Sensorimotor Neuropathy Market Outlook:

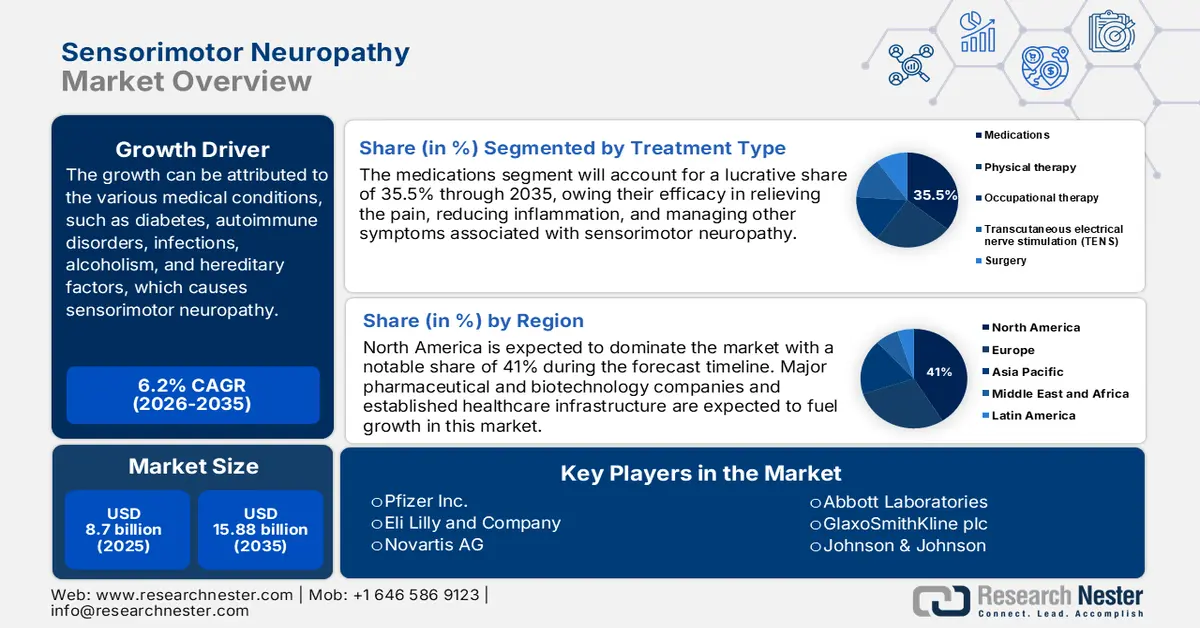

Sensorimotor Neuropathy Market size was over USD 8.7 billion in 2025 and is anticipated to cross USD 15.88 billion by 2035, witnessing more than 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of sensorimotor neuropathy is assessed at USD 9.19 billion.

The sensorimotor neuropathy market is experiencing an upward trajectory attributed mainly to the convergence of an aging population worldwide and rising prevalence of chronic metabolic diseases, particularly diabetes mellitus. For instance, as per the statistics from International Diabetes Federation, 1 in 8 adults, approximately 853 million, will be living with diabetes, an increase of 46%, by 2050. In addition, the latest IDF Diabetes Atlas (2025) reports that 11.1% or 1 in 9 – of the adult population (20-79 years) is living with diabetes and total count of people living with diabetes is projected to rise to 853 million by 2045.

Furthermore, advancements in diagnostic technology, including enhanced nerve conduction studies and high-resolution imaging technologies, result in earlier and more accurate detection and therefore an enhanced reported incidence. For instance, in March 2024, Researchers at The Ohio State University Wexner Medical Center and College of Medicine, led the gene therapy mouse study that is published online in the journal Molecular Therapy. They used a therapeutic viral construct to deliver proteins called neurotrophic factors to the fatty (adipose) tissue under the skin to help nerve cells survive, grow, and regenerate.

