- Introduction

- Market Definition

- Market Segmentation

- Product Overview

- Assumptions and Acronyms

- Research Methodology

- Research Process

- Primary Research

- Medical Polyoxymethylene Manufacturers

- Distributors/Suppliers

- End Users

- Secondary Research

- Market Size Estimation

- Analyst Review

- Executive Summary

- Market Size and Forecast

- Competitive Landscape

- Market Dynamics

- Regional Opportunity Analysis

- Market Dynamics

- Drivers

- Challenges

- Trends

- Opportunities

- Industry Risk Analysis

- Regulatory & Standard Landscape

- World Economic Outlook: Challenges for Global Recovery and its Impact on Global Medical Polyoxymethylene Market

- Ukraine-Russia crisis

- Potential US economic slowdown

- Impact of COVID-19 on Global Medical Polyoxymethylene Market

- Industry Growth Outlook

- Patent Analysis

- Industry Supply Chain Analysis

- Regional Demand Analysis

- Product Feature Analysis

- Competitive Landscape

- Market Share Analysis of Major Players (%), 2021

- Competitive Positioning

- BASF SE.

- Detailed Overview

- Assessment of Key Offering

- Analysis of Growth Strategies

- Exhaustive Analysis on Key Financial Indicators

- Recent Developments

- Celanese Corporation

- Polyplastics Co. Ltd

- DuPont de Nemours Inc

- Ensinger

- Korea Engineering Plastics Co. Ltd

- Mitsubishi Chemical Corporation

- Westlake Plastics Company

- Asahi Kasei Corporation

- PolyOne Corporation

- Global Medical Polyoxymethylene Market Outlook

- Market Overview

- By Value (USD million)

- By Volume (Kilo tons)

- By Type

- Homopolymer, 2023-2036F (USD million) & (Kilo tons)

- Copolymer, 2023-2036F (USD million) & (Kilo tons)

- By Grade

- Standard, 2023-2036F (USD million) & (Kilo tons)

- Weather Resistant, 2023-2036F (USD million) & (Kilo tons)

- Low VOC, 2023-2036F (USD million) & (Kilo tons)

- Reinforced, 2023-2036F (USD million) & (Kilo tons)

- Special Grade, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- By Application

- Drug Delivery Systems, 2023-2036F (USD million) & (Kilo tons)

- Inhalers, 2023-2036F (USD million) & (Kilo tons)

- Insulin Pens, 2023-2036F (USD million) & (Kilo tons)

- Hose Clamp/Clip, 2023-2036F (USD million) & (Kilo tons)

- Stop Cock/Manifold, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- Medical Devices, 2023-2036F (USD million) & (Kilo tons)

- Dialysis Machine, 2023-2036F (USD million) & (Kilo tons)

- Handles for Surgical Instruments, 2023-2036F (USD million) & (Kilo tons)

- Skin Stretchers, 2023-2036F (USD million) & (Kilo tons)

- Male Circumcision Device, 2023-2036F (USD million) & (Kilo tons)

- Cruciate Ligament Operation Device, 2023-2036F (USD million) & (Kilo tons)

- Infusion Pump and Rack System, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- Drug Delivery Systems, 2023-2036F (USD million) & (Kilo tons)

- Global Medical Polyoxymethylene Market by Region

- North America, 2023-2036F (USD million) & (Kilo tons)

- Europe, 2023-2036F (USD million) & (Kilo tons)

- Asia-Pacific, 2023-2036F (USD million) & (Kilo tons)

- Latin America, 2023-2036F (USD million) & (Kilo tons)

- Middle East & Africa, 2023-2036F (USD million) & (Kilo tons)

- North America Medical Polyoxymethylene Market Outlook

- Market Overview

- By Value (USD million)

- By Volume (Kilo tons)

- By Type

- Homopolymer, 2023-2036F (USD million) & (Kilo tons)

- Copolymer, 2023-2036F (USD million) & (Kilo tons)

- By Grade

- Standard, 2023-2036F (USD million) & (Kilo tons)

- Weather Resistant, 2023-2036F (USD million) & (Kilo tons)

- Low VOC, 2023-2036F (USD million) & (Kilo tons)

- Reinforced, 2023-2036F (USD million) & (Kilo tons)

- Special Grade, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- By Application

- Drug Delivery Systems, 2023-2036F (USD million) & (Kilo tons)

