Airborne Wind Turbine Market Outlook:

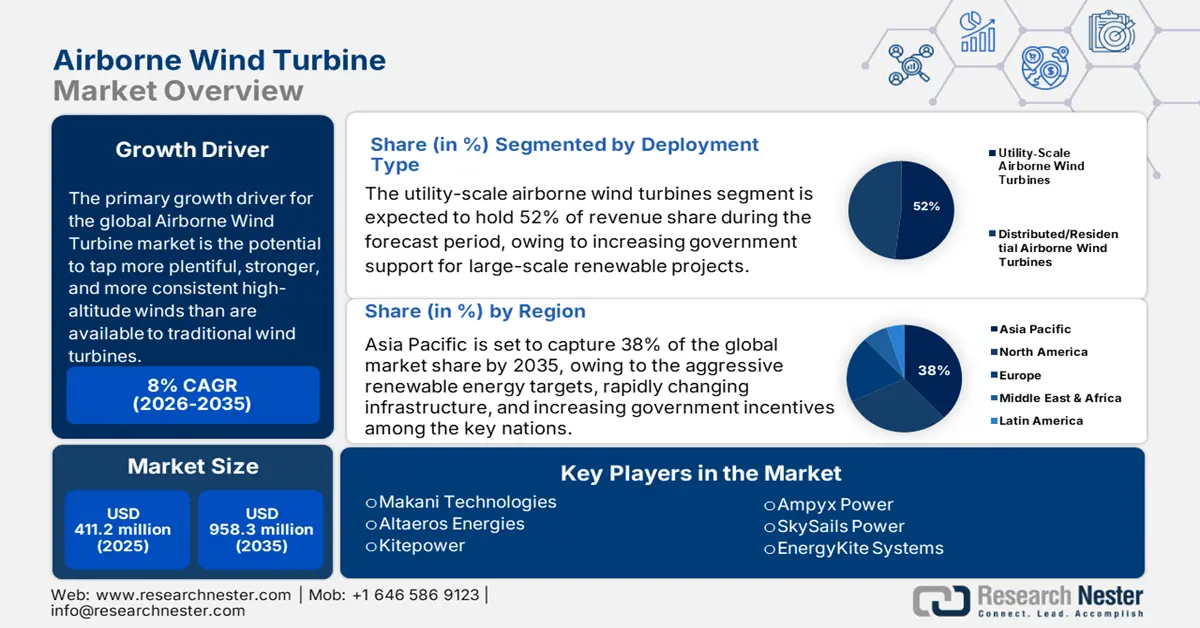

Airborne Wind Turbine Market size was valued at USD 411.2 million in 2025 and is projected to reach USD 958.3 million by the end of 2035, rising at a CAGR of 8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of airborne wind turbine is estimated at USD 447.4 million.

The primary growth driver of the airborne wind turbine industry is the potential to tap more plentiful, stronger, and more consistent high-altitude winds than are available to traditional wind turbines. Winds at or above 500 meters are both more powerful and more consistent, with energy potential as much as twice that of traditional ground-based wind systems. As per the Department of Energy (DOE), the maximum power rating, or capacity, of wind turbines has increased. In 2023, the average capacity of newly built wind turbines in the United States was 3.4 megawatts (MW), which is a 5% increase from 2022. The percentage of turbines installed in the 3.5 MW or bigger size category increased in 2023. From 100 meters (330 feet) in 2016 to roughly 150 meters (500 feet) in 2035, the average hub height for offshore wind turbines in the US is expected to increase even further. It is what gives airborne systems an edge for off-grid and remote applications.

