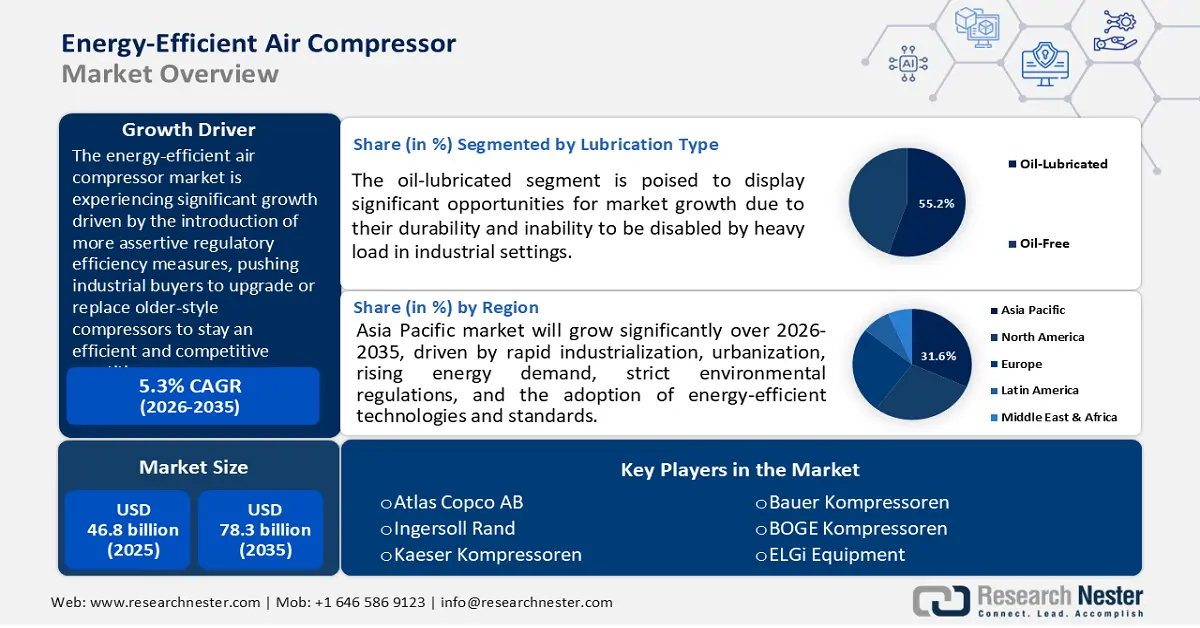

Energy-Efficient Air Compressor Market size was valued at USD 46.8 billion in 2025 and is projected to reach USD 78.3 billion by the end of 2035, rising at a CAGR of 5.3 % during the forecast period, from 2026 to 2035. In 2026, the industry size of energy-efficient air compressor is assessed at USD 48.7 billion.

The global energy-efficient air compressor market is expected to grow significantly over the forecast period, primarily driven by the introduction of more stringent regulatory efficiency measures, particularly in leading markets, which compel industrial buyers to upgrade or replace older-style compressors to remain efficient and competitive. For example, new air compressors produced after January 10, 2025, under the compressor regulation regime of the U.S. Department of Energy would be subject to minimum requirements on isentropic efficiency at covered size ranges. In addition, Natural Resources Canada is harmonizing its efficiency standard limits with the U.S. 10 CFR 431 test procedures and characterizing minimum isentropic efficiency curves of rotary lubricated compressors. Such regulatory pressures are fueling increased demand to replace older, less efficient compressor units in industrial settings with newer, more efficient units.

In terms of the supply chain and manufacturing growth, the steel, copper, rare earths, and specialty alloys (motor rotor, bearings, and control electronics) raw materials are vulnerable to global critical materials dynamics. The U.S. government reports that the country is 100% import-dependent on many essential minerals and over 50% import-dependent on numerous others. Additionally, the DOE, in turn, has proposed nearly USD 1 billion in funding to expand mining, processing, and manufacturing technologies along critical minerals and materials supply chains. Therefore, vertical bottlenecks in the supply of materials increase the cost and lead-time exposures of compressor manufacturers. Furthermore, on the production front, companies are shifting assembly lines to lower-cost locations and are retaining performance testing lines in the existing facilities; according to trade statistics, in the larger machinery industry. The total U.S. general imports of machinery increased by 21.3% to USD 248.4 billion in 2021, and imports of air-conditioning equipment and parts under the machinery category increased by USD 4.8 billion (24.3%) in 2021. At the same time, governmental investments in RDD are escalating: the strategy documents and funding announcements published by the DOE promise various measures to strengthen the industrial base and an innovation pipeline in clean energy.

