Wind Turbine Market Outlook:

Wind Turbine Market size was over USD 81.4 billion in 2025 and is estimated to reach USD 190.3 billion by the end of 2035, expanding at a CAGR of 9.9% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of wind turbine is estimated at USD 98.3 billion.

The worldwide wind turbine market is focused on playing an essential role in significantly enabling the renewable energy shift. In addition, chemicals, such as composites, coatings, polyurethane adhesives, and epoxy resins, are crucial for protective systems, towers, nacelles, and blades. Besides, according to a data report published by the IEA Organization in 2025, there has been an increase in electricity generation from renewables by 60%, which is projected to be achieved by 2030. This denotes a rise from 9,900 TWh in 2024 to 16,200 TWh by the end of 2030. Based on this, wind energy effectively accounts for nearly 1/3rd of the growth, which creates a positive impact on the market’s upliftment. Moreover, wind power is predicted to almost double to more than 2,000 GW by the same year, since both developing and advanced economies are continuously tackling challenges. Meanwhile, the yearly wind generation growth is required to be more than quadruple by the same year to gain a net-zero emissions scenario, thus suitable for bolstering the market globally.

Wind Power Generation in the Net-Zero Scenario (2015-2030)

|

Year |

Wind Power (TWh) |

|

2015 |

834 |

|

2016 |

963 |

|

2017 |

1,135 |

|

2018 |

1,277 |

|

2019 |

1,429 |

|

2020 |

1,601 |

|

2021 |

1,864 |

|

2022 |

2,120 |

|

2023 |

2,336 |

|

2024 |

2,531 |

|

2030 |

7,114 |

Source: IEA Organization

Furthermore, the presence of bio-based and sustainable materials, increased expansion in offshore wind, recycling and circular economy, along with smart manufacturing and digitalization, are other drivers fueling the wind turbine market growth globally. Besides, as per an article published by the U.S. Department of Energy in October 2024, over 2,740 million metric tons of renewable biomass supplies are readily available. In addition, the majority of governments have significantly analyzed the futuristic potential of renewable biomass. Therefore, based on this analysis, 42 nations have been estimated to supply almost 2,120 million metric tons of renewable biomass by the end of 2030. This readily denotes a surge by 431 million metric tons of biomass production. Therefore, with these availability and future predictions, there is a huge growth opportunity for the market across different nations.

Key Wind Turbine Market Insights Summary:

Regional Insights:

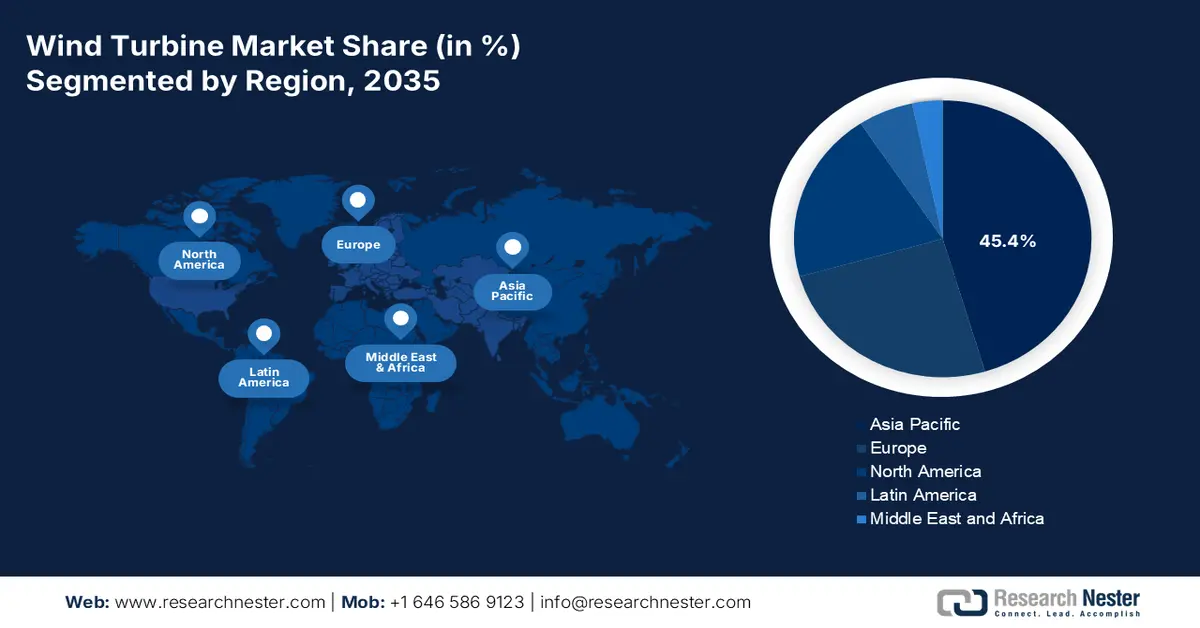

- Asia Pacific is forecast to capture a leading 45.4% share by 2035 in the wind turbine market, reinforced by China’s scale-up, India’s policy-led expansion, and accelerating offshore deployments across Australia, South Korea, and Japan.

- North America is positioned as the fastest-growing region through 2035, supported by onshore repowering momentum, IRA-enabled supply chain investments, and long-term policy certainty.

Segment Insights:

- The horizontal-axis wind turbine segment within turbine type is expected to dominate with a 92.5% share by 2035, strengthened by its proven efficiency, reliability, and suitability for large-scale commercial power generation.

- The utility-scale sub-segment under end use is projected to represent the second-largest share by 2035, facilitated by grid-connected multi-megawatt installations, favorable regulatory frameworks, and cost advantages from economies of scale.

Key Growth Trends:

- Increase in net-zero targets

- Rise in Turbine sizes

Major Challenges:

- Regulatory and environmental pressures

- Increased production expenses and technological gaps

Key Players: Dow Inc. (U.S.), Huntsman Corporation (U.S.), 3M Company (U.S.), PPG Industries, Inc. (U.S.), BASF SE (Germany), Covestro AG (Germany), Henkel AG & Co. KGaA (Germany), Akzo Nobel N.V. (Netherlands), Solvay S.A. (Belgium), Arkema S.A. (France), Evonik Industries AG (Germany), Mitsubishi Chemical Group Corporation (Japan), Toray Industries, Inc. (Japan), Sumitomo Chemical Co., Ltd. (Japan), LG Chem Ltd. (South Korea), Hanwha Solutions Corporation (South Korea), Reliance Industries Limited (India), Aditya Birla Chemicals (India), Petronas Chemicals Group Berhad (Malaysia), Orica Limited (Australia)

Global Wind Turbine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 81.4 billion

- 2026 Market Size: USD 98.3 billion

- Projected Market Size: USD 190.3 billion by 2035

- Growth Forecasts: 9.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (45.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Germany, India, United Kingdom

- Emerging Countries: Australia, Japan, Brazil, South Korea, Canada

Last updated on : 16 December, 2025

Wind Turbine Market - Growth Drivers and Challenges

Growth Drivers

- Increase in net-zero targets: The presence of policies, such as Europe’s Horizon Europe and the U.S. Inflation Reduction Act, has significantly escalated the adoption is sustainable chemicals, which is gradually uplifting the wind turbine market internationally. According to a report published by the PIB Government in August 2023, India’s cumulative emissions account for less than 4% of carbon dioxide emissions. However, the country declared its objective to achieve net zero by 2070, which is possible by implementing suitable approaches. For instance, the Ministry of Environment, Forest and Climate Change (MoEF&CC) has successfully introduced the National Clean Air Programme (NCAP), intended to optimize the air quality across 131 cities within 24 states. This particular program is also predicted to make reductions by almost 40% and readily achieve National Ambient Air Quality Standards for Particulate Matter 10 concentrations by the end of 2025, thereby driving the overall market’s growth.

