Recombinant Proteins Market Outlook:

Recombinant Proteins Market size was over USD 3.01 billion in 2025 and is poised to exceed USD 7.26 billion by 2035, witnessing over 9.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of recombinant proteins is estimated at USD 3.26 billion.

The market growth is mainly owing to the increasing demand for biopharmaceuticals, advancements in biotechnology, and rising prevalence of chronic diseases across the globe. Moreover, diabetes, which is a chronic disease, is one of the most prevalent diseases across the globe. Diabetes damages many organs in the body, including the eyes, nerves, brain, kidneys, heart, and blood vessels. Rise in adults with chronic disease and diabetes is expected to increase the demand for recombinant proteins during the forecast period. For instance, in the year 2021 it was noted that more than 530 million adults have diabetes, which is expected to rise to about 640 million by the year 2030. Hence, this is also expected to be a major factor to add to the growth of the global market.

In addition to this, biopharmaceuticals represent one of the fastest-growing sectors within the pharmaceutical industry, with a projected global revenue size of nearly USD 520 billion by the year 2024. Recombinant proteins are a critical component of many biopharmaceuticals, making up approximately 60% of all approved biologic drugs. Recombinant proteins are proteins that are produced using recombinant DNA technology, also known as genetic engineering. This technology involves the insertion of a gene encoding a specific protein into a host organism, such as bacteria, yeast, or mammalian cells, which then produces the protein of interest. Recombinant proteins are used in a wide range of applications, including biopharmaceuticals, research and development, diagnostics, and industrial processes.

Key Recombinant Proteins Market Insights Summary:

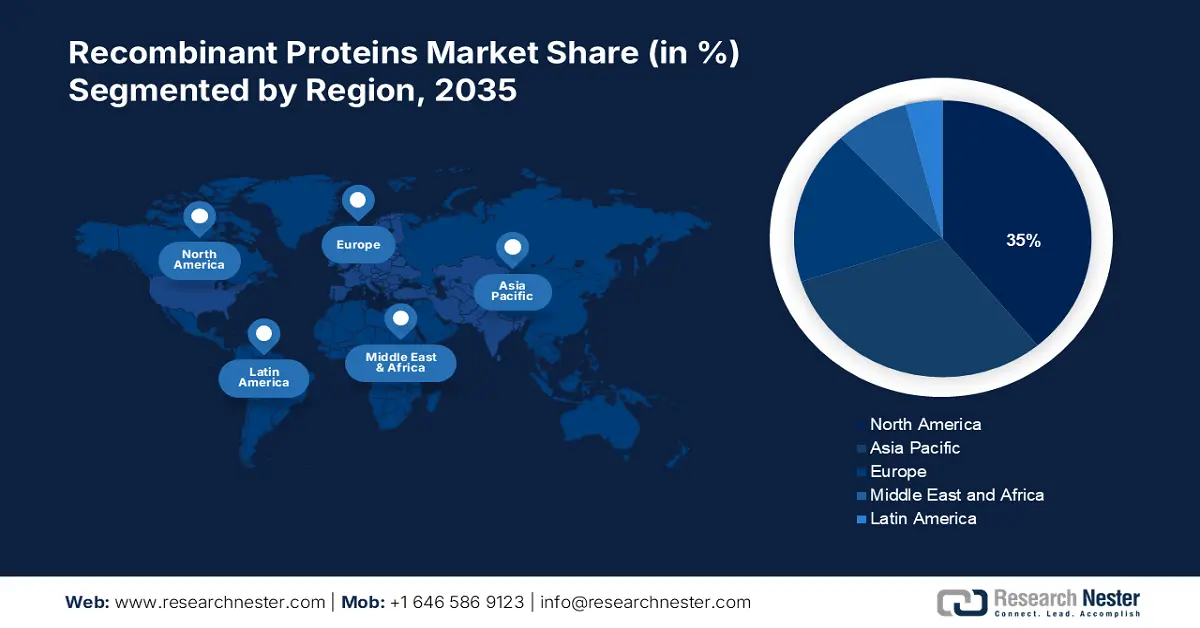

Regional Highlights:

- North America recombinant proteins market will secure around 35% share by 2035, driven by growing population, research activity, and health insurance coverage.

- Asia Pacific market will achieve a 24% share by 2035, driven by increasing demand for biopharmaceuticals and growing biotech industry.

Segment Insights:

- The mammalian segment in the recombinant proteins market is forecasted to capture a 60% share by 2035, influenced by high biologics demand and suitability of mammalian cells for complex proteins.

- The healthcare segment in the recombinant proteins market is expected to hold a 35% share by 2035, driven by the expanding patient base and growth of hospitals.

Key Growth Trends:

- Prevalence of Cancer Worldwide

- Rising Health Expenditure

Major Challenges:

- High development costs

- Regulatory challenges

Key Players: Thermo Fisher Scientific Inc., Merck KGaA, Lonza Group AG, GenScript Biotech Corporation, AbbVie Inc., Amgen Inc., Roche Holdings Inc., Novartis AG, Pfizer Inc., Sanofi SA.

Global Recombinant Proteins Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.01 billion

- 2026 Market Size: USD 3.26 billion

- Projected Market Size: USD 7.26 billion by 2035

- Growth Forecasts: 9.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 10 September, 2025

Recombinant Proteins Market Growth Drivers and Challenges:

Growth Drivers

-

Prevalence of Cancer Worldwide – In the year 2019, 18 million new cancer cases and 10 million cancer deaths were observed worldwide. Population growth and aging worldwide alone are expected to result in 27.5 million new cancer cases and 16.3 million cancer deaths. The increasing prevalence of chronic diseases such as cancer, diabetes, and autoimmune disorders is driving demand for biologic drugs, including recombinant proteins. For instance, the global industry for cancer treatment is expected to reach nearly USD 120 billion by the year 2025, with recombinant proteins playing a significant role in cancer treatment.

-

Rising Health Expenditure – According to the latest spending data, global healthcare spending has increased over the past two decades, effectively doubling from 8.5% in 2000 to USD 8.5 trillion in the year 2019, increasing GDP reached 9.8%. The boom will continue during the forecast period.

- Increasing Investments - in development of biopharmaceuticals and recombinant proteins are expected to drive market growth. For instance, the US government has pledged nearly USD 1.7 billion to support the development of COVID-19 treatments and vaccines, with a significant portion of this funding allocated to the development of recombinant protein-based therapies.

- Rise in Research Spending – Growth in the global market during the forecast period can be further attributed to increased investment in research and development activities to continuously find more viable solutions for recombinant proteins. Research reports show that global R&D spending has more than tripled in real terms since 2000, rising from about USD 680 billion to more than USD 2.5 trillion in the year 2019.

- Prevalence of Genetic Rare Diseases – Over 400 million people worldwide suffer from rare genetic diseases. This figure explains the urgent need for improved treatment and clinical settings and health awareness. The need for advanced research and knowledge of drug mechanisms of action is an important tool in drug development. Many regions have developed biobanks from cohort programs to provide researchers with high-quality samples and revolutionize therapeutic efforts. This may lead to increased interest in discovering biomarkers for various diseases. For instance, in August 2022, Ayvakit received FDA approval for the treatment of systemic mastocytosis, a rare blood disorder.

Challenges

-

High development costs: The development of recombinant proteins is a complex and expensive process that involves research and development, clinical trials, and regulatory approval. This can result in high development costs, which can make it difficult for smaller companies or organizations to enter the market.

-

Limited availability of manufacturing capacity

- Regulatory challenges

Recombinant Proteins Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.2% |

|

Base Year Market Size (2025) |

USD 3.01 billion |

|

Forecast Year Market Size (2035) |

USD 7.26 billion |

|

Regional Scope |

|

Recombinant Proteins Market Segmentation:

Application Segment Analysis

The global recombinant proteins market is segmented and analyzed for demand and supply by application into research, therapeutics, and healthcare. Out of the three types of applications, the healthcare segment is estimated to gain the largest market share of about 35% in the year 2035. The growth of the segment can be accredited to the presence of large number of patients in the healthcare industry, which is expanding notably. The hospitals in the healthcare sector are also growing rapidly in number. For instance, by the year 2022 there was noted to be approximately 6,100 hospitals in the United States. Hospitals provide a wide range of medical care. Physicians, called hospital doctors, typically specialize in internal medicine, pediatrics, or general practice. They have the knowledge to solve common problems and the resources to solve more complex medical problems. Hospitals may also offer specialized care, such as neurology, obstetrics and gynecology, and oncology. By definition of a hospital, a county hospital is typically a primary medical facility in a region with numerous intensive care and mobile beds for patients requiring long-term care.

Host Cell Segment Analysis

The global recombinant proteins market is also segmented and analyzed for demand and supply by host cell into insect cells, and mammalian. Amongst these two segments, the mammalian segment is expected to garner a significant share of around 60% in the year 2035. The growth of the segment can be accredited to the increasing demand for biologics. Biologics, including monoclonal antibodies and other complex proteins, are increasingly being used to treat a range of diseases, such as cancer and autoimmune disorders. The mammalian cell expression system is well-suited to produce these complex proteins, driving demand for the mammalian segment in the global recombinant protein market. The mammalian cell expression system is a commonly used platform for the production of recombinant proteins due to its ability to produce complex proteins with post-translational modifications similar to those found in human cells. Advances in technology, such as genetic engineering and cell line development, have improved the efficiency and productivity of the mammalian cell expression system, making it a more attractive platform for the production of recombinant proteins. The biopharmaceutical industry is growing rapidly, driven by the increasing demand for biologics. This growth is expected to continue, driving demand for the mammalian segment over the forecast period.

Our in-depth analysis of the global market includes the following segments:

|

By Host Cell |

|

|

By Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Recombinant Proteins Market Regional Analysis:

North American Market Insights

The recombinant proteins in the North America region, amongst the market in all the other regions, is projected to hold the largest market share of about 35% by the end of 2035. The regional growth can majorly be attributed to the growing population and research activity, health insurance covering various cancer diagnoses and related treatments requiring recombinant proteins. Rising economic status and affordability of advanced treatments for patients are estimated to boost the growth of the market in the region during the forecast period. According to the U.S. Bureau of Economic Analysis, personal income in the U.S. in August 2022 grew at a rate of 0.3% to reach USD 71.6 billion, while personal spending was observed to grow at a rate of 0.4% to reach USD 6.75 billion. In the United States, 1,752,735 new cancer cases were reported in 2019 and 599,589 people died from cancer, which is a chronic disease. Moreover, the insurance companies in North America offer efficient reimbursement policies to the patients going through treatment of chronic diseases, which encourages the patients to opt for advanced treatment methods. Hence, this is also estimated to add to the regional market growth significantly.

APAC Market Insights

The recombinant proteins in the Asia Pacific region, amongst the market in all the other regions, is projected to hold the second largest share of about 24% during the forecast period. The growth of the market in this region can primarily be attributed to the increasing demand for biopharmaceuticals. The demand for biopharmaceuticals is increasing rapidly in the Asia Pacific region, driven by the increasing prevalence of chronic diseases and the aging population. Biopharmaceuticals, including recombinant proteins, are being used to treat a range of diseases such as cancer, diabetes, and autoimmune disorders. The biotech industry in the Asia Pacific region is rapidly growing, driven by government initiatives and increasing investment in research and development. This growth is creating opportunities for the development and production of recombinant proteins. Many biopharmaceutical companies in the US and Europe are outsourcing their research and development activities to the Asia Pacific region owing to lower costs and favorable regulatory environments. This outsourcing is anticipated to drive the growth of the recombinant proteins market in the region.

Europe Market Insights

Further, the recombinant proteins in the Europe region, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The growth of the market can be attributed majorly to the advancements in technology in the region. Europe is home to some of the world's leading biopharmaceutical companies, and these companies are investing heavily in research and development to improve the efficiency and productivity of the production of recombinant proteins. This investment is driving the growth of the regional market. Europe has a well-established regulatory framework for the development and production of biopharmaceuticals, including recombinant proteins. This framework has encouraged investment in the region and contributed to the growth of the market. The biotech industry in Europe is growing rapidly, driven by government initiatives and increasing investment in research and development. This growth is creating opportunities for the development and production of recombinant proteins. Overall, the recombinant proteins market in Europe is expected to continue to grow steadily, driven by increasing demand for biopharmaceuticals, advancements in technology, and favorable regulatory environments.

Recombinant Proteins Market Players:

- Thermo Fisher Scientific Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck KGaA

- Lonza Group AG

- GenScript Biotech Corporation

- AbbVie Inc.

- Amgen Inc.

- Roche Holdings Inc.

- Novartis AG

- Pfizer Inc.

- Sanofi SA

Recent Developments

-

Merck KGaA: Merck announced that it had signed an agreement to acquire AmpTec, a leading provider of high-quality RNA and mRNA for research and commercial applications. The acquisition will strengthen Merck's capabilities in the field of mRNA-based therapeutics and vaccines.

-

Roche Holdings Inc.: Roche announced that it had received approval from the US Food and Drug Administration (FDA) for its recombinant protein Hemlibra, for the treatment of hemophilia A in patients without factor VIII inhibitors. Hemlibra is a bispecific antibody designed to bring together factors IXa and X, which are needed to activate the natural coagulation cascade and restore the blood clotting process.

- Report ID: 4632

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Recombinant Proteins Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.