Oral Antiviral Market Outlook:

Oral Antiviral Market size was over USD 39.9 billion in 2025 and is estimated to reach USD 51.6 billion by the end of 2035, expanding at a CAGR of 2.9% during the forecast timeline, i.e., 2026-2035. In 2026, the industry size of oral antiviral is assessed at USD 41 billion.

The amplifying epidemiology of viral infection and the increasing severity of these conditions are collectively maintaining a stable surge in the market. This can be testified by the World Health Organization (WHO) reporting 775 million and 7 million confirmed and death cases of SARS-CoV-2 affliction across the world till June 2024. It also mentioned that despite the decrease in fatalities after the pandemic, the KP.3 and LB.1 variants are still showing prevalence increase globally. Recently, another 2025 article from the NLM underscored the widespread occurrence of human neuroinvasive Toscana virus, accounting for a 2.34 per 1,000,000 average annual incidence rate in Italy between 2022 and 2023.

Similarly, other deadly pathogens, such as human immunodeficiency virus (HIV), Influenza, Herpes, Hepatitis B/C, and others, are affecting people worldwide, and hence, indicating the sustainability of the consumer base of the market. Besides, the convenience and affordability that come along with these therapies make them more attractive in comparison to other forms of antimicrobials, such as injectables. This is also clinically validated by various studies, including the 2025 NLM cohort, demonstrating an incremental cost-effectiveness ratio (ICER) of $253.51 per quality-adjusted life year (QALY) from the use of oral antiviral therapy (AVT) in treating chronic hepatitis B (CHB).

Key Oral Antiviral Market Insights Summary:

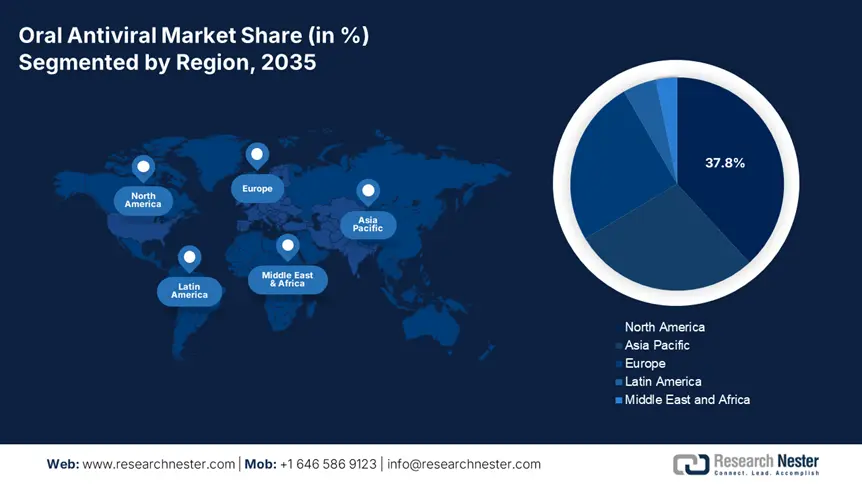

Regional Insights:

- North America is projected to command a 37.8% share of the oral antiviral market by 2035, supported by robust healthcare infrastructure and intensified government funding efforts.

- Europe is anticipated to retain a significant share of the market through 2035, underpinned by advanced healthcare systems and reinforced public health initiatives.

Segment Insights:

- HIV is set to account for a 33.5% revenue share in the oral antiviral market by 2035, propelled by its rising prevalence and expanding global awareness.

- Reverse transcriptase inhibitors (RTIs) are expected to hold a substantial revenue position over 2026–2035, bolstered by extensive governmental validation and large-scale therapeutic investments.

Key Growth Trends:

- Clinical benefits of early intervention

- Unmet needs of high-risk populations

Major Challenges:

- Worldwide burden of antimicrobial resistance

- Limitations in widespread adoption

Key Players: Merck & Co. (U.S.), GlaxoSmithKline (UK), Pfizer (U.S.), Roche (Switzerland), AbbVie (U.S.), Johnson & Johnson (U.S.), AstraZeneca (UK), Novartis (Switzerland), Bristol-Myers Squibb (U.S.), Cipla (India), Sun Pharmaceutical (India), CSL Limited (Australia), Celltrion (South Korea), Biocon (India), Hikma Pharmaceuticals (UK), Pharmaniaga (Malaysia), Hetero Drugs (India).

