Global Wind Turbine Inspection Drones Market Size, Forecast, and Trend Highlights Over 2025-2037

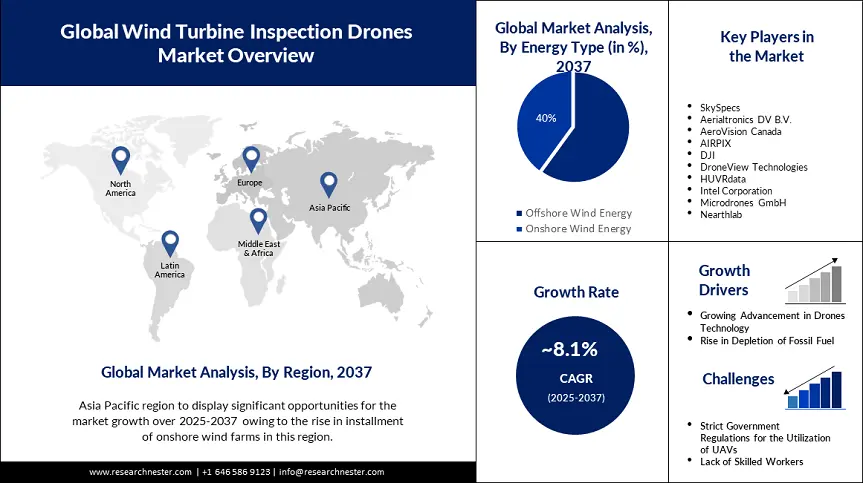

Wind Turbine Inspection Drones Market size was over USD 37.61 billion in 2024 and is poised to exceed USD 103.52 billion by the end of 2037, growing at over 8.1% CAGR during the forecast period i.e., between 2025-2037. In 2025, the industry size of wind turbine inspection drones is assessed at USD 40.05 billion.

The major element influencing the growth of the sector is the growing demand for renewable energy. According to the International Energy Agency in 2023, wind electricity generation increased by 10%, reaching 2330 TWh. Therefore, the need for the inspection of wind turbines is growing. It is anticipated that with the regular inspection of wind turbines, the defects would be detected earlier, hence further allowing timely repair of the components without affecting the energy production capacity.

Also, there is increased focus on sequestering carbon with various means. One of the effective measures to sequester carbon is installing wind farms. The American Clean Power Association found that 1 MWh of wind energy avoids almost 75 tons of carbon dioxide emissions on average. Subsequently, there is a surge in demand for wind turbine inspection drones, bolstering the market growth.

Wind Turbine Inspection Drones Sector: Growth Drivers and Challenges

Growth Drivers

-

Surge in advancements in drone technology: Various wind farm operators and maintenance teams are now using innovative tools that significantly enhance efficiency, safety, and longevity. Drone-based inspections have become a go-to method for wind turbine inspections because of their ability to promptly capture high-resolution images and data for faraway areas. Some of the prominent providers of drone-based inspection include Skydio, Parrot, DJI, and vHive. Some of the advantages of these inspection drones are safer inspection, reduced costs, and consistent data capture.

-

Rising cases of wind turbine damage: Cases of hurricanes and tornadoes are becoming frequent and posing challenges. For instance, the National Oceanic and Atmospheric Administration stated that 1,200 tornadoes occur per year in the U.S. alone. Such extreme events may cause damage to the wind turbines' blades or other parts. For instance, in August 2024, MidAmerican Energy’s Orient wind farm witnessed a tornado with a speed of 100 mph, causing 5 wind towers to fall to the ground. Wind turbine inspection drones are extremely useful in finding such damage, propelling the demand for the drones.

-

Drones reduce the cost of inspection: As compared to the traditional method of inspection, the inspections done using drones collect more data. Given that wind farms have quite big installations, a drone fitted with the right thermal camera could scan the entire farm with greater accuracy than someone standing on the ground with a hand-held thermal camera. The operational expense of drones is remarkably lower than conventional methods.

Challenges

-

Lack of skilled workers: There is a requirement for highly skilled professionals to operate drones. There is a requirement for comprehensive training programs and educational courses focused on drone technology to acknowledge the skill gap. Drone companies face a shortage of skilled people to operate drones.

-

Stringent government regulations: Rules ensure safer integration of drones into the wind turbine inspection and prevent unauthorized utilization. This also maintains aviation and public security.

