Binder Jet Market Outlook:

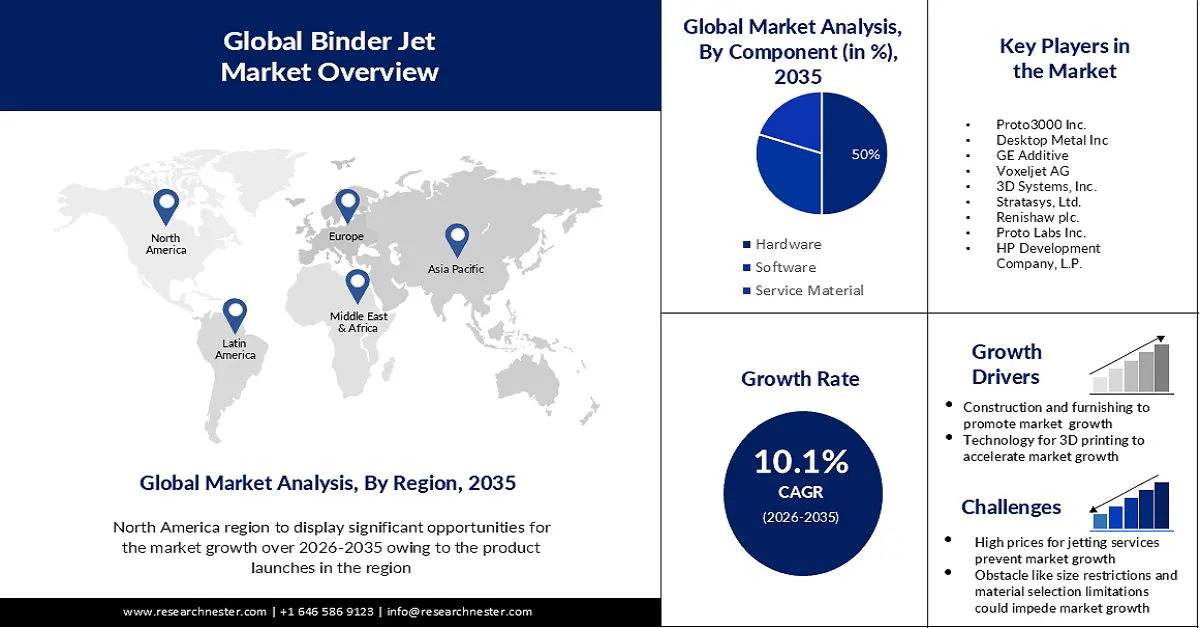

Binder Jet Market size was valued at USD 14.34 billion in 2025 and is likely to cross USD 37.53 billion by 2035, registering more than 10.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of binder jet is assessed at USD 15.64 billion.

The market is benefiting from technological advancements in binder formulations and post-processing techniques, enabling improved part strength, surface finish, and material versatility. For instance, in May 2024, Desktop Metal launched the upgraded Binder Jet 3D Printer with a Reactive Safety Kit that unlocks high-speed production of ultra-fine, titanium, and aluminum. Additionally, government and private sector investments in additive manufacturing research are accelerating innovation and commercialization.

Another key growth factor is the expanding use of binder jetting in sustainable manufacturing. Companies are leveraging the technology to produce sustainable alternatives to traditional manufacturing, using recycled powders and bio-based binders. The ability to print porous structures for filtration systems, energy-efficient components, and light-weight designs for transportation industries aligns with global sustainability goals, further driving market adoption.

Key Binder Jet Market Insights Summary:

Regional Insights:

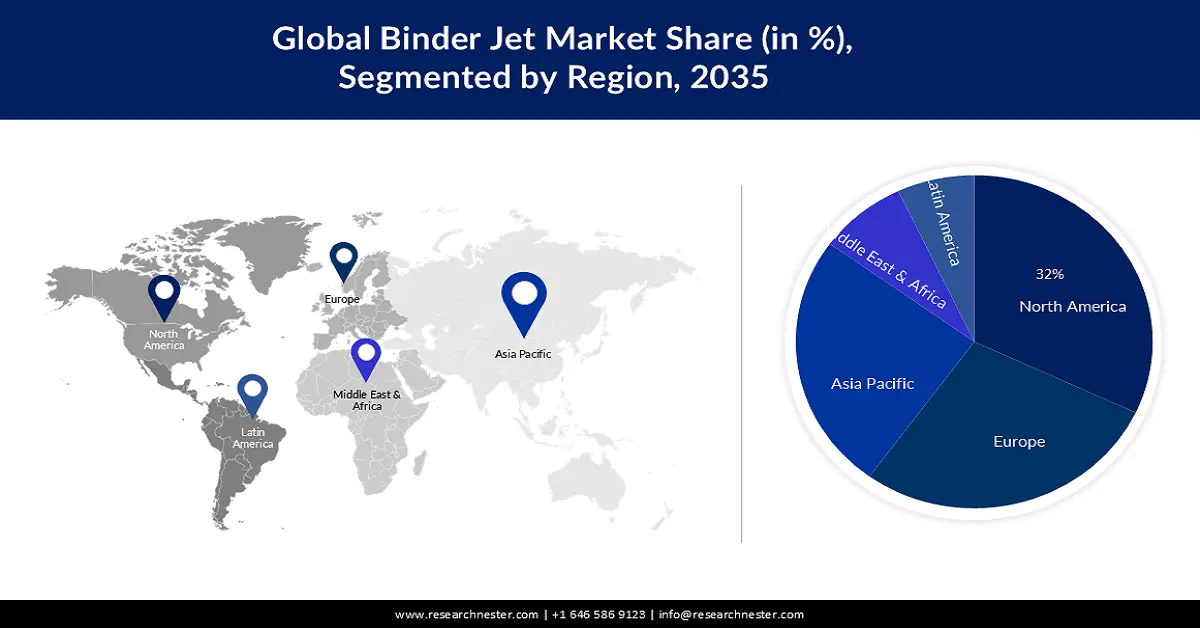

- By 2035, the North America binder jet market is forecast to hold a 32% share, attributable to increasing adoption in the aerospace, automotive, and healthcare industries.

- By 2035, Europe is anticipated to secure a 28% share, underpinned by strong demand from automotive and aerospace industries.

Segment Insights:

- By 2035, the hardware segment in the binder jet market is projected to account for a 50% share, propelled by growing consumer electronics penetration.

- By 2035, the automotive segment is expected to capture a 42% share, fostered by rising demand for customization in the automotive sector.

Key Growth Trends:

- Modern 3D printing technologies

- Rising number of construction and furnishings

Major Challenges:

- Limitation in material variety and performance

Key Players: Proto3000 Inc., Desktop Metal Inc, GE Additive, Voxeljet AG, 3D Systems, Inc., Stratasys, Ltd., Renishaw plc., Proto Labs Inc., HP Development Company, L.P.

Global Binder Jet Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.34 billion

- 2026 Market Size: USD 15.64 billion

- Projected Market Size: USD 37.53 billion by 2035

- Growth Forecasts: 10.1%

Key Regional Dynamics:

- Largest Region: North America (32% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Mexico, Singapore

Last updated on : 26 November, 2025

Binder Jet Market - Growth Drivers and Challenges

Growth Drivers

- Modern 3D printing technologies: Advances in powder binding processes, multi-material printing, and sintering techniques are expanding applications in several industries. The demand for high-volume production of complex geometries, coupled with sustainability initiatives and reduced material waste, is further accelerating the adoption of binder jetting worldwide. According to OECD, in November 2021, an upsurge of approximately USD 14,000 in imports of 3D printers is linked with a USD 3.3 million rise in the value of 3D printable goods exports, on average.

- Rising number of construction and furnishings: There are numerous applications for binder jetting technology in the construction and design industries, as it is crucial for exhibitions, retail fitting, and furniture development. It enables cost-efficient, sustainable, and rapid production of complex structures using concrete and sand-based materials, making it a significant area for manufacturers to establish themselves in. For instance, in January 2025, Roland DG launched the PB Series Powder 3D Printers, PB-600 and PB-400. The products are intended to build intricate ceramic objects, from architectural pieces and fine art replicas to crafts and bespoke interior decor.

Challenge

- Limitation in material variety and performance: This is a significant challenge, particularly for high-strength applications. While binder jet is effective in producing intricate parts, the range of materials that can be used with this technology is narrower compared to other 3D printing methods. This limits its adoption in industries requiring advanced material properties, such as aerospace and high-performance automotive manufacturing.

