Herpes Zoster Market Outlook:

Herpes Zoster Market size was valued at USD 236.44 million in 2025 and is set to exceed USD 333.52 million by 2035, expanding at over 3.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of herpes zoster is estimated at USD 243.89 million.

Expenditure on improved healthcare including diagnosis, treatment, and therapeutics is one of the major growth factors in the herpes zoster market. An NLM report, published in January 2022, published an estimation of the associated expenses in the U.S. related to herpes simplex virus diagnosis and management. It revealed that the screening, episodic therapy, suppressive therapy, and hospitalization for neonatal care ranged from USD 7–100, USD 0.53–35, USD 240–2580/year, and USD 5321–32,683. Such countries with well-developed medical facilities play a pivotal role in offering wider access to treatment and prevention. Thus, the significant contribution in reducing the prevalence and fatalities has propelled the production and development of these solutions.

The governments in such countries are also attributing to the expansion of the herpes zoster market by promoting the importance of treating and preventing shingles. In addition, their efforts to improve healthcare delivery and drug discoveries are inspiring research institutions to introduce new options for patients, broadening the product range in this sector. For instance, in August 2023, a team of R&D at the University of Georgia developed and patented a new molecule, POM-L-BHDU to offer an effective treatment for shingles. The POM-L-BHDU, 0.2% formulated in cocoa butter showed promising results against herpes simplex 1 and the varicella-zoster viruses in topical studies on adult human skin. The team aims to put the molecule on clinical trials to commercialize it as a broad-spectrum solution.

Key Herpes Zoster Market Insights Summary:

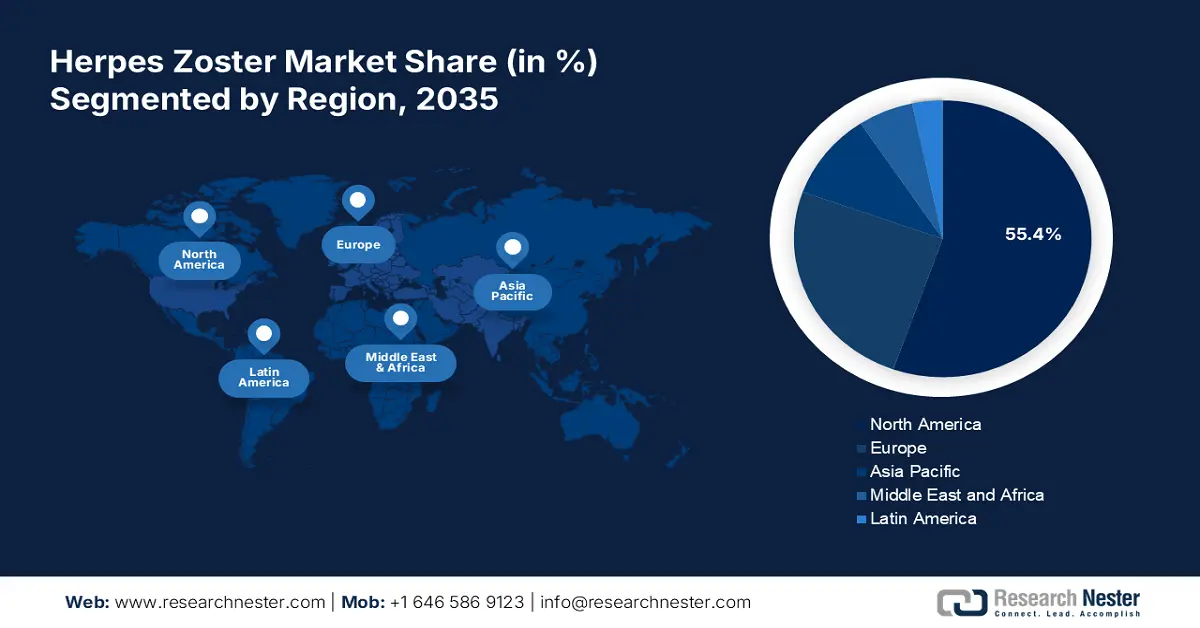

Regional Highlights:

- North America herpes zoster market will account for 55.40% share by 2035, attributed to rising VZV prevalence and government investment in vaccine R&D.

- Asia Pacific market will exhibit the fastest growth during the forecast period 2026-2035, driven by increased healthcare spending and advanced tech adoption.

Segment Insights:

- The oral segment in the herpes zoster market is projected to hold an 83.10% share by 2035, driven by rising demand for pain management drugs and effective oral antiviral therapies.

- The antiviral medications segment in the herpes zoster market is expected to hold a significant share by 2035, influenced by their role in reducing infection severity and duration, driving treatment adoption.

Key Growth Trends:

- Increasing population of immunity weakness

- Advancements in healthcare

Major Challenges:

- Expensive treatment and medication

- Limited awareness and acceptance among consumers

Key Players: GlaxoSmithKline plc, Astellas Pharma Inc., Foamix Pharmaceuticals, GeneOne Life Science, Merck & Co., NAL Pharma, Novartis AG, Hoffmann-La Roche Ltd, TSRL Inc..

Global Herpes Zoster Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 236.44 million

- 2026 Market Size: USD 243.89 million

- Projected Market Size: USD 333.52 million by 2035

- Growth Forecasts: 3.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (55.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Japan, Germany, United Kingdom, China

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 18 September, 2025

Herpes Zoster Market Growth Drivers and Challenges:

Growth Drivers

- Increasing population of immunity weakness: The impact of deadly diseases on immunocompromised patients was highlighted during the pandemic strike. The results of the WHO ISARIC CCP-UK prospective cohort study revealed in January 2023, that the mortality rate in hospital admission accounted to be higher for immunocompromised patients. The study further mentioned the probability of death in such cases was 88% for men and 83% for women aged 50 to 69 years. It showcased the need for precautions to save people from potential viral infections such as shingles. This further propels demand in the market.

- Advancements in healthcare: The growing adoption of innovative solutions has stimulated acceptance in the herpes zoster market. Improved diagnosis, vaccination, and drugs are being developed for better patient outcomes. This brings versatility in novel treatment options, driving growth in this sector. It is further inspiring leaders to engage their assets in the form of financial support and clinical expertise in more R&D projects. For instance, in February 2022, Moderna, Inc. unveiled three new development programs to expand its pipeline of mRNA vaccines for herpes simplex virus (HSV) and varicella-zoster virus (VSV).

Challenges

- Expensive treatment and medication: Newly introduced medical solutions in the herpes zoster market may become unaffordable for patients. Significant expenses on long-term treatment may also prevent low-income populations from adopting new treatment methods. In addition, limitations in health insurance coverage for such diseases may restrict access to prevention and treatment. This makes it difficult for the suppliers or service providers to widespread adequate treatment programs for shingles, hindering growth in this sector.

- Limited awareness and acceptance among consumers: Despite government promotions and proven efficacy, patients often hesitate to adopt vaccinations or new medications from the herpes zoster market. Misconceptions about the disease or treatment safety may also become a hurdle for authorities to reduce shingles incidences. This can dilute their interest in optimum implementation in healthcare facilities and investment. Moreover, the lack of knowledge in consumers may result in delayed diagnosis and treatment, limiting the proper effectiveness of these solutions.

Herpes Zoster Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.5% |

|

Base Year Market Size (2025) |

USD 236.44 million |

|

Forecast Year Market Size (2035) |

USD 333.52 million |

|

Regional Scope |

|

Herpes Zoster Market Segmentation:

Route of Administration Segment Analysis

Based on the route of administration, the oral segment is expected to account for more than 83.1% herpes zoster market share by the end of 2035. The driving factor of this segment majorly lies in the growing demand and popularity for pain management drugs. The effectiveness of antiviral drugs has also accumulated the interest of service providers to incorporate them as a part of oral therapeutics in their treatment process. New drugs are now being introduced to expand the product range of this segment. For instance, in July 2022, a research report was published, introducing a new treatment, TELTAB for severely painful Herpes infection. This painless injection method is dedicated to curing severely painful cases.

Treatment and Prevention Segment Analysis

In terms of treatment and prevention, the antiviral medications segment is expected to dominate the herpes zoster market with a significant share by the end of 2035. Being a crucial part of the mainstream treatment process, these drugs help reduce the severity and duration of the infection. The proven effectiveness of such medication has inspired companies and research institutions to explore more possibilities of application in this segment. For instance, in October 2024, NYU Langone revealed the results of the eight-year Zoster Eye Disease Study (ZEDS) on anti-viral drugs at the annual AAO meeting in Chicago. The report established the efficacy of a low dose of valacyclovir over a year, showcasing a 26% risk reduction of new or worsening keratitis or iritis at 18 months.

