Disposable Medical Devices Sensors Market Outlook:

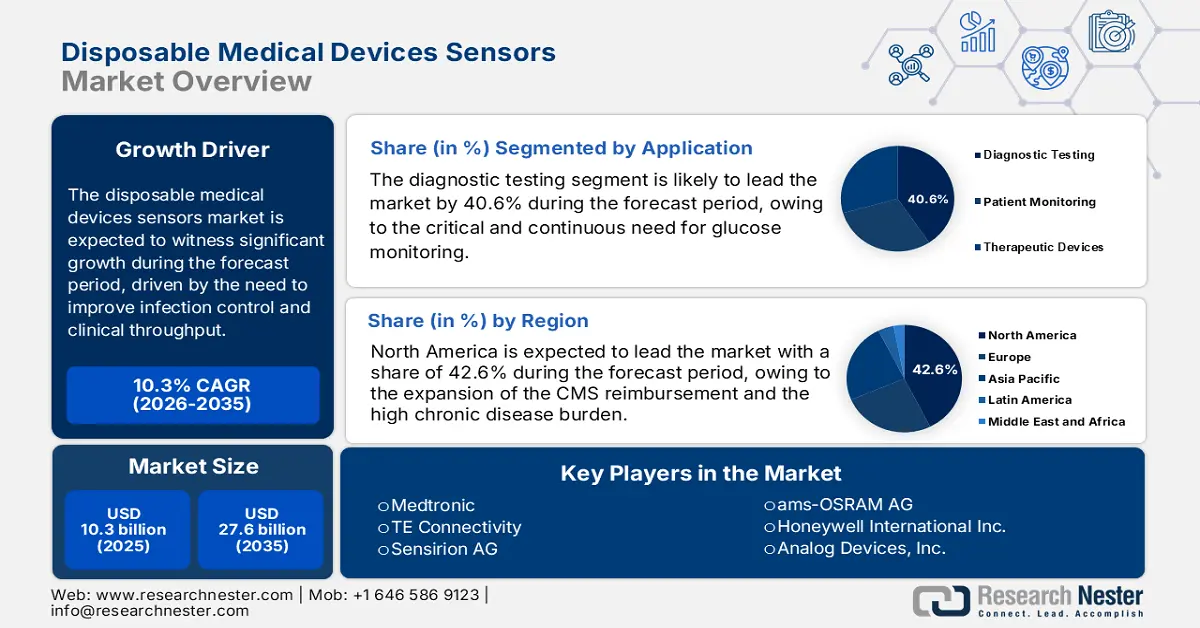

Disposable Medical Devices Sensors Market size was valued at USD 10.3 billion in 2025 and is projected to reach USD 27.6 billion by the end of 2035, rising at a CAGR of 10.3% during the forecast period, i.e., 2026-2035. In 2026, the industry size of disposable medical devices sensors at USD 11.4 billion.

Healthcare systems across the major economies are surging in the adoption of single-use sensing components to improve infection control, clinical throughput, and regulatory compliance. This drives the demand for the disposable medical device sensors market. In the U.S., hospital-acquired infections affect an estimated 1 in 31 hospitalized patients, which is 633,300 patients who contract infections annually, based on the AHRQ data in June 2024. This creates pressure to reduce the cross-contamination risks tied to reusable monitoring accessories and invasive devices. This has translated into rising procurement of disposable medical device sensors across patient monitoring, diagnostics, and point-of-care workflows, mainly in high-volume settings such as ICUs, emergency departments, and ambulatory surgery centers.

From a demand standpoint, the medical device consumption environment is expanding, and the U.S. health expenditure reached USD 4.9 trillion in 2023, with hospital care and physical services reaching over 10.4% of the total spend, as per the CMS 2023 data. Spending mix that favors scalable, low-risk consumables integrated into routine clinical processes. At the system level, government-backed infection prevention programs in the U.S., EU, and Japan are reinforcing purchasing shifts toward disposable sensing components in areas such as vital sign monitoring, respiratory care, and perioperative applications. Further, the spending patterns indicate the growth in disposable medical device sensors is being driven less by product innovation cycles and more by structural shifts in healthcare safety standards, reimbursement alignment, and public sector procurement policies, creating a stable volume-led demand environment for manufacturers and component suppliers.