Binder Jet Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

10.1% |

|

Base Year Market Size (2025) |

USD 14.34 billion |

|

Forecast Year Market Size (2035) |

USD 37.53 billion |

|

Regional Scope |

|

Binder Jet Market Segmentation:

Component Segment Analysis

The hardware segment is expected to hold 50% share of the binder jet market during the forecast period. Rapid prototyping and enhanced production methods have gained significant importance, that helped the hardware sector greatly. The main factors driving the expansion include growing consumer electronics penetration, developing civil infrastructure, and reduced labor costs. It is anticipated that the growing trend of creating small-scale enterprises for these services would encourage category expansion.

End-Use Segment Analysis

The automotive segment of the binder jet market is anticipated to hold the largest revenue share, about 42%, during the forecast period. The market growth is majorly attributed to the rising demand for customization in the automotive sector. The technology’s ability to produce cost-effective custom parts with shorter lead times is driving its adoption in automotive manufacturing, further solidifying its dominance in the market. For instance, in March 2021, Ford Motor Company and the ExOne Company developed a patent-pending process for rapid and reliable binder jet 3D printing and sintering of aluminum that delivers properties comparable to die casting.

Our in-depth analysis of the global binder jet market includes the following segments:

|

Component |

|

|

End-Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Binder Jet Market - Regional Analysis

North America Market Insights

North America binder jet market is anticipated to hold the largest revenue share of 32% by 2035 due to increasing adoption in the aerospace, automotive, and healthcare industries. Key factors driving this growth include advancements in 3D printing materials, cost-effective mass production capabilities, and the demand for lightweight complex parts. Government support for additive manufacturing and sustainability initiatives is also contributing to market initiatives.

In the U.S., the binder jet market is driven by strong R&D investments, the presence of key industry players, and a well-established manufacturing system. Factors such as rising defense applications, customised medical implants, and eco-friendly production methods are fueling demand. Rising investments and funding are also boosting the country’s market. For instance, in November 2022, Desktop Metal received a USD 9 million order from a major German automaker for binder jet additive manufacturing systems used for the mass production of powertrain components.

Europe Market Insights

The binder jet market in Europe is projected to hold the second-largest share of about 28% by the end of 2035. The region’s market is driven by additive manufacturing technologies and strong demand from industries including automotive and aerospace. The region is known for its robust manufacturing base, with companies focusing on high-precision and customised parts. The presence of key players and innovation hubs further supports the market’s expansion in the region.

Germany is a key player in the binder jet market. The country’s emphasis on advanced manufacturing technologies makes it a leading adopter of binder jetting for producing complex and high-quality parts. The country’s well-established manufacturing companies foster several collaborations and other strategies, further accelerating the adoption of binder jet in Germany. For instance, in November 2021, The Schunk Group purchased an X1 25Pro for the serial production of binder jet 3D printed metal parts as a service to the automotive, aerospace, medical, and other industries.

Binder Jet Market Players:

- ExOne

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Proto3000 Inc.

- Desktop Metal Inc

- GE Additive

- Voxeljet AG

- 3D Systems, Inc.

- Stratasys, Ltd.

- Renishaw plc.

- Proto Labs Inc.

- HP Development Company, L.P.

Key players in the binder jet market adopt competitive strategies focused on technological innovation, cost reduction, and market expansion. These companies are investing heavily in R&D to enhance printing speed, material compatibility, and precision, while also forming strategic partnerships with manufacturers to scale production. Here’s a list of the companies dominating the market:

Recent Developments

- In February 2025, Roland DG Corporation announced that its subsidiary, DGSHAPE Corporation, inaugurated DGSHAPE DENTAL INDIA PRIVATE LIMITED as a sales and marketing subsidiary in India.

- In June 2023, JPB System acquired a stake in Addimetal, intending to develop an open hardware platform and the metal binder jetting process.

- In October 2022, GE Additive commercially launched its Series 3 binder jet platform, which is proficient in depositing a proprietary binder into parts up to 25 kilograms in size, rapidly, with wall thicknesses of less than 500µm.

- In September 2022, Roland DG established a joint venture company engaged in binder-jet 3D printer business in China.

- Report ID: 5445

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Binder Jet Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.