Non-small Cell Lung Cancer Treatment Market Outlook:

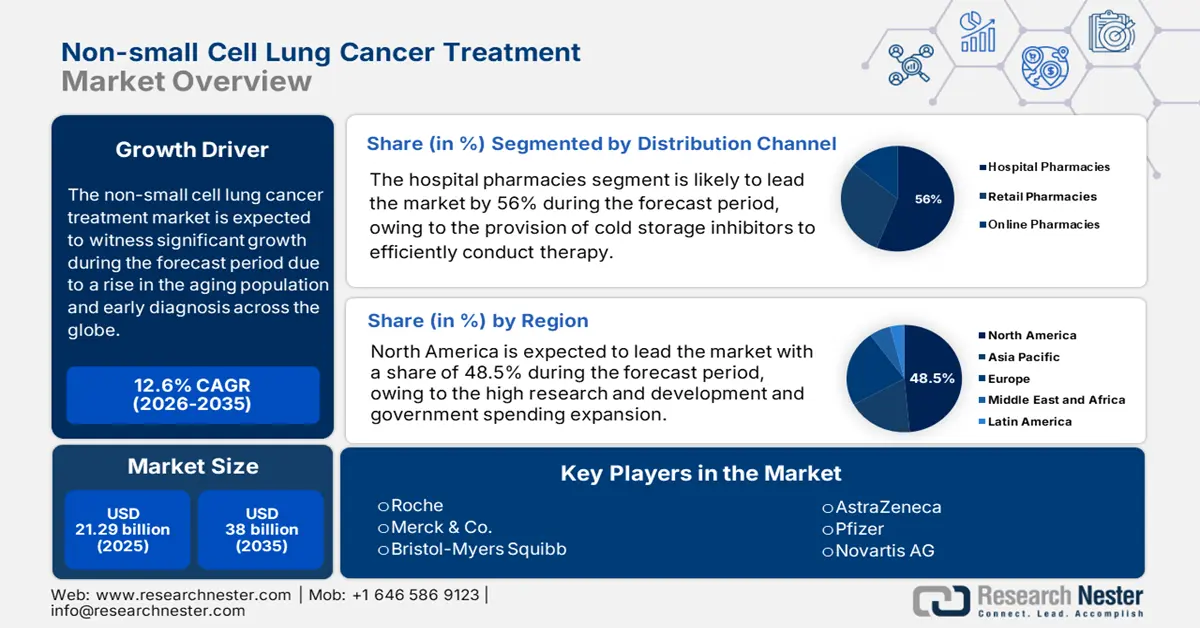

Non-small Cell Lung Cancer Treatment Market size was over USD 21.29 billion in 2025 and is estimated to reach USD 38 billion by the end of 2035, exhibiting a CAGR of 12.6% during the forecast period, i.e., 2026-2035. In 2026, the industry size of non-small cell lung cancer treatment is estimated at USD 23.57 billion.

According to the report published by the American Cancer Society (ACS), the number of new cases of lung cancer in the U.S. in 2025 is approximately 226,650. Lung cancer also causes about 124,730 deaths annually. The aging population is at high risk of non-small lung cancer due to the practice of smoking and exposure to pollution. The World Health Organization predicts that, with the greatest death rates among both men and women, lung cancer is the primary cause of cancer-related fatalities globally. This raises the demand for non-small cell lung cancer treatment. Furthermore, the supply chain management comprises complex logistics and sourcing of API to manufacture the drugs for non-small cell lung cancer treatment. Asia is the leading producer of API that are required for oncology drugs. On the contrary, linear accelerators used within radiation therapy are mainly manufactured in the U.S., Germany, and Japan.

Recent advancements in targeted therapies and immunotherapies have offered new possibilities in NSCLC therapies. The approval of new agents has provided greater options for patients with subpopulations and genetic alterations. The availability of these newer therapies has led to a more personalized and appropriate approach to patient therapy and possibly improved patient outcomes. There is also an increasing trend of offering NSCLC therapies in subcutaneous formulations to promote patient convenience and adherence. The approval of atezolizumab/hyaluronidase (Tecentriq Hybreza) as the first subcutaneous anti-PD-(L)1 cancer immunotherapy is a change in administration. The availability of subcutaneous therapy will foster a better patient experience and promote patient compliance with therapy.

