Noninvasive Medical Sensor Market Outlook:

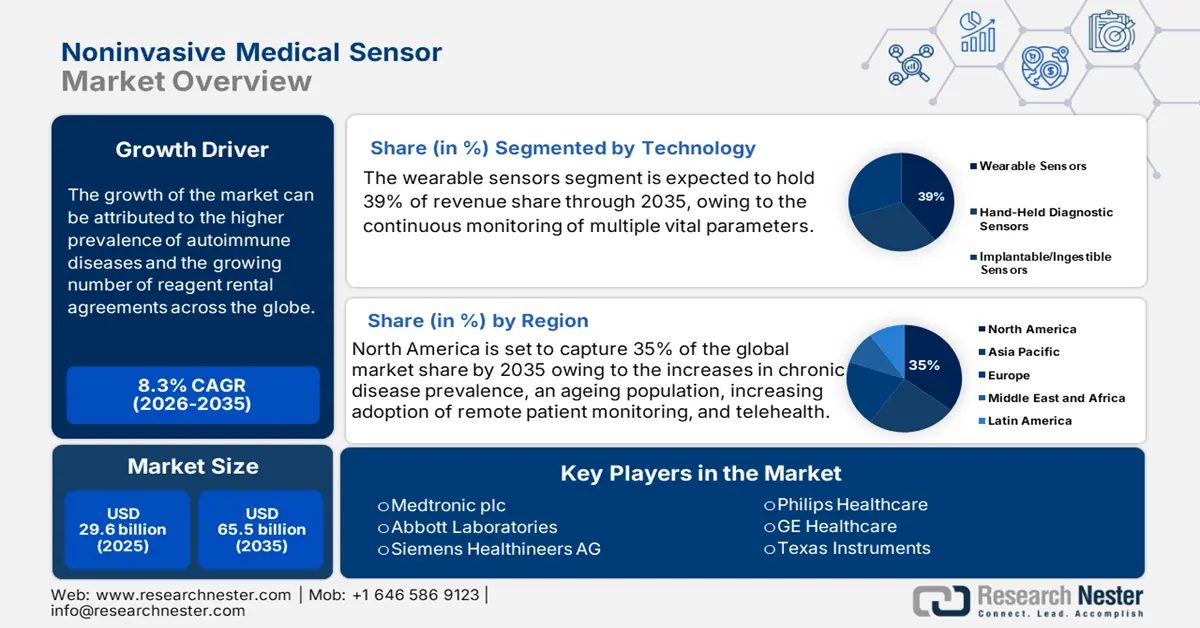

Noninvasive Medical Sensor Market size was valued at USD 29.6 billion in 2025 and is projected to reach USD 65.5 billion by the end of 2035, rising at a CAGR of 8.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of noninvasive medical sensors is evaluated at USD 32 billion.

The patient group using noninvasive medical sensors is expanding rapidly, with increased respiratory and cardiac monitoring capabilities for the chronic use cohort. As per the AHA Journal report released in July 2024, 45% of people with atrial fibrillation use wearable sensor devices to check their heart rate and ECG daily. Further, the device provides continuous physiologic data, including heart rate and blood pressure proxies. This indicates that there are substantial rates of increased use among Medicare beneficiaries for people using noninvasive ventilators.

On the supply chain side of things, with trade data, we can see organized import/export flows of medical sensor devices around the world. Based on the OEC data in 2023, the top exporter of medical instruments is the U.S., exporting worth USD 34.8 billion, including both invasive and noninvasive equipment. Further, wearable biosensors are becoming essential in chronic disease management and detection of biochemical substances. Moreover, these noninvasive medical sensors are demanding healthcare exponentially, as doctors can monitor the patient's health status remotely and reduce the direct visits.

Key Noninvasive Medical Sensor Market Insights Summary:

Regional Highlights:

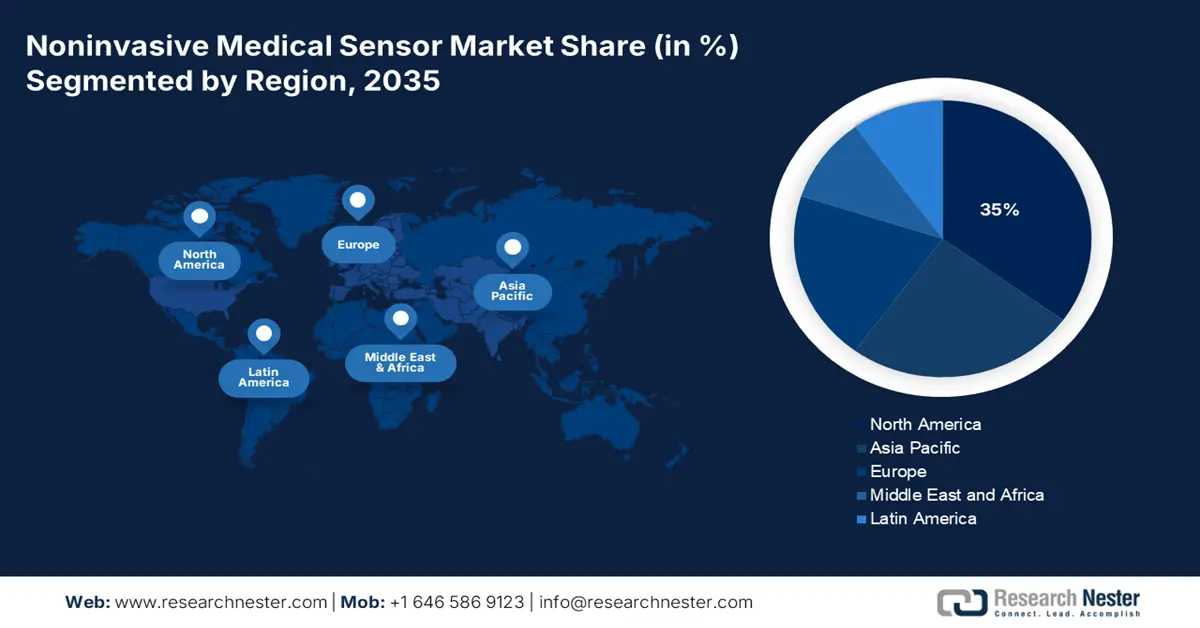

- North America is projected to hold a 35% share of the noninvasive medical sensor market by 2035, supported by rising chronic disease prevalence, expanding telehealth adoption, and integration of AI-enabled wearable diagnostics.

- Asia Pacific is expected to witness the fastest growth through 2035, impelled by aging populations, expanding digital health infrastructure, and supportive government initiatives for remote healthcare systems.

Segment Insights:

- The wearable sensors segment is projected to command a 39% share of the noninvasive medical sensor market by 2035, propelled by growing integration with telehealth applications and IoT frameworks enabling real-time monitoring of vital parameters.

- The blood glucose sensor segment is anticipated to secure the largest share by 2035, driven by the rising prevalence of diabetes and technological advancements in continuous glucose monitoring devices.

Key Growth Trends:

- Government spending on sensor-based care

- Patient pool & disease prevalence trends

Major Challenges:

- High patient cost burden

Key Players: Medtronic plc, Abbott Laboratories, Philips Healthcare, GE Healthcare, Siemens Healthineers, Texas Instruments, Honeywell International Inc., Analog Devices, Inc., Nihon Kohden Corporation, Nonin Medical, Inc., NXP Semiconductors N.V., Masimo Corporation, OMRON Healthcare, Inc., TE Connectivity, Terumo Corporation, iRhythm Technologies, Inc., Renesas Electronics Corporation, Sensirion Holding AG, VivaLNK Inc., Konica Minolta, Inc.

Global Noninvasive Medical Sensor Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 29.6 billion

- 2026 Market Size: USD 32 billion

- Projected Market Size: USD 65.5 billion by 2035

- Growth Forecasts: 8.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Malaysia, Mexico

Last updated on : 15 September, 2025

Noninvasive Medical Sensor Market - Growth Drivers and Challenges

Growth Drivers

- Government spending on sensor-based care: The Medicare usage of noninvasive ventilators indicates increasing reimbursement volumes for sensor-guided therapies and remote location equipment. This suggests increased demand for devices that support home-based intervention and remote monitoring. As per the Medpac data in July 2025, Medicare's share of national spending on durable medical equipment was 22% in 2023, 15% from Medicaid, and CHIP. These grants increase access to noninvasive, technology-driven monitoring in chronic illness management initiatives.

- Patient pool & disease prevalence trends: Populations at risk from chronic heart failure and pressure injuries represent growing sensor data target populations. For instance, 60% of U.S. patients have at least one chronic disease, based on the American Action Forum in July 2025. This highlights a large potential deployment population for preventative wearables. Meanwhile, the aging demographic, as well as the rise of chronic disease prevalence in North America and Europe, continues to expand the baseline need for non-invasive monitoring.

