Global Oral Generic Pharmaceutical Market

- An Outline of the Global Oral Generic Pharmaceutical Market

- Market Definition and Segmentation

- Study Assumptions and Abbreviations

- Research Methodology & Approach

- Primary Research

- Secondary Research

- Data Triangulation

- SPSS Methodology

- Executive Summary

- Growth Drivers

- Major Roadblocks

- Opportunities

- Prevalent Trends

- Government Regulation

- Growth Outlook

- Competitive White Space Analysis – Identifying Untapped Market Gaps

- Risk Overview

- SWOT

- Technological Advancement

- Technology Maturity Matrix for Oral Generic Pharmaceutical

- Recent News

- Regional Demand

- Global Oral Generic Pharmaceutical by Geography – Strategic Comparative Analysis

- Strategic Segment Analysis: Oral Generic Pharmaceutical Demand Landscape

- Oral Generic Pharmaceutical Demand Trends Driven by Rising Chronic Disease Burden, Dominant Route of Administration, and Aging Population (2026-2036)

- Root Cause Analysis (RCA) for discovering problems of the Oral Generic Pharmaceutical Market

- Porter Five Forces

- PESTLE

- Comparative Positioning

- Global Oral Generic Pharmaceutical – Key Player Analysis (2036)

- Competitive Landscape: Key Suppliers/Players

- Competitive Model: A Detailed Inside View for Investors

- Company Market Share, 2036 (%)

- Business Profile of Key Enterprise

- Sun Pharmaceuticals

- Lupin Pharmaceuticals

- Amneal Pharmaceuticals

- Viatris INC

- Sandoz Grup

- Teva Pharaceuticals

- Nordic Pharmaceutical

- Ratiopharm GmbH

- Business Profile of Key Enterprise

- Global Oral Generic Pharmaceutical Market Outlook

- Market Overview

- Market Revenue by Value (USD Million), Volume (Thousand Tons), and Compound Annual Growth Rate (CAGR)

- Oral Generic Pharmaceutical Market Segmentation Analysis (2026-2036)

- By Application

- Oncology, Market Value (USD Million), and CAGR, 2026-2036F

- Central Nervous System Disorder (USD Million), and CAGR, 2026-2036F

- Metabolic Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Cardiovascular Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Gastrointestinal Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Respiratory Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Infectious Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Hormones and Stress Related Diseases, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Prescription

- Branded Generic, Market Value (USD Million), and CAGR, 2026-2036F

- Non-Branded Generic, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturer

- Major Pharmaceutical Companies, Market Value (USD Million), and CAGR, 2026-2036F

- Generic Drug Manufacturer, Market Value (USD Million), and CAGR, 2026-2036F

- Contract Manufacturing/Research Organizations, Market Value (USD Million), and CAGR, 2026-2036F

- By Distribution Channel

- Online Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Hospital Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Retail Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Regional Synopsis, Value (USD Million), 2026-2036

- North America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Asia Pacific Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Middle East and Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Application

- Market Overview

- North America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Application

- Oncology, Market Value (USD Million), and CAGR, 2026-2036F

- Central Nervous System Disorder (USD Million), and CAGR, 2026-2036F

- Metabolic Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Cardiovascular Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Gastrointestinal Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Respiratory Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Infectious Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Hormones and Stress Related Diseases, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Prescription

- Branded Generic, Market Value (USD Million), and CAGR, 2026-2036F

- Non-Branded Generic, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturer

- Major Pharmaceutical Companies, Market Value (USD Million), and CAGR, 2026-2036F

- Generic Drug Manufacturer, Market Value (USD Million), and CAGR, 2026-2036F

- Contract Manufacturing/Research Organizations, Market Value (USD Million), and CAGR, 2026-2036F

- By Distribution Channel

- Online Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Hospital Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Retail Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- U.S. Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Canada Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Application

- Overview

- Europe Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Application

- Oncology, Market Value (USD Million), and CAGR, 2026-2036F

- Central Nervous System Disorder (USD Million), and CAGR, 2026-2036F

- Metabolic Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Cardiovascular Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Gastrointestinal Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Respiratory Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Infectious Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Hormones and Stress Related Diseases, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Prescription

