Joint Pain Injections Market Outlook:

Joint Pain Injections Market size was over USD 6.52 billion in 2025 and is projected to reach USD 14.88 billion by 2035, witnessing around 8.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of joint pain injections is assessed at USD 7.02 billion.

A key driver of the market growth is the aging population, which is more susceptible to chronic joint conditions, particularly in the developed and developing regions. According to the 2019 World Population Prospects, 1 in 6 people in the world will be over age 65, which is a big leap from 1 in 11 people in 2019. The rising incidence of obesity and sedentary lifestyles is further contributing to the growing need for joint pain management solutions worldwide.

As per the National Safety Council, injuries increased by 20% in 2021 from 2020, 12% in 2022, and now 2% in 2023. These rising numbers of physical injuries are also boosting the market growth. Disorders such as osteoarthritis, and other degenerative joint diseases are driving the market growth further. According to the Radiological Society of North America (RSNA) 2022, osteoarthritis affects 32.5 million adults in the U.S. 43% of people suffering from the disease are 65 or older and 88% of people with OA are 45 or older, and 62% of individuals with OA are women. In 2023, 3.7 million people were treated in emergency departments for injuries involving sports and recreational equipment. These factors are projected to significantly boost the joint pain injections market growth during the forecast period.

Key Joint Pain Injections Market Insights Summary:

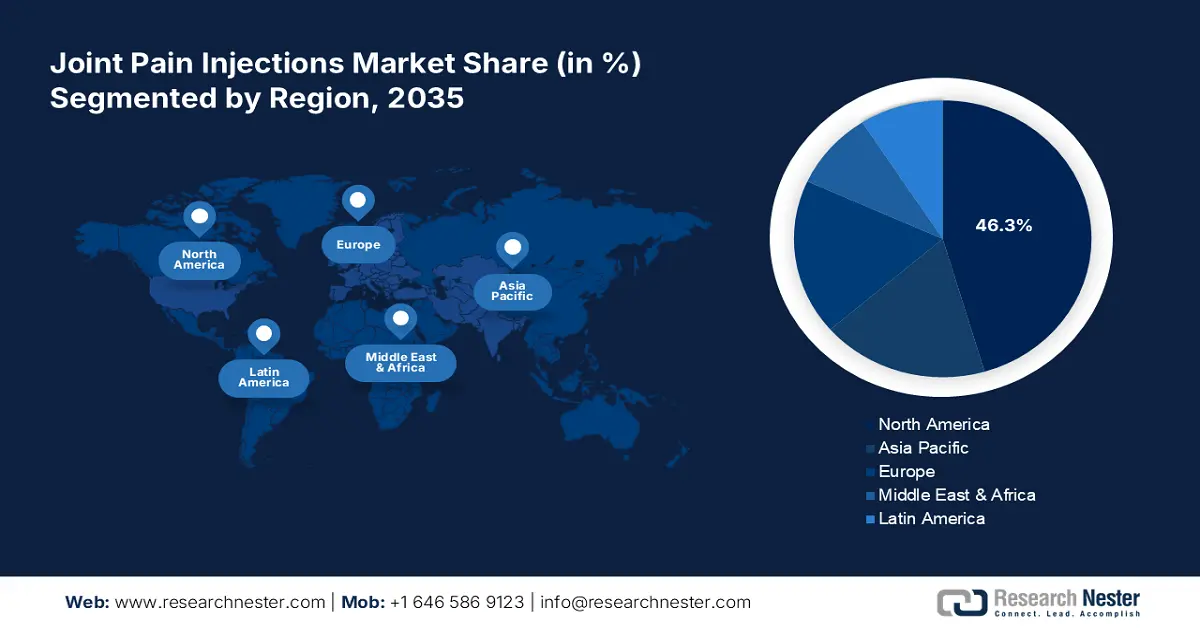

Regional Highlights:

- Asia Pacific holds a commanding 46.3% share in the joint pain injections market, driven by strong healthcare infrastructure and high adoption rate of advanced medical technologies, positioning it for significant growth through 2035.

