Overactive Bladder Treatment Market Outlook:

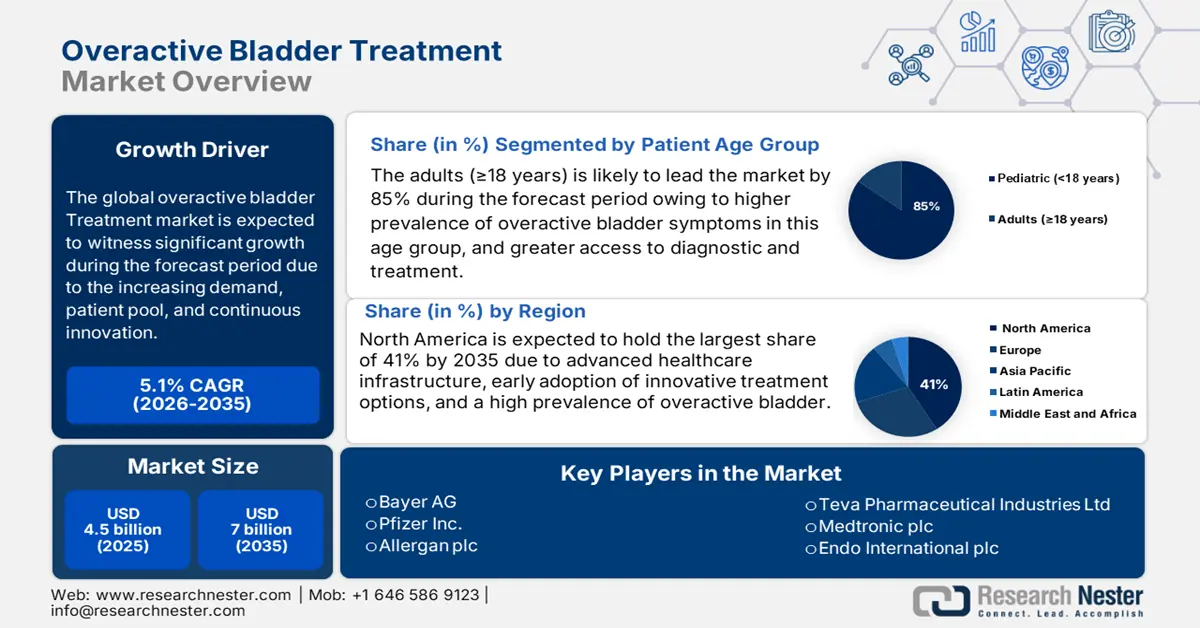

Overactive Bladder Treatment Market size was valued at approximately USD 4.5 billion in 2025 and is projected to reach around USD 7 billion by the end of 2035, rising at a CAGR of about 5.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of overactive bladder treatment is estimated at USD 4.7 billion.

The market for overactive bladder (OAB) treatment is expanding due to increasing treatment options, an aging population, and a growing number of cases. According to a report by NLM May 2023, women’s OAB has been documented at 16.9% but it increases with age, reaching 30.9% in those older than 65 years. The market includes a complex supply chain of pharmaceuticals such as antimuscarinics and β3-agonists (e.g., mirabegron) and medical devices for both conservative and advanced therapies. Underlying growth is caused by increasing awareness, aging population dynamics, and evolving drug formulations that offer improved tolerability and adherence. This involves holistic management across pharmacological treatment, patient behavioral intervention, and patient education as part of a systemic approach to improve outcomes.

The overactive bladder treatment market is driven by a structured approach to stepwise care. As per a NLM September 2022 report, 64% of patients go for conservative therapies, 76% for medical treatment, while 11% undergo more advanced third-line therapies such as botulinum toxin injections and the use of neuromodulation devices. The tiered utilization thus sustains steady demand for pharmaceuticals and specialized medical devices. Therapeutic options, in combination with conservative, pharmacological, or advanced treatment categories, indicate a highly dynamic supply chain involving raw materials for drug manufacturing and the assembly of high-tech devices. Furthermore, the integration of formalized care pathways is expected to drive market growth and promote efficient resource utilization.

