Injection Lipolysis Market Outlook:

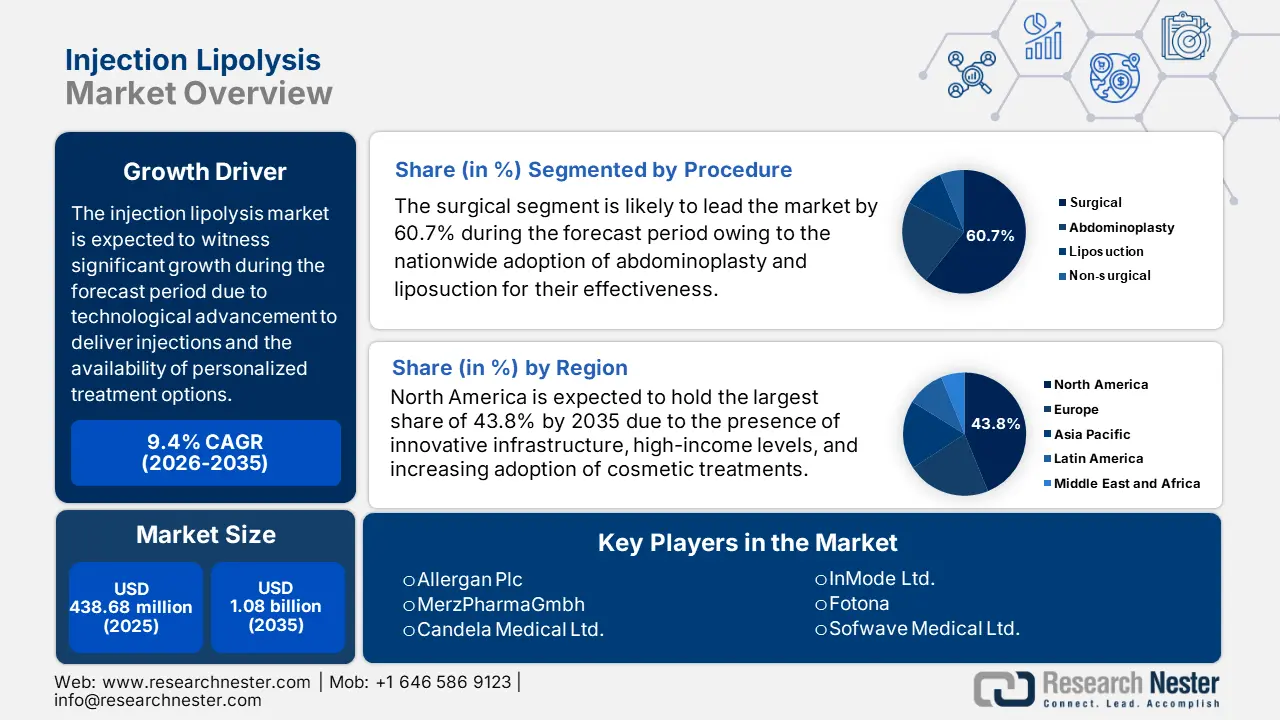

Injection Lipolysis Market size was over USD 438.68 million in 2025 and is anticipated to cross USD 1.08 billion by 2035, growing at more than 9.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of injection lipolysis is assessed at USD 475.79 million.

The injection lipolysis market has gained immense importance owing to the ability of targeting and reducing stubborn fat deposits in particular areas, and ensuring a non-surgical substitute to liposuction with nominal interruption. This treatment procedure is suitable for areas that struggle to exercise such as the abdomen, chin, and thighs, by providing a specific and operative body contouring solution. As per an analytical study published by NLM in November 2023, 100 patients underwent buccal fat pad removal, out of which 61 belonged to the injection lipolysis group and the remaining 39 to the control group. The success rate of the injection lipolysis group was 91.8% and 100% in the case of the control group, thereby denoting a growth opportunity for the market.

Furthermore, the development of the injection lipolysis highly depends upon the pricing strategy that readily impacts provider profitability and positively influences patient demand internationally. According to the 2025 America Society of Plastic Surgeons report, the cost of non-surgical fat reduction is USD 1,157 which is a part of the total cost, and this does not include other expenses. Besides, the market’s upliftment is also attributed to the export and import of syringes that are essential for the manufacturing of injections. As per the April 2025 OEC report, the global trade valuation of syringes is USD 7.58 billion and is the 741st most complex product that traded across nations with a complexity of 0.77, thereby effectively driving the market.

