Postoperative Pain Therapeutics Market Outlook:

Postoperative Pain Therapeutics Market size was valued at USD 16.4 billion in 2025 and is projected to reach USD 29.5 billion by the end of 2035, rising at a CAGR of 6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of postoperative pain therapeutics is estimated at USD 17.3 billion.

The continuously increasing surgical procedures, rising awareness of effective pain management, and a growing emphasis on reducing opioid dependency are the key factors propelling growth in the market. As per an article published by the National Institute of Health in January 2024, India’s total surgical rate was 1,385.28 surgeries per 100,000 people, while major surgeries accounted for 355.94 per 100,000 in a year. Minor surgeries showed a faster annual growth rate of 9.24% compared to 4.16% for major surgeries, hence denoting the huge necessity for these therapeutics.

Furthermore, the market is reaping advantages from the aspect of payers pricing who are focusing on cost-effective therapies that balance efficacy with safety, encouraging reimbursement for pain management strategies. The February 2023 NIH article revealed that it had analyzed the prices of 16 common surgical procedures across more than 3,000 hospitals in the U.S., utilizing data from the Hospital Price Transparency Rule. The study found that for 15 out of the 16 procedures, hospitals that are part of larger networks charged noticeably higher prices when compared to independent hospitals.

Key Postoperative Pain Therapeutics Market Insights Summary:

Regional Highlights:

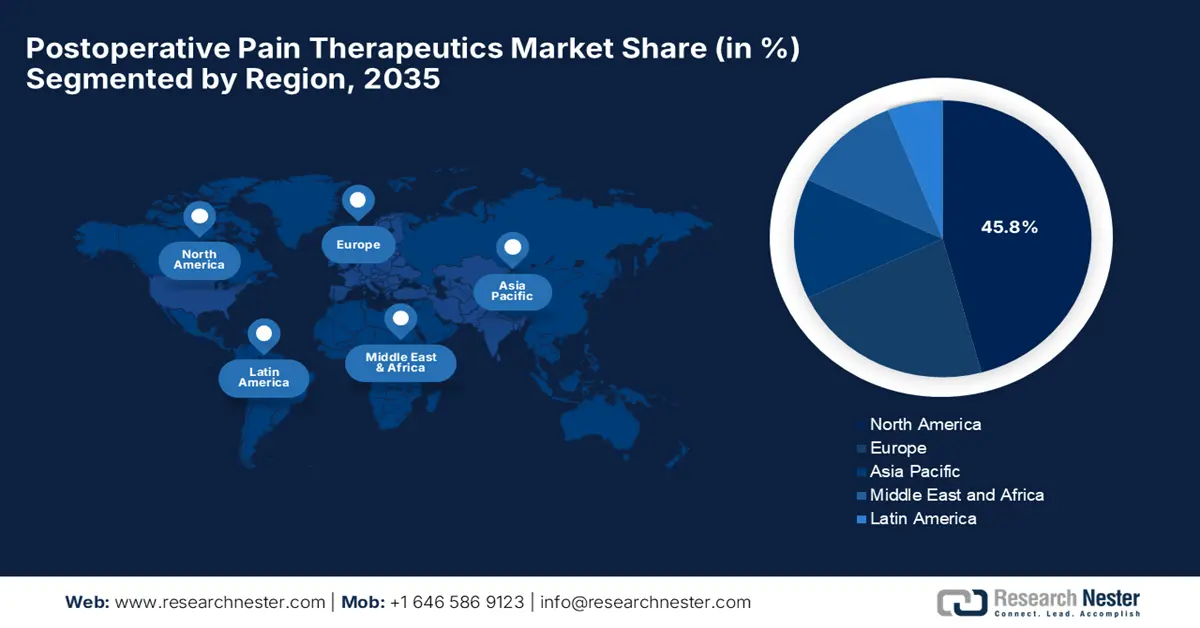

- North America is projected to command a 45.8% share of the postoperative pain therapeutics market by 2035, owing to the high rate of surgical procedures, increased R&D spending, and strong regulatory support for safer analgesic innovations.

- Europe is expected to sustain a significant market position through 2035, impelled by technological advancements in pain management and the growing adoption of multimodal analgesia techniques among healthcare providers.