Key Non-Small Cell Lung Cancer Treatment Market Insights Summary:

Regional Highlights:

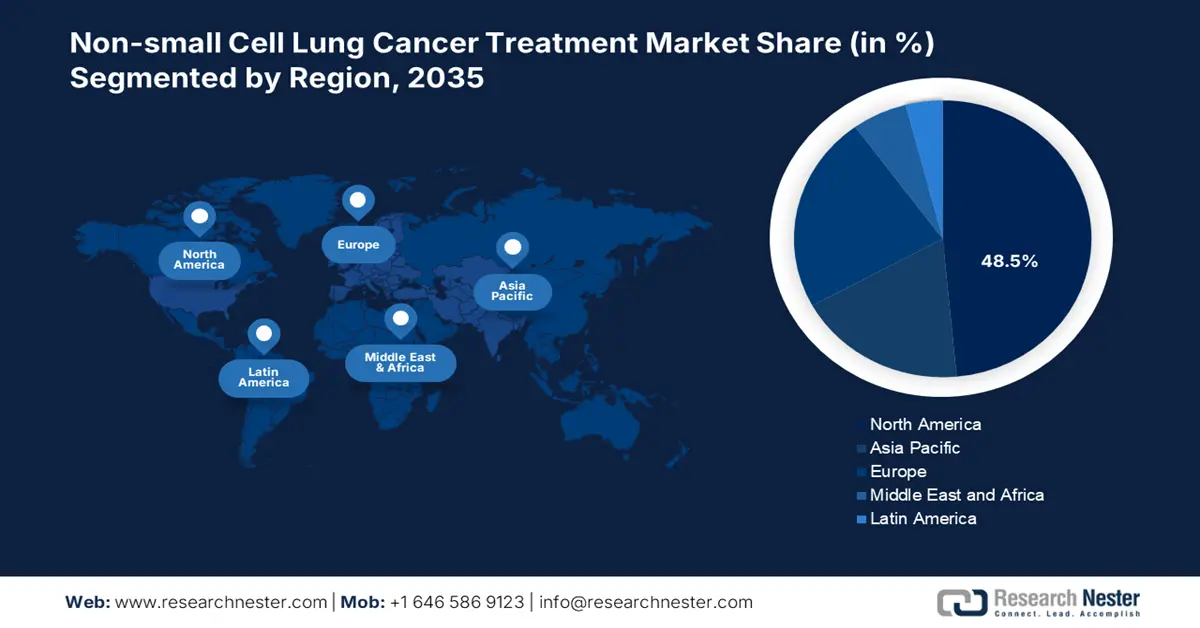

- By 2035, North America is projected to command a 48.5% share of the non-small cell lung cancer treatment market, supported by an expanding reimbursement framework and a strong biopharma innovation ecosystem owing to rising lung cancer prevalence.

- The Asia Pacific region is anticipated to secure an 18.5% share by 2035, propelled by increasing incidence rates and strengthened diagnostic capabilities facilitated by cost-effective clinical trial regulations.

Segment Insights:

- By 2035, the hospital pharmacies segment within the non-small cell lung cancer treatment market is expected to grow by 56%, impelled by higher immunotherapy infusion rates within hospital settings and faster reimbursement processing.

- The immunotherapy segment is set to hold a 42.5% share by 2035, underpinned by FDA-approved combination regimens and broader medicare coverage expansion.

Key Growth Trends:

- Higher patient pool

- Innovation and clinical trials

Major Challenges:

- Government control on the price cap and reimbursement issues

- Drug resistance and limited durability of response

Key Players: Roche, Merck & Co., Bristol-Myers Squibb, AstraZeneca, Pfizer, Novartis AG, Takeda, Eli Lilly, Daiichi Sankyo, Amgen, BeiGene, Sanofi, Regeneron, Celltrion, Eisai Co., Ltd., Dr. Reddy’s, Biocon, CSPC Pharma, Pharmaniaga, CSL.

Global Non-Small Cell Lung Cancer Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 21.29 billion

- 2026 Market Size: USD 23.57 billion

- Projected Market Size: USD 38 billion by 2035

- Growth Forecasts: 12.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: India, South Korea, Australia, Brazil, Singapore

Last updated on : 25 August, 2025

Non-small Cell Lung Cancer Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Higher patient pool: Unhealthy lifestyle and growing pollutants in the environment are adversely impacting the lung condition of the population, leading to an increased number of cases of non-small cell lung cancer. Global data analysis shows that more than 80% of the global lung cancer cases are from Europe and Germany, with a gradual rise in diagnosis. Advancement within the healthcare quality accelerates the patient pool for speedy recovery from health risks. As per the study of the Agency for Healthcare Research and Quality, early diagnosis and intervention lead to recovery through therapeutic intervention. This ensured raised awareness within the market and achieved a growth in early diagnosis and elevated market demand for non-small cell lung cancer treatment.

- Innovation and clinical trials: Constant research and development directed the market toward innovation that ensured better patient outcomes. It is anticipated that innovations such as targeted therapy and advancements in immune oncology will lead to market expansion. Companies, including AstraZeneca, achieved clearance for Osimertinib that ensures first-in-class treatment for patients dealing with non-small cell lung cancer. The Food and Drug Administration (FDA) approval provided adequate guidance and legal alignment for the checkpoint factor inhibitors and targeted therapies. This helped to bring better efficiency within the treatment landscape and ensure better patient outcomes. For instance, clinical trials are performed at a higher rate in the Asia Pacific and North America for biomarker-based therapy to accelerate the market performance.

- Advancements in targeted therapy and immunotherapy: The arrival of targeted therapies and immune checkpoint inhibitors altered the treatment landscape for NSCLC. The success of these agents has even continued to expand subsequent labels, including first-line approval and combination therapies. Pharmaceutical companies continue investing heavily in R&D, which keeps new agents coming to market and makes the pipeline strong. Additionally, with more patients receiving biomarker testing, the addition of personalized treatments is increasing and continuing to accelerate our market growth.

Challenges

- Government control on the price cap and reimbursement issues: Maintaining a balance with the cost of production and the revenue accumulation for the business often faces barriers due to the government control on the price caps. Collaborating with the national health agencies led the companies to bear high losses due to the price control. According to the data published by the World Health Organization, budget constraints lead the low-income countries to exclude the expenses of the non-small cell lung cancer treatment from national formularies. The high cost of the treatment created a high disparity in accessibility for patients due to limited reimbursement policies in the global platform.

- Drug resistance and limited durability of response: Although patients can see immediate benefits from targeted therapies or immunotherapy for long periods, they may eventually show resistance, and/or have disease progression. This is a limitation of long-term treatment effects that requires ongoing development of new agents and combination therapies. Additionally, a significant proportion of NSCLC is diagnosed at an advanced or metastatic state in which treatment options become limited and /or likely not effective. This will ultimately delay the opportunity for curative measures and lead to poor overall survival and complicated management plans.

Non-Small Cell Lung Cancer Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

12.6% |

|

Base Year Market Size (2025) |

USD 21.29 billion |

|

Forecast Year Market Size (2035) |

USD 38 billion |

|

Regional Scope |

|

Non-small Cell Lung Cancer Treatment Market Segmentation:

Distribution Channel Segment Analysis

The hospital pharmacies are anticipated to grow by 56% in 2035. As per the study of the Centers for Disease Control and Prevention, more than 75% of the immunotherapy is infused under the hospital infrastructure setup. This increases the demand for hospital pharmacies as a distribution channel in the non-small cell lung cancer treatment market. Apart from that, fast claim for reimbursement is initiated under hospital pharmacies that create a way for higher accessibility for the patients.

Treatment Type Segment Analysis

The immunotherapy segment possesses high performance ability in the non-small cell lung cancer treatment market with a 42.5% share. Approval conducted by the Food and Drug Administration for the combo therapy ensures better patient outcomes. The combo therapy includes the assimilation of pembrolizumab and chemotherapy, which enriched the functioning of immunotherapy in the concerned market. Expansion of Medicare coverage for immunotherapy is expanded according to the reporting of the Centers for Medicare & Medicaid Services, which raised accessibility of the market.

