Partial Discharge Monitoring Systems Market Outlook:

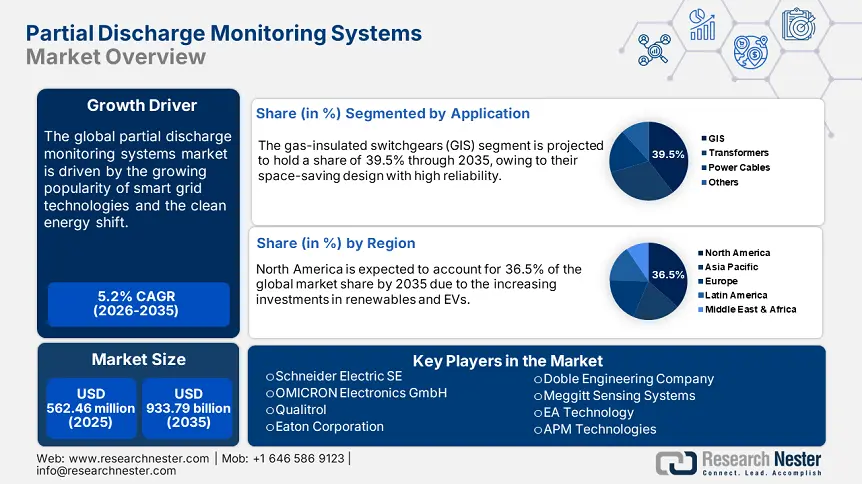

Partial Discharge Monitoring Systems Market size was valued at USD 562.46 million in 2025 and is expected to reach USD 933.79 million by 2035, expanding at around 5.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of partial discharge monitoring systems is evaluated at USD 588.78 million.

The increasing investments in green energy projects, including wind, solar, and hydro, are anticipated to propel the installation of reliable monitoring solutions for the efficient and effective operation of electrical systems. Modernization is driving the adoption of advanced partial discharge monitoring systems in power plants to ensure the health of the electrical infrastructure. The swift growth in the adoption of renewables, coupled with supportive government policies and initiatives, is poised to amplify the revenues of partial discharge monitoring system manufacturers in the years ahead.

The International Energy Agency (IEA) study highlights that the renewable energy share in the total electricity sector is expected to increase from 30.0% in 2023 to 46.0% by 2030. The worldwide clean energy generation is anticipated to cross 17,000 TWh by 2030, a 90.0% hike from 2023. By 2030, around 30.0% of renewable energy generation is set to be contributed by solar and wind sources. The U.S., Europe, and China mainly dominate the transport renewable energy demand. The decarbonization trend is primarily influencing the installations of clean energy infrastructure and opening lucrative doors for partial discharge monitoring system producers.

Key Partial Discharge Monitoring Systems Market Insights Summary:

Regional Highlights:

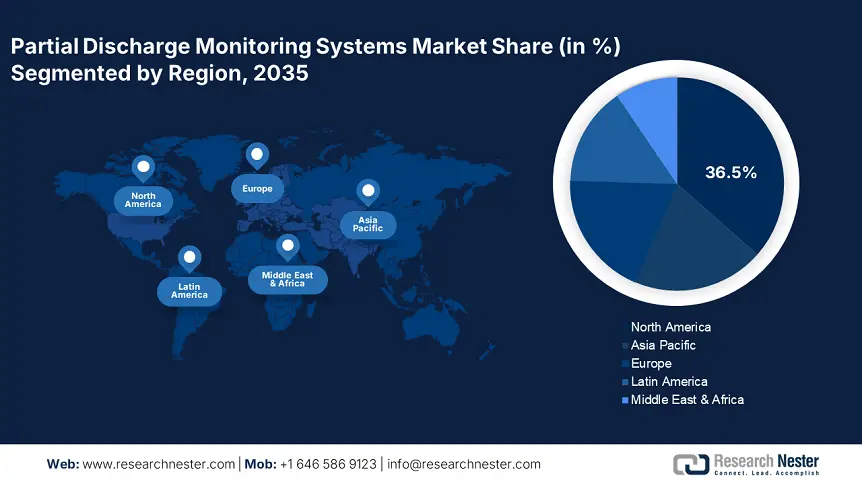

- North America commands a 36.5% share of the Partial Discharge Monitoring Systems Market, driven by well-established power infrastructure and early adoption of reliable technologies, ensuring growth through 2026–2035.

- The Partial Discharge Monitoring Systems Market in Asia Pacific is forecasted to grow rapidly through 2026–2035, fueled by swift industrialization, urbanization, and investment in power grid expansion.

