Jet Aerators Market Outlook:

Jet Aerators Market size was valued at USD 1.7 billion in 2025 and is projected to reach USD 2.8 billion by the end of 2035, rising at a CAGR of 5.8% during the forecast period, i.e., 2026-2035. In 2026, the industry size of jet aerators is assessed at USD 1.8 billion.

The primary growth driver for jet aerators is the expanding need to treat municipal and industrial wastewater as urbanization and regulatory pressure intensify. As of the October 2025 data from the U.S. Environmental Protection Agency, wastewater treatment facilities in the U.S. process around 34 billion gallons of wastewater on a daily basis, which contains nitrogen and phosphorus from human waste, food, and detergents. It also stated that upgrading the treatment systems helps reduce nutrient discharges and lower energy and chemical costs, thereby supporting municipalities. In addition, approximately 20 % of homes in the country rely on septic systems, with 10% to20 % failing over their lifetimes, which reflects the strong need for enhanced treatment technologies and investment in wastewater infrastructure, hence positively impacting jet aerators market growth.

Furthermore, in terms of supply chain and trade dynamics, the market is broadly associated with wastewater treatment machinery. In this regard, FRED reported that the producer price index for machinery and equipment domestic water systems reached 277.326 in August 2025, which reflects changes in the cost of producing equipment used in water treatment as well as distribution. It also stated that this index, not seasonally adjusted, provides an opportunity for tracking inflationary trends in the water systems machinery sector. Therefore, this increase in the PPI indicates rising investment in terms of more advanced water treatment machinery, which can drive modernization and expansion of wastewater infrastructure. As manufacturers respond to higher equipment demand, production capacity and efficiency improvements are likely to stimulate overall growth in the jet aerators market.

Key Jet Aerators Market Insights Summary:

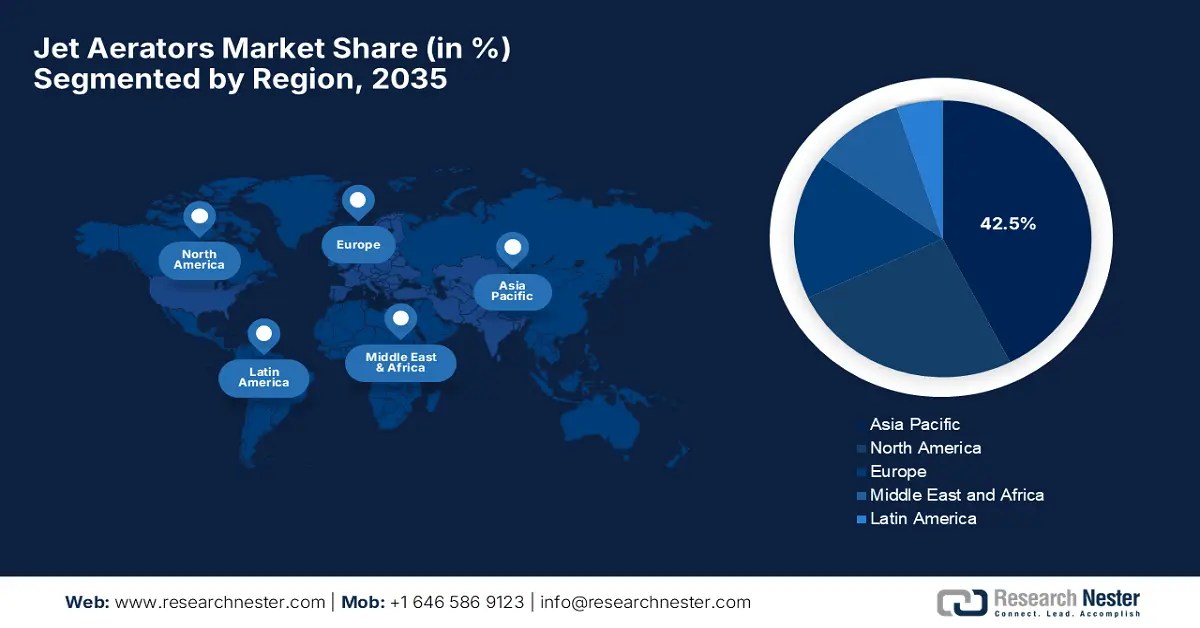

Regional Insights:

- The Asia Pacific region is anticipated to command a 42.5% share by 2035 in the jet aerators market, stemming from rapid urbanization, industrial expansion, and sizable infrastructure investments.