Key Energy-Efficient Air Compressor Market Insights Summary:

Regional Insights:

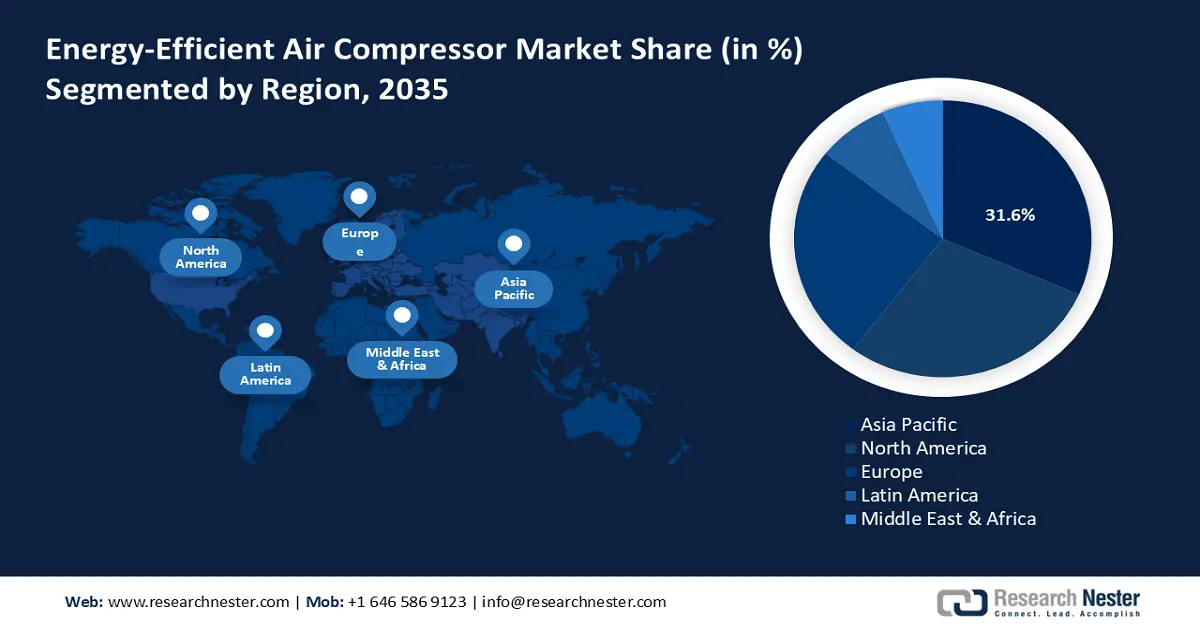

- The Asia Pacific energy-efficient air compressor market is anticipated to lead with a 31.6% share during 2026–2035, driven by rapid industrialization, urbanization, and strict environmental policies.

- The North American market is projected to account for 28.7% share by 2035, owing to growing industrial applications and stringent energy conservation regulations.

Segment Insights:

- The oil-lubricated segment in the energy-efficient air compressor market is projected to account for 55.2% share by 2035, owing to its durability and ability to operate under heavy industrial loads.

- The rotary screw compressors segment is expected to hold a 44.6% share during the forecast period 2026–2035, propelled by their energy efficiency and operational flexibility.

Key Growth Trends:

- Rising Energy Costs and Energy Intensity of Chemical Processes

- Innovation in Green Chemistry and Chemical Recycling/Advanced Catalytic Technologies

Major Challenges:

- Tariffs and Trade Barriers

- Standard Harmonization Delays

Key Players: Ingersoll Rand, Gardner Denver (part of Ingersoll Rand), Kaeser Kompressoren, Sullair (Hitachi Group), Bauer Kompressoren, BOGE Kompressoren, ELGi Equipment, Chicago Pneumatic (Atlas Copco), FS-Curtis, Hanwha Power Systems, Aerzener Maschinenfabrik, Boge Kompressoren (Australia), Mitsubishi Heavy Industries, Hitachi Industrial Equipment.