Segment Insights:

- The Gas-Insulated Switchgears (GIS) segment is anticipated to capture a 39.50% share by 2035, driven by growth in urban activities leading to power infrastructure expansion.

- Permanent Monitoring Systems segment are expected to hold a 68.1% share by 2035, fueled by continuous monitoring and cost-effective predictive maintenance.

Key Growth Trends:

- Rise in infrastructure development

- Increasing popularity of smart grid technologies

Major Challenges:

- High costs of advanced partial discharge monitoring systems

- Retrofitting infrastructure a challenging process

Key Players: Schneider Electric SE, OMICRON Electronics GmbH, Qualitrol, Eaton Corporation, and Megger Group Limited.

Global Partial Discharge Monitoring Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 562.46 million

- 2026 Market Size: USD 588.78 million

- Projected Market Size: USD 933.79 million by 2035

- Growth Forecasts: 5.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, Canada

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Partial Discharge Monitoring Systems Market Growth Drivers and Challenges:

Growth Drivers

- Rise in infrastructure development: Countries across the world, both developed and developing, are witnessing a continuous rise in industrial and urban activities, which is directly fueling energy demand. The ongoing and planned infrastructure development activities are creating a lucrative space for partial discharge (PD) monitoring systems producers. The Global Infrastructure Outlook analysis states that the infrastructure investment needs are poised to reach USD 4.6 trillion by 2040. The increasing investments in high-tech infrastructure and government support are further estimated to propel the sales of partial discharge monitoring systems.

- Increasing popularity of smart grid technologies: The rising investments in smart grid technologies are likely to offer positive growth in profits for the partial discharge monitoring system producers in the coming years. The integration of advanced technologies in the partial discharge (PD) monitoring systems aids in real-time data analysis and predictive maintenance, leading to enhanced grid stability. Considering the increasing smart grid technology trend, many partial discharge monitoring system manufacturers are focusing on the introduction of advanced PD solutions integrated with artificial intelligence, machine learning, the Internet of Things, and big data analysis. IEA study states that China leads the deployment of residential smart meters, followed by Japan, the U.S., and the EU. The global investments in the smart meters were calculated at USD 22.0 billion in 2022. Furthermore, the electricity grid investments are expected to reach an average of USD 600.0 billion annually by 2030 to achieve the net-zero emission scenario trajectory.

Challenges

- High costs of advanced partial discharge monitoring systems: Partial discharge monitoring systems are the most advanced detectors and analyzers in electrical equipment. These advanced solutions are integrated with smart technologies, which uplift their overall production costs. Many small-scale companies or end users with budgetary constraints often find it difficult to invest in advanced partial discharge monitoring systems, leading to limited sales growth. However, many market players are focused on R&D activities to reduce the cost of these advanced technologies, which is estimated to directly increase partial discharge monitoring system sales growth, globally.

- Retrofitting infrastructure a challenging process: The integration of partial discharge monitoring systems with existing infrastructure is a very complex process. The lack of advanced infrastructure and resistance to change/upgrade make the retrofitting process more challenging. The retrofitting of older technologies with these advanced partial discharge monitoring systems requires major downtime and CAPEX. Thus, to avoid hefty investments in upgradation, many small-scale companies prefer using the old technologies, limiting the overall partial discharge monitoring systems market growth to some extent.

Partial Discharge Monitoring Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.2% |

|

Base Year Market Size (2025) |

USD 562.46 million |

|

Forecast Year Market Size (2035) |

USD 933.79 million |

|

Regional Scope |

|

Partial Discharge Monitoring Systems Market Segmentation:

Type (Permanent Monitoring Systems, Temporary Monitoring Systems)

Permanent monitoring systems segment is expected to capture partial discharge monitoring systems market share of over 68.1% by 2035. Key properties, such as continuous monitoring, early detection, predictive maintenance, and cost-effectiveness, are majorly boosting the sales of permanent PD monitoring systems. The aging power infrastructure is also driving a high demand for advanced permanent monitoring solutions to prevent electrical failures. The government’s move towards improving grid stability is also expected to augment the sales of permanent monitoring systems in the coming years. Furthermore, the integration of smart technologies such as advanced sensors, data analytics, and artificial intelligence is foreseen to increase the efficiency and sales of permanent monitoring systems.

Application (Gas-Insulated Switchgears (GIS), Transformers, Power Cables, Others)

In partial discharge monitoring systems market, gas-insulated switchgears (GIS) segment is set to dominate revenue share of over 39.5% by 2035. The growth in urban activities leading to power infrastructure expansion is increasing the demand for advanced gas-insulated switchgears. GIS is emerging as a space-saving design with high reliability. The countries' increasing investments in modern power grids are set to fuel the sales of advanced and compact gas-insulated switchgears. The increasing popularity of smart grid technologies and hybrid systems is also creating a lucrative space for gas-insulated switchgear manufacturers to earn more.

