Transformer Monitoring Market Outlook:

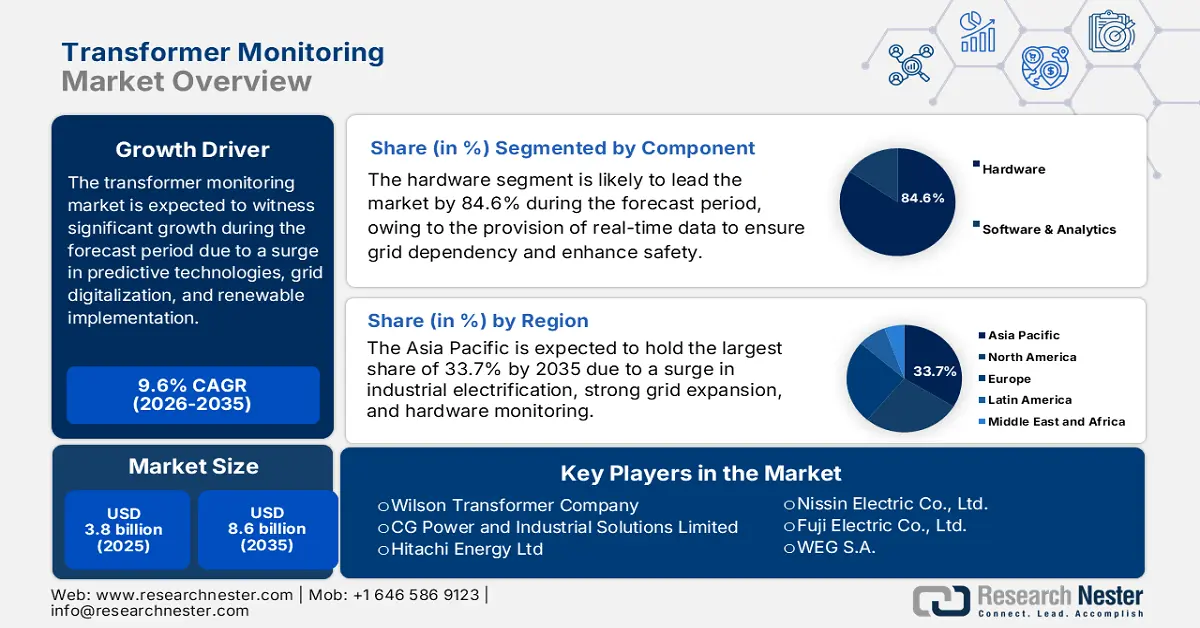

Transformer Monitoring Market size was over USD 3.8 billion in 2025 and is estimated to reach USD 8.6 billion by the end of 2035, expanding at a CAGR of 9.6% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of transformer monitoring is estimated at USD 4.1 billion.

The international transformer monitoring market is continuously expanding, driven by predictive maintenance technologies, renewable integration, and grid modernization, along with hardware solutions and retrofit installations. According to official statistics published by the IEA Organization in September 2022, the aspect of retrofitting 20% of existing building stock to a zero-carbon-based level by the end of 2030 is considered an ambitious, but required milestone toward the Net Zero Emissions by 2050 Scenario. Therefore, to achieve this objective, a yearly in-depth renovation rate of more than 2% is in demand from the current scenario till 2030 and beyond. Besides, as per the September 2024 Energy Efficient Organization article, building operations account for 30% of finalized energy consumption, along with 26% of emissions globally, thus making it suitable for boosting the market’s growth.

