Mobility as a Service Market Outlook:

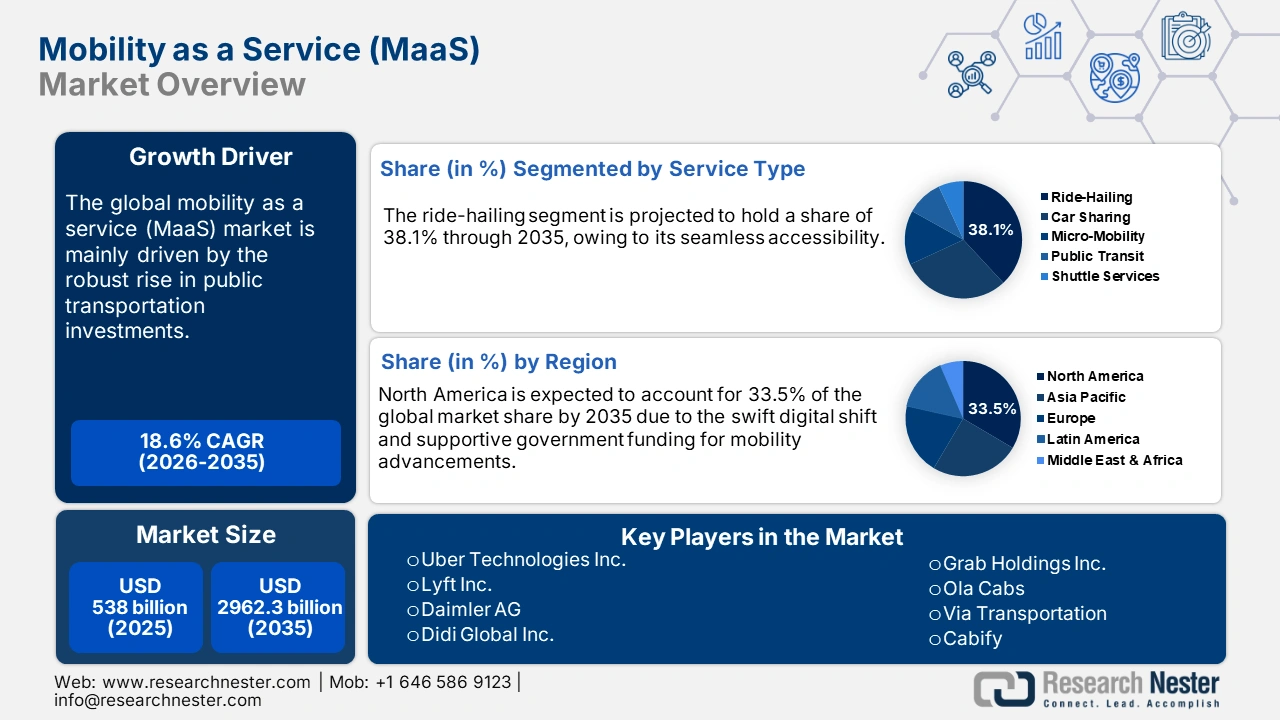

Mobility as a Service Market size was USD 538 billion in 2025 and is estimated to reach USD 2962.3 billion by the end of 2035, expanding at a CAGR of 18.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of mobility as a service is assessed at USD 638 billion.

The global mobility as a service (MaaS) sales are driven by a complex, interdependent supply chain that integrates transport infrastructure, ICT system integrators, and energy & vehicle OEMs. As per the analysis by the U.S. Department of Transportation (DOT), federal infrastructure investments through the Bipartisan Infrastructure Law are providing more than USD 108 billion for public transportation modernization. Such investments are poised to increase the deployment of MaaS solutions. The growing sales of assembly lines for MaaS hardware components, including electric vehicle fleets and micro-mobility devices, are also influencing the overall market growth. The report by the United States International Trade Commission (USITC) highlights that the imports of transportation equipment stood at USD 594.9 billion in 2024. The increasing demand for AI-driven transportation analytics and autonomous systems is anticipated to fuel a high demand for advanced MaaS solutions.