Key Disposable Medical Devices Sensors Market Insights Summary:

Regional Highlights:

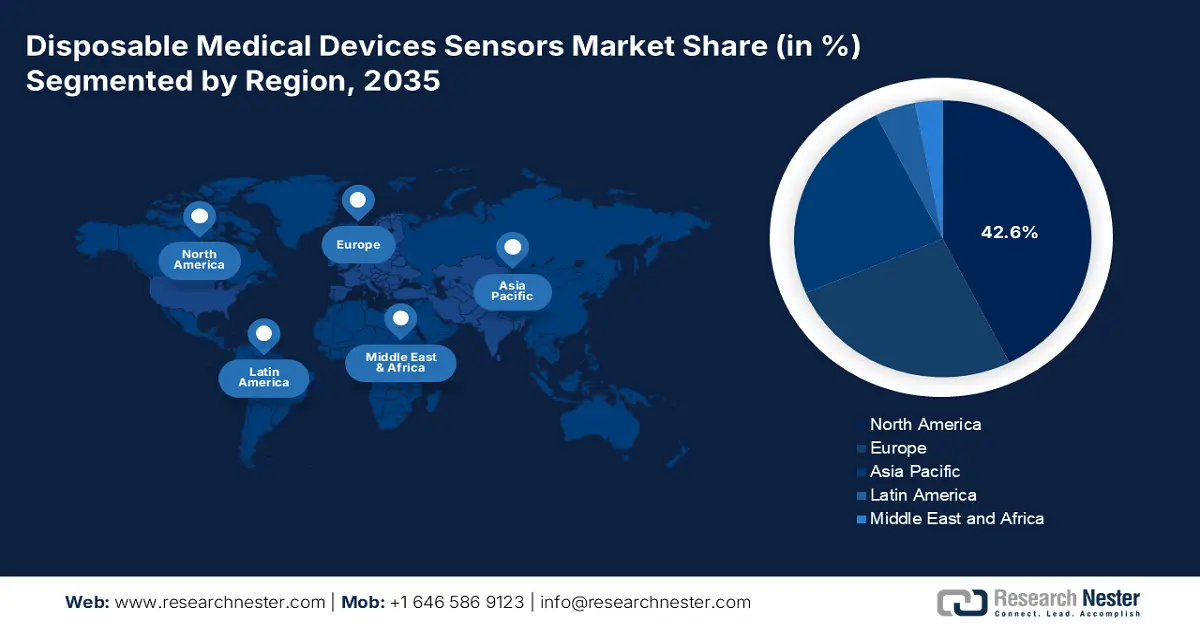

- North America is anticipated to command a 42.6% revenue share by 2035 in the disposable medical devices sensors market, reinforced by advanced healthcare infrastructure and expanded CMS reimbursement for remote patient monitoring.

- Asia Pacific is projected to register the fastest growth at a CAGR of 11.5% during 2026-2035, accelerated by rising healthcare expenditure and widespread adoption of telemedicine and remote patient monitoring.

Segment Insights:

- Diagnostic testing is the dominant application sub-segment in the disposable medical devices sensors market and is projected to account for a 40.6% share by 2035, underpinned by escalating demand for continuous glucose monitoring and the rapid expansion of point-of-care infectious disease testing.

- Home care settings represent the leading end-user sub-segment by 2035, strengthened by rising patient preference for remote self-management and supportive reimbursement frameworks accelerating adoption of disposable sensor-based home diagnostics.

Key Growth Trends:

- Expansion of public funding for critical care capacity

- Regulatory push for patient safety and single use devices

Major Challenges:

- Complex reimbursement and pricing pressure

- Technical challenges in miniaturization and accuracy

Key Players: Medtronic (Ireland), TE Connectivity (Switzerland), Sensirion AG (Switzerland), ams-OSRAM AG (Austria), Honeywell International Inc. (U.S.), Analog Devices, Inc. (U.S.), Texas Instruments Incorporated (U.S.), STMicroelectronics (Switzerland), NXP Semiconductors (Netherlands), Smiths Medical (U.S.), Merit Medical Systems, Inc. (U.S.), Sensile Medical (Switzerland), Microchip Technology Inc. (U.S.), Omron Corporation (Japan), Koninklijke Philips N.V. (Netherlands), Siemens Healthineers (Germany), TEKNICOR (South Korea), Nipro Corporation (Japan), Terumo Corporation (Japan), SCHOTT AG (Germany).