Global Oral Antiviral Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 39.9 billion

- 2026 Market Size: USD 41 billion

- Projected Market Size: USD 51.6 billion by 2035

- Growth Forecasts: 2.9%

Key Regional Dynamics:

- Largest Region: North America (37.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, South Korea

- Emerging Countries: India, Australia, Brazil, United Arab Emirates, United Kingdom

Last updated on : 12 August, 2025

Oral Antiviral Market - Growth Drivers and Challenges

Growth Drivers

- Clinical benefits of early intervention: Early commencement of treatments available in the market remarkably enhances clinical outcomes, which increases demand across both outpatient and inpatient care settings. Testifying to such credibility, in August 2024, the Centers for Disease Control and Prevention (CDC) concluded a 40% reduction in mortality or severity due to the first-day initiation of oseltamivir during hospital admission than the treatment provided between days two and five. Besides, early administration reduces the need for intensive care and mechanical ventilation, establishing a strong clinical and economic value of these therapies.

- Unmet needs of high-risk populations: The disparity in treatment access in both developed and emerging economies presents lucrative opportunities for the oral antiviral market. In this regard, the CDC published surveillance data, collected from a survey conducted in the U.S. between 2022 and 2023, which highlights a substantial treatment gap in the use of required medicines among high-risk pediatric and adolescent populations. The outcomes unveiled that among 12,543 patients with severe outcomes, only 21.1% received outpatient COVID-19 antiviral treatment, compared to 46.7% among those without severe outcomes. This underutilization points to a critical scope to expand access and improve uptake in this category, particularly in vulnerable groups.

- Sustained investments in pandemic preparedness: Financial backing from governing bodies to ensure a sufficient supply of resources during outbreaks continues to advance the market. As evidence, in November 2022, the National Institute of Allergy and Infectious Diseases (NIAID), under the National Institute of Health (NIH), sanctioned around $12 million grants to 3 individual institutions. These organizations were awarded following their progress in developing antiviral therapies targeting viruses with pandemic potential. Further, as a part of the Antiviral Program for Pandemics (APP), the funding is expected to total $61.5 million over five years if all options are exercised. Such a sustained inflow of capital indicates the scope of expansion in the pipeline of this sector.

Historic Patient Pool Expansion in the Market

Historic Expansion of Oral Antiviral Use (U.S.)

|

Metric |

Value |

|

Antiviral use in hospitalized flu patients (2010-2011) |

72% |

|

Antiviral use in hospitalized flu patients (2014-2015) |

89% |

|

Use among children <1 year (2010-2011) |

51% |

|

Use among children <1 year (2014-2015) |

82% |

|

Total Oseltamivir prescriptions during 2009 H1N1 pandemic |

5.4 million |

|

• Ages 0-17 |

2.15 million |

|

• Ages 18–64 |

2.98 million |

|

• Ages 65+ |

0.30 million |

|

Outpatients receiving antivirals within 5 days (2014-18) |

50%-55% |

|

Treated on same day of diagnosis (2014-2018) |

>80% |

Source: NLM and CDC

Global Pricing Trends in the Market

Global Pricing Trends for Oral Antivirals (2022)

|

Drug Name |

Type |

U.S. Federal Procurement Price |

|

Paxlovid (nirmatrelvir/ritonavir) |

Protease Inhibitor |

~$530 per course |

|

Molnupiravir (Lagevrio) |

RdRp Inhibitor |

~$700 per course |

Source: NLM

Challenges

- Worldwide burden of antimicrobial resistance: The growing incidences and complexity of viral resistance pose a remarkable roadblock in the oral antiviral market. As excessive and inappropriate use of these drugs can reduce their long-term effectiveness, particularly against rapidly mutating viruses, such as influenza and SARS-CoV-2, many of these antivirals often fail to deliver the expected clinical performance. Moreover, the increase in resistance leads to limitations in treatment options, potentially compromising the adoption rate in this sector.

- Limitations in widespread adoption: Severe gaps in access and affordability remain a major hurdle in the market. Despite the collective efforts from public and private organizations, many of the premium-priced medicines fail to comply with the cost-effectiveness criteria of enabling insurance coverage. Besides, supply chain-related disruptions also contribute to uneven availability across regions, lowering the volume of adoption and purchase in this sector. These limitations are particularly critical in low- and middle-income countries (LMICs) due to the constrained healthcare system, which hinders timely distribution and widespread use.