The airborne wind turbine supply chain is in the nascent stage and is taking components from the aerospace and specialty materials sectors. ARPA-E-sponsored Makani Power presented a tethered turbine possessing the potential to realize weight reduction up to 90% in case conventional turbines are employed for harnessing wind at an altitude of 1,000 feet and have scalability potential. The nature of government-sponsored entities like U.S. ARPA-E's Aero-MINE and Airborne Wind Energy projects has made breathtaking advances in high-altitude wind energy harvesting, with an 8-meter wingspan, 20 kW prototype, and less structural mass than conventional turbines, amounting to gigantic reductions in transportation, installation, and maintenance costs. Annual R&D appropriations towards airborne wind energy indicate a strong institutional commitment to commercialization. Similarly, the European Union's Horizon 2020 and International Renewable Energy Agency (IRENA) have put airborne wind at the top of decarbonization and distributed generation policy, cementing worldwide momentum.

Key Airborne Wind Turbine Market Insights Summary:

Regional Insights:

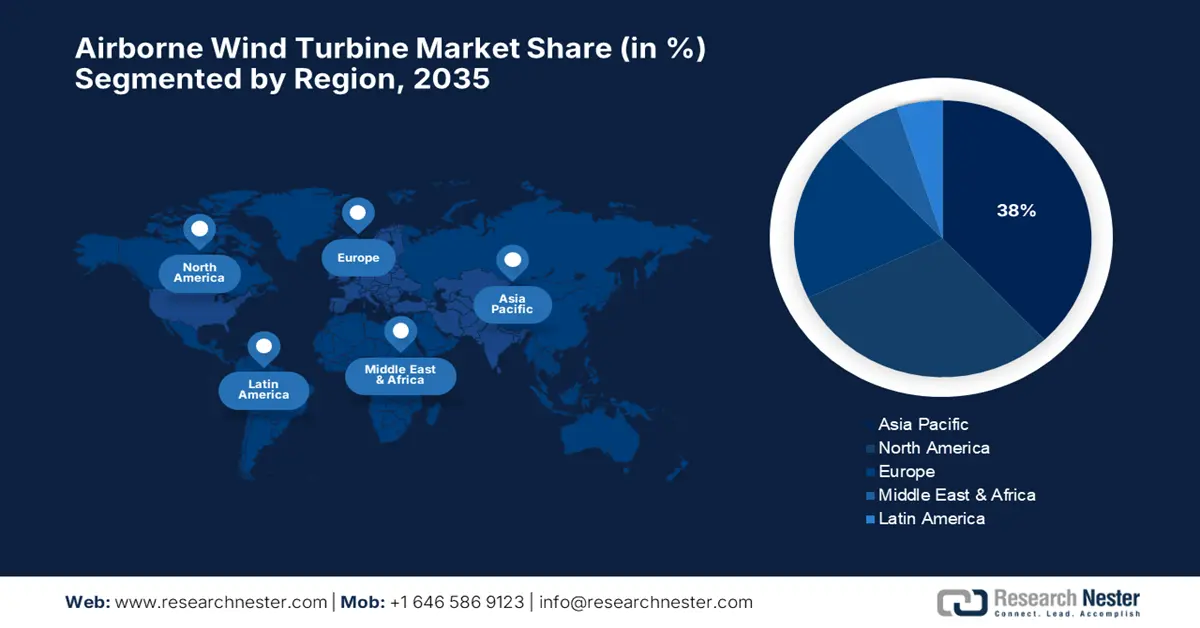

- Asia Pacific is projected to command around 38% share of the global Airborne Wind Turbine Market by 2035, owing to ambitious renewable energy targets, grid modernization initiatives, and robust government incentives.

- North America is expected to hold nearly 30% share by 2035, supported by rising technology adoption and favorable decarbonization policies enhancing renewable integration.

Segment Insights:

- Utility-scale airborne wind turbines are anticipated to account for 52% of total installations by 2035 in the Airborne Wind Turbine Market, propelled by increasing government backing for large-scale renewable initiatives.

- The renewable energy utilities subsegment is forecasted to secure a 40% market share by 2035, impelled by stringent decarbonization targets and expanding investments in clean energy infrastructure.