Furthermore, digitalization, retrofit dominance, machine learning, increased focus on cybersecurity, green energy, sustainability, and regulatory mandates are other factors driving the market demand globally. According to an article published by the NIELIT Government in May 2022, there has been an increase in Internet of Things (IoT)-based connected devices, accounting for 12.5 billion, readily surpassing 7 billion human beings. Additionally, it is expected to increase by 26 billion and 50 billion across different nations in the upcoming years. Besides, MeitY has significantly approved Rs 436.87 Crore for implementing the FutureSkill PRIME project. This aims to create an ecosystem, particularly a reskilling/upskilling ecosystem in 10 emerging and futuristic technologies, including IoT. Therefore, such devices are suitable for monitoring transformer health in real time, thereby denoting a positive outlook for the market’s exposure.

Key Transformer Monitoring Market Insights Summary:

Regional Highlights:

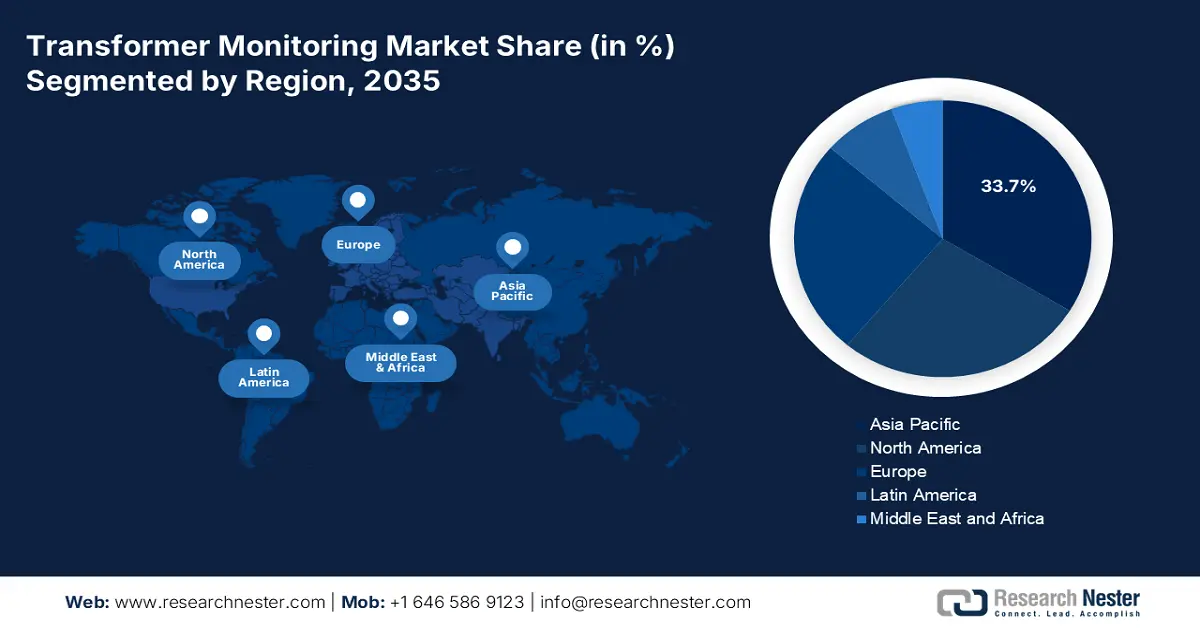

- Asia Pacific is projected to secure a leading 33.7% share by 2035 in the transformer monitoring market, supported by accelerated grid expansion, large-scale electrification, renewable energy integration, and widespread deployment of hardware-based monitoring solutions.

- Europe is expected to emerge as the fastest-growing region during the forecast period by 2035, propelled by stringent decarbonization targets, aging transmission assets, and rapid grid digitalization initiatives.

Segment Insights:

- The hardware sub-segment is anticipated to dominate with an 84.6% share by 2035 in the transformer monitoring market, anchored in its critical role in real-time data acquisition that strengthens predictive maintenance, grid reliability, and operational safety.

- The retrofit installation segment is forecast to capture the second-largest share by 2035, driven by aging transformer fleets and utility preference for cost-effective upgrades that extend asset life and improve condition visibility.

