Hyaluronidase Power Injection Market Outlook:

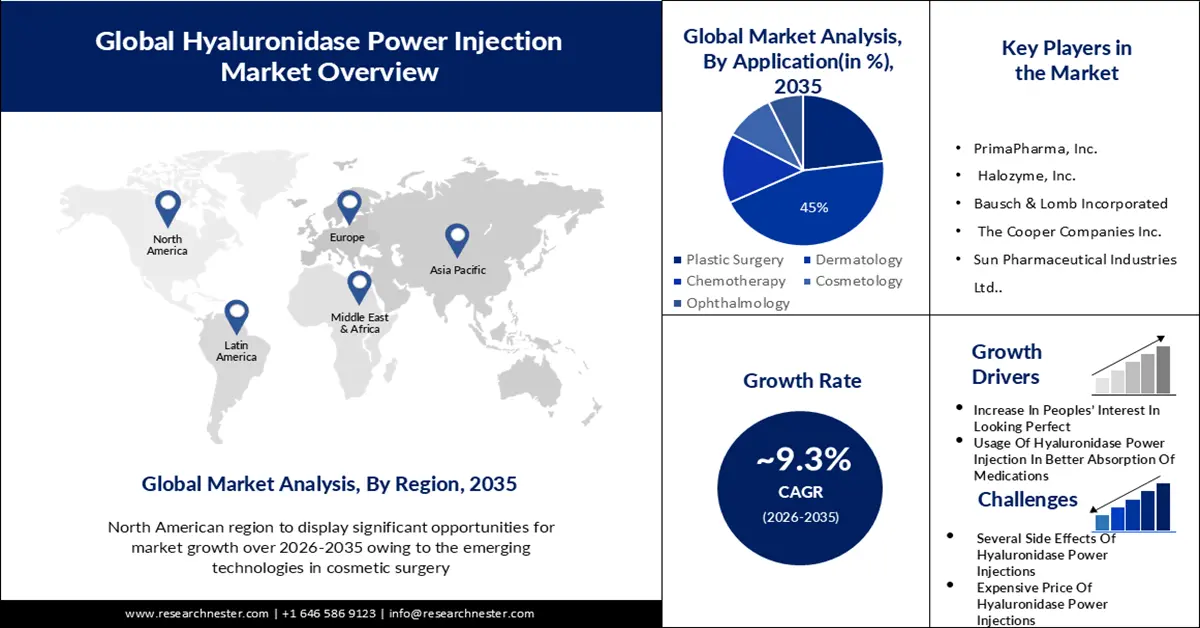

Hyaluronidase Power Injection Market size was over USD 1.07 billion in 2025 and is poised to exceed USD 2.6 billion by 2035, witnessing over 9.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hyaluronidase power injection is estimated at USD 1.16 billion.

The increasing acuteness across different application fields will act as the primary driver that will drive the market of hyaluronidase power injection and will take it to the anticipated CAGR. For instance, the degradation kinetics of the TEOSYAL RHA accumulation, manufactured by TEOXANE SA (Geneva, Switzerland), is implementing the maintained network technology (PNT) to use in different applications. In humans, six different hyaluronidases, HYAL1-4, HYAL-P1, and PH-20, have been identified. Hyaluronidase looks for applications in cosmetic therapies, cancer treatment, and ophthalmic therapeutic solutions.

Additionally, the increasing number of nominally invasive aesthetic surgeries is calculated to amplify the hyaluronidase power injection system's demand in the forecast period. For instance, The International Society of Aesthetic Plastic Surgery (ISAPS) announced the results of its yearly Global Survey on Aesthetic/Cosmetic Procedures this week at the ISAPS Olympiad Athens World Congress 2023, which rounded up more than 1,000 attendees from 90 countries to talk about the newest scientific research, novelties, and processes to modify patient protection in aesthetic plastic surgery. The report demonstrates an 11.2% complete rise in techniques executed by plastic surgeons in 2022 with more than 14.9 million surgical and 18.8 million non-surgical techniques executed across the world. Liposuction was the most general surgical technique in 2022 as in 2021, with more than 2.3 million techniques and a 21.1% rise.

Key Hyaluronidase Power Injection Market Insights Summary:

Regional Insights:

- By 2035, North America in the hyaluronidase power injection market is expected to command a 30% share owing to the rising volume of experimental procedures and strong presence of key manufacturers.

- Asia Pacific is projected to secure nearly 26% share by 2035 underpinned by escalating medical tourism for dermatology treatments across the region.

Segment Insights:

- The animal-derived hyaluronidase segment is projected to exceed a 55% share by 2035 propelled by the dominance of licensed brands originating from bovine and porcine sources.