Key Growth Trends:

- Regulatory push for renewable energy integration

- Technological innovation and sustainable manufacturing

Major Challenges:

- Technical reliability and safety concerns

- Regulatory uncertainty and airspace restrictions

Key Players: Makani Technologies (Google/Alphabet), Altaeros Energies, Kitepower, Ampyx Power, SkySails Power, EnergyKite Systems, KPS (Kite Power Solutions), WindLift, Skysails Marine, GreeMko Wind Technologies, Ampyx Power Asia, Blue KITE Power Systems, Toray Industries (Wind Division), SkyWind Technologies, Altaeros Asia Pacific.

Global Airborne Wind Turbine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 411.2 million

- 2026 Market Size: USD 447.4 million

- Projected Market Size: USD 958.3 millio by 2035

- Growth Forecasts: 8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Australia, Brazil, France

Last updated on : 24 September, 2025

Air borne Wind Turbine Market - Growth Drivers and Challenges

Growth drivers

- Regulatory push for renewable energy integration: Growing pressure from regional and national governments to decarbonize electricity generation is driving demand for new wind energy technologies, including aerial systems. In 2023, 82% of new electric capacity was generated from a combination of wind, solar, and storage. An amendment to the EU Climate Law was suggested by the European Commission, establishing a 90% reduction in net greenhouse gas (GHG) emissions as the EU climate target by 2040. The EU is on track to reach the 55% goal by 2030. All these developments are pushing utilities and grid operators toward the deployment of scalable, portable airborne turbines, particularly in low-infrastructure or remote areas, thereby growing the market size.

- Technological innovation and sustainable manufacturing: Advances in light-weight composite material and autopilot flight control systems have substantially improved the operating efficiency and environmental friendliness of air-borne wind turbines. The goal of the 2022 REPowerEU Strategy was to produce 10 million tons and import 10 million tons by 2030. About 10% of the EU's energy demands are expected to be met by renewable hydrogen by 2050, significantly lowering the carbon footprint of energy-intensive industrial operations and the transportation sector. Innovations like recycling tethers and reusing module units reduce environmental impact and maximize return on investment. These technologies are aligned with international sustainability objectives and have further appeal where carbon-neutral targets are legally binding, enabling direct market take-up and demand increase.

- Growing off-grid and remote area power demand: Remote communities, islands, mining projects, and defense bases often lack grid connections and expensive diesel generator fuel costs. Airborne wind turbines are a scalable renewable energy alternative for off-grid electricity generation, mobile manufactured products are portable, and provide electricity to the grid. Airborne wind turbines can be useful for disaster recovery, military operations, and sometimes rural electrification programs, and as global electrification programs expand, demand for distributed renewable energy solutions and airborne wind turbines will rise.

1. Emerging Trade Dynamics in the Market

Global trade in wind-powered electric generators was $6.34 billion in 2023, down 1.49% from $6.44 billion in 2022. Trade in this category has decreased at an annualized rate of 1.87% during the last five years.

Trade Data of Wind-Powered Electric Generators in 2023

|

Leading Exporters |

Export Value (USD) |

Leading Importers |

Import Value (USD) |

|

China |

$2.35B |

United Kingdom |

$589M |

|

Germany |

$1.53B |

Chile |

$578M |

|

Denmark |

$1.02B |

Canada |

$518M |

Source: OEC

Challenges

- Technical reliability and safety concerns: The airborne wind turbine industry is also facing harsh challenges in the safety and reliability of airborne structures in fluctuating weather. Turbulence at high altitudes, lightning strikes, and tether tension are risks to long-term durability and grid stability. The U.S. Department of Energy reports that many pilot projects have encountered recurrent operational failures owing to failures in control systems. These create challenges to investor confidence and slow commercial uptake, particularly in grid-scale deployment. Safety certification delays contribute to integration into regulated utility markets, driving time-to-market for developers.