Therapy Line Segment Analysis

Currently, first-line therapy is the largest segment of the non-small cell lung cancer treatment market. This is because it represents the first step in treatment, as it often involves the majority of patients diagnosed and treated. Recent developments in the field and with immunotherapy and many emerging biomarker-targeted therapies have significantly changed first-line therapy and have greatly improved the survival and response rates. Guidelines are increasingly recommending that non-small cell lung cancer patients undergo biomarker testing before starting therapy so that more patients can be appropriately stratified for first-line treatment. Clinical advances and guidelines are also important because insurance payers and health systems are focused on first-line interventions that can improve outcomes sooner rather than later.

Our in-depth analysis of the non-small cell lung cancer treatment market includes the following segments:

|

Segments |

Subsegments |

|

Therapy Type |

|

|

Distribution Channel |

|

|

Therapy Line |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Non-small Cell Lung Cancer Treatment Market - Regional Analysis

North America Market Insights

North America is poised to accumulate the largest market share of 48.5% by 2035 within the global market of non-small cell lung cancer treatment market. Availability of better research and development environment has flourished in the North American market to achieve dominance in the concerned market. Leading innovative biopharma companies have their headquarters in the North America region. Expanded rate of reimbursement leveraged the market accessibility and raised demand for non-small cell lung cancer treatment. According to the report published by the Centers for Disease Control and Prevention, lung cancer is the second most common health risk factor that results in higher levels of patient growth and dominant performance of the concerned market.

In the U.S. market, the adoption of immunotherapy accelerated the growth of the non-small cell lung cancer treatment market. The NSCLC treatment market in the United States is expanding due to high lung cancer incidence rates and rapid adoption of advanced therapies such as immunotherapy and targeted treatments. The presence of a strong biopharmaceutical industry and continuous R&D investment has led to frequent FDA approvals of novel drugs, improving survival rates and broadening treatment options. Precision medicine is becoming a standard, supported by widespread use of genetic testing to guide therapy decisions. Public and private healthcare coverage ensures access to cutting-edge treatments, and a large number of active clinical trials continue to push innovation. Increasing awareness and early detection programs also contribute to the growing number of diagnosed and treated cases.

The oncology market for non-small cell lung cancer treatment in Canada has been developing steadily for the last five years, due to rising cancer rates and the increasing use of novel cancer therapies. Support from government-sponsored cancer care and Canada's public healthcare system has led to an increase in innovative cancer therapies entering the market more quickly than in other countries. Cancer screening programs continue to develop nationally and at the provincial level, which has further enabled earlier diagnosis. Partnerships between research institutions in Canada and the pharmaceutical industry have fostered research and development to improve patient access to the next-generation therapies and therapies that can be used in combination with existing therapies.

Asia Pacific Market Insights

The Asia Pacific market is expected to accelerate with a market share of 18.5% by 2035. The growing rate of incidence of lung cancer and better diagnostic infrastructure are the driving factors to make the region an emerging region within the global market of non-small cell lung cancer treatment. According to the report of the World Health Organization, demographic shift in Asia Pacific is one of the primary factors contributing to the growth of lung cancer. Adoption of targeted therapies and immunotherapy gained a higher rate among the patients in the Asia Pacific. Clinical trial regulations are developed and made low-cost cost which has turned the region to be the hub of global clinical trials. Government spending through varied schemes like the Ayushman Bharat Program in India and many more ensured a better reimbursement rate to reduce inequality in accessibility within the concerned market.

The non-small cell lung cancer treatment market in China has the highest regional market share. The recent growth in the NSCLC treatment marketplace in China has outpaced past years, largely due to the large lung cancer burden and high incidence. Access to NSCLC treatment has been and will continue to be improved by broader public health insurance coverage for cancer care, quicker government approvals of innovative drugs, and more advanced treatment options. The speed with which China's domestic pharmaceutical sector has progressed and the willing investment in biotechnology have accelerated the development and usage of advanced therapeutics. Routine early lung cancer screening and public awareness have dramatically increased lung cancer detection and understanding.