- The dermatology segment is anticipated to retain about 45% share by 2035 supported by heightened emphasis on safety standards in hyaluronidase power injection applications.

Key Growth Trends:

- Therapeutic Uses of Hyaluronidase Power Injection

- Safer to Use in Surgeries to Increase the Absorption of Drugs

Major Challenges:

- Several Side Effects of Excessive Hyaluronidase Power Injection

- Lack of Trials and Tests of Hyaluronidase

Key Players: PrimaPharma, Inc., Halozyme, Inc., Bausch & Lomb Incorporated, The Cooper Companies Inc., Sun Pharmaceutical Industries Ltd., STEMCELL Technologies Inc., Shijiazhuang Yiang Technology Co., Ltd., Calzyme, Dermax Medical Technology (Hebei) Co., Ltd., Takeda Pharmaceuticals Co Limited, Janssen Global Services, LLC, Astellas Pharma Inc., Seagen Inc.

Global Hyaluronidase Power Injection Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.07 billion

- 2026 Market Size: USD 1.16 billion

- Projected Market Size: USD 2.6 billion by 2035

- Growth Forecasts: 9.3%

Key Regional Dynamics:

- Largest Region: North America (30% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Mexico, United Arab Emirates, Thailand

Last updated on : 26 November, 2025

Hyaluronidase Power Injection Market - Growth Drivers and Challenges

Growth Drivers

- Therapeutic Uses of Hyaluronidase Power Injection - Hyaluronidase has been utilized in medical usage for over 60 years. Internal hyaluronidases in the human body get physiological and pathophysiological importance because of their enzymatic activity at the time of the cleavage of hyaluronan. The possibility for therapeutic utilization of testicular and recombinant hyaluronidase has been even more recognized and modified in recent years. Most appropriate in practice is the co-application of hyaluronidase and other active materials to increase their bioavailability within the tissue. The US Food and Drug Administration has licensed hyaluronidase for symptoms like subcutaneous fluid infiltration (hypodermoclysis), as an accessory to accentuate the absorption and distribution of drugs in subcutaneous tissue or to maintain extravasation, and as an accessory to generate the absorption of contrast media in urinary tract angiography (subcutaneous urography).

- Safer to Use in Surgeries to Increase the Absorption of Drugs - Several patients with chronic diseases need injections as part of their persistent medical treatment. Hyaluronidase has been demonstrated to enhance the systemic submission of injectable drugs and give better therapy results for these patients. Cases of recent drugs being implemented in amalgamation with hyaluronidase comprise but are not restricted to insulin in diabetes, beta interferons in multiple sclerosis, biotherapeutics in rheumatoid arthritis, immunoglobulin substitution treatment in basic immunodeficiencies, and monoclonal antibodies in cancer treatment. Hyaluronidase has recently been utilized for multiple other kinds of medical management as well. Ordinary administration of hyaluronidase is via hypodermic injection with doses starting from 50 to 300 units/mL. When implementing this enzyme to increase the dispersion of another pharmaceutical agent, the administration is feasible in one of two ways. It may be injected first into the hypodermic tissue, and then the second agent may be injected consecutively with the same needle. Or it may be co-directed with the other agent in a single injection.

- Increase in Awareness of People About Their Beauty - Moreover, increasing concern associated with the conversion of physical images has taken to a rising need for cosmetics and aesthetic processes. The requirement for hyaluronidase around cosmetic dermatology is accelerating and is mainly propelled by the progress in the incidence of skin disorders and easy entrance to modified cosmetic therapies in different regions.

Challenges

- Several Side Effects of Excessive Hyaluronidase Power Injection - Quick hypersensitivity reactions caused by hyaluronidase are evident as erythematous edema after 1 to 2 hours, and there is no response to antibiotic treatment. In such cases, systemic steroids, antihistamines, and steroid cream applications are helpful. Postponed hypersensitivity reactions caused by hyaluronidase can appear even after 24 hours, and in such scenarios, a skin test will not generate a positive reaction within 20 minutes, aftermath in an adverse diagnosis. The most often faced side effects are injection site reaction, headache, fatigue, nausea, and fever. Serious reactions can comprise hypersensitivity reactions, anaphylaxis, hyperviscosity, and thromboembolism. Recombinant human hyaluronidase occurs with a black box warning of thrombosis. Animal-derived hyaluronidase is immunogenic and may create allergic reactions. Human recombinant hyaluronidase (rHuPH20) is better permitted and has less potential to create an allergic reaction. Roughly 6% of the population get anti-rHuPH20 antibodies that are non-neutralizing and get no clinically substantial results.

