Global Green Building Market

- Introduction

- Study Objective

- Scope of the report

- Market Taxonomy

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- SPSS Methodology

- Data Triangulation

- Executive Summary

- Global Industry Overview

- Market Overview

- Regional Synopsis

- Industry Supply Chain Analysis

- DROT Analysis

- Drivers

- Restraints

- Opportunities

- Trends

- Government Regulation

- Competitive Landscape

- Alumasc Group plc

- Amvic Inc.

- BASF

- Bauder Ltd

- Forbo Group

- Interface, Inc.

- Kingspan Group

- Owens Corning

- Panasonic Holdings Corporation

- Wienerberger AG

- Ongoing Technological Advancements

- Price Benchmarking

- SWOT Analysis

- Product Type Scenario

- Key Application

- Non-Residential Application

- Key Distribution Channel

- Recent Development

- Root Cause Analysis (RCA) for Green Building Market

- Contribution of the Industry Towards Decarbonization

- Building the Future: How IoT is Shaping Green Building Sustainability

- IoT in Action: Success Stories in Transforming Green Building Efficiency

- Industry Risk Assessment

- Growth Outlook

- Global Outlook and Projections

- Global Overview

- Market Value (USD Billion), Current and Future Projections, 2019–2037

- Increment $ Opportunity Assessment, 2019–2037

- Year-on-Year Growth Forecast (%)

- Global Segmentation (USD Billion), 2019–2037, By

- Product Type, Value (USD Billion)

- Exterior Products

- Interior Products

- Building Systems

- Solar Products

- Application, Value (USD Billion)

- Residential Buildings

- Commercial Buildings

- Industrial Buildings

- Type of Construction, Value (USD Billion)

- New Construction

- Renovation

- Distribution Channel, Value (USD Billion)

- Online

- Offline

- Regional Synopsis, Value (USD Billion), 2019–2037

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Product Type, Value (USD Billion)

- Global Overview

- North America Market

- Overview

- Market Value (USD Billion), Current and Future Projections, 2019–2037

- Increment $ Opportunity Assessment, 2019–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Billion), 2019-2037, By

- Product Type, Value (USD Billion)

- Exterior Products

- Interior Products

- Building Systems

- Solar Products

- Application, Value (USD Billion)

- Residential Buildings

- Commercial Buildings

- Industrial Buildings

- Type of Construction, Value (USD Billion)

- New Construction

- Renovation

- Distribution Channel, Value (USD Billion)

- Online

- Offline

- Country Level Analysis, Value (USD Billion)

- U.S.

- Canada

- Product Type, Value (USD Billion)

- Overview

- Europe Market

- Overview

- Market Value (USD Billion), Current and Future Projections, 2019–2037

- Increment $ Opportunity Assessment, 2019–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Billion), 2019-2037, By

- Product Type, Value (USD Billion)

- Exterior Products

- Interior Products

- Building Systems

- Solar Products

- Application, Value (USD Billion)

- Residential Buildings

- Commercial Buildings

- Industrial Buildings

- Type of Construction, Value (USD Billion)

- New Construction

- Renovation

- Distribution Channel, Value (USD Billion)

- Online

- Offline

- Country Level Analysis, Value (USD Billion)

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Russia

- Switzerland

- Poland

- Belgium

- Rest of Europe

- Product Type, Value (USD Billion)

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Billion), Current and Future Projections, 2019–2037

- Increment $ Opportunity Assessment, 2019–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Billion), 2019-2037, By

- Product Type, Value (USD Billion)

- Exterior Products

- Interior Products

- Building Systems

- Solar Products

- Application, Value (USD Billion)

- Residential Buildings

- Commercial Buildings

- Industrial Buildings

- Type of Construction, Value (USD Billion)

- New Construction

- Renovation

- Distribution Channel, Value (USD Billion)

- Online

- Offline

- Country Level Analysis, Value (USD Billion)

- UK

- Germany

- France

- Italy

- Spain

- Netherlands

- Russia

- Switzerland

- Poland

- Belgium

- Rest of Europe

- Product Type, Value (USD Billion)

- Overview

- Latin America Market

- Overview

- Market Value (USD Billion), Current and Future Projections, 2019–2037

- Increment $ Opportunity Assessment, 2019–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Billion), 2019-2037, By

- Product Type, Value (USD Billion)

- Exterior Products

- Interior Products

- Building Systems

- Solar Products

- Application, Value (USD Billion)

- Residential Buildings

- Commercial Buildings

- Industrial Buildings

- Type of Construction, Value (USD Billion)