- Branded Generic, Market Value (USD Million), and CAGR, 2026-2036F

- Non-Branded Generic, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturer

- Major Pharmaceutical Companies, Market Value (USD Million), and CAGR, 2026-2036F

- Generic Drug Manufacturer, Market Value (USD Million), and CAGR, 2026-2036F

- Contract Manufacturing/Research Organizations, Market Value (USD Million), and CAGR, 2026-2036F

- By Distribution Channel

- Online Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Hospital Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Retail Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- UK Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Germany Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- France Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Italy Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Spain Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Netherlands Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Russia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Switzerland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Poland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Belgium Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Europe Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Application

- Overview

- Asia Pacific Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Segmentation (USD million), 2026-2036, By

- By Application

- Oncology, Market Value (USD Million), and CAGR, 2026-2036F

- Central Nervous System Disorder (USD Million), and CAGR, 2026-2036F

- Metabolic Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Cardiovascular Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Gastrointestinal Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Respiratory Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Infectious Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Hormones and Stress Related Diseases, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Prescription

- Branded Generic, Market Value (USD Million), and CAGR, 2026-2036F

- Non-Branded Generic, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturer

- Major Pharmaceutical Companies, Market Value (USD Million), and CAGR, 2026-2036F

- Generic Drug Manufacturer, Market Value (USD Million), and CAGR, 2026-2036F

- Contract Manufacturing/Research Organizations, Market Value (USD Million), and CAGR, 2026-2036F

- By Distribution Channel

- Online Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Hospital Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Retail Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- China Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- India Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Korea Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Australia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Indonesia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Malaysia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Vietnam Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Thailand Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Singapore Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- New Zeeland Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Asia Pacific Excluding Japan Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Application

- Overview

- Latin America Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- By Application

- Oncology, Market Value (USD Million), and CAGR, 2026-2036F

- Central Nervous System Disorder (USD Million), and CAGR, 2026-2036F

- Metabolic Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Cardiovascular Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Gastrointestinal Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Respiratory Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Infectious Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Hormones and Stress Related Diseases, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Prescription

- Branded Generic, Market Value (USD Million), and CAGR, 2026-2036F

- Non-Branded Generic, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturer

- Major Pharmaceutical Companies, Market Value (USD Million), and CAGR, 2026-2036F

- Generic Drug Manufacturer, Market Value (USD Million), and CAGR, 2026-2036F

- Contract Manufacturing/Research Organizations, Market Value (USD Million), and CAGR, 2026-2036F

- By Distribution Channel

- Online Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Hospital Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Retail Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Brazil Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Argentina Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Mexico Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Latin America Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Application

- Overview

- Middle East & Africa Market

- Overview

- Market Value (USD Million), Current and Future Projections, 2026-2036

- Increment $ Opportunity Assessment, 2026-2036

- Year-on-Year Growth Forecast (%)

- Segmentation (USD million), 2026-2036, By

- By Application

- Oncology, Market Value (USD Million), and CAGR, 2026-2036F

- Central Nervous System Disorder (USD Million), and CAGR, 2026-2036F

- Metabolic Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Cardiovascular Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Gastrointestinal Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Respiratory Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Infectious Disease, Market Value (USD Million), and CAGR, 2026-2036F

- Hormones and Stress Related Diseases, Market Value (USD Million), and CAGR, 2026-2036F

- Others, Market Value (USD Million), and CAGR, 2026-2036F

- By Prescription

- Branded Generic, Market Value (USD Million), and CAGR, 2026-2036F

- Non-Branded Generic, Market Value (USD Million), and CAGR, 2026-2036F

- By Manufacturer

- Major Pharmaceutical Companies, Market Value (USD Million), and CAGR, 2026-2036F

- Generic Drug Manufacturer, Market Value (USD Million), and CAGR, 2026-2036F

- Contract Manufacturing/Research Organizations, Market Value (USD Million), and CAGR, 2026-2036F

- By Distribution Channel

- Online Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Hospital Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Retail Pharmacies, Market Value (USD Million), and CAGR, 2026-2036F

- Country Level Analysis, Value (USD Million)

- Saudi Arabia Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- UAE Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Israel Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Qatar Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Kuwait Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Oman Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- South Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- Rest of Middle East & Africa Market Value (USD Million) and CAGR & Y-o-Y Growth Trend, 2026-2036F

- By Application

- Overview

- Global Economic Scenario

- World Economic Outlook

- About Research Nester

- Our Global Clientele

- We Serve Clients Across World

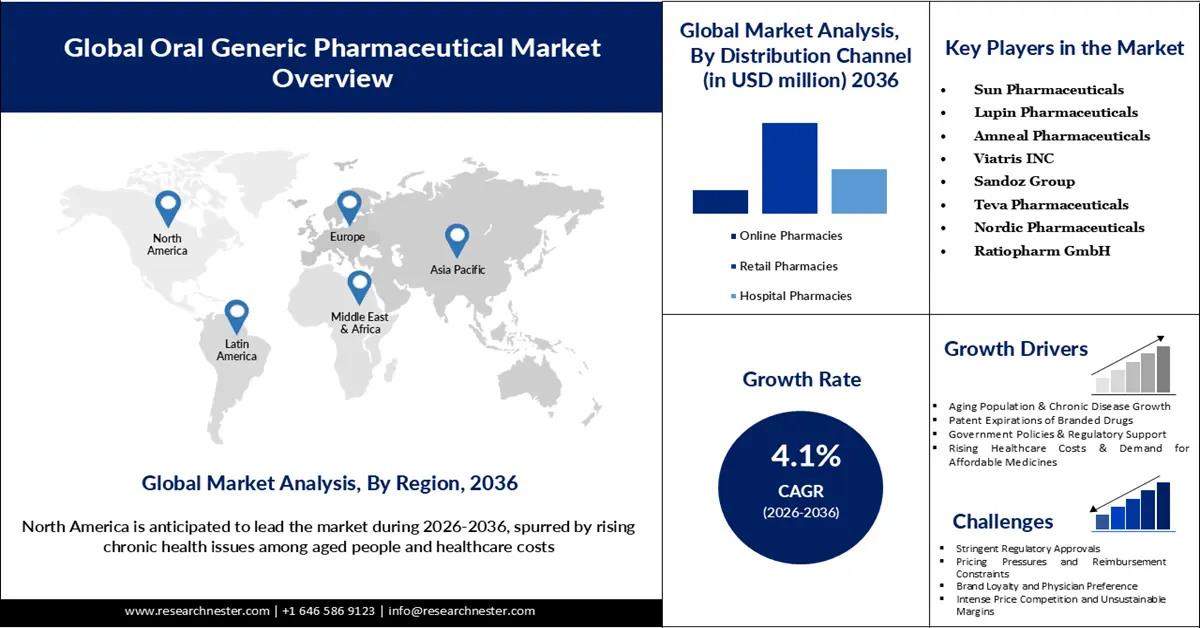

Oral Generic Pharmaceutical Market Outlook:

Oral Generic Pharmaceutical Market size was valued at USD 313.5 billion in 2025 and is projected to reach USD 484.5 billion by the end of 2036, rising at a CAGR of 4.1% during the forecast period, i.e., 2026-2036. In 2026, the industry size of oral generic pharmaceutical is assessed at USD 326.5 billion.

The market is entirely driven by the rising adoption of generic and cost-effective drugs that can be used for long-term treatment. To make healthcare accessible for all, governments and regulatory bodies have pushed manufacturers to sell generic drugs. For example, on October 4, 2025, the FDA launched the PreCheck program along with a pilot initiative to expedite domestic generic drug approvals. These actions aim to boost local manufacturing, reduce time-to-market, and enhance both market competition and patient access to affordable generics. Another major driving factor of the market is the aging population of different regions, which is further bringing more critical illnesses and chronic diseases. The cure to certain chronic diseases is long-term medication, which is often patented. Thus, the introduction of generic drugs will reduce the treatment expense to a greater extent. The oral generic pharmaceutical market is dominated by certain key players that have a strong ecosystem of manufacturing and global presence in generic drug distribution.

