Cognitive Behavioral Therapy Market Outlook:

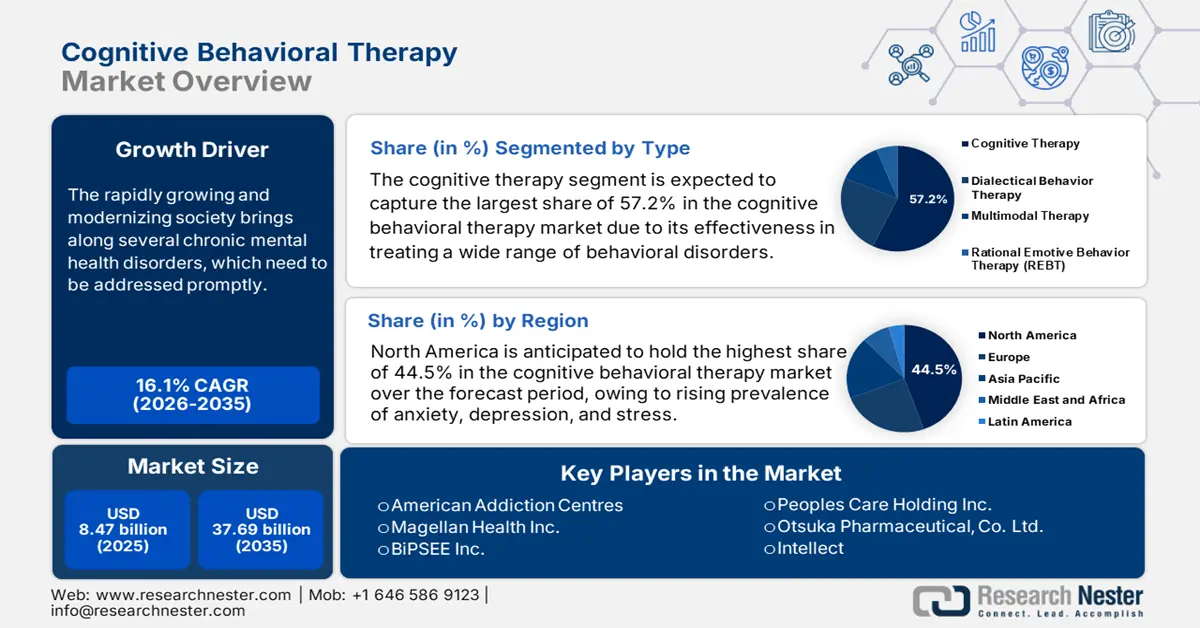

Cognitive Behavioral Therapy Market size was over USD 8.47 billion in 2025 and is projected to reach USD 37.69 billion by 2035, growing at around 16.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of cognitive behavioral therapy is evaluated at USD 9.7 billion.

The rapidly growing and modernizing society brings along several chronic mental health disorders, which need to be addressed promptly. The widespread of anxiety, depression, PTSD, and OCD among a wide spectrum of the population is becoming a serious public health concern worldwide. According to a study based on surveys conducted across 29 countries around the world, published in July 2023, 1 in every 2 habitats are predicted to develop these conditions during their life years. It further revealed that approximately 50.0% of the global population is poised to suffer from at least one mental disorder till they reach the age of 75. This is further boosting demand for effective interventions, propelling investment in the cognitive behavioral therapy market.

Statistical Presentation of Global Mental Disorder Prevalences (2021)

|

Condition |

Prevalence (in %) |

|

Depression |

28.0 |

|

Anxiety |

26.9 |

|

Post-traumatic Stress Symptoms |

24.1 |

|

Stress |

36.5 |

|

Psychological Distress |

50.0 |

|

Sleep Problems |

27.6 |

Source: NLM Study 2021

The enlarging economic burden of diseases is driving the need for accessibility in the cognitive behavioral therapy market. This form of treatment is already widely known as the most suitable and affordable alternative to other conventional methodologies, gaining maximum preferences. An NLM study from May 2021, established the optimized expense on each patient, with a reduction of USD 928.0 for enabling cognitive behavioral therapy (CBT). Later on, many more clinical studies put their efforts to provide this market with an eligible and standardized payers’ pricing. On this note, NLM concluded the cost-effectiveness threshold of CBT to retain at USD 95094.1/QALY (quality-adjusted-life-year), through evaluating the long-term effects and value-based pricing of this method in treating depression, in March 2024.

