Decorative Concrete Market Outlook:

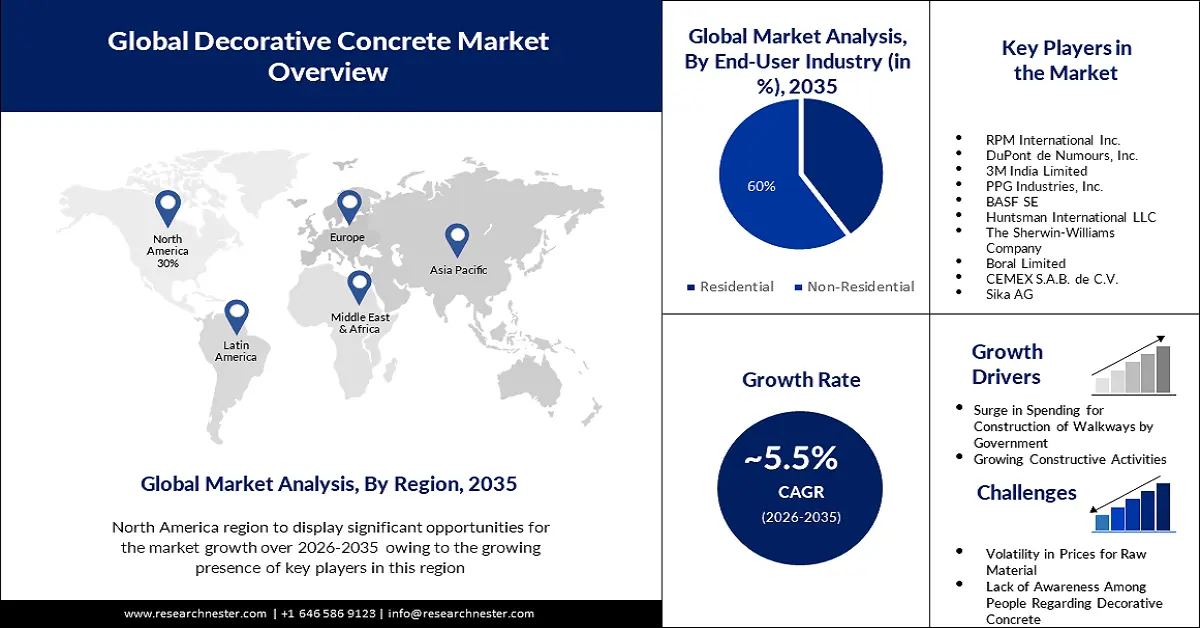

Decorative Concrete Market size was over USD 19.84 billion in 2025 and is anticipated to cross USD 33.89 billion by 2035, witnessing more than 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of decorative concrete is assessed at USD 20.82 billion.

The market's expansion can be attributable to the increase in architectural building construction. This could be a result of people's increasing taste for architecturally designed homes and an increase in the middle class's population in urban areas. For instance, more than 26% of India's middle class presently were residing in the 63 largest cities in India in 2022. Also, they were producing about 28% of the nation's disposable income, which increases demand for goods and services and stimulates the economy. Hence, this factor is estimated to boost the demand for decorative concrete.

There is prompting adaptations in the living arrangements of middle-class society to match evolving lifestyle preferences. These middle-class areas now feature diverse styles and atmospheres due to social progress. To economize and make a living more affordable, middle-class individuals have shifted away from traditional construction methods. Additionally, the increasing number of architectural innovations is expected to contribute to market growth in the foreseeable future. For instance, as of 2022, there were approximately 1,16,077 architects in India, and this number keeps rising.

