Ultrasonic Pipeline Monitoring System Market Outlook:

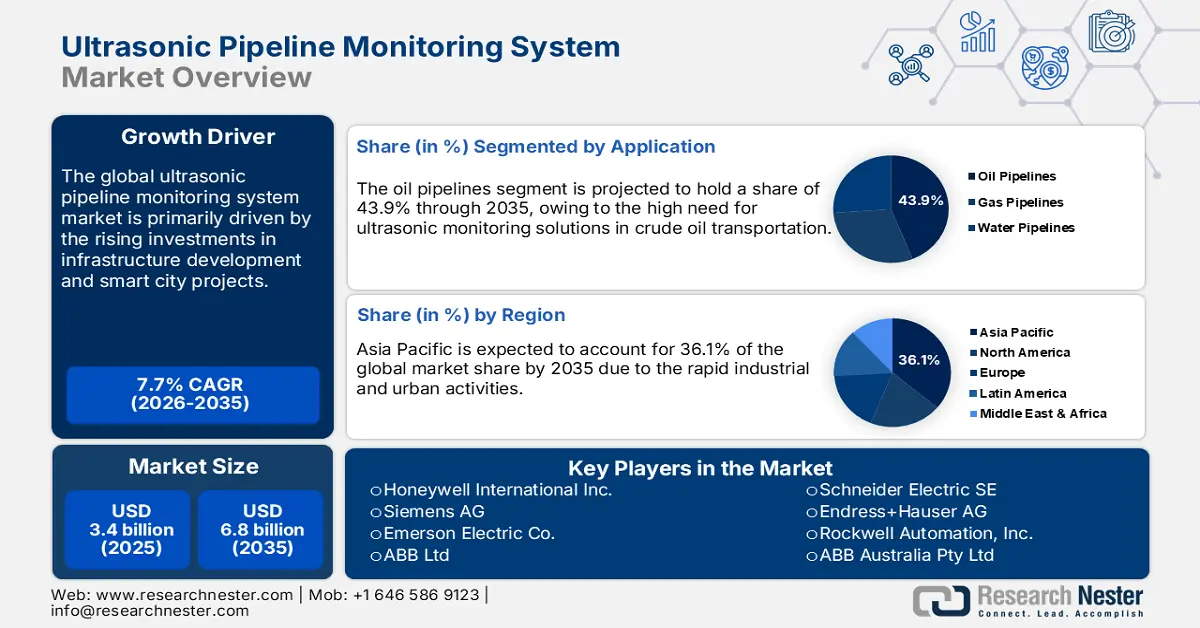

Ultrasonic Pipeline Monitoring System Market size was USD 3.4 billion in 2025 and is estimated to reach USD 6.8 billion by the end of 2035, expanding at a CAGR of 7.7% during the forecast period, i.e., 2026-2035. In 2026, the industry size of ultrasonic pipeline monitoring systems is assessed at USD 3.7 billion.

The primary driver of growth is regulatory and public-sector requirements pertaining to leak detection and integrity assessment that concurrently promote increased adoption of ultrasonic pipeline monitoring systems. PHMSA reported USD 28,010,135 invested in pipeline safety R&D in FY2021-FY2022, and PHMSA/industry guided-wave ultrasonic projects show multi-million-dollar program investments and validation activity. Together, these regulatory responsibilities and federal R&D investments require the operator to prioritize budgets and accelerate deployment of these systems.

The trade of ultrasonic pipeline monitoring systems is dependent on the stable supply chain of raw materials and components. The transducers, ultrasonic sensors, and electronic devices are vital for the production of advanced ultrasonic pipeline monitoring technologies. U.S. manufacturing shipments for electrical equipment and components exceeded USD 52.1 billion in recent monthly reports, while Census trade releases show electric-apparatus exports rose by $0.6 billion in April 2024, indicating active global trade in related goods. This reflects the high use of precision monitoring in pipeline networks to prevent loss and operational inefficiencies. The U.S. International Trade Commission (USITC) study reveals that the U.S. imports of ultrasonic instruments rose by 11.5% in 2023. These products were primarily sourced from Germany, Japan, and Singapore. The sectors such as oil & gas, water utilities, and hazardous materials pipelines are augmenting the sales of ultrasonic monitoring systems.

