Blepharospasm Treatment Market Outlook:

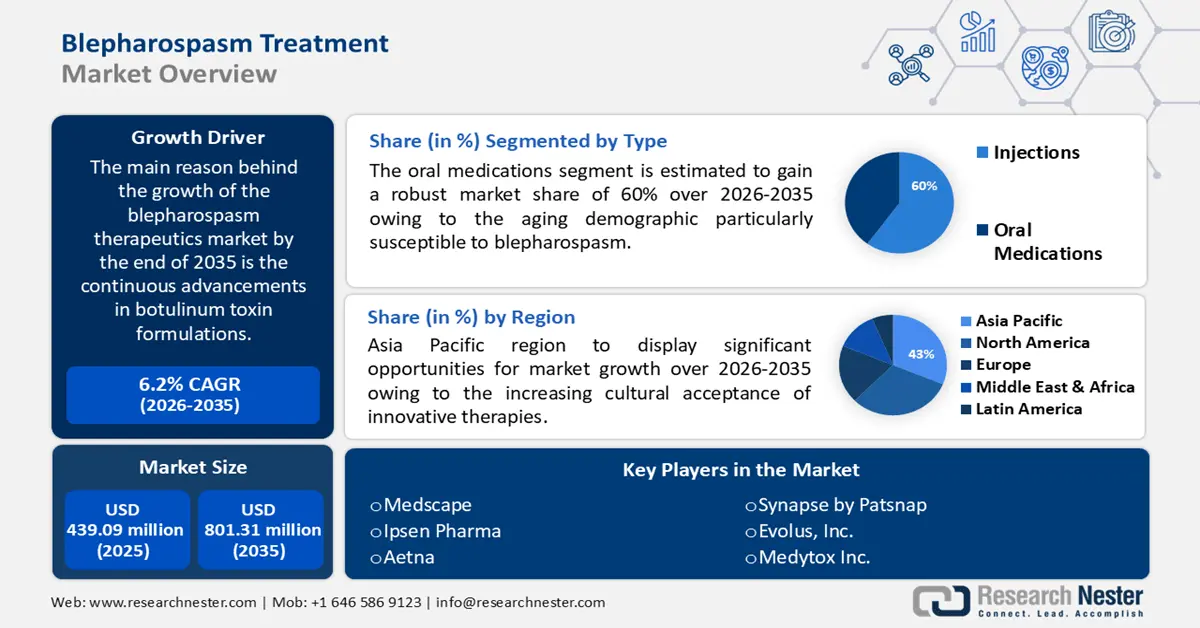

Blepharospasm Treatment Market size was valued at USD 439.09 million in 2025 and is expected to reach USD 801.31 million by 2035, registering around 6.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of blepharospasm treatment is evaluated at USD 463.59 million.

In recent years, the primary growth driver propelling the market is the continuous advancement in botulinum toxin formulations.

Botulinum toxin injections, notably Botox, have emerged as a cornerstone in managing blepharospasm, offering relief from the involuntary muscle contractions characteristic of the condition.

Pharmaceutical companies are investing significantly in research and development to enhance the precision and duration of botulinum toxin treatments. Innovations in formulations aim to improve targeted muscle localization, reduce side effects, and extend the intervals between injections, thereby offering patients a more convenient and effective therapeutic experience. According to a report, the botulinum toxin industry is projected to reach USD 15.86 billion by 2030.

Blepharospasm is a neurological disorder characterized by involuntary muscle contractions and spasms of the eyelid muscles. Furthermore, treatment for blepharospasm manage symptoms and enhance the quality of life for individuals affected by the same. General advancements in neurological treatments and understanding neurological disorders are responsible for stimulating growth in the blepharospasm treatment market.

Key Blepharospasm Treatment Market Insights Summary:

Regional Highlights:

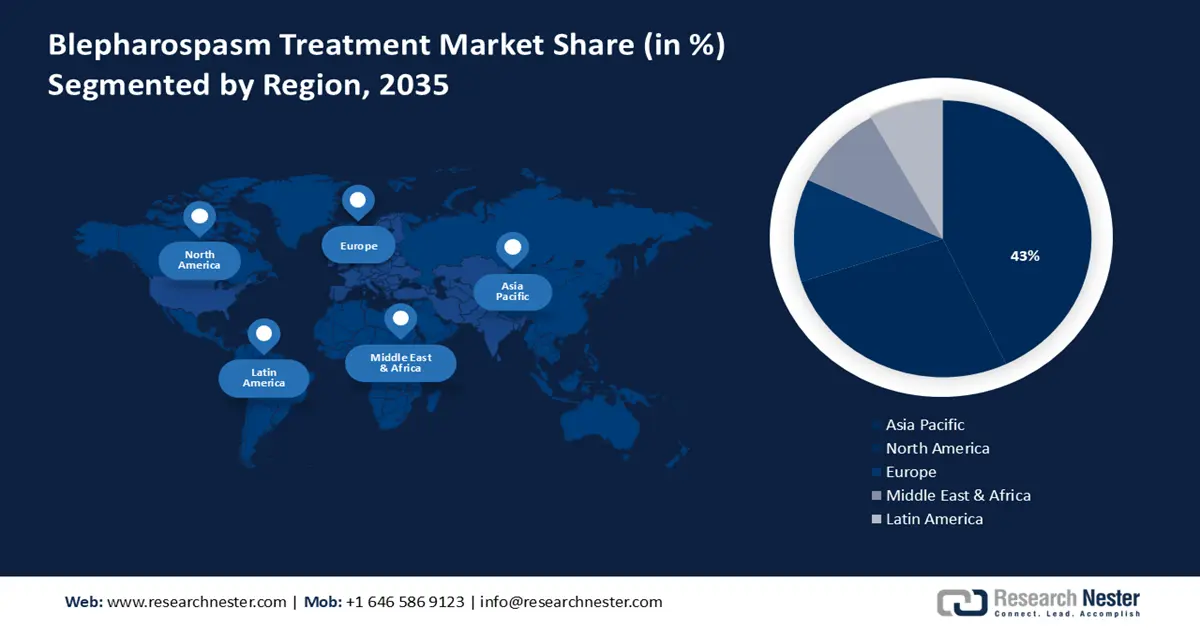

- By 2035, Asia Pacific is anticipated to command a 43% share in the blepharospasm treatment market owing to the increasing cultural acceptance of innovative therapies, including those for neurological disorders.

- The North American region is projected to secure the second-largest share during 2026–2035, supported by government initiatives and financial assistance that enhance the understanding and management of neurological disorders.

Segment Insights:

- The oral medications segment in the blepharospasm treatment market is poised to capture over 60% share by 2035, propelled by the aging demographic particularly susceptible to blepharospasm.

- The hospital segment is expected to attain a notable share by 2035, fostered by rising investments in neurology departments.

Key Growth Trends:

- Growing prevalence of blepharospasm

- Strategic collaborations and partnerships

Major Challenges:

- Limited awareness and early diagnosis

- High Cost of Treatment

Key Players: Ipsen Pharma, Medytox Inc., Revance Therapeutics, Inc., Merz Pharma GmbH & Co. KGaA, US WorldMeds LLC, Aetna.

Global Blepharospasm Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 439.09 million

- 2026 Market Size: USD 463.59 million

- Projected Market Size: USD 801.31 million by 2035

- Growth Forecasts: 6.2%

Key Regional Dynamics:

- Largest Region: Asia Pacific (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Canada, Australia

Last updated on : 26 November, 2025

Blepharospasm Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Growing prevalence of blepharospasm - The escalating prevalence of blepharospasm is a pivotal growth driver for the blepharospasm treatment market. As more individuals are diagnosed with this neurological disorder, there is an inherent demand for effective treatment options.

The rising awareness among both healthcare professionals and the general public contributes to early detection and intervention, driving the need for innovative therapeutic solutions. According to a comprehensive study, the global prevalence of blepharospasm has steadily increased in the U.S., and around 2000 cases are diagnosed annually. - Strategic collaborations and partnerships - Strategic collaborations and partnerships have emerged as instrumental growth drivers for the blepharospasm treatment market. Pharmaceutical companies, recognizing the complexity of neurological disorders, are pooling resources, expertise, and technologies to expedite the development of novel treatment. These collaborative efforts not only streamline the research and development process but also contribute to a diverse and robust pipeline of blepharospasm treatments.

- Expanding treatment modalities beyond botulinum toxin - The diversification of treatment modalities beyond traditional botulinum toxin injections is a noteworthy growth driver for the blepharospasm treatment market. Researchers are exploring neuroprotective agents, gene therapies, and neuromodulation techniques.

This expansion of therapeutic options not only addresses the varied needs of patients but also positions the market for sustained growth by offering a broader spectrum of interventions for blepharospasm management.

Challenges

- Limited awareness and early diagnosis - One of the significant challenges is the lack of awareness about blepharospasm among both healthcare providers and the general population. This often leads to delayed or misdiagnosed cases, hindering timely intervention.

Delayed diagnosis can result in prolonged suffering for patients and may limit the effectiveness of treatments. Increasing awareness through educational campaigns is crucial to address this challenge.