Global Disposable Medical Devices Sensors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.3 billion

- 2026 Market Size: USD 11.4 billion

- Projected Market Size: USD 27.6 billion by 2035

- Growth Forecasts: 10.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Brazil, South Korea, Mexico

Last updated on : 13 January, 2026

Disposable Medical Devices Sensors Market - Growth Drivers and Challenges

Growth Drivers

- Expansion of public funding for critical care capacity: Governments are scaling ICU and emergency care infrastructure, driving the higher consumption and demand for disposable medical devices sensors market for vitals, respiratory support, and hemodynamics. In the U.S., the federal COVID era investments permanently expand hospital surge capacity, with HHS continuing infrastructure grants to strengthen emergency preparedness. In parallel, the European Commission’s EU4Health program 2021 to 2027 has committed €5 billion to improve the healthcare system resilience, including hospital equipment modernization, based on the NLM study in February 2025. Disposable sensors benefit directly as hospitals standardize on infection safe low turnaround components in ICUs and operating rooms. This institutional stockpiling creates reliable, high-volume procurement contracts for manufacturers.

- Regulatory push for patient safety and single use devices: Regulators are strengthening safety standards that indirectly favor the adoption of disposable medical devices sensors market. The U.S.FDA continues to emphasize risk reduction in reusable device reprocessing while issuing regular guidance on infection control in medical settings. WHO’s Global Patient Safety Action Plan calls on governments to cut avoidable harm in healthcare, highlighting device-related infection risks. These frameworks are pushing the hospitals towards single-use sensing components in invasive and semi-invasive applications such as pressure monitoring, respiratory care, and perioperative monitoring. These factors position sensors as the regulatory alignment tools that reduce the compliance burden and inspection exposure for hospitals.

- Aging global demographics and long-term care need: The rising aging population in developed nations is a macroeconomic driver in the disposable medical devices sensors market. The PRB data in January 2024 projects that the number of people aged 65+ will be expected to rise from 58 million in 2022 to 82 million by 2050. This cohort has a higher prevalence of chronic conditions and utilizes a long term care services at a much greater rate, driving a sustained demand for monitoring devices in assisted living and home settings. Government healthcare spending, such as via Medicare, is inherently linked to serving this growing demographic, ensuring a budget allocation for necessary monitoring technologies. This sustained demographic trend guarantees a stable and growing end-market for monitoring solutions.

Challenges

- Complex reimbursement and pricing pressure: Securing insurance reimbursement codes is vital for adoption. The government payers, such as CMS, enforce stringent cost-effectiveness analyses leading to aggressive price negotiations. For example, the top player secured broad reimbursement but only after demonstrating long-term cost savings in diabetes management. The disposable medical devices sensors market is set to grow despite government pricing constraints squeezing manufacturing margins. The disposable medical devices sensors market is set to grow despite government pricing constraints squeezing manufacturing margins. For instance, achieving a new CPT code can take over two years.

- Technical challenges in miniaturization and accuracy: Achieving clinical-grade accuracy in a single use low cost form factor is the core technical hurdle. Drift calibration and interference must be eliminated. Companies excel by using CMOS-based technology to create tiny digital sensor modules, but such expertise is rare. Balancing performance, disposability, and cost requires breakthrough engineering that many newcomers lack. This often mandates costly, proprietary manufacturing processes from the outset.

Disposable Medical Devices Sensors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.3% |

|

Base Year Market Size (2025) |

USD 10.3 billion |

|

Forecast Year Market Size (2035) |

USD 27.6 billion |

|

Regional Scope |

|

Disposable Medical Devices Sensors Market Segmentation:

Application Segment Analysis

Within the disposable medical devices sensors market, the diagnostic testing sub-segment is the dominant application segment and is expected to hold the share value of 40.6% by 2035. The segment is fueled by the critical and continuous need for glucose monitoring in the global diabetic population and the expansion of point-of-care infectious disease testing. The shift towards decentralized healthcare and home-based diagnostics stimulated by the pandemic has solidified this segment’s lead as disposable sensors provide rapid, accurate results outside traditional labs. A key statistical driver is the substantial disease burden. In May 2024, reported that in 2021, 38.4 million people in the U.S. had diabetes, representing 11.6% of the population, which creates an immense and sustained demand for the disposable test strips and biosensors for daily management, ensuring this segment’s continued disposable medical devices sensors market supremacy.

End user Segment Analysis

In the end user segment, the home care settings sub-segment is the leading segment in the disposable medical devices sensors market. The segment is driven by the powerful convergence of patient preference, technological enablement, and evolving healthcare reimbursement models. The proliferation of user-friendly connected devices, such as continuous glucose monitors and disposable ECG patches, empowers patients to manage their chronic conditions remotely, reducing hospital visits and enabling proactive care. This trend is strongly supported by policy changes, for example, the CMS data shows a pivotal expansion with over a million Medicare beneficiaries gaining access to broader telehealth and remote monitoring services under pandemic era flexibilities extended via 2024. This regulatory and reimbursement tailwind directly fuels the adoption of disposable sensor-based kits designed explicitly for patient self-use outside clinical facilities.