Nationwide Syringes Export/Import

|

Countries |

Export |

Import |

|

United States |

USD 956 million |

USD 1.09 billion |

|

France |

USD 857 million |

USD 770 million |

|

China |

USD 814 million |

- |

|

Germany |

- |

USD 905 million |

Source: OEC, April 2025

Key Injection Lipolysis Market Insights Summary:

Regional Highlights:

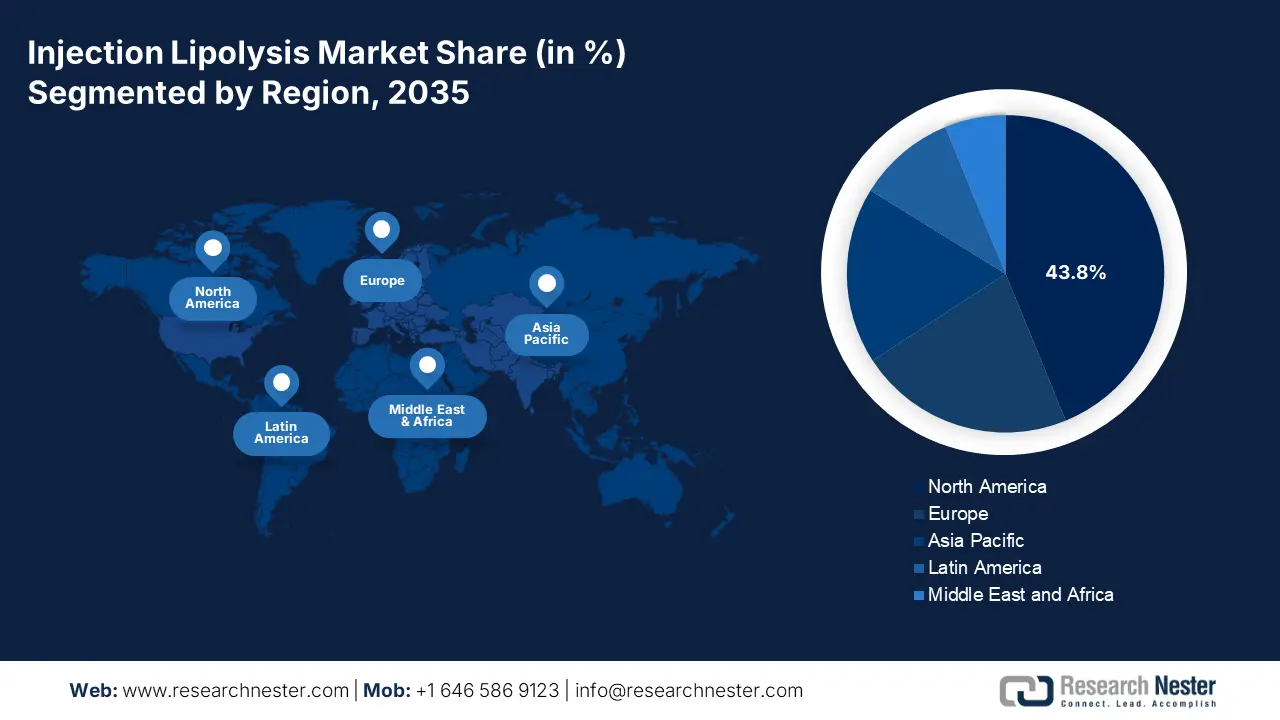

- North America dominates the injection lipolysis market with a 43.8% share, driven by medical innovation, rising disposable income, and widespread cosmetic procedures, ensuring robust growth through 2035.

- The Asia Pacific Injection Lipolysis Market is set for rapid growth by 2035, driven by increased acceptance of injection lipolysis and its effectiveness for body contouring.

Segment Insights:

- The Surgical procedure segment is anticipated to command a 60.7% share by 2035, fueled by the rising adoption of abdominoplasty and liposuction for effective fat removal.

- The deoxycholic acid segment is anticipated to hold a 59.8% share by 2035, fueled by U.S. FDA approval and widespread adoption in non-surgical fat reduction treatments.

