Knee Hyaluronic Acid Injections Market Outlook:

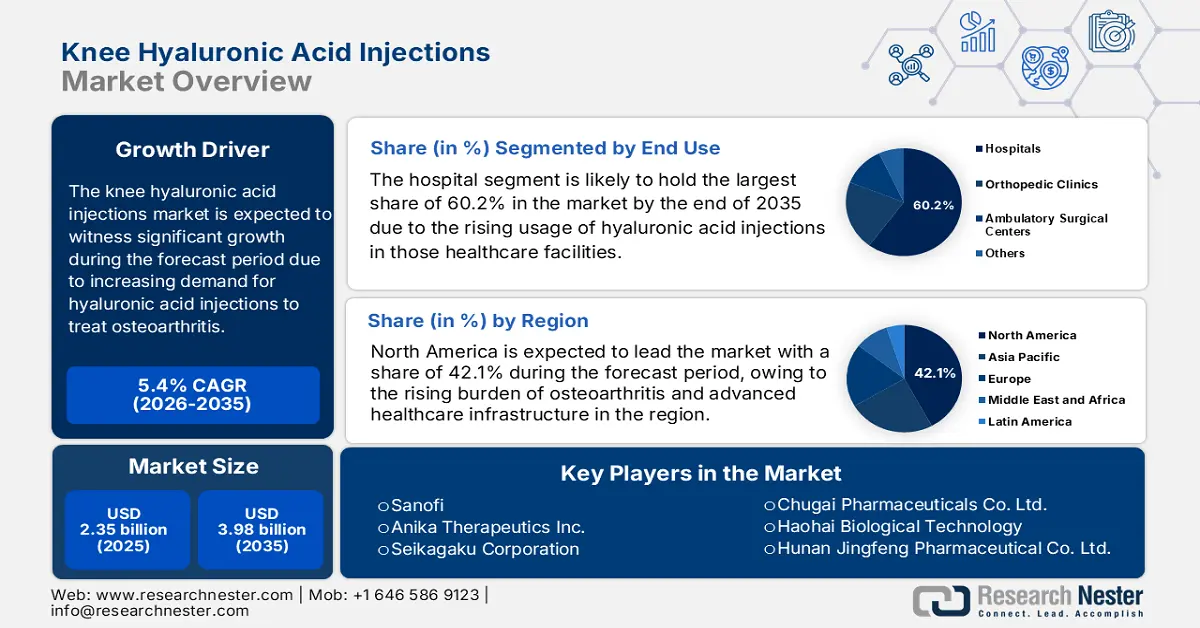

Knee Hyaluronic Acid Injections Market size was valued at USD 2.35 billion in 2025 and is set to exceed USD 3.98 billion by 2035, expanding at over 5.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of knee hyaluronic acid injections is estimated at USD 2.46 billion.

The market is expanding rapidly, driven by the increasing demand for minimally invasive treatments for knee osteoarthritis and the worldwide rise in healthcare expenditure. The ability of these injections to provide pain relief and improve joint mobility in patients is driving the progression of the industry.

As the instances of osteoarthritis grow, the demand for efficient treatment procedures also rises as a preferred alternative to surgical interventions. According to a WHO report in July 2023, nearly 528 million people were living with OA, which is a 113% increase from the past few decades. It further stated that knee is the most commonly affected joint, with a substantial prevalence of 365 million cases. This rising burden and the adoption of hyaluronic acid injections due to reduced side effects are also boosting the industry growth in the market.

Key Knee Hyaluronic Acid Injections Market Insights Summary:

Regional Highlights:

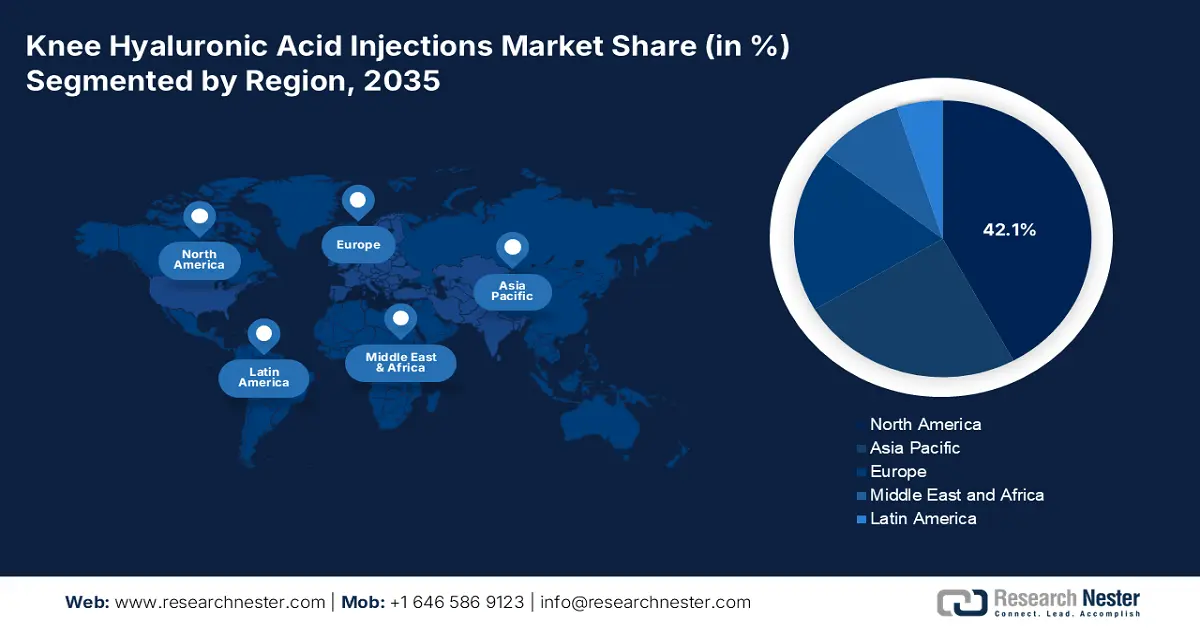

- North America's dominance in the Knee Hyaluronic Acid Injections Market, with a 42.1% share, is driven by advanced healthcare infrastructure and rising demand for OA treatments, ensuring robust growth through 2035.

- The Asia Pacific Knee Hyaluronic Acid Injections Market is projected for the fastest growth by 2035, driven by rising disposable income and innovations driven by pharmaceutical firms.

Segment Insights:

- The hospital segment is predicted to hold over 60.2% market share by 2035 due to the growing demand for HA injections, in addition to the rising instances of OA treatments in hospital settings.

- The three-injection segment is projected for substantial growth from 2026-2035, due to rising demand and accessibility of three-injection hyaluronic acid therapy.

Key Growth Trends:

- Rising geriatric population

- Shift toward outpatient treatments

Major Challenges:

- Rising costs and limited reimbursements

- Inconsistent clinical outcomes

Key Players: Seikagaku Corporation, Zimmer Biomet, Institut Biochimique SA (Bioventus LLC), Fidia Farmaceutici S.p.A, and

Global Knee Hyaluronic Acid Injections Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.35 billion

- 2026 Market Size: USD 2.46 billion

- Projected Market Size: USD 3.98 billion by 2035

- Growth Forecasts: 5.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (42.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Knee Hyaluronic Acid Injections Market Growth Drivers and Challenges:

Growth Drivers

- Rising geriatric population: One of the key drivers for the knee hyaluronic acid injections market is the rapidly increasing geriatric population globally, who are more susceptible to developing knee disorders. Age is the major risk factor contributing to the development of OA, fueling the demand for hyaluronic acid injections. As per a WHO report in October 2024, 1 out of 6 people is expected to be above 60 years by 2030. It further reported that by 2050, the number of people aged above 60 will double, with those over 80 will triple to 426 million maximum being from developing countries. This rise can significantly drive demand for knee hyaluronic acid injections in the market.

- Shift toward outpatient treatments: Another significant driver for the market is the global shift toward outpatient treatments over surgical interventions. According to a clinical study in June 2023, by The Journal of Arthroplasty, the total proportion of outpatient treatments in total knee arthroplasty rose from 0.4% to 14.1%. This implies that with bigger patient outcomes, the countries will be investing more in upgrading the healthcare infrastructure, resulting in high demand in the hyaluronic acid injections market for ensured safety.

Challenges

- Rising costs and limited reimbursements: The increasing costs of treatment that can lead to limited patient access is the major challenge posed by the market. These expenses are further exacerbated by the multiple injection sessions that are not covered in insurance claims or public healthcare systems, making it difficult for particular group of patients to access them. This creates a challenge in the knee hyaluronic acid injections market, limiting the industry expansion, particularly in price-sensitive regions.

- Inconsistent clinical outcomes: Another significant challenge is the variability in clinical outcomes associated with knee hyaluronic acid injections for knee osteoarthritis, straining the market penetration. Furthermore, this inconsistency, combined with ongoing debates within the medical community regarding the efficiency of these injections leads to hesitation among healthcare professionals to prescribe them. As a result, this hinders wider adoption, leading to slow market penetration.

Knee Hyaluronic Acid Injections Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.4% |

|

Base Year Market Size (2025) |

USD 2.35 billion |

|

Forecast Year Market Size (2035) |

USD 3.98 billion |

|

Regional Scope |

|

Knee Hyaluronic Acid Injections Market Segmentation:

End Use (Hospitals, Orthopedic Clinics, Ambulatory Surgical Centers)

Based on end use, the hospital segment is anticipated to dominate around 60.2% knee hyaluronic acid injections market share by the end of 2035. The growing demand for HA injections, in addition to the rising instances of OA treatments in hospital settings is the key driver for the dominance. As per a cohort study by NLM in February 2021, out of 515,256 individuals, the hospital admissions for conditions sensitive to outpatient care were 239 per 100,000 persons for OA patients. It further highlighted that there is an 11% increased risk for hospitalization in ACSCs. Hence, the study signifies the necessity, which in turn is boosting the market growth.

