Osteoarthritis Therapeutics Market Outlook:

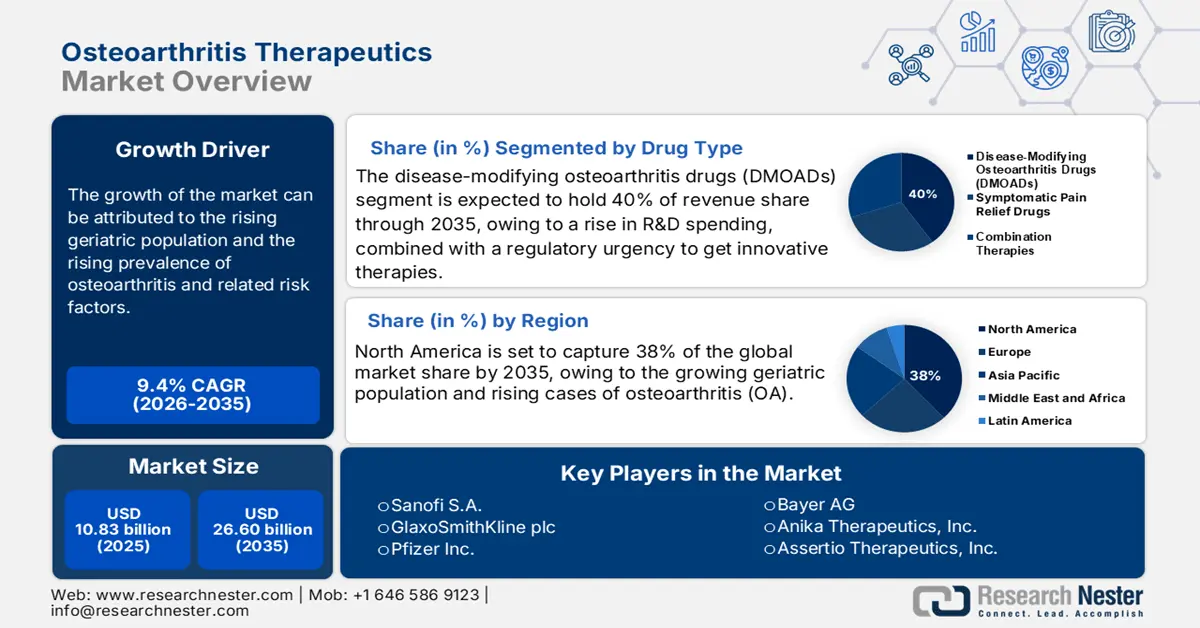

Osteoarthritis Therapeutics Market size was valued at USD 10.83 billion in 2025 and is projected to reach USD 26.60 billion by the end of 2035, rising at a CAGR of 9.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of osteoarthritis therapeutics is assessed at USD 11.85 billion.

The global market is experiencing change in a variety of ways, and, in particular, the sector is focused on revolutionary advances in therapies and technologies. Of particular note are disease-modifying osteoarthritis drugs (DMOADs), which aim to alter the progression of the disease rather than just treating its symptoms. DMOADs represent treatments that can repair cartilage and prevent joint damage, which certainly fills a critical but unmet medical need. At the same time, the advent of digital health technologies is delivered by allowing for continuous monitoring and tracking, personalized treatment plans, and improving patient adherence and engagement. In addition, strategies in personalized medicine are being fast-tracked as a result of advancements in stem cell research focusing on cartilage regeneration.

Regenerative treatments (i.e., injectable platelet-rich plasma (PRP) or stem cells) are finding wider acceptance as they are believed to restore joint function while alleviating pain and restoring joint flexibility with a lower risk of clinically significant adverse effects compared to traditional treatments. Similarly, requests for minimally invasive procedures like genicular artery embolization (GAE) are being directed more frequently toward hospitals and interventional radiologists as patients want to learn more about options that could provide effective pain relief without necessitating surgery. Overall, as pharmaceutical companies and emerging biotechnology companies continue to drive rapid innovation, partnerships will increasingly straddle a divide that combines lessons learned from years of applied biomedical research in mitigating osteoarthritis pain.