Key Overactive Bladder Treatment Market Insights Summary:

Regional Insights:

- North America is expected to hold the largest 41% share of the overactive bladder treatment market by 2035, attributed to robust government-funded clinical research and advancements in behavioral and neuromodulation therapies.

- The Asia Pacific region is projected to witness the fastest growth through 2026–2035, owing to rising healthcare awareness, a rapidly aging population, and improved access to advanced diagnostic and therapeutic solutions.

Segment Insights:

- The adult (≥18 years) patient age group segment in the overactive bladder treatment market is projected to account for nearly 85% share by 2035, propelled by rising treatment persistence and therapy adoption among adult patients.

- The idiopathic overactive bladder segment is anticipated to dominate by 2035, impelled by its high prevalence and increased emphasis on individualized treatment approaches.

Key Growth Trends:

- Increasing prevalence of overactive bladder

- Rising awareness and proactive management of OAB

Major Challenges:

- Limited long-term efficacy of combination therapies

- Challenges in advanced drug delivery adoption

Key Players: Bayer AG,Pfizer Inc.,Allergan plc / AbbVie Inc.,Teva Pharmaceutical Industries Ltd.,Medtronic plc,Endo International plc,Urovant Sciences ,Sanofi S.A.,Johnson & Johnson (Janssen),Aurobindo Pharma Ltd.,Dr. Reddy’s Laboratories Ltd.,Sun Pharmaceutical Industries Ltd.,Viatris Inc.,Mylan N.V.,AbbVie (merged with Allergan)

Global Overactive Bladder Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 4.5 billion

- 2026 Market Size: USD 4.7 billion

- Projected Market Size: USD 7 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: India, South Korea, Brazil, Australia, Indonesia

Last updated on : 11 September, 2025

Overactive Bladder Treatment Market - Growth Drivers and Challenges

Growth Drivers

- Increasing prevalence of overactive bladder: With the increasing population of the older generation, the overactive bladder treatment market is growing. A report by NLM in March 2022 stated that 41% of middle-aged women experienced overactive bladder (OAB) with incontinence at a higher rate than 26% experiencing OAB without incontinence. Demand for effective OAB therapies continues to rise with the aging of populations and increasing risk factors relating to BMI and the environment. The healthcare systems and treatment providers can start interventions that address this need with available solutions.

- Rising awareness and proactive management of OAB: Growing familiarity with overactive bladder treatment as a chronic condition severely affects the quality of life while increasing the economic costs. As reported by NLM in July 2024, overactive bladder (OAB) imposed a substantial economic burden, with estimated annual costs reaching approximately €7 billion in Europe and USD 66 billion in the U.S. Increased recognition of this burden, including associations with diabetes, depression, and sleep disorders, has made healthcare providers very aware and proactive. This growing focus on early intervention is increasing the demand for new ways to manage OAB and supporting continued growth in the treatment market.

- Influence of cohabitation and shared environmental factors on overactive bladder prevalence: A report by NLM March 2022 emphasized that the environment in which individuals live and intimate social relationships influence the incidence of overactive bladder, particularly among middle-aged women. The report has also stated that a large-scale cross-sectional analysis involving 970 cohabiting couples revealed that women residing with partners affected by overactive bladder (OAB) exhibited an increased likelihood of developing OAB themselves. More precisely, the odds of OAB with incontinence (OABwet) were more than twice (OR 2.35) when the partner had OABwet, whereas the odds of OAB without incontinence (OABdry) increased significantly (OR 1.81) when the partner had OABdry.