Key Ultrasonic Pipeline Monitoring System Market Insights Summary:

Regional Insights:

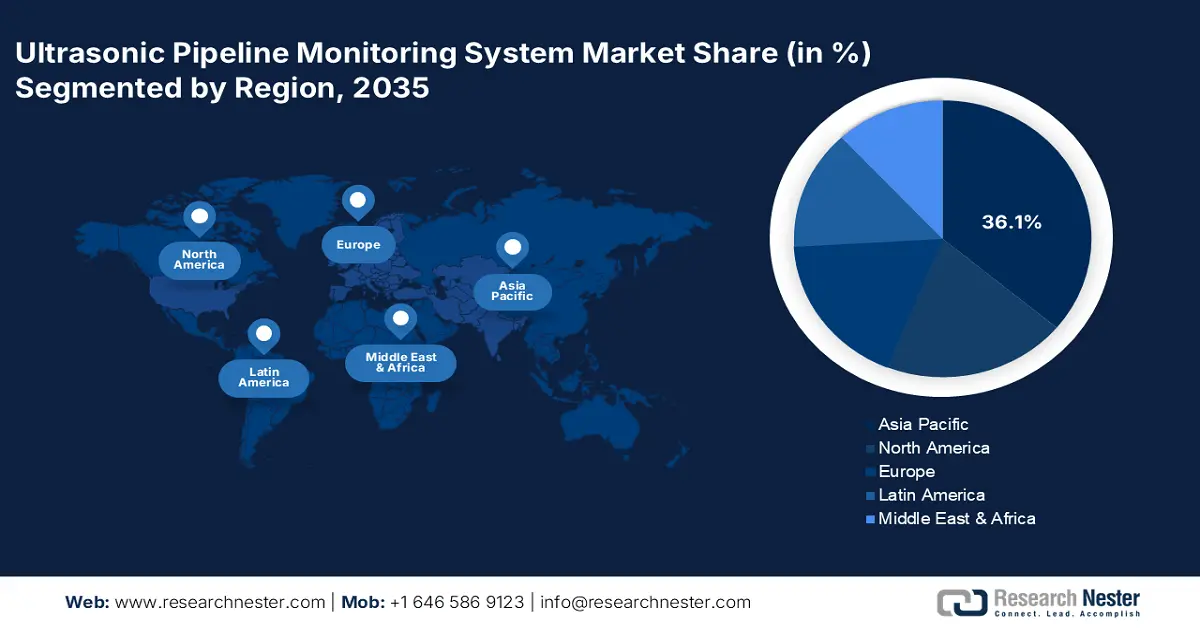

- The Asia Pacific ultrasonic pipeline monitoring system market is estimated to hold 36.1% of the global revenue share through 2035, supported by rapid industrialization, urban expansion, and increasing public spending on infrastructure modernization.

- The North America market is projected to register a CAGR of 8.9% from 2026 to 2035, bolstered by heavy infrastructure investments and stringent regulatory mandates enhancing pipeline safety standards.

Segment Insights:

- The oil pipelines segment in the Ultrasonic Pipeline Monitoring System Market is projected to account for 43.9% of the market share by 2035, propelled by stringent safety regulations and rising adoption of advanced integrity monitoring systems.

- The leak detection segment is anticipated to hold 39.5% share through 2026–2035, sustained by increasing demand for real-time micro-leak identification that minimizes environmental damage and operational losses.

Key Growth Trends:

- Rising global demand for energy infrastructure security

- Aging pipeline infrastructure

Major Challenges:

- High capital costs

- Inadequate infrastructure

Key Players: Honeywell International Inc., Siemens AG, Emerson Electric Co., ABB Ltd, General Electric Company (GE), Schneider Electric SE, Endress+Hauser AG, Rockwell Automation, Inc., ABB Australia Pty Ltd, Samsung SDS, Infosys Limited, Tata Consultancy Services (TCS), MDEC Technologies Sdn Bhd, BHEL (Bharat Heavy Electricals Ltd), CIMB Group Technology, Toshiba Corporation, Hitachi Ltd, Yokogawa Electric Corporation, Mitsubishi Electric Corporation, Fuji Electric Co., Ltd.

Global Ultrasonic Pipeline Monitoring System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.4 billion

- 2026 Market Size: USD 3.7 billion

- Projected Market Size: USD 6.8 billion by 2035

- Growth Forecasts: 7.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36.1% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, India, Germany

- Emerging Countries: South Korea, Canada, Australia, Italy, United Kingdom

Last updated on : 6 October, 2025

Ultrasonic Pipeline Monitoring System Market - Growth Drivers and Challenges

Growth Drivers

- Rising global demand for energy infrastructure security: The increasing frequency of pipeline leaks and sabotage incidents is fueling global security concerns. About 4.18 trillion kilowatt-hours (kWh) of electricity were generated at the utility scale in the United States in 2023. According to EIA estimates, small-scale solar photovoltaic systems produced roughly 0.07 trillion kWh of electricity. Such cases are set to fuel the global trade of ultrasonic pipeline monitoring technologies during the study period. The ability of ultrasonic systems to offer non-intrusive, real-time detection and risk mitigation is increasing and driving their sales growth. Leading end users are expected to invest in advanced ultrasonic monitoring for cross-border pipelines to reduce downtime and environmental fines in the years ahead.