Key Oral Generic Pharmaceutical Market Insights Summary:

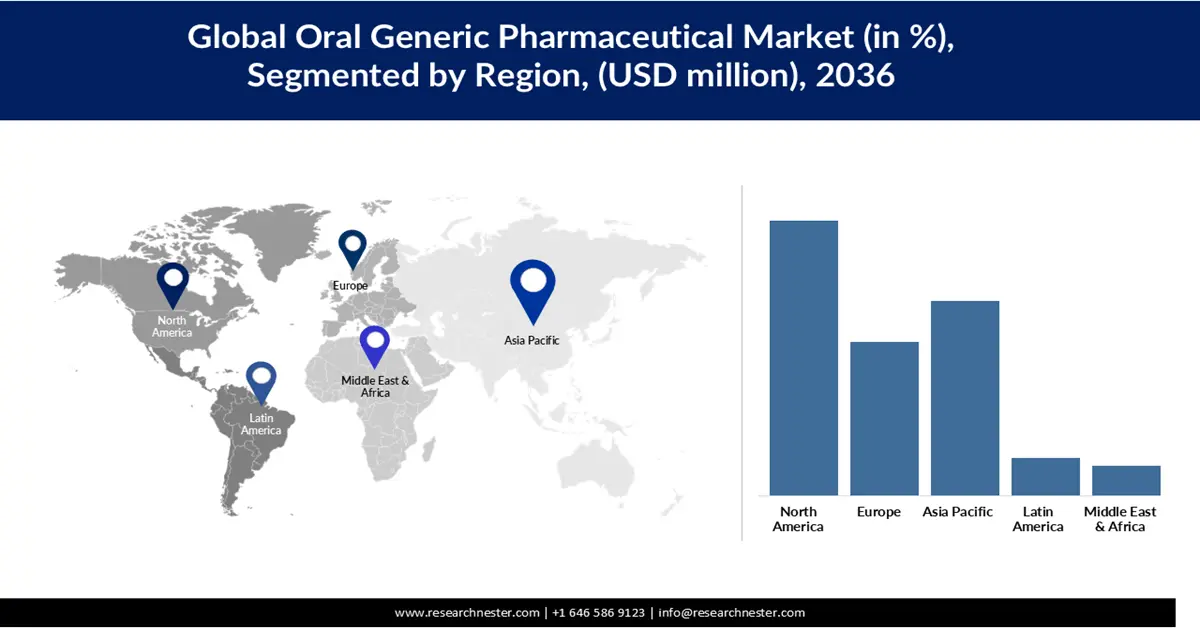

Regional Highlights:

- By 2036, North America is anticipated to secure a 39.8% share of the oral generic pharmaceutical market, underpinned by high U.S. generic prescription volumes and robust distribution networks.

- Europe is projected to maintain steady expansion through 2026–2035, supported by healthcare cost-containment measures and broad policy-driven generic substitution.

Segment Insights:

- By 2036, the cardiovascular disease (CVD) segment in the oral generic pharmaceutical market is projected to account for a 22.5% share, sustained by the widespread need for long-term, affordable therapies for chronic cardiac conditions.

- The retail pharmacy segment is expected to strengthen through 2026–2035, owing to its broad patient reach and expanding promotion of cost-effective generic substitution.

Key Growth Trends:

- Aging population with chronic diseases

- Patent expirations of branded drugs

Major Challenges:

- Stringent regulatory approvals

- Pricing pressures and reimbursement constraints

Key Players: Sun Pharmaceuticals (India), Lupin Pharmaceuticals (India), Amneal Pharmaceuticals (U.S.), Viatris INC (U.S.), Sandoz Group (Switzerland), Teva Pharmaceuticals (Israel), Nordic Pharmaceuticals (Denmark), Ratiopharm GmbH (Germany).