- Emerging trends in telehealth and AI integration: Personalized medicine, remote patient engagement, and care models are being revolutionized by the combination of noninvasive sensors, telehealth platforms, and AI diagnostics. The NIH report in April 2025 states that patients with AI screening have reduced the 47% readmissions and reduced the readmission cost to USD 109,000. Initiatives integrating these technologies are being increasingly funded by emerging government programs in North America and Europe, which are supporting market expansion and opening up new clinical avenues for sensor-based interventions.

Import and Export Data on Medical Instruments in 2023

|

Country |

Import (USD billion) |

Export (USD billion) |

|

U.S. |

34.8 |

37.7 |

|

Germany |

13.1 |

28.4 |

|

Netherlands |

1.48 |

9.38 |

|

China |

1.5 |

12.3 |

|

Japan |

0.36 |

7.21 |

|

India |

0.59 |

1.46 |

Source: OEC 2023

Challenges

- High patient cost burden: Underinsured Individuals still face high out-of-pocket costs for sensor-based devices. In studies with Medicaid beneficiaries and low-income populations, cost was identified as a primary reason for not adopting diabetes-related sensor technology. Insurance plans, co-pays, and deductibles can still impede regular use and limit manufacturers' potential for scaling device access in their populations.

Noninvasive Medical Sensor Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

8.3% |

|

Base Year Market Size (2025) |

USD 29.6 billion |

|

Forecast Year Market Size (2035) |

USD 65.5 billion |

|

Regional Scope |

|

Noninvasive Medical Sensor Market Segmentation:

Technology Segment Analysis

The wearable sensors segment is poised to dominate the noninvasive medical sensor market with a share of 39% during the analyzed period. Wearables are dominant technology categories because they are integrated with telehealth uses and IoT frameworks, and enable continuous monitoring of multiple vital parameters. According to the JMIR publication report in February 2025, the adoption rate of wearable devices in the U.S. increased to 36.36% in 2022. Further, WHO highlights wearable health technologies as instrumental for lowering noncommunicable disease burdens globally.

Type Segment Analysis

The blood glucose sensor segment is estimated to account for the largest share in the noninvasive medical sensor market over the discussed timeframe. The growth is driven by the rising incidence of diabetes around the world, especially in the aging population. As the American Diabetes Association report in 2025 states that nearly 38.4 million U.S. people have diabetes in 201. This is contributing to increasing demand for continuous glucose monitoring (CGM) devices. With regulatory support for CGM devices or FDA approvals at times for noninvasive CGM devices, these advances have also helped to move through planning for adoption. Also, advances in technology mean sensors are becoming more accurate and easier to use, thus promoting better patient compliance and reimbursement.

Application Segment Analysis

The chronic illness & at-risk monitoring segment is poised to dominate the noninvasive medical sensor market during the analyzed period. The application segment is benefitting from a growing focus within healthcare on early disease detection and the remote monitoring of patients. The Agency for Healthcare Research and Quality has highlighted that noninvasive sensors can reduce hospitalizations. Moreover, governments are pushing home care, creating demand for sensors to monitor vital signs within at-risk populations.

Our in-depth analysis of the global noninvasive medical sensor market includes the following segments:

|

Segments |

Subsegments |

|

Type |

|

|

Application |

|

|

Technology |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Noninvasive Medical Sensor Market - Regional Analysis

North America Market Insights

North America is anticipated to capture the highest share of 35% in the global noninvasive medical sensor market by the end of 2035. The major drivers of the regional diagnostics market are increases in chronic disease prevalence, an ageing population, increasing adoption of remote patient monitoring, and telehealth. The development of wearable and biosensors, as well as increasing integration with AI/IoT, a surge in home diagnostics, augmenting the regional diagnostic market. As per the National Center for Health Report released in 2025, nearly 30% of the U.S. population is using wearable electronic devices for continuous monitoring of their health status. This highlights the demand for noninvasive medical sensor devices in the region

The demand for non-invasive medical sensors market in the U.S. continues to increase dramatically as a result of the ailing chronic illness rate, remote monitoring, telehealth, and other public health surveillance increases. The CDC’s total core health funding for FY 2021 was about USD 8 billion, with additional mandatory funding from the Prevention and Public Health Fund, as stated in the Congress.gov, July 2024 report. Non-invasive wearable monitoring grants maintain funding under a cooperative agreement with the CDC. Medicaid reimbursements, under the CMS, for remote physiologic monitoring and non-invasive sensor devices have included uncomplicated cases. Industry groups advocate for more sensor-based diagnostics to be included in wide healthcare practices.

Scintigraphy Medical Devices Trade Data in 2023

|

Country |

Export |

Import |

|

U.S. |

USD 76.1M |

USD 93.1M |

|

Canada |

USD 606K |

USD 135K |

Source: OEC 2023

APAC Market Insights

Asia Pacific is the fastest-growing region in the noninvasive medical sensor market throughout the discussed period. The market growth is being fueled by aging populations, increased demand for remote, home-based care, and governmental shifts to digital health infrastructure. The Ministry of Health, Labour and Welfare (MHLW) and the Japan Agency for Medical Research and Development (AMED) in Japan are actively modernizing regulations by increasing conditional approvals. India and Malaysia are seeing demand domestically, augmented by national digital health policies and privatized pilot programs. South Korea is further developing very specific reimbursement mechanisms and public subsidies through its National Health Insurance Service (NHIS).

India is leading the noninvasive medical sensor market in the Asia Pacific. The government of India has significantly increased its focus on affordable healthcare. Spending on medical devices, including diagnostics and monitoring sensors, has risen under initiatives like the National Health Mission and the PLI scheme. According to the IBEF report in May 2025, 70% to 80% of the medical devices, including noninvasive medical sensors, are imported from the U.S., Germany, and China. Further, Russia and India have set a trade target of USD 30 billion by 2025 to advance the opportunities in medical devices, pharmaceuticals, chemicals, and more.

Europe Market Insights

Europe's noninvasive medical sensor market is estimated to hold a notable market share during the forecast period. Growth in this area is being driven by the European Union (EU) digital health strategy, which is supported by programs such as EU4Health. This promotes sensor-based diagnostics and remote monitoring systems. The arrangements, combined with EU-funded research grants for Horizon 2020 and Horizon Europe projects, have utilized tens of millions of EU funding for innovations in wearable and AI-powered biosensors, in diabetes, cardiac, and aging care. Each Member state with digital health strategies is investing in digital health infrastructure that enables the integration of non-invasive sensor data into service delivery and public health surveillance platforms. The rise in chronic disease is driving additional demand.

Germany is leading the noninvasive medical sensor market. According to the German Digital Health Market Update release in February 2024, Germany has spent nearly 13% of its GDP which is accounted to €500 billion on healthcare. This funding is used for adoption of digitalization in health and care. The Federal Ministry of Health, BMG, has added intermittent, wearable, and remote monitoring devices to the guidelines for care and treatment with the GKV covering continuous monitoring for chronic conditions, which include heart failure, diabetes, and hypertension. In general, Germany's healthcare system and the high per capita usage of medical devices have created the space for one of the largest non-invasive sensors markets in Europe.

Key Noninvasive Medical Sensor Market Players:

- Medtronic plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott Laboratories

- Philips Healthcare

- GE Healthcare

- Siemens Healthineers

- Texas Instruments

- Honeywell International Inc.

- Analog Devices, Inc.

- Nihon Kohden Corporation

- Nonin Medical, Inc.

- NXP Semiconductors N.V.

- Masimo Corporation

- OMRON Healthcare, Inc.

- TE Connectivity

- Terumo Corporation

- iRhythm Technologies, Inc.

- Renesas Electronics Corporation

- Sensirion Holding AG

- VivaLNK Inc.

- Konica Minolta, Inc.

The noninvasive medical sensor market is very competitive with key players from Europe and the U.S, emphasizing technologies for wearable and remote patient monitoring. In addition to Medtronic, Abbott, and Siemens, many firms have long product development pipelines and have acquired other firms to diversify their sensor product lines. Companies in Japan, South Korea, and India are expanding rapidly due to their favorable regulatory environments and strong regional manufacturing.

Below is the list of some prominent players operating in the global noninvasive medical sensor market:

Recent Developments

- In August 2025, Biobeat announced the global expansion and officially signed agreement with Infinity Pharma SA in Chile and Argentina, to develop innovative health monitoring solutions.

- In June 2025, PharmaSens collaborated with SiBionics to develop the next-generation niia signature, which is an all-in-one wearable device that integrates insulin delivery and glucose sensing into a single compact patch pump.

- Report ID: 7977

- Published Date: Sep 15, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Noninvasive Medical Sensor Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.