Key Mobility as a Service (MaaS) Market Insights Summary:

Regional Highlights:

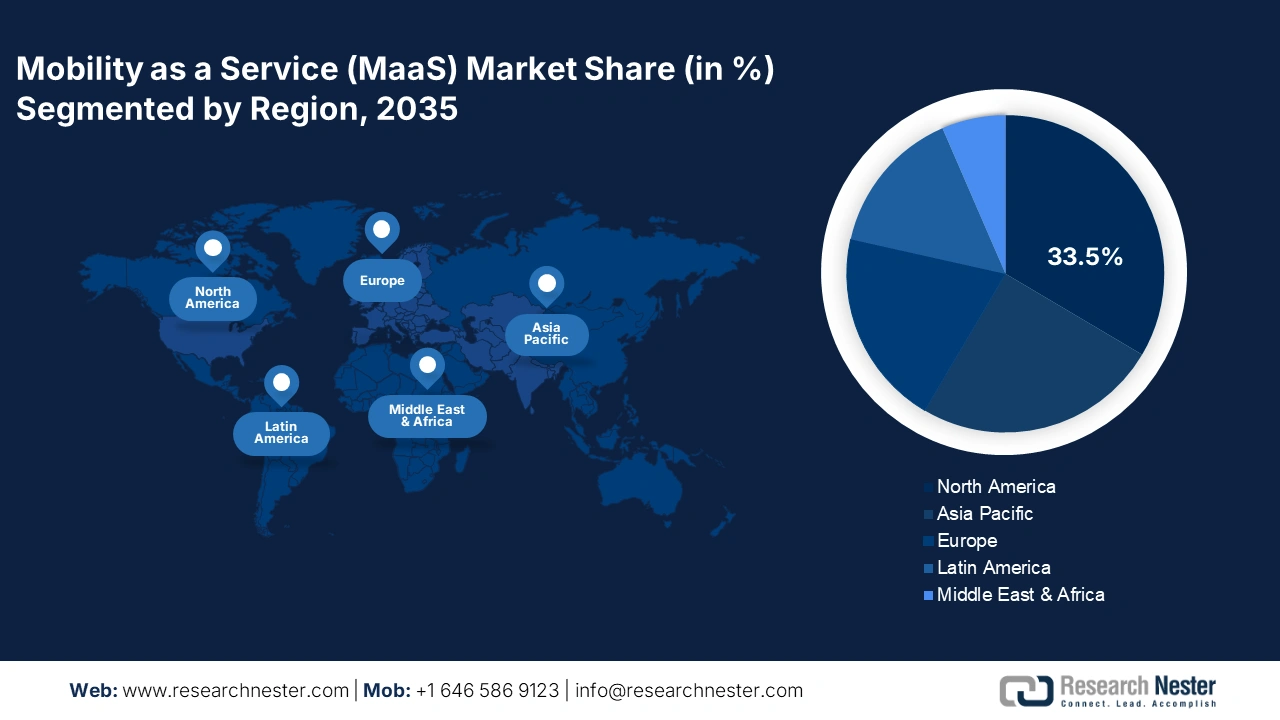

- By 2035, the North America Mobility as a Service (MaaS) Market is anticipated to secure a 33.5% revenue share, attributed to increasing investments in connected mobility.

- The Asia Pacific market is expected to expand at a 19.7% CAGR during 2026–2035, supported by rising demand for autonomous vehicles.

Segment Insights:

- By 2035, the ride-hailing segment in the Mobility as a Service (MaaS) Market is projected to capture a 38.1% share, propelled by strong demand for flexible urban transportation solutions.

- The personal mobility segment is poised to hold a 41.5% share through 2035, owing to increasing environmental consciousness.

Key Growth Trends:

- Growing demand for autonomous vehicles

- Advancements in digital connectivity networks

Major Challenges:

- Inconsistent regulatory outlines

- Lack of modern infrastructure

Key Players: Uber Technologies Inc., Lyft Inc., Daimler AG (Moovel Group), Didi Global Inc., Grab Holdings Inc., Ola Cabs, Via Transportation, Cabify, Transdev Group, Gett Inc., GoCatch, Kakao Mobility, Careem (Uber subsidiary), Easy Taxi, MyTaxi (now Free Now), Myanma Mobility, Toyota Connected Co., Ltd., Japan Taxi, DeNA Co., Ltd., ZMP Inc., SoftBank Corp.

Global Mobility as a Service (MaaS) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 538 billion

- 2026 Market Size: USD 638 billion

- Projected Market Size: USD 2962.3 billion by 2035

- Growth Forecasts: 18.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (33.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Singapore, Brazil, United Arab Emirates

Last updated on : 3 October, 2025

Mobility as a Service Market - Growth Drivers and Challenges

Growth Drivers

- Growing demand for autonomous vehicles: The rising demand for autonomous vehicles is expected to boost the adoption of MaaS solutions during the study period. MaaS platforms, including Waymo, are likely to integrate AVs for on-demand services. The digitalization and automation trends are driving the adoption of autonomous vehicles and, subsequently, mobility as a service solution application in developing countries. The ongoing technological developments through public and private investments are estimated to boost the production of MaaS-powered automation vehicles in developing markets.