Global Oral Generic Pharmaceutical Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 313.5 billion

- 2026 Market Size: USD 326.5 billion

- Projected Market Size: USD 484.5 billion by 2036

- Growth Forecasts: 4.1%

Key Regional Dynamics:

- Largest Region: North America (39.8% Share by 2036)

- Fastest Growing Region: Asia-Pacific

- Dominating Countries: United States, China, India, Germany, Japan

- Emerging Countries: Brazil, Indonesia, Vietnam, Mexico, Turkey

Last updated on : 21 November, 2025

Oral Generic Pharmaceutical Market - Growth Drivers and Challenges

Growth Drivers

- Aging population with chronic diseases: The aging global population, particularly in countries like Japan, Europe, and the U.S., is a major driver of the oral generic pharmaceutical market. According to the U.S. Census Bureau, 2025, the population aged 65 and older rose by 3.1% from 2023 to 2024, reaching 61.2 million. Older adults are more susceptible to chronic diseases such as diabetes, hypertension, cardiovascular disorders, and dementia, which require long-term medication. The high cost of brand-name drugs for these chronic conditions makes generics an attractive, affordable alternative. Governments and healthcare systems encourage the adoption of cost-effective generics to reduce healthcare expenditure while maintaining treatment quality. Consequently, the growing elderly population with chronic conditions sustains demand and accelerates market growth for oral generics worldwide.

- Patent expirations of branded drugs: As exclusivity periods end for high-value branded pharmaceuticals, generic companies gain the ability to file approvals and introduce affordable bioequivalent oral therapies. This shift typically leads to a rapid decline in drug prices and encourages wider use of generics across healthcare systems and insurance programs. The transition is particularly impactful in large therapeutic areas such as cardiovascular disease, diabetes, and oncology, where patient populations are high and treatment durations are long. Increased manufacturer participation after patent expiration intensifies competition, expanding access for patients and reducing national healthcare expenditures. Therefore, patent cliffs continue to be one of the most influential forces accelerating global oral generic pharmaceutical market growth.

- Rising cost of healthcare and demand for cheaper medicines: Escalating global healthcare expenditures are compelling governments, insurers, and patients to seek cost-effective treatment options, significantly boosting the adoption of oral generic pharmaceuticals. As generics are typically priced 40–85% lower than their branded counterparts after market entry, they offer substantial savings for long-term therapies, especially for chronic conditions such as hypertension, diabetes, and cancer. Health systems in both developed and emerging economies are increasingly encouraging generic substitution to reduce prescription spending and extend budget capacity for advanced or specialty treatments. In many countries, reimbursement policies and formulary preferences are aligned to promote generics, further accelerating their market penetration. As a result, the need to manage rising healthcare costs remains a fundamental driver of growth in the global oral generic pharmaceutical market.

Challenges

- Stringent regulatory approvals: Stringent and often lengthy regulatory approval processes can slow the expansion of the global oral generic pharmaceutical market. In many regions, generic manufacturers must demonstrate bioequivalence, safety, stability, and manufacturing quality, which requires extensive clinical and analytical testing that increases development timelines and costs. The approval cycle can take several months to multiple years, particularly in highly regulated markets such as the U.S., European Union, and Japan, delaying the entry of lower-cost alternatives after patent expiration. Smaller manufacturers may struggle to meet compliance expectations, reducing market competition and limiting supply availability. Consequently, these rigorous regulatory standards, while essential for patient safety, can hinder timely access to affordable generic medicines and slow market growth.

- Pricing pressures and reimbursement constraints: Pricing pressures and restrictive reimbursement policies present a significant challenge to the growth of the global oral generic pharmaceutical market. Governments and healthcare payers often enforce reference pricing, tender-based procurement, and periodic price revisions, which push generic drug prices downward and reduce profit margins for manufacturers. In some countries, reimbursement lists favor the lowest-priced alternative, making it difficult for companies to sustain production and invest in new generic development. These constraints can also discourage market entry for smaller firms, limiting competition and potentially causing supply shortages. As a result, despite strong demand for cost-effective medicines, pricing and reimbursement pressures can restrict revenue potential and slow overall market expansion.