Key Growth Trends:

- Rise in electricity demand

- Focus on renewable integration

Major Challenges:

- Increased upfront expenses and ROI concerns

- Cybersecurity risks in IoT-based monitoring

Key Players: ABB Ltd (Switzerland), Siemens Energy AG (Germany), General Electric Company (U.S.), Schneider Electric SE (France), Eaton Corporation plc (Ireland), Mitsubishi Electric Corporation (Japan), Toshiba Energy Systems & Solutions Corporation (Japan), Hyundai Electric & Energy Systems Co., Ltd. (South Korea), Larsen & Toubro Limited (India), Bharat Heavy Electricals Limited (India), Wilson Transformer Company (Australia), CG Power and Industrial Solutions Limited (India), Hitachi Energy Ltd (Switzerland), Hyosung Heavy Industries Corporation (South Korea), Nissin Electric Co., Ltd. (Japan), Fuji Electric Co., Ltd. (Japan), WEG S.A. (Brazil), SGB-SMIT Group (Germany), TNB Research Sdn Bhd (Malaysia), SPX Transformer Solutions, Inc. (U.S.)

Global Transformer Monitoring Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.8 billion

- 2026 Market Size: USD 4.1 billion

- Projected Market Size: USD 8.6 billion by 2035

- Growth Forecasts: 9.6%

Key Regional Dynamics:

- Largest Region: Asia Pacific (33.7% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, France

- Emerging Countries: India, Spain, Canada, South Korea, Italy

Last updated on : 14 January, 2026

Transformer Monitoring Market - Growth Drivers and Challenges

Growth Drivers

- Rise in electricity demand: The international electricity consumption is projected to increase, necessitating suitable grid facilities, which is positively impacting the market’s growth. According to official statistics published by the IEA Organization in 2025, there has been an increase in the international electricity demand by 4.3% as of 2024, denoting a 2.5% growth from 2023. Besides, the average electricity pace was 2.7% as of 2023, thereby doubling the rate of the overall energy demand growth within the same timeline. Moreover, internationally, the electricity consumption has readily increased by 1,080 TWh, which is almost twice the yearly average. The electricity consumption in China has increased by over 550 TWh, thereby bolstering the market’s development.

Modification in the Total Electricity Consumption Globally (2012-2024)

|

Year |

Electricity Capacity (TWh) |

|

2012-2022 |

562.5 |

|

2023 |

629.4 |

|

2024 |

1,080.1 |

Source: IEA Organization

- Focus on renewable integration: Countries such as Germany, India, and China are increasingly extending renewable capacity, thereby increasing stress on transformers and skyrocketing the transformer monitoring market demand internationally. As stated in an article published by the IEA Organization in 2026, the worldwide renewable energy capacity is projected to be more than double by the end of 2030, denoting an upsurge by 4,600 GW. In this regard, solar PV caters to nearly 80% of the increase, which is followed by geothermal, bioenergy, hydropower, and wind. Besides, in over 80% of nations globally, the renewable power capacity is expected to grow rapidly by 2030, in comparison to the previous 5-year timeline, thus making it suitable for boosting the overall market.

Renewable Electricity Capacity Growth by Technology Industry (2013-2030)

|

Source Type |

2013-2018 |

2019-2024 |

2025-2030 |

|

Solar PV (GW) |

438 |

1,622 |

3,546 |

|

Wind (GW) |

298 |

566 |

873 |

|

Hydropower (GW) |

205 |

138 |

154 |

|

Other (GW) |

52 |

48 |

32 |

Source: IEA Organization

- Surge in government investments: The presence of governmental programs, such as the Asia Pacific smart grid strategies, the U.S. DOE efficiency standards, and Europe Green Deal, is readily channeling into grid modernization. Based on government data put forth by the Government of Canada in November 2025, the Greening Government Fund in Canada has readily approved an estimated USD 60 million in funding for projects in January 2025, with the intention of diminishing greenhouse gas emissions in government-based operations. Besides, as per the 2025 U.S. DOE article, Smart Grid Grants in the U.S. are expected to invest almost USD 3 billion, which is USD 600 million per year by the end of 2026 for grid resilience solutions and technology, thereby denoting a huge growth opportunity for the market globally.