Global Energy-Efficient Air Compressor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 46.8 billion

- 2026 Market Size: USD 48.7 billion

- Projected Market Size: USD 78.3 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (31.6% Share during 2026–2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, Indonesia, Brazil, Vietnam, South Korea

Last updated on : 31 October, 2025

Energy-Efficient Air Compressor Market - Growth Drivers and Challenges

Growth Drivers

- Rising Energy Costs and Energy Intensity of Chemical Processes: The chemical industry is highly energy-consuming, as within the EU-27, the chemical and petrochemical industry contributed 22% of final industrial energy use in 2020. Electricity and natural gas will constitute almost two-thirds of the total industrial energy consumption in the EU industrial energy mix in 2023 (32.6% and 31.3% respectively). With increasing energy costs and their increasing volatility, chemical plants feel the pressure to minimise off-process energy waste (including in compressors). Since compressed air systems frequently can be a significant share of auxiliary electrical demand, any relatively small percentage improvement in compressor efficiency can pay off with large cost reductions and mitigate energy price risk. Regulatory incentives to lower carbon emissions and energy consumption only increase the cost penalty of inefficiency over time.

- Innovation in Green Chemistry and Chemical Recycling/Advanced Catalytic Technologies: Nominated technologies through the EPA Green Chemistry Challenge program have so far eliminated 830 million pounds of hazardous chemicals each year, saved 21 billion gallons of water, and reduced 7.8 billion pounds of CO2 equivalent emissions. These innovations translate into widespread adoption of waste-reduction and energy-reduction processes. In the meantime, within the U.S. TRI (Toxics Release Inventory) model, since 2019, companies have reported 4,907 green chemistry-engineering activities in more than 170 TRI chemicals or categories, meaning the industry is actively involved in optimization or replacement of processes. Such operations commonly involve the modernization of equipment or the closer monitoring of reaction and separation processes, which means that plants need more flexible and efficient compressed-air and gas management systems.

- Regulatory Tightening on Air Toxics and Emissions: The current rules and regulations by the U.S. EPA, including the latest regulation requiring over 200 chemical plants to cut down on emissions of pollutants such as ethylene oxide (EtO), chloroprene, benzene, and 1,3-butadiene by almost 80% in some cases, place greater requirements on cleaner equipment, including air compressors that have lower leakage, improved sealing and greater energy efficiency. The rule also focuses on 112 toxicants and imposes stricter regulation under the Clean Air Act, which leads to the reduction of VOCs by an estimated 1 million tons/year, with 81% throughout the sector. Under this regime, EPA has estimated that in total capital costs at affected facilities amount to 450m and the annualized costs amount to 230m. To chemical producers, the higher energy consumption and overhead costs of operating equipment such as compressors, which have lower leakages, are more sealing, and more control, making it relatively more appealing to take the costs of regulatory compliance.

Challenges

- Tariffs and Trade Barriers: When manufacturers and suppliers of energy-efficient air compressors are seeking to export their products, tariffs and trade barriers prove to be a challenge. These involve importation taxes, licensing fees, and complicated customary procedures that may add expenses and delay shipments. Although energy-efficient technologies may be environmentally advantageous, not all nations consider them as priority goods to receive fast-track clearance or tariff elimination. Consequently, businesses can struggle to venture into other markets or remain competitive with domestic producers who do not encounter similar trade barriers. The different rules of various countries also make global expansion even harder when there can be a wide range of technical specifications or documentation requirements.

- Standard Harmonization Delays: Although air compressors may adhere to high efficiency requirements, various jurisdictions usually have their own safety, performance, labelling, or energy use regulations. The differences require manufacturers to adjust their products to local standards of each country, and this requires time-intensive testing, certification, and, in some cases, redesign. With no internationally harmonized standards, these technical differences slow down the launch of products and raise the costs of production. Even small deviations in the testing methods or documentation can lead to a delay in product entry to the new market, resulting in missed opportunities. Such obstacles are especially difficult when companies have to expand their operations internationally and still ensure compliance and quality in various jurisdictions.