- Regulatory uncertainty and airspace restrictions: Insufficient harmonized international rules on airspace use, especially for tethered airborne systems, significantly limit deployment. National air transport authorities, including the FAA and EASA, have yet to provide dedicated corridors or altitude rights for commercial AWT operation. This generates uncertainty that limits location choice near populated or flight-concerned locations. Moreover, the timelines for permitting remain indeterminate, dissuading utility collaborations. Such regulatory loopholes reduce scalability and increase legal risk for producers and developers, essentially halting broader deployment despite the nature of the technology as being renewable.

Airborne Wind Turbine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8% |

|

Base Year Market Size (2025) |

USD 411.2 million |

|

Forecast Year Market Size (2035) |

USD 958.3 million |

|

Regional Scope |

|

Airborne Wind Turbine Market Segmentation:

Deployment Type Segment Analysis

Utility-scale airborne wind turbines are expected to hold the largest share of installations by 2035, accounting for 52%, driven by increasing government support for large-scale renewable projects. Such utility projects reap the benefits of economies of scale and better capacity factors, in particular when situated offshore or remotely. Over 220,000 jobs are supported by the offshore oil and gas sector, which also produced nearly £30 billion in gross value added in 2022—roughly 1.5% of the UK's total GDP. According to OEUK projections, by the end of the decade, 90% of the needs for carbon transport and storage and 70% of the demand from offshore wind activity are likely to rely on the same supply chain capabilities that already support oil and gas.

End user Segment Analysis

The renewable energy utilities subsegment in the end-user markets is expected to hold a 40% market share in 2035. Aggressive decarbonization targets in key regions, such as the EU and Asia-Pacific, have driven utilities to engage in airborne wind turbines to diversify their renewable portfolios and build grid resilience. Billions are invested in clean energy infrastructure, proving that utilities players are consciously turning to scalable and profitable airborne solutions. According to IRENA's 2023 report, the global average LCoEs for various renewable energy technologies were approximately 33 e/kWh for onshore wind, 44 e/kWh for utility-scale solar PV, and 75 e/kWh for offshore wind. In addition, partnerships between utilities and technology providers are fast-tracking the commercialization and deployment of airborne wind technologies.

Application Segment Analysis

Grid-Scale Energy Storage Integration is the highest subsegment in the application segment, which is expected to hold 38% market share by 2035. The tandem of airborne wind turbines and state-of-the-art storage techniques is essential to counteract renewable intermittency and sustain the grid. Improvements to the electricity system will cost $65 billion of the $1.2 trillion infrastructure plan enacted under the Infrastructure Investment and Jobs Act. Comprising 160,000 miles of high-voltage power lines, millions of low-voltage power lines, and over 7,300 power plants, the grid is an overdue investment. Backing policies like the Clean Energy Package from the EU and U.S. federal regulations under FERC that create incentives for large-scale hybrid deployments. These integration trends would also enable better load balancing, so utilities can continue to supply peak demand through cleaner energy generation.

Our in-depth analysis of the global airborne wind turbine market includes the following segments:

|

Segments |

Subsegments |

|

Deployment Type |

|

|

Technology Type |

|

|

Application |

|

|

End Use |

|

|

Type |

|

|

Power Capacity |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Airborne Wind Turbine Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is expected to hold the largest regional market size of approximately 38% of the overall airborne wind turbine market in 2035, due to aggressive renewable energy targets, rapidly changing infrastructure, and increasing government incentives among the key nations. The region's ethos of decarbonization, grid modernization, and the adoption of sustainable energies provides the best arena for the airborne wind turbines, especially where it cannot find land offshore but has at its disposal offshore wind. The financing of smart grids and energy storage facilities supports airborne wind projects in enabling the utility and industrial consumers to work better on the cost and reliability of energy. Local collaboration in scale-up manufacturing and supply chain resilience also fuels market development forward, evolving Asia Pacific into a top destination for airborne wind turbine commercialization and innovation.