Segment Insights:

- The oral segment is anticipated to account for 40.7% share of the postoperative pain therapeutics market by 2035, driven by its ease of administration, improved patient adherence, and cost efficiency.

- The opioids segment is projected to hold 38.5% share by 2035, fueled by its superior efficacy in managing moderate to severe pain and the rising global demand for effective pain control therapies.

Key Growth Trends:

- Rising aging demographics & chronic disease burden

- Shift towards non-opioid & multimodal pain management

Major Challenges:

- Opioid dependency

- Personalized treatment needs

Key Players: Pacira BioSciences Inc., Pfizer Inc., Johnson & Johnson, GlaxoSmithKline plc (GSK), Novartis AG, Teva Pharmaceutical Industries Ltd., Eli Lilly and Company, Hikma Pharmaceuticals PLC, Viatris Inc., Endo International plc, AstraZeneca PLC, Merck & Co. Inc., Fresenius Kabi AG, B. Braun Melsungen AG, Sun Pharmaceutical Industries Ltd., Dr. Reddy's Laboratories Ltd., Mallinckrodt Pharmaceuticals, Daiichi Sankyo Company Limited, CSPC Pharmaceutical Group Limited, MSD (Merck Sharp & Dohme).

Global Postoperative Pain Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 16.4 billion

- 2026 Market Size: USD 17.3 billion

- Projected Market Size: USD 29.5 billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, South Korea, Australia

Last updated on : 1 October, 2025

Postoperative Pain Therapeutics Market - Growth Drivers and Challenges

Growth Drivers

- Rising aging demographics & chronic disease burden: This is the primary driver for the market since diseases such as orthopedic and cardiovascular procedures are constantly driving business in this field. The American Heart Association in 2025 reported that in a span of three years, 127.9 million adults in the U.S., which is 48.6% of the total, had some form of cardiovascular disease. Therefore, this indicates an enormous patient population that is at high risk for requiring surgical interventions such as coronary artery bypass grafts, valve replacements, and stent placements.

- Shift towards non-opioid & multimodal pain management: As there has been a growing concern about opioid side effects, misuse, and addiction, the demand for non-opioid alternatives such as NSAIDs, local anesthetics, novel analgesics, and multimodal strategies is notably expanding. As per the January 2023 NIH article, multimodal analgesia combines pharmacologic and non-pharmacologic approaches to manage postoperative pain and has proven effective in reducing pain scores and opioid-related side effects, offering a safer, evidence-based approach to post-surgical pain management.

- Regulatory support & policy support: The support from administrative bodies for newer, safer drugs, policies, and reimbursement frameworks favoring nonopioid therapies is continuously stimulating innovation and adoption in the postoperative pain therapeutics market. In January 2025, the U.S. FDA reported it approved Journavx (suzetrigine), the first non-opioid analgesic for moderate to severe acute pain in adults, which works by targeting sodium channels in the peripheral nervous system and showed superior pain relief in surgical trials.

Country-wise Surgical Procedure Rates per 100,000 Population

|

Country/Region |

2021 |

2022 |

2023 |

|

Albania |

2,001 |

- |

- |

|

Bhutan |

- |

2,909 |

- |

|

Canada |

6,928 |

- |

- |

|

Estonia |

- |

14,832 |

- |

|

Finland |

- |

15,870 |

- |

|

Germany |

- |

19,124 |

- |

|

Spain |

- |

- |

6,953 |

|

Mauritius |

- |

4,051 |

- |

|

Sweden |

- |

14,380 |

- |

Source: World Bank - Lancet Commission on Global Surgery (2025)

Median Commercially Negotiated Prices for Surgical Procedures at Network vs Independent Hospitals in the US (2021-2022)

