Japan Turbo Compressor Market Outlook:

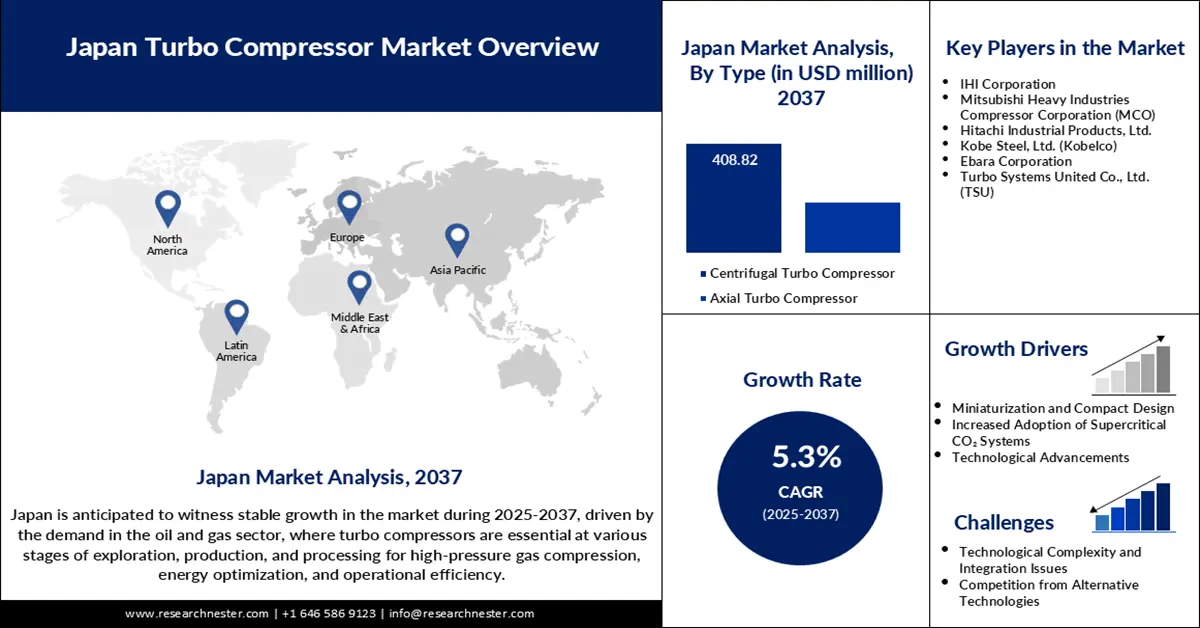

Japan Turbo Compressor Market size was valued at USD 303.4 million in 2024 and is projected to reach a valuation of USD 599.6 million by the end of 2037, rising at a CAGR of 5.3% during the forecast period, i.e., 2025-2037. In 2025, the industry size of Japan turbo compressor is estimated at USD 319.7 million.

Japan turbo compressor market is witnessing steady expansion as a result of decarbonization policies and the modernization of infrastructure. Companies are concentrating on localized R&D to comply with industrial and environmental standards. In December 2024, Mitsubishi Heavy Industries launched single-shaft turbo compressors through digital twin simulations that were tested in Hiroshima. This design improves the performance forecasting of complex refinery arrangements. Growth is sustained with government-led energy initiatives and revived domestic capacity investment. The continued trend towards smart, automated systems continues to strengthen market uptake among verticals.

The governmental strategic efforts also affect adoption trends. These guidelines facilitate energy saving and reduce contamination during operation. The urban municipalities have started pilot deployments, which is an indication of increased institutional involvement. The overall sustainability drive is supported by long-term rewards such as Japan’s carbon neutrality roadmap. OEMs are riding on this momentum to realign portfolios with regulatory needs. With the differentiation of demand, energy-efficient application-specific compressors are garnering rapid demand.

Key Japan Turbo Compressor Market Insights Summary:

Segment Insights:

- The centrifugal turbo compressor sub-segment is projected to hold 68% share by 2037, driven by its compactness, high efficiency in continuous operations, and versatility across industries.

- The multi-stage turbo compressor sub-segment is expected to account for 70% share by 2037, impelled by its high pressure ratios and suitability for industrial processes like petrochemical production and hydrogen compression.

