Concrete Floor Coatings Market Outlook:

Concrete Floor Coatings Market size was valued at USD 5.52 Billion in 2025 and is expected to reach USD 9.25 Billion by 2035, expanding at around 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of concrete floor coatings is evaluated at USD 5.78 Billion.

The market growth is mainly owing to the growing demand for high-performance coatings that can withstand harsh conditions and the increasing popularity of decorative coatings that can improve the aesthetics of concrete floors, and the increasing growth of the construction industry. The US construction industry was noted to see growth in 2021, with a projected increase of 7.4% in spending on construction, according to a report. market refers to the industry that produces and supplies coatings or sealants for concrete floors. These coatings can be used for a variety of purposes, such as protecting concrete surfaces from abrasion, chemicals, and moisture, as well as enhancing their appearance.

In addition to this, in Asia Pacific, the construction industry is projected to grow by 5.6% in the year 2023. Other factors that are fueling market growth include the rising construction activities in both residential and commercial sectors, as well as the need to repair and refurbish existing concrete surfaces. Rising construction activities can refer to the increasing amount of construction projects taking place in a certain region or country. Overall, the market is expected to continue growing in the coming years, driven by the increasing demand for high-performance and decorative coatings, as well as the ongoing investments in infrastructure development around the world.

Key Concrete Floor Coatings Market Insights Summary:

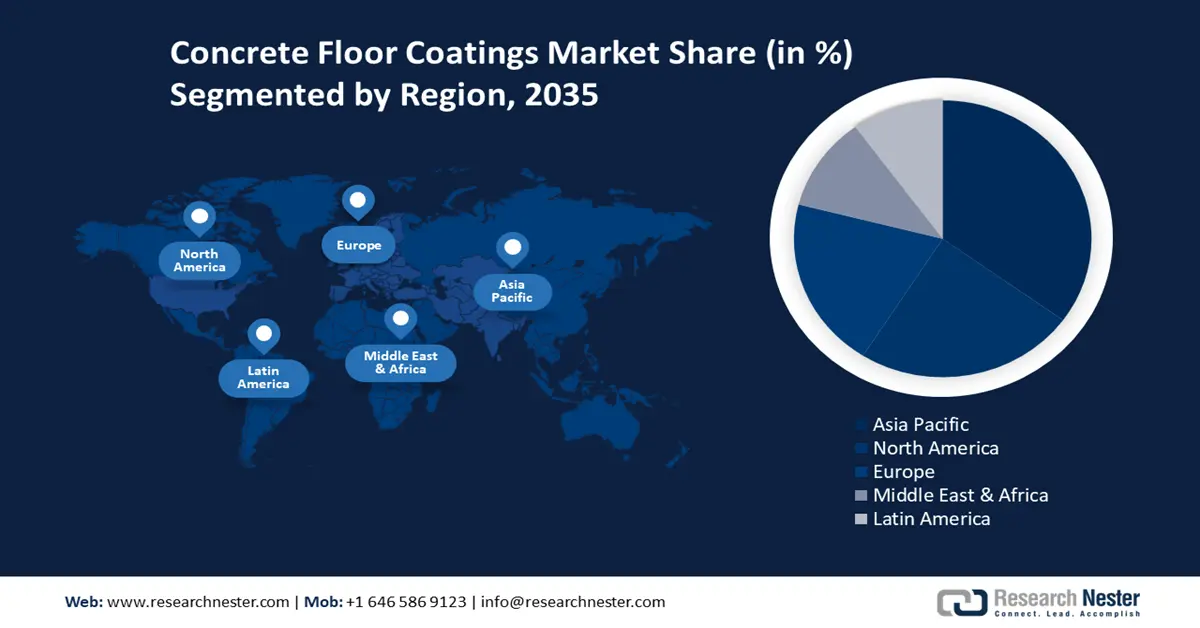

Regional Highlights:

- The Asia Pacific concrete floor coatings market will secure around 35% share by 2035, driven by significant growth in construction and industrialization.

- The North America market will achieve a 24% share by 2035, attributed to increasing construction and rising demand for eco-friendly coatings.

Segment Insights:

- The residential segment in the concrete floor coatings market is expected to command a 60% share by 2035, driven by the growing demand for decorative and eco-friendly concrete floor coatings.

- The epoxy segment in the concrete floor coatings market is projected to hold a 30% share by 2035, driven by the high performance and durability of epoxy coatings in various applications.

Key Growth Trends:

- Rising Construction Activities

- Increasing Demand for Protective Coatings

Major Challenges:

- Environmental regulations

- Fluctuating raw material prices

Key Players: AkzoNobel N.V,The Sherwin-Williams Company, PPG Industries, Inc., BASF SE, RPM International Inc., Sika AG, Asian Paints Limited, Kansai Paint Co., Ltd., The Dow Chemical Company, Tennant Company.

Global Concrete Floor Coatings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.52 Billion

- 2026 Market Size: USD 5.78 Billion

- Projected Market Size: USD 9.25 Billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

Concrete Floor Coatings Market Growth Drivers and Challenges:

Growth Drivers

- Rising Construction Activities – According to a report, the global construction output is expected to reach USD 12.9 trillion by the year 2024. In the Middle East and North Africa (MENA) region, the construction sector is projected to grow at a CAGR of 6.4% from 2021 to 2025, driven by large-scale infrastructure projects. The construction industry is a major driver of demand for concrete floor coatings.

- Increasing Demand for Protective Coatings: The demand for protective coatings for concrete floors is driven by the need to protect surfaces from harsh conditions. For instance, the global demand for protective coatings for industrial applications is expected to reach 7.7 million metric tons by 2025, according to a report.

- Growing Popularity of Decorative Coatings: Decorative coatings for concrete floors are becoming increasingly popular owing to their ability to enhance aesthetics. For instance, the global industry for decorative coatings is expected to reach nearly USD 12.6 billion by 2027, driven by the increasing demand for aesthetic enhancements in various end-use industries including construction, according to a report.

- Increasing Demand for Eco-friendly Coatings: There is a growing demand for eco-friendly coatings in the construction industry owing to increasing environmental concerns. For instance, the industry for waterborne coatings is expected to reach USD 146.11 billion by 2025, driven by the increasing demand for eco-friendly coatings in various end-use industries including construction.

- Rise in Research Spending – Growth in the global market during the forecast period can be further attributed to increased investment in research and development activities to continuously find more viable solutions for concrete floor coatings. Research reports show that global R&D spending has more than tripled in real terms since 2000, rising from about USD 680 billion to more than USD 2.5 trillion in the year 2019.

Challenges

- Environmental regulations: The use of certain chemicals in the manufacture of concrete floor coatings can hurt the environment. As a result, there is increasing pressure from regulatory bodies to limit the use of these chemicals. Compliance with environmental regulations can increase the cost of production and affect the profitability of manufacturers.

- Fluctuating raw material prices

- Intense competition

Concrete Floor Coatings Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 5.52 Billion |

|

Forecast Year Market Size (2035) |

USD 9.25 Billion |

|

Regional Scope |

|

Concrete Floor Coatings Market Segmentation:

By Application

The global concrete floor coatings market is segmented and analyzed for demand and supply by application into residential, and non-residential. Out of the two types of applications, the residential segment is estimated to gain the largest market share of about 60% in the year 2035. The growth of the segment can be accredited to the growing demand for decorative coatings. The residential sector is a major end-user of decorative concrete floor coatings. Decorative coatings are increasingly popular owing to their ability to enhance aesthetics. For instance, according to a report, the demand for decorative concrete flooring in the US is projected to grow 6.2% annually to reach 371 million square feet in 2024. Concrete floor coatings are a popular choice for residential flooring owing to their durability and low-maintenance properties. There is a growing demand for eco-friendly coatings in the residential sector owing to increasing environmental concerns. Consumers are increasingly looking for sustainable options that are less harmful to the environment.