|

Surgical Procedure |

Hospitals Reporting ≥1 Price |

Median Price at Network Facilities (IQR), USD |

Median Price at Independent Facilities (IQR), USD |

|

Shoulder arthroscopy with cartilage removal |

1075 |

4432 (1611-10,593) |

2643 (519-8286) |

|

Knee cartilage removal |

1454 |

5275 (2759-8045) |

3829 (1680-7063) |

|

Inguinal hernia repair |

1471 |

4653 (2375-8893) |

3683 (1444-7225) |

|

Tonsil removal |

1071 |

4954 (2478-7068) |

3981 (1360-7856) |

|

Colonoscopy |

1693 |

1986 (1069-3284) |

1692 (844-3073) |

|

EGD (esophagogastroduodenoscopy) |

1755 |

1678 (858-2936) |

1433 (695-2511) |

|

Colonoscopy, snare |

1679 |

2008 (1073-3308) |

1732 (879-2962) |

|

Cholecystectomy |

1519 |

6567 (3744-13,321) |

5778 (2163-11,132) |

|

Colonoscopy, diagnostic |

1696 |

1787 (913-2914) |

1562 (785-2530) |

|

Prostatectomy |

904 |

9567 (3657-18,944) |

8601 (4038-17,575) |

|

Diagnostic heart catheterization |

1264 |

6664 (3742-10,316) |

6132 (2876-10,975) |

|

EGD |

1738 |

1572 (863-2709) |

1450 (697-2512) |

|

Cataract removal |

1117 |

3466 (2124-5954) |

3289 (1863-5937) |

|

Laser cataract removal |

911 |

1182 (645-2127) |

1122 (749-2806) |

|

Cesarean delivery |

526 |

3460 (2213-6329) |

3886 (2452-6679) |

|

Prostate biopsy |

1554 |

1641 (703-3309) |

2142 (992-3703) |

Source: NIH

Challenges

- Opioid dependency: One of the major challenges associated with the postoperative pain therapeutics market is the ongoing opioid crisis. Opioids are widely recognized for their effectiveness in managing severe postoperative pain, but they also carry a high risk of addiction and overdose in a few instances. Therefore, this has led to increased regulatory scrutiny, which is limiting their adoption among both service providers and consumers.

- Personalized treatment needs: Another major hurdle in the postoperative pain therapeutics market is the wide variability in how patients experience and respond to pain. Besides the factors such as genetics, age, and type of surgery, reports indicate that a one-size-fits-all approach is often ineffective in terms of pain therapeutics. Therefore, the aspect of this variability creates complications in drug development and prescribing practices since treatments need to be suitable for individual patients for positive outcomes.

Postoperative Pain Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 16.4 billion |

|

Forecast Year Market Size (2035) |

USD 29.5 billion |

|

Regional Scope |

|

Postoperative Pain Therapeutics Market Segmentation:

Route of Administration Segment Analysis

Based on the route of administration, the oral segment is expected to garner the largest revenue share of 40.7% in the postoperative pain therapeutics market during the discussed timeframe. The ease of use, patient compliance, and cost effectiveness are the key factors behind the subtype’s dominance in this field. On the other hand, the advances in formulation technologies, enhancing bioavailability and reducing side effects, also contribute to a wider segment adoption.

Drug Type Segment Analysis

In terms of drug type, the opioids segment is anticipated to gain a lucrative share of 38.5% in the postoperative pain therapeutics market by the end of 2035. The growth in this segment is due to the higher efficacy in managing moderate to severe pain and the huge demand for effective pain management. In this regard, INCB, in March 2025, reported that there is a continued disparity in access to opioid analgesics such as morphine, wherein only 18% of global morphine production is used for direct pain relief, primarily in high-income countries. Also, the lower-income regions continue to face shortages, underscoring the urgent need to increase production.

Drug Class Segment Analysis

Based on drug class, the NSAIDs segment is predicted to gain a significant share of 35.4% in the postoperative pain therapeutics market during the analyzed timeframe. Their effectiveness in controlling inflammation and pain with very few side effects when used for a short time is the key factor behind this leadership. In February 2024, Hikma Pharmaceuticals announced that it had launched COMBOGESIC IV in the U.S., which is an opioid-free intravenous pain relief medication combining acetaminophen (1000 mg) and ibuprofen (300 mg) for adult patients needing IV pain relief.

Our in-depth analysis of the postoperative pain therapeutics market includes the following segments:

|

Segment |

Subsegments |

|

Route of Administration |

|

|

Drug Type |

|

|

Drug Class |

|

|

Therapeutic Use |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Postoperative Pain Therapeutics Market - Regional Analysis

North America Market Insights

North America is predicted to capture the largest revenue share of 45.8% in the postoperative pain therapeutics market by the end of 2035. The region’s upliftment in this field is effectively attributed to the high volume of surgical procedures, strong R&D investments, and regulatory push toward safer analgesic alternatives. In August 2025, Johnson & Johnson is expanding its U.S. manufacturing footprint with a USD 2 billion investment in a 160,000+ sq. ft. facility at FUJIFILM’s Holly Springs site in North Carolina, which will support the company's broader plan to manufacture most of its advanced medicines domestically.