Key Growth Trends:

- Digital transformation and smart systems

- Carbon neutrality and specialized compressors

Major Challenges:

- Strict noise compliance in urban areas

- Regulatory standardization across global markets

Key Players: IHI Corporation, Mitsubishi Heavy Industries Compressor Corporation (MCO), Hitachi Industrial Products, Ltd., Kobe Steel, Ltd. (Kobelco), Ebara Corporation

Global Japan Turbo Compressor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2024 Market Size: USD 303.4 million

- 2025 Market Size: 319.7 million

- Projected Market Size: USD 599.6 million by 2037

- Growth Forecasts: 5.3% CAGR (2025-2037)

Key Regional Dynamics:

- Largest Region: Japan

- Fastest Growing Region: Europe

- Dominating Countries: Japan, South Korea, China, Germany, United States

- Emerging Countries: India, Vietnam, Thailand, Indonesia, Malaysia

Last updated on : 6 October, 2025

Japan Turbo Compressor Market - Growth Drivers and Challenges

Growth Drivers

- Digital transformation and smart systems: Digital transformation continues to be a key growth lever in Japan’s turbo compressor industry. In June 2024, Hitachi incorporated AI-powered diagnostics in its Lumada platform for compressor units. This innovation is capable of supporting predictive maintenance and anomaly detection in real time. With the manufacturing sector in Japan moving towards Industry 4.0, smart compression systems are picking up pace. These systems also comply with the national automation objectives of the Connected Industries initiative. The attraction is the decreased downtime, operational transparency, and adaptive performance tuning.

- Carbon neutrality and specialized compressors: Carbon neutrality objectives are driving OEMs to invest in special compressor systems. In August 2024, Mitsubishi Heavy Industries increased the production of MAC-series compressors that can handle CO₂ at 10,000 psi. These units serve carbon capture needs in refineries and gas storage locations. The technology aligns with Japan’s shift to carbon recycling and sequestration. This segment is receiving policy attention with the 2050 net-zero target. As the industry changes, high-pressure and environmentally compliant systems are becoming the norm.

- Hydrogen infrastructure and clean fuel networks: Hydrogen infrastructure is defining new investment avenues. In May 2025, the University of Tokyo, Kobe Steel, Hitachi, and 15 other Organizations launched a research initiative to assess material reliability for carbon-neutral infrastructure, including hydrogen, ammonia, and CO2 CCS applications. Such systems are connected to clean fuel networks and have ultra-low temperature requirements. The government’s energy diversification roadmap reinforces this need. When hydrogen and ammonia establish their place in power generation, compression technology for the concerned industry gets more R&D money. This trend places the hydrogen segment as a high-potential growth segment.

1. Emerging Trade Dynamics in Japan

Air pumps provide initial airflow and steady intake pressure for turbo compressors, pre-pressurizing or scavenging air to enable smooth startup, stable operation, and higher efficiency while reducing compressor strain. In 2024, Japan exported ¥788 billion and imported ¥433 billion in air pumps, ranking 22nd in exports and 40th in imports.

Japan Air Pumps Trade in 2024

|

Exporting Country |

Value (¥ Billion) |

Importing Country |

Value (¥ Billion) |

|

United States |

202.0 |

China |

217.0 |

|

China |

125.0 |

United States |

46.4 |

|

Germany |

65.4 |

Thailand |

38.8 |

|

Thailand |

58.7 |

South Korea |

28.1 |

|

South Korea |

41.4 |

Germany |

15.3 |

Source: OEC

Challenges

- Strict noise compliance in urban areas: One challenge in the Japan turbo compressor market is strict noise regulations in urban areas, with mandatory limits implemented in October 2024 for compressors in noise-sensitive locations. This forces OEMs to develop innovative housing designs and dampening technologies for acoustic control, potentially affecting product margins. These advancements are crucial for meeting the specific demands of urban environments. As such, OEMs have to invest in research and development in order to design quiet but high performing compressors to comply with such regulations.

- Regulatory standardization across global markets: Another challenge for the market is the standardization of regulation in global markets, with Japan harmonizing JIS B 8341 testing standard with ISO 5389 in January 2024, necessitating redesign efforts on behalf of OEMs to conform to the international protocols, and adding complexity for manufacturers of both domestic and overseas markets, pressuring smaller firms As a result, manufacturers need to be proactive to keep up with changing global standards to remain competitive.

Japan Turbo Compressor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2037 |

|

CAGR |

5.3% |

|

Base Year Market Size (2024) |

USD 303.4 million |

|

Forecast Year Market Size (2037) |

USD 599.6 million |

|

Regional Scope |

|

Japan Turbo Compressor Market Segmentation:

Type Segment Analysis

The centrifugal turbo compressor segment is expected to lead the market, accounting for 68% share during the forecast period. This type is preferred due to its compactness, increased efficiency in continuous operations, and ability to be used in various industries. In February 2025, LG Chem’s HVO facility in South Korea placed an order for a centrifugal compressor with Hitachi. Designed and manufactured in Japan, the project increased exposure for Japan’s energy-efficient compressor technologies. Massive use in the oil, gas, and clean energy industries further consolidates its market lead.