Key Cognitive Behavioral Therapy Market Insights Summary:

Regional Highlights:

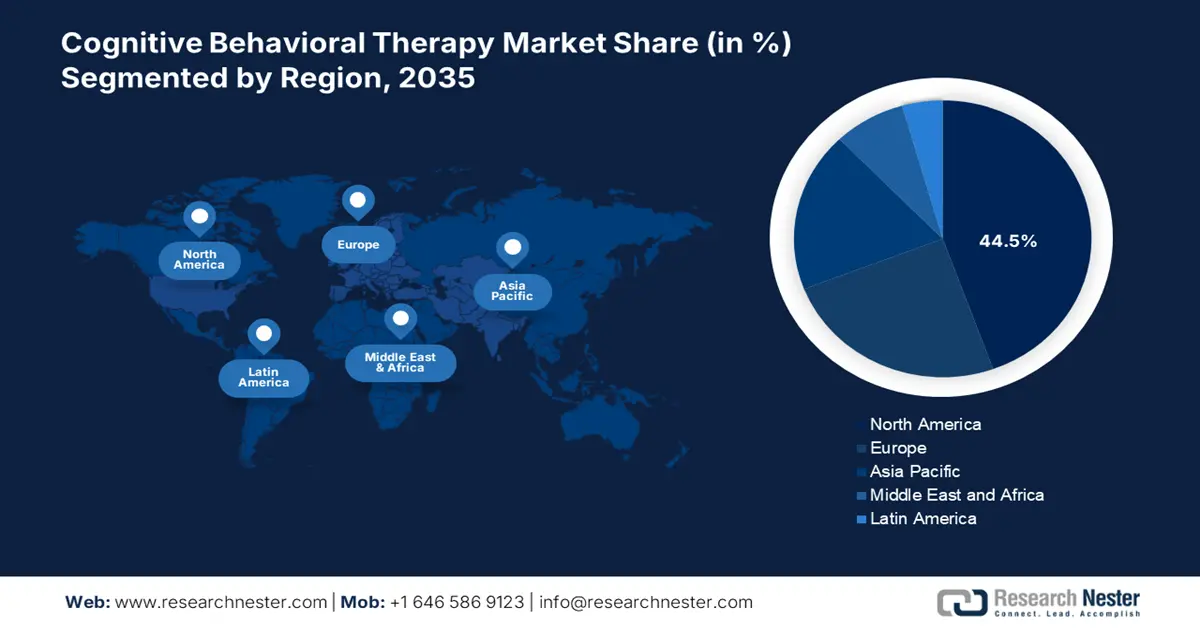

- North America leads the Cognitive Behavioral Therapy Market with a 44.5% share, propelled by a large consumer base and rising occurrence of behavioral diseases, ensuring strong growth through 2035.

- Asia Pacific’s cognitive behavioral therapy market is set to grow at an exceptional pace from 2026–2035, driven by fully equipped leaders revolutionizing mental health service delivery.

Segment Insights:

- Cognitive Therapy segment is anticipated to hold a 57.2% share by 2035, propelled by its effectiveness in treating behavioral disorders with a tailored approach.

Key Growth Trends:

- Recognition and integration in primary healthcare

- Growing acceptance and efficacy of therapies

Major Challenges:

- Shortage of sufficient resources and professionals

- Limitations in reimbursement coverages

- Key Players: American Addiction Centres, Magellan Health Inc., Springstone, Universal Healthcare Services Inc., Behavioral Health Group, Peoples Care Holding Inc., Acadia HealthCare.

Global Cognitive Behavioral Therapy Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.47 billion

- 2026 Market Size: USD 9.7 billion

- Projected Market Size: USD 37.69 billion by 2035

- Growth Forecasts: 16.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, United Kingdom, Germany, Canada, Australia

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 12 August, 2025

Cognitive Behavioral Therapy Market Growth Drivers and Challenges:

Growth Drivers

-

Recognition and integration in primary healthcare: As the awareness about mental health diseases increases, the demand for the cognitive behavioral therapy market inflates. This medical department is continuously becoming a streamlined sector across various healthcare dynamics. The annual middle-point pay grade for band-7 therapists and band-8a supervisors was set to USD 39596.0 and USD 47921.4 accordingly, as per the National Health Service (2020) in the UK.