Oral Antiviral Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2026-2035 |

|

CAGR |

2.9% |

|

Base Year Market Size (2025) |

USD 39.9 billion |

|

Forecast Year Market Size (2035) |

USD 51.6 billion |

|

Regional Scope |

|

Oral Antiviral Market Segmentation:

Indication Segment Analysis

HIV is poised to represent itself as a dominant indication segment in the oral antiviral market with a 33.5% revenue share by the end of 2035. The widespread awareness and high disease prevalence are a few of the major growth factors behind the leadership. In this regard, the U.S. Department of Health & Human Services (HHS) revealed that 39.9 million people across the globe were living with HIV as of 2023. This volume further extended to 40.8 million in 2024, marking a consistent rise in the patient population, as unveiled by the WHO. Further, the enlarging epidemiology is dragging the focus of the public organizations on promoting and enabling wide access to effective antiviral therapies.

Drug Class Segment Analysis

Reverse transcriptase inhibitors (RTIs) are predicted to maintain their position as a significant contributor to the revenue generation in the oral antiviral market over the assessed period. Being an essential component of treatment for HIV and other prevalent viral infections, government entities are validating and investing in this category at a large scale to improve patient outcomes. As evidence, in July 2025, Merck received FDA acceptance for the review of the New Drug Application (NDA) for doravirine/islatravir (DOR/ISL). This investigational, once-daily, oral, two-drug regimen for adults with HIV-1 infection is designed to virologically suppress on antiretroviral therapy. Besides, the impressive availability of both nucleoside and non-nucleoside reverse transcriptase inhibitors makes it a suitable option for patients from underserved regions.

Distribution Channel Segment Analysis

Retail pharmacies are expected to command a considerable distribution channel for the oral antiviral market throughout the analyzed timeframe. These distributors play a crucial role in ensuring equitable patient access to a wide range of medications, particularly for outpatient treatment and chronic disease management. As a result, the segment becomes the most preferred choice for pioneers in this field to augment their commercial expansion across the globe. Additionally, the influence of digitalization made the procurement of antivirals from these dispensaries easier for patients in need through the penetration of e-commerce platforms. This can be testified by the growing value of the e-drug store industry in India, totaling $ 36 billion in 2022, as per the NLM.

Our in-depth analysis of the oral antiviral market includes the following segments:

| Segment | Subsegment |

|

Indication |

|

|

Drug Class |

|

|

Formulation |

|

|

Age Group |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oral Antiviral Market - Regional Analysis

North America Market Insights

North America is predicted to lead the global oral antiviral market by capturing the largest revenue share of 37.8% during the discussed tenure. The region's dominance is highly controlled by its robust healthcare infrastructure, substantial government funding, and ongoing R&D investments. The amplification of financial backing can be exemplified by the national healthcare expenditure (NHE) allocation by the government of the U.S., which grew by 7.5% to $4.9 trillion in 2023, as per the Centers for Medicare & Medicaid Services (CMS). Furthermore, the region is fueled by government-led pandemic preparedness efforts and streamlined regulatory pathways through the FDA and Health Canada.

The augmentation of the U.S. oral antiviral market is backed by government investments and expanded healthcare coverage. Evidencing the same, in 2023, the CDC allocated $5 billion toward antiviral initiatives to community-based organizations (CBOs) to empower and advance Mpox prevention. The Biden Administration of the country further propelled development through a $3 billion allocation under the roadmap of the American Rescue Plan, promoting next-generation treatments. Additionally, increased research and development focus on antivirals targeting respiratory syncytial virus (RSV) and influenza reflects ongoing priorities to strengthen pandemic preparedness and address unmet clinical needs.

Canada is augmenting the North America antiviral market steadily, which is backed by a strong healthcare infrastructure, targeted public health programs, and increasing awareness of viral infections. The country experiences consistent demand for antiviral drugs due to the prevalence of chronic viral conditions such as hepatitis, HIV, and seasonal influenza. Besides, government initiatives and funding to escalate the scale of development and distribution in this category are also fueling the sector. This can be testified by the Government of Canada procuring a total of 1,50,400 doses of COVID-19 oral antiviral treatment, PAXLOVID, from Pfizer by March 2022.

APAC Market Insights

Asia Pacific is estimated to exhibit the highest pace of growth in the global antiviral market during the analyzed timeline. The region's pace of progress in this sector is attributable to a large and increasingly urbanized population, rising healthcare expenditures, and improved awareness of infectious diseases. The growing burden of viral infections such as hepatitis, HIV, and influenza, combined with extending healthcare access to rural areas, is fueling demand in this field. Besides, government efforts to expand the range and scale of immunization and antiviral distribution, along with the presence of major generic drug manufacturers, are solidifying the region's position in the field.