Product Type Segment Analysis

Among the product types, the strip sensors maintain the highest revenue share in the disposable medical devices sensor market. The segment is driven by the colossal non-discretionary demand for the blood glucose test strips from the global diabetic population. Despite competition from emerging wearable technologies, the sheer volume, low cost per test, and established reimbursement pathways for strips ensure their sustained dominance. Their essential role is qualified by public health data; the U.S. Food and Drug Administration report in February 2025 indicates that nearly 8.4 million U.S. people use insulin, a therapy that typically requires frequent fingerstick glucose testing with disposable strips for safe and effective daily management. This massive, routine consumable need secures the strip sensor's leading position in the product landscape.

Our in-depth analysis of the disposable medical devices sensors market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Sensor Technology |

|

|

Application |

|

|

End user |

|

|

Placement Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Disposable Medical Devices Sensors Market - Regional Analysis

North America Market Insights

The North America disposable medical devices sensors market is dominating and is expected to hold the revenue share of 42.6% by 2035. The disposable medical devices sensors market is defined by the advanced healthcare infrastructure, high adoption of digital health, and favorable reimbursement policies. The key drivers include the expansion of the CMS reimbursement for remote patient monitoring and the high chronic disease burden. Strategic trends involve the integration of disposable sensors into value-based care models to reduce hospital readmissions and a strong focus on cybersecurity compliance for connected devices. The shift towards decentralized care and home-based management, supported by an aging population, ensures sustained demand for disposable monitoring solutions in both acute and ambulatory settings. Further, the FDA cybersecurity guidance mandates robust data protection features in new sensor designs.

The U.S. disposable medical devices sensors market is fundamentally driven by the structured reimbursement policies and a high chronic disease burden. The expansion of Medicare reimbursement for remote patient monitoring has created a direct economic model for providers to adopt sensor-based home monitoring kits. This is underpinned by substantial public health need the CDC's May 2022 report depicts that nearly 11.3% of the U.S. population has diagnosed with diabetes, ensuring consistent demand for glucose monitoring sensors. Further, the FDA’s evolving cybersecurity guidelines for connected devices mandate built-in security features shaping the next-gen product development and increasing compliance, such as the hospital readmissions reduction program, which financially incentivizes the health system to utilize monitoring technologies to improve outcomes and avoid penalties.

Estimated Prevalence of Diabetes in the U.S.

|

Characteristic |

Diagnosed diabetes Percentage |

Undiagnosed diabetes Percentage |

Total diabetes Percentage |

|

Men |

12.6 (11.1–14.3) |

2.8 (2.0–3.9) |

15.4 (13.5–17.5) |

|

Women |

10.2 (8.8–11.7) |

3.9 (2.7–5.5) |

14.1 (11.8–16.7) |

Source: CDC May 2024

Canada disposable medical devices sensors market is supported by a well-established medical technology manufacturing and R&D ecosystem, positioning the country as both a production base and innovation hub for single-use sensing components used in monitoring, diagnostics, and therapeutic applications. The report from Statistics Canada in December 2025 states that in 2023, Canada’s medical devices manufacturing sector generated CAD 13.7 billion in value added, with CAD 404 million to 445 million invested annually in R&D, of which nearly 85% is directed toward experimental development, reinforcing continuous product advancement in sensor enabled disposable devices. On the trade side, Canada has exported CAD 2.7 billion in medical devices, reflecting a deep supply chain integration with the U.S. healthcare system and enabling Canadian manufacturers to participate in high volume procurement cycles for infection control, point-of-care diagnostics, and patient monitoring. These structural strengths position Canada as a strategic supply and innovation for the disposable medical device sensors industry.