- North America is projected to secure a substantial share from 2026–2035, underpinned by the region’s strong emphasis on modernizing municipal and industrial wastewater infrastructure to meet environmental compliance.

Segment Insights:

- The wastewater treatment segment is projected to secure a 45.5% share by 2035 in the jet aerators market, propelled by stringent government regulations for wastewater discharge and the urgent need to upgrade aging water infrastructure.

- By 2035, the municipal segment is expected to hold a 38.4% share, supported by rising urban populations and increasing public investment in sanitation.

Key Growth Trends:

- Stringent environmental regulations

- Need for energy efficiency

Major Challenges:

- High initial investment costs

- Operational and maintenance complexity

Key Players: Sulzer Ltd. - Switzerland, KSB SE & Co. KGaA - Germany, Grundfos Holding A/S - Denmark, Ebara Corporation - Japan, Wilo SE - Germany, Torishima Pump Mfg. Co., Ltd. - Japan, NETZSCH Pumpen & Systemtechnik GmbH - Germany, Jung Pumpen GmbH - Germany, Seepex GmbH - Germany, Aquatec Maxcon Pty Ltd. - Australia, ArCh Enviro Equipment Pvt Ltd. - India, Euro Detox - India, Sun Mines Electrics Co., Ltd. - Taiwan, Parkson Corporation - U.S.

Global Jet Aerators Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.7 billion

- 2026 Market Size: USD 1.8 billion

- Projected Market Size: USD 2.8 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.5% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, Brazil, Indonesia, Mexico, United Arab Emirates

Last updated on : 17 November, 2025

Jet Aerators Market - Growth Drivers and Challenges

Growth Drivers

- Stringent environmental regulations: This, coupled with the infrastructure upgrades, is leading to increased volumes of wastewater, in turn prompting stricter discharge standards. Therefore, aeration standards are increasingly adopted by treatment plants to meet higher oxygen and mixing demands. In April 2024, the Europe Parliament reported that it had approved new rules revising the urban wastewater treatment directive to enhance public health and environmental protection. It also stated that by the end of 2035, all agglomerations above 1,000 p.e. must implement secondary treatment, with tertiary nutrient removal required by 2039 for plants above 150,000 p.e., and quaternary treatment for micro-pollutants mandated by 2045. Furthermore, the legislation also introduces extended producer responsibility for pharmaceuticals and cosmetics to fund advanced treatment, hence suitable for standard jet aerators market growth.

- Need for energy efficiency: The need for cost reduction and energy efficiency is prompting an extremely profitable business for the jet aerators market. Technologies that improve oxygen transfer efficiency and reduce operational costs are gaining traction, wherein jet aerators are preferred when they provide better mixing and lower energy use relative to legacy systems. Therefore, the EPA in June 2025 stated that municipal water and wastewater utilities are among the largest energy consumers, which are accounting for around 30% to 40% of total municipal energy use, wherein energy costs represent up to 40% of operating expenses. It also highlights that implementing energy efficiency measures, such as optimizing pumping, aeration, and motor systems, can reduce energy use by a significant 15% to 30%, providing substantial cost savings that positively impact market growth.

- Rising urbanization and wastewater volumes: Since there has been an increasing urban population and expanding industrial activity in emerging regions, the volume of wastewater requiring treatment is also growing significantly. Also, the ageing infrastructure in most of the regions, the need to expand or replace conventional aeration equipment, becomes a major opportunity for jet aerators. In this regard, the revised EU urban wastewater treatment directive, which came into force from January 2025, strengthens the collection and treatment of urban wastewater in towns over 1,000 inhabitants to protect human health and the environment. Besides, it also mandates tertiary nutrient removal, quaternary micropollutant treatment funded by polluters, and energy-neutral operations while promoting water reuse and resource recovery.

Challenges

- High initial investment costs: This has created hesitation among small-scale firms to establish their footprint in the jet aerators market. Jet aerators, especially industrial-scale systems, come with considerable amounts of expenses in terms of installation and commissioning, hindering widespread adoption. In this regard, smaller wastewater treatment facilities and the emerging firms often find the initial investment restrictive, which can hinder the expansion of this market. The high cost includes equipment along with the supporting infrastructure such as piping, blowers, and control systems, making it less attractive when compared to alternative aeration methods such as diffused or surface aeration systems.