- New Construction

- Renovation

- Distribution Channel, Value (USD Billion)

- Online

- Offline

- Country Level Analysis, Value (USD Billion)

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Product Type, Value (USD Billion)

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Billion), Current and Future Projections, 2019–2037

- Increment $ Opportunity Assessment, 2019–2037

- Year-on-Year Growth Forecast (%)

- Segmentation (USD Billion), 2019-2037, By

- Product Type, Value (USD Billion)

- Exterior Products

- Interior Products

- Building Systems

- Solar Products

- Application, Value (USD Billion)

- Residential Buildings

- Commercial Buildings

- Industrial Buildings

- Type of Construction, Value (USD Billion)

- New Construction

- Renovation

- Distribution Channel, Value (USD Billion)

- Online

- Offline

- Country Level Analysis, Value (USD Billion)

- Saudi Arabia

- UAE

- Israel

- Qatar

- Kuwait

- Oman

- South Africa

- Rest of Middle East & Africa

- Product Type, Value (USD Billion)

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

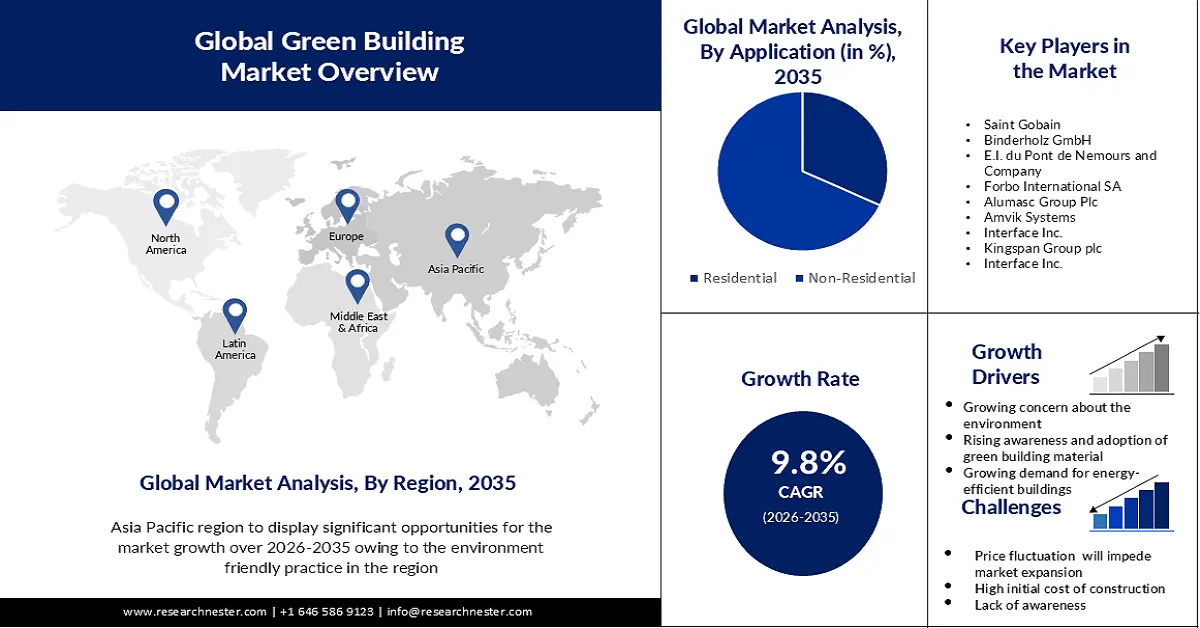

Green Building Market Outlook:

Green Building Market size was valued at USD 700.96 billion in 2025 and is expected to reach USD 1.79 trillion by 2035, expanding at around 9.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of green building is evaluated at USD 762.78 billion.

The green building market is experiencing a shift due to the rising regulatory standards, corporate sustainability targets, and consumer awareness and expectations towards sustainable buildings. As the regulatory environment becomes increasingly stringent in regions worldwide, market players are embracing innovative solutions and environmentally friendly building materials to maintain their competitiveness. In October 2024, the European Bank for Reconstruction and Development (EBRD) provided a EUR 5 million loan to Shunkhlai Holding to refurbish its headquarters in Mongolia to create more sustainable offices. The initiative also helps to improve the decarbonization of the construction industry in Mongolia and provides a best practice model to implement commercial deep retrofitting. These are some of the trends that have been observed and are in line with the global shift towards carbon neutrality in both emerging and developed markets.

Additional impetus is being created through integrated material efficiency standards, digital building intelligence, and life cycle-oriented emission control measures. The London Energy Transformation Initiative set an embodied carbon budget of 600 kgCO2e/m2 in 2024, which has become a bar for sustainable construction in most cities around the world. Through the promotion of low-emission materials and resource-efficient renovation solutions, the initiative contributes to spreading circular design values. This move is in line with EU-wide decarbonization initiatives and raises material innovation to a competitive advantage factor in the construction supply chain. There is a growing focus on green buildings not only as sustainable investments but as essential drivers of climate transition strategies.

Key Green Buildings Market Insights Summary:

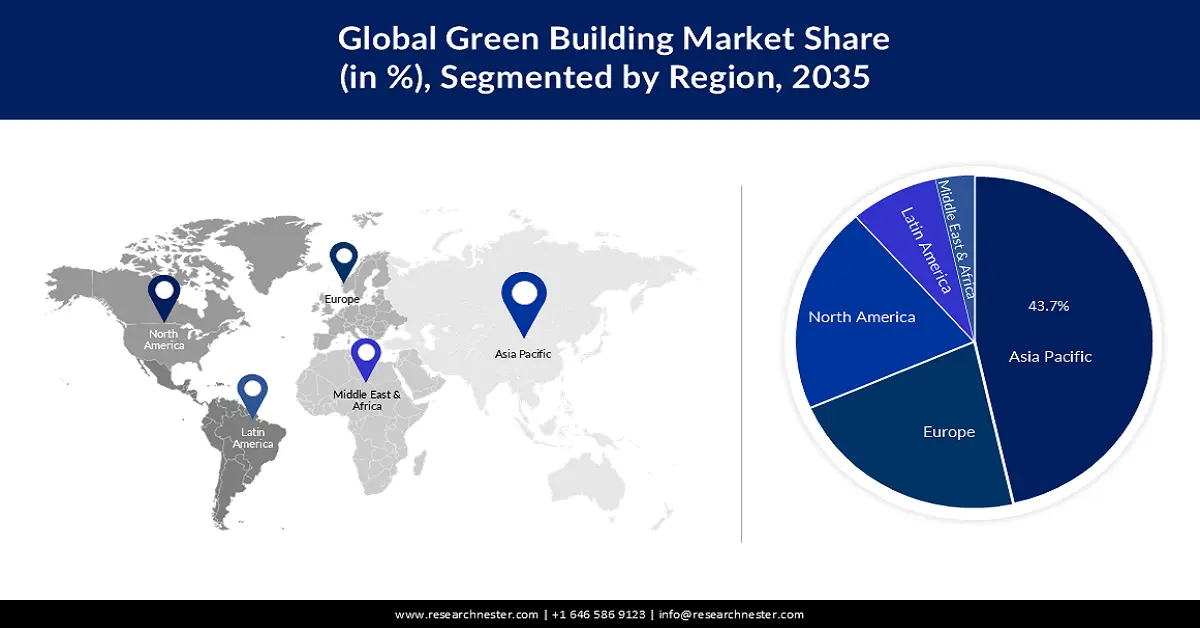

Regional Highlights:

- Asia Pacific green building market will hold around 43.7% share by 2035, driven by increased urbanization, favorable policies, and growing investments in green construction.

- North America market will register significant CAGR during 2026-2035, fueled by federal energy efficiency policies, infrastructure spending, and consumer sustainability trends.

Segment Insights:

- The non-residential buildings segment in the green building market is forecasted to achieve a 68% share by 2035, driven by urbanization and growing demand for sustainable construction solutions.

- The solar products segment in the green building market is forecasted to capture a 52% share by 2035, attributed to cost efficiency, energy access, and carbon footprint reduction.

Key Growth Trends:

- Regulatory frameworks and policy incentives

- Integration of renewable energy systems in building design

Major Challenges:

- Lifecycle data availability and standardization

- Infrastructure readiness and adoption in emerging markets

Key Players: Alumasc Group plc, Amvic Inc., BASF, Bauder Ltd, Forbo Group, Interface, Inc., Kingspan Group, Owens Corning, Panasonic Holdings Corporation, Wienerberger AG.

Global Green Buildings Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 700.96 billion

- 2026 Market Size: USD 762.78 billion

- Projected Market Size: USD 1.79 trillion by 2035

- Growth Forecasts: 9.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (43.7% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Canada, India, Germany

- Emerging Countries: China, India, Japan, Singapore, South Korea

Last updated on : 9 September, 2025

Green Building Market Growth Drivers and Challenges:

Growth Drivers

-

Regulatory frameworks and policy incentives: It is evident that government regulation is still the most influential driver of the green building market. Legislations like the EU Energy Performance of Buildings Directive (EPBD) and the U.S. Building Performance Standards (BPS) require mandatory renovations and energy efficiency upgrades by 2030. In April 2024, the World Green Building Council released the European Manifesto for a Sustainable Built Environment, which presents the policy objectives to decrease energy consumption and the use of fossil fuels. Backed by 24 national councils, the program focuses on employment, economic stability and sustainability, and green cities. Such frameworks are not only reshaping the public domain but are also creating new possibilities for the private sector to explore.

-

Integration of renewable energy systems in building design: One of the emerging trends in green building is the incorporation of renewable energy sources into the building’s systems. In July 2024, Kingspan Group and LONGi Green Energy Technology partnered to integrate solar solutions into building materials. This synergy contributes to the creation of net-zero infrastructure by integrating photovoltaic technology with the building skin. The alliance is a shift toward the use of integrated elements that produce energy, decrease expenses, and improve design. It demonstrates the increasing importance of energy generation systems as a component of sustainable architecture.

-

Corporate climate commitments and innovation in materials: Businesses are sourcing products with low lifecycle emissions and materials for the construction of low-carbon products. In January 2025, Interface launched a carbon-negative Nora rubber flooring sample that aims to have a carbon footprint that is lower than the amount of carbon it captures. This innovation provides answers to the problem of carbon offsets and attempts to directly capture carbon through material science with the goal of achieving new industry standards. These trends are revolutionizing the value proposition of commercial interiors and contributing to a larger trend toward performance-based sustainability in construction materials.

Challenges

-

Lifecycle data availability and standardization: One of the key challenges to the growth of the sustainable green building market is the lack of consistency when it comes to lifecycle carbon tracking and emissions data, even with the advancements in sustainable building design. This is attributed to the fact that there is no clear set of metrics and reporting tools that can be used to benchmark the environmental performance of buildings and building materials. This also hampers the ability to have a proper evaluation of the lifecycle impacts of buildings, thus resulting in poor decision-making regarding design and construction.

-

Infrastructure readiness and adoption in emerging markets: Due to the lack of well-developed infrastructures and the limited availability of green materials, many emerging economies struggle to implement sustainable construction technologies at a large scale. This can entail challenges such as inadequate energy and water resources, insufficient human resources, and insufficient supportive regulations. However, one of the main challenges of using green building materials and technologies in these markets is the high upfront cost. Therefore, the level of green building uptake remains low in most developing nations compared to developed countries.

Green Building Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.8% |

|

Base Year Market Size (2025) |

USD 700.96 billion |

|

Forecast Year Market Size (2035) |

USD 1.79 trillion |

|

Regional Scope |

|

Green Building Market Segmentation:

Application Segment Analysis

The non-residential segment in the green buildings market is anticipated to hold the largest share of about 68% during the forecast period. Rapidly increasing urbanization and the rise in urban populations across the globe are leading to market growth. In 2022, the proportion of urbanized population worldwide has increased to 57 %. It is also due to the growing demand for environmentally friendly and sustainable solutions. In addition, it is now necessary for all construction companies not directly involved in the housing sector to prioritize sustainability design and construction techniques so that they can take advantage of the planet's limited resources. Sustainable business practices are crucial to green buildings, reducing energy consumption, and protecting natural resources throughout the majority of countries. Furthermore, the growing concern over climate change has led to environmentally responsible and sustainable activities which have increased demand for green buildings materials in non-residential buildingss. According to a recent study, 72% of consumers reported buying more eco-friendly products than five years ago. In five years, the number of worldwide online searches for sustainable goods has risen by 71%. In the case of eco-friendly brands, 55% of consumers are willing to pay more.

Product Segment Analysis

Green buildings market from the solar products segment is expected to account for largest revenue share of about 52% over the forecast period. The fact that solar installation is extremely cost efficient, increases access to energy, and reduces the carbon footprint can be accounted for. Furthermore, the investment in photovoltaic panels and their maintenance is regarded as a safe bet that will help to drive future market growth. In 2021, solar power accounted for around 4% of the world's energy supply. That's an increase from 3% in 2020. The total contribution of renewable energies to overall electricity generation was 38%, with the solar sector accounting for 11.5%. Overall, this gives the figure of 4.37%.

