Disposable Oral Care Devices Market Outlook:

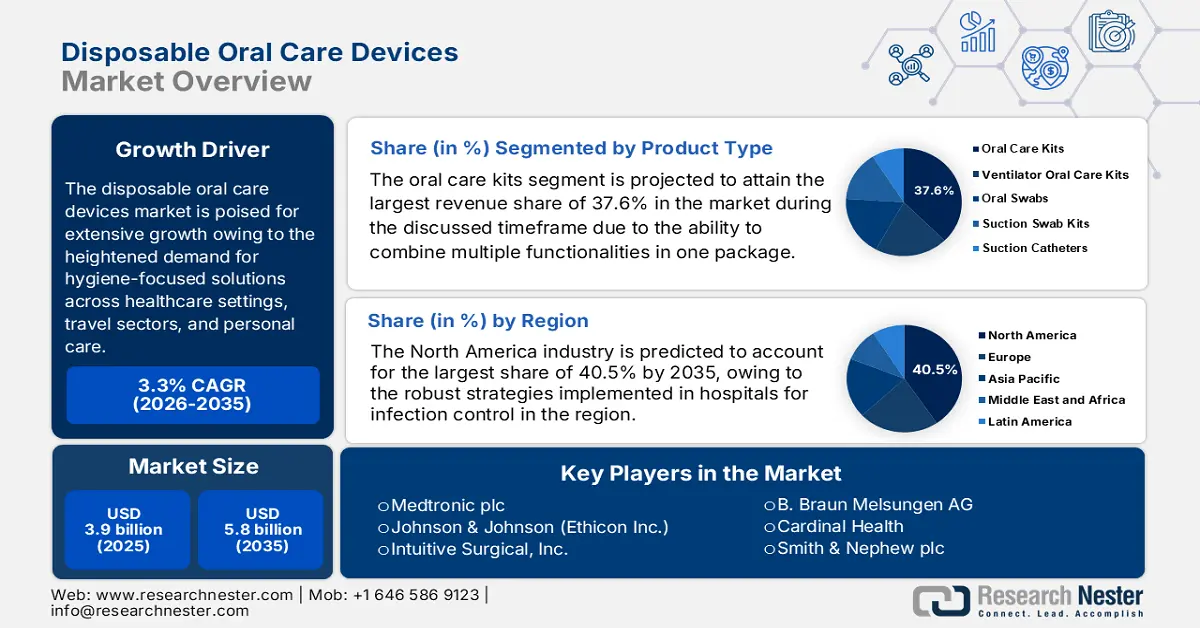

Disposable Oral Care Devices Market size was valued at USD 3.9 billion in 2025 and is projected to reach USD 5.8 billion by the end of 2035, rising at a CAGR of 3.3% during the forecast period, i.e., 2026‑2035. In 2026, the industry size of the disposable oral care devices is estimated at USD 4.0 billion.

The disposable oral care devices market is poised for extensive growth owing to the heightened demand for hygiene-focused solutions across the healthcare settings, travel sectors, and personal care as well. Rising awareness about infection control, especially in hospitals and long-term care settings, continues to promote the adoption of single-use oral care products such as toothbrushes, swabs, and mouth swabs. As per an article published by the WHO in March 2025, oral disorders affect around 3.7 billion people, wherein poor hygiene is one of the most significant factors creating a huge necessity for disposable solutions.

Furthermore, there has been a significant impact of economic burden on oral health, especially in the well-established markets. Testifying to this, the CDC in October 2024 revealed that annual dental care costs in the U.S. surpassed USD 136 billion, wherein untreated oral conditions also lead to substantial productivity losses, estimated at nearly USD 46 billion each year. In addition, the study also observed that oral health issues affect employment opportunities, wherein about 18% of working-age adults reported that their mouth and teeth appearance impacts job interviews.