Our in-depth analysis of the global partial discharge monitoring systems market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Partial Discharge Monitoring Systems Market Regional Analysis:

North America Market Forecast

North America partial discharge monitoring systems market is expected to dominate revenue share of over 36.5% by 2035. The well-established power infrastructure and early adoption of reliable technologies are likely to augment the sales of partial discharge monitoring systems in the years ahead. High investments in clean energy projects and electric vehicle (EV) battery charging infrastructure development are also set to fuel the trade of partial discharge monitoring technologies. The smart home trend in both the U.S. and Canada is expected to amplify the sales of partial discharge monitoring solutions.

The increasing innovations in electric vehicles and their charging infrastructure are likely to boost the demand for partial discharge monitoring solutions in the U.S. The IEA report states that around 1.4 million electric cars were registered in the U.S. in 2023. The revised qualifications for zero-emission vehicles and tax benefits are fueling the adoption of EVs. This growth signifies the need for advanced charging infrastructure in the country, which directly contributes to the increasing installations of partial discharge monitoring systems.

The robust advancements in clean energy expansion are projected to increase the sales of partial discharge monitoring systems in Canada. The Canadian Renewable Energy Association states that around 24 GW of wind, solar, and energy storage installed capacity was recorded in the country in 2024. The same source also states that in the last 5 years (2019-2024), the solar energy capacity of the country increased by 92.0%, wind (35.0%), and energy storage (192.0%). This robust green power infrastructure is poised to propel the sales of partial discharge monitoring systems in the coming years.

Asia Pacific Market Statistics

The Asia Pacific partial discharge monitoring systems market is projected to expand at the fastest CAGR from 20205 to 2035. The swift growth in industrialization and urbanization is offering attractive opportunities for partial discharge monitoring technology producers. The countries' increasing investment in power grid expansion and modernization is propelling the adoption of advanced partial discharge monitoring technologies. The increasing expansion of industrial companies in China, Japan, India, and South Korea is fueling the production and commercialization of partial discharge monitoring systems.

China’s advancement in electrical component production is expected to drive its position in the Asia Pacific partial discharge monitoring systems market. The strong presence of industry giants and high-tech companies is contributing to the development of innovative partial discharge monitoring systems. The manufacturing intensity of partial discharge monitoring systems market is anticipated to be around 13.6% during the same period. Thus, the innovation and power transformation trend is set to fuel the sales of PD monitoring systems in the years ahead.

The increasing investments in green energy projects are creating a profitable environment for partial discharge monitoring system manufacturers in India. The positive government policies and initiatives, and foreign direct investments, are likely to boost the expansion of power infrastructure in the country. The India Brand Equity Foundation (IBEF) states that the country is focused on investing around USD 107.9 billion in the power transmission infrastructure by 2032. This move is set to expand the capacity of the country and aid in meeting increasing electricity demand. The country’s renewables account for 44.7% of the total power installed capacity, and this is expected to rise in the coming years.

Key Partial Discharge Monitoring Systems Market Players:

- Schneider Electric SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- OMICRON Electronics GmbH

- Qualitrol

- Eaton Corporation

- Megger Group Limited

- HVPD Ltd.

- LS Cable & System

- Prysmian Group

- Doble Engineering Company

- Meggitt Sensing Systems

- EA Technology

- APM Technologies

- IPEC Limited

- Dynamic Ratings

- Altanova Group

- Dimrus

- PowerPD Inc.

- Innovit Electric

- Rugged Monitoring

The partial discharge monitoring systems market are employing several organic and inorganic marketing strategies to earn high revenues. The organic tactics are poised to offer lucrative gains to the market players during the foreseeable period. The industry giants are investing in research and development activities to develop innovative partial discharge monitoring systems. They are also collaborating with high-tech companies and partnering with other players to uplift the product folio and market reach. To earn higher gains, the companies are also entering into untapped markets.

Some of the key players includes in partial discharge monitoring systems market:

Recent Developments

- In November 2024, Schneider Electric SE revealed the launch of its partial discharge monitoring solution, PowerLogic PD100. This product is designed for medium voltage (MV) switchgear for early detection of anomalies to prevent unplanned downtime.

- In March 2024, OMICRON Electronics GmbH announced the launch of PARADIMO 100, a partial discharge monitoring solution for gas-insulated switchgear and gas-insulated lines. This smart edge computing device automatically detects and classifies the type of insulation defect.

- Report ID: 7529

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Partial Discharge Monitoring Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.