Medical Morphine Market Outlook:

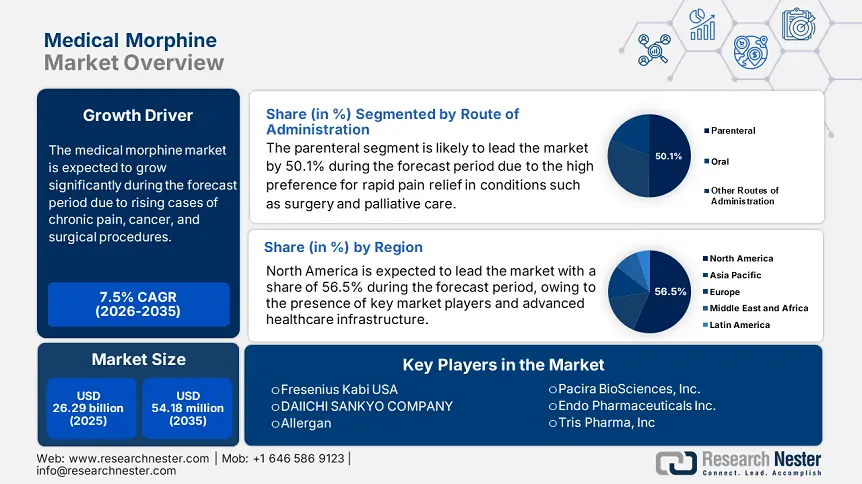

Medical Morphine Market size was over USD 26.29 billion in 2025 and is projected to reach USD 54.18 billion by 2035, growing at around 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of medical morphine is evaluated at USD 28.06 billion.

The rising awareness about comforting care is driving growth in the medical morphine market. The increasing prevalence of chronic pain conditions among the aging population worldwide inflates the demand for morphine therapeutics. Additionally, the surge in cancer cases, coupled with post-surgical pain management, further fuels the market demand. According to a study published in January 2021 by the Annals of Palliative Medicine, 96.2% of cancer patients achieved pain control within 24 hours using opioid titration. It further reported that morphine remained effective in overall pain medication, ensuring its continued demand in oncology. The study also confirmed that morphine use is safe, supporting regulated use and encouraging key players to expand more.

Additionally, the market is evolving due to regulatory measures and supply chain challenges. For instance, according to a study by NLM in February 2024, the discontinuation of ordine in Australia led to the approval of overseas alternatives under section 19A of the Therapeutic Goods Act 1989 to prevent any type of shortages. This development emphasizes the role of regulatory authorities in ensuring a stable supply of opioids while maintaining safety standards. Therefore, the measures can strengthen the market by improving supply chain stability and regulatory flexibility.

Key Medical Morphine Market Insights Summary:

Regional Highlights:

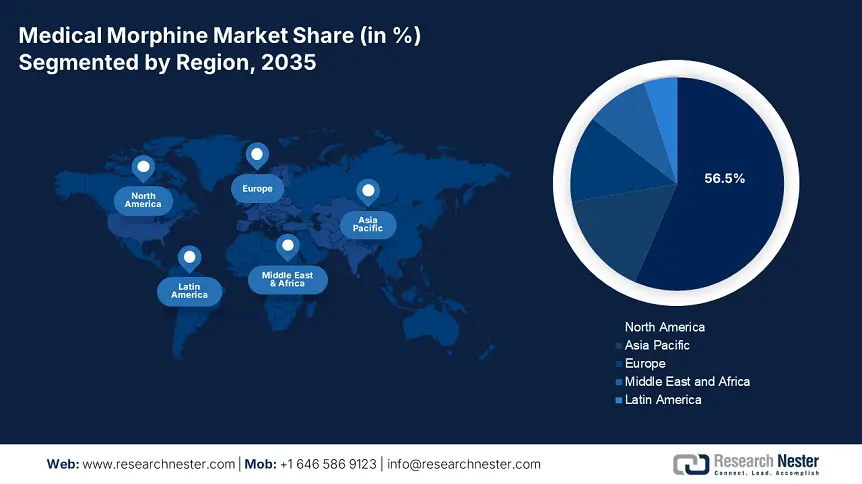

- North America commands a 56.5% share in the Medical Morphine Market, fueled by advanced healthcare infrastructure and increased prevalence of long-lasting pain, solidifying its dominance through 2035.

- The medical morphine market in APAC is experiencing the fastest growth by 2035, attributed to rising surgical procedures and evolving regulatory frameworks.

Segment Insights:

- The Cancer segment is projected to hold a significant share through 2035, driven by the growing reliance on opioids for cancer pain management.