- Operational and maintenance complexity: This continues to obstruct growth in the jet aerators market since they involve high-velocity fluid dynamics to achieve efficient oxygen transfer, which can result in increased wear and tear of components such as nozzles, pumps, and jets. On the other hand, continuous operation demands regular maintenance, skilled work personnel, and monitoring to prevent efficiency loss exacerbates these costs. In addition, facilities without trained staff or adequate maintenance protocols may experience higher downtime, reduced reliability, and raised operational costs in the long run, thus negatively impacting market growth.

Jet Aerators Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 1.7 billion |

|

Forecast Year Market Size (2035) |

USD 2.8 billion |

|

Regional Scope |

|

Jet Aerators Market Segmentation:

Application Segment Analysis

The wastewater treatment segment in terms of application is projected to gain the largest revenue share of 45.5% in the jet aerators market during the forecast period. This dominance is due to the stringent government regulations for wastewater discharge and the urgent need to upgrade aging water infrastructure. Most of the prominent organizations across the world emphasize the crucial role of advanced treatment, which also includes aeration, in protecting water quality and public health as well. Testifying to this in September 2022, Energy Nexus revealed that biological wastewater treatment often relies on aeration, which supplies oxygen to microorganisms that degrade organic pollutants under aerobic conditions, producing carbon dioxide, biomass, and water. It also stated that the process of aeration is highly essential for maintaining microbial activity and enhancing the efficiency of contaminant removal in biological processes, hence denoting a wider segment scope.

End-user Segment Analysis

By the end of 2035, the municipal segment based on end user is expected to attain a significant share of 38.4% in the jet aerators market. The rising urban populations and increasing public investment in investment in sanitation are the key factors driving the segment’s leadership in this field. Organizations advocate for improved wastewater treatment as a fundamental public health concern, which is pushing municipal authorities to adopt efficient aeration technologies, creating an encouraging opportunity for players in this field. In addition, the public health organizations and regulatory bodies emphasize the importance of effective wastewater treatment to prevent waterborne diseases and environmental contamination, further motivating municipalities to adopt advanced aeration solutions. Therefore, the presence of these factors collectively creates a substantial growth opportunity, particularly for those offering energy-efficient and scalable systems.

Product Type Segment Analysis

In terms of product type floating jet aerators segment is predicted to attain a lucrative share of 32.7% in the international jet aerators market during the analyzed tenure. The growth of the segment is efficiently driven by their operational flexibility, ease of installation, and high efficiency in terms of deep tanks and lagoons. Also, their design is well-suited for the different water levels, which are common in municipal and industrial treatment plants. In June 2021, Xylem stated that its Flygt Biboα is an energy-efficient dewatering pump that reduces energy use by up to 60% and lowers maintenance costs by 50% through smart, adaptive operation. It also reported that Field trials at Sweden’s Renström mine displayed a 40% savings in repairs and a 30% reduction in dewatering expenses, highlighting the impact of intelligent water technologies, hence denoting a wider segment scope.

Our in-depth analysis of the jet aerators market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

End user |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Jet Aerators Market - Regional Analysis

APAC Market Insights

Asia Pacific jet aerators market is expected to dominate the global dynamics, capturing the largest share of 42.5% during the forecast period. The region emerges as the leading growth area for aeration equipment owing to factors such as rapid urbanization, industrial growth, and large infrastructure investments in countries such as China and India. Governments in these markets are enforcing stricter effluent standards, in turn driving demand for jet aerator solutions. According to the United Nations Economic and Social Commission for Asia and the Pacific, February 2025 data, urbanization in the region is home to more than 2.2 billion urban residents, and is driving large-scale infrastructure development, including wastewater management systems. Also, the rapid industrialization, demographic changes, and climate pressures are pushing to expand sustainable water and wastewater infrastructure, thus fostering investment in advanced aeration technologies.

China in the jet aerators market has gained enhanced traction owing to the presence of beautiful China environmental cleanup initiatives and five-year plan targets for water quality improvements. On the other hand, large numbers of new and upgraded municipal treatment plants, coupled with industrial effluent requirements, are driving adoption of high-efficiency aeration technologies. For instance, in April 2025, Henan Eco Environmental Protection Equipment Co., Ltd. announced that it is exporting its latest jet aeration equipment to clients in China and the U.S., which reflects the rising global emphasis on sustainable wastewater treatment. The company also highlighted that the system enhances dissolved oxygen levels and optimizes mixing efficiency across various treatment instances, thereby positioning the country as a key growth contributor in the regional dynamics.