Addressing the challenges requires collaborative efforts from the medical community, pharmaceutical industry, regulatory bodies, and patient advocacy groups. Continuous research, education, and advocacy are vital to improving the landscape of blepharospasm treatment. - High Cost of Treatment

- Adverse Effects and Tolerance Development

Blepharospasm Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6.2% |

|

Base Year Market Size (2025) |

USD 439.09 million |

|

Forecast Year Market Size (2035) |

USD 801.31 million |

|

Regional Scope |

|

Blepharospasm Treatment Market Segmentation:

Type Segment Analysis

In blepharospasm treatment market, oral medications segment is likely to dominate over 60% share by 2035. The aging demographic, particularly susceptible to blepharospasm, favors the oral medications segment.

As the elderly often contend with polypharmacy (multiple medications), the convenience of oral administration aligns with the broader healthcare needs of this population. The oral medications segment is poised to benefit from the rising geriatric population seeking comprehensive and manageable treatment regimens.

Oral medications involve the use of illicit or prescription drugs and according to a report, 161 million people in the U.S. use prescription drugs simultaneously increasing growth in the oral medication segment.

The growth of the oral medications segment in the blepharospasm treatment market is further driven by increasing patient acceptance, advancements in formulations, targeted research, improved side effect profiles, and considerations related to the rising geriatric population.

End-User Segment Analysis

The hospital segment is expected to garner a significant share in the year 2035. Hospitals investing in their neurology departments contribute to the growth of the hospital segment in the blepharospasm treatment market.

Increased financial support enables the expansion of neurology services, fostering the recruitment of skilled professionals and the adoption of cutting-edge technologies, ultimately enhancing the quality of care for patients with blepharospasm. Hospitals play a central role in meeting the rising demand for botulinum toxin injections, a primary therapeutic modality for blepharospasm.

The expertise of healthcare professionals in hospitals, combined with the availability of specialized facilities, positions hospitals as key providers of this widely utilized treatment. The growth in demand underscores the significance of hospitals in delivering effective therapeutic solutions.

Our in-depth analysis of the market includes the following segments:

|

Type |

|

|

End-User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Blepharospasm Treatment Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific industry is likely to dominate majority revenue share of 43% by 2035, The increasing cultural acceptance of innovative therapies, including those for neurological disorders, is a notable growth driver.

As attitudes toward advanced treatments evolve positively, there is a greater willingness among patients in the Asia Pacific region to explore and adopt novel therapeutic options for conditions such as blepharospasm. Patient surveys in India indicate that over 30 million people are dealing with neurological disorders.

The blepharospasm treatment market in the Asia Pacific region is propelled by the rising geriatric population, increasing healthcare expenditure, technological advancements, government initiatives, and the cultural acceptance of innovative therapies. These factors collectively create a conducive environment for the development, adoption, and growth of therapeutic interventions for managing blepharospasm in this dynamic and diverse region.

North American Market Insights

The blepharospasm treatment market in the North American region is projected to hold the second-largest share during the forecast period. Government initiatives and financial support are pivotal in advancing the understanding and management of neurological disorders.

The substantial increase in funding reflects a commitment to addressing the healthcare needs of the population, including those with conditions like blepharospasm.

Government support acts as a catalyst for research, development, and accessibility of therapeutic solutions. Government spending on medical research in North America is nearly USD 30.1 billion as reported by the National Institutes of Health (NIH). North America is at the forefront of adopting cutting-edge technologies in the healthcare industry.

These advancements in the region enhance the precision and efficacy of therapeutic interventions for neurological disorders, including blepharospasm. The integration of innovative treatment modes contributes to improved patient outcomes and drives the growth of the blepharospasm treatment market.

Blepharospasm Treatment Market Players:

- Medscape

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Ipsen Pharma

- Medytox Inc.

- Revance Therapeutics, Inc.

- Merz Pharma GmbH & Co. KGaA

- US WorldMeds, LLC

- Evolus, Inc.

- Synapse by Patsnap

- Aetna

Recent Developments

- Ipsen acquired Epizyme, Inc., a US-based biotech company developing novel EZH2 inhibitors for cancer treatment, for USD 1.45 per share coupled with a contingent value right of USD 1.00 per share. This acquisition expanded Ipsen's oncology portfolio and added Tazverik® (tazemetostat), a first-in-class treatment for epithelioid sarcoma, to their pipeline.

- Ipsen completed the acquisition of Albireo Pharma, Inc., a US-based leader in bile-acid modulators for rare liver diseases, for USD 42.00 per share plus a contingent value right of USD 10 which is non-transferable. This acquisition strengthened Ipsen's rare disease portfolio with promising treatment for pediatric and adult cholestatic liver diseases and innovative pipeline potential.

- Report ID: 5484

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Blepharospasm Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.