- The Parenteral segment of the Medical Morphine Market is projected to achieve a 50.10% share from 2026 to 2035, fueled by the rising number of surgical procedures increasing demand for pain management.

Key Growth Trends:

- Rising palliative care needs

- Advancements in pain management technologies

Major Challenges:

- Stringent regulatory measures

- Opioid crisis and stigma

- Key Players: Allergan, Pacira BioSciences, Inc., Endo Pharmaceuticals Inc., Tris Pharma, Inc..

Global Medical Morphine Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 26.29 billion

- 2026 Market Size: USD 28.06 billion

- Projected Market Size: USD 54.18 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (56.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, Germany, United Kingdom, Japan, France

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 12 August, 2025

Medical Morphine Market Growth Drivers and Challenges:

Growth Drivers

- Rising palliative care needs: The increasing incidence of rare pain conditions, such as carcinoma, osteoarthritis, and neuropathic pain, are key drivers for the medical morphine market to showcase lucrative growth opportunities during the forecast period. Additionally, the aging population is more susceptible to chronic illnesses necessitating long-term pain management. According to WHO reports in July 2023, nearly 528 million people worldwide have been diagnosed with osteoarthritis; among them, 73% of people living with osteoarthritis are older than 55 years. Thus, the growing need for palliative care underscores the requirement for medical morphine therapeutics, encouraging market expansion.

- Advancements in pain management technologies: With the advancements in pain management technologies, the frequency of innovation in the medical morphine market increases. The development of patient-controlled analgesia and transdermal patches enhanced safety and efficacy, minimizing the risk of side effects. For instance, in February 2025, Nutriband Inc. partnered with Kindeva Drug Delivery to integrate Aversa Fentanyl abuse-deterrent transdermal technology into opioid-based pain management solutions. Such innovations could pave the way for similar technologies in medical morphine, improving controlled pain relief with regulatory compliance.

Challenges

- Stringent regulatory measures: The products of the medical morphine market face significant challenges due to strict regulations and stringent control measures imposed by governments and medical authorities. This may limit the expansion of this sector as the usage of morphine is subjected to tight distribution and prescription monitoring to prevent illicit usage. In addition, these regulatory hurdles not only increase administrative burdens for healthcare providers but also delay the availability of morphine-based medications and restrict product exposure across the healthcare industry.

- Opioid crisis and stigma: Despite having limited adverse reaction cases, growth in the medical morphine market can be hindered due to rising concerns over opioids and dependency. Due to the global opioid crisis, there is growing skepticism among both manufacturers and consumers regarding the long-term use of morphine, which is limiting market penetration. This may further create a hurdle for this sector to captivate the optimum consumer base in the medical morphine industry. Moreover, this highly fragmented field can bring uncertainty in profit-making and consistent growth.

Medical Morphine Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 26.29 billion |

|

Forecast Year Market Size (2035) |

USD 54.18 billion |

|

Regional Scope |

|

Medical Morphine Market Segmentation:

Route of Administration (Parenteral, Oral)

In medical morphine market, parenteral segment is poised to hold revenue share of more than 50.1% by 2035. This drug works as an excellent indication for severe pain in critical care settings. Intravenous and intramuscular morphine administration ensures precise dosing and immediate pain relief, playing a crucial role in hospital surgical procedures. According to an ISAPS global survey published in June 2024, aesthetic procedures increased by 5.5% to 15.8 billion. Additionally, liposuction is the most common surgery, followed by breast augmentation. Thus, the rising number of surgical procedures increases the demand for pain management, supporting the growth of the parenteral segment.

Application (Cancer, Arthritis, Myocardial Infarction, Kidney Stones, Diarrhea)

In terms of application, the cancer segment is projected to garner a significant share of the medical morphine market during the forecast period. This segment is pledged with the growing need for morphine-based therapeutics to cure such medical conditions. In August 2024, according to the America Cancer Society, a few morphine as opioids such as Apokyn, Avinza, Kadian, MS-Contin are essential for managing moderate to severe cancer pain, with morphine sulfate being a key treatment option. Therefore, the growing reliance on opioids for cancer pain management supports the dominance of the cancer segment in the market.

Our in-depth analysis of the global medical morphine market includes the following segments:

|

Route of Administration |

|

|

Application |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Medical Morphine Market Regional Analysis:

North America Market Analysis

By 2035, North America medical morphine market is set to account for around 56.5% revenue share. Advanced healthcare infrastructure and the increased prevalence of long-lasting pain in the region highlight the growing need for advanced opioid drugs such as medical morphine in this region. Additionally, rising medical expenditure for advanced pain management practices encourages global players to expand their footprint in the country. Furthermore, supportive government initiatives and opioid stewardship are shaping the responsible use of morphine, thereby mitigating illicit usage.