Primary Endpoints for Phase III Trials Evaluating Mirabegron in Patients with OAB (2022)

|

Trial |

N |

Treatment |

Mean Number of Micturitions/24 h (SE) |

P value |

Mean Number of Incontinence Episodes/24 h (SE) |

P value |

|

SCORPIO (12 weeks) |

1987 |

Mirabegron 50 mg |

−1.93 (0.11) |

<0.001 |

−1.57 (0.11) |

0.003 |

|

Mirabegron 100 mg |

−1.77 (0.10) |

0.005 |

−1.46 (0.11) |

0.010 |

||

|

Tolterodine ER 4 mg |

−1.59 (0.11) |

0.11 |

−1.27 (0.11) |

0.11 |

||

|

Placebo |

−1.34 (0.11) |

– |

−1.17 (0.11) |

– |

||

|

ARIES (12 weeks) |

1328 |

Mirabegron 50 mg |

−1.66 (0.13) |

<0.05 |

−1.47 (0.11) |

<0.05 |

|

Mirabegron 100 mg |

−1.75 (0.14) |

<0.05 |

−1.63 (0.12) |

<0.05 |

||

|

Placebo |

−1.05 (0.13) |

<0.05 |

−1.13 (0.11) |

<0.05 |

||

|

CAPRICORN (12 weeks) |

1306 |

Mirabegron 25 mg |

−1.65 (0.13) |

0.007 |

−1.36 (0.12) |

0.005 |

|

Mirabegron 50 mg |

−1.60 (0.12) |

0.015 |

−1.38 (0.12) |

0.001 |

||

|

Japanese Patient Trial (16 weeks) |

1139 |

Mirabegron 50 mg |

−1.67 (2.21) |

<0.001 |

−1.12 (1.48) |

<0.05 |

|

Tolterodine ER 4 mg |

−1.4 (2.17) |

– |

−0.97 (1.61) |

– |

||

|

Placebo |

−0.86 (2.35) |

– |

−0.66 (1.86) |

– |

||

|

TAURUS (52 weeks) |

2444 |

Mirabegron 50 mg |

−1.30 |

– |

−1.05 |

– |

|

Mirabegron 100 mg |

−1.43 |

– |

−1.23 |

– |

||

|

Tolterodine ER 4 mg |

−1.47 |

– |

−1.33 |

– |

Source: NLM September 2022

Challenges

- Limited long-term efficacy of combination therapies: It is globally observed that combination treatments are believed to suffer from loss of effectiveness in the long term in some patients, which limits adherence and repeat usage, and thus market growth and pharmaceutical investment for newer, more durable therapies are discouraged the world over. As a result, people depend on the treatments that are easily available to them, with some not being completely effective in addressing patients' needs; the therapy progresses overall in a limited manner.

- Challenges in advanced drug delivery adoption: New drug delivery technologies such as liposomes and hydrogels face regulatory, cost, and infrastructure challenges. This scenario hinders the faster adoption of these technologies worldwide, thereby restricting the market growth, as conventional therapies are still the prescription in many regions, which are less patient-friendly and efficacious. Overcoming these hurdles requires coordinated efforts among regulators, manufacturers, and healthcare providers to ensure accessibility and acceptance.

Overactive Bladder Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 4.5 billion |

|

Forecast Year Market Size (2035) |

USD 7 billion |

|

Regional Scope |

|

Overactive Bladder Treatment Market Segmentation:

Patient Age Group Segment Analysis

The patient age group segment is expected to be dominated by adults (≥18 years), with almost 85% of the market share by 2035. According to a report of NLM, March 2024, the adult patient age group segment includes patients aged 18 and above who require treatment for OAB with medications such as mirabegron or antimuscarinics. This segment is significant as it constitutes the biggest and most researched population being treated with OAB therapies. The switch and persistence pattern of treatment in adult patients has become an area of interest for manufacturers and healthcare organizations, creating demand for the market and further growth.

Disease Type Segment Analysis

The disease type segment is expected to be dominated by idiopathic overactive bladder. The idiopathic overactive bladder is driven by its huge prevalence and patient load. According to the 2024 American Urological Association clinical guideline, the treatment is individualized rather than given through a stepwise approach to any patient. As per an NLM July 2023 report, research shows that 70% to 84% of patients with spinal cord injuries have neurogenic bladder dysfunction at some point in their lives. The focus is on shared decision-making, where practitioners can select treatments based on the patient's wants, ranging from behavioral interventions, medication, and minimally invasive options.