- Lack of Trials and Tests of Hyaluronidase

- Limitations in The Knowledge of People on How to Use Hyaluronidase Power Injection

Hyaluronidase Power Injection Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.3% |

|

Base Year Market Size (2025) |

USD 1.07 billion |

|

Forecast Year Market Size (2035) |

USD 2.6 billion |

|

Regional Scope |

|

Hyaluronidase Power Injection Market Segmentation:

Source Segment Analysis

The animal-derived hyaluronidase segment in the hyaluronidase power injection market is projected to hold its position with over 55% of revenue share by the end of the predicted timeline. It is because most licensed and advertised brands, at present, are taken from animal sources, and the most commonly implemented animal sources are bovine and porcine products. To illustrate, the US FDA has approved the recombinant human hyaluronidase PH20 (rHuPH20) which works locally to provisionally eliminate the glycosaminoglycan hyaluronan’s barrier, enabling quick subcutaneous (SC) submission of large volumes and/or high doses of successively or co-directed therapeutics. Moreover, the animal-derived hyaluronidase market has witnessed a substantial number of product approvals, contributing to the massive demand for the animal-derived hyaluronidase segment in the coming years.

Application Segment Analysis

Hyaluronidase power injection market from the dermatology segment held the largest profit share in 2023 and is estimated to hold this position with approximately 45% revenue share by the end of 2035. The increasing importance of hyaluronidase power injections’ safety in dermatology has resulted in the highest profit production. In December 2021, a research study released by the American Society for Dermatologic Surgery (ASDA) expressed that hyaluronic acid fillers VYC-20I were harmless and efficient for cheek augmentation via cannula and noninferior to needle injection. Utilizing cannulas to provide facial fillers may limit negative events (AEs) in comparison with needle injection. The setup of a standard technique is anticipated to modify the momentum of market expansion in the future.

Our in-depth analysis of the global hyaluronidase power injection market includes the following segments:

|

Source |

|

|

Application |

|

|

Distribution Channels |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hyaluronidase Power Injection Market - Regional Analysis

North American Market Insights

North America industry is set to dominate majority revenue share of 30% by 2035. This is due to the increasing number of experimental procedures that present an in-vitro assessment of the biological attainability of hyaluronidase and the appearance of key players producing these products in the region. According to The American Society of Plastic Surgeons (ASPS), the globe's largest plastic surgery company, symbolizing 92 percent of all board-certified plastic surgeons in the United States data released in 2022, there were 26.2 million surgical and minimally invasive cosmetic and reconstructive techniques experimented as well as executed in the United States in 2022. More particularly, there has been a 19% surge in cosmetic surgery techniques since 2019. Moreover, the high adoption of progressed therapy choices and an acknowledgeable number of dermatology clinics advocating such therapies contribute to immense market expansion across North America.

APAC Market Insights

Asia Pacific hyaluronidase power injection market is projected to expand at the quickest CAGR during the forecast period and is set to hold the position of second largest shareholder with almost 26% profit share. This growth is wheeled as a result of medical tourism for dermatology therapies and dermatological device applications in different countries of the region. In line with the Korea Health Industry Development Institute, the number of medical tourists exploring South Korea increased eightfold in ten years—from 60,000 in 2011 to almost half a million in 2021. Overseas patients now make up almost half of all plastic surgeries executed in South Korea. In addition, the presence of a significant number of suppliers together with the emergence of technologies in South Korea is further anticipated to drive the market expansion.

Hyaluronidase Power Injection Market Players:

- Argenx SE

- Company Overview

- Business Planning

- Main Product Offerings

- Financial Execution

- Main Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- PrimaPharma, Inc.,

- Halozyme, Inc.

- Bausch & Lomb Incorporated

- The Cooper Companies Inc.,

- Sun Pharmaceutical Industries Ltd.

- STEMCELL Technologies Inc.

- Shijiazhuang Yiang Technology Co., Ltd.

- Calzyme

- Dermax Medical Technology (Hebei) Co., Ltd.

Recent Developments

- Argenx SE, an international immunology organization that works to modify the lives of people with serious autoimmune diseases, reported affirmative topline information from the Phase 3 ADAPT-SC study testing subcutaneous (SC) efgartigimod (1000 mg efgartigimod-PH20) as a therapy for generalized myasthenia gravis (gMG). Argenx delivered a biologics approval application (BLA) to the US FDA.

- The Food and Drug Administration (FDA) released a letter sanctioning the emergency utilization of the Alinity m Resp-4-Plex for the coexisting qualitative detection and distinction of RNA from SARS-CoV-2, influenza A virus (flu A), influenza B virus (flu B), and/or Respiratory Syncytial Virus (RSV) in anterior nasal or nasopharyngeal swab specimens accumulated by a healthcare provider (HCP).

- Report ID: 5456

- Published Date: Nov 26, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.