Challenges

- Increased upfront expenses and ROI concerns: One of the most significant barriers to the transformer monitoring market is the high initial investment required for hardware, installation, and integration with existing grid infrastructure. Advanced monitoring devices such as dissolved gas analysis (DGA) sensors, bushing monitors, and partial discharge systems are expensive, and utilities often struggle to justify the cost against short-term budgets. While predictive maintenance can save millions in avoided outages, many utilities, particularly in developing economies, operate under constrained capital expenditure plans. This creates hesitation in deploying monitoring systems at scale. Additionally, the return on investment (ROI) is often realized over several years, making it less attractive for organizations focused on immediate cost savings.

- Cybersecurity risks in IoT-based monitoring: As transformer monitoring systems increasingly depend on IoT sensors, cloud platforms, and AI-driven analytics, cybersecurity emerges as a critical challenge. These systems collect sensitive operational data and transmit it across networks, making them vulnerable to cyberattacks. A breach could compromise grid reliability, disrupt industrial operations, or expose confidential utility data. Governments and regulators are raising concerns about the resilience of digital infrastructure, particularly in critical sectors like energy. Utilities must invest heavily in secure communication protocols, encryption, and compliance with standards such as NIST cybersecurity frameworks. However, implementing robust cybersecurity measures adds cost and complexity, discouraging smaller players from adoption, thus negatively impacting the market growth.

Transformer Monitoring Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.6% |

|

Base Year Market Size (2025) |

USD 3.8 billion |

|

Forecast Year Market Size (2035) |

USD 8.6 billion |

|

Regional Scope |

|

Transformer Monitoring Market Segmentation:

Component Segment Analysis

The hardware sub-segment, which is part of the component segment, is expected to hold the largest share of 84.6% in the transformer monitoring market by the end of 2035. The sub-segment’s upliftment is attributed to the foundational element offering the crucial capability for real-time data acquisition that tends to enable predictive maintenance, ensure grid reliability, and enhance safety. According to an article published by the DOE in December 2024, the National Renewable Energy Laboratory (NREL) has estimated that there exist 60 million to 80 million distribution transformers, along with a capacity ranging between 2.5 TVA and 3.5 TVA, which is more than 2.5 billion kilowatts to 3.5 billion kilowatts. Additionally, this caters to an estimated 55% of in-service units that are more than 33 years old, thereby denoting the sub-segments' demand to be adopted increasingly.

Installation Type Segment Analysis

By the end of the forecast period, the retrofit segment, part of the installation type, is predicted to hold the second-largest share in the market. The segment’s growth is highly driven by the aging fleet of transformers across North America, Europe, and the Asia Pacific, where many units have been in service for years. Instead of replacing costly infrastructure, utilities and industries prefer to retrofit existing transformers with monitoring systems such as dissolved gas analysis (DGA), bushing monitoring, and partial discharge sensors. Retrofit solutions are cost-effective, extend asset life, and provide immediate visibility into transformer health without disrupting operations. Governments and regulators also encourage retrofitting as part of grid modernization programs, emphasizing resilience and sustainability.

End user Segment Analysis

Based on the end user, the utilities segment in the transformer monitoring market is projected to garner the third-largest share during the stipulated duration. The segment’s development is propelled by its dependence on transformers for transmission and distribution, making monitoring critical to ensure grid reliability, reduce outages, and optimize maintenance. Utilities face increasing challenges from aging infrastructure, renewable integration, and rising electricity demand, all of which heighten the need for real-time monitoring. Advanced solutions such as IoT-enabled sensors, AI-driven analytics, and digital twin technologies allow utilities to detect anomalies early, prevent catastrophic failures, and extend transformer life. Regulatory mandates further accelerate adoption; for instance, the Europe Commission’s energy efficiency directives and the U.S. DOE’s transformer standards require utilities to improve performance and resilience.