The U.S. is augmenting its leadership over the postoperative pain therapeutics market, which represents a major part of the regional revenue. This is effectively propelled by the heightened patient demand for pain relief options that balance efficacy and safety. For instance, in September 2025, AtriCure announced the launch of the cryoXT device, which is a part of its cryoICE platform to address post-operative pain following amputations. The device is U.S. FDA 510(k)-cleared and targets peripheral nerves, making use of cryoablation technology to reduce residual and phantom limb pain.

Canada is vigorously growing in the postoperative pain therapeutics market, primarily fueled by the rising awareness about the risks associated with opioid dependency, as well as by policy and regulatory support for alternative pain management strategies. In March 2022, Heron Therapeutics reported that it received Health Canada approval for ZYNRELEF, which is the first and only extended-release local anesthetic in the country for postoperative pain management, hence encouraging more players to make investments in this field.

U.S. Pharmaceutical Manufacturing Investments Supporting the Postoperative Pain Therapeutics Market (2025)

|

Company |

Investment Focus |

Investment Amount |

Year |

|

Johnson & Johnson |

General US medicine manufacturing capacity |

Part of the USD 55 billion program |

2025 |

|

Novartis |

Chemical drug & oral dosage form production |

Part of the USD 23 billion program |

2025 |

|

AbbVie |

API production for neuroscience/immunology |

USD 195 Million |

2025 |

|

Eli Lilly |

API synthesis & injectable therapy production |

Part of USD 50 billion+ plan |

2025 |

|

Gilead Sciences |

General US manufacturing capacity expansion |

Part of a USD 11 billion investment |

2025 |

|

Merck & Co. |

Biologics & antibody-drug conjugate manufacturing |

USD 1 Billion |

2025 |

|

GSK |

Sterile liquid medicine manufacturing |

Up to USD 800 Million |

2024/2025 |

Source: DCAT

APAC Market Insights

Asia Pacific is recognized as the fastest-growing region in the postoperative pain therapeutics market during the discussed timeframe. The region’s progress in this sector is constantly supported by the rising surgical volumes, expanding healthcare infrastructure, and increasing awareness of pain management options. Besides the investments in anesthesia techniques and the introduction of non-opioid alternatives, they are also readily shaping the clinical preferences across diverse nations. Furthermore, there has been an increased preference from governments and healthcare providers due to enhanced outcomes and reduced hospital stays.

China is considered to be the powerhouse of innovation in the regional postoperative pain therapeutics market, owing to the modernized healthcare system that adopts international standards of care. In June 2025, CSPC Pharmaceutical Group reported that it had received drug registration approval in the country for Meloxicam Injection (III), which is indicated for treating moderate to severe postoperative pain. Besides, the product uses nanocrystal technology to reduce drug particle size, allowing high-dose, intravenous administration with a long-lasting effect of up to 24 hours.

India is also evidently growing in the postoperative pain therapeutics market, effectively propelled by the financial assistance from governing bodies and a greater emphasis on patient comfort and recovery. For instance, in February 2022, Dr. Reddy's Laboratories notified that it had entered into an exclusive sales and distribution agreement with Novartis India Limited for the Voveran, Calcium, and Methergine product ranges in the country, strengthening its portfolio in pain management, hence suitable for steady market growth.

Europe Market Insights

Europe is maintaining a strong position in the postoperative pain therapeutics market owing to the advancements in pain management technologies and increasing awareness among healthcare providers about multimodal analgesia approaches. The prominent countries in the region are proactively adopting innovative drug delivery systems and personalized pain management protocols that remarkably enhance patient outcomes. In this regard, hospitals across this region are integrating non-opioid pain relief methods, such as nerve blocks and regional anesthesia, to enhance recovery after surgery, hence denoting the existence of heightened demand.