Key Disposable Oral Care Devices Market Insights Summary:

Regional Highlights:

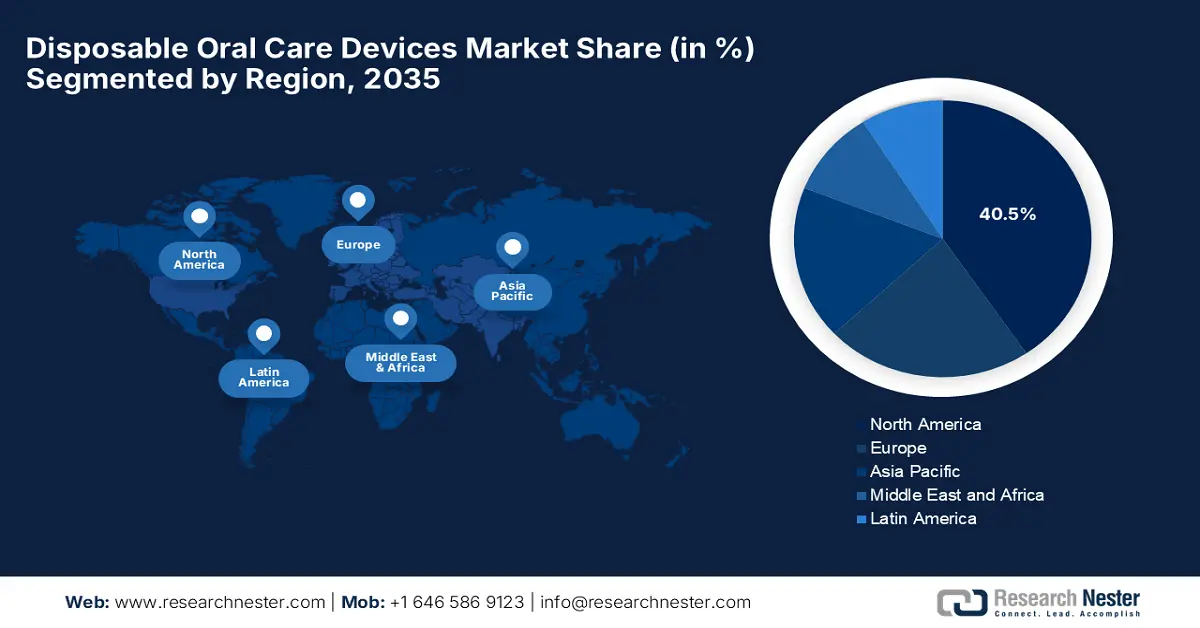

- North America is projected to capture a 40.5% share by 2035 in the disposable oral care devices market, attributed to robust strategies implemented in hospitals for infection control and long-term care provisions.

- Asia Pacific is expected to exhibit the fastest expansion through 2026-2035, stemming from a surge in healthcare infrastructure and rising awareness of infection control practices.

Segment Insights:

- The oral care kits segment is projected to attain a 37.6% share by 2035 in the disposable oral care devices market, supported by its integrated multi-function packaging.

- The online retail segment is anticipated to hold a 31.3% share by 2035, aided by the expanding convenience of e-commerce.

Key Growth Trends:

- Heightened demand in healthcare settings

- Rising awareness of oral hygiene

Major Challenges:

- Environmental concerns

- Regulatory & compliance hurdles

Key Players: Procter & Gamble Co., Colgate-Palmolive Company, 3M Company, Johnson & Johnson, Sunstar Americas, Inc., Unilever PLC, GlaxoSmithKline plc (GSK), Dr. Fresh, LLC, Jordan AS, Church & Dwight Co., Inc., High Ridge Brands Co., Supersmile, Yatsen Holding Ltd., Lion Corporation, LG Household & Health Care, Hawley & Hazel Chemicals Co., Dabur India Ltd., The Himalaya Drug Company, CCA Industries, Inc., Groupement Les Mousquetaires.