Key Decorative Concrete Market Insights Summary:

Regional Highlights:

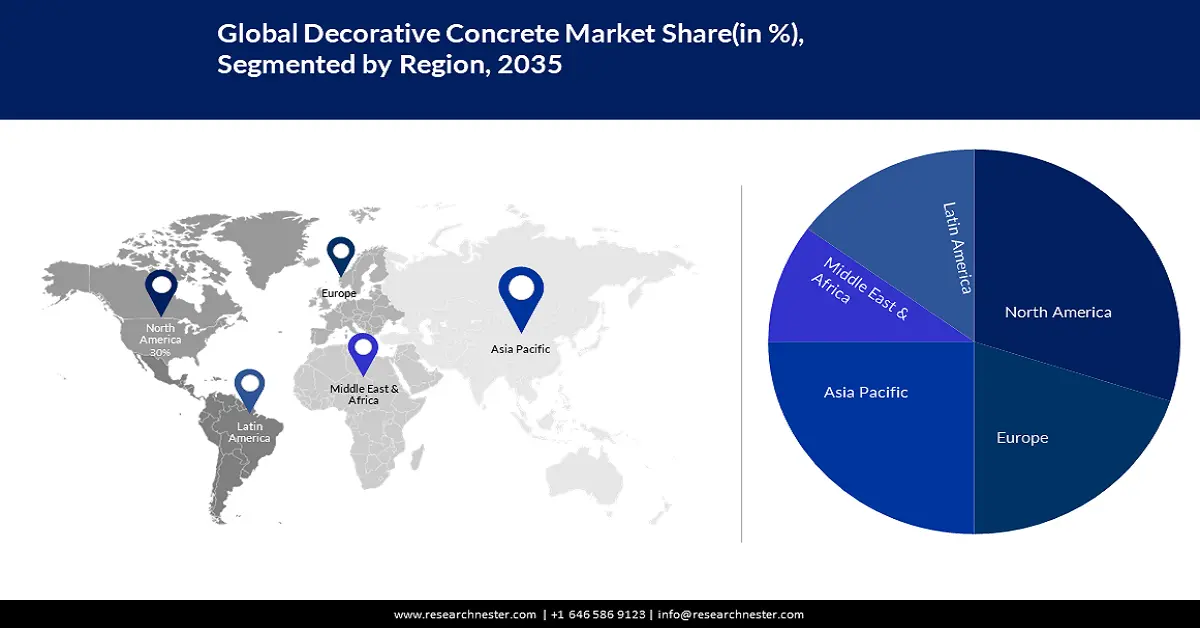

- North America decorative concrete market will dominate more than dominant revenue share by 2035, growing presence of key players and rising urban population boosting construction.

Segment Insights:

- The non-residential segment in the decorative concrete market is projected to command a 60% share by 2035, driven by growing spending on non-residential construction activities.

Key Growth Trends:

- Residential & Commercial Renovations

- Increasing Construction Activity

Major Challenges:

- Lack of Awareness Among People Regarding Decorative Concrete

- Difficult to Repair Decorative Concrete

Key Players: DuPont de Numours, Inc. ,3M India Limited,PPG Industries, Inc.,BASF SE,Huntsman International LLC,The Sherwin-Williams Company,Boral Limited,CEMEX S.A.B. de C.V.,Sika AG Nippon Concrete Industries Co.

Global Decorative Concrete Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 19.84 billion

- 2026 Market Size: USD 20.82 billion

- Projected Market Size: USD 33.89 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, Italy

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 10 September, 2025

Decorative Concrete Market Growth Drivers and Challenges:

Growth Drivers

-

Residential & Commercial Renovations - Renovation and remodeling projects often require the use of materials that can both enhance the aesthetic appeal of the space and provide cost-effective solutions. Decorative concrete has emerged as a popular choice for these projects due to its versatility, durability, and affordability. In the US in 2020, a household spent more than USD 13,000 on renovations on average, and around 50% of respondents said they had renovated their homes

-

Increasing Construction Activity-Growth in the construction industry, both residential and commercial, drives the demand for decorative concrete as property owners seek attractive and durable flooring and paving solutions. From 2002 and 2021, the value of public residential construction investments increased significantly in the US. In residential development projects in 2021, the public sector made an estimated 10 billion USD in investments.