- Aging pipeline infrastructure: The developed economies are facing issues with aging infrastructure, due to which they are investing heavily in pipeline upgradation projects. Such modernization activities are anticipated to double the revenue of ultrasonic pipeline monitoring system manufacturers in the coming years. The Pipeline and Hazardous Materials Safety Administration (PHMSA) reveals that in the U.S., major pipelines are more than 60 years old. By the end of 2024, only about 1% of natural gas distribution pipelines in the United States were made of iron pipe, and the majority, 99%, were made of steel or plastic. These are increasing the risk of corrosion and leakage, and subsequently fueling the demand for advanced and reliable ultrasonic pipeline monitoring technologies.

- Rising focus on environmental protection: Leaks from a pipeline can lead to soil contamination, groundwater pollution, and greenhouse gas emissions. Governments and communities are asking for more proactive prevention of leaks. In a compressed air system, leaks are a major source of energy waste, frequently wasting 20% to 30% of the compressor's output. Ultrasonic monitoring provides very accurate real-time detection of anomalies that could lead to a release of hazardous materials. As sustainability targets are expected to tighten across the globe and environmental liability costs continue to rise, utilities and energy companies will implement ultrasonic systems for the protection of ecosystems and to improve public trust. Environmental issues represent a significant market driver.

Emerging Trade Dynamics in the Market

Trade of Plastic Pipes in 2023

|

Exporting Country |

Value (USD B) |

Importing Country |

Value (USD B) |

|

Germany |

4.79 |

United States |

3.56 |

|

United States |

3.97 |

Germany |

2.39 |

|

China |

3.93 |

Mexico |

1.76 |

Source: OEC

Trade of Aluminium Pipes in 2023

|

Exporting Country |

Value (USD M) |

Importing Country |

Value (USD M) |

|

China |

457 |

Mexico |

291 |

|

United States |

342 |

Germany |

234 |

|

Germany |

281 |

United States |

234 |

Source: OEC

Trade of Stainless Steel Pipe or Tubing, Cold Rolled in 2023

|

Exporting Country |

Value (USD) |

Importing Country |

Value (USD) |

|

China |

1.04 B |

China |

336 M |

|

Japan |

398 M |

United States |

316 M |

|

India |

277 M |

Germany |

215 M |

Source: OEC

Challenges

- High capital costs: The ultrasonic pipeline monitoring system is a capital-intensive business that makes market entry for new players more challenging. Many public utilities in emerging markets delayed planned sensor upgrades because of limited budgets and financial constraints. The high initial investments in the ultrasonic pipeline monitoring systems majorly deter small-scale enterprises from expanding their operations. Thus, the high costs are anticipated to be a major drawback for the growth of the ultrasonic pipeline monitoring system market.

- Inadequate infrastructure: The foundational infrastructure of the budget-constrained economies is of poor quality. The inadequate availability of pipeline networks, electrical technologies, and advanced communication networks challenges the integration of ultrasonic pipeline monitoring systems. These technologies are heavily dependent on reliable power, connectivity, and structural compatibility with existing pipeline systems. Over half of the water systems in Sub-Saharan Africa are unsuitable for upgrading with digital sensor technology. Thus, infrastructure gaps are limiting the sales of ultrasonic pipeline monitoring systems.

Ultrasonic Pipeline Monitoring System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.7% |

|

Base Year Market Size (2025) |

USD 3.4 billion |

|

Forecast Year Market Size (2035) |

USD 6.8 billion |

|

Regional Scope |

|

Ultrasonic Pipeline Monitoring System Market Segmentation:

Pipeline Type Segment Analysis

The oil pipelines segment is projected to capture 43.9% of the market share by 2035. The majority of crude oil transportation through pipeline is fueling the segment's growth. The stringent safety and maintenance standards are expected to drive innovations in oil pipelines. In addition, the advanced and reliable oil pipelines are set to gain traction to avoid catastrophic leaks and environmental disasters. The U.S. Pipeline and Hazardous Materials Safety Administration (PHMSA) mandates advanced pipeline integrity monitoring systems to comply with safety standards. These regulatory compliance needs are estimated to boost the adoption of ultrasonic monitoring in oil pipelines.