Global Disposable Oral Care Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.9 billion

- 2026 Market Size: USD 4.0 billion

- Projected Market Size: USD 5.8 billion by 2035

- Growth Forecasts: 3.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (40.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, Brazil, South Korea, Indonesia, Mexico

Last updated on : 6 October, 2025

Disposable Oral Care Devices Market - Growth Drivers and Challenges

Growth Drivers

- Heightened demand in healthcare settings: Since there has been an increased risk of infections, healthcare facilities are readily adopting disposable oral care. In March 2024, the CDC in March 2024 reported that hospitals and long-term care facilities have increasingly adopted disposable oral care devices to prevent non-ventilator healthcare-associated pneumonia, which is a common and serious infection in hospitalized patients. It also stated that the Department of Veterans Affairs’ HAPPEN project reduced pneumonia rates by 40% to 60% and saved millions in healthcare costs by using proper oral care protocols, hence presenting an optimistic market opportunity.

- Rising awareness of oral hygiene: The public health initiatives, along with dental associations, are readily promoting oral care, which is creating a greater consumer demand in this field. In March 2025, the European Federation of Periodontology, along with Dentaid, introduced an oral health throughout life campaign to raise awareness about the importance of maintaining oral health. The campaign also states that oral diseases affect people at every stage, thereby encouraging regular dental care and hygiene for people across all ages.

- Enhanced convenience: The disposable devices enable ease of use, making them highly preferable among travelers, caregivers, and individuals with limited mobility. In this regard, Oracura in August 2025 reported that it has expanded its water flosser line with travel-friendly kits, which are especially designed for busy travelers and families, combining advanced technology and portability to maintain oral hygiene, hence denoting a positive market outlook.

Prevalence and Age-Standardized Rates of Selected Oral Health Disorders

|

Disorder |

Prevalent Cases |

Age-Standardized Prevalence Rate (per 100,000) |

|

Caries of Permanent Teeth |

578.76 million |

30,658.1 |

|

Periodontal Diseases |

33.88 million |

1,794.7 |

|

Edentulism |

1.14 million |

60.4 |

|

Other Oral Disorders |

29.25 million |

1,549.6 |

Source:NIH

Challenges

- Environmental concerns: Despite the heightened demand, one of the pressing challenges in the disposable oral care devices market is the growing emphasis on sustainability and environmental responsibility. Most of these products are prepared from single-use plastics, which contribute to landfill waste and ocean pollution. Since the regulatory bodies and consumers are widely preferring eco-friendly alternatives, manufacturers face a dual challenge of redesigning products with biodegradable materials.

- Regulatory & compliance hurdles: The disposable oral care devices market operates under strict regulations associated with product safety, sterility, and clinical effectiveness, especially in hospitals and ICUs. Therefore, the regulatory frameworks necessitate compliance requirements that can ultimately cause a delay to the product launch, thereby limiting innovation in this field. Furthermore, regional variations in regulatory standards stand as a major obstacle to market upliftment.

Disposable Oral Care Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

3.3% |

|

Base Year Market Size (2025) |

USD 3.9 billion |

|

Forecast Year Market Size (2035) |

USD 5.8 billion |

|

Regional Scope |

|

Disposable Oral Care Devices Market Segmentation:

Product Type Segment Analysis

Based on product type, the oral care kits segment is projected to attain the largest revenue share of 37.6% in the disposable oral care devices market during the discussed timeframe. The ability of these kits to combine multiple functionalities in one package is a key factor driving the segment’s dominance. In January 2024, Lion Corporation announced the launch of its new oral care brand OCH-TUNE, offering products designed for personal brushing styles, which include toothpastes, toothbrushes, and mouthwashes in two styles: FAST for quick, refreshing care and SLOW for relaxed, thorough cleaning.