- Inhalers, 2023-2036F (USD million) & (Kilo tons)

- Insulin Pens, 2023-2036F (USD million) & (Kilo tons)

- Hose Clamp/Clip, 2023-2036F (USD million) & (Kilo tons)

- Stop Cock/Manifold, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- Medical Devices, 2023-2036F (USD million) & (Kilo tons)

- Dialysis Machine, 2023-2036F (USD million) & (Kilo tons)

- Handles for Surgical Instruments, 2023-2036F (USD million) & (Kilo tons)

- Skin Stretchers, 2023-2036F (USD million) & (Kilo tons)

- Male Circumcision Device, 2023-2036F (USD million) & (Kilo tons)

- Cruciate Ligament Operation Device, 2023-2036F (USD million) & (Kilo tons)

- Infusion Pump and Rack System, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- Drug Delivery Systems, 2023-2036F (USD million) & (Kilo tons)

- By Country

- United States

- Canada

- Europe Medical Polyoxymethylene Market Outlook

- Market Overview

- By Value (USD million)

- By Volume (Kilo tons)

- By Type

- Homopolymer, 2023-2036F (USD million) & (Kilo tons)

- Copolymer, 2023-2036F (USD million) & (Kilo tons)

- By Grade

- Standard, 2023-2036F (USD million) & (Kilo tons)

- Weather Resistant, 2023-2036F (USD million) & (Kilo tons)

- Low VOC, 2023-2036F (USD million) & (Kilo tons)

- Reinforced, 2023-2036F (USD million) & (Kilo tons)

- Special Grade, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- By Application

- Drug Delivery Systems, 2023-2036F (USD million) & (Kilo tons)

- Inhalers, 2023-2036F (USD million) & (Kilo tons)

- Insulin Pens, 2023-2036F (USD million) & (Kilo tons)

- Hose Clamp/Clip, 2023-2036F (USD million) & (Kilo tons)

- Stop Cock/Manifold, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- Medical Devices, 2023-2036F (USD million) & (Kilo tons)

- Dialysis Machine, 2023-2036F (USD million) & (Kilo tons)

- Handles for Surgical Instruments, 2023-2036F (USD million) & (Kilo tons)

- Skin Stretchers, 2023-2036F (USD million) & (Kilo tons)

- Male Circumcision Device, 2023-2036F (USD million) & (Kilo tons)

- Cruciate Ligament Operation Device, 2023-2036F (USD million) & (Kilo tons)

- Infusion Pump and Rack System, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- Drug Delivery Systems, 2023-2036F (USD million) & (Kilo tons)

- By Country

- United Kingdom

- Germany

- France

- Italy

- Spain

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific Medical Polyoxymethylene Market Outlook

- Market Overview

- By Value (USD million)

- By Volume (Kilo tons)

- By Type

- Homopolymer, 2023-2036F (USD million) & (Kilo tons)

- Copolymer, 2023-2036F (USD million) & (Kilo tons)

- By Grade

- Standard, 2023-2036F (USD million) & (Kilo tons)

- Weather Resistant, 2023-2036F (USD million) & (Kilo tons)

- Low VOC, 2023-2036F (USD million) & (Kilo tons)

- Reinforced, 2023-2036F (USD million) & (Kilo tons)

- Special Grade, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- By Application

- Drug Delivery Systems, 2023-2036F (USD million) & (Kilo tons)

- Inhalers, 2023-2036F (USD million) & (Kilo tons)

- Insulin Pens, 2023-2036F (USD million) & (Kilo tons)

- Hose Clamp/Clip, 2023-2036F (USD million) & (Kilo tons)

- Stop Cock/Manifold, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- Medical Devices, 2023-2036F (USD million) & (Kilo tons)

- Dialysis Machine, 2023-2036F (USD million) & (Kilo tons)

- Handles for Surgical Instruments, 2023-2036F (USD million) & (Kilo tons)

- Skin Stretchers, 2023-2036F (USD million) & (Kilo tons)

- Male Circumcision Device, 2023-2036F (USD million) & (Kilo tons)

- Cruciate Ligament Operation Device, 2023-2036F (USD million) & (Kilo tons)

- Infusion Pump and Rack System, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- Drug Delivery Systems, 2023-2036F (USD million) & (Kilo tons)

