- Introduction

- Market Definition

- Market Segmentation

- Product Overview

- Assumptions and Acronyms

- Research Methodology

- Research Process

- Primary Research

- Manufacturers

- Suppliers and Distributors

- End-Users

- Secondary Research

- Market Size Estimation

- Executive Summary – Global Dermatological Devices Market

- Analysis on Market Dynamics

- Regulatory & Standards Landscape

- Value Chain Analysis

- Porter’s Five Forces Analysis

- Impact of COVID-19 on the Market

- Competitive Positioning

- Competitive Landscape

- Market Share Analysis, 2023

- Competitive Benchmarking

- Canfield Scientific, Inc.

- Detailed Overview

- Assessment of Key Offering

- Analysis on Growth Strategies

- Exhaustive Analysis on Key Financial Indicators

- Recent Developments

- DermLite

- Aerolase

- HEINE Optotechnik GmbH & Co. KG

- Image Derm Inc.

- Cutera Inc.

- Solta Medical

- Cynosure

- Alma Lasers

- Candella Corporation.

- Canfield Scientific, Inc.

- Global Dermatological Devices Market, 2023-2036

- Market Overview

- Market by Value (USD million)

- Global Dermatological Devices Market– Segmentation Analysis, 2023-2036

- By Product

- Diagnostic Device, 2023-2036F (USD million)

- Dermatoscope, 2023-2036F (USD million)

- Biopsy Devices, 2023-2036F (USD million)

- Microscopes, 2023-2036F (USD million)

- Therapeutic Devices, 2023-2036F (USD million)

- Lasers, 2023-2036F (USD million)

- Electrosurgical Device, 2023-2036F (USD million)

- Phototherapy Devices, 2023-2036F (USD million)

- Microdermabrasion Devices, 2023-2036F (USD million)

- Liposuction Devices, 2023-2036F (USD million)

- Cryotherapy Devices, 2023-2036F (USD million)

- Diagnostic Device, 2023-2036F (USD million)

- By Application

- Diagnostic Device, 2023-2036F (USD million)

- Skin Cancer Diagnosis, 2023-2036F (USD million)

- Other Diagnostic Application, 2023-2036F (USD million)

- Treatment Devices

- Cellulite Reduction, 2023-2036F (USD million)

- Hair Removal Acne, Psoriasis & Tattoo Removal, 2023-2036F (USD million)

- Body Contouring & Fat Removal, 2023-2036F (USD million)

- Skin Rejuvenation, 2023-2036F (USD million)

- Wrinkle Removal & Skin Resurfacing, 2023-2036F (USD million)

- Vascular & Pigment Lesion Removal, 2023-2036F (USD million)

- Other, 2023-2036F (USD million)

- Diagnostic Device, 2023-2036F (USD million)

- By End-use

- Hospitals, 2023-2036F (USD million)

- Clinics, 2023-2036F (USD million)

- Others, 2023-2036F (USD million)

- By Region

- North America, 2023-2036F (USD million)

- Latin America, 2023-2036F (USD million)

- Europe, 2023-2036F (USD million)

- Asia Pacific, 2023-2036F (USD million)

- Middle East & Africa, 2023-2036F (USD million)

- By Product

- North America Dermatological Devices Market Outlook

- Market Overview

- Market by Value (USD million)

- By Product

- Diagnostic Device, 2023-2036F (USD million)

- Dermatoscope, 2023-2036F (USD million)

- Biopsy Devices, 2023-2036F (USD million)

- Microscopes, 2023-2036F (USD million)

- Therapeutic Devices, 2023-2036F (USD million)

- Lasers, 2023-2036F (USD million)

- Electrosurgical Device, 2023-2036F (USD million)

- Phototherapy Devices, 2023-2036F (USD million)

- Microdermabrasion Devices, 2023-2036F (USD million)

- Liposuction Devices, 2023-2036F (USD million)

- Cryotherapy Devices, 2023-2036F (USD million)

- By Application

- Diagnostic Device, 2023-2036F (USD million)

- Skin Cancer Diagnosis, 2023-2036F (USD million)

- Other Diagnostic Application, 2023-2036F (USD million)

- Treatment Devices

- Cellulite Reduction, 2023-2036F (USD million)