Key Sensorimotor Neuropathy Market Insights Summary:

Regional Highlights:

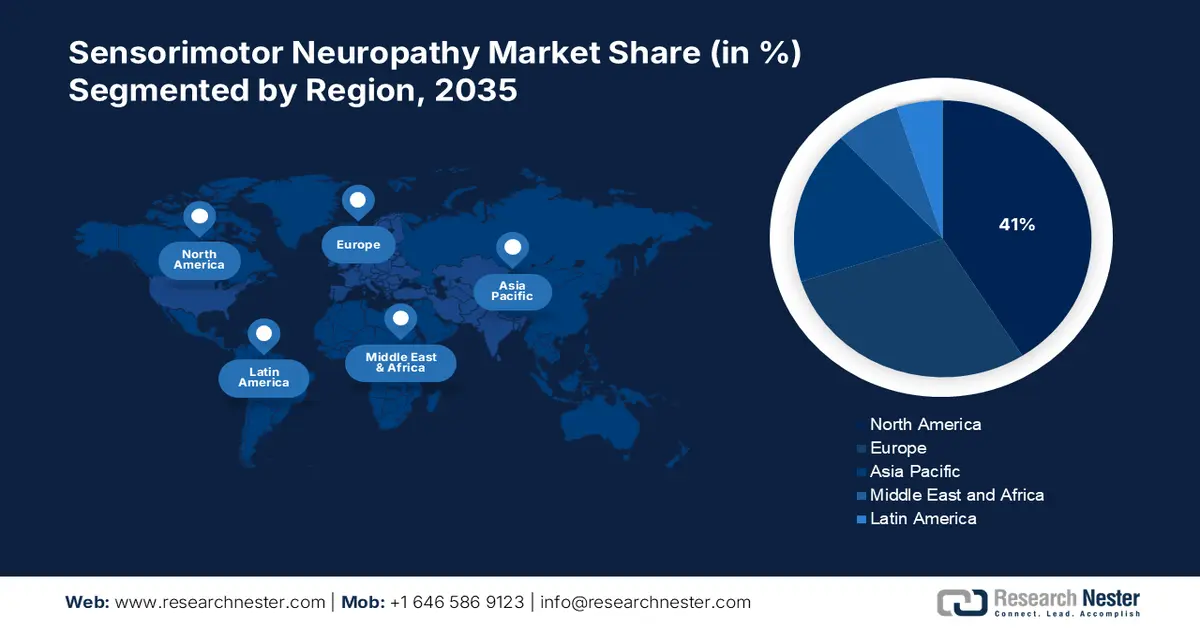

- North America is projected to hold over 41% share of the sensorimotor neuropathy market, supported by expanding healthcare facilities and escalating investments in research and development for advanced treatments.

- Asia Pacific is expected to grow rapidly, driven by the expansion of healthcare infrastructure and increased access to diagnostic and treatment options.

Segment Insights:

- Medication segment is projected to dominate with over 35.5% share of the sensorimotor neuropathy market, driven by growing demand for symptomatic treatment and ongoing R&D in novel therapeutics.

- Over 2026–2035, the EMGs and Motor Nerve Conduction Test segment is expected to rise significantly, propelled by the critical diagnostic insights provided by advanced electrophysiological testing technologies.

Key Growth Trends:

- Rising awareness for peripheral neuropathy

- Growing adoption of precision medicine

Major Challenges:

- Complexity and Heterogeneity as a hurdle

- Obstacle in early and accurate diagnosis

Key Players: Pfizer Inc., Eli Lilly and Company, Novartis AG, Abbott Laboratories, GlaxoSmithKline plc, Johnson & Johnson, Merck & Co., Inc., Sanofi S.A., Biogen Inc.

Global Sensorimotor Neuropathy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.7 billion

- 2026 Market Size: USD 9.19 billion

- Projected Market Size: USD 15.88 billion by 2035

- Growth Forecasts: 6.2%

Key Regional Dynamics:

- Largest Region: North America (41% share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: India, China, South Korea, Brazil, Australia

Last updated on : 3 December, 2025

Sensorimotor Neuropathy Market - Growth Drivers and Challenges

Growth Drivers

-

Rising awareness for peripheral neuropathy: The sensorimotor neuropathy is experiencing rapid growth owing to the surge in the public consciousness and medical awareness towards peripheral neuropathy. For instance, in October 2022, it was updated by the National Library of Medicine that, about 2.4% of the world population is affected by peripheral nerve disorders, an increase up to 8% in older populations. In addition, in September 2023, by July 2020, it provided data on 2,334 patients with neuropathic pain. It unveiled that, 38% patients were self-referred to a neurologist, while 27% by a general practitioner, and 12% by an oncologist, and psychological support was given to 8.1%.