India is emerging as one of the most prominent players in the jet aerators market, wherein its wastewater infrastructure is modernizing in line with urban growth and national sanitation programmes. The country also benefits from a strong focus on nutrient removal, water reuse, and energy-efficient treatment systems, positioning aeration technologies as key equipment. In this regard, the NITI Aayog in November 2025 reported that, in partnership with the Government of Karnataka and BWSSB, it hosted a national workshop on the Reuse of Treated Wastewater in India to promote circular water management and strengthen water security for Viksit Bharat 2047. It stated that the discussions emphasized creating unified national standards, scaling up state-level reuse policies, and adopting cost-effective, decentralized treatment systems, which creates a greater potential for jet aerators to capitalize in this field.

North America Market Insights

North America has acquired a prominent position in the jet aerators market, capturing a lucrative revenue share from 2026 to 2035. This upliftment is readily propelled by a strong focus on upgrading the existing municipal and industrial wastewater infrastructure to comply with environmental regulations, in turn reducing operational energy costs. Therefore U.S. and Canada are adopting advanced aeration systems, which are a part of the retrofitting wave, emphasizing energy efficiency, monitoring, and automation. Furthermore, domestic manufacturers and service providers in the region benefit from the large installed base, service‑contract business models, and regulatory drivers for nutrient removal and lower emissions. Hence, the presence of all of these factors positions North America as a critical leader in the global market of jet aerators, hence creating opportunities for both domestic and international players.

The U.S. for the jet aerators market presents an extremely supportive dynamic, which is fueled by EPA regulation, clean water mandates, and a large number of publicly‑owned treatment works requiring upgrade or replacement. The aeration segment, including jet, diffused, and mechanical systems, is gaining business from municipal and industrial operators who are seeking lower energy consumption along with higher reliability. In February 2024, Newterra Inc. announced that it finalized the acquisition of Aeromix aeration and mixing portfolio from Fluence Corporation Ltd., thereby expanding its capabilities in industrial and municipal wastewater treatment. It also stated that the acquisition includes established brands such as Tornado, Hurricane, Typhoon, and Zephyr, which are best known for their float-mounted and sub-surface aeration systems, thus reinforcing its focus on customer value in the environmental treatment sector.

Canada has a huge opportunity to capitalize on the regional jet aerators market, which is efficiently driven by water‑quality regulation, industrial effluent standards, and a focus on energy-efficient water and wastewater treatment, supporting the adoption of aeration technologies. The municipalities and provinces in the country are increasingly investing in upgrades that include improved aeration components under federal and provincial financial programmes. In March 2023, the Government of Canada, together with the Federation of Canadian Municipalities, announced a substantial investment of USD 487,000 to support the City of Prince Rupert’s innovative wastewater management pilot project. The initiative was funded through the Green Municipal Fund, and it aims to integrate natural landscape features such as soils and plants into wastewater treatment to improve water quality and cut emissions, hence denoting a positive market outlook.

Europe Market Insights

Europe is emerging as one of the most influential and large markets for the jet aerators market, led by prominent countries such as Germany and the UK, which are focused on sustainability, nutrient removal, and circular economy drivers in wastewater treatment. The region’s market also benefits from stricter effluent standards and encourages the adoption of energy-efficient treatment equipment. In March 2023, WBIF reported that the European Investment Bank and the Government of North Macedonia signed a €70 million investment grant in Europe under the Western Balkans Investment Framework to build the country’s largest wastewater treatment plant in Skopje. It further underscored that the project is a part of the region’s Green Agenda and Economic and Investment Plan, which will improve wastewater management for around 500,000 residents, thus enhancing environmental and public health standards.

Germany in the jet aerators market is readily expanding on account of wastewater infrastructure benefits from strong regulatory oversight, and a robust manufacturing base for wastewater treatment equipment. The country also has a high standard for energy‐efficient systems, which provides an encouraging opportunity for both national and international players in this field. On the other hand, the treatment plants in this country are often early adopters of advanced aeration solutions, which include jet and fine‑bubble systems, supported by service networks and long-term performance contracts. Moreover, the country has a strong focus on sustainable water management and strict environmental compliance, which drives continuous innovation in aeration technologies. Hence, this creates an extremely favorable environment for the research, development, and deployment of jet aerators with enhanced efficiency and lower operational costs.

