Unified Communication as a Service Market Outlook:

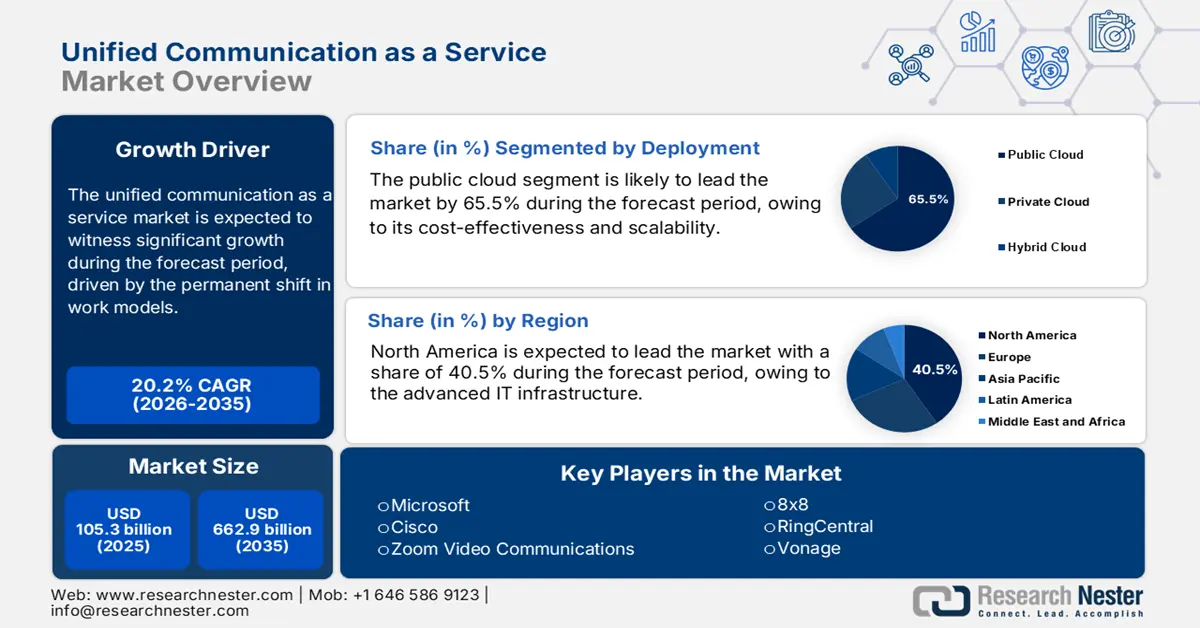

Unified Communication as a Service Market size was valued at USD 105.3 billion in 2025 and is projected to reach USD 662.9 billion by the end of 2035, rising at a CAGR of 20.2% during the forecast period, i.e., 2026-2035. In 2026, the industry size of unified communication as a service is assessed at USD 126.5 billion.

The unified communication as a service (UCaaS) market is experiencing significant growth, largely driven by a permanent shift in work models and federal mandates for digital modernization. According to the Federal Communications Commission report in May 2025, the broadband access reached over 95% of U.S. households and small businesses at a speed of 100 Mbps, with the support of the USD 65 billion Infrastructure Investment and Jobs Act (IIJA), based on the GFOA data in 2025, strengthening enterprise-grade connectivity and unified communication capabilities. The above data directly affect expansion and form the digital backbone that enables cloud-based communication ecosystems to scale nationally, hence allowing UCaaS platforms to commit to consistent, high-quality connectivity across enterprise and public networks, thus acting as a foundational enabler of market growth. Further, hybrid work flows continue to rise the market.

Investment in underlying digital infrastructure is a key enabler for UCaaS adoption. According to the NTIA, Federal broadband funding programs play a pivotal role in ensuring reliable and high-speed connectivity, which is required for the quality of voice and video services. Cybersecurity remains the primary concern for enterprise adoption. CISA guidance on securing collaborative services influences heavily in procurement decisions, which places pressure on providers to embed advanced security protocols into their solutions and ensure data residency. The market trajectory further depends on specific sectoral investments. For example, continued funding for telehealth in the HHS budget creates targeted demand for integrated UCaaS platforms that can address the particular needs related to regulated industries, such as those through HIPAA, demonstrating the technology's role in core operational functions beyond general corporate communication.