- Hair Removal Acne, Psoriasis & Tattoo Removal, 2023-2036F (USD million)

- Body Contouring & Fat Removal, 2023-2036F (USD million)

- Skin Rejuvenation, 2023-2036F (USD million)

- Wrinkle Removal & Skin Resurfacing, 2023-2036F (USD million)

- Vascular & Pigment Lesion Removal, 2023-2036F (USD million)

- Other, 2023-2036F (USD million)

- Diagnostic Device, 2023-2036F (USD million)

- By End-use

- Hospitals, 2023-2036F (USD million)

- Clinics, 2023-2036F (USD million)

- Others, 2023-2036F (USD million)

- By Region

- US, 2023-2036F (USD million)

- Canada, 2023-2036F (USD million)

- Diagnostic Device, 2023-2036F (USD million)

- Europe Dermatological Devices Market Outlook

- Market Overview

- Market by Value (USD million)

- By Product

- By Application

- By End Use

- By Country

- Germany, 2023-2036F (USD million)

- France, 2023-2036F (USD million)

- Italy, 2023-2036F (USD million)

- Spain, 2023-2036F (USD million)

- UK, 2023-2036F (USD million)

- Rest of Europe, 2023-2036F (USD million)

- Asia Pacific Dermatological Devices Market Outlook

- Market Overview

- Market by Value (USD million)

- By Product

- By Application

- By End Use

- By Country

- India, 2023-2036F (USD million)

- China, 2023-2036F (USD million)

- Japan, 2023-2036F (USD million)

- South Korea, 2023-2036F (USD million)

- Singapore, 2023-2036F (USD million)

- Rest of APAC, 2023-2036F (USD million)

- Latin America Dermatological Devices Market Outlook

- Market Overview

- Market by Value (USD million)

- By Product

- By Application

- By End Use

- By Country

- Brazil, 2023-2036F (USD million)

- Mexico, 2023-2036F (USD million)

- Argentina, 2023-2036F (USD million)

- Rest of LATAM, 2023-2036F (USD million)

- Middle East & Africa Dermatological Devices Market Outlook

- Market Overview

- Market by Value (USD million)

- By Product

- By Application

- By End Use

- By Country

- Saudi Arabia, 2023-2036F (USD million)

- UAE, 2023-2036F (USD million)

- Rest of MEA, 2023-2036F (USD million)

Dermatology Devices Market Outlook:

Dermatology Devices Market size was over USD 15.8 billion in 2025 and is poised to exceed USD 45.68 billion by 2035, growing at over 11.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of dermatology devices is estimated at USD 17.39 billion.

The growth of the market can be attributed to the increasing count of people suffering from hair loss problems and skin issues. Hair loss has been a common problem among people, the occurrence of problems is associated with unhealthy food habits, pollution, stress, and others. hair loss problems can be pseudo-treated by microblading and can be permanently treated by micro grafting. These procedures are likely to boost the demand for dermatological devices. About 80% of Americans experience hair loss, while 15% of women experience acne outbreaks, according to the American Academy of Dermatology Association.

In addition to these, factors that are believed to fuel the market growth of the dermatology devices market include the increased prevalence of skin procedures, including microneedling and dermabrasion, owing to its lesser invasion, higher effectiveness and quick process. The National Library of Medicine claims that microneedling increases the delivery of drugs through the skin's physical barriers. Evidently, this has led to a 47% enlargement of the follicular infundibulum, which helps to further boost the flow of medication through the skin barrier. In addition, around 3 million treatments involving tissue fillers were carried out globally in 2020. Additionally, nearly 140,000 dermabrasion treatments were performed globally.

Key Dermatology Devices Market Insights Summary:

Regional Highlights:

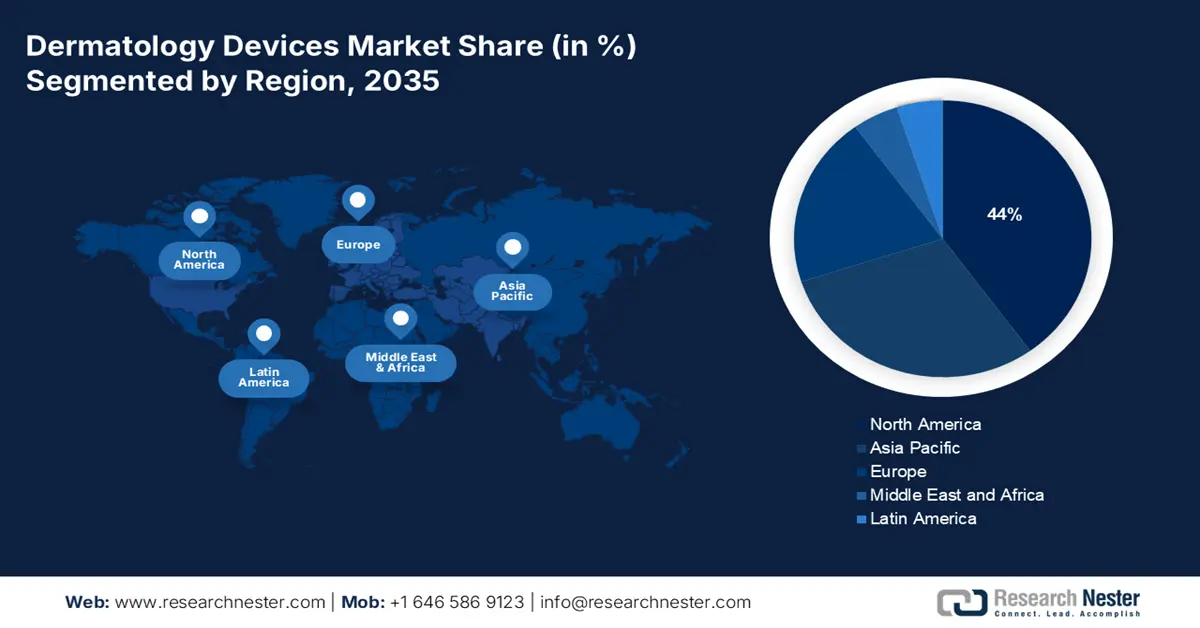

- North America dermatology devices market is predicted to capture 44% share by 2035, driven by higher tattoo removal rates, rising demand for cosmetic treatments, and increasing plastic surgery procedures.

Segment Insights:

- The treatment device (application) segment in the dermatology devices market is projected to generate maximum revenue by 2035, fueled by the growing popularity of skin tightening, rejuvenation, and body contouring procedures.

- The therapeutic device segment in the dermatology devices market is anticipated to maintain the largest share by 2035, propelled by rising demand for liposuction and other cosmetic therapeutic procedures.

Key Growth Trends:

- Higher Number of People Living with Acnes and Skin Problems

- Rise in the Skin Tightening and Rejuvenation Process

Major Challenges:

- Risk and Discomfort Associated with Plastic Surgery

- Charges for Cosmetic Treatment Are Exorbitant

Key Players: DermLite, Aerolase, Canfield Scientific, Inc., HEINE Optotechnik GmbH & Co. KG, Image Derm Inc., Cutera Inc., Solta Medical, Cynosure, Alma Lasers, and Candella Corporation.

Global Dermatology Devices Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 15.8 billion

- 2026 Market Size: USD 17.39 billion

- Projected Market Size: USD 45.68 billion by 2035

- Growth Forecasts: 11.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Dermatology Devices Market Growth Drivers and Challenges:

Growth Drivers

- Higher Number of People Living with Acnes and Skin Problems - Acne and other skin issues are treated with laser therapy and light therapies. Moreover, there are other devices such as anti-blemish devices, facial devices, and others to treat acne. Therefore, the rising problem of acne is boosting the demand for dermatological device. The prevalence of Acne Vulgaris, a skin disorder marked by blemishes and deep scars, is 50.9% in women aged 20 to 29 and 26.3% in those aged 40 to 49, as per the statistics of the NIH.

- Rise in the Skin Tightening and Rejuvenation Process - There are various cosmetic treatments that can be performed for skin rejuvenation and skin tightening, Moreover, devices such as dermabrasion ion therapy devices, thermage systems, and others are used for these skin-enhancing procedures. The number of non-surgical procedures, such as derma fillers, skin tightening, skin treatments, and others has increased by over 48% in 2021.