In the UK, utility companies are witnessing regulatory drivers from both water quality targets and carbon‑reduction commitments, which are driving consistent growth in the jet aerators market. In this regard, the dual pressure is pushing wastewater treatment operators to adopt upgraded aeration systems, which have an improved oxygen transfer and lower energy demand. In July 2025, the country’s government announced that it is planning to abolish Ofwat and create a single, powerful water regulator, alongside a £104 billion investment to upgrade sewage and water infrastructure, which is set to drive extensive demand for advanced wastewater treatment technologies. Also, stricter pollution controls and environmental targets are encouraging treatment plants to adopt energy-efficient aeration solutions, which also include jet aerators. Therefore, this regulatory overhaul and infrastructure expansion position the country as a growing jet aerators market for high-performance aeration systems.

Key Jet Aerators Market Players:

- Xylem Inc. - U.S.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sulzer Ltd. - Switzerland

- KSB SE & Co. KGaA - Germany

- Grundfos Holding A/S - Denmark

- Ebara Corporation - Japan

- Wilo SE - Germany

- Torishima Pump Mfg. Co., Ltd. - Japan

- NETZSCH Pumpen & Systemtechnik GmbH - Germany

- Jung Pumpen GmbH - Germany

- Seepex GmbH - Germany

- Aquatec Maxcon Pty Ltd. - Australia

- ArCh Enviro Equipment Pvt Ltd. - India

- Euro Detox - India

- Sun Mines Electrics Co., Ltd. - Taiwan

- Parkson Corporation - U.S.

- Xylem Inc. is a major player in the water‑technology space, with a broad portfolio that includes aeration and mixing systems such as its VARI‑CANT Jet Aeration System, which uses motive‑liquid jets and entrained air to provide high oxygen transfer efficiency. The company emphasises digital integration, energy efficiency, and long‑life service, positioning itself to capture demand in municipal and industrial wastewater treatment upgrades globally.

- Sulzer Ltd. provides aeration equipment, including self‑aspirating jet aerators as part of its Flow Equipment division. The company leverages its engineering heritage and large global footprint to offer modular, energy‑efficient aeration solutions capable of servicing municipal and industrial plants, and supports the lifecycle of its equipment via extensive service networks.

- KSB SE & Co. KGaA is recognised for its broad fluid‑handling portfolio and also extends into aeration systems, including next‑generation jet aerators for wastewater treatment. With its deep experience in pumps and mixers, KSB emphasises process reliability, adaptability to differing regulatory regimes, and supporting customers with both equipment and after‑market services in a competitive global arena.

- Grundfos Holding A/S, while best known for its pump business, has expanded into aeration technology, including compact energy‑saving systems suited for municipal wastewater and aquaculture. Its competitive approach focuses on integration with plant automation, real‑time performance analytics, and decarbonisation credentials, which appeal strongly to operators under tightening sustainability mandates.

- Ebara Corporation is the predominant leader in industrial machinery with wastewater treatment equipment, which produces aeration systems that handle challenging chemical or saline conditions often encountered in industrial effluent treatment. The company’s strategy emphasises reliability under harsh conditions, R&D in materials, and global service support, which helps it address niche segments and differentiate from more generic aeration‑equipment suppliers.

Below is the list of some prominent players operating in the global jet aerators market:

The global jet aerators market is dominated by established engineering-driven players such as Xylem, Sulzer, and KSB. These companies focus on energy-efficient and smart aeration solutions to meet stringent environmental regulations and the growing demand for wastewater infrastructure upgrades. Remote monitoring, predictive maintenance service, partnerships with EPC contractors, and acquiring niche technology firms are a few strategies opted for by the pioneers to uplift market growth internationally. In August 2025, Axius Water announced that it had acquired S&N Airoflo, which is a leading supplier of surface aeration systems, to expand its nutrient removal capabilities for municipal and industrial wastewater treatment. Hence, this strategic acquisition strengthens the firm’s global portfolio of high-performance wastewater solutions and enhances its ability to optimize treatment efficiency and reduce nutrient pollution.

Corporate Landscape of the Jet Aerators Market:

Recent Developments

- In October 2024, Newterra reported that it had significantly expanded its production and service footprint across North America, opening new facilities in Coraopolis, PA, Chaska, MN, San Luis Obispo, CA, and a service center in Bridgeville, PA, while increasing production capacity in Heber Springs, AR, and Brockville, Ontario.

- In March 2024, AERZEN announced that it had inaugurated a new 5,614-square-meter turbo manufacturing plant in South Korea, enhancing its production capacity and technological capabilities. The expansion enables a 10% energy efficiency improvement, over 30% turndown increase, strengthening AERZEN’s position in sectors such as water treatment, food processing, and air transportation.

- Report ID: 8239

- Published Date: Nov 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Jet Aerators Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.