Key Unified Communication as a Service Market Insights Summary:

Regional Highlights:

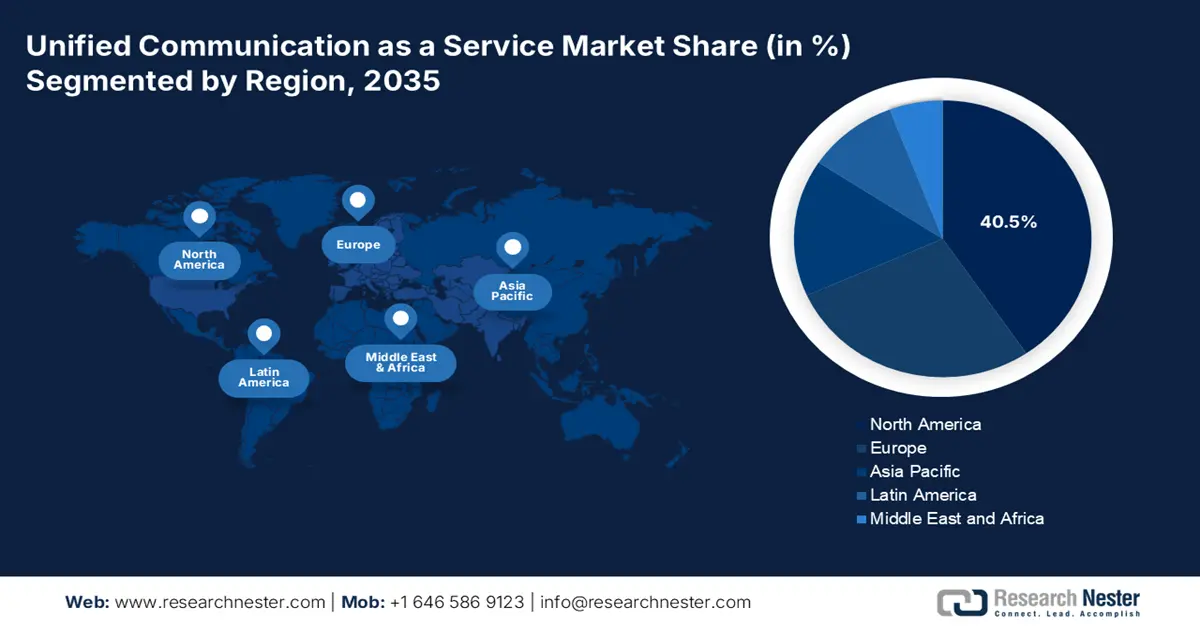

- North America is anticipated to hold a 40.5% market share by 2035, fueled by advanced IT infrastructure, high cloud adoption, and proliferation of hybrid work models in enterprises.

- Asia Pacific is expected to witness rapid growth during 2026–2035, impelled by digital transformation in SMEs and massive investments in cloud infrastructure.

Segment Insights:

- The public cloud segment is projected to account for 65.5% share by 2035, propelled by its seamless support for distributed workforces and integration with other cloud-based business applications.

- The integrated suite under the delivery model is expected to lead, owing to the demand for a unified user experience and a consolidated administrative interface.

Key Growth Trends:

- Rising of hybrid and remote workflow models

- Modernization of legacy IT infrastructure

Major Challenges:

- Differentiation in a feature-saturated market

- Ensuring carrier-grade reliability

Key Players: Microsoft (USA)Company Overview,Cisco (USA),Zoom Video Communications (USA),8x8 (USA),RingCentral (USA),Vonage (USA),GoTo (USA),Five9 (USA),Dialpad (USA),Mitel (USA),Alcatel-Lucent Enterprise (France),Ringover (France),Dstny (Belgium),NEC Corporation (Japan),Fuze (USA),Telstra (Australia),LG Uplus (South Korea),Airtel (India),Telekom Malaysia (Malaysia),Avaya (USA).