- Technological Advancements: In recent years, decorative concrete has experienced a surge in popularity, owing to the advancements in technology and the application techniques employed in its creation. This has opened up a world of design possibilities, enabling individuals to create unique and intricate patterns that were previously impossible to achieve. Additionally, the improved quality of decorative concrete means that it is now more durable and long-lasting than ever before, making it a fantastic choice for a range of different applications.

Challenges

-

Volatility in Prices for Raw Material - The cost of producing decorative concrete is affected by fluctuating energy and raw material prices. This could lead to an increase in the overall cost of decorative concrete, as coatings, pigments, cement, adhesives, and sealants are all affected. Vendors may respond by raising prices or reducing profit margins, which could negatively impact decorative concrete market growth.

-

Lack of Awareness Among People Regarding Decorative Concrete

- Difficult to Repair Decorative Concrete

Decorative Concrete Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 19.84 billion |

|

Forecast Year Market Size (2035) |

USD 33.89 billion |

|

Regional Scope |

|

Decorative Concrete Market Segmentation:

Type Segment Analysis

Decorative concrete market from the stamped concrete segment is expected to have significant growth over the forecast period. Given its outstanding resistance to traffic, stamped concrete is one of the most resilient floor coverings available. This is the reason why this material is so popular for covering streets, parks, garages, and residential area entrances. Also, it could tolerate ongoing temperature variations and UV radiation as a decorative covering. It adjusts to various weather conditions, including frost. Also, stamped concrete may be installed quickly and easily.

End-User Industry Segment Analysis

The non-residential segment is anticipated to garner the highest revenue by the end of 2035 accounting for 60% share of the decorative concrete market. The growth of the segment can be attributed to growing spending on non-residential construction activities. Spending on nonresidential building construction was anticipated to increase by about 4% in 2022 and then further to approximately 5% in 2023.

Our in-depth analysis of the global decorative concrete market includes the following segments:

|

Type |

|

|

End-User Industry |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Decorative Concrete Market Regional Analysis:

North American Market Insights

The North America decorative concrete market is projected to dominate revenue share by 2035, backed by growing presence of key players in this region, along with surge in investment by regional governments in order to construct commercial buildings. There has been rising urban population in this region which is also estimated to boost the market growth over the forecast period. The urban population in North America in 2021 increased by 0.4% from 2020 to about 306,343,264. This growth in urban population has further boosted residential construction activities. region.

APAC Statistics Insights

The Asia Pacific decorative concrete market is estimated to have the highest growth till 2035. Residential development is booming in India, China, the Philippines, Vietnam, and Indonesia. Asian economies are expected to grow by 1.2% in 2023 and 1.3% per year from 2024 to 2027. China's government is investing heavily in infrastructure, leading to rapid growth in the construction industry. With many airport projects planned or underway, demand for decorative concrete will increase in both residential and non-residential sectors.

Decorative Concrete Market Players:

- RPM International Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DuPont de Numours, Inc.

- 3M India Limited

- PPG Industries, Inc.

- BASF SE

- Huntsman International LLC

- The Sherwin-Williams Company

- Boral Limited

- CEMEX S.A.B. de C.V.

- Sika AG

Recent Developments

- November 22, 2021: Sika AG has increased its production capacity in the quickly expanding Chinese construction sector by building a new mortar production facility in Jiaxing City, in the province of Zhejiang in Eastern China. Sika is responding to the area's high demand by commissioning the new facility. This phase also ensures improved logistics, a reduction in CO2 emissions, and shorter transit routes for raw materials and finished items.

- September 29, 2020: PPG Industries, Inc. announced the introduction of PPG Flooring coatings, which was anticipated to be a comprehensive line of coating systems that comprise primers, bases, and topcoats and are customized to deliver the best performance based on the unique work environment. Customers had the choice of selecting one of four flooring coating systems: general purpose, wear resistance, chemical resistant, and urethane cement.

- Report ID: 4831

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Decorative Concrete Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.