-

Growing acceptance and efficacy of therapies: Considering the heightened severity and disability rate of related conditions, more patients and clinicians are willing to invest in the cognitive behavioral therapy market. The wide range of applications of this technique is proven by several pieces of clinical evidence. This is encouraging more medical systems to adopt innovations in this sector as a crucial part of their offerings. For instance, in October 2024, Mayo Clinic Platform Accelerate united the Japan External Trade Organization (JETRO) and the U.S. healthcare industry, magnifying the business opportunities for MedTech pioneers in both countries. The program enlisted 16 companies from Japan, including the CBT leaders BiPSEE and Splink.

Challenges

-

Shortage of sufficient resources and professionals: Performing therapies from the cognitive behavioral therapy market requires a high level of training and knowledge on the human body functions. Although the number of certified physicians and practitioners, particularly in resource-constrained regions, is limited. This limits the widespread adoption and acceptance. However, the introduction of certification programs is mitigating this shortage by creating a large workforce of educated professionals with specialized training.

-

Limitations in reimbursement coverages: The social stigma and cultural barriers about this medical condition often prevent insurance companies from covering the services offered by the cognitive behavioral therapy market. As this psychological practice is still undergoing a developmental stage, these service providers may hesitate to include them among their covered disciplines. Thus, the lack of financial support creates an economic hurdle for both medical facilities and patients in adopting such advanced solutions.

Cognitive Behavioral Therapy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

16.1% |

|

Base Year Market Size (2025) |

USD 8.47 billion |

|

Forecast Year Market Size (2035) |

USD 37.69 billion |

|

Regional Scope |

|

Cognitive Behavioral Therapy Market Segmentation:

Type (Cognitive Therapy, Dialectical Behavior Therapy, Multimodal Therapy, Rational Emotive Behavior Therapy (REBT))

Based on type, the cognitive therapy segment is set to hold cognitive behavioral therapy market share of more than 57.2% by 2035. This type of therapy has gained popularity due to its effectiveness in treating a wide range of behavioral disorders such as depression, anxiety, and OCD. Many clinical studies have established its efficacy, which is attracting both patients and companies to invest in this segment. Moreover, the tailored and targeted approach of this method is capable of addressing the specific needs of individual residents, making it more preferable for all, compared to other therapies. The improved outcomes and inflated engagement are concomitantly contributing to this sub-type’s growth.

Indications (Addiction, Anger Issues, Depression, Anxiety, Panic Attacks, Phobias)

In terms of indications, the depression segment is poised to dominate the cognitive behavioral therapy market throughout the assessed timeframe. Higher prevalence and severe impact on overall health are the major drivers in this segment. As per an NLM article, published in June 2023, the globally over 322.0 million habitats were suffering from symptoms related to depression. It also mentioned that around 30.0% of the total major depressive disorder (MDD) patient pool across the U.S. were non-responsive to the conventional treatments. This reflects the growing urge for new therapeutics, such as CBT, to cope with the resistant cases. This is fueling this segment with a broader audience and attracting more MedTech and pharma companies to invest.

Our in-depth analysis of the global cognitive behavioral therapy market includes the following segments:

|

Type |

|

|

Indications |

|

|

Age Group |

|

|

Service Provider |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Cognitive Behavioral Therapy Market Regional Analysis:

North America Market Analysis

North America in cognitive behavioral therapy market is expected to capture around 44.5% revenue share by the end of 2035. This region presents a large consumer base for this field, attributable to the rising occurrence of behavioral disease. The National Health Statistics Report, from November 2024, states that the incidences of anxiety and depression took place in 18.2% and 21.4% of the adult citizens in the U.S., aged 18 and over, respectively, in 2022. Besides the domestic pioneers, this demography is also attracting foreign cultivation. Furthermore, the efforts from the government to secure adequate resources for coping with the surging demand are crafting a profitable business environment in this region.

Leaders in the U.S. are investing and engaging significantly in the cognitive behavioral therapy market to combat the widespread scenario. The stress originated from the developed working culture and fast-evolving society is impacting the well-being of the younger generation. This is influencing the clinical service providers to incorporate these therapies in their listed offerings, extending availability in this sector. For instance, in May 2024, AppliedVR introduced a comprehensive and immersive adjunctive virtual (VR) device, RelieVRx, built on the principles of CBT. This prescription therapeutic was intended to associate with workers’ compensation by offering them relief from chronic lower back pain (CLBP).

The Canada cognitive behavioral therapy market is enriched with government initiative and supportive funding. For instance, in February 2023, the Canadian Institutes of Health Research (CIHR) allocated a USD 5.0 million grant for 25 ongoing R&D projects to enhance the quality and approach of the existing mental health and substance use services. Later on, in December 2024, the Federal Government announced the commencement of two new Integrated Youth Services (IYS) initiatives: IYS Collaboration Centre and IYS Data Platform, backed by a USD 500.0 million fund. Such efforts to elevate the form and effectiveness of therapies, improving outcomes in families, the young generation, adults, and children, are propelling this sector’s growth.

APAC Market Statistics

Asia Pacific is predicted to witness an exceptional pace of expansion in the cognitive behavioral therapy market during the assessed timeline. The region is home to many fully equipped and progressive leaders, who are revolutionizing the pathway of mental health service delivery. For instance, in August 2022, Intellect announced the plans of extending its territory in APAC by launching its proprietary services, including CBT, in Japan. It also mentioned raising a series A funding of USD 20.0 million, led by Tiger Global, which underscores its significance and strong presence in this region’s mental health industry. Such inspirational portfolios are encouraging other investors and service providers to participate in this landscape.

India is augmenting the cognitive behavioral therapy market with its excellence in telehealth services and their networks. Penetration of remote and on-call healthcare commodities in the primary settings has multiplied the patient engagement in this sector. In addition, the support from the government in promoting these solutions through initiatives such as Tele MANAS and KIRAN Helpline is increasing accessibility. Further, their ambitious goals and meticulous efforts to reduce suicide incidences across the country are inspiring private service providers to indulge cutting-edge methodologies, such as CBT, in their clinical practice. For instance, in 2022, the Ministry of Health and Family Welfare (MoHFW) launched the National Suicide Prevention Strategy (NSPS) to lessen these cases by 10% till 2030.

China is investing significantly in the cognitive behavioral therapy market, considering the heightening prevalence. Based on the learnings from the consequences faced by the nation’s habitats due to the severity of mental disorders, the authorities are now prioritizing this medical category. According to the 2022 report from the Institute for Health Metrics and Evaluation, China was bearing the highest load (16.82%) of neurological, psychiatric, and substance use disorders. Thus, they are upgrading their clinical and regulatory infrastructure to avail adequate resources for people in need. On this note, a 2022 NLM article reported that the overall implementation of improved mental health policies in China accounted for 32.6%. This signifies a greater scope of developments in this field.

Key Cognitive Behavioral Therapy Market Players:

- American Addiction Centres

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Magellan Health Inc.

- Springstone

- Universal Healthcare Services Inc.

- Behavioral Health Group

- Peoples Care Holding Inc.

- Acadia HealthCare

- Click Therapeutics, Inc.

- Headspace

The cognitive behavioral therapy market is evolving with the integration of advanced technologies in detecting these conditions at an early stage. Key players in this sector are also focusing on new clinical findings that showcase business possibilities in an extensive range of diseases. For instance, in May 2024, DexCom presented its State of Type 2 Report, based on the determinations from a survey on type-II diabetes patients. It identified 61.0% and 52.0% candidates with anxiety and depression respectively, caused by the mental impact of diabetes. These discoveries encourage cognitive behavioral therapy market leaders to enable new targeted pipelines, specific to these cases. On this note, Better Therapeutics announced the commercial launch of its CBT-based app, AspyreRx, after getting the FDA clearance for use in type-II diabetes, in October 2023. Such players are:

Recent Developments

- In May 2024, Click Therapeutics acquired assets from Better Therapeutics to leverage the development of its digital solution, CT-181, for obesity and cardiometabolic disease. The company aimed to utilize AspyreRx, an FDA-approved therapy for type-2 diabetes, to empower its AI-enabled platform and support future discoveries.

- In April 2024, Headspace launched a direct-to-customer (D2C) services for its subscribers. The cohort of this pipeline includes mental health coaching, following an action-oriented approach to care, built with clinically validated techniques such as cognitive behavioral therapy (CBT).

- Report ID: 7322

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Cognitive Behavioral Therapy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.