Hyaluronidase Market Outlook:

Hyaluronidase Market size was over USD 1.8 billion in 2025 and is estimated to reach USD 6.4 billion by the end of 2035, expanding at a CAGR of 15.2% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of hyaluronidase is assessed at USD 2 billion.

The worldwide market is witnessing a significant transformation, readily evolving from a niche surgical aid to a severe enabler of modernized biologic drug delivery. This particular enzyme is currently at the forefront of pharmaceutical advancement, driven by the need for cost-effective and patient-friendly treatment modalities. Besides, according to an article published by NLM in June 2025, intravenous biologics have been readily approved with investigational hyaluronidase versions, including atezolizumab, with a Medicare spending of USD 819 million, which was cleared in September 2024. Likewise, Efartigimod alfa, with a USD 154 million Medicare cost, was approved in June 2023, thus suitable for boosting the market’s exposure.

Furthermore, the rise of drug-device combinations, expansion in aesthetic reversal, technological purity focus, and transition towards subcutaneous biologics are also uplifting the global market. As per an article published by ACS Publications in January 2023, the international pharmaceutical drug delivery market is expected to reach USD 2,206.5 billion, along with a 5.9% growth rate by the end of 2026. This has readily resulted in drug delivery advancements, featuring standard efforts to deliver biologics. For instance, conjugating polyethylene glycol increased their circulation duration for almost 20 PEGylated protein formulations, which is readily uplifting the market’s development.

Key Hyaluronidase Market Insights Summary:

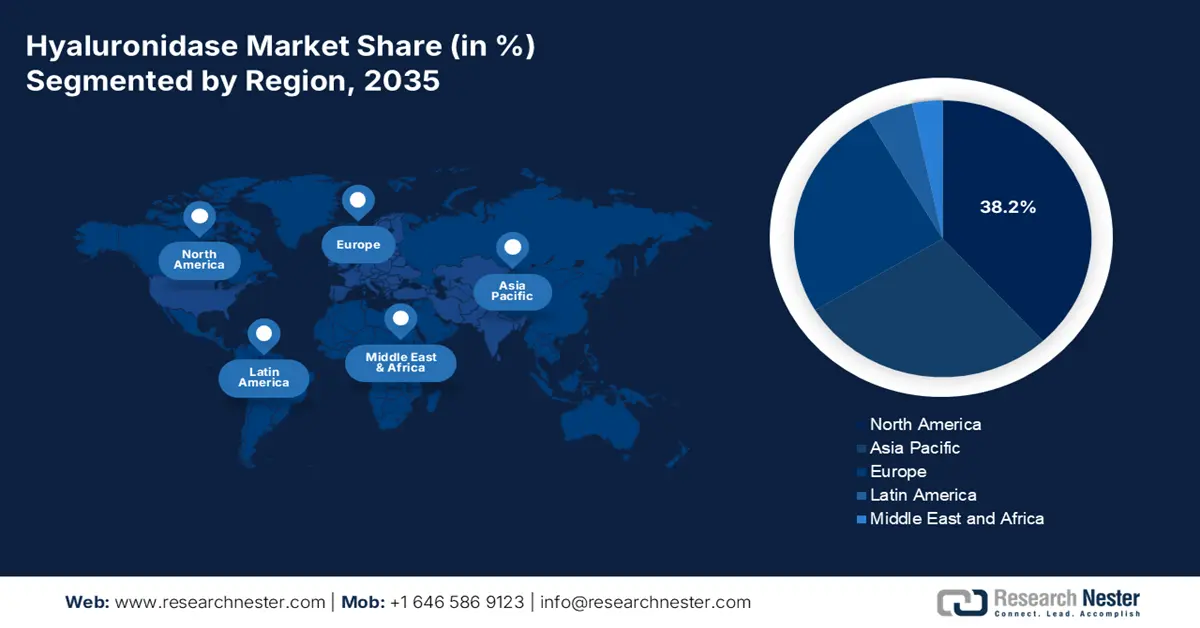

Regional Highlights:

- North America is predicted to account for 38.2% share by 2035, driven by the shift to subcutaneous biologics administration and strong regulatory support.

- Europe is projected to emerge as the fastest-growing region during the forecast period, owing to healthcare innovation, rising chronic disease prevalence, and patient-centric care initiatives.

Segment Insights:

- Recombinant segment is expected to garner 68.7% share by 2035, driven by its versatile, consistent, and safer alternative to animal-derived hyaluronidase.

- Direct tender (institutional sales) segment is anticipated to hold the second-largest share during the forecast period, propelled by cost-effectiveness and bulk procurement efficiency.

Key Growth Trends:

- Rise in chronic conditions

- Containment in healthcare expenses

Major Challenges:

- Complicated manufacturing and high costs

- Reimbursement uncertainty and administrative obstacles

Key Players: Halozyme Therapeutics, Inc. (U.S.), STEMCELL Technologies Inc. (Canada), Bausch & Lomb Incorporated (U.S.), Shreya Life Sciences Pvt. Ltd. (India), Sun Pharmaceutical Industries Ltd. (India), CooperSurgical, Inc. (U.S.), Pfizer Inc. (U.S.), Sanofi (France), Galderma S.A. (Switzerland), Allergan plc (Now part of AbbVie Inc.) (U.S.), Merck KGaA (Germany), Roche AG (Switzerland), LG Chem Ltd. (South Korea), JW Life Science (South Korea), Croma-Pharma GmbH (Austria), Gufic Biosciences Ltd. (India), Troikaa Pharmaceuticals Ltd. (India), ROHTO Pharmaceutical Co., Ltd. (Japan), Hikma Pharmaceuticals PLC (U.K.), Proteomics International Laboratories Ltd. (Australia)

Global Hyaluronidase Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.8 billion

- 2026 Market Size: USD 2 billion.

- Projected Market Size: USD 6.4 billion by 2035

- Growth Forecasts: 15.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.2% Share)

- Fastest Growing Region: Europe

- Dominating Countries: United States, Germany, Japan, France, Canada

- Emerging Countries: China, India, South Korea, Brazil, Australia

Last updated on : 22 October, 2025

Hyaluronidase Market - Growth Drivers and Challenges

Growth Drivers

- Rise in chronic conditions: The increasing international incidence of autoimmune, retinopathy, diabetic, and cancer diseases is expanding the patient pool directly, which is positively driving the market globally. According to an article published by the CDC in October 2024, 3 in 4 adults in America are affected with at least 1 chronic disease, and more than half have 2 or more conditions. Besides, adults aged over 65 years constitute 90% of almost 1 chronic disorder, more than 75% midlife adults aged between 35 to 64 years have over 1 such condition, and 60% adults aged 18 to 34 years also comprise 1 condition, thus suitable for increasing the market’s demand.

- Containment in healthcare expenses: The presence of subcutaneous administration has reduced the burden on hospital-based infusion facilities, resulting in lowered overhead expenses, which is also uplifting the hyaluronidase market across different nations. For instance, as per the June 2025 PIB Government data report, in India, the Ayushman Bharat- Pradhan Mantri Jan Arogya Yojana (PM-JAY) readily caters to 55 crore people, with the provision of over 2.6 lakhs treatment options, amounting to Rs. 496 crores. This particularly caters to the elderly population, thereby determining a massive growth opportunity for the market.

- Tactical pharma-based partnerships: The aspect of licensing drug delivery platforms proprietary by large-scale pharmaceutical organizations is also escalating the market’s development and commercialization. For instance, in March 2024, Zencore Biologics Co., Ltd. as well as Apeloa Pharmaceutical Co., Ltd entered into a strategic cooperation-based deal. This agreement deliberately covers collaborative research and development, suitable for initiating production in the Antibody-drug Conjugates (ADCs) field.

Payer’s Pricing Inputs of Different Drugs Uplifting the Hyaluronidase Market (2025)

|

Drug Type |

Commercial Price |

Medicare Price |

|

Daratumumab FASPRO (1,800 mg/15 mL) |

USD 5.8 per mg |

USD 5.1 per mg |

|

Lenalidomide (25 mg) |

USD 35.6 |

USD 35.6 |

|

Lenalidomide (10 mg; maintenance) |

USD 89.1 |

USD 89.1 |

|

Bortezomib (3.5 mg) |

USD 57.8 |

USD 22.2 |

Source: JMCP

Challenges

- Complicated manufacturing and high costs: The stable, consistent, and high-purity hyaluronidase production, especially the recombinant variant, is considered a technically capital-intensive and complex process. It demands strict quality controls, maintains adherence to good manufacturing practice standards, and a sophisticated biotechnology infrastructure, which has created an entry barrier in the hyaluronidase market. This directly contributes to the increased cost of the finalized product, thereby impacting the cost-effectiveness. For healthcare payers and systems, particularly in budget-based environments, these increased expenses can emerge as a significant barrier to widespread adoption and reimbursement.

- Reimbursement uncertainty and administrative obstacles: The regulatory pathway for the market, particularly when utilized as a drug delivery enhancement for the newest biologic, is regarded to be complex and varies significantly across different regions. Agencies, such as the EMA and FDA, demand expanded data to prove that hyaluronidases do not alter the efficiency, safety, or pharmacokinetics of the primary medication. Moreover, the aspect of achieving standard reimbursement is a major challenge, causing a hindrance in the market’s upliftment. In this regard, payers frequently struggle with classifying and paying for these combination therapies.

Hyaluronidase Market: Key Insights

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.2% |

|

Base Year Market Size (2025) |

USD 1.8 billion |

|

Forecast Year Market Size (2035) |

USD 6.4 billion |

|

Regional Scope |

|

Hyaluronidase Market Segmentation:

Product Segment Analysis

The recombinant segment in the market is expected to garner the largest share of 68.7% by the end of 2035. The segment’s exposure depends on the provision of a more versatile, consistent, and safer alternative to hyaluronidase, which has been readily derived from animal sources. According to an article published by the Drug Metabolism and Disposition in June 2023, the cytochrome P450 enzyme readily performs an effective xenobiotic biotransformation share, which CYPZD6, and it comprises an approximate 20% to 30% metabolism of common prescribed medications, thus making it suitable for the segment’s growth.

Distribution Channel Segment Analysis

The direct tender (institutional sales) segment in the hyaluronidase market is anticipated to account for the second-largest share during the forecast period. The segment’s upliftment is propelled by the involvement of manufacturers in negotiating supply contracts with institutional buyers, including private and public hospital networks, group purchasing organizations, and government health ministries. Besides, this model is effectively preferred for its cost-effectiveness and efficiency, since bulk processing through competitive tenders permits institutions to achieve generous volume discounts.

Application Segment Analysis

The drug delivery and dispersion segment in the market is projected to cater to the third-largest share by the end of the predicted duration. The segment’s growth is driven by its importance in breaking down hyaluronic acid, which is considered a substance in the extracellular matrix that tends to block drug dispersion and delivery. Besides, in November 2023, Acumen Pharmaceuticals, Inc. notified the international non-exclusive license agreement and collaboration with Halozyme Therapeutics Inc. to offer ENHANZE drug delivery accessibility, thereby denoting a positive impact on the overall segment.

Our in-depth analysis of the market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

Distribution Channel |

|

|

Application |

|

|

End user |

|

|

Therapy Area |

|

|

Formulation & Delivery |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hyaluronidase Market - Regional Analysis

North America Market Insights

North America market is predicted to account for the highest share of 38.2% by the end of 2035. The market’s growth in the region is extremely propelled by the paradigm transition from intravenous to subcutaneous monoclonal and biologics antibodies administration, the existence of a technological platform, the pivotal role of the U.S. Federal Reimbursement, and provincial health aspects. According to the August 2025 NLM article, there has been an increase in biologics, accounting for 170 in the past five years and 139 over 10 years, successfully approved by the FDA. Additionally, biologics catered to 32% of drug approvals, thereby making it suitable for the market’s growth.

Historical FDA Approval for Small Molecule, Antibodies, Non-Antibody Biologics, and CAR-T Drugs

|

Years |

Small Molecule |

Antibodies |

Non-Antibody Biologics |

CAR-T Drugs |

Total |

|

2014 |

31 |

9 |

7 |

- |

47 |

|

2015 |

33 |

10 |

7 |

- |

50 |

|

2016 |

11 |

6 |

3 |

- |

20 |

|

2017 |

34 |

10 |

3 |

2 |

49 |

|

2018 |

38 |

11 |

5 |

- |

54 |

|

2019 |

34 |

9 |

2 |

- |

45 |

|

2020 |

36 |

12 |

2 |

1 |

51 |

|

2021 |

33 |

10 |

5 |

2 |

50 |

|

2022 |

20 |

11 |

4 |

1 |

36 |

|

2023 |

33 |

12 |

6 |

- |

51 |

|

2024 |

30 |

15 |

1 |

1 |

47 |

Source: NLM

U.S. market is growing significantly, owing to the aspect of suitable reimbursement policies, federal research fund, rapid transition in the drug delivery system, reduced healthcare expenses, optimization of patient convenience, and Medicare Part B coverage for administered drugs. As per an article published by NLM in June 2025, a total of 9 biologics constituted approved hyaluronidase versions, and the Medicare spending for these drugs amounted to USD 10.3 billion as of 2022. In addition, hyaluronidase versions accounted for 5% to 83% of the overall Medicare expenditure for 4 of these drugs, thus creating a positive impact for the market.