In- House R&D Expenditure (2023)

|

Metric |

Expenditure (USD million) |

|

Total in-House R&D |

370 |

|

Current in-House R&D |

361 |

|

Capital in-House R&D |

9 |

Source: Statistics Canada December 2025

APAC Market Insights

The Asia Pacific disposable medical devices sensors market is the fastest growing and is expected to grow at a CAGR of 11.5% during the forecast period 2026 to 2035. The market is driven by its large population, rising healthcare expenditure, increasing prevalence of chronic diseases, and significant government investments in digital health infrastructure. The key drivers include the push for universal health coverage, the expansion of private healthcare, and a growing middle class with greater access to advanced medical care. A prominent trend is the rapid adoption of telemedicine and remote patient monitoring, stimulated by the COVID-19 pandemic, which has created a sustained demand for connected single-use diagnostic and monitoring devices. The disposable medical devices sensors market is highly diverse, with mature economies such as Japan and South Korea focusing on high-tech innovation and aging demographics, while the emerging countries, such as China and India, are driven by volume, accessibility, and cost-effective solutions.

Government-led healthcare expansion and rising chronic disease burden are fueling the India disposable medical devices sensors market. The flagship Ayushman Bharat Pradhan Mantri Jan Arogya Yojana, the world’s largest government-funded healthcare insurance scheme, is a primary driver by providing million beneficiaries and creating a massive new market for essential diagnostic tools that often use disposable sensors. Further, the government production-linked incentive scheme for medical devices directly stimulates domestic manufacturing, including sensors, to reduce import dependency. This push aligns with the urgent need to address a growing non-communicable disease crisis. As per the JAPI study in May 2025, the prevalence of diabetes was 32 million in the year 2000, which rose to 74 million in 2021, and it is now 101 million. This data highlights the vast, continuous demand for glucose monitoring strips and other related single-use sensors, boosting the market volume and cost-sensitive nature.

China disposable medical devices sensors market is defined by the government-led technological upgrading, rapidly aging demographic, and the world’s largest patient base for chronic conditions. The central Healthy China 2030 blueprint prioritizes innovation in medical devices and the widespread adoption of digital health, creating a top-down policy environment highly favorable for smart connected disposable sensors. A key driver is the push to localize high-tech medical manufacturing and reduce the reliance on imports with state investment in domestic R&D and production capabilities. This strategy is vital to serve a vast aging population, according to the People’s Republic of China, in October 2024, the population aged above 60 reached 297 million in 2023. Further, the national prevalence of chronic disease is 81.1% based on the NLM study in February 2024. This creates a sustained large-scale demand for the home-based and institutional monitoring devices for elderly care, positioning China as the dominant player in the APAC region.

Europe Market Insights

The Europe disposable medical devices sensors market is defined by a strong regulatory framework, significant demographic pressures adn strategic investment from EU institutions. The primary drivers include a rapidly aging population, which increases the prevalence of chronic diseases requiring continuous monitoring, and the ongoing implementation of the medical device regulation mandating high safety and performance standards. A key strategic trend is the integration of sensor data into digital health ecosystems and value-based care models supported by the EU4Health Programme, aimed at strengthening health system resilience. The push for healthcare digitization, coupled with the need for cost effective solution in home care and remote patient monitoring, is creating a strong demand across both hospital and ambulatory settings.

Germany disposable medical devices sensors market is emerging as a strategic growth market for disposable medical devices sensors, supported by strong clinical adoption, regulatory progress, and industrial investment in smart healthcare technologies. One of the recent developments is Medtronic’s CE Mark approval of Simplera, an all-in-one disposable CGM, launched at the EASD meeting in Hamburg in September 2023, which highlights Germany’s role as a key entry point for the next gen single use glucose monitoring systems integrated with smart insulin delivery addressing the unmet need where less than 30% of MDI patients using the CGM achieve glycemic targets. At the same time, Germany’s medtech ecosystem is being strengthened by broader investments in sensor-enabled care platforms, including Henkel’s backing of Smartz AG’s smart adult care solutions in December 2022, which combine printed electronics with disposable hygiene products for continuous monitoring in care facilities. These developments position Germany as a major adoption market for disposable device sensors in the healthcare industry.

The UK disposable medical devices sensors market is fundamentally shaped by the unique pressures of its national health services, with a strong emphasis on operational efficiency and home-based care to reduce the hospital burden. The key growth drivers include the government’s strategic integration of digital health technologies into standard care pathways to manage high patient volumes, as evidenced by initiatives such as NHS England’s Virtual Wards program. A critical demographic driver is the aging population. The data from Richmond in August 2025 shows that the total percentage of the population aged above 65 is 17.2% in 2025, and this number is expected to rise. This trend directly fuels the demand for remote monitoring sensors for conditions such as chronic obstructive pulmonary disease and heart failure. The market is navigating with the UK Medicines and Healthcare products Regulatory Agency establishing its own approval framework for medical devices, creating a distinct pathway from the EU’s MDR.