Route of Administration Segment Analysis

The route of administration segment is expected to be dominated by oral within the forecast period. The oral routes are associated with certain advantages, such as easy administration, high patient compliance, and convenience, in contrast to invasive procedures. This sub-segment thrives mainly because patients and clinicians prefer to manage OAB symptoms efficiently with the well-established oral forms of antimuscarinics and β3 agonists. Moreover, the persistent improvements in the oral formulations of drugs are not just increasing their efficacy but also diminishing their side effects, which is further influencing the inclination of the market.

Our in-depth analysis of the overactive bladder treatment market includes the following segments:

|

Segment |

Sub-segments |

|

Therapy / Drug Class |

|

|

Disease Type |

|

|

Route of Administration |

|

|

Distribution Channel |

|

|

Patient Age Group |

|

|

End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Overactive Bladder Treatment Market - Regional Analysis

North America Market Insight

The overactive bladder treatment market in North America is expected to hold the highest market share of 41% during the forecast period. According to a report by NIH in February 2024, research sponsored by agencies such as the NIH and NIDDK in the U.S. has helped to increase intervention studies in the fields of behavioral therapy and neuromodulation for OAB, fitting into safer and patient-centered care. Public resources, such as datasets and clinical trial registries, serve as a testament to the public sector's commitment to advancing meaningful innovation in OAB treatment, thereby ensuring quality in healthcare.

The market in the U.S. is expected to grow steadily within the forecast period. Advancements in healthcare research come as the top priority in the U.S. within the forecast period. According to a report by NIH in January 2023, the U.S. government, through its NIH and NIDDK, has supported research into OAB, with funding going to projects on innovative treatments and diagnostics. The innovative treatments include the manufacture of wireless implantable devices for the real-time monitoring of the bladder and multi-interdisciplinary action plans targeting OAB care and the diminution of cognitive risks stemming from certain therapies. These serve the dual purpose of improving clinical practices and patient outcomes.

The overactive bladder treatment market in Canada is growing due to the aging population within the forecast period. The OAB treatment market in Canada showcases serious gaps in cost-effectiveness data, especially for first- and third-line therapies. Bringing much strength to health technology assessments (HTAs) with fresh data collection is expected to inform reimbursement decisions, support market access strategies, and lead to innovations that would promote treatment adoption and improve outcomes in Canada’s publicly funded health care system.

Asia Pacific Market Insight

The overactive bladder treatment market in the Asia Pacific is expected to hold the fastest-growing market within the forecast period due to increasing healthcare awareness, a growing aging population, and expanding access to advanced diagnostic and treatment options. According to a report by NIH in December 2023, the prevalence of an overactive bladder has been greatly different in the Asia Pacific Region, with surveys proving that 53% of women suffer from symptoms in China, yet very few undergo treatment for the condition. This points to an unmet need and an opportunity for market expansion, as well as for government-driven awareness programs and healthcare infrastructure.

The market in China is expected to grow steadily within the forecast period. OAB has been noted to be on the rise in women in China, which is indicative of a broad public health issue. More specifically, the middle-aged group and people with higher BMI have been most affected by the rising OAB prevalence in China. The need for diverse and more advanced treatment options requires greater public health intervention and improvement of healthcare services in China’s growing OAB market. This growing demand is driving increased investment in innovative therapies and improved healthcare infrastructure to better manage and treat OAB across the country.

The overactive bladder treatment market in India is expected to grow steadily within the forecast period due to urinary incontinence (UI), including the urge incontinence associated with OAB, which continues to be a major but under-reported health problem. A recent study by the International Journal of Community Medicine and Public Health, June 2023, has shown that UI, with a prevalence rate of 27.1% and 25% of urge UI, suggests the need for awareness generation, government intervention, and treatment opportunities to meet patient care and enhance their quality of life in India. The Indian government has launched campaigns for women’s health and increased focus on chronic disease management, which would help in the management of OAB and improve patient outreach.