Our in-depth analysis of the global herpes zoster market includes the following segments:

|

Route of Administration |

|

|

Treatment and Prevention |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Herpes Zoster Market Regional Analysis:

North America Market Insights

North America in herpes zoster market is anticipated to hold more than 55.4% revenue share by 2035. The well-established healthcare infrastructure of this region is driving growth in this sector. The rising prevalence rate of VZV infection has forced regional authorities to focus on implementing preventive and curative measures in all healthcare institutions to ensure accessibility. According to the CDC report, published in June 2024, around 99.5% population born before 1980 in the U.S. is infected with wild type varicella-zoster virus. The report further stated that nearly 1 in 3 people in the country are poised to suffer from herpes zoster at least once in their lifetime.

Weakness of immunity found in a majority of the population of the U.S. has forced the country’s public health associations to take initiatives in promoting and penetrating preventive solutions such as vaccination. This is further inspiring for them to invest and encourage more research projects, propelling growth in its domestic herpes zoster market. For instance, in October 2023, NIH announced a USD 2.8 million fund to support Rational Vaccines’s R&D, developing new vaccines for and other treatment methods for HSV.

Canada is also proactively taking part in the herpes zoster market by strengthening its healthcare infrastructure to reduce the widespread infection across the region. The cautious impact of the virus on the country’s population is concerning the governing bodies and pushing them to adopt proven and tested treatments and preventive solutions. However, the lack of funding is impacting the vaccine access and development progress of this landscape. In this regard, the National Advisory Committee on Immunization in Canada has recommended to implement adult herpes vaccines.

APAC Market Insights

The Asia Pacific landscape is expected to witness the fastest growth in the herpes zoster market by the end of 2035. Emerging economies such as China, India, and Japan are contributing to regional progress with increased expenditure on healthcare. The International Monetary Fund revealed in April 2024, that the GDP of APAC achieved a 5% increment in 2023. They are remarkably adopting innovative treatments and therapies to reduce the incidences and improve patient outcomes. Moreover, the integration of advanced technologies such as AI and cloud computing have highly influenced drug discoveries, revolutionizing their approach towards viral diseases.

India, with its strong emphasis on pharmaceutical progress, it has created a great business atmosphere for both domestic and global leaders in the herpes zoster market. According to an IBEF estimation, the pharma industry of India is projected to reach USD 130 billion by 2030. The country’s lucrative marketplace is now attracting foreign forces for investments and participation. For instance, in April 2023, GSK launched Shingrix in India to prevent shingles in adults, aging 50 years or over. The strategic expansion was aimed at setting its footprint in such a dynamic landscape.

China is significantly growing in the herpes zoster market with its efforts to make vaccines and medicines accessible and affordable for all citizens. As the economic burden of HSV treatments is a setback in this sector, the country is focusing on heightening the willingness to vaccinate among citizens. For instance, in October 2023, Rational Vaccines collaborated with Shenzhen Mellow Hope Pharm Industrial Co., Ltd. to develop, manufacture, and commercialize live vaccines against herpes simplex viruses in China. The joint R&D venture aimed at offering a prominent solution to serve the broad range of consumers in the country.

Herpes Zoster Market Players:

- GlaxoSmithKline plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Astellas Pharma Inc.

- Foamix Pharmaceuticals

- GeneOne Life Science

- Merck & Co.

- NAL Pharma

- Novartis AG

- Hoffmann-La Roche Ltd

- TSRL Inc.

- Pfizer Inc.

Besides developing new techniques and medications, global leaders are taking initiatives to grow public awareness about the available solutions, expanding the reach of the herpes zoster market worldwide. The widespread popularity of antiviral drugs is further captivating the focus of pharma giants, willing to solidify their global dominance. This is bringing innovations in this sector, marking steady and potential growth. For instance, in September 2024, GSK partnered with Brooke Shields to spread education about risk and vaccination for shingles by encouraging people aged 50 years or over. As a part of the THRIVE@50+ campaign, the partners aim to promote the effectiveness and importance of available treatments in aging. Such key players include:

Recent Developments

- In April 2024, GlaxoSmithKline plc announced the positive results of the long-term follow-up phase III trial of ZOSTER-049, highlighting its 82.0% effectiveness even after 11 years of vaccination with Shingrix. The data further revealed 79.7% efficacy against shingles in adults over 50 and over during the same timeline.

- In February 2023, Pfizer Inc. collaborated with BioNTech SE to initiate a Phase 1/2 trial on the safety, tolerability, and immunogenicity of mRNA vaccine candidates against shingles. The multicenter, randomized, controlled, and dose-selection study aims to evaluate and explore the potential of mRNA technology.

- Report ID: 6930

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Herpes Zoster Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.