Application Segment Analysis

The leak detection segment is poised to hold 39.5% of the ultrasonic pipeline monitoring system market share throughout the forecast period. The is expected to remain the most sought-after application for ultrasonic pipeline monitoring systems owing to their precise, real-time detection of micro-leaks, minimizing environmental damage, and reducing operational losses. About 10,000 gallons of water are wasted annually by leaks in the average household, and 10% of homes have leaks that waste 90 gallons or more every day. As per the analysis by the U.S. Environmental Protection Agency (EPA), early leak detection technologies reduce hazardous emissions and water contamination risks. Such recommendations accelerate the adoption of ultrasonic pipeline monitoring technologies.

Product Type Segment Analysis

The ductile iron pipe segment is expected to hold a significant share in the ultrasonic pipeline monitoring system market by 2035. Primarily due to its widespread use in municipal water distribution, sewage, and industrial pipelines. Comparing these pipes to traditional cast iron pipes, they are around 30% lighter. Its widespread use is the result of high durability, corrosion resistance, and high-pressure capabilities, which make it a great material for essential water infrastructure. Ultrasonic monitoring works especially well for ductile iron pipe, as it offers early detection of leaks, wall thickness measurements, and operational integrity measures, which are improving demand over stainless steel, plastic or other materials.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Pipeline Type |

|

|

Application |

|

|

Technology Type |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ultrasonic Pipeline Monitoring System Market - Regional Analysis

APAC Market Insights

The Asia Pacific ultrasonic pipeline monitoring system market is estimated to account for 36.1% of the global revenue share through 2035. The robust rise in industrial and urban activities is fueling the sales of ultrasonic pipeline monitoring technologies. The increasing public spending on infrastructure modernization is poised to double the revenues of ultrasonic pipeline monitoring system manufacturers in the years ahead. Digital transformation initiatives and rising ICT infrastructure expansion are also set to augment the trade of ultrasonic pipeline monitoring systems. China, Japan, India, and South Korea are growing markets for ultrasonic pipeline monitoring system producers.

China is anticipated to lead the sales of ultrasonic pipeline monitoring systems during the study period. In August 2023, CNOOC Energy Development Company introduced an in-house ultrasonic internal inspection system for 15 subsea pipelines in China, cutting deployment to 5-7 days, analysis to 30 days, and improving the minimum detectable defect size from 5 mm to 3 mm. The rising government investments are expected to attract numerous ultrasonic pipeline monitoring system investors in the years ahead. Strict regulations and initiatives such as the Digital Silk Road and Smart Cities are likely to boost the adoption of ultrasonic pipeline monitoring technologies.

The government-backed smart infrastructure programs are fueling the sales of ultrasonic pipeline monitoring technologies in India. The digital infrastructure expansion and robust investments in the road projects are expected to increase the application of ultrasonic pipeline monitoring systems in the country. The Ministry of Road Transport & Highways’ Demand for Grants 2025-26 allocates ₹1,16,292 crore specifically for roads and bridges, highlighting the government’s significant commitment to strengthening national highway infrastructure and enhancing connectivity across India during the fiscal year 2025-26. The favorable government policies and investments are likely to accelerate the overall market growth in the coming years.

North America Market Insights

The North America ultrasonic pipeline monitoring system market is expected to increase at a CAGR of 8.9% from 2026 to 2035. The U.S. and Canada are investing heavily in infrastructure modernization projects following several high-profile pipeline incidents. The stricter regulatory requirements are directly accelerating the trade of ultrasonic pipeline monitoring systems. In 2021, corrosion caused roughly USD 6 billion losses of a USD 96.1 billion GDP, with best practices potentially reducing petroleum–petrochemical industry costs by 14%-33%. The ICT and broadband infrastructure expansion is also opening lucrative doors for ultrasonic pipeline monitoring system producers.

The strict regulatory oversight and technological innovations are anticipated to fuel the demand for ultrasonic pipeline monitoring systems in the U.S. PHMSA's Office of Hazardous Materials Safety creates regulations and standards for both the classification and the handling and packaging of more than 1 million shipments of hazardous materials daily in the United States. The Office of Pipeline Safety manages safety through the design, construction, operation, maintenance, and spill response planning for more than 2.6 million miles of natural gas and hazardous liquid transportation pipelines in the United States. This is promoting the sales of ultrasonic sensors powered by IoT and AI analytics. Increasing capital expenditure is estimated to fuel the trade of ultrasonic pipeline monitoring solutions in the years ahead.