The market in Canada is also growing due to the existence of provincial health technology assessment, standard care protocols, optimistic recommendations from agencies, such as the Canada-based Agency for Drugs and Technologies in Health (CADTH), an increase in health and medical spending, and provincial formularies. As stated in the August 2022 Government of Canada data report, Health Canada has effectively declared an estimated USD 40 million in funding for 73 advanced community-centric projects to combat illegal drug supply and delivery. In this regard, an overall USD 5,323,303 has been allocated in Alberta for AAWEAR's Peer Outreach Harm Reduction Teams Alberta Addicts, while USD 6,849,526 has been allocated in British Columbia through Burnaby Family Life Institute, thus uplifting the market’s growth.

Europe Market Insights

Europe market is projected to emerge as the fastest-growing region during the forecast period. The market’s development in the region is attributed to innovation in healthcare facilities, increased chronic disease prevalence, robust regulatory framework, and intense focus on patient-centric care and medical efficiency. Besides, in September 2025, the IHI EuropHeartPath constituted the intention of transforming care for people with cardiovascular diseases in the overall region. This has been possible by optimizing the complete care pathway, from diagnosis to early detection and monitoring, ailment and prevention, and also by adopting current-generation solutions and advancements.

The hyaluronidase market in Germany is also gaining increased exposure, owing to the rapid drug adoption process, an upsurge in health and medical spending, facilitation by the Federal Ministry of Health (BMG), the pivotal role of the German Institute for Drugs and Medical Devices (BfArM) for ensuring national market authorization, and the presence of a strong clinical research facility. For instance, in October 2024, Janssen-Cilag International NV, which is a part of Johnson & Johnson, declared the Type II variation application to the Europe Medicines Agency (EMA). The purpose was to gain clearance for extending DARZALEX for aiding patients with multiple myeloma, thus suitable for uplifting the market in the country.

UK market is also developing due to the NHS’s contribution towards community and outpatient-based care services, critical guidance, positive technology appraisals for subcutaneous formulations, integration of cost-effective technologies, and NICE’s guidance for modern medications in comparison to conventional IV formulations. As per the April 2025 UK Government article, the Medicines and Healthcare products Regulatory Agency (MHRA) cleared nivolumab, which is an under-the-skin injection of the cancer therapy. This particular subcutaneous formulation of nivolumab can be provided as a 3-to-5-minute injection instead of 30 to 60 minutes of IV infusion, suitable for treating neck, head, skin, bladder, kidney, and bowel, and lung cancers.

APAC Market Insights

Asia Pacific market is anticipated to grow steadily by the end of the predicted period. The market’s upliftment in the region is fueled by an increase in the aging population, particularly in South Korea and Japan, enhanced health and medical access in India and China, a rise in oncological and ophthalmic disorders, government initiatives, and strong healthcare facility extension. According to the 2022 UNESCAP Organization data report, 670 million people in the overall region were aged more than 60 years as of 2022, accounting for approximately 1 in every 7 people. In addition, the number is expected to double to 1.3 billion by the end of 2050, thus making it suitable for expanding the market in the overall region.

The hyaluronidase market in China is gaining increased traction, owing to the National Medical Products Administration’s (NMPA) acceleration in approving different subcutaneous biologics by readily utilizing hyaluronidase. This, in turn, reflects a tactical transition to effectively manage the healthcare demand of its huge population, while generous funding provision from the government, with support from regulatory bodies, are also bolstering the market. As per an article published by NLM in September 2024, there has been a surge in public financial resources to healthcare in the country from 141.8 billion yuan in 2007 to 2,254.2 billion as of 2023. During this period, the healthcare expenditure’s growth rate peaked at 47.5%, which denotes a positive impact on the market.

The hyaluronidase market in India is also bolstering due to the presence of generous government approaches, such as the Ayushman Bharat scheme, and the continuous growth in private healthcare. In addition to these, the overall budget for medical supplies and pharmaceuticals has also increased, which has optimized accessibility to ophthalmic and surgical care. Besides, the patient pool is immensely growing, which is effectively fueled by the increased incidence of ophthalmic and diabetes complications. Therefore, based on these factors, the market in the country is continuously expanding, leading to its enhanced demand.