Wind Turbine Inspection Drones Market: Key Insight

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

8.1% |

|

Base Year Market Size (2024) |

USD 37.61 billion |

|

Forecast Year Market Size (2037) |

USD 103.52 billion |

|

Regional Scope |

|

Wind Turbine Inspection Drones Segmentation

Application (Blade Inspection, Tower Inspection, Nacelle Inspection)

The blade inspection segment in the wind turbine inspection drones market is poised to generate the highest revenue by the end of 2037. Blade inspection is an essential element of maintaining a wind turbine overall, since damaged blades could decrease the power and potentially seriously harm the wind tower. It may be time-consuming and expensive to inspect the blades using traditional methods, which include personnel ascending the tower. Drones are capable of reducing the cost of blade inspection. According to Chemical and Engineering News in August 2022, in the U.S. alone, almost 8,000 blades were pulled down. Inspection and maintenance is important to prevent problems in wind turbine blades.

Energy Type (Offshore Wind Energy, Onshore Wind Energy)

Wind turbine inspection drones market from the offshore wind energy segment is expected to have a significant rise over the projected period. Offshore farms are becoming more popular than onshore wind energy farms because of the presence of higher wind speeds and lack of physical interference. According to the World Economic Forum in November 2022, at COP27, 9 new countries joined the global offshore wind alliance started by IRENA (International Renewable Energy Agency). Additionally, the worldwide offshore wind installation in 2023 is projected 4th largest annual installed capacity with 6,326 MW.

Our in-depth analysis of the global wind turbine inspection drones market includes the following segments:

|

Drone Type |

|

|

Application |

|

|

Energy Type |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Wind Turbine Inspection Drones Industry - Regional Synopsis

Asia Pacific Market Statistics

The Asia Pacific industry is poised to dominate the revenue share by 2037. The market expansion can be attributed to the rise in the installation of onshore wind farms in this region. According to the Global Wind Energy Council, the Asia Pacific could reach onshore capacity of 1,084 GW by 2030. This growth in these projects is influenced by growing electricity demand, rising urbanization, and industrialization. Other than this, according to the Asian Development Bank, in Sekong and Attapeu, a 600-megawatt monsoon wind power project that includes 133 wind turbines is being constructed. Regular wind turbine inspections have become crucial than before to identify potential issues early on, allowing for replacement and repair on time. These factors are bolstering the growth of the market in the region.

North America Market Forecast

North America wind turbine inspection drones market is also projected to have noteworthy growth over the forecasted period. The growth of the market can be attributed to the rising adoption of renewable sources for electricity generation. For instance, according to the U.S. Energy Information Administration in the U.S., electricity generation from wind energy reached 434 billion kWh in 2022. Also, the American Clean Power Association in 2024 stated that wind is the largest source of renewable energy electricity generation in the country, accounting for 10.1% of the total electricity. The traditional methods of inspection of a wind turbine drain the maintenance budget, and drone inspection cuts down the inspection cost by up to 80%.

The market in Canada is also gaining traction as drone inspection services for wind farms have revolutionized wind farm maintenance in the country. It has enhanced safety, reduced costs, and minimized operational downtime. According to the government of Canada, in 2022, the country raised its installed wind energy capacity by 1 gigawatt to a total of 15.31 GW.

Companies Dominating the Wind Turbine Inspection Drones Landscape

- SkySpecs

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aerialtronics DV B.V.

- AeroVision Canada

- AIRPIX

- DJI

- DroneView Technologies

- HUVRdata

- Intel Corporation

- Microdrones GmbH

- Nearthlab

The competitive landscape of the market is rapidly evolving as established key players, wind farm giants, and new entrants are investing in novel technologies. Key players in the market are focused on products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global market:

Recent Developments

- In August 2024, GEV Wind Power launched new heavy lift cargo drones to support wind industry operations. The advanced technologies are playing a crucial role in capturing detailed imagery, conducting comprehensive blade inspections.

- In March 2024, Aerones launched the autonomous drone inspection service for wind turbine blades. The advanced drone visual inspection service offers industrial-grade drones with a custom high-resolution camera module. In autopilot mode, Aerones is capable of inspecting 1 turbine within 30 minutes.

- Report ID: 5076

- Published Date: Nov 27, 2024

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert