Industrial Floor Coating Market Outlook:

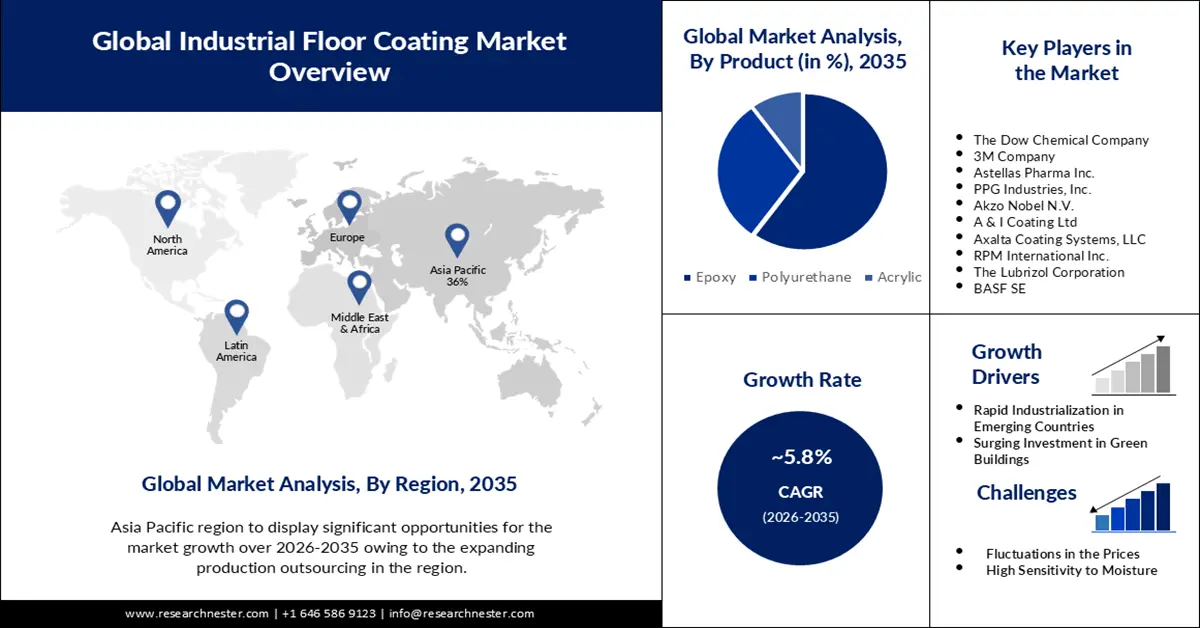

Industrial Floor Coating Market size was over USD 6.38 billion in 2025 and is poised to exceed USD 11.21 billion by 2035, witnessing over 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of industrial floor coating is estimated at USD 6.71 billion.

This growth is attributed to the growing warehouse industry, industrial flooring provides a durable surface for the warehouse to avoid accidents.

Additionally, factors that are believed to fuel the industry growth include the rising importance given to the strength of the flooring in buildings. There has been surging demand for different products, such as epoxy owing to its low cost, and its ease of maintenance. The industrial floor coating handles the heavy impact of constant traffic and provides resistance against corrosive liquid. There has also been growing awareness among the end users related to the benefits of floor coating that propels the growth of the industry.

Key Industrial Floor Coating Market Insights Summary:

Regional Highlights:

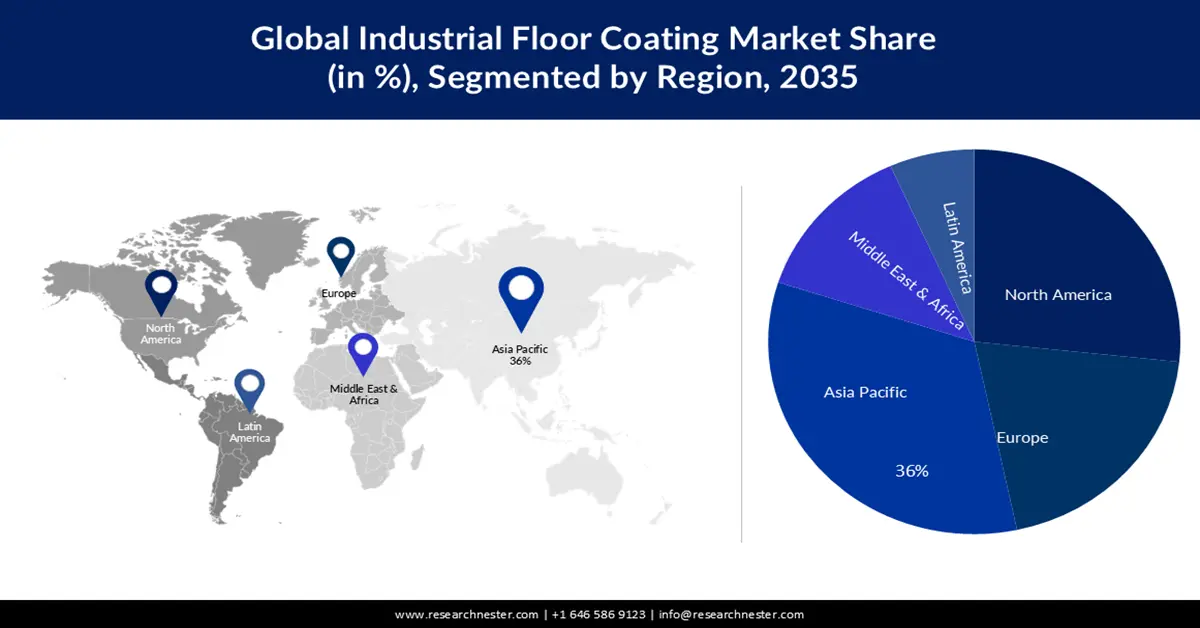

- Asia Pacific industrial floor coating market will hold over 36% share by 2035, driven by the rise in manufacturing units due to production outsourcing and the increasing growth in industries like aviation and marine.

- North America market will capture a 28% share by 2035, driven by the surging renovation and remodeling in residential and commercial sectors, and increased R&D investments in floor coatings.

Segment Insights:

- The epoxy floor coatings segment in the industrial floor coating market is expected to hold a significant share by 2035, propelled by the exceptional durability and chemical resistance of epoxy coatings.

- The manufacturing end use segment in the industrial floor coating market is projected to hold the largest share by 2035, driven by the expansion of manufacturing and other industries demanding durable floor coatings.

Key Growth Trends:

- Rapid Industrialization in Emerging Countries

- Increasing Growth of Construction Industries

Major Challenges:

- Disruption in the Supply Chain

- Fluctuations in the Prices of the Raw Material

Key Players: BASF SE, The Dow Chemical Company, 3M Company, Astellas Pharma Inc., PPG Industries, Inc., Akzo Nobel N.V., A & I Coating Ltd, Axalta Coating Systems, LLC, RPM International Inc., The Lubrizol Corporation.

Global Industrial Floor Coating Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 6.38 billion

- 2026 Market Size: USD 6.71 billion

- Projected Market Size: USD 11.21 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 10 September, 2025

Industrial Floor Coating Market Growth Drivers and Challenges:

Growth Drivers

- Rapid Industrialization in Emerging Countries – There has been an increasing industrialization rate in emerging countries, which is improving the industrial infrastructure. This boosts industrial floor coating market growth.

- Surging Investment in Green Buildings - There has been a surge in the use of eco-friendly and lightweight materials in green buildings. Moreover, the concrete floor coating is designed to be eco-friendly, thus increasing demand for green building projects.

- Increasing Growth of Construction Industries – The growth of the construction industry in terms of residential, commercial, and industrial, is surging the demand for industrial floor coating. The growth of urban land consumption outpaces population growth by up to 50%, adding 1.2 million km2 of new urban built-up area to the world by 2030.