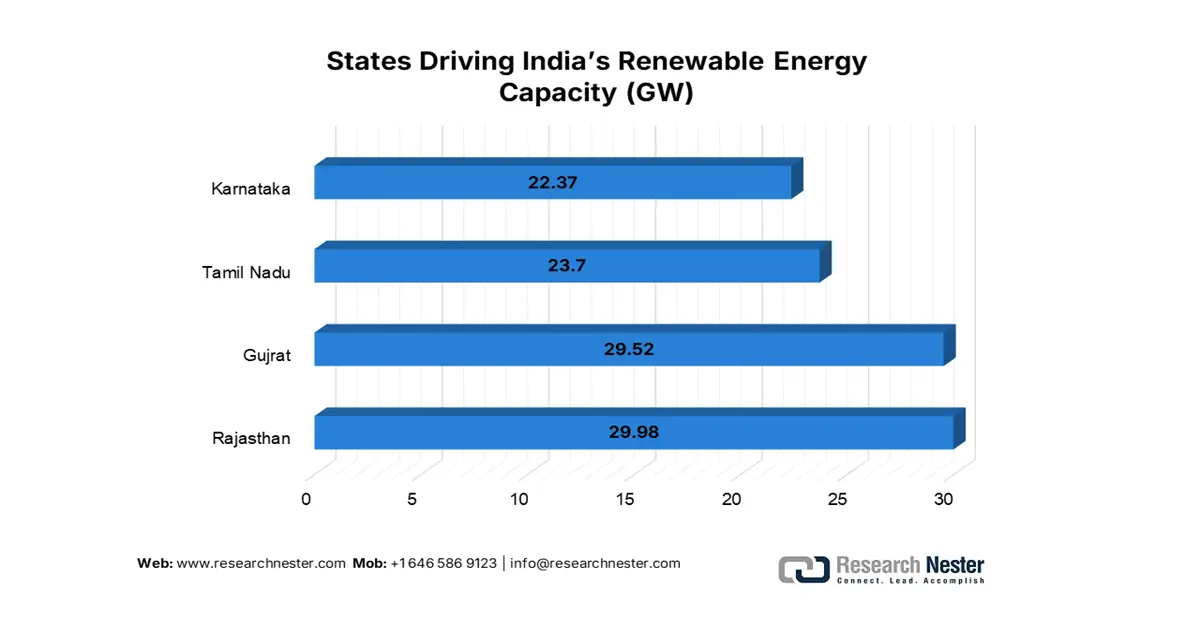

India is projected to grow to a significant market share by 2035. The Central Electricity Authority reports that the current overall capacity for electricity generation based on renewable energy is 203.18 GW. This accomplishment demonstrates India's increasing dedication to renewable energy and its advancements in creating a more environmentally friendly future. India's installed capacity for renewable energy increased by an incredible 24.2 GW (13.5%) in a single year, from 178.98 GW in October 2023 to 203.18 GW in October 2024. India's growing industrialized economy and enlarging grid of electric power need new answers to counterbalance supply intermittency and expand system resilience. Despite the infrastructure challenges, ongoing investment in domestic manufacturing and technology partnerships is positioning the nation for steady airborne wind turbine market expansion.

Source: PIB

India Renewable Energy Capacity Deployment Details in 2024

|

Renewable Energy Resource |

Capacity (GW) |

Workforce |

|

Solar Power |

92.12 |

238,000 |

|

Wind Power |

47.72 |

52,200 |

|

Hydroelectric Power |

46.93 |

453,000 |

|

Bio Power |

11.32 |

85,000 |

Source: PIB

North America Market Insights

North America is expected to hold approximately 30% of the global airborne wind turbine market share by 2035 due to increased technology adoption and increased policy-driven incentives. The energy transition policy in the region is centered on the integration of high-capacity flexible renewables to achieve stringent decarbonization targets. Airborne wind turbines are increasingly being seen to have the potential to harvest high-altitude, consistent winds, which can complement other renewable sources such as solar and conventional wind. North America is characterized by a developed industrial base, cutting-edge research facilities, and public and private investment, which underpins technology innovation and adoption. Supply chain efficiency and infrastructure improvements also contribute to the market growth, making it the most significant airborne wind market.