The U.S. has become the hub for global leaders in the medical morphine market due to its wide consumer base and excellent expansion channels. The country presents a stringent monitoring program for balancing accessibility and safety. For instance, in January 2025, Purdue Pharma L.P. and the Sackler family announced a USD 7.4 billion settlement, marking a significant step toward addressing the opioid crisis in the U.S. The agreement will provide funding over the next 15 years to support addiction treatment. Thus, the settlement aims to bring relief to affected communities combating opioid misuse nationwide.

Canada is steadily consolidating its position in the medical morphine market with proactive government initiatives and pain management strategies. The healthcare system ensures safe access to morphine for post-surgical care while enforcing the regulatory guidelines. In December 2024, Health Canada announced USD 650 million for substance use treatment and pain management, strengthening the demand for medical morphine. Additionally, USD 4.5 million was allocated to Pain Canada to enhance national pain relief coordination. This is further inflating demand in this sector due to the proven efficacy of medical morphine therapeutics in pain management.

APAC Market Statistics

Asia Pacific is expected to demonstrate the fastest growth in the medical morphine market with its strong captivity in healthcare infrastructure. The region is augmenting such growth with the developmental tendency of countries such as China, India, and Japan. The rise in surgical procedures, growing awareness about pain management, and evolving regulatory frameworks are inspiring domestic leaders to take leadership in this sector. Thus, the growth in this region is further carried forward with the pharmaceutical advancements and collaborations between companies bringing innovations in this field.

India is propagating the regional medical morphine market with its strong demand in oncology and mollifying care. Domestic pharmaceutical production and opioid accessibility for medical use are anticipated to boost market expansion in the coming years. In September 2023, the Ministry of Social Justice and Empowerment reported that opioids are among the most commonly used psychoactive substances in India, highlighting the demand for regulated pain management solutions. With over 11 crore (110 million) people reached under Nasha Mukt Bharat Abhiyaan, the focus on structured opioids in healthcare is critical. Thus, the crucial step reinforces the role of medical opioids in pain management.

China is one of the biggest suppliers of the medical morphine market, which is emerging as a great distribution source in this region. The rising prevalence of cancer has driven the need for effective opioid analgesics, fostering a favorable business environment. As per a report by the Journal of Pain and Symptom Management in April 2020, China’s estimated morphine need for cancer pain management is 15,196.6 kg, but the actual morphine equivalent remains 3268.9 kg (21.51%), highlighting the treatment gap. Thus, the requirement necessitates the demand for improved opioid accessibility and pain management solutions in the country.

Key Medical Morphine Market Players:

- Fresenius Kabi

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Allergan

- Pacira BioSciences, Inc.

- Endo Pharmaceuticals Inc.

- Tris Pharma, Inc

- Purdue Pharma L.P.

- VERVE HEALTH CARE LTD.

- Taj Pharmaceuticals Limited

- AbbVie Inc.

- Mallinckrodt Pharmaceuticals

- Alcaliber S.A

- Arrotex Pharmaceuticals

- Johnson Matthey

- Northeast Pharmaceutical Group Co., Ltd

- Sun Pharmaceutical Industries Ltd

- Teva Pharmaceutical Industries Ltd

- Pfizer Inc

- Cipla Inc.

- Mylan N.V.

- Nutriband Inc.

- GE HealthCare Technologies Inc.

- Endo Health Solutions Inc.

- Amneal Pharmaceuticals, Inc.

The competitive demographic of the medical morphine market is inspiring global leaders to enforce their resources, innovating effective solutions. They are putting efforts into promoting adoption to push their territory forward. According to a study published by TGA in January 2025, (morphine) oral liquid, previously discontinued by Mundipharma Deutschland GmbH & Co. KG, is now supplied by Arrotex Pharmaceuticals. In the interim, substitute overseas registered products such as Morphini HCL Steuli, RA-MORPH, and Morphine sulfate are available under Section 19A. Thus, this shortage reinforces the demand for medical morphine, showcasing lucrative growth opportunities during the forecast timeline.

A few key players in the market include:

Recent Developments

- In April 2024, Amneal Pharmaceuticals, Inc. announced the U.S. FDA approval and launch of OTC Naloxone Hydrochloride Nasal Spray for emergency opioid overdose treatment.

- In February 2024, Endo Health Solutions Inc. agreed to a global resolution of civil investigations into its sales and marketing practices, ensuring long-term transparent practices.

- Report ID: 7481

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Medical Morphine Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.