Key Growth Trends:

- Demand for non-invasive beautifying treatments

- Rising occurrence of obesity

Major Challenges:

- Regulatory obstacles and safety issues

- Lack of training and scientific understanding

- Key Players: Alma Lasers, Cynosure, Inc., MerzPharma Gmbh, Candela Medical Ltd..

Global Injection Lipolysis Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 438.68 million

- 2026 Market Size: USD 475.79 million

- Projected Market Size: USD 1.08 billion by 2035

- Growth Forecasts: 9.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Injection Lipolysis Market Growth Drivers and Challenges:

Growth Drivers

-

Demand for non-invasive beautifying treatments: Cosmetic enhancement has gained more importance, which is the primary driver for the injection lipolysis market growth across nations. As stated in the February 2024 NLM article, fillers and botox are common noninvasive cosmetic procedures with a success rate of 23.8% and 38.4%, which inevitably caters to patients’ satisfaction level by improving the overall appearance and quality of life. Therefore, the presence and availability of such treatment options prove to be a fruitful for the evolution of the market.

- Rising occurrence of obesity: The urge to maintain the overall physical appearance by overcoming diseases such as obesity is yet another factor for the development of the injection lipolysis market. According to the March 2024 WHO report, 1 in 8 people usually reside with obesity. Additionally, in 2022, 2.5 billion adults suffered from being overweight, of which 890 million were obese. Besides, 390 million children between the age range of 5 to 19 years were overweight, with 160 million living with obesity. This is a huge opportunity for the increasing demand and expansion of the market globally.

Challenges

-

Regulatory obstacles and safety issues: The aspect of strict policies to maintain safety protocols causes a huge hindrance to the upliftment of the injection lipolysis market globally. Ingredients that are utilized to prepare these injections do not always receive approval from regulatory organizations. This eventually results in delayed production that ultimately leads to their unavailability in the market for standard treatment requirements. Besides, the approval for certain injections is time-consuming, which also negatively impacts the market growth as well as their acceptance.

- Lack of training and scientific understanding: The aspect of poor training has resulted in adverse effects after receiving injections, which deliberately hinders the growth of the injection lipolysis market globally. Besides, the unrealistic evolution in the market results in poor efficacy, especially among physicians. This ultimately leads to improper scientific understanding, which also negatively impacts the market expansion across nations. However, the need for qualified professionals is essential to combat these situations.

Injection Lipolysis Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.4% |

|

Base Year Market Size (2025) |

USD 438.68 million |

|

Forecast Year Market Size (2035) |

USD 1.08 billion |

|

Regional Scope |

|

Injection Lipolysis Market Segmentation:

Procedure (Surgical, Abdominoplasty, Liposuction, Non-surgical)

Based on procedure, the surgical segment is projected to garner the largest share of 60.7% in the injection lipolysis market by the forecast timeline. This growth is attributed to the rising implementation of abdominoplasty and liposuction for the effective removal of fat deposits, and is considered a significant choice for patients. According to a clinical study published by MDPI in September 2024, 20 patients were categorized into laser-based lipolysis and surgical fat removal groups. The evaluation was executed by utilizing measurements of skin texture, elasticity, and thickness, wherein the thickness was reduced by 34% in comparison to 17% for the surgical procedure. This denotes that the segment is gaining importance among patients, which positively impacts the market growth.

Drug Type (Deoxycholic Acid, Phosphatidylcholine)

Based on drug type, the deoxycholic acid segment is expected to account for a share of 59.8% in the injection lipolysis market during the forecast period. The segment’s growth is fueled by the U.S. FDA acceptance and nationwide adoption in non-surgical fat reduction treatments. As per the November 2022 Medline Plus government report, deoxycholic acid-based injection is available in a liquid form, which can be received 50 times in a particular treatment session. In the case of additional sessions, doctors can recommend 6 more sessions with a one-month gap, depending on the condition and response of patients. Therefore, this denotes the increasing demand for the drug type, which ensures the overall market expansion.

Our in-depth analysis of the global injection lipolysis market includes the following segments:

|

Procedure |

|

|

Drug Type |

|

|

Treatment Site |

|

|

Service Provider |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Injection Lipolysis Market Regional Analysis:

North America Market Analysis

North America is anticipated to hold the highest share of 43.8% in the injection lipolysis market by the end of 2035. The availability of innovation in medical facilities, an increase in the level of disposable income, and nationwide implementation of cosmetic procedures are certain factors that are responsible for boosting the market growth in the region. In addition, the presence of organizations and their effective contributions through the adoption of cutting-edge technologies is yet another factor for the market to increasingly gain more exposure in the region.