- Rise in Turbine sizes: The existence of large-scale turbines requires robust resins, coatings, and adhesives to withstand significant mechanical stress, which is suitable for bolstering the wind turbine market. Based on this factor, offshore-based mega projects require innovative anti-corrosion solutions, suitable for establishing such turbines. As per an article published by the U.S. Department of Energy (DOE) in August 2024, there has been an increase in the hub height for utility-scale land-specific wind turbines by 83% to almost 103.4 meters as of 2023. Besides, the average hub height for offshore wind turbines in the U.S. is expected to grow from 100 meters, which is 330 feet, to nearly 150 meters, that is 500 feet, by the end of 2035, thereby creating a huge growth opportunity for the overall wind turbine market.

- Generous investments in renewable energy: The aspect of allocating suitable funds in the form of investments from governmental organizations caters to the continuous upliftment of the wind turbine market globally. As stated in an article published by the PIB Government in November 2024, India’s overall renewable energy capacity has crossed 200 GW, and this outstanding growth readily aligns with the ambitious renewable energy target of gaining 500 GW from non-fossil fuel sources by the end of 2030. Besides, the overall renewable energy-driven electricity generation capacity currently stands at 203.1 GW, and this particular achievement has readily underscored the country’s growing commitment to clean energy, thus creating an optimistic outlook for the overall market’s expansion.

Challenges

- Regulatory and environmental pressures: The chemical inputs utilized in the wind turbine market, such as epoxy resins, adhesives, and coatings, frequently comprise hazardous substances and energy-intensive production processes. Regulatory bodies, including the Europe Chemicals Agency (ECHA), the U.S. EPA, and national ministries, are tightening rules on emissions, waste disposal, and chemical safety. For instance, stringent Europe-based REACH regulations require companies to reformulate products to minimize toxicity and environmental impact. While these measures align with sustainability goals, they increase compliance costs and necessitate significant research and development investment. Besides, the recycling of turbine blades is another pressing issue since the majority of blades are made of thermoset composites that are difficult to recycle, leading to landfill accumulation.

- Increased production expenses and technological gaps: The aspect of producing advanced wind turbine chemicals, such as high-performance composites, corrosion-resistant coatings, and recyclable resins, requires significant capital investment and specialized expertise. The cost of developing bio-based or recyclable alternatives is often higher than conventional petrochemical products, limiting adoption in price-sensitive markets. Offshore wind projects, which demand superior materials to withstand harsh marine environments, further amplify cost pressures. Smaller manufacturers struggle to compete with global giants like BASF, Dow, and Mitsubishi Chemical, who have the resources to invest in R&D and scale production, thereby causing a hindrance in the market’s expansion.

Wind Turbine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.9% |

|

Base Year Market Size (2025) |

USD 81.4 billion |

|

Forecast Year Market Size (2035) |

USD 190.3 billion |

|

Regional Scope |

|

Wind Turbine Market Segmentation:

Turbine Type Segment Analysis

The horizontal-axis wind turbine segment, which is part of the turbine type, is anticipated to garner the highest share of 92.5% in the wind turbine market by the end of 2035. The segment’s upliftment is highly attributed to its importance in emerging as the most dominant technology for commercial and large-scale electricity generation. This is due to its ability, proven reliability, and increased efficiency to harness consistent and robust winds at greater heights. According to an article published by the World Wind Energy Association in April 2025, the overall capacity of wind power has exceeded 1,174 GW, with 121 GW added in 2024. Besides, China has significantly installed 87 GW of wind turbines, accounting for 72% of new international capacity. Moreover, countries with the largest wind turbine market volume, including Brazil with 5.4 GW, the U.S. with 4.2 GW, India with 3.4 GW, Australia with 3.3 GW, Germany with 3.2 GW, and the UK with 2.2 GW, are also proliferating the segment’s growth.

End use Segment Analysis

By the end of 2035, the utility-scale sub-segment, part of the end use segment, is expected to account for the second-largest share in the wind turbine market. The sub-segment’s growth is highly propelled by the aspect of multi-megawatt installations connected directly to national or regional grids, supplying electricity at scale to meet industrial, commercial, and residential demand. Additionally, the growth is also driven by government-backed renewable portfolio standards, corporate power purchase agreements (PPAs), and long-term decarbonization targets. Besides, utility-scale projects benefit from economies of scale, reducing the levelized cost of energy (LCOE) compared to smaller distributed systems. Meanwhile, technological advancements, such as turbines, are further enhancing efficiency and output, thus creating a positive impact on the segment’s upliftment.