Oral Generic Pharmaceutical Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2036 |

|

CAGR |

4.1% |

|

Base Year Market Size (2025) |

USD 313.5 billion |

|

Forecast Year Market Size (2036) |

USD 484.5 billion |

|

Regional Scope |

|

Oral Generic Pharmaceutical Market Segmentation:

Application Segment Analysis

The cardiovascular disease (CVD) segment of the oral generic pharmaceutical market is expected to hold a market share of 22.5% by 2036. The market growth is due to the high prevalence of conditions such as hypertension, heart failure, and hyperlipidemia globally. Patients with CVD often require long-term, daily medication, creating sustained demand for affordable treatment options. With the expiration of patents on many blockbuster cardiovascular drugs, generic manufacturers can offer bioequivalent oral therapies at reduced costs, increasing accessibility for a broader patient population. Governments and healthcare systems actively promote generic substitution in CVD treatment to reduce healthcare expenditures while maintaining therapeutic efficacy. The combination of chronic treatment requirements, aging populations, and cost-conscious healthcare policies ensures that cardiovascular drugs remain a leading application segment for oral generics worldwide.

Prescription Segment Analysis

Non-branded generics significantly drive growth in the prescription segment of the global oral generic pharmaceutical market by delivering high-volume, affordable alternatives to brand-name drugs, which increases prescription volume. In the U.S., for example, 91% of all prescriptions are filled as generic drugs, according to the FDA. This widespread use reduces costs and increases accessibility, making generics a default choice for prescribers and payers. The cost savings are enormous: FDA data shows that generics saved U.S. residents around US$338 billion in 2020. Because non-branded generics are produced by multiple manufacturers, they foster competition, push prices down, and help sustain prescription demand even after drug patents expire, fuelling sustained market expansion.

Distribution Channel Segment Analysis

The retail pharmacy segment plays a critical role in expanding the global oral generic pharmaceutical market by serving as the primary point of access for patients. Retail pharmacies ensure widespread availability of generic drugs, making them convenient for both chronic and acute therapies. They often promote generic substitution through incentives, discounts, and pharmacy-led education, encouraging patients to choose cost-effective alternatives over branded drugs. The increasing presence of organized retail chains, especially in emerging markets like India and China, enhances distribution efficiency and market penetration. Furthermore, retail pharmacies support volume-driven growth as prescriptions for chronic diseases are dispensed repeatedly, reinforcing sustained demand for oral generics worldwide.

Our in-depth analysis of the oral generic pharmaceutical market includes the following segments:

|

Segment |

Subsegment |

|

Application |

|

|

Prescription |

|

|

Manufacturers |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Oral Generic Pharmaceutical Market - Regional Insights

North America Market Insights

The oral generic pharmaceutical market in North America is experiencing steady growth and is expected to grow at a market share of 39.8% by 2036, driven primarily by the U.S., where approximately 90% of prescriptions are filled with generics. High adoption rates are supported by cost-containment policies, patent expirations of branded drugs, and incentives for generic substitution. Canada also shows strong growth, with generic unit sales rising from 76% in 2018 to 81% in 2024. The presence of well-established retail and institutional distribution channels ensures widespread accessibility. Overall, the region’s focus on affordability, efficiency, and patient access continues to propel the oral generic pharmaceuticals market forward.

The oral generic pharmaceutical market in the U.S. is growing steadily, with around 91% of prescriptions now filled with generics. This growth is supported by efficient regulatory pathways like the ANDA, which allow rapid approval of generics after patent expiration. Competition among generics drives down drug prices, meeting the demand for more affordable long-term therapies. Federal incentives and healthcare policies further encourage generic substitution, enhancing market penetration. Consequently, generics remain a key component of the U.S. pharmaceutical landscape, balancing accessibility and cost containment.

Canada’s oral generic pharmaceutical market is also expanding, with generics accounting for about 76.6% of all prescriptions while representing only 22.3% of total drug spending. Retail sales of generics have risen significantly, supported by policies such as the pan‑Canadian Pharmaceutical Alliance (pCPA) that promote lower prices and broader adoption. High utilization in chronic therapies, combined with ongoing cost-containment initiatives, drives sustained demand. Efficient distribution channels across retail and institutional pharmacies enhance accessibility. Overall, generics continue to reduce healthcare costs while ensuring patient access to essential medicines.

Asia Pacific Market Insights

The oral generic pharmaceutical market in Asia‑Pacific (APAC) is expanding rapidly, driven by rising healthcare access, growing populations, and an increasing burden of chronic disease. Governments across the region are promoting affordable medicines, bolstering the adoption of generics. Large manufacturing hubs like India and China are scaling production, lowering costs, and exporting generics globally. Improvements in insurance coverage and public-health systems further enhance demand for low-cost, essential oral drugs. As a result, APAC is one of the fastest-growing regions in the global oral generic market.

In China, the oral generic pharmaceutical market is growing rapidly, driven by healthcare reforms, an aging population, and increasing prevalence of lifestyle-related chronic diseases. Rising health awareness and government policies encouraging the use of cost-effective generics are key growth enablers. The country’s pharmaceutical industry is benefiting from modernization in manufacturing, improved quality standards, and streamlined regulatory processes. Additionally, patent expirations of branded drugs provide significant opportunities for generic substitution. Expanding healthcare infrastructure and insurance coverage further support greater accessibility and consumption of oral generics across the population.

The oral generic pharmaceutical market in India is witnessing strong growth due to a well-established domestic manufacturing base and cost advantages that make medicines more affordable. Rising healthcare awareness, an expanding middle-class population, and increasing prevalence of chronic diseases are driving higher demand for oral generics. India’s position as a major exporter of generics also supports market expansion, while regulatory initiatives promoting generic substitution and faster approvals further strengthen the sector. Technological advancements in drug formulation and efficient distribution networks enhance accessibility across urban and rural areas, fueling steady growth.

Europe Market Insights

The oral generic pharmaceutical market in Europe is expanding steadily, driven by cost-containment pressures on healthcare systems and the need to provide affordable treatment options. Increasing prevalence of chronic diseases, an aging population, and rising patient awareness are boosting demand for oral generics. Government policies and healthcare reforms across the region support generic substitution, while patent expirations of major branded drugs create significant market opportunities. Technological advancements in drug formulation, efficient distribution channels, and growing adoption of digital healthcare solutions further accelerate growth. Overall, the European market reflects a mature yet progressively expanding landscape for oral generics.

In Germany, the oral generic pharmaceutical market is growing due to strong government support for cost-effective medicines and policies that encourage generic substitution. High prevalence of chronic conditions and an aging population drive sustained demand. Patent expirations of widely used branded drugs provide opportunities for generics to capture market share. Advanced manufacturing infrastructure ensures high-quality production and supply reliability. Additionally, efficient healthcare reimbursement systems facilitate widespread access to oral generics across the population.

The oral generic pharmaceutical market in France is witnessing steady growth, supported by government initiatives aimed at reducing healthcare expenditure. Rising chronic disease prevalence and increased patient awareness enhance demand for generics. Patent expirations of key branded drugs enable generics to expand their market presence. Well-established distribution networks and pharmacies ensure accessibility nationwide. Regulatory reforms promoting faster approvals and generic substitution further contribute to market expansion.

Key Oral Generic Pharmaceutical Market Players:

- Sun Pharmaceuticals (India)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lupin Pharmaceuticals (India)

- Amneal Pharmaceuticals (U.S.)

- Viatris INC (U.S.)