The strong governmental support aligned with the country’s priorities on environmental protection and infrastructure resilience is set to accelerate the sales of ultrasonic pipeline monitoring systems in Canada. By the end of 2025‑26, FSDS aims to invest USD 20 billion in green infrastructure projects designed to lower greenhouse gas emissions, enhance climate resilience, and improve overall environmental quality across various sectors and communities. The robust advancements in wireless connectivity networks are also contributing to the rising demand for ultrasonic pipeline monitoring technologies. The swiftly expanding oil and gas operations in the country are also creating a profitable environment for ultrasonic pipeline monitoring system producers.

Europe Market Insights

The Europe ultrasonic pipeline monitoring system market is estimated to account for 18% of the global revenue share through 2035. The European market is steadily increasing, driven by the demand for reliable and efficient monitoring of pipeline systems. The oil and gas, water and wastewater, and chemical industries are among those adopting ultrasonic pipeline monitoring solutions to prevent leaks, decrease maintenance costs, and ensure compliance with regulatory standards. The market growth in Europe is also supported by advancements in sensor technology, as well as the demand for monitoring pipelines in real time in order to increase operational safety and efficiency and reduce operational costs.

The ultrasonic pipeline monitoring system market in Germany is seeing growth on account of eager interest and demand for efficient and reliable monitoring of pipelines in industries such as oil and gas, water and wastewater, and chemicals. Over 96% of Germans connect to public sewers spanning 540,723 km, discharging wastewater into nearly 10,000 treatment plants, with 98% undergoing biological treatment with nutrient removal. The increased adoption of ultrasonic technology in these industries for pipeline monitoring is driven by better prevention of leaks, reduced maintenance costs, and regulatory compliance. The growth of the market in Germany is also assisted by advancements in sensor technology and the need to monitor pipelines in real time to increase operational safety, efficiency, and reduce operational costs.

The UK ultrasonic pipeline monitoring systems market is growing due to the increasing demand for efficient and reliable pipeline monitoring in the oil and gas, water and wastewater, and chemical industries, among others. The adoption of ultrasonic technology for pipeline monitoring is attributed to the need to detect leaks, lower maintenance costs, and improve regulatory compliance. Professional UK leak detection typically costs £550-£1,250 depending on complexity. Affinity Water’s 2023 report revealed 68% of homes experienced leaks, causing an estimated £697 million in annual water bill losses nationwide. The innovative use of sensor technology is also stimulating the market for monitoring ultrasonically. In addition to this, the increasing demand for real-time monitoring to improve operational safety and efficiency is driving the market for ultrasonic pipeline monitoring systems in the region.

Key Ultrasonic Pipeline Monitoring System Market Players:

- Honeywell International Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- Emerson Electric Co.

- ABB Ltd

- General Electric Company (GE)

- Schneider Electric SE

- Endress+Hauser AG

- Rockwell Automation, Inc.

- ABB Australia Pty Ltd

- Samsung SDS

- Infosys Limited

- Tata Consultancy Services (TCS)

- MDEC Technologies Sdn Bhd

- BHEL (Bharat Heavy Electricals Ltd)

- CIMB Group Technology

- Toshiba Corporation

- Hitachi Ltd

- Yokogawa Electric Corporation

- Mitsubishi Electric Corporation

- Fuji Electric Co., Ltd.

The ultrasonic pipeline monitoring system market is described by the presence of gigantic players and the increasing emergence of start-ups. The leading companies focus on advanced R&D and global expansion is expected to double their revenue shares. They are continuously innovating their product portfolios with AI and IoT-integrated solutions. Key players are also expected to increase their market presence through strategic partnerships and competitive pricing strategies. The supportive government policies and digital infrastructure expansion investments are set to open lucrative earning opportunities for ultrasonic pipeline monitoring system manufacturers in the years ahead.

Here is a list of key players operating in the global market:

Recent Developments

- In June 2024, Honeywell International Inc. introduced the Ultrasonic Guardian Platform, combining edge computing hardware with enhanced cybersecurity protocols. The company states that it registered a 15.3% rise in pipeline system contracts in the second quarter of 2024.

- In March 2024, Siemens AG announced the launch of its SIWA Leak Finder AI Monitoring software with AI-driven anomaly detection with cloud-based real-time analytics. This product led to a 12.4% revenue rise in their industrial automation segment in the first quarter of 2024.

- Report ID: 7784

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ultrasonic Pipeline Monitoring System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.