The centrifugal models are gaining significant traction in LNG and hydrogen-related projects. Their low maintenance needs and scalable architecture make them appealing for continuous load operations. Japanese OEMs are also incorporating digital layers for smarter operation. In June 2022, Ebara added Elliott’s digital control systems to its compressors in order to optimize performance in LNG terminals. These systems increase uptime and life cycle cost reduction, enhancing centrifugal dominance.

Stage Segment Analysis

Multi-stage turbo compressors are anticipated to account for 70% share of the market by 2037. These compressors offer greater pressure ratios, thereby suitable for industrial processes such as petrochemical production and hydrogen compression. In December 2024, METI approved subsidies for multi-stage compressors for CO₂ capture applications. The focus was on systems with high gas reinjection abilities. Such applications need exact pressure control, which proves the worth of the multi-stage section.

For operational reliability and redundancy, industries are increasingly preferring multi-stage systems. With regulations heating up concerning safety and efficiency, the ability to fine-tune operations across stages is critical. In May 2024, Hitachi added dual-redundant leak detectors and auto shutdowns to their compressor line to conform to Japan’s High-Pressure Gas Safety Act. These enhancements cater to high-pressure settings common for the multi-stage designs and contribute to adoption.

Application Segment Analysis

The oil & gas segment is projected to account for 40% of the turbo compressor market share through 2037. This industry needs strong compression technology for refinery, gas processing, and enhanced oil recovery. In December 2024, Mitsubishi Heavy Industries tested steam turbine-driven compressors in its Hiroshima plant for a U.S. ethane cracker. Despite being intended for export, the development highlights Japan’s role in providing high-performance units. Domestic refineries also continue to require customized, durable systems.

The growth of the segment is also driven by Japan’s energy security objectives and the stable investments into gas infrastructure. Existing assets are being modernized, which is leading to compressor upgrades. In August 2024, the Ministry of Land, Infrastructure, Transport, and Tourism approved LNG terminal retrofits with smart turbo compressors. Yokohama and Osaka ports began procurement rounds. These projects highlight the continued requirement for high-quality compression in the oil & gas supply chain.

Our in-depth analysis of the Japan turbo compressor market includes the following segments:

|

Segment |

Subsegments |

|

Type |

|

|

Stage |

|

|

Capacity |

|

|

Power Output |

|

|

Speed |

|

|

Application |

|

Key Japan Turbo Compressor Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

Japan turbo compressor market is highly competitive, characterized by innovation and strong domestic players. Some of the top manufacturers are IHI Corporation, Mitsubishi Heavy Industries Compressor Corporation, Hitachi Industrial Products, Kobe Steel, Ebara Corporation, and Turbo Systems United. These companies are not only competing in the local market but also looking to venture into the APAC and global infrastructure markets. R&D, compliance readiness, and integration of smart technologies are their strong points. Differentiation is more and more oriented towards efficiency, flexibility, and digitalization.

Mitsubishi Heavy Industries' high-efficiency electric compressor enhances fuel cell performance and decarbonization technology. The system is designed for Japanese power firms and chemical plants and includes automated shutdown and real-time analytics. The move signals MHI’s dedication to smart manufacturing and fits in with national energy resilience objectives. Competitors are also moving in this direction by incorporating similar capabilities, and smart functionality is becoming a new standard in competitive differentiation.

Some of the key players operating in the market are listed below:

|

Company Name |

Country of Origin |

Approx. Market Share (%) |

|

IHI Corporation |

Japan |

30% |

|

Mitsubishi Heavy Industries Compressor Corporation (MCO) |

Japan |

25% |

|

Hitachi Industrial Products, Ltd. |

Japan |

20% |

|

Kobe Steel, Ltd. (Kobelco) |

Japan |

18% |

|

Ebara Corporation |

Japan |

10% |

|

Turbo Systems United Co., Ltd. (TSU) |

Japan |

9% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In February 2024, Ebara’s Elliott brand launched new centrifugal compressors tailored for LNG and refining. Manufactured in Japan, they support high-capacity, energy-efficient operations. The models are equipped with VFD control and oil-free design options. They strengthen Ebara’s ESG-focused "E-Vision 2030" global strategy.

- In June 2023, IHI Corporation’s Japan-based team designed a compact electric turbo compressor using air-bearing technology. It delivers 100 kW and is used in fuel cell systems and sustainable aviation. This development enhances Japan’s leadership in lightweight, zero-emission compressors. The innovation triples output compared to IHI’s prior generation units.

- In March 2024, Hitachi developed high-efficiency centrifugal compressors with advanced impeller designs. These systems cater to Japan’s petrochemical, chemical, and gas industries. The products contribute to Hitachi’s long-term environmental goals. They also improve thermal stability and performance in industrial settings.

- Report ID: 7681

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Japan Turbo Compressor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.