Energy-Efficient Air Compressor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 46.8 billion |

|

Forecast Year Market Size (2035) |

USD 78.3 billion |

|

Regional Scope |

|

Energy-Efficient Air Compressor Market Segmentation:

Lubrication Type Segment Analysis

The oil-lubricated segment in the energy-efficient air compressor market is expected to grow with the largest revenue share of 55.2% by 2035, owing to its durability and inability to be disabled by heavy loads in industrial settings. According to the U.S. Department of Energy, lubrication helps minimize wear, increase the life of equipment, and efficiency of compressed air systems. Increases in efficiency of oil-lubricated compressors, such as the use of advanced synthetic lubricants and variable-speed drives, can assist greatly in saving energy. In manufacturing processes that require high reliability, such compressors ensure high consistency and are generally more economical than oil-free versions. Government-wide energy efficiency programs encourage retrofits to more modern oil-lubricated compressor technologies as inexpensive methods of reducing industrial energy consumption and pollution.

Splash-lubricated compressors are simple and reliable, and they work by spreading oil onto mechanical parts through splashing and last longer than many other types of compressors. According to the U.S. Department of Energy, with such systems, stable compressor operation is enabled with moderate maintenance and helps to improve industrial energy efficiency. Meanwhile, the pressure-lubricated compressors provide better durability and greater efficiency, operating with pressurized oil to lubricate bearings and slide parts that are crucial in the heavy-duty manufacturing environment. These systems employ advanced synthetic oil that lowers friction and consumes less energy by as much as 20% according to official research, improving compressor operation and reducing emissions. These segments combine to drive the oil-based lubrication in the global market by maximizing reliable winner-takes-all in industrial processes.

Compressor Type Segment Analysis

The rotary screw compressors segment is anticipated to grow with a significant share of 44.6% during the projected years. They are common in industry as they can provide continuous and reliable operation and adjust output with variable speed drives to save 15% or more energy used in compressed air system operation. The U.S. Department of Energy estimates that 70% of manufacturing plants in the U.S. utilize compressed air systems with rotary screw compressors, which may be optimized to yield 30% to 60% energy savings. They consume less energy and are more efficient and flexible in their operations, which makes them more favoured in manufacturing and industrial industries where issues of reliability and energy savings are paramount. A growing trend in the use of rotary screw compressors is the use of variable speed compressors, which are even more efficient and have less carbon footprint in industrial use of compressed air.

Fixed Speed Rotary Screw compressors are used in this segment to stimulate growth by providing reliable and efficient operation at a constant demand workload. The U.S. Department of Energy states that fixed-speed rotary screws provide significant life-cycle cost savings of about USD 8,002 with paybacks of approximately 2.4 years, which makes it an affordable option in stable industrial applications. They tend to be lubricant-injected, air- or liquid-cooled compressors with higher standards of isentropic efficiency, and provide better energy savings compared to older compressors. Variable speed drive (VSD) Rotary Screw compressors further boost energy-efficient air compressor market growth, where motor speed dynamically adjusts to air demand to save significant energy consumed by parts. As NREL emphasizes, VSD systems are very efficient in different load conditions, which reduces electrical use and emissions, as well as enhances the flexibility of the system with durability.

End-Use Segment Analysis

The manufacturing industry segment is likely to grow with a significant energy-efficient air compressor market share by 2035. According to the U.S. DOE, about 10% of all industrial electricity is consumed by compressed air systems, and 70% of all manufacturing facilities use compressed air systems. Compressed air can be made more efficient in manufacturing to save substantial energy with short payback periods. Optimization also includes equipment improvements such as variable speed rotary screw compressors and leak repair programs, which improve reliability and product. To enhance competitiveness, mitigate carbon emissions, and meet regulatory standards, government energy programs have continually encouraged energy-saving projects in compressed air systems in manufacturing.