Installation Segment Analysis

Based on the installation, the onshore wind segment in the wind turbine market is predicted to cater to the third largest share during the forecast timeline. The segment’s development is highly fueled by the lower capital expenditure in comparison to offshore projects, shorter permitting cycles, and mature supply chains that enable rapid deployment. Countries such as China, India, and the U.S. have massive land resources and favorable wind conditions, making onshore projects cost-effective and scalable. This particular segment is also central to repowering initiatives, wherein older turbines are replaced with modern, higher-capacity models, extending asset life and boosting efficiency. Onshore wind benefits from strong government support, with India’s Ministry of New & Renewable Energy emphasizing onshore expansion and China’s National Development and Reform Commission continuing to prioritize land-based wind in its renewable energy mix.

Our in-depth analysis of the wind turbine market includes the following segments:

|

Segment |

Subsegments |

|

Turbine Type |

|

|

End use |

|

|

Installation |

|

|

Drive Drain Technology |

|

|

Capacity |

|

|

Component |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wind Turbine Market - Regional Analysis

APAC Market Insights

The Asia Pacific in the wind turbine market is anticipated to hold the highest share of 45.4% by the end of 2035. The market’s upliftment in the region is primarily attributed to India’s policy-driven growth, China’s upscale, and expansion in offshore pipelines across Australia, South Korea, and Japan. According to a data report published by the JWPA in February 2024, the yearly gross installation consists of 24 windfarms, 572.3 MW, and 158 units in Japan. Likewise, the yearly net installation constitutes 20 windfarms, 487.4 MW, and 86 units, thereby making the overall cumulative capacity to 5,213.4 MW, along with 2,626 units, thus positively contributing to the market’s growth in the overall region. Besides, the aspects of offshore ramp-up, policy stability, and large-scale deployments are also fueling the market’s exposure in the region.

China in the wind turbine market is growing significantly, owing to an increase in onshore and offshore deployment, ongoing policy-driven investments, and unmatched scale. As per an article published by the State Council in January 2024, the overall investment in notable energy projects under construction and those recently initiated increased to 2.8 trillion yuan (USD 391 billion) from the previous year. In addition, investments in new energy also surged over 34% YoY, and meanwhile, completed investments in solar power generation upsurged 670 billion yuan in the previous year, while wind power investments increased by 380 billion yuan. Besides, based on domestic engineering, manufacturing, and innovation, international photovoltaic power and wind generation expenses have reduced by more than 80% and 60%, which is readily uplifting the market’s growth and demand.

India in the wind turbine market is also growing due to alignment in grid reforms, leasing rules for offshore, repowering, and the presence of accelerated auctions. As per an article published by the Ministry of New and Renewable Energy in December 2025, the country has a coastline of almost 7,600 km, which is significantly surrounded by water on three sides, and constitutes suitable prospects of harnessing offshore-based wind energy. Additionally, offshore wind turbines are larger, with a capacity of almost 15 MW per turbine, against 2 MW to 3 MW for the onshore wind turbines. Besides, the country’s Ministry has set the plan to successfully carry out the needed evaluation through the NIWE and offer basic data to stakeholders by conducting a geological survey for 365 square km in Gujarat for the 1.0 GW project capacity, thereby denoting a huge growth opportunity for the overall wind turbine market in the country.

North America Market Insights

North America market is expected to emerge as the fastest-growing region during the forecast period. The wind turbine market’s development in the region is highly propelled by the presence of mature onshore repowering cycles, IRA-based supply chain investments, as well as policy stability. According to an article published by the U.S. Department of Energy in 2024, USD 2.1 billion has been funded in the regional offshore wind sector to create transmission, supply chain, vessels, and ports as of 2023. Additionally, this has helped in developing 125,580 employment opportunities to assist in powering the regional land-driven wind energy sector. Moreover, USD 37 million has also been funded in the newest U.S.-based distributed wind projects in 2023. Besides, 13 states in the U.S. comprise policies that collectively and successfully support 115,130 MW of offshore wind by the end of 2050, thus driving the market’s growth.

Wind Turbine Market in U.S is gaining increased traction, owing to the existence of federal incentives and policies, an increase in utility-scale demand, chemical industry linkages, and advanced safety and manufacturing. As per an article published by the EIA Government in June 2024, wind turbines in the country are established based on the yearly average wind speed, accounting for almost 9 miles per hour or 4.0 meters per second, particularly for small wind turbines, along with 13 mph for utility-scale turbines. Besides, large-scale wind turbines are significantly placed on towers that tend to range from nearly 500 feet to 900 feet tall. Moreover, nearly 10%, which is 425 billion kWh of the overall domestic utility-scale electricity generation has been from wind energy projects across 41 states. Regarding this, Illinois, Kansas, Oklahoma, Iowa, and Texas jointly produce 59% of the country’s wind electricity generation, thus fueling the market’s growth.

Canada in the wind turbine market is also developing due to clean energy targets, governmental expenditure, onshore wind dominance, chemical industry integration, along with the presence of safety and partnership programs. As per an article published by the Government of Canada in August 2025, in the upcoming 5 years, the country’s clean energy gross domestic product (GDP) is expected to reach USD 107 billion, which is gradually fueled by USD 58 billion in yearly investments by the end of 2030, along with providing over 600,000 employment opportunities. Moreover, the country’s population is ready to diminish the nation’s overall energy-based expenses by as much as USD 15 billion through the transition to a net-zero future. Additionally, between 140 GW and 190 GW of additional clean electricity-generating capacity is expected to be required by the end of 2050, which readily drives the wind turbine market’s growth.

Europe Market Insights

Europe is projected to witness considerable growth by the end of the stipulated timeline in the wind turbine market. The market’s growth in the region is highly propelled by the sustained onshore repowering, as well as escalating offshore build-out in the Nordics, the UK, Germany, and the rest of the region. According to an article published by Wind Europe in February 2025, the region has significantly installed 16.4 GW of newest wind power capacity as of 2024. In addition, the regional-27 also installed 12.9 GW out this overall capacity. Moreover, 84% of the newly built wind capacity has been successfully built in the region, which was onshore, and meanwhile, 2.6 GW of new offshore wind power capacity has been connected to the grid. Besides, the region currently has 285 GW of wind power capacity, of which 248 GW is onshore, and the remaining 37 GW is offshore, thereby suitable for boosting the market’s growth.

Yearly Onshore and Offshore Wind Power Capacity in Europe (2015-2024)

|

Year |

Onshore (GW) |

Offshore (GW) |

|

2015 |

10.8 |

3.0 |

|

2016 |

13.3 |

1.5 |

|

2017 |

13.0 |

3.2 |

|

2018 |

9.6 |

2.7 |

|

2019 |

11.8 |

3.7 |

|

2020 |

11.3 |

3.7 |

|

2021 |

14.4 |

2.9 |

|

2022 |

16.4 |

2.5 |

|

2023 |

14.7 |

3.7 |

|

2024 |

13.8 |

2.6 |

Source: Wind Europe

The wind turbine market in Germany is gaining increased exposure, owing to the existence of an industrial base that tends to localize materials and components, continued additions, and immense support provided by large-scale onshore repowering. As per the 2023 Federal Ministry for Economic Affairs and Climate Action data report, the occurrence of good wind conditions, along with an immense increase in photovoltaics construction, has brought almost 7% year-on-year (YoY) increase to 273.2 TWh in electricity generation from renewable energy. Besides, the country has anchored the objective of achieving nearly 80% of the gross electricity consumption, which is to be generated from renewable energy by the end of 2030. Furthermore, electricity demands in the country are expected to rise from almost 550 TWh to 750 TWh, thereby bolstering the market’s demand.