Key Osteoarthritis Therapeutics Market Insights Summary:

Regional Highlights:

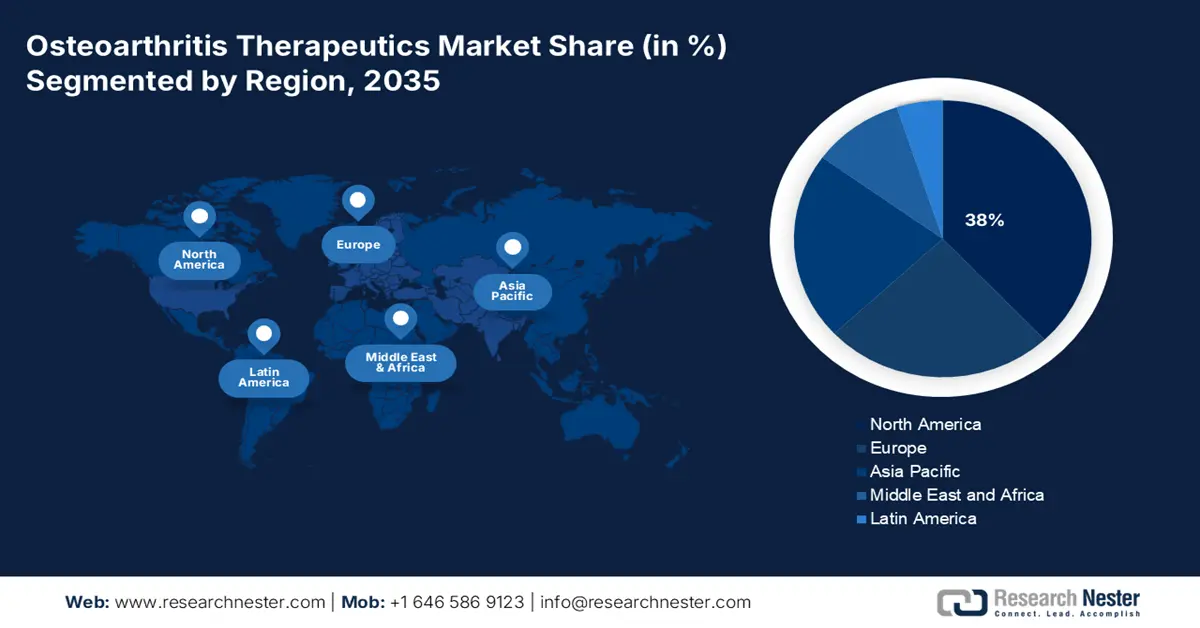

- By 2035, North America is projected to secure a leading 38% share of the Osteoarthritis Therapeutics Market, supported by its aging population and robust access to advanced orthopedic care.

- Europe is expected to post a strong CAGR through 2026–2035, underpinned by established healthcare systems, rising healthcare expenditures, and supportive reimbursement frameworks that encourage the uptake of advanced osteoarthritis therapies.

Segment Insights:

- The disease-modifying osteoarthritis drugs (DMOADs) segment is anticipated to command a 40% share by 2035 in the Osteoarthritis Therapeutics Market, bolstered by heightened R&D spending and growing emphasis on early intervention.

- The regenerative therapies (stem cell & PRP) segment is projected to hold a 30% share by 2035, supported by expanding clinical validation and increasing adoption of minimally invasive biologic treatments.

Key Growth Trends:

- Rising geriatric population

- Rising prevalence of osteoarthritis and related risk factors

Major Challenges:

- Limited disease-modifying treatment options

- High cost of advanced therapies

Key Players: Sanofi S.A., GlaxoSmithKline plc, Pfizer Inc., Bayer AG, Zimmer Biomet Holdings, Inc., Novartis AG, Anika Therapeutics, Inc., Assertio Therapeutics, Inc., Bioventus LLC, Ferring Pharmaceuticals, Flexion Therapeutics, Inc., Arthrex, Inc., Royal Biologics, Teva Pharmaceutical Industries Ltd., Abbott Laboratories, Eli Lilly and Company, Johnson & Johnson, Horizon Therapeutics PLC, Hanmi Pharm. Co., Ltd., Kolon Life Science Inc.