Moreover, increased awareness is driving increasing demand for diagnostic equipment, treatment modalities, and supportive care services and thereby forging a strong sensorimotor neuropathy market growth trajectory in related medical devices, drugs, and rehabilitation therapy. For instance, in October 2023, Rhythmlink International, LLC made the announcement of a new product family, concentric needles, that complements their current line of products designed exclusively for EMG and NCV studies. The concentric needle is available in four sizes or gauges, which also differ in needle diameter, length and color, corresponding to currently accepted workflows. -

Growing adoption of precision medicine: A significant growth driver for the sensorimotor neuropathy market is the growing upsurge in the use of precision medicine. For instance, in November 2023, the NIH stated that, in 2021, diabetes was more prevalent in high-income countries, at a rate of 11.1% as compared to low-income countries (5.5%). These estimates are highlighting the imperative need for effective prevention, management, and healthcare measures to meet the expanding burden of diabetes globally and combat the neuropathy incidences.

Moreover, it has the ability to identify unique genetic and molecular origins of individual patient neuropathies, precision medicine enables one to develop personalized therapeutic strategies and diagnostic tools. For instance, in December 2024, NeuroKaire raised USD 10 million in funding to move development of its clinical test that aids in the identification of drug efficacy for depression patients. This capital allowed the firm to scale up operations and continue to expand pharmaceutical collaborations. Such personalized strategy can enhance the effectiveness of treatment, enhance patient stratification for clinical trials, and eventually propel market expansion for sensorimotor neuropathic disorder.

Challenges

-

Complexity and Heterogeneity as a hurdle: The intrinsic complexity and intrinsic heterogeneity are the largest barriers to progress in sensorimotor neuropathy market. The etiologic heterogeneity, from genetic mutations and metabolic derangements to autoimmune diseases and toxicities, and the heterogeneity of nerve fiber involvement and clinical presentation make it difficult to define universally effective diagnostic and therapeutic approaches. Such heterogeneity requires sophisticated knowledge of patient profiles on an individualized basis and makes identification of broad-spectrum treatments impossible. As a result, management of such complexity calls for advanced diagnostic methods that can differentiate specific neuropathy subtypes and etiologic mechanisms.

-

Obstacle in early and accurate diagnosis: In the sensorimotor neuropathy market, difficulty diagnosis the disease earlier and accurately, pose a major challenge. The typically insidious onset and non-specificity of initial symptoms, potentially overlapping with other systemic or neurological diseases, cause delay of diagnosis. Delayed or erroneous diagnoses may thus preclude the timely application of specific treatments that could avoid permanent damage to nerves and loss of function. It involves overcoming diagnostic hurdles such as the creation and verification of novel biomarkers, improvement of electrophysiological and imaging technologies towards greater sensitivity.

Sensorimotor Neuropathy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 8.7 billion |

|

Forecast Year Market Size (2035) |

USD 15.88 billion |

|

Regional Scope |

|

Sensorimotor Neuropathy Market Segmentation:

Treatment Segment Analysis

In sensorimotor neuropathy market, medication segment is poised to dominate revenue share of over 35.5% by 2035, supported by the resultant need for symptomatic management and treatment of the disease. In addition, continued R&D efforts in creating new drug formats and treatment specific to the cause fuel the segment's consistent growth. For instance, in November 2024, Sangamo Therapeutics, Inc. announced that the U.S. FDA had cleared the investigational new drug (IND) application for its ST-503 program. It is an investigational epigenetic regulator for the treatment of intractable pain due to idiopathic small fiber neuropathy (iSFN), a type of chronic neuropathic pain.

Diagnosis Segment Analysis

The EMGs and motor nerve conduction test segment is emerging as one of the most prominent segments in the sensorimotor neuropathy market largely driven by the importance of the diagnostic information offered by such electrophysiological diagnostic tests. For instance, in August 2023, Cadwell Industries, Inc., had successfully launched Sierra NMUS1, a neuromuscular ultrasound device for electrodiagnostic medicine. This launch has expanded upon the released Sierra 4 software, a device which combines neuromuscular ultrasound (NMUS), clinical evoked potentials (EP), nerve conduction studies (NCS), and electro myography (EMG). The dual advantage of directly measuring both the target muscle and the motor nerve makes it essential.

Our in-depth analysis of the global sensorimotor neuropathy market includes the following segments:

|

Type |

|

|

Diagnosis |

|

|

Treatment |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Sensorimotor Neuropathy Market - Regional Analysis

North America Market Insights

North America sensorimotor neuropathy market is estimated to capture revenue share of over 41% by 2035, characterized by increasing healthcare facilities in emerging economies which ensures more access of patients to treatment and diagnosis. Besides, growth is also likely to be achieved because of escalating investments in research and developments. For instance, in January 2022, Eisana Corporation and Cortex Design have solidified a collaborative agreement for the development of Eisana’s first product to prevent chemotherapy-induced peripheral neuropathy (CIPN).