China holds a strong position in the Asia Pacific antiviral market on account of its large population, rising incidence of viral infections, and increasing healthcare expenditure. The amplifying volume of the middle class and growing awareness of early disease prevention lead to greater financial and commercial outcomes in this sector. Government health initiatives and reforms aimed at improving access to treatment further contribute to the exponential rise in demand. Additionally, the nation's exceptional pharmaceutical manufacturing capabilities, including a focus on generic antiviral drugs, position it as both a major consumer and supplier in the field.

India plays a vital role in the global-scale expansion of the regional antiviral market, which is owed to the high burden of viral diseases and a strong emphasis on the pharma industry. As evidence, a PIB report unveiled that the values of domestic consumption and export of pharmaceutical products in the country accounted for USD 23.5 billion and USD 26.5 billion, respectively, between 2023 and 2024. Besides, India is one of the world’s largest producers of generic antiviral drugs, making treatments more affordable and accessible both locally and internationally. Furthermore, government allocations aimed at combating viral epidemics are supporting market growth.

Europe Market Insights

Europe represents a mature and well-established landscape in the global antiviral market, with the potential to retain its position as the significant shareholder over the period between 2026 and 2035. The well-proportionated distribution of advanced healthcare systems, strong regulatory frameworks, and widespread public health initiatives are collectively backing the region's significance in this sector. Besides, the increasing incidences of viral affliction are also a notable demand propelling factor in this landscape, where HIV/AIDS alone accounted for 2.6 million in 2024, as per the WHO findings. Continuous flow of funding and amplifying focus on R&D further contribute to the development and adoption of new antiviral therapies in Europe.

Germany is leading the Europe antiviral market with a robust healthcare system, high healthcare expenditure, and a strong emphasis on pharmaceutical R&D. The country experiences ongoing demand increase for antiviral treatments due to the frequent occurrences of chronic viral infections and seasonal outbreaks. Government support for public health initiatives and early adoption of innovative therapies further attract more pioneers to invest in this marketplace. Additionally, the country's well-developed pharma industry and favorable regulatory environment ensure equitable availability and quality of antiviral medications across the nation.

The UK accounts for a prominent position in the regional antiviral market in support by its comprehensive public medical system, proactive disease surveillance, and commitment to preventive care. The country sees consistent extension in this field with the growing need to manage conditions, such as influenza, hepatitis, and HIV, creating a sustainable consumer base. Further, government-backed capital influx, national health programs, and public-private partnerships (PPPs) widen access to antiviral therapies. Currently, the country is focusing on clinical research and innovation to ensure the development and timely approval of new antiviral treatments.

Key Oral Antiviral Market Players:

- Gilead Sciences (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck & Co. (U.S.)

- GlaxoSmithKline (UK)

- Pfizer (U.S.)

- Roche (Switzerland)

- AbbVie (U.S.)

- Johnson & Johnson (U.S.)

- AstraZeneca (UK)

- Novartis (Switzerland)

- Bristol-Myers Squibb (U.S.)

- Cipla (India)

- Sun Pharmaceutical (India)

- CSL Limited (Australia)

- Celltrion (South Korea)

- Biocon (India)

- Hikma Pharmaceuticals (UK)

- Pharmaniaga (Malaysia)

- Hetero Drugs (India)

The antiviral market is highly competitive, which is led by major U.S. and Europe-based pharma giants, such as Gilead, Merck, and GSK, who leverage their strong R&D capabilities to adhere to the current commercial trends. Their cohort of strategies includes global partnerships, mergers and acquisitions, procurement of government contracts, and securing compliance with fast-track regulatory approvals. On the other hand, companies operating in emerging economies, such as Cipla and Sun Pharma, are more focused on the manufacturing of affordable options to supply for outbreaks of dengue and COVID-19.

Such key players are:

Recent Developments

- In December 2024, Pfizer commenced the Phase III, Double-Blind, 2-Arm trial for its next-generation COVID-19 antiviral, ibuzatrelvir. The evaluation is aimed at determining the ability of this oral therapy as a safer alternative to PAXLOVID in treating high-risk patients who are not hospitalized but at risk of severe disease progression.

- In May 2023, Pfizer attained approval for its combination therapy, PAXLOVID (nirmatrelvir tablets and ritonavir tablets), for the treatment of mild-to-moderate COVID-19 in adults. The medicine showed an 86% reduction in risk of COVID-19-related hospitalization or death during the Phase 2/3 EPIC-HR study.

- Report ID: 7997

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oral Antiviral Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.