Global Osteoarthritis Therapeutics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.83 billion

- 2026 Market Size: USD 11.85 billion

- Projected Market Size: USD 26.60 billion by 2035

- Growth Forecasts: 9.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38% Share by 2035)

- Fastest Growing Region: Europe

- Dominating Countries: United States, China, Germany, United Kingdom, Japan

- Emerging Countries: India, Brazil, South Korea, Mexico, Australia

Last updated on : 12 September, 2025

Osteoarthritis Therapeutics Market - Growth Drivers and Challenges

Growth Drivers

- Rising geriatric population: According to the World Health Organization, by 2030, there will be 1.4 billion persons over 60 in the world, up from 1.1 billion in 2023. In emerging nations, this trend is more noticeable and swifter. The increasing aging population worldwide is a primary driver for the osteoarthritis therapeutics sector. Osteoarthritis primarily affects older adults due to the natural wear and tear of joints over time. As life expectancy rises, a larger proportion of the population is vulnerable to joint degeneration and related disorders. This demographic shift significantly raises the demand for effective therapeutics to manage symptoms and improve quality of life. Governments and healthcare systems are also focusing more on age-related diseases, driving investments in osteoarthritis treatments.

- Rising prevalence of osteoarthritis and related risk factors: The Centers for Disease Control and Prevention estimates that women were more likely than males to have arthritis (21.5%) in 2022, with the age-adjusted prevalence of diagnosed arthritis among individuals aged 18 and older being 18.9%. The increasing prevalence of osteoarthritis is propelled by various factors, including obesity, sedentary lifestyle habits, and joint injuries. Increased weight on joints, especially on weight-bearing joints such as knees and hips, leads to further cartilage deterioration. Increased activity in sports leads to an increased prevalence of injuries, both in sports and in the workplace, leading to an earlier incidence of osteoarthritis.

- Advancements in disease-modifying osteoarthritis drugs (DMOADs): The discovery of new disease-modifying osteoarthritis drugs represents a major growth driver. DMOADs are differentiated from traditional therapeutics that manage osteoarthritis pain and inflammation in ways that create and promote long-term benefits by repairing cartilage and stopping or slowing the progression of the disease states. Healthcare providers and their patients are anticipating more of these treatments as available therapies emerge from the clinical trial phase and research results indicate the potential to impact their disease outcomes.

Challenges

- Limited disease-modifying treatment options: Despite continuing research, genuine disease-modifying osteoarthritis drugs (DMOAD) are in short supply. Most treatments available are designed to relieve symptoms, not change the course of joint degeneration. As a result, long-term treatment efficacy for both patients and physicians is limited; disease management often tops patient outcomes related to achieving a cure.

- High cost of advanced therapies: Emerging modalities of treatment, such as biologics, regenerative medicine, and minimally invasive techniques, can be expensive, thus obstructing access and often complicating access for patients in low and middle-income populations. Barriers to affordability still exist, both for the patients and the healthcare system, and can pose difficulties for the dissemination of cutting-edge therapies.

Country-Specific Prevalence Rates of Knee Osteoarthritis (KOA) in 2019

|

Country |

KOA Prevalence Rate (per 100,000, 2019) |

Notes |

|

Japan |

12,610.12 |

Highest prevalence rate, about 10x Somalia |

|

Somalia |

1,178.23 |

The lowest prevalence rate is mentioned |

|

United Arab Emirates |

Not reported |

Exception: KOA prevalence/incidence/DALYs lower or not reported |

Sources: Frontiers

Country and Regional Osteoarthritis (OA) Prevalence and Burden Estimates (2020)

|

Country/Region |

OA Prevalent Cases / Rate |

Notes |

|

Southeast Asia |

5,677.4 per 100,000 (UI 5029.8–6318.1) |

Age-standardized prevalence rate in 2020 |

|

High-income Asia Pacific |

8,632.7 per 100,000 (UI 7852.0–9469.1) |

Highest age-standardized prevalence rate by region |

|

Global (all countries) |

595 million cases (7.6% of global population) |

Total OA cases in 2020 |

|

Global (adults 70+) |

7th ranked cause of Years Lived with Disability (YLDs) |

Indicates a significant OA burden in elderly |

Source: NIH

Osteoarthritis Therapeutics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.4% |

|

Base Year Market Size (2025) |

USD 10.83 billion |

|

Forecast Year Market Size (2035) |

USD 26.60 billion |

|

Regional Scope |

|

Osteoarthritis Therapeutics Market Segmentation:

Drug Type Segment Analysis

The disease-modifying osteoarthritis drugs (DMOADs) segment is estimated to account for the largest share of 40% in the market over the discussed timeframe. DMOADs are positioned in the first-line group of osteoarthritis treatment options because they are indicated to modify disease progression instead of just controlling symptoms. Per the National Institute of Arthritis and Musculoskeletal and Skin Diseases (NIAMS), DMOADs may improve cartilage health and slow or stop the deterioration of the joint, ultimately, filling a critical unmet need. There is a rise in R&D spending - combined with a regulatory urgency to get innovative therapies to market - is contributing to greater development for DMOADs. Furthermore, more patients understand early intervention and are incurring more symptomatic management, are further increases the growth potential in the segment.

Therapy Type Segment Analysis

The regenerative therapies (stem cell & PRP) segment is poised to dominate the osteoarthritis therapeutics market with a share of 30% during the analyzed period. PRP (platelet-rich plasma) injections and stem cell therapy have the potential to relieve pain and regenerate cartilage. The Arthritis Foundation states that stem cells, along with PRP, can help improve joint function, with fewer side effects than other therapies. As government-funded agreements and clinical trials continue to expand the evidence base for stem cells and PRP therapies, these therapies will continue to be more commonly used in clinical practice.

Route of Administration Segment Analysis

During the examined period, the intra-articular injections segment is expected to hold a 24% market share in the osteoarthritis therapeutics industry. Injections administered directly into the joint (e.g. steroids or hyaluronic acid) will remain a treatment option to try because these injections have a therapeutic effect on the joints being injected. In fact, the Centers for Disease Control and Prevention (CDC) speaks specifically to the use of intra-articular injections in the management of pain and improvement of mobility for patients with osteoarthritis. As long as injections are accepted, easy to give, and paid for by insurance, this sub-segment of injections will continue to be a steady source of revenue.

Our in-depth analysis of the osteoarthritis therapeutics market includes the following segments:

|

Segments |

Subsegments |

|

Drug Type |

|

|

Therapy Type |

|

|

Route of Administration |

|

|

End User |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Osteoarthritis Therapeutics Market - Regional Analysis

North America Market Insights

North America is anticipated to capture the highest share of 38% in the global osteoarthritis therapeutics market by the end of 2035. The region has a sizable and aging population, which in turn increases the prevalence of osteoarthritis (OA), a degenerative condition that mainly impacts older adults. Moreover, North America has a well-established healthcare ecosystem with good access to diagnostic technology and specialty orthopedic treatment that allows for early diagnosis and treatment.

The U.S. ranks first due to its sizable older demographic with an increased prevalence of osteoarthritis. It also has developed healthcare systems, broad insurance coverage, and significant investment in biomedical research that incentivizes a very fast transition from discovery to adoption of new and innovative therapeutics, including disease-modifying osteoarthritis drugs (DMOADs) and regenerative therapies. In addition, it has a friendlier regulatory process and more proactive healthcare systems, which also encourage growth in the market.

Canada's market growth is driven by an increase in the occurrence of osteoarthritis with its aging population and the general publicly funded healthcare systems, which create access to better diagnostics and treatment. Additionally, government initiatives that promote musculoskeletal health and funding for regenerative medicine research all dipped into Canada's increasing market share.

Europe Market Insights

Throughout the projection period, Europe is anticipated to experience a strong CAGR in the global osteoarthritis therapeutics market due to the established healthcare systems, increasing healthcare spending, and increasing prevalence of osteoarthritis due to aging populations. Countries like Germany, the UK, and France currently have advanced diagnostic and therapeutic facilities that allow for early intervention and continued treatment of osteoarthritis. In addition, the support of government and healthcare policies along with reimbursement enable the use of advanced therapies like disease-modifying drugs appropriate and regenerative therapies more acceptable. Europe has strong pharmaceutical and medical devices industry with substantial scientific research and development into osteoarthritis and public health awareness and promotion.