Global Unified Communication as a Service Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 105.3 billion

- 2026 Market Size: USD 126.5 billion

- Projected Market Size: USD 662.9 billion by 2035

- Growth Forecasts: 20.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Canada, United Kingdom, Germany, Japan

- Emerging Countries: India, China, Singapore, Australia, South Korea

Last updated on : 20 November, 2025

Unified Communication as a Service Market - Growth Drivers and Challenges

Growth Drivers

- Rising of hybrid and remote workflow models: The structural shift to distributed workforces remains the primary demand driver for the unified communications as a service market. The data from the U.S. Bureau of Labor Statistics in October 2024 depicts that nearly 33% of people are working remotely in 2022, cementing the need for a robust, cloud native communication platform. This trend has made a transition from deploying temporary solutions to making permanent strategic investments in UCaaS as a core IT infrastructure. Businesses now actively require reliable, enterprise-grade tools that ensure productivity and seamless collaboration for hybrid teams. This fundamental change in work models necessitates integrated, long-term UCaaS strategies, positioning these platforms as essential for operational continuity and competitive advantage in a decentralized work environment.

- Modernization of legacy IT infrastructure: The high cost and rigidity of maintaining legacy on-premises communication systems, such as PBX, are compelling organizations toward UCaaS. The U.S. General Services Administration promotes the shift to cloud-based telecommunications. The driver is propelled by the need for operational expenditure flexibility, scalability, and access to continuous innovation. Replacing legacy systems with a subscription model reduces capital expenditure and simplifies IT management, providing a clear financial and operational incentive for adoption across both private and public sectors.

- Integration of AI and automation: The rising demand for AI-powered features is reshaping the unified communication as a service market from a utility to a productive intelligence platform. Functions such as real-time meeting transcription, automated summaries, and sentiment analysis are becoming key differentiators. The National Institute of Standards and Technology provides a framework for examining the AI technologies, which includes speech-to-text. investments in these advanced capabilities are vital for vendors to justify premium pricing and deepen their value proposition within enterprises by providing actionable insights from the communication data. Investment is heavily focused on generative AI for tasks like automated meeting minute generation and predictive action item assignment. To justify this statement, the NITRD data for the fiscal year 2019 to 2025 has reported that USD 1,578.2 million was allocated to core AI R&D in 2021, underscoring the strategic value of these capabilities.

Federal Budget for AI R&D

|

Year |

Budget (USD millions) |

|

2021 |

2,409.6 |

|

2022 |

2,914.1 |

|

2023 |

3,121.9 |

|

2024 |

2,977.5 |

|

2025 |

3,316.1 |

Source: NITRD fiscal year 2019 to 2025

Challenges

- Differentiation in a feature-saturated market: With features such as chat and video conferencing that are becoming more commoditized, differentiation is a major challenge. New companies entering the market must innovate in areas such as AI-enabled analytics, industry-driven workflow, and high user experience to be competitive. Dialpad has focused its differentiation on AI that provides real-time call transcription and sentiment analysis. Further, developing such unique, patented technology requires a highly demanding, specialized workforce and significant investment, which is difficult to overcome when competing against the broad, integrated suites of the market leaders.

- Ensuring carrier-grade reliability: UCaaS is a mission-critical utility for businesses that requires assured uptime. Achieving this demands a globally redundant network infrastructure, distributed and advanced monitoring tools. Any significant outage can irreparably damage a provider's reputation. The disapproval of Zoom's encryption and dependability prompted the company to launch a multi-million-dollar project to construct its own global data center footprint to increase control and enhance service quality. This project is a significant constraint for new competitors in the market.