The most significant growth driver in the U.S. sensorimotor neuropathy market is innovations in healthcare technology, including sophisticated imaging modalities. Biomarkers, and gene therapies, are likely to enable more accurate diagnoses and personalized treatments. For instance, in October 2022, Astellas Pharma Inc. and Taysha Gene Therapies, Inc. announced a strategic investment to further advance Taysha's adeno-associated virus (AAV) gene therapy development programs for the treatment of Rett syndrome and GAN. It leveraged Astellas' worldwide R&D, manufacturing and commercialization resources in gene therapy to Taysha's cutting-edge AAV gene therapy development programs for CNS genetic diseases.

In Canada the growth in the sensorimotor neuropathy market is projected to grow rapidly during the stipulated timeline. The Government of Canada is working relentlessly to enhance Canada's life sciences and biomanufacturing industry in order to create safe and effective next-generation medicines. For instance, in March 2025, it was unveiled that, since March 2020, more than USD 2.3 billion has been invested to restore Canada's vaccines, therapeutics and biomanufacturing capacity across the nation. In addition, the federal government announced Canada is partnering with OmniaBio to increase its facility to produce cell and gene therapies and offer manufacturing services to firms globally, enhancing Canada's engagement in global value chains.

Asia Pacific Market Insights

The Asia Pacific sensorimotor neuropathy market is expanding at a rapid pace owing to the growing healthcare infrastructure in developing economies such as India and China. Furthermore, by providing patients with more access to diagnosis and treatment options the market is expected to experience growth. In addition, due to increased investment in research and development activities by pharmaceutical and biotechnology companies to develop new treatments regarding the potential complications associated with sensorimotor neuropathy.

In India, the sensorimotor neuropathy market is spurred by the focus of local governments to strengthen its healthcare ecosystem and create a conducive environment for all kinds of therapeutic treatments by fulfilling efficacy goals. For instance, I August 2024, India committed to invest USD 250 million in setting up the WHO's Global Centre for Traditional Medicine. The investment covered financial assistance to the work plan of the Centre, temporary offices, and the building of a new facility. This will be used to enhance the evidence base for traditional medicine through the provision of information on traditional medicine policies, practices, products, and public use.

In China, the sensorimotor neuropathy market is witnessing substantial growth attributed to the emphasis of pharmaceutical and biotechnology firms who are putting efforts and investments on the research and development to identify new treatments for sensorimotor neuropathy. For instance, in August 2023, Neurophth Therapeutics, Inc. unveiled the closing of close to 95 million USD of Series C+ financing. The raised funds were used to progress clinical trials for Neurophth's core products, improve the company's R&D competence and increase its pipeline.

Sensorimotor Neuropathy Market Players:

- Pfizer Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Eli Lilly and Company

- Novartis AG

- Abbott Laboratories

- GlaxoSmithKline plc

- Johnson & Johnson

- Merck & Co., Inc.

- Sanofi S.A.

- Biogen Inc.

Visionary pharmaceutical and medical technology companies are strategically investing in the sensorimotor neuropathy market. Research is increasingly being focused on individual treatment strategies and collaborative research studies, which are essential in propelling important progress. It ultimately results towards the betterment of the treatment and quality of life of sensorimotor neuropathy patients. For instance, in November 2024, Averitas Pharma, Inc., Grünenthal's U.S. affiliate, had finished recruiting for the Phase III clinical study AV001. The trial could support an extension of the U.S. label for QUTENZA (capsaicin) to 8% topical system, which is being used to treat post-surgical neuropathic pain (PSNP), if successful.

Here's the list of some key players in sensorimotor neuropathy market:

Recent Developments

- In June 2024, Argenx SE announced that it had presented new data from its entire autoimmune pipeline at the 2024 Peripheral Nerve Society (PNS) Annual Meeting in Montréal, Quebec.

- In April 2024, Vertex Pharmaceuticals Incorporated reported significant progress in its suzetrigine pain program, previously known as VX-548. It might be the first new class of medication for neuropathic and acute pain.

- Report ID: 7558

- Published Date: Dec 03, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Sensorimotor Neuropathy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.