Key Hyaluronidase Market Players:

- Halozyme Therapeutics, Inc. (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- STEMCELL Technologies Inc. (Canada)

- Bausch & Lomb Incorporated (U.S.)

- Shreya Life Sciences Pvt. Ltd. (India)

- Sun Pharmaceutical Industries Ltd. (India)

- CooperSurgical, Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Sanofi (France)

- Galderma S.A. (Switzerland)

- Allergan plc (Now part of AbbVie Inc.) (U.S.)

- Merck KGaA (Germany)

- Roche AG (Switzerland)

- LG Chem Ltd. (South Korea)

- JW Life Science (South Korea)

- Croma-Pharma GmbH (Austria)

- Gufic Biosciences Ltd. (India)

- Troikaa Pharmaceuticals Ltd. (India)

- ROHTO Pharmaceutical Co., Ltd. (Japan)

- Hikma Pharmaceuticals PLC (U.K.)

- Proteomics International Laboratories Ltd. (Australia)

- Halozyme Therapeutics, Inc. is considered the definitive market innovator and leader, fueled by its outstanding ENHANZE drug delivery platform. The organization’s approach usually revolves around suitable partnerships with large-scale pharmaceutical firms. Besides, as per its 2023 annual report, the organization increased the total number of platforms from 5 to 7 through partnered products, and successfully supplied more than 40 million devices globally.

- STEMCELL Technologies Inc. is one of the most notable supplier of research-grade hyaluronidase, usually serving in biotechnology and life science research and developmental industries. The company’s generous contributions often lie with high-purity reagents that are essential for tissue dissociation and cell isolation, especially in industrial and academic laboratories.

- Bausch & Lomb Incorporated is considered the most dominant player in the ophthalmic surgery field, readily supplying hyaluronidase for vitreoretinal procedures. The firm has leveraged its expanded international surgical portfolio and distribution network to constitute the enzyme as a standard-of—care agent. Meanwhile, in its 2024 yearly report published in February 2025, the revenue amounted to USD 1.2 billion, with adjusted EBITDA accounting for USD 259 million and a 9% growth in the revenue.

- Shreya Life Science Pvt. Ltd. is an effective domestic supplier and manufacturer of affordable hyaluronidase in India-based and developing markets. The organization plays a critical role in optimizing accessibility to crucial enzymes for a comprehensive range of therapeutic and surgical applications.

- Sun Pharmaceutical Industries Ltd. is one of the major specialty pharmaceutical and generics companies with a significant presence in the hyaluronidase market. The organization deliberately contributes through its established manufacturing facilities and expanded marketing reach, especially in ophthalmology and dermatology across diversified global economies.

Here is a list of key players operating in the global market:

The worldwide hyaluronidase market is characterized and semi-consolidated by distinct tactical tiers, and the U.S.-specific Halozyme Therapeutics is the undisputed market leader and innovator, accounting for a dominating share through ENHANZE, which is a drug delivery platform, licensed to the majority of pharmaceutical organizations, including Baxalta, Pfizer, and Roche. This has effectively created a royalty-based and high-value revenue model, which is extremely difficult to replicate. For instance, in September 2024, Roche declared that the U.S. FDA has successfully cleared Tecentriq Hybreza, which is the first-ever PD-(L)1 inhibitor for subcutaneous. This can be easily injected for an estimated 7 minutes, in comparison to the 30 to 60 minutes strategy, thereby denoting an optimistic approach for the market globally.

Corporate Landscape of the Hyaluronidase Market:

Recent Developments

- In September 2025, Merck notified that the U.S. FDA has effectively cleared KEYTRUDA QLEX, which is a standard injection for subcutaneous administration, particularly among the adult population, readily administered by health and medical providers.

- In May 2025, Bristol Myer Squibb announced that Europe-based Commission has cleared the latest Opdivo formulation, which is related to the newest route of administration, suitable for aiding adult solid tumors as a monotherapy.

- In March 2025, AstraZeneca, along with Alteogen Inc, significantly entered into a licensed agreement for ALT-B4, which is a suitable hyaluronidase, utilizing Hybrozyme platform technology.

- Report ID: 5293

- Published Date: Oct 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hyaluronidase Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.