Our in-depth analysis of the transformer monitoring market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Installation Type |

|

|

End user |

|

|

Application |

|

|

Voltage Class |

|

|

Monitoring Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Transformer Monitoring Market - Regional Analysis

APAC Market Insights

Asia Pacific transformer monitoring market is anticipated to garner the highest share of 33.7% by the end of 2035. The market’s upliftment in the region is primarily attributed to hardware-based monitoring, renewable integration, industrial electrification, and robust grid expansion. As per official statistics published by the IEA Organization in 2026, the total electricity production in the region accounts for 15,489,513 GWh, along with an increase in the trends by 266%, and significantly catering to 51% of the international share as of 2023. Besides, the share of power in emissions accounts for 55% of the overall energy-based carbon dioxide emissions within the same year. Furthermore, there has been an increase in the per-capita electricity consumption by 2%, leading to 3.5 MWh per capita and more than 192% trends as of 2023. Moreover, there are other sources of electrification in the region, which are also bolstering the market.

Electricity Generation Sources in the Asia Pacific (2023)

|

Source Type |

Capacity (GWh) |

|

Coal |

8,771,340.0 |

|

Oil |

129,532.0 |

|

Natural Gas |

1,493,420.0 |

|

Nuclear |

791,177.0 |

|

Hydropower |

1,868,812.0 |

|

Biofuels |

343,408.0 |

|

Waste |

42,267.0 |

|

Wind |

1,056,485.0 |

|

Solar PV |

930,435.0 |

|

Geothermal |

930,435.0 |

|

Other Sources |

20,493.0 |

Source: IEA Organization

The transformer monitoring market in China is growing significantly due to leadership in chemicals, a strong industrial base, and the presence of massive utility networks. As per the April 2024 ITIF Organization article, the country accounted for 44% of international chemical production, along with 46% of capital investment. Besides, the country has an estimated 300,000 chemicals, of which nearly 2,000 chemicals are developed every year, denoting an almost 6% rate. This denotes a slow-advancement industry, which is suitable for the country to expand. According to the February 2023 State Council Government article, there has been a rise in investment by 19% year-on-year (YoY) for product manufacturing and chemical raw materials, denoting 7.4% points higher than other industries, thereby denoting an optimistic outlook for the overall market in the country.

The market in India is also growing, owing to policy-backed modernization, industrial electrification, and an increase in grid expansion. According to government estimates put forth by the India Investment Grid Government article published in October 2025, the country has successfully emerged as one of the international leaders, comprising one of the highest synchronized interconnected electricity grids and readily spanning 4,63,758 km of transmission lines, along with 11,56,105 MVA of transformation capacity in January 2023. In addition, the domestic electricity grid is continuously rising with an outstanding 6.5% yearly growth in transmission lines. Besides, there has been an upsurge in the inter-regional transmission capacity from 35,950 MW to 1,12,250 MW as of February 2022, thereby deliberately aligning the accelerated electricity demand and generation.

Top Transmission Lines Across States in India (2025)

|

States |

Number of Transmission Lines |

|

Rajasthan |

79 |

|

Gujarat |

36 |

|

Karnataka |

23 |

|

Uttar Pradesh |

21 |

|

Maharashtra |

15 |

|

Haryana |

14 |

Source: India Investment Grid Government

Europe Market Insights

Europe market is expected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is highly propelled by decarbonization mandates, aging asset fleets, grid digitalization, along with industries and utilities deploying hardware-based monitoring. According to official statistics published by the EU Electric Organization in May 2023, the region originally committed to reducing nearly 40% of carbon dioxide emissions by the end of 2030, and has further set the objective of 80% to 95% reduction by the end of 2050. However, the newest targets are aimed at diminishing the region’s net greenhouse gas emissions by nearly 55% by the end of 2030, and also to gain climate neutrality by 2050. Moreover, to overcome the dependency on Russia, the regional commission has deliberately enhanced the decarbonization ambition by adding 41 GW of wind power, along with 62 GW of solar photovoltaic.

