Active Pharmaceutical Ingredient Market Outlook:

Active Pharmaceutical Ingredient Market size was over USD 220.92 billion in 2025 and is anticipated to cross USD 414.7 billion by 2035, growing at more than 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of active pharmaceutical ingredient is assessed at USD 233.84 billion.

The growth of the market can primarily be attributed to the higher prevalence of chronic diseases such as cardiovascular diseases, and cancer across the globe, the rising demand for pharmaceutical drugs, and increasing geopolitical changes. The prevalence of chronic diseases is so high that nearly 40 million people lose their lives annually, out of which, about 15 million of them are classified as premature globally.

Key Active Pharmaceutical Ingredient Market Insights Summary:

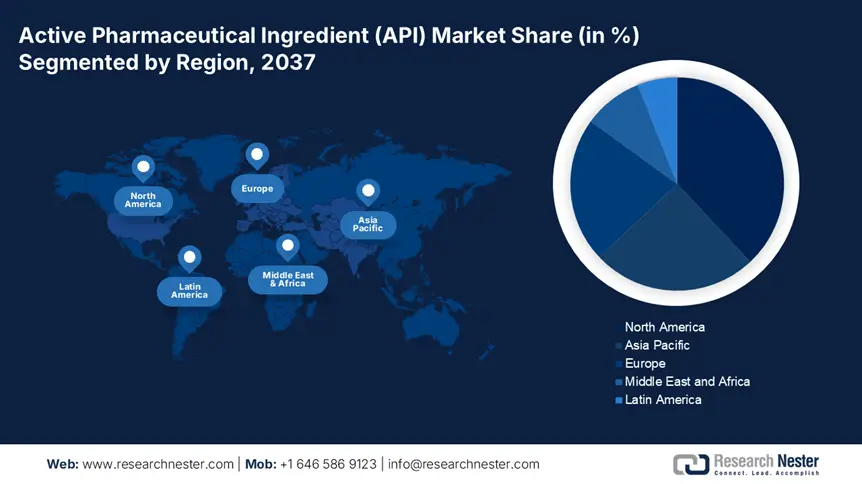

Regional Highlights:

- North America active pharmaceutical ingredient market is predicted to capture 38.8% share by 2035, driven by a high prevalence of cardiovascular diseases and rising healthcare.

- Asia Pacific market will register noteworthy growth during the forecast timeline, driven by the growing geriatric population and favorable healthcare policies.

Segment Insights:

- The synthetic segment in the active pharmaceutical ingredient market is expected to maintain the highest market share by 2035, driven by the low production cost of synthetic APIs.

- The biotech segment in the active pharmaceutical ingredient market is forecasted to grow at a steady CAGR over 2026-2035, driven by rising demand for biopharmaceuticals and innovation.

Key Growth Trends:

- Spiking Cases of Medication Errors that Lead to Increase in Patient Mortality

- Higher Utilization of APIs to Treat Diabetes Across the World

Major Challenges:

- Price Policies Changing Periodically

- Lack of Awareness among the Global Population

Key Players: Teva Pharmaceutical Industries Ltd., Pfizer Inc., Abbott Laboratories, AbbVie Inc., Mylan N.V., GSK plc, Eli Lilli and Company, Sun Pharmaceutical Industries Ltd., Novartis AG, Merck & Co. Inc.

Global Active Pharmaceutical Ingredient Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 220.92 billion

- 2026 Market Size: USD 233.84 billion

- Projected Market Size: USD 414.7 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.8% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, India, United States, Germany, Japan

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 9 September, 2025

Active Pharmaceutical Ingredient Market Growth Drivers and Challenges:

Growth Drivers

- Escalating Geriatric Population Rising Need for More Formulations - Data provided by the World Bank showed that there were 747,238,580 people aged 65 and above in 2021 around the world. People of elderly age are more likely to get sick or acquire chronic diseases since the body becomes weak with the passing of time. Geriatrics are more dependent on medicines than adults. Hence, this factor is projected to hike the growth of the pharmaceutical ingredient market

- over the forecast period.

- Spiking Cases of Medication Errors that Lead to Increase in Patient Mortality – The U.S. FDA stated in 2019, that it receives over 100,000 reports of medication errors annually. Additionally, over 6 million patients in the United States get affected by some sort of medication error every year.

- Higher Utilization of APIs to Treat Diabetes Across the World – With the rising indulgence of the population in an unhealthy lifestyle, the prevalence of diabetes among people has grown considerably. Thus, the demand for active pharmaceutical ingredients is expected to increase for the timely treatment of the patient. A report published by the International Diabetes Federation (IDF) estimated the number of people living with diabetes to reach 643 million by 2030 across the world.

- Spiking Prevalence of Cardiovascular Diseases Owing to Unhealthy Eating Habits and Sedentary Lifestyle – Recently, the cases of cardiovascular diseases have increased drastically owing to an unhealthy diet and reduced physical activity. To treat patients with cardiovascular disease, the need for active pharmaceutical ingredients is expected to grow to create a positive outlook for market growth during the forecast period. Cardiovascular diseases are very prevalent worldwide, for instance, approximately 18 million people die annually due to some sort of cardiovascular disease in the world.

- Increasing Healthcare Expenditure Per Capita Demanding for API Synthesis – As a result of developing economies, the per capita income of people has also escalated which has ultimately increased the spending capacity in the healthcare sector, and for treatment processes. Hence, the preference for the active pharmaceutical ingredient is anticipated to rise for an effective treatment process. The global healthcare expenditure was projected to rise Y-O-Y reaching about USD 1100 per capita in 2019.

Challenges

- Price Policies Changing Periodically - The change in the price policy of drugs impacts the pricing and manufacturing cost of the companies. The unintended price drop can lead to a huge loss for the manufacturers and have a negative impact hindering the growth of the active pharmaceutical ingredient market in the forecast period.

- Lack of Awareness among the Global Population

- Higher Price Associated with the Manufacturing Process

Active Pharmaceutical Ingredient Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 220.92 billion |

|

Forecast Year Market Size (2035) |

USD 414.7 billion |

|

Regional Scope |

|

Active Pharmaceutical Ingredient Market Segmentation:

Application (Cardiology, Oncology, Pulmonology, Neurology, Ophthalmology)

The global active pharmaceutical ingredient market is segmented and analyzed for demand and supply by application into cardiology, oncology, pulmonology, neurology, ophthalmology, and others. Amongst these segments, cardiology is anticipated to obtain the largest market share during the forecast period. The growth of the segment is ascribed to the higher prevalence of heart diseases, the increasing old population with high blood pressure, growing obesity, and cholesterol issues leading to surgeries or death in severe cases. For instance, approximately 600,000 people die due to heart disease per year solely in the USA. Furthermore, the surge in the number of cardiac arrest, usage of cardiacimplants and heart transplant procedures around the world which require surgical procedures also brings the need for active pharmaceutical ingredients which in turn is anticipated to fuel segment growth.

Synthesis Type (Biotech, Synthetic)

The global active pharmaceutical ingredient market is also segmented and analyzed for demand and supply by biotech and synthetic. Out of these, the synthetic segment is attributed to garnering the highest market share during the forecast period. Owing to the great advantages of synthetic active pharmaceutical ingredients including the low production cost of chemically synthesized ingredients coupled with the reduced cost of raw materials are considered to be major factors anticipated to impetus a significant revenue generation. Furthermore, the easy process of developing these synthetic active pharmaceutical ingredients is considered to be another growth factor for segment expansion in the upcoming years. On the other hand, the biotech segment is also projected to hold a significant market share by growing at a steady CAGR value. The main factor for segment growth is the escalation in the demand for biopharmaceuticals along with the increased number of innovations in biologics to address the unmet medical needs for diseases. Also, the biotech segment attracts big pharmaceutical enterprises and major key players owing to the increased number of FDI approvals for biological drugs and medicines including vaccines, blood components, and recombinantproteins. Hence, all the factors add up to propel segment growth.

Our in-depth analysis of the global active pharmaceutical ingredient market includes the following segments:

|

By API Type |

|

|

By Synthesis Type |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Active Pharmaceutical Ingredient Market Regional Analysis:

North America Market Forecast

North America region is expected to account for more than 38.8% market share by 2035. The growth of the market in the region can be accounted for by the higher prevalence of cardiovascular diseases. Data provided by the Centers for Disease Control and Prevention stated that every 34 seconds, 1 person dies due to cardiovascular diseases in the USA while in 2020, 697,000 lost their lives due to a similar reason. Furthermore, recent policies of the U.S. government and rising healthcare infrastructure in the region, the rising number of novel drugs, and increasing molecular entities that go off-patent are also anticipated to propel the growth of the market over the forecast period. Furthermore, the presence of a strong healthcare network in the region along with rising healthcare expenditures is also anticipated to boost the market growth.

Asia Pacific Market Forecast

On the other hand, the Asia Pacific active pharmaceutical ingredient market is also projected to hold a significant market share with a noteworthy CAGR over the forecast period. The major factor for market growth is the growing geriatric population coupled with the presence of a large patient pool in the region. In addition, favorable policies by the regulatory bodies that promote the market players to opt for an active pharmaceutical ingredient for timely treatment and supportive reimbursement policies are also expected to contribute to the market growth in the region. In addition, the region's expanding healthcare industry is also expected to boost active pharmaceutical ingredient market growth during the forecast period.

Active Pharmaceutical Ingredient Market Players:

- Teva Pharmaceutical Industries Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc.

- Abbott Laboratories

- AbbVie Inc.

- Mylan N.V.

- GSK plc

- Eli Lilli and Company

- Sun Pharmaceutical Industries Ltd.

- Novartis AG

- Merck & Co. Inc.

Recent Developments

-

Pfizer Inc. acquires U.S. FDA approval along with Myovant for MYFEMBREE, a once-daily treatment for premenopausal women with endometriosis to reduce non-menstrual and menstrual pain. Additionally, both companies are jointly commercializing MYFEMBREE with immediate product availability.

-

Abbott Laboratories to collaborate with WW International, Inc. to integrate WeightWatchers, a weight management program, to provide requisite assistance to people diagnosed with diabetes and improvise their health issues.

- Report ID: 4214

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.