- By Country

- Australia

- Japan

- Singapore

- South Korea

- India

- China

- Rest of Asia Pacific

- Latin America Medical Polyoxymethylene Market Outlook

- Market Overview

- By Value (USD million)

- By Volume (Kilo tons)

- By Type

- Homopolymer, 2023-2036F (USD million) & (Kilo tons)

- Copolymer, 2023-2036F (USD million) & (Kilo tons)

- By Grade

- Standard, 2023-2036F (USD million) & (Kilo tons)

- Weather Resistant, 2023-2036F (USD million) & (Kilo tons)

- Low VOC, 2023-2036F (USD million) & (Kilo tons)

- Reinforced, 2023-2036F (USD million) & (Kilo tons)

- Special Grade, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- By Application

- Drug Delivery Systems, 2023-2036F (USD million) & (Kilo tons)

- Inhalers, 2023-2036F (USD million) & (Kilo tons)

- Insulin Pens, 2023-2036F (USD million) & (Kilo tons)

- Hose Clamp/Clip, 2023-2036F (USD million) & (Kilo tons)

- Stop Cock/Manifold, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- Medical Devices, 2023-2036F (USD million) & (Kilo tons)

- Dialysis Machine, 2023-2036F (USD million) & (Kilo tons)

- Handles for Surgical Instruments, 2023-2036F (USD million) & (Kilo tons)

- Skin Stretchers, 2023-2036F (USD million) & (Kilo tons)

- Male Circumcision Device, 2023-2036F (USD million) & (Kilo tons)

- Cruciate Ligament Operation Device, 2023-2036F (USD million) & (Kilo tons)

- Infusion Pump and Rack System, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- Drug Delivery Systems, 2023-2036F (USD million) & (Kilo tons)

- By Country

- Mexico

- Argentina

- Brazil

- Rest of Latin America

- Middle East and Africa Medical Polyoxymethylene Market Outlook

- Market Overview

- By Value (USD million)

- By Volume (Kilo tons)

- By Type

- Homopolymer, 2023-2036F (USD million) & (Kilo tons)

- Copolymer, 2023-2036F (USD million) & (Kilo tons)

- By Grade

- Standard, 2023-2036F (USD million) & (Kilo tons)

- Weather Resistant, 2023-2036F (USD million) & (Kilo tons)

- Low VOC, 2023-2036F (USD million) & (Kilo tons)

- Reinforced, 2023-2036F (USD million) & (Kilo tons)

- Special Grade, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- By Application

- Drug Delivery Systems, 2023-2036F (USD million) & (Kilo tons)

- Inhalers, 2023-2036F (USD million) & (Kilo tons)

- Insulin Pens, 2023-2036F (USD million) & (Kilo tons)

- Hose Clamp/Clip, 2023-2036F (USD million) & (Kilo tons)

- Stop Cock/Manifold, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- Medical Devices, 2023-2036F (USD million) & (Kilo tons)

- Dialysis Machine, 2023-2036F (USD million) & (Kilo tons)

- Handles for Surgical Instruments, 2023-2036F (USD million) & (Kilo tons)

- Skin Stretchers, 2023-2036F (USD million) & (Kilo tons)

- Male Circumcision Device, 2023-2036F (USD million) & (Kilo tons)

- Cruciate Ligament Operation Device, 2023-2036F (USD million) & (Kilo tons)

- Infusion Pump and Rack System, 2023-2036F (USD million) & (Kilo tons)

- Others, 2023-2036F (USD million) & (Kilo tons)

- Drug Delivery Systems, 2023-2036F (USD million) & (Kilo tons)

- By Country

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

Medical Polyoxymethylene Market Outlook:

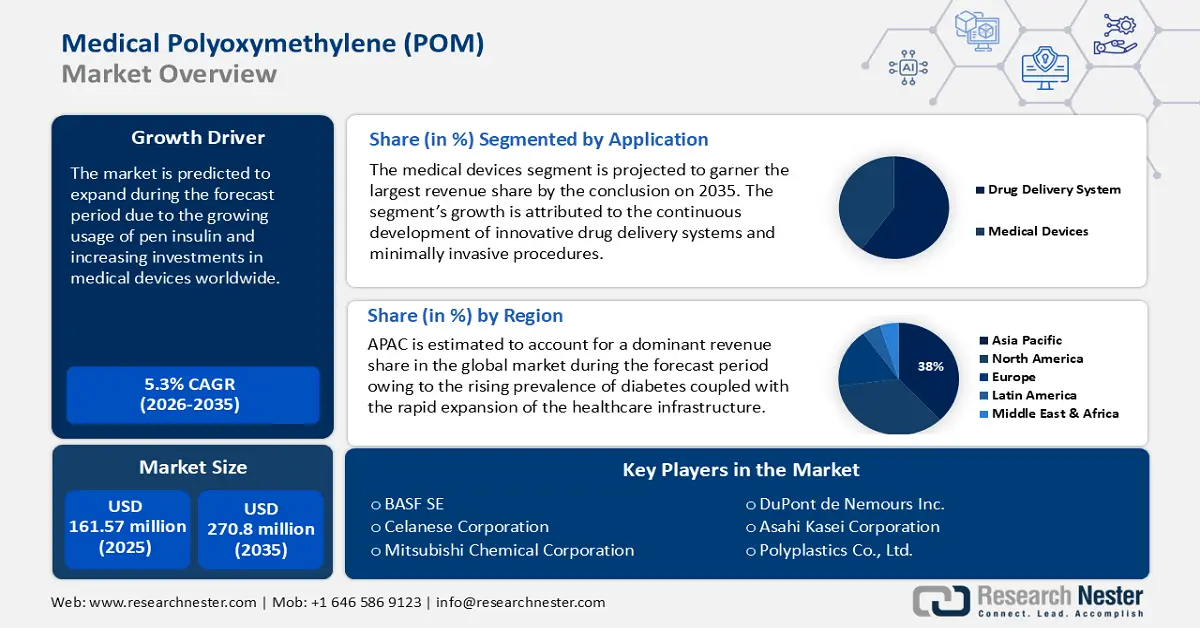

Medical Polyoxymethylene Market size was over USD 161.57 million in 2025 and is projected to reach USD 270.8 million by 2035, growing at around 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical polyoxymethylene is evaluated at USD 169.28 million.

The growth can be attribute to rise in prevalence of diabetes all around the world. A total of 537 million individuals (20-79 years old) worldwide has diabetes. By 2030, there would be 643 million diabetics worldwide, and by 2045, there would be 783 million, according to the international diabetes federation. Hence owing to this, the demand for insulin pen treatment is expected to increase. For instance, in the United States, there were 27, 860,691 visits for insulin treatment between 2016 and 2020. Treatment visits with insulin pens grew from 36.1% in 2016 to 58.7% in 2020.

Further, there has been growth in medical industry which is also estimated to boost the growth of the market. This growth in medical industry is further booming demand for healthcare and medical devices. Additionally, POM has a significant history in the medical industry, notably as an implantable substance. The use of polyoxymethylene in tissue engineering is made possible by its properties, including excellent dimensional stability and thermal stability that enable steam sterilization. This is anticipated to influence the market potential for the expansion of the global medical polyoxymethylene market. Moreover, POM is an appropriate material for tissue culture since it significantly inhibited hematopoietic stem cells' ability to grow and form colonies, whether it was used as a growth substrate or as a medium-wetted component. Consequently, this is expected to create a huge opportunity for the market for medical polyoxymethylene to expand.

Key Medical Polyoxymethylene Market Insights Summary:

Regional Highlights:

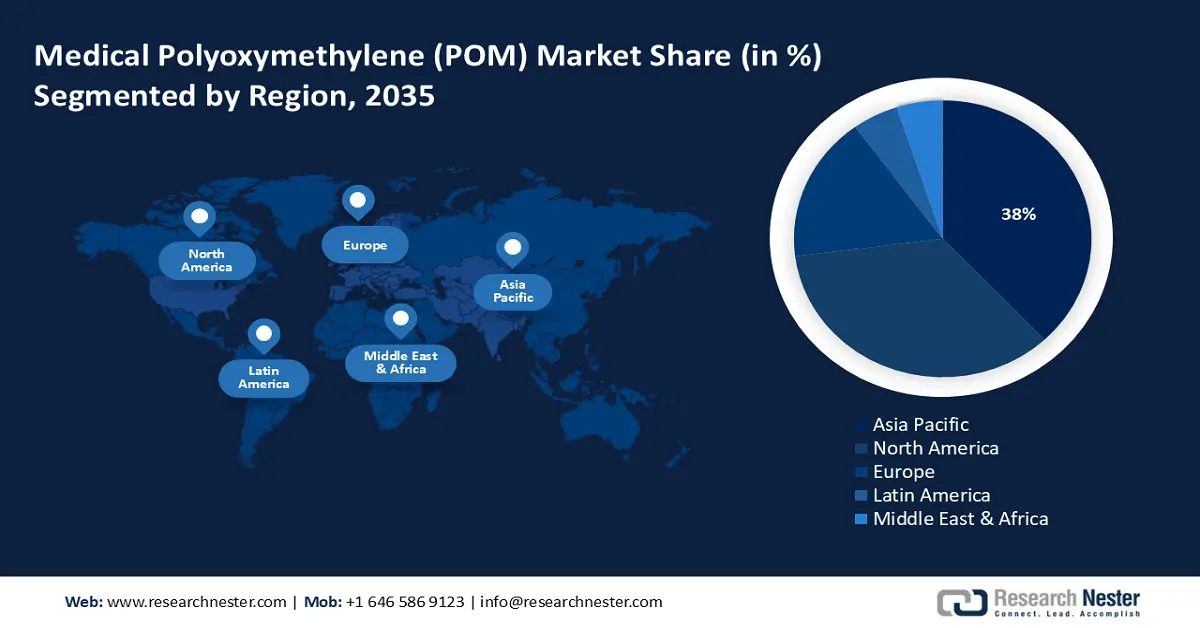

- Asia Pacific medical polyoxymethylene (pom) market will secure around 38% share by 2035, fueled by expanding healthcare sector and diabetes prevalence.

Segment Insights:

- The weather resistant segment in the medical polyoxymethylene market is forecasted to experience the highest CAGR over 2026-2035, driven by demand for weather-resistant surgical instruments for high-temperature sterilization.

- The drug delivery system segment in the medical polyoxymethylene market is expected to experience the highest CAGR from 2026-2035, driven by the use of polyoxymethylene for high mechanical strength in medical devices.

Key Growth Trends:

- Growing Prevalence of Hospital Care-Associated Infections (HCAIs)

- Rise in Use of Pen Insulin

Major Challenges:

- Availability of Substitutes

- Frequent Changes in Price of Raw Material

Key Players: BASF SE, Celanese Corporation, Polyplastics Co. Ltd, DuPont de Nemours Inc, Ensinger, Korea Engineering Plastics Co. Ltd, Mitsubishi Chemical Corporation, Westlake Plastics Company, Asahi Kasei Corporation, PolyOne Corporation.

Global Medical Polyoxymethylene Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 161.57 million

- 2026 Market Size: USD 169.28 million

- Projected Market Size: USD 270.8 million by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (38% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 10 September, 2025

Medical Polyoxymethylene Market Growth Drivers and Challenges:

Growth Drivers

- Growing Prevalence of Hospital Care-Associated Infections (HCAIs) - In developed countries, seven patients out of every 100 hospitalized patients and ten patients out of every 100 patients in developing nations contract an HCAI. 10 Additional research from high-income nations revealed that 5%-15% of hospitalized patients develop HCAIs, which could influence patients confined to intensive care units by 9% to 37%. Hospital-associated infections (HCAIs) may arise as a direct result of medical or surgical treatment or indirectly from contact with a healthcare environment. Up to 20% of all surgical patients experience a serious infection at the surgical site or wound. Hence the use of polyyoxymethylene medical instruments are expected to have huge demand in the medical polyoxymethylene (POM) market.

- Rise in Use of Pen Insulin - In the US, the use of insulin pens climbed to 59% between June 2020 and June 2021, while it was predicted to reach 93.6% in Europe, according to an IQVIA® analysis.

- Surge in Investment in Medical Devices Industry - Foreign investments in the medical equipment sector surged 98% year over year in FY20, from USD 151.87 million to USD 301.01 million.

- Significant Growth in the Cases of Cardiovascular Disease - According to the World Health Organization, estimation, 17.9 million deaths worldwide in 2019 were attributable to CVDs, or 32% of all fatalities. Heart attack and stroke deaths accounted for 85% of these fatalities.

- Advancements in Technology - The Mitsubishi Engineering-Plastics Corporation's Iupital 05 Series is a new polyacetal that reduces the formation of formaldehyde. Formaldehyde odors, which are a problem in molding and subsequent processing, would be eliminated by the Iupital 05 Series, which is made to enhance working conditions.