The transformer monitoring market in Germany is gaining increased traction due to a strong decarbonization agenda, expanded distribution and transmission networks, and a massive industrial base. As per official statistics published by Clean Energy Wire Organization in January 2026, the country’s grid agency has significantly issued permits for constructing nearly 2,000 kilometers of high-voltage transmission lines. In addition, permits were effectively increased by 45% as of 2025, in comparison with 1,280 kilometers in 2024. Besides, the country has recently made plans to expand its transmission grid by an overall 16,800 kilometers, of which almost 3,500 kilometers have been developed in June 2025. Moreover, the country’s present transmission grid measures almost 39,000 kilometers, and meanwhile, the distribution grid comprises voltage levels, with an overall length of almost 1.8 million kilometers.

The transformer monitoring market in Spain is also developing, owing to industrial efficiency initiatives, grid digitalization, acceleration in renewable integration, and a surge in solar and wind capacity. As per official statistics published by the Renewable Institute Organization in 2026, the country’s renewables account for 55.5% of the domestic electricity generation, further rising to approximately 56.6%. In addition, the overall renewable output has reached 150.8 TWh, and in December 2025, more 11.3 TWh has been generated, thus denoting a 5.2% rise from 2024. Moreover, this represents 48.9% of the overall electricity production, and meanwhile, low-carbon technologies altogether account for almost 70% of power production, thereby suitable for reinforcing the country as part of the overall region’s clean energy systems.

North America Market Insights

North America transformer monitoring market is predicted to witness considerable growth by the end of the stipulated timeline. The market’s growth in the region is highly fueled by an increase in grid modernization, aging asset fleets, reliability mandates, and policy momentum, including finalized energy standards for transformer distributions. According to the 2026 Belfer Center Organization article, the Biden administration has successfully established the national objective of achieving 100% carbon-free electricity by the end of 2035, along with reaching net-zero and economic-based greenhouse gas emissions by the end of 2050. Besides, the electric grid in the U.S. comprises 600,000 transmission lines that are connected to more than 1 million megawatts of electricity generation capacity. Additionally, more than 70% of these lines are 25 years old, almost into their estimated 50-year lifetime, thereby denoting a huge demand for the market in the region.

The transformer monitoring market in the U.S. is gaining increased exposure due to administrative efficiency standards, cybersecurity and resilience mandates, industrial demand, particularly for manufacturing and chemicals, and the aspect of federal funding. Based on government data published by the EIA Government in December 2023, the overall electricity consumption in the country was almost 4.0 trillion kWh as of 2022, which is the highest amount recorded, and is 14 times greater than the electricity utilization decades ago. In addition, the overall direct electricity utilization by commercial and industrial industries was nearly 3.5% of the total electricity end use consumption in the same year. Besides, the retail electricity sales to the residential industry were 2.6% higher, and to the commercial sector were almost 4.7% higher, thereby making it suitable for boosting the market’s exposure.

The transformer monitoring market in Canada is also growing, driven by renewable energy integration, smart grid investments, reliability in harsh climates, government spending on clean energy, and the presence of safety and sustainability programs. According to the January 2025 Government of Canada article, by the end of 2030, 90% of the country's electricity is projected to be generated from non-emitting and renewable sources in the long term, and 100% of the country’s electricity is projected to be generated from non-emitting and renewable sources by 2030. Besides, as per the September 2025 Government of Canada article, the Minister of Artificial Intelligence and Digital Innovation and the Minister responsible for the Federal Economic Development Agency for Southern Ontario declared an investment of USD 6 million for Northern Transformer Corporation for unveiling the latest state-of-the-art Large Power Transformer (LPT) facility in Ontario.