Our in-depth analysis of the global green buildings market includes the following segments:

|

Product |

|

|

Distribution Channel |

|

|

End-Use |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Green Building Market Regional Analysis:

North America Market Insights

North America region is likely to observe significant growth till 2035, owing to federal energy efficiency policies, infrastructure spending, and consumer sustainability trends. According to the U.S. Department of Energy, there is an estimated 30% energy saving in buildings when IoT lighting and climate control are adopted. In March 2025, Holcim decided to rebrand its North America operation as Amrize in order to meet the regional decarbonization objectives. The company will prioritize circular materials, digital construction advancements, and carbon net-zero supply chains, garnering market position.

The U.S. is anticipated to observe stable growth during the forecast period owing to its construction and regulation of sustainable markets. Government initiatives and private financing options are driving adoption across the commercial as well as residential sectors. The government’s proactive approach towards climate change and the increased emphasis on corporate sustainability initiatives are set to drive the green building market even further.

Canada is steadily moving towards green building with solid governmental backing and sustainability goals across provinces. In July 2024, the government launched the Canada Green Buildings Strategy with funding for low-carbon construction materials, retrofitting incentives, and skilled workforce training. The program complements Canada’s net-zero initiatives and encourages the country’s provinces to work together toward creating sustainable structures. The strategy is a clear indication of the growing status of Canada as a regional powerhouse in sustainable urban development.

Asia Pacific Market Insights

Asia Pacific green building market is expected to capture revenue share of over 43.7% by 2035, due to increased urbanization, the presence of favorable policies, and increasing investments in green construction. In April 2022, the Ministry of Housing and Urban-Rural Development of China introduced The Code for Building Energy Efficiency and Renewable Energy Utilization, which applies to all building types. This regulation is a first step towards increasing the adoption of green building practices in one of the largest construction industries globally.

China quest for sustainability at the political level remains impactful in the global green building trends. The energy efficiency code requires the use of renewable energy and smart devices in newly constructed and existing buildings. Local authorities are also promoting green infrastructure in the form of incentives to install solar panels, sustainable water systems, and prefabricated modular construction. These policies are consistent with a broader national approach to decarbonizing the construction sector and encouraging circular design practices.

The green building market in India has shown considerable growth over the years owing to factors such as favorable economics, high urban demand, and institutionalization. In March 2024, Green Building Renewables purchased JL Phillips Renewable Energy Ltd to incorporate renewable energy products into green housing schemes. Such developments highlight how energy infrastructure and building systems are integrated into India construction sector, presenting new possibilities for sustainable scale and affordability.

Green Building Market Players:

- Alumasc Group plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Amvic Inc.

- BASF

- Bauder Ltd

- Forbo Group

- Interface, Inc.

- Kingspan Group

- Owens Corning

- Panasonic Holdings Corporation

- Wienerberger AG

The green building market is saturated due to the recent advancements in sustainable construction materials, integrated energy systems, and digital solutions for the building’s life cycle. Some of the major players in the industry are Alumasc Group plc, Amvic Inc., BASF, Bauder Ltd, Forbo Group, Interface Inc., Kingspan Group, Owens Corning, Panasonic Holdings Corporation, and Wienerberger AG. These firms are using research and development, partnerships, and acquisitions as key strategies for green building market development and operational excellence. In July 2023, Alumasc Group purchased ARP Group for USD 12.66 million in order to strengthen its position in architectural aluminum and rainwater systems. This acquisition is in line with Alumasc’s long-term strategy of expanding its portfolio of high-performance exterior products for sustainable construction. The trend highlights how selective M&A transactions are strengthening market segmentation and driving innovation in green building parts.

Here are some leading companies in the green building market:

Recent Developments

- In March 2025, One Click LCA and the U.S. Green Building Council announced a strategic partnership to streamline life-cycle assessment and decarbonization in buildings. The collaboration enables LEED-certified projects to integrate One Click LCA tools, enhancing material carbon footprint analysis. This initiative accelerates data-driven sustainability in construction. It marks a pivotal advancement in lifecycle carbon transparency for green buildings.

- In February 2025, SOL Properties unveiled stringent green building design principles for its upcoming Solara Tower in Dubai. The high-rise will integrate sustainable materials, water efficiency systems, and energy-saving technologies. This initiative reflects Dubai’s shifting regulatory and investor focus toward sustainable construction. Solara Tower is set to become a benchmark for eco-conscious urban developments.

- In February 2025, the International Finance Corporation (IFC) announced Indonesia’s first sustainability-linked loan to decarbonize retail properties. The loan will support energy efficiency upgrades and green building certifications in commercial real estate. The initiative aims to unlock green finance in Southeast Asia’s construction sector. It also demonstrates how financial tools are accelerating sustainable property development.

- Report ID: 3509

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Green Buildings Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.