- Launch of Technologically Advanced Dermatological Devices - Innovation of better devices and improvement of technology always create huge opportunities for the dermatology devices market. For instance, in 2021, Casio Computer Co., Ltd. launched the DZ-D100 DERMOCAMERA, which enables the lens to directly touch the skin and get close-up shots of the affected area along with ordinary shots, and it can be all done with the use of a single camera.

- Growing Popularity of Med Spas - As of 2017, there were around 4200 med spas in the United States, and the industry was worth USD 4 billion. Moreover, by the end of 2023, there will be nearly 10,000 med spas which are likely to reach a value of around USD 2o billion.

- Increasing Count of Professional Dermatologist - The higher number of dermatologists will be able to treat a larger pool of patients, which in turn is to boost the demand for dermatological devices. In the United States, there were around 3700 dermatologists practicing.

Challenges

- Risk and Discomfort Associated with Plastic Surgery – Plastic surgery are associated with various severe side effects, including seroma, blood loss, scarring, hematoma, never infection, and deep vein thrombosis. Many people fail to achieve their desired look which leads to disappointment. Moreover, in liposuction surgery, several slits are made, which can be very stressful for the internal organs of the body. in some unfortunate cases, if any perforation reaches an internal organ, it can puncture them and can even lead to death.

- Charges for Cosmetic Treatment Are Exorbitant

- Poor Reimbursement Policies for Cosmetic Treatment

Dermatology Devices Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

11.2% |

|

Base Year Market Size (2025) |

USD 15.8 billion |

|

Forecast Year Market Size (2035) |

USD 45.68 billion |

|

Regional Scope |

|

Dermatology Devices Market Segmentation:

Product Segment Analysis

The therapeutic device segment is estimated to gain the largest market revenue at the end of 2035. The growth of the segment can be attributed to the higher usage of liposuction therapy. The rising obsession of people to achieve an appealing look and to reduce unnecessary fat from their bodies has increased the popularity of liposuction. In 2020, around 300,000 liposuction procedures were carried out in America, making it the most popular cosmetic surgery. On the other hand, other therapeutic devices, such as cryotherapy devices are used in the treatment of skin cancer. Therefore, rising cases of cancer are expected to augment segment growth. In the United States, every day around 9500 people get diagnosed with skin cancer, making it the most common cancer in the U.S. Furthermore, the therapeutic device segment is categorized into lasers, electrosurgical devices, phototherapy devices, microdermabras ion devices, liposuction devices, and cryotherapy devices.

Application Segment Analysis

The treatment device is to garner the maximum revenue at the end of 2035. The treatment device segment is further fragmented into cellulite reduction, hair removal, acne, psoriasis & tattoo removal, body contouring & fat removal, skin rejuvenation, wrinkle removal & skin resurfacing, vascular & pigment lesion removal and others. The segment growth is expected on the account of growing popularity of skin tightening, skin rejuvenating, and body contouring, including breast augmentation and nose reshaping.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Application |

|

|

By End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Dermatology Devices Market Regional Analysis:

North American Market Insights

The North American dermatology devices market is estimated to hold 44% revenue share by 2035. The growth of the market can be attributed majorly to the higher rate of tattoo removal and the increased number of people wanting cosmetic treatment and plastic surgery for various purposes, such as breast shaping, tissue fillers, eyelid surgery, and others. All these cosmetic treatments are expected to create huge demand for dermatological procedures. In 2020, around 30% of Americans have tattoos and nearly 23% of the total population want their removal which makes up around 20 million people. Moreover, in 2020, around 400,000 noses reshaping surgery, and more than 4 million minimal cosmetics minimally invasive surgery has been carried out.

Dermatology Devices Market Players:

- DermLite

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Aerolase

- Canfield Scientific, Inc.

- HEINE Optotechnik GmbH & Co. KG

- Image Derm Inc.

- Cutera Inc.

- Solta Medical

- Cynosure

- Alma Lasers

- Candella Corporation

Recent Developments

-

Alma Lasers one of the world's leading providers of power-based medical and aesthetic solutions introduced the new Alma PrimeXTM platform. It is a non-invasive treatment for body contouring and skin tightening.

-

Canfield Scientific, Inc., the "Andreas Syggros" Hospital Melanoma and Skin Cancer Center has received a donation from the Onassis Foundation for the first VECTRA® WB360 whole-body imaging equipment in Greece, designed by Canfield.

- Report ID: 4674

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Dermatology Devices Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.