Key Transformer Monitoring Market Players:

- ABB Ltd (Switzerland)

- Siemens Energy AG (Germany)

- General Electric Company (U.S.)

- Schneider Electric SE (France)

- Eaton Corporation plc (Ireland)

- Mitsubishi Electric Corporation (Japan)

- Toshiba Energy Systems & Solutions Corporation (Japan)

- Hyundai Electric & Energy Systems Co., Ltd. (South Korea)

- Larsen & Toubro Limited (India)

- Bharat Heavy Electricals Limited (India)

- Wilson Transformer Company (Australia)

- CG Power and Industrial Solutions Limited (India)

- Hitachi Energy Ltd (Switzerland)

- Hyosung Heavy Industries Corporation (South Korea)

- Nissin Electric Co., Ltd. (Japan)

- Fuji Electric Co., Ltd. (Japan)

- WEG S.A. (Brazil)

- SGB-SMIT Group (Germany)

- TNB Research Sdn Bhd (Malaysia)

- SPX Transformer Solutions, Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- ABB Ltd is one of the leading players in transformer monitoring, offering advanced digital solutions integrated with IoT and AI analytics. The company’s focus on smart grids and predictive maintenance has positioned it strongly in Europe and Asia, where modernization of transmission networks is accelerating.

- Siemens Energy AG emphasizes condition monitoring and digital twin technologies for transformers, enabling utilities to optimize asset performance. Its strong presence in Europe and partnerships with renewable energy projects drive demand for monitoring systems, particularly in high-voltage applications.

- General Electric Company provides comprehensive transformer monitoring solutions, including dissolved gas analysis (DGA) and bushing monitoring systems. With a strong footprint in North America, GE leverages its expertise in grid resilience and industrial electrification to support utilities and chemical industries.

- Schneider Electric SE integrates transformer monitoring into its broader energy management and automation portfolio. Its solutions focus on sustainability and efficiency, aligning with Europe-based Green Deal initiatives and supporting industrial customers in reducing downtime and energy losses.

- Eaton Corporation plc delivers monitoring systems tailored for distribution transformers, with emphasis on safety, reliability, and retrofit solutions. Its market strength lies in North America and Europe, where utilities adopt Eaton’s monitoring technologies to comply with regulatory standards and extend asset life.

Here is a list of key players operating in the global market:

The international market is highly competitive, with leading players focusing on digitalization, predictive analytics, and sustainability to strengthen their positions. Companies such as ABB, Siemens, and GE leverage AI-driven monitoring systems to enhance grid reliability, while Asia manufacturers, such as Mitsubishi and Hyundai, emphasize cost-effective solutions for emerging markets. India-based firms, including L&T and BHEL, are expanding through government-backed infrastructure projects, and Australia and Malaysia players contribute niche expertise. Besides, in October 2025, KEC International Ltd. received the latest order of 1,064 crore for designing, supplying, and installing 380 kV transmission lines in Saudi Arabia. Therefore, with such huge developments, there is a huge growth opportunity for the transformer monitoring industry globally.

Corporate Landscape of the Market:

Recent Developments

- In January 2026, Iberdrola successfully accomplished the energization of the finalized section of the Alto Paranaíba Project, thereby deliberately marking the effective delivery of the largest electricity transmission strategies in Brazil.

- In August 2025, Hitachi Energy India Ltd. declared a generous investment of INR 300 crores for its components and insulation business in India by extending its manufacturing infrastructure in Karnataka.

- In June 2025, Larsen & Toubro received new grid facility orders in India and internationally to significantly develop 400 kV and 765 kV transmission line opportunities, deliberately pertaining to integrating a renewable energy zone in Andhra Pradesh.

- Report ID: 8345

- Published Date: Jan 14, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Transformer Monitoring Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.