Segment Insights:

- The Hyaluronic Acid Injections segment is expected to secure more than 68.9% market share by 2035, driven by its long-term relief effectiveness and fewer side effects.

- The Knee segment is anticipated to experience steady growth over 2026-2035, driven by high osteoarthritis prevalence and advancements in injection therapies.

Key Growth Trends:

- Aging population and rising occurrence of joint disorders

- Increase in demand for minimally invasive treatments

Major Challenges:

- High cost associated with the products

- Limited effectiveness and long-term results

- Key Players: Anika Therapeutics, Inc., Zimmer Biomet, Pacira BioSciences, Inc., Teva Pharmaceutical Industries Ltd..

Global Joint Pain Injections Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.52 billion

- 2026 Market Size: USD 7.02 billion

- Projected Market Size: USD 14.88 billion by 2035

- Growth Forecasts: 8.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 14 August, 2025

Joint Pain Injections Market Growth Drivers and Challenges:

Growth Drivers

- Aging population and rising occurrence of joint disorders: As the elderly population grows, the demand for effective pain management solutions increases, particularly for chronic conditions that impact mobility and quality of life. The rising occurrence of joint disorders including osteoarthritis and rheumatoid arthritis are major drivers of the joint pain injections market growth. More than 35% of men and 40% of women in West Virginia suffered from arthritis in 2023. Furthermore, 60% of people aged between 75 and 84 years in the UK were living with a musculoskeletal condition in 2024. Hence, the demographic shift and the rising incidence of these diseases are leading to greater utilization of injectable therapies for targeted relief and improved joint function.

- Increase in demand for minimally invasive treatments: as patients and healthcare providers seek alternatives to surgical interventions, there is a growing demand for minimally invasive treatments. The joint pain injections market is driven by this factor as treatments such as hyaluronic acid and corticosteroid injections provide effective, localized pain relief with minimal downtime, making them a popular choice. Advancements in injection techniques and increased awareness of the benefits of non-surgical options are further driving demand across various patient groups. For instance, in October 2021, a new hydrogel injection for knee osteoarthritis, Arthrosamid, was officially launched to the UK market at the British Orthopaedic Association (BOA) Annual Congress and harnesses non-biodegradable hydrogel technology.

Challenges

- High cost associated with the products: Expenses associated with advanced treatments pose a significant challenge to the joint pain injections market growth. Many patients, especially in regions with limited insurance coverage or out-of-pocket payment systems, find these treatments to be a financial burden, limiting their accessibility and widespread adoption. High prices of the products hence pose a threat to the market, limiting its wider expansion.

- Limited effectiveness and long-term results: Some of the injection therapies in the joint pain injections market have inadequate effectiveness and lack long-term results which hinders their appeal among the patients. While they offer temporary relief, the need for repeated treatments and variable outcomes reduces patient satisfaction and confidence, driving some to seek alternative solutions, such as physical therapy or surgical interventions.

Joint Pain Injections Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

8.6% |

|

Base Year Market Size (2025) |

USD 6.52 billion |

|

Forecast Year Market Size (2035) |

USD 14.88 billion |

|

Regional Scope |

|

Joint Pain Injections Market Segmentation:

Product (Corticosteroid Injections, Hyaluronic Acid Injections, Platelet Rich Plasma Injections, Others)

Based on product, hyaluronic acid injections segment is set to account for joint pain injections market share of more than 68.9% by the end of 2035. This is majorly due to their effectiveness in providing long-term relief in the knee joint. In January 2018, OrthogenRx, Inc. launched TriVisc (sodium hyaluronate) treating osteoarthritic (OA) knee pain for people who fail to receive adequate relief from painkillers and physical therapies. Increasing regulatory approvals from governments of various regions, growing awareness of its benefits among the patients, and a shift towards viscosupplementation over corticosteroids due to fewer side effects further boost their demand.