- Advancements in digital connectivity networks: The robust demand for advanced connectivity networks, such as 4G and 5G, and IoT technologies, is augmenting the demand for real-time route planning and tracing MaaS solutions. According to the analysis by 5G Americas in 2024, the global wireless industry hit a major milestone, with 2.25 billion 5G connections worldwide. The growth in 5G innovation and expansion is poised to drive the trade of MaaS solutions in the years ahead.

- Technological innovations: The ongoing technological advancements are set to offer double-digit percent revenue growth opportunities for MaaS companies during the forecast period. The modernization of transportation systems and technologies is expected to fuel the sales of innovative mobility as a service solutions. In August 2025, Hyundai Motor Group started the Next Urban Mobility Alliance (NUMA), a partnership between public and private groups to improve city transportation using advanced mobility technologies. The incorporation of AI and ML is poised to propel the productivity and effectiveness of MaaS platforms. The increasing number of tech-savvy end users is also anticipated to augment the sales of AI and ML-powered MaaS systems in the coming years.

Challenges

- Inconsistent regulatory outlines: The uneven regulations across the different jurisdictions are estimated to limit the sales of MaaS solutions in the coming years. The regulatory fragmentation delays manufacturers' ability to introduce innovative mobility as a service solution worldwide. This highlights that the uneven regulations are challenging the sales of MaaS companies.

- Lack of modern infrastructure: Mobility as a service depends on robust digital and physical infrastructure, such as 5G networks and EV charging stations. Scant infrastructure, particularly in price-sensitive markets, delays the launch of the latest technologies. This directly hampers the revenue growth of leading manufacturers. To overcome such challenges, there is a need for infrastructure investments, both public and private.

Mobility as a Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

18.6% |

|

Base Year Market Size (2025) |

USD 538 billion |

|

Forecast Year Market Size (2035) |

USD 2962.3 billion |

|

Regional Scope |

|

Mobility as a Service Market Segmentation:

Service Type Segment Analysis

The ride-hailing segment is projected to capture 38.1% of the mobility as a service (MaaS) market share through 2035. Ride-hailing is emerging as the most sought-after service model for businesses. The prime factors boosting its sales are seamless accessibility, reduced operational costs, and strong demand for flexible urban transportation solutions. As per the analysis by the U.S. Department of Transportation (USDOT), initiatives such as Integrated Mobility Innovation (IMI) grants and Mobility on Demand (MOD) sandbox programs are contributing to the increasing adoption of app-based ride-hailing solutions. These efforts empowered pilot programs across the majority of cities and offered services such as on-demand shuttles, microtransit, and shared taxi operations. Such government-supported programs are expected to empower organizations to enhance mobility offerings efficiently in the coming years.

Application Segment Analysis

The personal mobility segment is poised to hold 41.5% of the mobility as a service (MaaS) market share during the assessed period. The rapid urbanization, a growing demand for flexible commuting solutions, and increasing environmental consciousness are backing the application of MaaS for personal mobility. The European Environment Agency (EEA) states that the majority of EU citizens chose low-emission personal mobility options, including e-bikes, scooters, or app-based ride-sharing services. Personal mobility trend is expected to offer significant opportunities for businesses to meet evolving consumer needs during the foreseeable period.

Business Model Segment Analysis

The B2C segment is estimated to capture the largest market share throughout the projected timeframe. This model leads as it directly targets the most immediate customer base, that are individual commuters. The cost-effectiveness and increasing number of advanced public transit systems are also contributing to the segmental growth. In December 2024, the U.S. Department of Transportation gave USD 54 million in grants for 34 projects across 21 states as part of the final round of SMART Stage 1 Grants. The robust rise in smart cities projects across the world is further accelerating investments in B2C models.

Our in-depth analysis of the mobility as a service market includes the following segments:

|

Segment |

Subsegment |

|

Service Type |

|

|

Application |

|

|

Business Model |

|

|

Transportation Type |

|

|

Enterprise Size |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Mobility as a Service Market - Regional Analysis

North America Market Insights

The North America mobility as a service (MaaS) market is anticipated to hold 33.5% of the global revenue share by 2035. The prime factors fueling mobility as a service solution sales are the rise in digital transportation policies and increasing investments in connected mobility. Supportive government policies and spending are also expected to increase the production and commercialization of MaaS solutions in the years ahead. The growth in 5G infrastructure is further set to drive seamless connectivity in MaaS solutions.

The U.S. is expected to witness a swift rise in the sales of MaaS solutions during the foreseeable period. The government-led initiatives and advancements in digital infrastructure are contributing to the increasing MaaS demand. Government support for 5G network expansion and smart city projects is generating profitable opportunities for MaaS producers. The Federal Communications Commission (FCC) allocation of nearly USD 9.0 billion to the 5G Fund for Rural America has also accelerated the deployment of vehicle-to-everything (V2X) communication and expanded the reach of connected mobility solutions. These initiatives are anticipated to uplift the position of the U.S. in the global market.