Challenges

- Availability of Substitutes - It is projected that the development of new plastics appropriate for medical devices, such as PEEK and PC, would hamper the growth of the market under consideration. Some manufacturers, such as Ensinger, prefer to employ polyphenylsulfone (PPSU) and polyetheretherketone (PEEK), which offer somewhat higher performance levels, for use in medical devices owing to their superior physical, chemical, and biocompatible qualities. Therefore, the presence of alternatives hinders market expansion.

- Frequent Changes in Price of Raw Material

- Strict Regulation in Order to Protect Environment from the Harmful Thermoplastics

Medical Polyoxymethylene Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 161.57 million |

|

Forecast Year Market Size (2035) |

USD 270.8 million |

|

Regional Scope |

|

Medical Polyoxymethylene Market Segmentation:

Application Segment Analysis

The global medical polyoxymethylene (POM) market is segmented and analyzed for demand and supply by application into drug delivery system, and medical devices. Out of which, the medical devices segment is anticipated to garner the largest revenue by the end of 2035. Further, the medical devices segment is sub-segmented into dialysis machine, skin stretchers, male circumcision device, cruciate ligament operation device, infusion pump and rack system, and others.. However, the dialysis machine sub-segment is expected to garner the second highest revenue by the end of 2035. The growth of the segment can be attributed to the rising cases of kidney malfunctioning and related diseases. Nearly 786,000 Americans have end-stage renal disease (ESRD), with about 70% receiving dialysis and 30% receiving a kidney transplant, according to a research from the National Institute of Diabetes and Digestive and Kidney Diseases. Between 2008 and 2018, the number of patients receiving home dialysis doubled. Hence this growth in kidney malfunctioning is expected to boost the use of dialysis machine. Since, various top manufacturers employ polyoxymethylene as an appropriate raw material for making dialysis machines as it provides important attributes such as high mechanical strength and stiffness, outstanding dimensional stability and more, this segment is expected to boost the market growth. However, the drug delivery system segment is expected to grow with a highest CAGR over the forecast period.

Grade Segment Analysis

The weather resistant segment is anticipated to grow at a highest CAGR over the forecast period, backed by growth in number of surgeries which is further boosting demand for surgical instruments. Many reusable surgical instruments are sterilized using heat, which calls for a polymer with weather-resistant qualities to endure such high temperatures. The weather-resistant grade gives polymeric materials the ability to survive the activities of extreme ambient agents (solar radiation, heat, oxygen, moisture, industrial gases, and so on) without substantial shift in their exterior form and functional capabilities (mechanical, dielectric, and others). Hence, these advantages are provided by polyoxymethylene copolymers.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By Grade |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Polyoxymethylene Market Regional Analysis:

APAC Market Insights

The Asia Pacific medical polyoxymethylene (POM) market, amongst the market in all the other regions, is poised to dominate 38% revenue share by 2035, growing at a highest CAGR of 6.7% over the forecast period. The growth of the market in this region can be attributed to upsurge in industrialization, and expanding healthcare sector. Further, growing prevalence of diabetes is also estimated to boost the market growth in this region. For instance, India has about 16% of all diabetes patients worldwide, earning it the moniker "Diabetes Capital of the World." India has close to 70 million diabetics in 2022, and by the year 2045, that figure is projected to rise to about 134 million.

Medical Polyoxymethylene Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Celanese Corporation,

- Polyplastics Co. Ltd,

- DuPont de Nemours Inc,

- Ensinger, Korea Engineering Plastics Co. Ltd,

- Mitsubishi Chemical Corporation,

- Westlake Plastics Company,

- Asahi Kasei Corporation,

- PolyOne Corporation

Recent Developments

-

Previously reported in December 2020, Korea Engineering Plastics Co. (KEP), a joint venture held equally by Celanese Corporation and Mitsubishi Gas Chemical Firm, Inc. (MGC), has undergone the restructuring Celanese Corporation, a worldwide chemical and specialty materials company, has declared is complete.

-

Mitsubishi Chemical Corporation said that it has chosen to raise the yearly manufacturing capacity of SoarnoL ethylene vinyl alcohol copolymer (EVOH) resin at its consolidated subsidiary Noltex L.LC by 3,000 tonnes to 41,000 tonnes.

- Report ID: 4680

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Polyoxymethylene Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.