Distribution Channel Segment Analysis

In terms of the distribution channel, the online retail segment is predicted to garner a considerable share of 31.3% in the disposable oral care devices market by the end of 2035. The growth in the segment is highly subject to the rise of e-commerce, which is extremely convenient. For consumers, especially in developing countries. The online platforms are increasingly being utilized for disposables and shipping packages, which is further being influenced by the promotions and subscriptions facilitating repeat purchases.

End user Segment Analysis

Based on the end user, the hospitals segment is likely to capture a share of 29.6% in the disposable oral care devices market during the analyzed timeframe. The increasing awareness of hospital-acquired infections, stricter hygiene standards, and regulatory mandates are the key factors propelling this leadership. According to the CDC reports in November 2024, around 1 in 31 hospital patients in the U.S. has at least one healthcare-associated infection on any given day. Also, between 2022 and 2023, acute care hospitals saw significant reductions in several HAI types, including a 16% decrease in MRSA, 13% in CLABSI, 13% in C. difficile, 11% in CAUTI.

Our in-depth analysis of the disposable oral care devices market includes the following segments:

|

Segment |

Subsegments |

|

Product Type |

|

|

Distribution Channel |

|

|

End user |

|

|

Material Type |

|

|

Age Group |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Disposable Oral Care Devices Market - Regional Analysis

North America Market Insights

The North America market is anticipated to garner the largest revenue share of 40.5% of the global disposable oral care devices market by the end of 2035. The growth in the region is backed by robust strategies implemented in hospitals for infection control and long-term care provisions. Testifying to this, the CDC in May 2024 emphasized the importance of single-use or disposable devices in dental care, which are designed for use on one patient during a single procedure and should not be cleaned or reused due to their limited heat tolerance and cleaning concerns.

There is a sustained trajectory for the disposable oral care devices market in the U.S., backed by the presence of robust funding grants and key global pioneers. In 2024, MCHB reported that it funded nine four-year cooperative agreements, which are aimed at improving access to integrated preventive oral health care, especially for high-risk maternal and child health. The funding includes a total grant of USD 1.4 million to the National Maternal and Child Oral Health Resource Center for providing technical assistance across the country, and up to USD 425,000 annually to demonstration projects in seven states and one territory.

In Canada, the disposable oral care devices market is portraying steady growth owing to the combination of factors such as sustainability trends and substantial funding grants. As of the August 2024 Health Canada article, the Oral Health Access Fund is a grants and contributions program designed to complement the country’s dental care plan by expanding access to oral health care for targeted populations facing non-financial barriers. The total budget commitment for the plan is USD 250 million over three years, beginning in 2025, wherein funding is provided through two streams for both treatment and prevention of oral diseases.

APAC Market Insights

The Asia Pacific disposable oral care devices market is anticipated to thrive and register the fastest growth rate during the timeline between 2026 and 2035. The growth of the market is driven by a surge in healthcare infrastructure and rising awareness of infection control practices. China leads the market in the region, and growth is fueled by government initiatives, and there has also been a launch of various education campaigns, fostering the market growth. Furthermore, the old age population is rising in the country and is more susceptible to issues associated with gums and tooth decay, making disposable products highly appealing.

China is displaying huge dominance over the regional disposable oral care devices market owing to the government initiatives and an aging population that is increasingly susceptible to oral health issues. In September 2024, Hongshengyuan (Liaoning) Technology Co., Ltd., developed by CY International, announced that it had inaugurated its new factory in Dandong, which spans around 10,000 square meters and specializes in high-quality direct and indirect restoration materials. Therefore, this milestone marks the company’s global presence in the dental industry, making it suitable for standard market growth.

India has become the central player in the Asia Pacific’s disposable oral care devices market, due to the rising awareness about oral hygiene and the government's focus on improving healthcare infrastructure. As of September 2025, data from the country’s government shows that it has launched the National Oral Health Programme to provide integrated oral health care through existing healthcare facilities. It also stated that the programme aims to equip dental units with skilled professionals and necessary equipment at district and sub-district levels, with support for consumables and training to enhance oral health services.