Our in-depth analysis of the energy-efficient air compressor market includes the following segments:

|

Segment |

Subsegments |

|

Compressor Type |

|

|

Lubrication Type |

|

|

End-use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Energy-Efficient Air Compressor Market - Regional Analysis

Asia Pacific Market Insights

The Asia Pacific region is expected to lead the energy-efficient air compressor market with the largest revenue share of 31.6% during the projected years from 2026 to 2035, mainly driven by the fast industrialization and urbanization, as well as strict environmental policies. This rise is further justified by the fact that, according to projections made by the ASEAN Centre of Energy, by 2050, air conditioning energy usage in the ASEAN region shall rise to 35.5 million tonnes of oil equivalent, which is roughly 25% of the energy needs in the building sector. Indonesia is among the nations taking the lead in embracing energy-saving technologies. This influx of demand highlights the necessity of energy-efficient air compressors to support the increased energy needs. To help improve air conditioning energy efficiency within the region, governments are also adopting Minimum Energy Performance Standards (MEPS). For example, in Singapore, MEPS of air conditioners have been gradually increased by the National Environment Agency (NEA) since its implementation. By January 2022, the NEA had increased MEPS ratings of casement and window air-conditioners to the two-tick level and raised MEPS ratings of split-type air-conditioners by 7%, indicating the sustainable growth of the industry and the growing need for energy-saving air compressor systems in the APAC region.

By 2035, China’s energy-efficient air compressor market is expected to dominate the Asia Pacific region, attributed to strict government policies and a well-established manufacturing base. In December 2022, the Ministry of Industry and Information Technology (MIIT) published a catalogue, proposing energy-saving technologies and devices, such as compressors, which can be offered to enterprises in order to save more energy and money. In addition to the policy support, the manufacturing industry in China is adopting smart manufacturing. For example, policy frameworks in China promote the use of energy-saving technologies. The home appliances trade-in policy, which covers air conditioners, has seen its annual sales of energy-saving models grow by 82%, reflecting a wider interest in energy saving. Moreover, various companies in the country have applied novel technologies such as AI visual inspection and industrial IoT to their production lines, which have enabled high automation levels and accuracy. This is expected to promote the manufacture of energy-saving air compressors that satisfy the domestic and foreign markets. Supportive policies combined with well-developed manufacturing capabilities make China a leader in energy energy-efficient air compressor market, which can be used on the domestic market and on export markets worldwide.

The energy-efficient air compressor market in India is expected to grow with the fastest CAGR over the forecast years by 2035, owing to industrial growth and government policies. The Star Labelling Programme is an air compressor labelling programme introduced by the Bureau of Energy Efficiency (BEE) of the Ministry of Power in January 2021. This is a voluntary scheme to encourage the use of energy-efficient products by providing. Based on the data on the Urja Dakshata Information Tool (UDIT) managed by the BEE, the total energy savings of all appliances and equipment under the S&L program during the period 2022-2023 are estimated at approximately 132.16 billion units (BU). This represents a tremendous energy saving, which translates to a tremendous saving of costs to the consumers. Ensuring the development of energy-efficient equipment like air compressors indirectly happens through other government programs like the Perform, Achieve and Trade (PAT) scheme and the National Action Plan on Climate Change (NAPCC). Energy energy-efficient air compressor market in India has a lot of potential since most industries in the country are slowly appreciating the long-term cost savings and environmental impacts of using energy-saving technologies. The role of government policies and programs is important in speeding up this shift to more sustainable industrial practices.

North America Market Insights

The North American energy-efficient air compressor market is projected to grow with a significant revenue share of 28.7% by 2035, attributed to increased demand in industrial applications, particularly in the chemical, pharmaceutical, and automotive production industries. The strong industrial performance and stringent environmental regulations, spearheaded by U.S. federal efforts to promote energy conservation and emission reductions, drive energy energy-efficient air compressor market in North America. For example, the DOE has announced up to USD 70 million in 2022 to create a Clean Energy Manufacturing Innovation Institute aimed at industrial decarbonization, by electrifying process heating. This program helps advance technologies to cut emissions and increase the efficiency of energy consumption in energy-intensive sectors, such as chemicals. The Department of Energy (DOE) Advanced Manufacturing Office sponsors the projects in the field of enhancing the efficiency of compressors, which is reflected in the growing number of their use in chemical industry plants. Additionally, OSHA occupational safety standards promote safer workplaces, thus indirectly promoting the need for modern compressors with better safety measures. Smart compressors that can predictively maintain and operate efficiently by being powered by the IoT are becoming increasingly popular. Additionally, the U.S. Department of Energy (DOE) has funded projects that incorporate smart technologies into air compressors. For example, the DOE in 2023 awarded Oak Ridge National Laboratory and Emerson Climate Technologies a USD 500,000 grant to create the Emerson CoreSense electric module. This module allows compressors to sense the loss of refrigerant charge in real time by measurement of suction and discharge pressures and temperatures to support predictive maintenance and to provide better operational efficiency.

The U.S. energy-efficient air compressor market is expected to lead the North American region with a substantial revenue share over the forecast years, influenced by the industrial base of the nation, which is mainly in the chemical, manufacturing, and energy industries. The International Journal of Energy Economics and Policy estimates that about 10% of industrial power is spent on industrial compressed air systems, showing that much could be saved by increasing efficiency. A total of 38 states in the FY 2024 round awarded Implementation Grants totaling over USD 40 million to 219 small and medium-sized manufacturers to implement energy-saving recommendations of Industrial Assessment Centers (ITAC/IAC). Moreover, the tough Occupational Safety and Health Administration (OSHA) standards demand safer compressor systems, compelling industries to buy modern and efficient ones. In 2023, the DOE Advanced Manufacturing Office announced a total of USD 45 million of federal funding in 14 projects to support clean energy manufacturing and innovation. The increasing popularity of smart compressors with incorporated IoT technologies allows predictive maintenance and operational performance.

The market in Canada is anticipated to grow steadily by 2035, supported by federal government efforts to reduce energy usage and curb greenhouse gas (GHG) emissions in the industrial sectors. According to Natural Resources Canada, electricity provides 20% of the industrial energy consumption in Canada (i.e., industrial energy consumption by type of fuel includes 20% electricity). In support of clean energy RD&D, NRCan has core funding of CAD 116 million/year through the Energy Innovation Program (EIP), which includes CAD 45.6 million over three years of funding available in smart-grid R&D under EIP. Under EIP, NRCan has chosen projects to be awarded up to CAD 53 million of RD&D in such areas as industrial fuel switching, clean fuels production, and hydrogen codes/standards. The Clean Energy Fund in Canada also encourages the use of energy-efficient equipment to achieve the Canadian commitment to cut down on emissions by 40% of 2005 levels by the year 2030. In addition, the Canadian Centre of Occupational Health and Safety (CCOHS) workplace safety standards put an emphasis on the safe use of compressed air, which fuels the trend toward safer, more sophisticated compressor systems. The adoption of smart compressors is on the rise as manufacturers turn to the Internet of Things to improve energy and predictive maintenance. It is projected that the market will expand at a CAGR of 6.2% up to 2035.

Europe Market Insights

The European energy-efficient air compressor market is projected to hold a significant position in the global landscape, with a revenue share of 25.3% during the projected years, mainly due to the trend in Europe toward industrial decarbonization and stricter energy legislation, which is quickly changing the demand for these air compressors. The new Energy Efficiency Directive (EU/2023/1791) requires that combined final energy consumption is reduced by 11.7% by 2030 relative to the 2020 estimates, which pressures industry to maximise energy consumption. Meanwhile, the additional market incentives include EU funding of clean industrial equipment R&D and increased emissions levels in the Industrial Emissions Directive (IED 2.0) that entered effect in 2024 to enhance the best available techniques and resource efficiency. To comply and reduce operating costs, manufacturers are beginning to upgrade their older compressors to smart, IoT-based devices that help minimize leaks. Additionally, high-energy prices and net-zero targets increase pressure on the UK manufacturing and industrial sectors. The Department for Energy Security and Net Zero claimed a record low of 19.5 mton (million tonnes of oil equivalent) of industrial energy consumption in 2024, which was due, in part, to efficiency savings and structural transformation. IEEA programme has also pledged to fund the implementation of energy-saving technology through a Net Zero Innovation Portfolio to the tune of 8.2 million in grant money.