The injection lipolysis market growth in the U.S. is attributed to the presence of regulatory bodies that are responsible for the approval and acceptance of numerous injections, catering to the ailment of chronic disorders. For instance, in June 2021, the U.S. FDA approved Wegovy (semaglutide) injection for chronic weight supervision, especially among adults with obesity and overweight with at least one weight-related condition. This can additionally be used to reduce calorie intake and increase physical activity. Therefore, the authoritative acceptance of such injection-based drugs through regulatory organizations is uplifting the market readily.

The injection lipolysis market in Canada is subjected to expansion owing to investment-based strategies undertaken by the government. According to the May 2022 Government of Canada report, there has been the provision of USD 192 million as a fund for research and countermeasures to develop different vaccines since the onset of COVID-19. Besides, the government also provided an investment of USD 415 million to Sanofi Pasteur Limited to ensure the development of an end-to-end influenza vaccine manufacturing facility, thus a prolific opportunity for the market to expand in the country.

APAC Market Statistics

The Asia Pacific region is poised to be the fastest-growing region in the injection lipolysis market by the end of the forecast period. The growth is fueled by the acceptability and increased medical practice pertaining to this treatment in the region. Additionally, the procedure is considered an effective option for body contouring and has achieved traction owing to its capability to target localized fat deposits. Moreover, the presence of clinics and the need to maintain appropriate facial features are other factors responsible for driving the market growth in the region.

The injection lipolysis market in India is significantly growing since it is considered a standard and a non-surgical substitute to liposuction for body contouring and fat decrease in precise body areas. Additionally, the presence of dedicated hospitals and clinics in the country is also a factor driving the market development. For instance, Pristyn Care, which is located in Delhi, specializes in tailoring advanced treatments that include the utilization of Kybella injection. This injection, as stated in their 2025 report, efficiently diminishes under-chin fat by breaking down fat cells with deoxycholic acid, thus amplifying the market in the country.

The injection lipolysis market in China is gaining more exposure owing to the aspect of facial fat distribution among both the men and women populations. As per the October 2020 NLM article, patients with low face height with an approximate ethnic ideal rate of 54%, constitute exclusive facial attractiveness. The faces of people from the country are characterized by a retruded forehead, chin, and low nasal bridge, with certain features believed to bring good fortune. Therefore, based on these aspects, the market is projected to expand in the country in the upcoming years.

Key Injection Lipolysis Market Players:

- Allergan Plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Alma Lasers

- Cynosure, Inc.

- MerzPharmaGmbh

- Candela Medical Ltd.

- Solta Medical Bausch Health Companies, Inc.

- Lutronic Corporation

- InMode Ltd.

- Fotona

- Sofwave Medical Ltd.

- Sciton Inc.

- MicroAire Surgical Instruments

- Tris Pharma, Inc.

- Levita Magnetics

- Establishment Labs Holdings Inc.

Organizations in the injection lipolysis market are focusing on product unveiling, brand reputation, and market reach through strategies including mergers and acquisitions, and partnerships. For instance, in January 2025, MicroAire Surgical Instruments, part of Marmon Medical, notified the acquisition of NEOSYAD, which is an advanced medical device company that developed a breakthrough technology for adipose tissue engineering. This company received the approval of AdiMate device that optimizes operating times by combining the infiltration, liposuction, and adipose tissue preparation functions, thus driving market growth globally.

Here's the list of some key players:

Recent Developments

- In January 2025, Tris Pharma, Inc. declared its positive topline results from its ALLEVIATE-1 pivotal Phase 3 clinical trial evaluating cebranopadol, an investigational therapy, for the treatment of moderate-to-severe acute pain in patients following abdominoplasty surgery.

- In March 2024, Levita Magnetics proclaimed a significant breakthrough in surgical technology through its deployment of augmented reality (AR) in abdominal surgeries with the combined utilization of Levita’s MARS system with the Meta Quest 3 Headset.

- Report ID: 7595

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Injection Lipolysis Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.