Utilization of Dental Health Services and Associated Factors Among Adults in Ernakulam District, Kerala 2024

|

Parameter |

Statistic |

Value/Details |

|

Sample Size |

Total participants |

544 |

|

Dental Healthcare Utilization |

Percentage who visited the dentist within ≤1 year |

15.4% ± 2.9% |

|

Age Groups |

18–35 years |

24.3% (132) |

|

36–60 years |

48.2% (262) |

|

|

61+ years |

27.6% (150) |

|

|

Gender |

Male |

42.6% (232) |

|

Female |

57.4% (312) |

Source: Journal of Oral Biology and Craniofacial Research

Europe Market Insights

Europe is anticipated to garner a considerable share of the disposable oral care devices market by the end of 2035, propelled by strict regulations for infection prevention. The amalgamation of factors such as digital interoperability, government funding, and plastic bans is acting as a catalyst for market growth. In September 2021, GSK Consumer Healthcare reported that it had launched the first-ever carbon-neutral toothbrush called Dr.BEST GreenClean, which comprises a handle made from renewable cellulose and tall oil, and bristles that are derived from 100% renewable castor oil, thus a wider market scope.

Germany’s disposable oral care devices market is positioned as the largest revenue-sharing in Europe due to supported reimbursement policies by the German Medical Association. The combination of various factors, such as robust funding mechanisms and sustainability mandates, ensures the dominance of the country in the market in the coming years. In August 2025, DÜRR DENTAL SE notified that it has been named the country’s innovation Champion 2025, taking first place in WirtschaftsWoche’s ranking of the country’s most innovative medium-sized companies. The award, based on an evaluation of over 4,000 firms, recognized the firm for its strong R&D investment and a huge commitment to sustainable technologies.

The U.K. has a huge potential to capitalize on the disposable oral care devices market, effectively fueled by consumer preferences for convenience and hygiene. Besides the products, such as single-use toothbrushes, pre-pasted toothbrushes, and disposable flossers, are extensively utilized in travel, hospitality, and emergency settings. Furthermore, the key pioneers in the country are focusing on innovation and sustainability to meet the rapidly emerging demands of consumers seeking eco-friendly and convenient oral care solutions.

Key Disposable Oral Care Devices Market Players:

- Procter & Gamble Co.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Colgate-Palmolive Company

- 3M Company

- Johnson & Johnson

- Sunstar Americas, Inc.

- Unilever PLC

- GlaxoSmithKline plc (GSK)

- Dr. Fresh, LLC

- Jordan AS

- Church & Dwight Co., Inc.

- High Ridge Brands Co.

- Supersmile

- Yatsen Holding Ltd.

- Lion Corporation

- LG Household & Health Care

- Hawley & Hazel Chemicals Co.

- Dabur India Ltd.

- The Himalaya Drug Company

- CCA Industries, Inc.

- Groupement Les Mousquetaires

The global disposable oral care devices market is partially fragmented, wherein the large consumer goods corporations such as P&G and Colgate-Palmolive are dominating the landscape. These pioneers are also leveraging extensive distribution networks and strong brand loyalty, which is facilitating a favourable business environment in this sector. There has been an intensifying competition between the players owing to the huge focus on product innovation by developing eco-friendly materials and products for sensitive teeth.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In October 2024, V6CO and Dr.@home together launched DentalDuo, which is an all-in-one, disposable oral care tool designed for busy professionals, travelers, and people with braces or Invisalign. The toothbrush has built-in toothpaste, a double flosser, a removable toothpick, and a tongue scraper.

- In September 2024, InfuSystem and Sanara MedTech Inc. together announced that they entered into a strategic alliance with ChemoMouthpiece, LLC to bring together our combined technical, operational, and commercial strengths to deliver proprietary, efficacious dental products to patients.

- Report ID: 3679

- Published Date: Oct 06, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Disposable Oral Care Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.