The wind turbine market in the UK is also growing due to the presence of steady auction frameworks, mature supply chains, and increased expansion in offshore. As per a data report published by the IEA in 2023, the renewable energy’s share in the country has reached a newest 47.3% share record, denoting a surge of 5.3% from 2022. Besides, wind energy in the country has also reached a record share of nearly 29% of the overall demand. Apart from all these, the renewable energy capacity continued to grow by 2.7 GW as of 2023, of which 1.4 GW caters to wind energy. In this regard, offshore wind accounted for 0.8 GW, and onshore with 0.5 GW, thereby bringing the cumulative capacities to 14.7 GW and 15.3 GW. However, the country has readily set the target of 50 GW of offshore wind, which is to be installed by the end of 2030, thereby making it suitable for driving the wind turbine market’s exposure.

Key Wind Turbine Market Players:

- Dow Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Huntsman Corporation (U.S.)

- 3M Company (U.S.)

- PPG Industries, Inc. (U.S.)

- BASF SE (Germany)

- Covestro AG (Germany)

- Henkel AG & Co. KGaA (Germany)

- Akzo Nobel N.V. (Netherlands)

- Solvay S.A. (Belgium)

- Arkema S.A. (France)

- Evonik Industries AG (Germany)

- Mitsubishi Chemical Group Corporation (Japan)

- Toray Industries, Inc. (Japan)

- Sumitomo Chemical Co., Ltd. (Japan)

- LG Chem Ltd. (South Korea)

- Hanwha Solutions Corporation (South Korea)

- Reliance Industries Limited (India)

- Aditya Birla Chemicals (India)

- Petronas Chemicals Group Berhad (Malaysia)

- Orica Limited (Australia)

- Dow Inc. supplies advanced epoxy resins and composite materials widely used in wind turbine blades. Its innovations in lightweight composites and sustainable chemistries help improve turbine efficiency and durability, supporting global renewable energy expansion.

- Huntsman Corporation is a notable provider of polyurethane resins and adhesives essential for blade manufacturing. The company’s focus on high-performance materials enhances turbine reliability and supports large-scale offshore projects.

- 3M Company significantly contributes protective coatings, adhesives, and tapes that extend turbine blade life and reduce maintenance costs. Its solutions are critical for minimizing erosion and wear in harsh onshore and offshore environments.

- PPG Industries, Inc. readily specializes in advanced coatings and paints that protect turbine towers and blades from corrosion. Its products are widely adopted in offshore wind farms, where durability against saltwater exposure is vital.

- BASF SE is regarded as one of the leading suppliers of epoxy systems, composites, and specialty chemicals for turbine blades and nacelles. Its R&D in sustainable materials aligns with Europe’s Green Deal, driving the adoption of eco-friendly solutions in wind energy.

Here is a list of key players operating in the global market:

The worldwide wind turbine market is extremely competitive, with notable players from Asia Pacific, the U.S., and Europe readily dominating through advancement, tactical partnerships, and sustainability. Besides, organizations, such as Mitsubishi Chemical, Dow, and BASF, are generously investing in advanced materials and eco-friendly solutions to meet rising demand for renewable energy infrastructure. Strategic initiatives include mergers, acquisitions, and collaborations with turbine manufacturers to strengthen supply chains and expand geographic reach. Besides, in December 2025, GE Vernova Inc. declared that it has readily signed a deal with Public Power Corporation Renewables to commission, install, and supply 14 of its 6.1 MW to 158m turbines for a wind farm in Romania, thereby denoting an optimistic outlook for the overall wind turbine market’s growth.

Corporate Landscape of the Wind Turbine Market:

Recent Developments

- In November 2025, Envision Energy, along with Global Energy Services, successfully signed a tactical Framework Agreement to make advancements in the large-scale deployment of battery energy storage systems as well as wind turbine generators across Europe and Spain.

- In December 2024, Vesta’s infrastructures on the Isle of Wight have readily played a vital role in manufacturing turbine blades for wind projects across different regions. Currently, the organization has introduced manufacturing blades for the V174 offshore turbine.

- In June 2024, BASF and Vattenfall have signed service and supply contracts with Vestas for 112 wind turbines, particularly of the V236-15.0 MW type, which is poised to be utilized in the Nordlicht 1 and 2 offshore wind projects, which are owned by BASF and Vattenfall.

- Report ID: 8317

- Published Date: Dec 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Wind Turbine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.