Joint Type (Knee, Hip, Hand & Wrist, Others)

Based on joint type, the knee segment is anticipated to register steady growth during the forecast period in the joint pain injections market. The segment is driven by a high prevalence of osteoarthritis, increased physical activity levels, and rising obesity rates. In September 2024, Sun Pharma and Moebius Medical Limited received U.S. FDA Fast Track designation (FTD) approval for MM-II for treating osteoarthritis knee pain. Data from a randomized, controlled, Phase 2b study showcased that a single intra-articular injection of 3mL offered better pain relief in comparison to a placebo for up to 26 weeks. Advancements in injection therapies, including hyaluronic acid and platelet-rich plasma, provide targeted relief, driving their adoption for knee treatments.

Our in-depth analysis of the global market includes the following segments:

|

Product |

|

|

Joint Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Joint Pain Injections Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is expected to hold largest revenue share of 46.3% by 2035. Furthermore, rising awareness of non-surgical treatments and the adoption of advanced therapies are boosting the market growth in India. Lifestyle changes, including sedentary habits and higher obesity rates, contribute to the growing need for joint pain management in the country.

India joint pain injections market is expanding due to the increasing burden of arthritis and related disorders, coupled with rising healthcare investments. According to Research Nester, the number of arthritis cases in senior citizens all over India is forecasted to reach more than USD 90.0 million by 2050. Additionally, the demand for cost-effective treatments and the presence of a large patient population contribute to the market’s upward trajectory.

China joint pain injections market stands out in the APAC region driven by increased adoption of joint injections for chronic pain management, particularly in large urban centers where healthcare access is more robust. Government policies aimed at improving elderly care are supporting market growth. Moreover, the expansion of domestic pharmaceutical companies and partnerships with global players is enhancing the availability and quality of joint pain treatments.

North America Market Analysis

North America joint pain injections market is poised for significant growth, driven by the increasing prevalence of musculoskeletal disorders and the rising geriatric population. In 2023 , more than 29.0% of women and 21.0% of men in the U.S. suffered from arthritis. With a strong healthcare infrastructure and a high adoption rate of advanced medical technologies, North America is the leading region in this market.

The U.S. market is a significant contributor to North America’s leadership. Key players are driving innovation by developing advanced treatments and expanding their product portfolios. For instance, in April 2022, Dr. Reddy’s Laboratories Ltd. launched Methylprednisolone Sodium Succinate for Injection, USP, the generic equivalent of SOLU-MEDROL in the U.S. market approved by the U.S. FDA. The U.S. market is further fueled by rising healthcare expenditures and a large patient pool.

Canada joint pain injections market is experiencing moderate growth due to a well-established healthcare system and rising awareness of non-surgical pain management options. The Canada market is supported by government healthcare initiatives aimed at improving the quality of life for aging populations. Like the U.S., Canada is witnessing increased demand for hyaluronic acid and platelet-rich plasma (PRP) injections for knee and hip treatments.

Key Joint Pain Injections Market Players:

- Bioventus

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Anika Therapeutics, Inc.

- Zimmer Biomet

- Pacira BioSciences, Inc.

- Teva Pharmaceutical Industries Ltd.

- Ferring B.V.

- Dr. Reddy’s Laboratories Ltd.

Companies in the joint pain injections market are leveraging mergers and acquisitions to expand their portfolios. Geographical expansions and product launches are two more growth strategies adopted by these players in the market. For instance, in August 2021, Seikagaku Corporation launched HyLink, through TCM Biotech International Corp., in Taiwan. HyLink is an intra-articular single-injection viscosupplement, aimed at treating knee osteoarthritis. Such developments are anticipated to lead to steady industry expansions for these companies and boost market growth significantly. Here’s a list of the prominent players in the joint pain injections market:

Recent Developments

- In March 2024, the U.S. FDA granted Pacira BioSciences, Inc. developed PCRX-201, a novel, intra-articular helper-dependent adenovirus (HDAd) gene therapy product, the Regenerative Medicine Advanced Therapy (RMAT) designation.

- In January 2022, Avanos Medical, Inc. completed the acquisition of OrthogenRx, Inc. based on a purchase price of USD 130 million in cash at closing with an additional contingent cash consideration of USD 30 million, which is payable upon achieving growth milestones in relation to the company's commercial hyaluronic acid therapy products, GenVisc 850 and TriVisc.

- Report ID: 6758

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Joint Pain Injections Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.