The cancer treatment industry in India is flourishing, largely due to the rising burden of lung cancer. The multitude of factors impacting lung cancer rates in India, including smoking, pollution, and urbanization, is driving the demand. Higher and greater healthcare awareness is demonstrating the downstream effects of differences in early diagnosis, and as patients become more aware and are intent on seeking treatment, there are going to be imposed differences. The government is facilitating the development of cancer care infrastructure, and private oncology centers/profiles continue to grow, which allows for better access to advanced treatment. Investment in clinical trials and partnerships with better-known therapeutic corporations continues to support the expansion in options for newer therapies that reach the market in India. Overall, the long-term opportunities for sustained growth in NSCLC treatment is one that continues to be focused on currently.

Europe Market Insights

The evolution of Europe's non-small cell lung cancer treatment market is led by the growing lung cancer burden, increases the demand for effective therapies. There have been numerous advances in precision medicine, which improve the diverse patient population's treatment outcomes relative to the historic treatment plan. The rise of advanced diagnostic tools also enables actionable intervention by promoting faster and more accurate testing. Furthermore, as the European health care system invests more and more into cancer, this translates into greater endorsement of the use of innovative therapy by way of increased funding, reimbursement, and access programs. The European Commission estimates that the number of cancer cases is expected to rise by 24% by 2035, making it the leading cause of death in the EU.

The NSCLC treatment market in France is growing as lung cancer incidence continues to rise due to smoking and environmental factors. Personalized medicine has also improved the survival and quality of life of patients through targeted therapies and immunotherapies. The French healthcare system supports patients via public subsidies and reimbursement that allow for greater access to innovative treatment opportunities. Further, the country is increasing lung cancer screening and boosting early diagnosis initiatives to provide a larger patient demographic for treatment.

The growing NSCLC treatment market in Germany remains driven by an aging population and the growing and increasing number of lung cancer cases. The broad acceptance of precision medicine strategies has shifted treatment paradigms and led to better clinical outcomes. In Germany, an established healthcare framework and extensive health insurance coverage have translated into opportunities for the patient population to receive excellent treatment. Additionally, lung cancer screening initiatives and heightened early detection studies have yielded higher diagnosis rates. There are also still investments in oncology research, but the ongoing collaboration between academic and pharmaceutical companies is also a contributing factor.

Key Non-small Cell Lung Cancer Treatment Market Players:

- Roche

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck & Co.

- Bristol-Myers Squibb

- AstraZeneca

- Pfizer

- Novartis AG

- Takeda

- Eli Lilly

- Daiichi Sankyo

- Amgen

- BeiGene

- Sanofi

- Regeneron

- Celltrion

- Eisai Co., Ltd.

- Dr. Reddy’s

- Biocon

- CSPC Pharma

- Pharmaniaga

- CSL

A highly consolidated market is experienced in the non-small cell lung cancer treatment market. More than 50% of the market share is accumulated by top players like Roche, Merck, and so on. The key strategies that are implemented to derive a competitive edge include immunotherapy dominance, targeted therapy expansion, biosimilar competition, and expansion in the Asia Pacific market. Companies such as Merck launched Keytruda and BMS’s Opdivo led to a significant increase in their sale and directed revenue accumulation of more than USD 20 million in 2023. AstraZeneca focused on targeted therapy expansion through launching Tagrisso and Alunbrig, which delivered a competitive edge to the business. Business firms, includingDr. Reddy’s, Biocon relied on cost-controlled production and delivered an affordable range of products to the market.

Recent Developments

- In September 2024, Roche launched Tecentriq Hybreza, which is considered to be the first subcutaneous anti-PD-L1 therapy. This resulted in a reduction of administration timing maximum of 9 minutes, resulting in better clinical efficiency.

- In December 2024, Xcovery Holdings introduced Ensartinib, which demonstrated the median progression-free scopes of survival of 25.9 months. It enables to offering higher level of first-line treatment opportunity to the patients.

- Report ID: 3024

- Published Date: Aug 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Non-Small Cell Lung Cancer Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.