Challenges

- Disruption in the Supply Chain - Owing to the international barriers, there has been a disruption in the supply chain. The supply of the raw material required for the production of the industrial floor coating gets disturbed, making it difficult for the manufacturers to deal with the scarcity of raw materials. Therefore, it is anticipated to restrain the growth of the market.

- Fluctuations in the Prices of the Raw Material

- High Sensitivity to Moisture

Industrial Floor Coating Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 6.38 billion |

|

Forecast Year Market Size (2035) |

USD 11.21 billion |

|

Regional Scope |

|

Industrial Floor Coating Market Segmentation:

End Use Industry Segment Analysis

The manufacturing segment in the industrial floor coating market is estimated to gain the largest revenue share in the year 2035. The growth of industries such as manufacturing, automotive, food and beverage, pharmaceuticals, and aerospace drives the demand for industrial floor coatings. As these industries expand, they require robust and durable floor coatings to protect their floors from wear and tear, chemicals, and other potential damage. There has been a growing awareness among businesses about the importance of floor protection to ensure workplace safety, enhance aesthetics, and increase the lifespan of industrial floors. This has led to an increased adoption of industrial floor coatings.

Product Segment Analysis

Industrial floor coating market from the epoxy segment is expected to garner a significant share in the year 2035. The versatility of epoxy coatings in terms of design and customization was noted as a key factor attracting commercial spaces, retail outlets, and public facilities to opt for epoxy floor coatings. This aspect was likely to contribute to the segment's growth. Epoxy coatings are known for their exceptional durability and resistance to chemicals, making them suitable for industrial environments where floors are exposed to heavy traffic, impact, and various chemicals. This property has been a major driver for the adoption of epoxy coatings in industries such as manufacturing, automotive, aerospace, and pharmaceuticals.

Our in-depth analysis of the global market includes the following segments:

|

End Use Industry |

|

|

Product |

|

|

Component |

|

|

Flooring Material |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Industrial Floor Coating Market Regional Analysis:

APAC Market Insights

The industrial floor coating market in the Asia Pacific region is projected to hold the largest market share of 36% by the end of 2035. The market is impelled by the increasing shift towards production outsourcing from Asian countries. Countries such as China, and India are hubs for manufacturing set-up owing to the availability of resources at a lower cost. This has led to a rise in the number of manufacturing units that are producing goods at lower costs, and surging the demand for industrial floor coating. The increasing growth in the aviation, construction, marine, and other industries in the Asia Pacific region, is further predicted to boost the growth of the market.

North American Market Insights

The North America industrial floor coating market is set to register a share of about 28% by the end of 2035. The growth of the market is fueled by the surging renovation, and remodeling in the residential, as well as commercial construction sectors. The presence of key players in industrial floor coating in the region is further projected to surge the growth of the market in the region. Added to this, the increasing research and development investment for floor coating in countries such as the U.S. and Canada is also expected to expand the market’s growth in the region.

Industrial Floor Coating Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Dow Chemical Company

- 3M Company

- Astellas Pharma Inc.

- PPG Industries, Inc.

- Akzo Nobel N.V.

- A & I Coating Ltd

- Axalta Coating Systems, LLC

- RPM International Inc.

- The Lubrizol Corporation

Recent Developments

- BASF has launched the manufacturing of its first bio-based polyol, Sovermol, in Mangalore, India. This product meets Asia Pacific's rapidly expanding need for environmentally friendly goods for use in New Energy Vehicles (NEV), windmills, flooring, and protective industrial coating.

- Axalta Coating Systems introduced a new Paint Shop Management (PSM) system built on the Axalta New Generation Software (NGS) color control center system throughout Asia Pacific and the Middle East and North Africa (MENA). The PSM module is intended to help automotive refinish suppliers and body shops with performance and business improvement as an effective management tool.

- Report ID: 4877

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Industrial Floor Coating Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.