The U.S. market for airborne wind turbines is expected to account for approximately 25% of the world's market by 2035. More than 9,200 electric generating units with a combined output capacity of more than 1 million megawatts are connected by more than 600,000 miles of transmission lines, making the U.S. electric grid a technical achievement. Enacting the Inflation Reduction Act with tax credits and grants, speeding commercial deployments, helped. Utilities and independent power producers look for airborne wind solutions for portfolio diversification and grid strengthening, particularly for remote and offshore markets. The nation's robust system of innovation and increasing manufacturing capacity allow for rapid scale-up, remaining the global leader in the innovation of airborne wind technology.

Europe Market Insights

With a strict decarbonization policy and a well-developed renewable energy infrastructure, Europe is positioned to capture approximately 20% of the global airborne wind turbine market by 2035. In a traditional wind turbine, 30% of the blade's outermost end generates 60% of the energy. To produce the same amount of energy, an aerial vehicle with wings that are equal to 30% of the blade area can take its place. By substituting an aircraft connected by a ground cable for the wind turbine's tower and blades, this conversion into an AWES system results in a 50% CAPEX savings in a typical infrastructure. Offshore wind deployments, predominantly in the North Sea and Baltic areas, offer a conducive situation for airborne wind systems to fill in as an adjunct to conventional offshore turbines by tapping into high-altitude winds. Regulatory incentives, such as feed-in tariffs and green certificates, lower market entry barriers and accelerate technology adoption.

The offshore wind industry is advocating for a New Deal on offshore wind, in which governments pledge to construct 15 GW of new offshore wind annually between 2031 and 2040, and the sector pledges to cut costs by 30% as a result. The offshore wind supply chain in Europe is expanding. It is capable of producing at least 10 GW of turbines annually. With the help of the EU Wind Power Action Plan for 2023, the industry is now investing over €13 billion in new factories along the whole offshore wind value chain.

Key Airborne Wind Turbine Market Players:

- Makani Technologies (Google/Alphabet)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Altaeros Energies

- Kitepower

- Ampyx Power

- SkySails Power

- EnergyKite Systems

- KPS (Kite Power Solutions)

- WindLift

- Skysails Marine

- GreeMko Wind Technologies

- Ampyx Power Asia

- Blue KITE Power Systems

- Toray Industries (Wind Division)

- SkyWind Technologies

- Altaeros Asia Pacific

The global airborne wind turbine market is characterized by a mix of innovative startups and established renewable energy firms, predominantly from the USA, Europe, and Asia. Leading players such as Makani Technologies and Altaeros Energies leverage advanced aerodynamic designs and strong R&D capabilities to optimize performance and reduce costs. European firms, particularly from the Netherlands and Germany, emphasize scalable solutions for offshore and remote applications, supported by robust regulatory frameworks. Asian manufacturers, notably from Japan, South Korea, India, and Malaysia, focus on adapting airborne wind systems for diverse climatic and grid conditions, often forming strategic partnerships to enhance local manufacturing and deployment. Across the board, companies are investing in modular, easily deployable systems and pursuing collaborations with utility operators to accelerate commercial adoption and grid integration, driving competitive differentiation in this emerging market.

Below is the list of the key players associated with the global airborne wind turbine market:

Recent Developments

- On March 12, 2025, Skysail’s Power announced a $250 million Series C funding round led by the International Renewable Energy Agency (IRENA) to scale up airborne wind turbine deployments across Europe and North America. The investment supports SkySails’ plan to double production capacity by 2027, focusing on offshore wind projects and remote area electrification. This initiative aligns with growing government mandates to increase renewable energy penetration and reduce carbon emissions globally.

- In December 2022, Kitemill, a Norwegian company, introduced the KM2 system, a utility-scale airborne wind energy device with a 16-meter wingspan and the ability to take off and land vertically. Following the successful testing of the KM1 prototype, which operated continuously for more than 500km, the system aims to produce 100kW on average.

- Report ID: 8116

- Published Date: Sep 24, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Airborne Wind Turbine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.