By Product

The global market for concrete floor coatings is also segmented and analyzed for demand and supply by-products into epoxy, polyurethanes, and polyaspartic. Amongst these three segments, the epoxy segment is expected to garner a significant share of around 30% in the year 2035. The growth of the segment can be accredited to its high performance and durability. Epoxy coatings are known for their high performance and durability, making them a popular choice for industrial and commercial applications. Epoxy coatings are versatile and can be used in a wide range of applications, from industrial flooring to decorative coatings for residential floors. This versatility has made epoxy coatings a popular choice among end-users. Epoxy coatings are easy to apply and can be used on a variety of surfaces, including concrete, metal, and wood. The ease of application has led to increased adoption of epoxy coatings in various applications. Epoxy coatings are a cost-effective solution for improving the durability and aesthetics of floors. The low cost and long lifespan of epoxy coatings make them an attractive option for end-users. All these factors are estimated to add to the segmental growth notably over the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Product |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Concrete Floor Coatings Market Regional Analysis:

APAC Market Insights

The concrete floor coatings in the Asia Pacific region, amongst the market in all the other regions, is projected to hold the largest market share of about 35% by the end of 2035. The regional growth can majorly be attributed to the growing construction industry. The Asia Pacific region is witnessing significant growth in the construction industry, driven by factors such as rapid urbanization, population growth, and increasing infrastructure development.

The Asia Pacific region is witnessing significant industrialization, driven by factors such as rising demand for consumer goods, increasing investments in manufacturing industries, and favorable government policies. The increasing industrialization is leading to the growth of the concrete floor coatings market, as industrial floors require coatings for enhanced durability and safety. The Asia Pacific region is witnessing increasing demand for decorative concrete floor coatings, driven by the rising middle-class population and increasing disposable incomes. There is an increasing emphasis on green building practices in the Asia Pacific region, driven by factors such as increasing environmental concerns, government regulations, and cost savings. The adoption of green building practices is leading to the growth of the market, as eco-friendly coatings are increasingly preferred.

North American Market Insights

The concrete floor coatings in the North American region, amongst the market in all the other regions, is projected to hold the second largest share of about 24% during the forecast period. The growth of the market in this region can primarily be attributed to the growing construction industry. The North American construction industry is witnessing significant growth, driven by factors such as population growth, increasing infrastructure development, and rising investments in the real estate sector. The North American region is witnessing increasing demand for eco-friendly coatings, driven by factors such as environmental concerns, government regulations, and increasing awareness among end-users. The North American region is witnessing significant industrialization, driven by factors such as increasing demand for consumer goods and rising investments in the manufacturing industry. The North American region is witnessing rising demand for decorative concrete floor coatings, driven by factors such as increasing disposable incomes, rising demand for aesthetically appealing interiors, and growing awareness about the benefits of decorative coatings.

Europe Market Insights

Europe region is anticipated to register substantial growth through 2035. The growth of the market can be attributed majorly to the increasing construction activities. The Europe region is witnessing increasing construction activities, driven by factors such as population growth, urbanization, and increasing investments in the real estate sector. The Europe region is witnessing growing demand for green coatings, driven by factors such as increasing environmental concerns, government regulations, and growing awareness among end-users. The Europe region is witnessing increasing demand for industrial coatings, driven by factors such as increasing industrialization, rising demand for high-performance coatings, and growing investments in the manufacturing sector. The Europe region is witnessing increasing demand for decorative concrete floor coatings, driven by factors such as rising disposable incomes, growing demand for aesthetically appealing interiors, and increasing awareness about the benefits of decorative coatings.

Concrete Floor Coatings Market Players:

- AkzoNobel N.V.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- The Sherwin-Williams Company

- PPG Industries, Inc.

- BASF SE

- RPM International Inc.

- Sika AG

- Asian Paints Limited

- Kansai Paint Co., Ltd.

- The Dow Chemical Company

- Tennant Company

Recent Developments

- The Sherwin-Williams Company: The Sherwin-Williams Company announced the launch of its new line of concrete coatings, called Dura-Plate 301W. The new coatings are designed for use in concrete floors in industrial and commercial settings and are meant to provide long-lasting protection against abrasion, impact, and chemical exposure.

- Sika AG: Sika AG announced that it had acquired the Danish company Bexel Consulting A/S, which specializes in the development of software for the design of industrial floor coatings. The acquisition is meant to strengthen Sika's position in the industrial coatings market, by providing it with access to advanced software technology for the design and optimization of coatings.

- Report ID: 4406

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Concrete Floor Coatings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.