A well-established healthcare system, and a growing elderly population create strong demand for osteoarthritis therapeutics in France. The country also has a firm reimbursement structure that allows patients to have access to new medications. Moreover, an environment full of active research and development to manage osteoarthritis reinforces its prominence as a market.

Germany has a strong market share with its sophisticated medical infrastructure systems and large healthcare expenditures. Germany's focus on early diagnosis, disease management, and adoption of new therapies, strong clinical research, and government programs, drives demand for osteoarthritis therapeutics.

APAC Market Insights

Asia Pacific is expected to have a substantial CAGR in the global osteoarthritis therapeutics market during the forecast period. The growth in this area is largely fueled by lifestyle changes, including more urban living, sedentary habits, and rising obesity rates. Countries like China, India, and Japan are seeing a notable increase in joint-related issues as life expectancy rises and healthcare becomes more accessible. On top of that, the development of healthcare infrastructure, government efforts to enhance musculoskeletal health, and higher disposable incomes are all driving the uptake of advanced osteoarthritis treatments in the region.

India's increasing elderly population, along with a heightened awareness of osteoarthritis, is fueling demand in this rapidly evolving healthcare market. With more investments in healthcare infrastructure, better access to diagnostics, and government efforts aimed at enhancing chronic disease management, the market is set to grow. On top of that, the affordability of treatments and the rise in medical tourism are boosting India's share in the healthcare sector.

China's market is really taking off. The growth is driven by its huge population, an aging demographic, and an increasing number of osteoarthritis cases that are often linked to lifestyle changes and urban living. The government's strong focus on healthcare reforms, combined with rising healthcare expenditures and improved pharmaceutical research and development, is setting the stage for the adoption of innovative osteoarthritis treatments. This positions China as a significant player in this expanding sector.

Key Osteoarthritis Therapeutics Market Players:

- Sanofi S.A.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- GlaxoSmithKline plc

- Pfizer Inc.

- Bayer AG

- Zimmer Biomet Holdings, Inc.

- Novartis AG

- Anika Therapeutics, Inc.

- Assertio Therapeutics, Inc.

- Bioventus LLC

- Ferring Pharmaceuticals

- Flexion Therapeutics, Inc.

- Arthrex, Inc.

- Royal Biologics

- Teva Pharmaceutical Industries Ltd.

- Abbott Laboratories

- Eli Lilly and Company

- Johnson & Johnson

- Horizon Therapeutics PLC

- Hanmi Pharm. Co., Ltd.

- Kolon Life Science Inc.

The osteoarthritis therapeutics industry is quite lively, with both major pharmaceutical companies and up-and-coming biotech firms competing fiercely for their slice of the pie. Big names like Sanofi, GlaxoSmithKline, and Pfizer are using their robust research and development capabilities, along with their vast distribution networks, to stay ahead of the game. For instance, the products of Sanofi Synvisc and Synvisc One are available in more than 60 countries, thanks to hefty investments in R&D.

Recent Developments

- In August 2025, Genascence Corporation declared that GNSC-001, a possible first-in-class gene therapy that blocks interleukin 1 (IL-1), has been given the Regenerative Medicine Advanced Therapy (RMAT) designation by the U.S. Food and Drug Administration (FDA) to treat osteoarthritis (OA) in the knee. An optimized human interleukin-1 receptor antagonist (IL-1Ra), a naturally occurring protein that inhibits IL-1 signaling, is expressed via the genetic medicine GNSC-001, a recombinant adeno-associated viral vector.

- In September 2024, Sun Pharma and Moebius Medical were granted fast-track designation by the USFDA for their non-opioid treatment MM-II, which is intended to alleviate knee pain caused by osteoarthritis. This designation permits a quicker review process and possibly a quicker approval process. The businesses want to apply for a CE Mark in the EU and start Phase 3 clinical studies.

- Report ID: 195

- Published Date: Sep 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Osteoarthritis Therapeutics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.