- Sandoz Group (Switzerland)

- Teva Pharmaceuticals (Israel)

- Nordic Pharmaceuticals (Denmark)

- Ratiopharm GmbH (Germany)

- Sun Pharmaceuticals is one of India’s largest pharmaceutical companies and a major global supplier of oral generic medicines. The company offers a wide range of oral solid dosage forms, including tablets and capsules, across chronic and acute therapeutic areas. Its strong R&D capabilities and extensive manufacturing network support competitive pricing and high-quality production. Sun Pharma continues to strengthen its presence in regulated markets such as the U.S. and Europe. Its strategic focus on complex generics and specialty products enhances its growth in the oral generics segment.

- Lupin is a leading Indian generic drug manufacturer with a strong portfolio in oral generics, particularly in cardiovascular, diabetes, respiratory, and central nervous system therapies. The company invests heavily in research to develop complex oral formulations and biosimilars. Lupin has a global footprint, supplying generics to major markets including the U.S., Europe, and Asia. Its manufacturing capabilities support high-volume production with stringent quality standards. Expansion into specialty and high-value generics continues to drive its oral generics growth.

- Amneal Pharmaceuticals is a U.S.-based generic drug manufacturer known for a robust oral generics portfolio. The company offers a broad range of oral solid and liquid formulations across multiple therapeutic categories. Amneal’s growth is supported by strong development pipelines, strategic acquisitions, and partnerships to diversify its product base. The company focuses on high-value complex generics to strengthen its competitive position. Its well-established distribution network ensures strong market reach in the U.S. healthcare system.

- Viatris, formed through the merger of Mylan and Upjohn (a division of Pfizer), is a global leader in oral generic pharmaceuticals. The company provides a wide portfolio of cost-effective oral drugs across major therapeutic areas and is present in more than 165 countries. Viatris emphasizes quality, access, and sustainable supply to support global healthcare needs. The company leverages its broad manufacturing presence and regulatory expertise to deliver affordable generics. Its focus on complex generics and biosimilars strengthens long-term growth prospects.

- Sandoz, a global leader in generics and biosimilars, offers an extensive portfolio of oral generic medicines across chronic and acute treatments. Known for its strong European presence, Sandoz delivers high-quality, cost-effective oral formulations through advanced manufacturing and R&D capabilities. The company plays a key role in reducing healthcare expenditure through widespread access to generics. Sandoz continues advancing complex formulations and value-added generics to enhance patient outcomes. Its global distribution network and strong regulatory expertise support sustained market leadership in oral generics.

Here are a few areas of focus covered in the competitive landscape of the market:

Key players are driving the global oral generic pharmaceutical market by expanding their portfolios with cost-effective formulations and focusing on high-demand therapeutic categories such as cardiovascular, diabetes, and CNS disorders. They are investing heavily in R&D to develop complex and value-added generics, enabling faster market penetration as patent expirations create growth opportunities. Strategic mergers, acquisitions, and global distribution partnerships are strengthening their geographic reach and improving supply chain efficiency. Many companies are enhancing manufacturing capabilities to ensure large-scale, high-quality production aligned with regulatory standards in major markets. Collectively, these efforts support wider access to affordable medications and accelerate the market’s overall growth.

Corporate Landscape of the Global Oral Generic Pharmaceutical Market

Recent Developments

- In October 2025, Lupin introduced an authorized generic of Ravicti (Glycerol Phenylbutyrate) Oral Liquid in the U.S. This medication is a crucial therapy for both children and adults with urea cycle disorders (UCDs), a rare genetic condition. The launch of this generic version is expected to increase access and provide a more cost-effective option for patients who rely on this life-saving treatment.

- In October 2025, Amneal Pharmaceuticals announced that the FDA approved its generic version of GE Healthcare's Omnipaque. The product, iohexol injection, is a contrast agent used in medical imaging scans like CT and X-rays. Amneal expects to make this more affordable alternative available to patients in the first quarter of 2026.

- Report ID: 8260

- Published Date: Nov 21, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Oral Generic Pharmaceutical Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.