Product (Three Injection, Single Injection, Five Injection)

Based on the product, the three-injection segment is projected to account for a lucrative share in the knee hyaluronic acid injections market during the forecast period. The three injections provide sustained relief with reduced side effects, making it ideal for treatment procedure. As per research published in NLM in April 2022, the three-injection hyaluronic acid was most common out of 38 cases; 28.9% were three injections and 5.3% as two weekly injections. The increasing demand for these injections has boosted their production and accessibility across the diverse market, making them the ideal preference.

Our in-depth analysis of the global market includes the following segments:

|

End Use |

|

|

Product |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Knee Hyaluronic Acid Injections Market Regional Analysis:

North America Market Analysis

North America's knee hyaluronic acid injections market is projected to capture revenue share of around 42.1% by the end of 2035. The region benefits from an advanced healthcare infrastructure and a rising demand for hyaluronic acid injections for OA treatment. For instance, in December 2023, Bioventus Inc. announced an exclusive deal with Aetna Medicare to access DUROLANE, which is used for the treatment of osteoarthritis using single-injection hyaluronic acid-based joint fluid. Hence, the increasing collaborations between healthcare companies are propelling further market growth in the region.

The market in the U.S. is driven by advancements in technology and the growing demand for OA pharmaceuticals. Additionally, regulatory standards set by the FDA emphasize efficacy transparency and security, further boosting investments in the industry. According to a study by NLM in November 2022, the U.S. demonstrated significant linear growth from past decades below .001 with a mean absolute percent error of 7.3%. Thus, the study showcases the increasing demand for the product, driving the market expansion further.

Canada's market is witnessing growth due to its emphasis on improving healthcare access across its vast geography. The demand for knee OA treatment has surged, encouraging pharmaceutical firms to launch new products. For instance, in January 2021, Nuvo Pharmaceuticals Inc. announced the launch of NeoVisc + and NeoVisc ONE 4ml in Canada for pain management and joint functionality. It is to be indicated for mechanical arthropathy or age-related knee concerns. With such innovative launches the country’s market is anticipated to showcase lucrative growth opportunities during the forecast timeline.

Asia Pacific Market Statistics

The Asia Pacific knee hyaluronic acid injections market is projected to witness the fastest growth during the forecast period. Emerging countries in the region are focusing on shifting from traditional medicine to evidence-based joint treatments. The governing bodies across the region are enhancing healthcare access by adopting HA injections, especially in urban hospitals. This growth is majorly contributed by rising disposable income and expanding pharmaceutical firms driving innovations in the region, further boosting market expansion.

India's market is expanding majorly due to government initiatives and cost-effective treatment procedures. Additionally, the significant results from the hyaluronic acid injections are encouraging key players to launch more of such formulations. According to a study published in April 2022 by the International Journal of Research in Orthopaedics, a single intra-articular injection of Hylan GF-20 provided significant pain relief in grade III knee OA patients at 3,6 and 12 months. Such positive consequences are significantly boosting market innovation and expansion for a greater outcome during the forecast timeline.

China's market witnesses growth owing to its advanced manufacturing capabilities and extensive research infrastructure. The global players in the industry are focusing on exclusive partnerships for product launches to transform this sector. For instance, in April 2020, Eisai Co., Ltd. with Seikagaku Corporation announced the collaboration for the development and marketing of SI-613 (diclofenac conjugated sodium hyaluronate) in China, which is indicated for OA. Therefore, due to great demand from the aging population in the country and such launches, the market will witness significant progression.

Key Knee Hyaluronic Acid Injections Market Players:

- Sanofi

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Anika Therapeutics Inc. (DePuy Synthes Inc.)

- Seikagaku Corporation

- Zimmer Biomet

- Institut Biochimique SA (Bioventus LLC)

- Fidia Farmaceutici S.p.A

- Meiji Seika Pharma Co. Ltd. (OrthogenRx)

- Ferring B.V.

- Viatrus Inc.

- RION

- Hanmi Pharm Co. Ltd. (Teva Pharmaceuticals Industries Ltd.)

- Chugai Pharmaceuticals Co. Ltd.

- Haohai Biological Technology

- LG Chem Ltd.

- Yifan Pharmaceutical

- Hunan Jingfeng Pharmaceutical Co. Ltd.

Companies involved in the knee hyaluronic acid injections market are focusing on regional expansion by acquiring strong firms in emerging markets to improve supply chain efficiency. For instance, in December 2021, Avanos Medical, Inc. acquired OrthogenRx, Inc. for USD 160 million to strengthen its position in the hyaluronic acid industry by adding HA therapy products, such as GenVisc 850 and TriVisc, used in the treatment of OA knee pain. These expansion strategies are boosting companies’ growth and maintaining competition in the market significantly.

Below is the list of some prominent players in the industry:

Recent Developments

- In March 2025, RION announced the first patient enrollment for the phase 1b clinical study to analyze Purified Exosome Product (PEP), the single intra-articular injections to treat knee osteoarthritis.

- In July 2024, LG Chem Ltd. announced that its partner from China, Yifan Pharmaceutical, launched Synovian, which is a cross-linked hyaluronic acid - a single injection for osteoarthritis patients in China.

- Report ID: 7561

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.