Unified Communication as a Service Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

20.2% |

|

Base Year Market Size (2025) |

USD 105.3 billion |

|

Forecast Year Market Size (2035) |

USD 662.9 billion |

|

Regional Scope |

|

Unified Communication as a Service Market Segmentation:

Deployment Model Segment Analysis

The public cloud is dominating the deployment model and is expected to hold the highest share value of 65.5% by 2035. The segment is preferred for its cost-effectiveness, scalability, and reduced IT overhead. It allows organizations to deploy and access rapidly on the latest features without managing the physical infrastructure. As per the Flexera report in March 2025, nearly one-third which is 33% of organizations are actively spending more than USD 12 million annually on the public cloud alone. The ability of public cloud UCaaS to seamlessly support a distributed workforce and integrate with other cloud-based business applications (like CRM and ERP) solidifies its dominant market position and future growth trajectory.

Delivery Model Segment Analysis

Under the delivery model segment, the integrated suite leads and is driven by the demand for a unified user experience and a consolidated administrative interface that reduces the complexity and IT overhead. Managing separate applications for telephony, messaging, and video, nowadays, organizations prefer a single application, cohesive platform that ensures seamless interoperability and a consistent workflow. As per the National Institute of Standards and Technology, cloud interoperability often supports integrated systems to improve manageability and security. This preference for a holistic solution over a collection of best-of-breed point solutions makes the integrated suite the preferred choice for enterprises seeking to streamline collaboration and simplify vendor management.

Organization Size Segment Analysis

By 2035, large enterprises are expected to continue leading the organization size segment in the unified communication as a service market, particularly because of their complex needs for communication, strategic focus on digital transformation, and extensive remote workforce. Large organizations that have the capital to invest in comprehensive, integrated suites can replace outdated infrastructure. The need for strong security and compliance, particularly in regulated industries, is also a driving force. In that regard, the Cybersecurity and Infrastructure Security Agency points out the need to secure collaborative services, thereby pushing large entities toward enterprise-grade UCaaS. Moreover, the scale of operations makes such economies achieved by consolidating communication tools on a single platform substantial enough to justify the investment.

Our in-depth analysis of the unified communication as a service market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Solution |

|

|

Service |

|

|

Organization Size |

|

|

Vertical |

|

|

Deployment Model |

|

|

Delivery Model |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Unified Communication as a Service Market - Regional Analysis

North America Market Insights

North America is dominating the unified communication as a service market and is expected to hold a market share of 40.5% by 2035. The market is driven by the advanced IT infrastructure, high cloud adoption, and proliferation of hybrid work models. The report from the U.S. Bureau of Labor Statistics data in April 2023 states that 40.1% of the private sector employees have teleworked, sustaining the demand for integrated collaboration tools. Further, the strategic convergence of UCaaS with contact center as service and AI-powered analytics is the primary trend, hence creating a unified platform for customer and employee experience. Security and compliance improvements continue to be a primary emphasis for business adoption, and the market is further driven by the continuous need for operational cost reduction and a strong presence of important providers.

The unified communication as a service market in the U.S. is defined by the rapid integration of artificial intelligence to automate meeting transcription, improve user productivity, and generate insights. Adoption of secure, FedRAMP-authorized platforms for federal agencies, market consolidation, and driving vendor compliance are the significant trends driving the market growth. The NIH study on the overview of telehealth in the United States, released in July 2023, depicts that the U.S. has increased the use of telehealth services by 154% during the early stage of the pandemic. This data fuels a persistent demand for UCaaS solutions in the healthcare industry. Further, the nonprofit consortia, such as Internet2, provide high-performance networking, which supports advanced real-time collaboration tools for research and education, pushing the boundaries of UCaaS capabilities and security requirements nationwide.

In Canada, the unified communication as a service market is characterized by the federal digital transformation initiative and the requirement to connect a geographically dispersed workforce. The Government of Canada’s Cloud First strategy promotes cloud services to be considered as the first option for IT investments, as it surges the adoption of UCaaS in the public sector. The nation has experienced a rise in telework, with 20% employees working from home, creating a stable demand for urgent requirements of robust communication platforms, based on the Statistics Canada report in January 2024. Further, the investments by organizations such as CANARIE, which is Canada's advanced network organization, ensure that the research and education sector has the secure, high-capacity infrastructure that is necessary to support next-gen UCaaS applications and collaborative science.

APAC Market Insights

The Asia Pacific is the fastest-growing unified communication as a service market and is expected to grow at a CAGR of 13.5% during the forecast period from 2026 to 2035. The market is driven by the rapid digital transformation, mainly in the SME sector, and massive investments in cloud infrastructure. Permanent hybrid work models, government-led digitalization initiatives, and mobile-first solutions are considered the key drivers for the market growth. Integration of AI and automation, providing real-time translation, meeting summaries, and intelligent call routing, are the primary market trends making platforms more accessible across a diverse linguistic landscape. For instance, the IBEF report in August 2025 has highlighted that India’s digital economy is expected to reach USD 1 trillion, creating a huge demand for a massive base for the adoption of UCaaS. The competitive landscape features a mix of global giants and strong local players customizing solutions to specific regional needs.

By 2035, the unified communication as a service market in China is projected to hold the largest revenue share during the preferred timeline. The country is ruled by giants such as Tencent and Alibaba, powered by robust data sovereignty laws and government-driven digitalization. The Digital China initiative has indicated the National Data Administration and prioritizes integrated cloud infrastructure, directly boosting UCaaS adoption integrated cloud infrastructure. The People's Republic of China in October 2025 has reported that the cloud computing sector in the country has increased by 13.7% year-on-year revenue, thus creating a strong tailwind for native UCaaS platforms. One of the trends that have emerged is the comprehensive integration of UCaaS with super-apps such as WeChat Work and DingTalk, thus communication becoming the core of business and social workflows.

India’s unified communication as a service market is driven by a huge population connected digitally and a booming SME sector actively adopting cloud tools for agility. The Digital India programme focuses on the expansion of the broadband network infrastructure and promoting cloud technologies. The key driver is the rapid adoption of hybrid work. To prove this, the report from IWWAGE 2023 depicts that 60% of the countries evaluated to have a remote or flexible work policy. This data sustains a high demand for collaborative platforms. Market trends include a strong mobile-first approach, localization of interfaces and support, and the bundling of UCaaS with productivity suites to offer cost-effective solutions for businesses undergoing digital transformation.

Europe Market Insights

The Europe UCaaS market is growing and is driven by the region's rapid digital transformation, strict data privacy regulations such as GDPR, and widespread acceptance of hybrid work models. The need for scalable and secure communication solutions that facilitate cross-border collaboration within the EU's single market are the key drivers for the market growth. One of the key trends is the strategic push toward digital sovereignty, driving up demand for vendors who ensure data residency within Europe. This is supported by heavy public investment; for example, the EU4Health programme, as outlined on, has a budget of €5.3 billion for 2021-2027 to strengthen health resilience, part of which is dedicated to digital health tools such as telehealth platforms based on UCaaS infrastructure. In addition, the convergence of UCaaS with Contact Center as a Service (CCaaS) creates unified platforms that improve both employee and customer experience-a key focus for European enterprises.

The UK is evaluated to hold the highest revenue share in Europe during the forecast period, 2026 to 2035. The country has a strong financial service requiring compliant communication and a proactive government digital policy. The government’s Cloud First policy mandates that public sector firms consider cloud solutions before alternatives is the key market growth factor. Nearly 28% of people have adopted hybrid work models, as per the Office for National Statistics data in June 2025, which creates a sustained demand for flexible UCaaS tools. Trends include a strong emphasis on cybersecurity, with the National Cyber Security Center offering guidelines that influence enterprise UCaaS procurement, and the integration of AI to meet productivity goals. The UK's departure from the EU has also intensified focus on its own data protection standards, influencing vendor offerings.

Germany will be the second largest in revenue share, driven by the transformation of the strong manufacturing sector to Industry 4.0 and a very high value being placed on data sovereignty and security. The German Federal Ministry for Economic Affairs and Energy-backed initiative, GAIA-X, aims at developing a secure and federated data infrastructure in Europe, which directly impacts demand for those UCaaS providers that guarantee data residency. Other trends are tight integration with business software such as SAP and the rise of UCaaS for manufacturing in order to connect distributed production and engineering teams. Supportive data from the German Digital Industry Association proves that German companies use cloud computing, while communication services top the list of applications, which underlines great market potential.

Key Unified Communication as a Service Market Players:

- Microsoft (USA)Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Cisco (USA)

- Zoom Video Communications (USA)

- 8x8 (USA)

- RingCentral (USA)

- Vonage (USA)

- GoTo (USA)

- Five9 (USA)

- Dialpad (USA)

- Mitel (USA)

- Alcatel-Lucent Enterprise (France)

- Ringover (France)

- Dstny (Belgium)

- NEC Corporation (Japan)

- Fuze (USA)

- Telstra (Australia)

- LG Uplus (South Korea)

- Airtel (India)

- Telekom Malaysia (Malaysia)

- Avaya (USA)

- Microsoft is a competitive player in the unified communication as a service market and has made significant advancements by deeply integrating Teams platforms with the cloud ecosystem. This strategy reshapes Teams from a simple video conferencing tool into a comprehensive workstream collaboration hub. By embedding communication directly into business workflows, the company uses its enterprise footprint to drive the adoption, making UCaaS a central nervous system.

- Cisco has strongly advanced its position in the Unified Communication as a Service market by focusing on enterprise-grade security, reliability, and hybrid work solutions via its Webex platform. Strategic initiatives like incorporating advanced AI for features such as real-time translation and noise removal, and acquiring companies to enhance the collaboration portfolio. The 2025 annual report has depicted that USD 2 billion is allocated for AI infrastructure orders, provide a computational backbone for AI-powered UCaaS features.

- Zoom Video Communications has expanded its influence in the unified communication as a service market by developing from a specialist video conferencing provider to a full-scale communication platform. Key advancements include the strategic introduction of Zoom Phone, Zoom Rooms, and contact center solutions. The 2025 annual report depicts that in 2024 Q4, the active monthly users increased by 68%.

- 8x8 has carved a strong niche in the unified communication as a service market by pioneering in the incorporation of communications with contact center functionalities into a single cloud platform. Its strategic advancement is based on one-platform approach that combines UCaaS, CCaaS, and CPaaS to provide a unified data model.

- RingCentral has made a substantial development in the unified communication as a service market via a strategy of robust partnerships and relentless platform innovation. Its flagship MVP platform is distributed via strategic alliances with major hardware and telecom providers such as Avaya and AT&T, dramatically expanding the global reach. API-rich platform integrates various business applications, ensuring the UCaaS solution is both embedded and versatile within the business core.

Here is a list of key players operating in the global market:

Of the top listed global unified communications as a service market players are dominated by the U.S. giants with significant contributions from the Europe and Asia players. The competitive environment is intensely dynamic and is defined by the rapid technological integration of AI, analytics, and collaboration tools into core platforms. Key strategic initiatives include aggressive mergers and acquisitions to expand the footprint and consolidate the market presence, and strategic partnerships with telecom providers for global reach. For example, Ericsson has announced the complete acquisition of Vonage. Ericsson will create short-term synergies by offering its current clients Vonage Unified Communications as a Service and Contact Center as a Service solutions. Further, developing an all-in-one solution that blends the UCaaS with contact center as a service and customer relationship management creates a differentiated, comprehensive workstream collaboration suite.

Corporate Landscape of the Unified Communication as a Service Market:

Recent Developments

- In July 2024, Novatech has launched NovaVoice a robust unified communications solution built to serve businesses of all sizes. NovaVoice delivers powerful, secure, and fully integrated voice and collaboration tools designed to empower today’s dynamic workforce.

- In July 2024, Vodafone Business extends its unified communications platform to more than 30 countries globally. Customers can combine and customize messaging, video meetings, file sharing and virtual phone systems via a single user interface accessible on any internet-enabled device, mobile or fixed.

- In June 2024, NICE has announced 1CX, which is a new Unified Communications as a Service (UCaaS) solution designed for rapid implementation and fast ROI. The price of it is fixed at a market-shattering USD 5 per user per month.

- Report ID: 8254

- Published Date: Nov 20, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Unified Communication as a Service Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.