Key Disposable Medical Devices Sensors Market Players:

- Medtronic (Ireland)

- TE Connectivity (Switzerland)

- Sensirion AG (Switzerland)

- ams-OSRAM AG (Austria)

- Honeywell International Inc. (U.S.)

- Analog Devices, Inc. (U.S.)

- Texas Instruments Incorporated (U.S.)

- STMicroelectronics (Switzerland)

- NXP Semiconductors (Netherlands)

- Smiths Medical (U.S.)

- Merit Medical Systems, Inc. (U.S.)

- Sensile Medical (Switzerland)

- Microchip Technology Inc. (U.S.)

- Omron Corporation (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Siemens Healthineers (Germany)

- TEKNICOR (South Korea)

- Nipro Corporation (Japan)

- Terumo Corporation (Japan)

- SCHOTT AG (Germany)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medtronic is a leader in the disposable medical devices sensors market leverages its vast integrated device portfolio to create closed-loop sensing and therapy systems. Its strategic focus is on embedding advanced disposable sensors into insulin pumps, neurostimulators, and cardiac diagnostics to enable automated data-driven treatment adjustments and predictive analytics, thereby strengthening its ecosystem lock-in. In 2025, the company invested USD 2.7 billion in R&D.

- TE Connectivity competes in the disposable medical devices sensors market as the critical component supplier, specializing in the highly reliable miniaturized sensor solutions for acute applications such as patient monitoring and ventilators. Its strategy hinges on deep material science expertise and co-engineering with the OEMs to develop novel sensing elements that meet the medical standards for accuracy and disposability. According to the 2024 annual report, the company has made a 10% of net sales in the sensor segment.

- Sensirion AG has carved a significant niche in the disposable medical devices sensors market via its mastery of CMOS-based microsensing technology. The company’s strategic initiative focuses on providing OEMs with compact digital and cost-effective sensor modules for parameters such as flow, humidity, and volatile organic compounds, enabling their integration into disposable diagnostics and respiratory devices.

- Ams-OSRAM AG is a pivotal player in the disposable medical devices sensors market, and it provides advanced optical sensing solutions, including miniature spectrometers and biosensing modules. Its strategy involves combining high performance emitters detectors and ASICs to create disposable lab-on-chip and point-of-care testing devices that bring critical blood analysis and vital sign monitoring to decentralized settings.

- Honewell International Inc. applies its industrial sensing heritage to the high-reliability segment of the disposable medical devices sensors market. Its strategic focus is on developing robust, single-use sensors for parameters such as pressure and gas in critical hospital equipment, ensuring patient safety and meeting rigorous regulatory requirements via proven, scalable manufacturing.

Here is a list of key players operating in the global disposable medical devices sensors market:

The global disposable medical device sensors market is highly competitive and fragmented, and is defined by the dominance of established multinational medtech giants alongside innovative smaller specialists. The key players strategically focus on extensive R&D to pioneer miniaturized cost effective and wireless sensor technologies, integrating IoT and connectivity for remote patient monitoring. The growth is primarily driven by acquisitions to expand product portfolios and geographic reach, as well as strategic partnerships with healthcare providers and digital health platforms to create integrated ecosystems. For example, in February 2025, Micro-Tech officially completed the acquisition of a 51% stake in Creo Medical S.L.U., a wholly owned subsidiary of Creo Medical Group plc. Further, the regulatory compliance and cost pressures are pushing manufacturers towards scalable production and value-based healthcare solutions.

Corporate Landscape of the Disposable Medical Devices Sensors Market:

Recent Developments

- In April 2025, Medtronic plc announced the U.S. Food and Drug Administration (FDA) approval for the Simplera Sync sensor for use with the MiniMed 780G system. With this approval, the MiniMed 780G system now offers more flexibility for users of the company's most advanced insulin delivery system.

- In January 2025, Arterex, a leading global medical device developer and contract manufacturer, announced the completion of its acquisition of Phoenix S.r.l., a European developer and manufacturer of medical devices with global sales.

- In June 2024, Insulet Corporation, the global leader in tubeless insulin pump technology with its Omnipod brand of products, announced that Omnipod 5, compatible with both Dexcom G6 and Abbott FreeStyle Libre 2 Plus continuous glucose monitor (CGM) sensors, is now fully available in the U.K. and the Netherlands for individuals aged two years and older with type 1 diabetes.

- Report ID: 8335

- Published Date: Jan 13, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Disposable Medical Devices Sensors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.