Germany has a strong potential in the postoperative pain therapeutics market, effectively driven by a strong focus on clinical research, increasing investments, and the adoption of advanced pain management techniques. In December 2022, Evonik reported that it had invested in Allay Therapeutics, which is developing implants that relieve knee surgery pain for up to three weeks. The company also stated that this technology aims to reduce or eliminate the need for opioid painkillers, promoting faster recovery with fewer side effects.

The U.K. in the postoperative pain therapeutics market is gaining enhanced traction, shaped by national health policies that are encouraging safer opioid prescribing and the promotion of alternative analgesics. In March 2025, the country’s government reported that the MHRA had removed the indication for prolonged-release opioids such as morphine and oxycodone for treating post-operative pain due to risks of persistent opioid use. It also stated that only immediate-release opioids should be prescribed for short-term acute post-surgical pain.

Clinical Developments in Post-Surgical and Acute Pain Management (2021-2025)

|

Year |

Company |

Product |

Study Phase |

Indication |

Key Points |

|

2025 |

Allay Therapeutics |

ATX101 |

Phase 2b is ongoing |

Post-surgical pain (Total Knee Replacement) |

Ultra-sustained analgesic; FDA breakthrough therapy designation; reducing opioid needs |

|

2025 |

Tris Pharma |

Cebranopadol |

Phase 3 positive results |

Moderate-to-severe acute pain (abdominoplasty) |

Statistically significant pain reduction; favorable safety profile; dual-NMR agonist |

|

2025 |

Cali Biosciences |

CPL-01 |

Phase 2b is ongoing |

Post-operative pain |

Continuing the MERIT-1 trial, focus on reducing opioid use, long-acting ropivacaine |

|

2024 |

Vertex |

VX-548 |

Phase 3 completed |

Moderate-to-severe acute pain (abdominoplasty, bunionectomy) |

Statistically significant pain reduction; good safety; NDA planned mid-2024 |

|

2022 |

Heron Therapeutics |

ZYNRELEF |

Published clinical study |

Total Knee Arthroplasty (TKA) |

Non-opioid multimodal analgesic; reduced severe pain & opioid use; good safety profile |

|

2021 |

Cali Biosciences |

CPL-01 |

Phase 2b initiated |

Post-operative pain (inguinal hernia) |

Extended-release ropivacaine; aiming to reduce opioid use; no safety issues in Phase 2a |

Key Postoperative Pain Therapeutics Market Players:

- Pacira BioSciences, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc.

- Johnson & Johnson

- GlaxoSmithKline plc (GSK)

- Novartis AG

- Teva Pharmaceutical Industries Ltd.

- Eli Lilly and Company

- Hikma Pharmaceuticals PLC

- Viatris Inc.

- Endo International plc

- AstraZeneca PLC

- Merck & Co., Inc.

- Fresenius Kabi AG

- B. Braun Melsungen AG

- Sun Pharmaceutical Industries Ltd.

- Dr. Reddy's Laboratories Ltd.

- Mallinckrodt Pharmaceuticals

- Daiichi Sankyo Company, Limited

- CSPC Pharmaceutical Group Limited

- MSD (Merck Sharp & Dohme)

The postoperative pain therapeutics market is highly fragmented and extremely competitive, wherein the top pioneers such as Pacira Biosciences and Pfizer are dominating through innovative non-opioid products. The shift towards multimodal analgesia, R&D in long-acting local anesthetics, NSAIDs, and novel mechanisms to reduce opioid reliance are pivotal turning points in this field. On the other hand, mergers and acquisitions to bolster product pipelines, expansion into high-growth emerging markets, and the development of abuse-deterrent formulations for opioids are a few strategies implemented by the players to uplift market growth internationally.

Below is the list of some prominent players operating in the postoperative pain therapeutics market:

Recent Developments

- In February 2025, Allay Therapeutics reported that it had dosed the first patients in its Phase 2b trial evaluating ATX101, which provides extended pain relief for post-surgical pain management after total knee replacement surgery.

- In January 2025, Vertex Pharmaceuticals reported that its JOURNAVX (suzetrigine), a first-in-class, non-opioid oral pain signal inhibitor for adults with moderate-to-severe acute pain, was accepted by the U.S. FDA.

- Report ID: 8155

- Published Date: Oct 01, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.