The MaaS solution sales in Canada are set to increase at a high pace in the coming years due to the favorable public plans and robust advancements in the wireless connectivity networks. The smart city projects are fueling innovation in urban mobility and further accelerating the demand for integrated transportation solutions. The rise in government spending on smart mobility is expected to create a profitable environment for MaaS producers.

APAC Market Insights

The Asia Pacific market is projected to increase at a 19.7% CAGR between 2026 and 2035. The increasing demand for autonomous vehicles is opening fruitful doors for the MaaS manufacturers. Growing investments in smart transportation are likely to increase the adoption of MaaS solutions in the coming years. China and India are projected to emerge as win-win markets, owing to the strong presence of end users. Further, the know-how tactics are anticipated to drive innovations in the Japan and South Korea markets.

Sales of MaaS solutions are estimated to increase at a rapid pace in China, due to the large-scale urbanization and advancements in regional transportation. Government backing and consistent public-private investment strategies are expected to fuel the demand for innovative MaaS solutions in the coming years. The International Energy Agency (IEA) reports that China led the world in electric car sales in 2024, with nearly half of all cars sold there being electric. The 11 million electric cars sold in the country last year were more than the total global electric car sales two years earlier. The robust rise in smart mobility sales is creating lucrative space for key players.

The market in India is projected to exhibit the fastest CAGR throughout the forecast period. The rise in digital infrastructure expansion and investments in public transit is driving the attention of Maas technology investors. The India Brand Equity Foundation (IBEF) reported that the Ministry of Heavy Industries started the PM E-DRIVE Scheme with around USD 1.28 billion to support India’s electric vehicle (EV) industry. The scheme aims to encourage electric transportation and reduce the use of fossil fuels. This is also increasing the number of new companies in the MaaS business. Thus, mobile-first MaaS solutions are estimated to hold a dominant share throughout the study period.

Europe Market Insights

The Europe market is foreseen to account for a large global revenue share throughout the forecast period. The convergence of sustainability mandates and digital adoption is propelling the sales of mobility as a service solutions. The rise in public-private partnerships for public transit, e-scooters, bike-sharing, and ride-hailing is further creating a high-earning environment for key players. The European Union’s Green Deal and Fit for 55 targets are some of the major drivers for the overall market growth.

Germany leads the sales of MaaS, owing to its strong automotive base and advanced digital infrastructure. The federal support for sustainable mobility is likely to fuel the adoption of MaaS solutions. The infrastructure modernization of rail and other public transit is accelerating the trade of MaaS. The mobility options, such as e-scooters and car-sharing, are most popular in the country, creating a high application environment for MaaS.

The U.K. market is projected to be driven by the dense urban population and the strong demand for public transport systems. The supportive government policies and funding are increasing the sales of MaaS. The smart mobility initiatives to reduce urban congestion and meet its net-zero by 2050 target are also contributing to the overall market growth. Furthermore, the EV infrastructure expansion is set to attract several international companies in the years ahead.

Key Mobility as a Service Market Players:

- Uber Technologies Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lyft Inc.

- Daimler AG (Moovel Group)

- Didi Global Inc.

- Grab Holdings Inc.

- Ola Cabs

- Via Transportation

- Cabify

- Transdev Group

- Gett Inc.

- GoCatch

- Kakao Mobility

- Careem (Uber subsidiary)

- Easy Taxi

- MyTaxi (now Free Now)

- Myanma Mobility

- Toyota Connected Co., Ltd.

- Japan Taxi

- DeNA Co., Ltd.

- ZMP Inc.

- SoftBank Corp.

The leading companies in the market are employing various organic and inorganic strategies to stand out in the crowd. Industry giants are focusing on new product launches and technological innovations to increase their sales. They are also entering into strategic collaborations with other players to boost market reach. Partnerships with public transport providers are projected to double their revenue shares in the years ahead. To increase product offerings, key players are adopting mergers and acquisitions tactics. Also, to earn high profits, market players are entering into untapped regions.

Recent Developments

- In May 2025, Uber Technologies, Inc. and May Mobility, Inc. announced a new long-term partnership. May Mobility plans to add thousands of self-driving vehicles to the Uber platform in the coming years, starting with a launch in Arlington, Texas, by the end of 2025.

- In March 2025, Rivian created a new company called Also, Inc. to handle its micromobility business. Also, Inc. is set to focus on making small, lightweight vehicles to address current and future global transportation needs.

- Report ID: 3412

- Published Date: Oct 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Mobility as a Service (MaaS) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.