Europe Market Insight

The overactive bladder treatment market in Europe is expected to continue to rise during the forecast period. According to a study by the UK Parliament in May 2025, the European arena, especially in the UK, government initiatives aim to detail advanced UTI management techniques due to antibiotic resistance threatening OAB treatment protocols. Investments in rapid diagnostics and treatments are swiftly building up in support of the strategies of antibiotic stewardship: lessening recurrence rates and patient outcome improvements are the prime factors for market growth and strategic stakeholder engagement investments.

The U.K. urinary health market is growing due to increasing UTI cases are accompanied by treatment demands for OAB. According to a report by the Government of the UK in July 2024, almost 200,000 hospital admissions in England occurred for UTI between 2023-24, leading to a heavy load on healthcare in addition to resource utilization. To ease the situation for urinary condition patient management and rare expensive hospital stays, government programs have been developed to promote diagnostics and outpatient pathways for urinary conditions.

In Germany, the OAB treatment market is growing due to the aging population and upsurge in its prevalence. The early treatment and detection of urological disorders is now more possible due to the increasing knowledge about the disorders and the new methods in healthcare technologies. Moreover, the novel treatment options and advanced healthcare facilities further fuel the growth of the market. The initiatives for elderly care and urological health from the government also have an impact. Thus, the market is expected to grow steadily throughout the forecast period.

Exporters and Importers of Medical Instruments in 2023 in Europe:

|

Country |

Export Value (2023) |

Country |

Import Value (USD) (2023) |

|

Germany |

18.4 billion |

Netherlands |

14.1 billion |

|

Netherlands |

9.38 billion |

Germany |

13.1 billion |

|

Ireland |

9.0 billion |

France |

6.4 billion |

|

Switzerland |

4.5 billion |

Italy |

4.6 billion |

|

France |

3.9 billion |

Belgium |

4.5 billion |

|

Belgium |

3.2 billion |

UK |

4.4 billion |

|

Italy |

3.1 billion |

Russia |

2.0 billion |

|

UK |

3 billion |

Spain |

3.3 billion |

|

Poland |

1.4 billion |

Ireland |

1.9 billion |

|

Austria |

1.3 billion |

Austria |

1.6 billion |

|

Hungary |

1.1 billion |

Portugal |

694 million |

|

Denmark |

1.1 billion |

Sweden |

1.1 billion |

|

Finland |

924 million |

Hungary |

587 million |

|

Czechia |

917 million |

Greece |

538 billion |

Source: OEC August 2025

Key Overactive Bladder Treatment Market Players:

- Bayer AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Pfizer Inc.

- Allergan plc / AbbVie Inc.

- Teva Pharmaceutical Industries Ltd.

- Medtronic plc

- Endo International plc

- Urovant Sciences

- Sanofi S.A.

- Johnson & Johnson (Janssen)

- Aurobindo Pharma Ltd.

- Dr. Reddy’s Laboratories Ltd.

- Sun Pharmaceutical Industries Ltd.

- Viatris Inc.

- Mylan N.V.

- AbbVie (merged with Allergan)

The global OAB treatment market is highly competitive. Astellas, Pfizer, Allergan, and AbbVie dominate this market via flagship drugs such as Myrbetriq (mirabegron) and Vesicare, generics from Teva, and also neuromodulation devices marketed by Medtronic. In the competitive landscape, the new entrants from Japan, Sumitomo/Urovant with Gemtesa, Hisamitsu with OABLOK patch, and local manufacturers are developing diversified innovations into non-oral routes and device therapies. Indian generics companies such as Aurobindo, Dr. Reddy's Laboratories, and Sun Pharma reinforce the market on affordability and accessibility in emerging regions.

Here is a list of key players operating in the global market:

Recent Developments

- In December 2024, the first beta3 agonist, GEMTESA, brought by Sumitomo Pharma America into the market following FDA approvals, gained recognition for treating symptoms of overactive bladder in men undertaking pharmacological therapy for BPH, thereby expanding the OAB treatment option marketplace.

- In January 2024, the acquisition of Axonics for $3.7B was announced by Boston Scientific as a means of further strengthening its position in the overactive bladder treatment market with innovative sacral neuromodulation technologies for stimulation in urinary and bowel dysfunction.

- Report ID: 4868

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Overactive Bladder Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.