Furthermore, Germany is the largest energy consumer in the EU, with its industrial sector serving as a key source of energy-efficient technology adoption. Germany Energy Efficiency in Industry overviews cites 667 TWh of final energy as the 2022 consumption of the German industrial sector, most of which is used in process heating potential area for efficiency improvements. The new Energy Efficiency Act proposed by the Federal government, to be effective in 2024, will provide energy savings targets, with the federal government itself required to save 45 TWh/year. Germany, with solid policy support, industrial requirements of either energy or environmental management systems, and under regulatory pressures against EU directives, is well-positioned to implement energy-efficient compressed air systems, especially in energy-intensive industries such as chemicals, machinery, and manufacturing.

Key Energy-Efficient Air Compressor Market Players:

- Atlas Copco AB

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ingersoll Rand

- Gardner Denver (part of Ingersoll Rand)

- Kaeser Kompressoren

- Sullair (Hitachi Group)

- Bauer Kompressoren

- BOGE Kompressoren

- ELGi Equipment

- Chicago Pneumatic (Atlas Copco)

- FS-Curtis

- Hanwha Power Systems

- Aerzener Maschinenfabrik

- Boge Kompressoren (Australia)

- Mitsubishi Heavy Industries

- Hitachi Industrial Equipment

The energy-efficient air compressor market is extremely competitive, with big multinationals in Europe, the USA, and Asia leading in terms of innovation and market penetration. Atlas Copco and Kaeser Kompressoren are European giants that prioritize sustainable technology and the use of IoT-powered compressors to encourage Industry 4.0 projects. Ingersoll Rand is an American-based company that specializes in mergers and the expansion of networks. Japanese gamers drive oil-free compressor technologies to conserve energy, and Indian and South Korean manufacturers are fighting on price and localizing to the market. The usual efforts to grow the energy-efficient air compressor market include strategic investments in digital transformation, green technology adoption, and efficient R&D, particularly in fast-growing industrializing regions of the Asia-Pacific that have increasing manufacturing needs.

Top Global Energy-Efficient Air Compressor Manufacturers

Recent Developments

- In September 2025, ELGi Equipment unveiled the Demand Match system, a new technology that aims to conserve energy in fixed-speed air compressors. The Demand Match system is smarter than conventional compressors that continue to run at a constant speed by bypassing the compressor with excess air, instead of using it to satisfy the actual requirements of the plant at that moment. The result of this dynamic adjustment is energy savings up to 17%, mechanical stress reduction, and long equipment life. The system provides the energy conservation features of Variable Frequency Drives (VFDs) at less than half their cost, thus providing a gita-friendly alternative to other industries like textiles, automotive, pharmaceuticals, and food processing. The aligns with the global tendencies of sustainable and energy-efficient production processes by enhancing reliability and minimizing carbon footprints.

- In November 2024, Daikin and Copeland declared a joint venture to bring the inverter swing rotary compressor technology of Daikin to the American residential HVAC market. The purpose of this cooperation is to improve energy saving and facilitate the use of heat pumps, which are more environmentally friendly and in line with government regulations. The inverter technology allows for control of the motor speed with a great degree of precision, which contributes to decreasing the amount of power used and finely controlling temperature. The joint venture would come online by the first half of 2025 with the intention of having a dedicated manufacturing facility in North America to fulfill growing demand. This trend shows how the industry is moving towards renewable and energy-efficient solutions in the HVAC market.

- In May 2024, Bobcat launched PA12.7v, a Portable Air Compressor with FlexAir technology. FlexAir allows the operating pressure to be set to 5.5 to 12.1 bar, with free air of 5.2 to 7 m3/min. This flexibility allows the compressor to serve a wide variety of uses, including construction and industrial cleaning, to maximize energy use by modifying output to suit specific tasks. The optional features added, which include aftercoolers and generators, also enhance efficiency. The PA12.7v with a bundled base to prevent spills, long service life, and easy maintenance is a worldwide trend in green manufacturing. Diversity and power conservation capabilities are some of the reasons why it is a good investment in the new energy-efficient air compressor market.

- Report ID: 8204

- Published Date: Oct 31, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.